Feature Enhancements in Version 18.3

Support for Know Before You Owe 2 Mortgage Disclosure Updates

Why we made these updates: The following updates are being made to support the Consumer Financial Protection Bureau (CFPB) Know Before You Owe 2 (KBYO2) rule changes to the RESPA-TILA Integrated Mortgage Disclosure Rules that go into effect with new applications taken on or after October 1, 2018. These are mandatory updates needed to remain compliant with disclosure requirements.

Updates are being made to the Loan Terms table and Projected Payments table on the Loan Estimate Page 1 and Closing Disclosure Page 1 input forms to support updated disclosure requirements for construction and construction-to-permanent loans. These include:

-

Adjustments in the Monthly Principal and Interest section on the Loan Terms table to support disclosure updates for construction and construction-to-permanent loans using the Method A (Half Loan) option for the estimated interest.

-

Updates to the Projected Payments table to support updates in the way escrow is disclosed when it is imposed during the construction or permanent phase of a construction-to-permanent loan.

CBIZ-12507

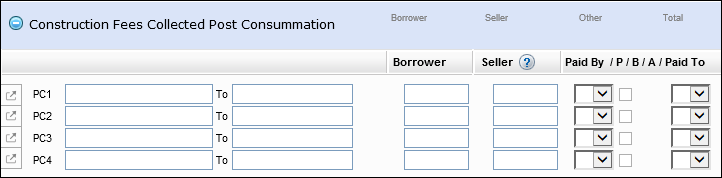

A new Construction Fees Collected Post Consummation section has been added to the bottom of the 2015 Itemization input form to display construction fees that are collected after closing. This section displays only when Construction or Construction-Perm is selected for the Purpose of Loan (field ID 19).

Because these fees are not collected at closing, they do not impact Cash to Close calculations on the Loan Estimate and Closing Disclosure. They are included in the total of payments and APR calculations and are subject to tolerance depending on the category in which they are disclosed.

The section includes four lines labeled PC1 through PC4. Each line has fields for entering the fee description, the fee recipient, and the fee amounts paid by the Borrower and Seller. Each entry also includes a Paid By and Paid To dropdown list, and a P checkbox that indicates whether the fee is paid outside closing. The checkbox is selected by default when an amount is entered in the Borrower field.

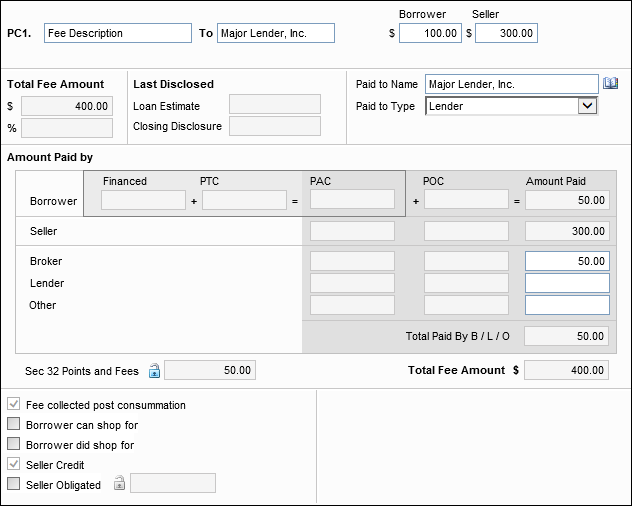

The Fee Details windows for lines PC1–PC4 also includes a Fee collected post consummation checkbox that is always selected by default for these fees.

Only the following fields are editable in the Fee Details windows for these fees:

-

All the fields in the top row.

-

The Borrower and Seller amounts are copied to the borrower and seller rows in the Amount Paid column in the Amount Paid By section.

-

The Paid to Name and Paid To Type fields

-

In the Amount Paid By section, when a Borrower amount is entered, the Broker, Lender, and Other fields in the Amount Paid column can be edited.

Amounts entered for Broker, Lender, and Other are subtracted from the Borrower amount.

-

The Borrower can shop for, Borrower did shop for, and Seller Obligated fields on the lower-left.

When B, L, or O (Broker, Lender, or Other) is selected from the Paid By dropdown list on the 2105 Itemization input form, the borrower portion is populated in the Borrower amount at the top of the Fee Details window, but the Borrower Amount Paid field is cleared, and the fee amount is populated in the appropriate Amount Paid field for the Broker, Lender, or Other.

The following logic is used to categorize the PC1-PC4 fees on the Fee Variance Worksheet without affecting the Cash to Close amounts:

-

Fees are classified as Can Change when the borrower can and did shop for the service.

-

Fees are classified as Cannot Increase when the borrower cannot and did not shop for the service.

-

Fees are classified as Cannot Increase when the borrower can shop, but did not shop for the service and the fee is paid to the Lender, Affiliate, Broker, or Investor.

-

Fees are classified as Can Increase More than 10% when the borrower can shop, but did not shop for the service and the fee is not paid to the Lender, Affiliate, Broker, or Investor.

