Manage Services

There are several services in Encompass Consumer Connect that you can enable to improve borrower experience and streamline the loan application process. These services include the following:

| Service |

Description |

| Order Credit |

Allows borrowers to order a credit report while completing a

loan application. |

| EPPS |

Encompass Product and Pricing Service (EPPS) allows borrowers to check current mortgage rates.

|

| Automated Underwriting |

Automatically submits a loan to your underwriting provider when certain criteria is met in a loan application.

|

| Asset verification |

Allows borrowers to verify their assets while filling out a

loan application. |

What would you like to do?

The Credit Ordering service lets a borrower order a credit report during the application process. When a credit report is returned, it is added to the borrower's application package.

To enable credit ordering, you must have an account with one of the credit providers listed in Order Credit Settings section. You'll use the same credentials required by your credit provider to enable credit ordering on your Encompass Consumer Connect site.

To Enable the Credit Ordering Service:

- In the Encompass Consumer Connect administration portal, click Services Management.

- Click Order Credit Settings.

- Click Yes to enable credit ordering. If you select No, the borrower will not see the Order Credit option on your site when applying for a loan.

- Select the credit provider you want to use, then enter the username and password for the account.

- Select an option to run Joint or Individual credit reports.

- Select the Credit Bureaus you want to use for credit reports.

- In the Credit Authorization Agreement field, enter the text that displays on the Credit Order page on your site.

Note: To return to the default text, click Reset to Encompass Default. - Click Save.

Enable Encompass Product and Pricing Service (EPPS) so that borrowers can search for and view the mortgage rates and loan programs offered on your site.

To enable EPPS, you must first have an account set up in Encompass. You'll use the same credentials from that account to enable EPPS on your Encompass Consumer Connect site.

To Enable EPPS:

- In the Encompass Consumer Connect administration portal, go to Services Management.

- Click Encompass Product and Pricing Settings.

- Click Yes to enable EPPS. If you select No, the borrower will not see this option on your site when applying for a loan.

- Enter the EPPS login credentials that Encompass Consumer Connect will use to request information from EPPS.

- Determine how you want EPPS information displayed on your site. Choose Classic or BestEx.

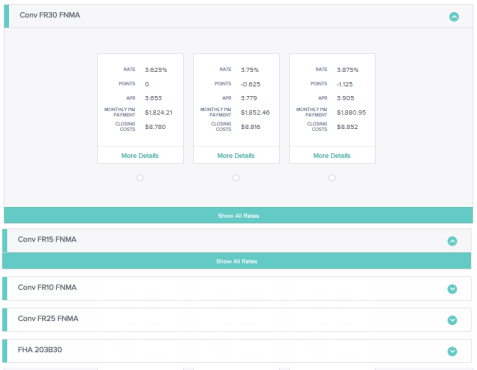

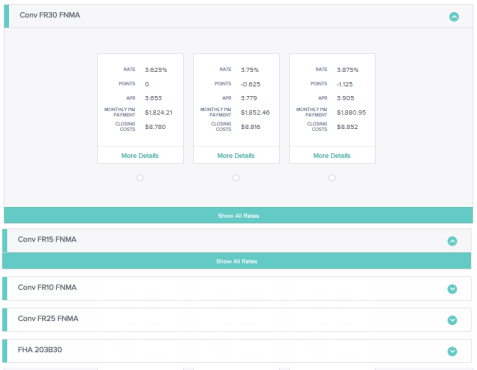

Example of Classic:

