Encompass Consumer Connect Administration Updates

Encompass Consumer Connect Administrator Portal Updates

The Encompass Consumer Connect Terms and Conditions of Use agreement is now displayed when an Encompass Consumer Connect administrator clicks the Create a Site button to create their first site. The user can read the agreement and click I Accept to continue.

CND-938

Loan applications submitted through an Encompass Consumer Connect website can now be sent automatically to either Fannie Mae Desktop Underwriter (DU) or Freddie Mac Loan Product Advisor (LPA) services. With this feature, underwriting results and conditions for a loan application are quickly returned and saved to the eFolder in Encompass. Loan officers can then view the results as they review the loan application, saving a considerable amount of time in the loan process.

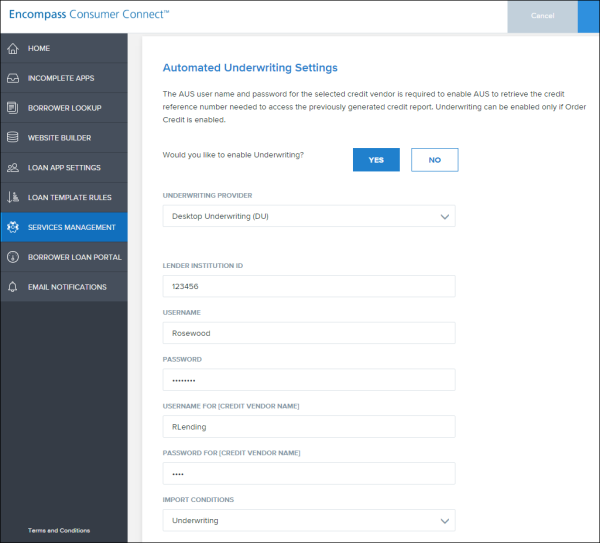

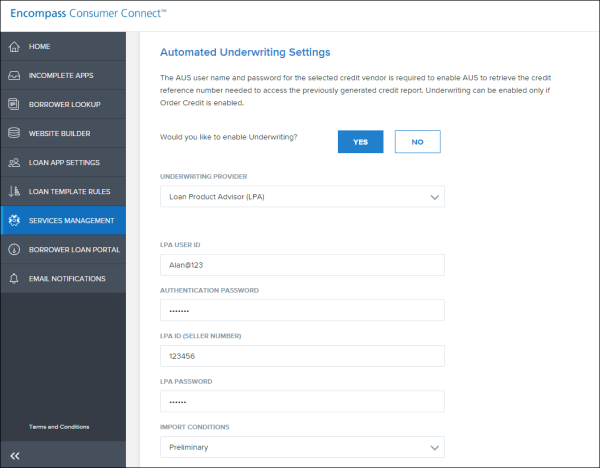

An Encompass Consumer Connect administrator configures the underwriting feature from the Services Management page in the Encompass Consumer Connect administration portal.

To successfully run a preliminary underwriting report, make sure the following requirements are met:

- The Order Credit, EPPS, and Automated Underwriting services must be enabled in Encompass Consumer Connect administration portal.

To learn how to enable these services, see Manage Services.

- Your organization must have an existing account with either Freddie Mac LPA or Fannie Mae Desktop Underwriter (DU). You'll need your organization's login credentials to complete the setup.

- The borrower must complete all the fields in the application that are required to trigger the automated underwriting service. In addition, the borrower must choose to Order Credit, Get Rate Results, and select a Rate.

When these requirements are met, the loan data is automatically submitted to the underwriting service (DU or LPA) and results are saved to the eFolder in Encompass.

To Set Up LPA as the Automated Underwriting Service:

-

In the Encompass Consumer Connect administration portal, click Services Management.

- Click Automated Underwriting Settings.

- Click Yes to enable automatic underwriting.

- Select an underwriter provider. You must have an account already set up with the underwriter provider you select.

-

Enter login credentials for the underwriter provider.

For Desktop Underwriting (DU):

- Enter the Lender Institution ID, user name and password for DU. Make sure to enter the user name and password designated by your company for use with Encompass Consumer Connect requests.

- Enter the user name and password for the underwriter provider to use to connect with the credit vendor you specified in the Credit Ordering settings. The underwriter provider uses these credentials to retrieve the credit reference number so that the service can access the previously generated credit report.