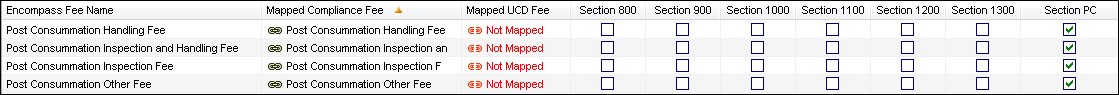

The post-consummation construction fees are also available in the Itemization Fee Management setting and can be added to Closing Costs templates.

CBIZ-14291, CBIZ-14296, CBIZ-15785, CBIZ-17848

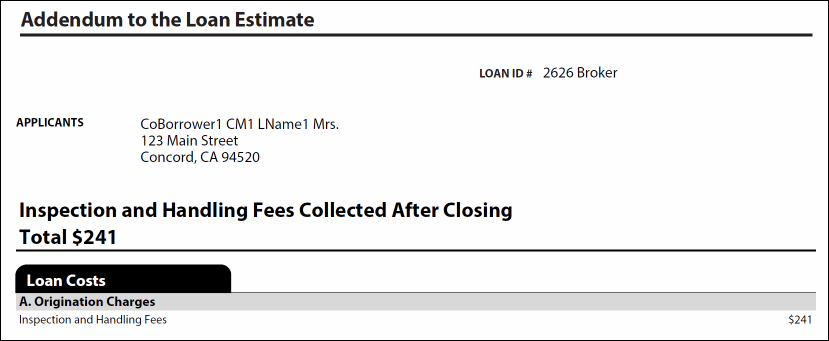

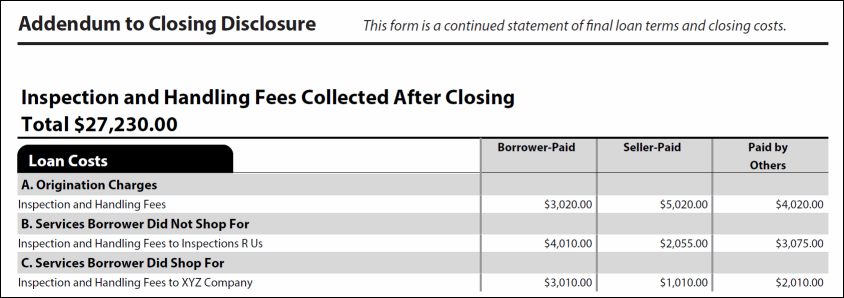

Support is being added for post-consummation fees for construction loans. Construction inspection and handling fees collected at or before consummation will now be disclosed in the Loan Costs table. Construction inspection and handling fees collected post-consummation will be disclosed on an addendum.

For additional information about how to configure these compliance fees when running Encompass Compliance Service tests, refer to the release notes for the Encompass Compliance Service July 2018 Major Release when the release notes are available later in July.

CBIZ-14286

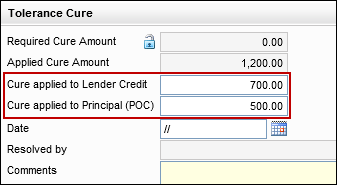

Updates have been made to support applying a tolerance cure in one of two ways:

-

As a Lender credit

-

As a post-consummation principal reduction paid outside closing (POC).

These types of cures are managed from the Fee Variance Worksheet, where the following two new fields are being added to enter principal reduction adjustments:

-

Cure applied to Lender Credit (field ID FV.X396)

-

Cure applied to Principal (POC) (field ID FV.X397)

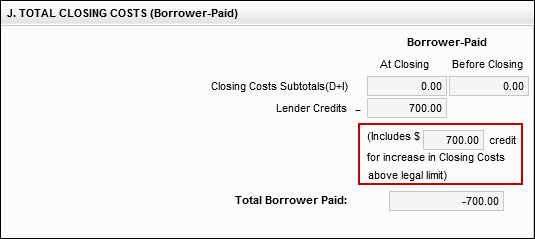

Tolerance Cure as a Lender Credit

If a lender is providing a lender credit to the consumer for the excess amount, the lender must disclose the lender credit on the Closing Disclosure Page 2. The credit is included in the cash to close calculation. The cure is managed from the Fee Variance Worksheet, where the following field is being added to enter principal reduction adjustments as a lender credit:

-

Cure applied to Lender Credit (field ID FV.X396)

The amount is disclosed on the Closing Disclosure Page 2, where a new field (field ID CD2.X2) has been added to capture the additional lender credits used to offset the increase in closing costs above the legal limit. The amount is also recorded in the CD snapshot.

Tolerance Cure as a Principal Reduction

If a lender is reducing the amount of the principal to offset the excess amount, the lender provide a statement informing the borrower that the lender is providing a principal reduction to offset the charges that exceed the legal limit. Post-consummation principal reduction adjustments are handled as a paid outside closing (POC) fee that is not included in the cash to close calculation. However, the cure amount is disclosed through the Closing Disclosure (standard and alternate versions) to satisfy disclosure guidelines set out in Know Before You Owe (KBYO) regulations.