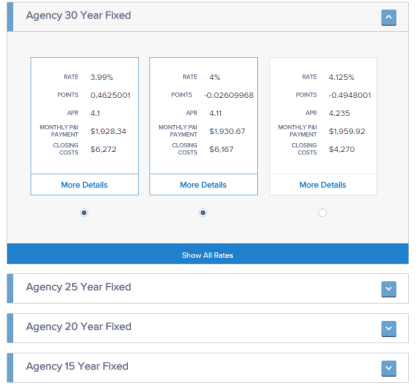

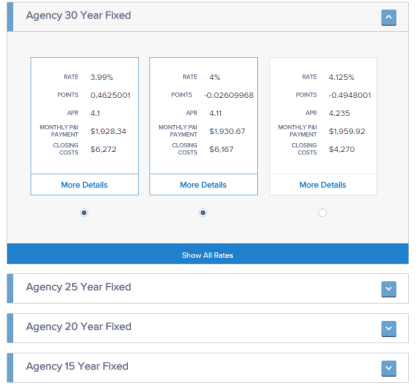

Example of BestEx or best-execution mortgage rates

- Select the lock period to display.

- Enter the text for the assumptions to show on the pricing results page.

To enable EPPS, you must first have an account set up in Encompass. You'll use the same credentials from that account to enable EPPS on your Encompass Consumer Connect site.

Loan applications submitted through an Encompass Consumer Connect site can be sent automatically to an underwriter service. When this feature is configured, the automated underwriting results for a loan application are quickly returned and saved to the eFolder in Encompass. Loan officers can then view the results as they review the loan application, saving a considerable amount of time in the loan process.

Borrowers are not made aware of the underwriting service when they submit a loan from an Encompass Consumer Connect site and underwriting results are not sent to the borrower automatically.

Review Automated Underwriting Requirements

For underwriting services to run successfully, the following are required:

The underwriting service must be enabled and configured. For instructions, see Set Up the Underwriting Service.

The borrower's credit report. Please note that an estimated credit score doesn't replace the credit report requirement. Make sure the Credit Ordering service is enabled. See Enable the Credit Ordering Service for instructions.

A loan program selected by the borrower. Borrowers can select a loan program during the application process only when the Encompass Product and Pricing Service (EPPS) is enabled. To enable EPPS, see Enable Encompass Product and Pricing Services (EPPS).

To Set Up the Automated Underwriting Service:

In the Encompass Consumer Connect administration portal, go to Services Management.

- Click Automated Underwriting Settings.

- Click Yes to enable automatic underwriting.

- Select an underwriter provider. You must have an account already set up with the underwriter provider you select.

- Enter login credentials for the underwriter provider.

For Desktop Underwriting (DU):

- Enter the Lender Institution ID, user name and password for DU. Make sure to enter the user name and password designated by your company for use with Encompass Consumer Connect requests.

- Enter the user name and password for the underwriter provider to use to connect with the credit vendor you specified in the Credit Ordering settings. The underwriter provider uses these credentials to retrieve the credit reference number so that the service can access the previously generated credit report.

For Loan Product Advisor (LPA):

- Enter the LPA User ID and Authentication Password. Make sure to enter the user ID and password designated by your company for use with Encompass Consumer Connect requests.

- Enter the LPA ID (Seller Number) and LPA Password to use to connect with the credit vendor you specified in the Credit Ordering settings. The underwriter provider uses these credentials to retrieve the credit reference number so that the service can access the previously generated credit report.

- Select the import conditions you want to use.

- Select Preliminary to import automatic underwriting conditions to the Encompass eFolder's Preliminary Conditions tab.

- Select Underwriting to import automatic underwriting conditions to the eFolder's Underwriting Conditions tab.

- To submit FHA loans to automatic underwriting, either the FHA Lender ID or the Sponsor ID and Sponsor Originator EIN must be provided. If you provide information for all of these fields, only the FHA Lender ID will be used.

- Click Save.

The Asset Verification service allows borrowers to verify their assets during the loan application process. To enable this service, you must have an account with the FormFree asset verification service.

To Enable the Asset Verification Service:

In the Encompass Consumer Connect administration portal, go to Services Management.

- Click Asset Verification.

- Click Yes to enable asset verification.

- Select FormFree from the Asset Verification Services list.

- Enter your 5 digit FormFree access token.

- Click Save.