For Loan Product Advisor (LPA):

- Enter the LPA User ID and Authentication Password. Make sure to enter the user ID and password designated by your company for use with Encompass Consumer Connect requests.

- Enter the LPA ID (Seller Number) and LPA Password to use to connect with the credit vendor you specified in the Credit Ordering settings. The underwriter provider uses these credentials to retrieve the credit reference number so that the service can access the previously generated credit report.

- Select the import conditions you want to use.

- Select Preliminary to import automatic underwriting conditions to the Encompass eFolder's Preliminary Conditions tab.

- Select Underwriting to import automatic underwriting conditions to the eFolder's Underwriting Conditions tab.

- To submit FHA loans to automatic underwriting, either the FHA Lender ID or the Sponsor ID and Sponsor Originator EIN must be provided. If you provide information for all of these fields, only the FHA Lender ID will be used.

- Click Save.

CND-760

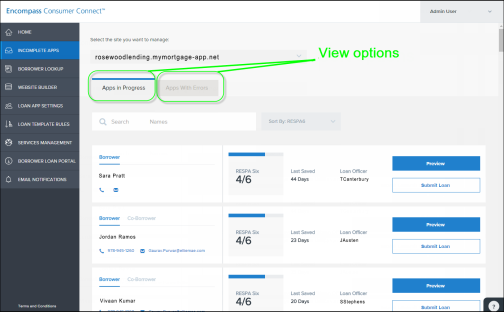

Encompass Consumer Connect administrators can now view all incomplete applications for a selected site ID and organization. Previously, administrators could view only the loans to which they were assigned.

On the Incomplete Applications page, you can view:

- Apps in Progress - Displays all incomplete applications started on the site and includes the name of the loan officer who is assigned to the loan. Administrators can preview and convert an application into a loan in Encompass by submitting it. When submitted to Encompass, the loan is saved in the loan officer's loan folder in Encompass.

- Apps with Errors - Displays all applications that failed to submit to Encompass from the site. Administrators can view error messages associated with the application and resubmit to Encompass. For information about resolving errors, see Encompass Consumer Connect Tips.

To learn more about incomplete applications, see Incomplete Applications .

CLA-2069

Document Management & eSigning Updates

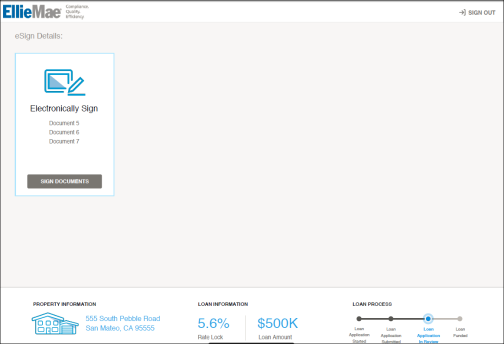

As part of the loan process, loan officers are required to sign documents. When Encompass prompts a loan officer to eSign a document, the loan officer can eSign at that time or can choose to eSign later. When choosing to sign later, Encompass sends an email request to the loan officer. The email request contains a link to the loan documents in the Lender eSign portal. The loan officer simply clicks the link and logs into the portal using their Encompass credentials. From here the loan officer can view, print and eSign documents.

Loan officers cannot track packages from this site. Documents on the site can only be accessed via the links provided in email requests.

CLA-2070

Your business partners such as realtors, attorneys, and other non-Encompass users can contribute to a loan file using Encompass Loan Connect. When you request documents from a business partner, Encompass sends a notification email to your business partner. The email contains a link to the loan file in Encompass Loan Connect. Your business partner will create an account in Encompass Loan Connect and sign in to complete loan tasks.

Encompass Loan Connect replaces the Encompass Loan Center for Consumer Connect loans. Loan Center will continue to be available while older loans are still being processed. Please inform your business partners to use the site provided in the notification email to contribute to the loan, whether it points to Loan Center or Loan Connect.

Features available in Loan Connect include:

- To-Do lists (pending and completed)

- Upload documents

- View uploaded documents

- View notifications

- Manage account

For detailed procedures, see the following topics:

Upload Documents with Loan Connect

CBP-1720