The cure is managed from the Fee Variance Worksheet, where the following new field is being added to enter principal reduction adjustments as a paid outside closing (POC) fee:

-

Cure applied to Principal (POC) (field ID FV.X397)

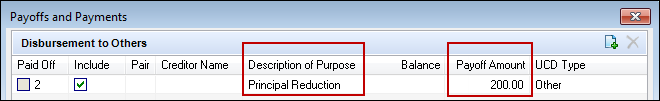

When a post-consummation principal reduction cure is entered as a Cure applied to Principal (POC) on the Fee Variance Worksheet, a non-VOL principal reduction entry is automatically added on the Payoffs and Payments table. When the cure amount is updated or removed on the Fee Variance worksheet, Encompass updates or deletes the non-VOL record for the principal reduction cure on the Payoffs and Payments table.

Prior to Encompass 18.3, Encompass users could add a principal reduction directly. The reduction was not a cure, and the reduction amount was included in the cash-to-close calculation.

If you utilize the Encompass Software Development Kit (SDK) to populate a value to the Cure applied to Principal (POC) field (field ID FV.X397) on the Fee Variance Worksheet, an additional call is now required in order for this value to automatically copy over to Section K on the CD Page 3. After the FV.X397 value is set, call the calculation using the “COPYLIABILITIESTOCDPG3” option in the ExecuteCalculation method. Here is some sample code:

//create a new loan with firstname & last name

string LoanGuid = "{e96050d4-5a62-49c2-9917-e667cfb1594d}";

private static Loan loan = session.Loans.Open(LoanGuid);

loan.Fields["FV.X397"].Value = 3100;

loan.ExecuteCalculation(CalculationTriggerOptions.Calculation_COPYLIABILIESTOCDPG3);

CBIZ-15817, CBIZ-13859

Updates have been made in the functionality for entering a principal reduction that is not being used to cure a fee tolerance violation pursuant to Know Before You Owe 2 final comment 38-4, which provides that the disclosure of a non-cure principal reduction must include:

-

The amount of the principal reduction.

-

The phrase principal reduction or a similar phrase

-

The name of the payee (for a principal reduction disclosure under § 1026.38(t)(5)(vii)(B) only).

-

For amounts paid outside closing, the phrase “Paid Outside of Closing” or “P.O.C.” and the name of the party making the payment.

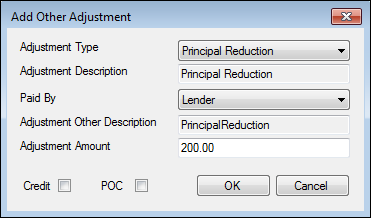

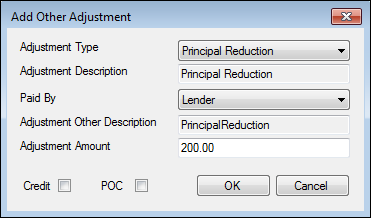

To support non-cure, non-VOL principal reductions, the following updates have been made on the Payoffs and Payments window that is accessible by clicking the Payoffs & Payments button on the Loan Estimate Page 2 and the Closing Disclosure Page 3 input forms.

For loans using standard disclosures:

-

A new Add icon displays on the upper-right of the Payoffs and Payments Table.

-

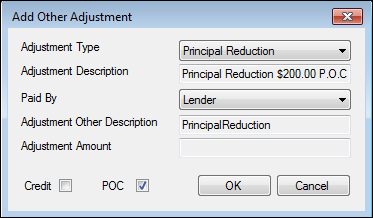

Click the icon to open the Add Other Adjustment window.

-

In the window, Principal Reduction is already populated in the Adjustment Type, Adjustment Description, and Adjustment Other Description fields. These fields cannot be edited.

-

Encompass users can enter an Adjustment Amount and can select a Paid By option from the list.

-

checkboxes on the lower-left can be used to indicate whether the reduction is a Credit or is POC (Paid Outside Closing).

-

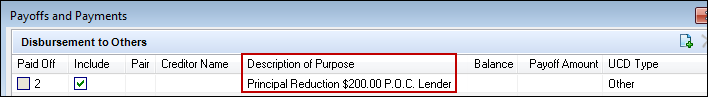

When the POC checkbox is cleared, the principal reduction is added to the Payoffs and Payments table with the Description of Purpose and the Payoff Amount listed in their own columns.

-

When the POC checkbox is selected, the Adjustment Amount field is cleared and the Adjustment Description field includes the words Principal Reduction followed by the principal reduction amount, the letters P.O.C., and the Paid By selection. On the Payoffs and Payments table, this information is populated to the Description of Purpose field, and the Payoff Amount column is cleared.

For loans using alternate disclosures:

-

The Add button on the upper-right of the Payoffs and Payments Table has been replaced with an Add icon.

-

Click the icon to open the Add Other Adjustment window.

-

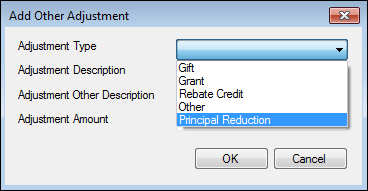

In the window, a Principal Reduction option has been added to the Adjustment Type dropdown list.

-

-

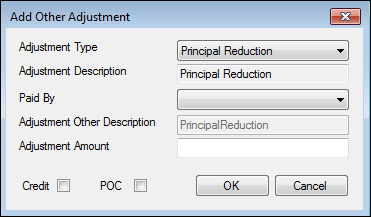

When Principal Reduction is selected from the list, a new set of fields and options display on the window.

-

Principal Reduction is already populated in the Adjustment Type, Adjustment Description, and Adjustment Other Description fields.

-

Encompass users can revert to the original options for the window by selecting a different Adjustment Type.

-

For Principal Reduction entries, the remaining fields and checkboxes on the window (and the logic for populating the entries to the Payoffs and Payments table) function as described above for loans using standard disclosures.

CBIZ-14656

Updates have been made to the calculations used to populate the total payment amounts in the In 5 years Total you will have paid field (field ID LE3.X17) on the Loan Estimate Page 3 and the Total of Payments field (field ID CD5.X1) on the Closing Disclosure Page 5. The calculation for both fields is being updated to include post-consummation construction fees (for construction and construction-to-permanent loans) that are the responsibility of the borrower. The calculation for the Total of Payments field is also being updated to use only the borrower-paid portion of fees from sections F. Prepaids and G. Initial Escrow Payment at Closing on the Closing Disclosure Page 2.

CBIZ-12508, CBIZ-16130

To comply with Know Before You Owe 2 (KBYO2) guidelines for construction and construction-to-permanent loans that use Method A for the estimated interest, updates have been made to the Adjustable Payments (AP) Table on the Loan Estimate Page 2 and Closing Disclosure Page 4 input forms.

Construction Loans

When the Purpose of Loan (field ID 19) is Construction, the following content is populated to the Adjustable Payments (AP) Table:

-

The Interest Only Payments? (field ID CD4.X23) is populated with Yes and the payments (field ID CD4.X46) is populated with the value from the construction Period (field ID 1176) minus 1 month.

-

In the Monthly Principal and Interest Payments section:

-

The First Change/Amount (field ID CD4.X30) is populated with 1st Payment.

-

The Subsequent Changes (field ID CD4.X33) is populated with Every Payment.

-

The Maximum Payment (field ID CD4.X34) is populated with the disclosed the loan amount plus the final interest payment, followed by starting at, followed by the value from the construction Period (field ID 1176).

-

When updating to Encompass 18.3, if an existing construction loan using Method A has already been disclosed, the fields for Interest Only Payments? (field ID CD4.X23), First Change/Amount (field ID CD4.X30), Subsequent Changes (field ID CD4.X33), Maximum Payment (field ID CD4.X34), and the number of interest-only payments (field ID CD4.X46) are locked and are not updated.

Construction-to-Permanent Loans

When the Purpose of Loan (field ID 19) is Construction-Perm, in the Monthly Principal and Interest Payments section:

-

The First Change/Amount (field ID CD4.X30) is populated with 1st Payment.

-

The Subsequent Changes (field ID CD4.X33) is populated with Every Payment.

When updating to Encompass 18.3, if an existing construction-to-permanent loan using Method A loan has already been disclosed, the First Change/Amount (field ID CD4.X30), Subsequent Changes (field ID CD4.X33), and Maximum Payment (field ID CD4.X34) are locked and are not updated.

CBIZ-16791

Updates have been made to the way information is populated to the Loan Terms table on the Loan Estimate Page 1 and the Closing Disclosure Page 1 for construction and construction-to-permanent loans when Method A is selected as the Est. Interest On option (field ID SYS.X6).

-

For non-ARM construction loans, Yes is now populated for the Can this amount increase after closing? dropdown list for the Monthly Principal & Interest. Prior to Encompass 18.3, No was populated in this field.

-

For construction and construction-to-permanent loans, the first bulleted point for the Monthly Principal & Interest now states that the amount adjusts every Month starting in Month 1.

CBIZ-16262

A change is being made in the way estimated escrow displays on the Projected Payments Table on input forms such as the Loan Estimate Page 1 and the Closing Disclosure Page 1 for some construction-to-permanent loans. When escrow is not imposed during the construction phase, and the permanent phase is NOT disclosed in the first column, Encompass now displays a dash (-) instead of a zero (0) for Estimate Escrow in the first column of the table. This change occurs when all of the following conditions are true:

-

The Purpose of Loan (field ID 19) is Construction-Perm.

-

Construction Loan Term (field ID 1176) is 12 or 24.

-

The Escrow First Payment Basis (field ID HUD69) is 1st Amort Date

CBIZ-14661

For loans created or disclosed after updating to Encompass 18.3, the Prepaid Property Taxes/Other fees are now being recorded in the Charges that Can Change section on the Fee Variance Worksheet. This conforms to KBYO guidelines that state that fees from lines 904 and 907-912 on the 2015 Itemization input form can change from a fee variance perspective and are deemed in good faith if they are bona fide and disclosed properly.The following updates have been made to the Fee Variance Worksheet tool to accommodate moving the Prepaid Property Taxes/Other Fees to the Charges that Can Change section.

-

Amounts from lines 904 and 907-912 on the 2015 Itemization are now listed in the Charges that Can Change section on the Fee Variance Worksheet. These fee descriptions and amounts should appear in alphabetical order based on the fee description on the Fee Variance worksheet in the Can Shop For section.

-

In the Charges that Cannot Increase section, updates have been made to the calculations for line F4. Prepaid Property Taxes/Other for Initial LE (field ID FV.X370), LE Baseline (field ID FV.X371), CD Baseline (field ID FV.X372), and Itemization (field ID FV.X373) to exclude the fees from lines 904 and 907-912.

-

Change must impact only loans that have creation dates after the installation date of the new feature on the lender's Encompass Instance

These updates apply to loans created after updating to Encompass 18.3. The existing logic for prepaid property taxes and other fees is retained for loans created prior to updating to Encompass 18.3, however the updates will apply to existing loans that meet both of the following criteria:

-

Prior to the Encompass 18.3 update, the loan had no disclosure tracking history or no values entered on line F4 on the Fee Variance Worksheet (fields IDs FV.X370, FV.X371, FV.X372, or FV.X373).

-

After the update, a fee amount is entered in any of the affected fee lines (904 or 907-912).

Workaround Information:

The following workaround was provided for this production issue and is no longer required for Encompass 18.3 and later.

-

In the Fee Details window on the 2015 Itemization for lines 904 or 907-912, select the Can Shop For checkbox and then select the Property Tax, Homeowner’s Insurance, or Other checkbox. This would move the fee to the Can Change section on the Fee Variance Worksheet.

CBIZ-14246, CBIZ-14247

To enable lenders to select the Closing Date or the First Payment Date as the basis for calculating the escrow costs within the first year, updates have been made to the will have an escrow account section in the Loan Disclosures – Escrow section on the Closing Disclosure Page 4 input form.

A new Escrowed Property Costs Basis dropdown list (field ID CD4.X51) has been added below the Totals row. The dropdown list contains two options:

-

Consummation Date

-

1st Payment Date

When Consummation Date is selected, escrowed costs within one year are calculated from Closing Date (typically 10 or 11 payments). If First Payment Date is selected, escrowed costs within one year are calculated from First Payment Date (typically 12 or 13 payments). The default selection is Consummation Date.

Additionally, two field names have been updated:

-

The Escrowed property costs within 1 year of Consummation field has been renamed Escrowed property costs within 1 year (field ID CD4.X40).

-

The Non-Escrowed property costs within 1 year of Consummation field has been renamed Non-Escrowed property costs within 1 year (field ID CD4.X41).

When updating to Encompass 18.3, if an existing loan has already been disclosed, the Total Escrowed property costs over year 1 (field ID HUD66), Total Non-Escrowed property costs over year 1 (field ID HUD67), Escrowed property costs within 1 year (field ID CD4.X40), Non-Escrowed property costs within 1 year (field ID CD4.X41), Monthly Escrow Payment (field ID CD4.X10), and the will have an escrow account checkbox (field ID CD4.X9) are locked and are not updated.

CBIZ-15693

The following escrow calculations on the Closing Disclosure Page 4 input form in Encompass are being updated to include the USDA annual fee (for USDA loans), monthly mortgage insurance (for monthly loans), and biweekly mortgage insurance (for biweekly loans):

-

Total Escrowed Property Costs over Year 1 (field ID HUD66)

-

Escrowed property costs within 1 year (of consummation or 1st payment date) (field ID CD4.X40)

-

Monthly Escrow Payment (field ID CD4.X10)

Additionally, the will have an Escrow Account or will not have an Escrow Account checkbox (field ID CD4.X9) is now selected based on the Escrowed Payment (field ID HUD24) on the Aggregate Escrow Account input form.

When updating to Encompass 18.3, if an existing loan has already been disclosed, the Total Escrowed property costs over year 1 (field ID HUD66), Total Non-Escrowed property costs over year 1 (field ID HUD67), Escrowed property costs within 1 year (field ID CD4.X40), Non-Escrowed property costs within 1 year (field ID CD4.X41), Monthly Escrow Payment (field ID CD4.X10), and the will have an escrow account checkbox (field ID CD4.X9) are locked and are not updated.

CBIZ-15105, CBIZ-14112

To adhere to KBYO2 guidelines, Encompass is adding support for non-borrowing owners (for example, title-only spouses). Prior to Encompass 18.3, a workaround was necessary in which non-borrowing owners were added to a loan as co-borrowers prior to sending eDisclosures, and were then removed from the loan before drawing the closing documents to ensure that the non-borrowing owners were not included in the vesting forms. To support non-borrowing owners, the following features are being added to Encompass 18.3.

CBIZ-15633

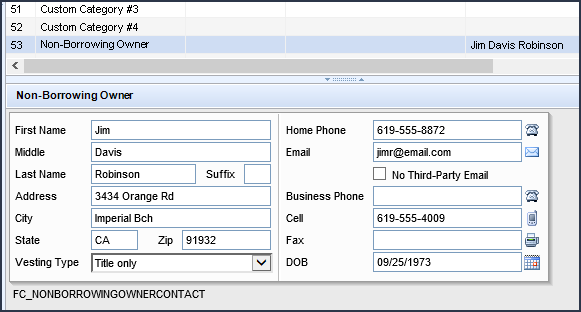

The File Contacts tool has been updated to provide an Add icon and a Delete icon to enable users to add (and delete if necessary) a non-borrowing owner file contact. When you click the Add icon, a blank non-borrowing owner contact is added to the end of the File Contacts list. For each non-borrowing owner contact that is added, you can enter their name, mailing address, phone numbers, email address, and date of birth. The Vesting Type dropdown list provided in the non-borrowing owner contact (field ID NBOC0109) lists the following options to define the Vesting Type used for the non-borrowing owner on vesting forms:

-

Title Only

-

Title Only Trustee

-

Title Only Settlor Trustee

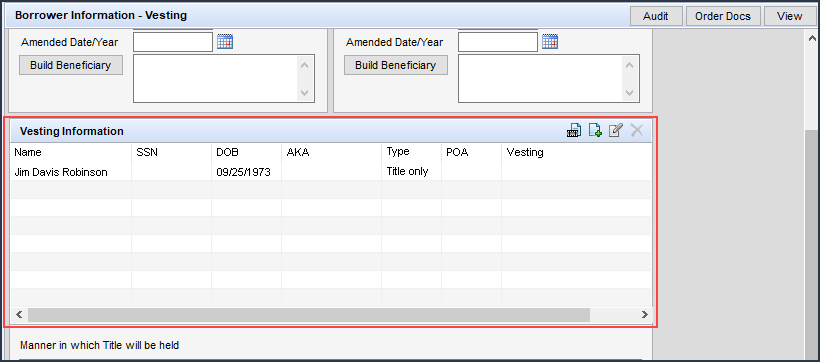

Creating a non-borrowing owner file contact automatically populates vesting information for the contact on the Borrower Information – Vesting input form and places the non-borrowing owner in the correct workflow when generating disclosures and closing documents so that they are automatically set up to be sent to the non-borrowing owner file contact. Non-borrowing owners receive the following closing disclosure forms: Closing Disclosure, Closing Disclosure (Alternate), and Acknowledgment of Receipt of Closing Disclosure.

In Encompass 18.3 and later, it is important to always add non-borrowing owners via the File Contacts tool. When a non-borrowing owner is added via the Borrower Information - Vesting form, the eFolder functionality is disabled for the borrower.

To Add a Non-Borrowing Owner File Contact:

- Open a loan, click the Tools tab, and then click File Contacts.

- In the File Contacts header, click the Add icon.

- A Non-Borrowing Owner file contact is added to the end of the File Contacts list. When you click this file contact, a Non-Borrowing Owner contact record displays in the lower panel.

- In the lower panel, enter the non-borrowing owner’s name, contact information, vesting type, email address, and date of birth.

CBIZ-15634, NICE-7988

After adding a non-borrowing owner in the File Contacts tool, the contact is automatically copied to the Vesting Information section of the Borrower Information - Vesting form. (A minimum of the first name, last name, and vesting type must be provided in the non-borrowing owner file contact record in order for the non-borrowing owner information to copy to the Vesting Information section of the form.) Considering that the disclosures process is driven based on borrower pairs, the non-borrowing owners need to be associated to a borrower pair so they can be included in the disclosure process. By default, Encompass associates the non-borrowing owner from the File Contacts tool to the first borrower pair. You can update this association on the Borrower Information – Vesting form as needed.

To edit the Vesting Information for a non-borrowing owner contact, double-click the contact and then edit the information. Edits to the contact name in the Vesting Information entry are not copied back to the File Contacts tool. Edits to the contact’s date of birth and the Vesting Type are copied back to the File Contacts tool.

As mentioned earlier, prior to Encompass 18.3 a workaround was necessary in which non-borrowing owners were added to a loan as co-borrowers prior to sending eDisclosures, and were then removed from the loan before drawing the closing documents to ensure they were not included on the vesting forms. For existing loans created in earlier versions of Encompass where a non-borrowing owner was added to the file through this workaround, the non-borrowing owner will not be automatically indicated as a Non-Borrowing Owner in the File Contacts tool and they will not be automatically included in the correct workflow when generating disclosures and closing documents (as discussed in the eFolder Support for Non-Borrowing Owners section below). In order to take advantage of these new features, delete the non-borrowing owners from the Borrower Information – Vesting input form that were added using the workaround, and then add them to the loan file via the File Contacts tool as described in the New Non-Borrowing File Contacts section above.

Note that you can still use the Add icon provided in the Vesting Information section of the Borrower Information – Vesting input form to add title-only borrowers to the loan. However, these borrowers will not be automatically included in the correct workflow when requesting eConsent approval and generating disclosures and closing documents, nor will they inherit any of the other new functionality that is now provided for non-borrowing owners starting in Encompass 18.3.

CBIZ-15639, CBIZ-17424, NICE-7988, NICE-10036

For piggyback loans and construction-to-permanent loans that are linked, when a non-borrowing owner is attached to the primary loan file, the non-borrowing owner file contact fields and the fields on the Borrower Vesting pop-up window on the Borrower Information – Vesting input form are synchronized on the linked loans.

CBIZ-16821

For consistency, Vesting Type is now being used for the labels on the dropdown lists that are used to configure the vesting type on the three Borrower Summary forms. Previously, Type was used on the Borrower Summary - Origination and Borrower Summary - Processing input forms, and Borrower Type was used in the Vesting pop-up window on the on the Borrower Information - Vesting input form.

CBIZ-16785

Updates have been made to the Electronic Document Management features in the eFolder to enable Encompass users to select non-borrowing owners as recipients on the Send windows for the following features in the Encompass eFolder:

-

Requesting eConsent

-

Requesting documents

-

Sending eDisclosure packages

-

Sending files to a borrower or partner

-

Sending Status Online updates to borrowers or partners

On rescindable transactions, all parties, including non-borrowing owners receive separate copies of the Closing Disclosure.

Additionally, the tracking records created in the Disclosure Tracking tool for eConsent requests, eDisclosure packages, and pre-closing packages will include the non-borrowing owners. In addition to loans originated in Encompass, the non-borrowing owner updates in the Disclosure Tracking tool take into consideration loans originated from Encompass WebCenter and Encompass Consumer Connect websites.

- Disclosure Details – Details Tab – The Details tab in the Disclosure Details window that provides tracking information about specific disclosure entries has been updated for loans with at least one non-borrowing owner. For these types of loans, a new Select Disclosure Recipient dropdown list is provided at the top of the window where you can select the borrower(s) or non-borrowing owner(s) for the loan to view their disclosure tracking information. (This dropdown is provided for Loan Estimate and Closing Disclosure tracking entries.) The borrower(s) or borrower pairs for the loan are listed first, followed by the non-borrowing owner(s), in the dropdown list. When a non-borrowing owner is selected, the right panel displays information about how and when the non-borrowing owner received disclosures.

![]()

-

Disclosure Details - eDisclosure Tracking tab – Like the Details tab, the eDisclosure Tracking tab now also includes a new Select Disclosure Recipient dropdown list for loans with non-borrowing owners. For these types of loans, you can select the borrower(s) or non-borrowing owner(s) for the loan from this dropdown to view the dates when the loan party took action on the selected eDisclosure package and details about the latest eDisclosure Fulfillment Service package that was printed and sent to the borrower(s) or non-borrowing owner(s) (if applicable). (This dropdown is provided for Loan Estimate and Closing Disclosure tracking eDisclosure entries.) The borrower(s) or borrower pairs for the loan are listed first, followed by the non-borrowing owner(s), in the dropdown list. When a non-borrowing owner is selected, the pertinent dates when the non-borrowing owner took action are displayed.

- eConsent Status - The eConsent date (field ID 3983) in the Compliance Timeline is automatically populated when all the parties of the Send eConsent Request have accepted the eConsent agreement. This field logic now includes non-borrowing owners who have accepted the eConsent agreement. To view the eConsent status of the loan parties, click the Lookup icon (magnifying glass) next to the eConsent date field. The Status for non-borrowing owners in the loan is now included in the eConsent Status window. (Before borrowers can receive loan documents electronically, they must review and accept the eDisclosures Agreement. Borrowers, and now non-borrowing owners, can then grant or decline the eConsent request. Once they accept and return the eDisclosures Agreement, the eConsent Status field is set to Accepted.)

EDM-18918, NICE-8669, NICE-8825, NICE-8814, NICE-8857, NICE-10342

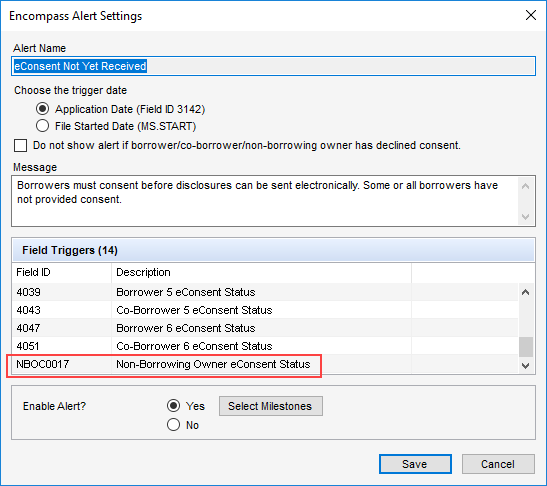

The eConsent Note Yet Received alert is intended to notify you when you have not yet received consent to receive electronic disclosures (eConsent) from all applicable parties. This helps ensure you receive eConsent before sending the disclosures electronically. The settings for this alert have been updated to consider non-borrowing owners so that the alert will trigger based on the non-borrowing owner eConsent Status field (field ID NBOC0017) and alert you if eConsent has not yet been received from non-borrowing owners in the loan prior to sending eDisclosures.

In the alert details provided when the alert is viewed by a loan team member, the trigger field ID for the non-borrowing owner’s eConsent status (NBOC0[x]17; where [x] denotes the incremented count of each non-borrowing owner in the loan file), a description for each non-borrowing owner included in the loan (default, cannot be modified), the non-borrowing owner’s name (as indicated in the File Contacts tool), and the current eConsent status for the non-borrowing owner.

Also, when viewing the alert details, you can click the View eConsent button to check the status of the borrower’s eConsent to receive loan documents electronically. (Before borrowers can receive loan documents electronically, they must review and accept the eDisclosures Agreement. Borrowers, and now non-borrowing owners, can then grant or decline the eConsent request. Once they accept and return the eDisclosures Agreement, the eConsent Status field is set to Accepted.) This eConsent Status window has been updated to include non-borrowing owners in the loan.

NICE-7997, NICE-8190, NICE-8825

The following additional resources are also available for the Non-Borrowing Owners feature:

New Change of Circumstance Fee-Level Management

Why we made this enhancements: These enhancements enable clients to meet regulator expectations for receiving fee level changes as part of the electronic examination process.

Several new enhancements have been added to Encompass to enable clients to document changed circumstances at a more granular fee level (i.e., redisclose any time a 2015 Itemization fee is changed or added.) These enhancements include updates to input forms and tools, as well as updates to administrative settings.

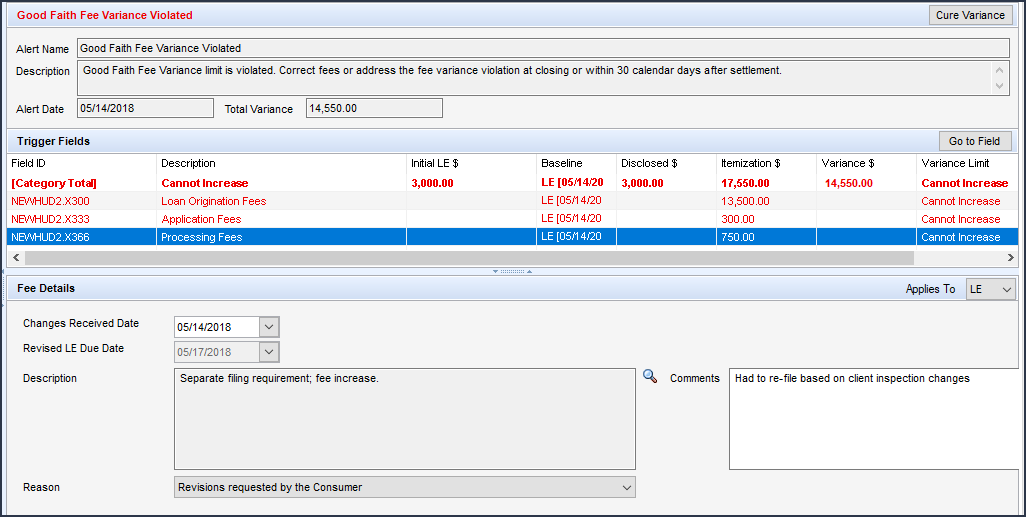

This new fee-level change of circumstance workflow starts with the Good Faith Fee Variance Violated alert that is generated when a fee is changed that results in a variance between the Loan Estimate or Closing Disclosure and the 2015 Itemization calculated in the Total Good Faith Amount section of the Fee Variance Worksheet. When this alert is triggered, users can now view the alert details and use the new Fee Details section to enter all the details about the changed fee, including the changed circumstance date and the revised LE or CD due date. The changed circumstance details entered in the alert are then automatically populated to the applicable fields in the LE Page 1 and CD Page 1, along with applicable areas in the Disclosure Tracking tool. These details must be entered in the alert- they cannot be entered directly on the LE Page 1, CD Page 1, or Disclosure Tracking tool.

All of the Change of Circumstance enhancements described in the following entries are provided for use with 2015 loans only, and not 2010 loans. This determination is based on the version of the forms being used for the loan. (To view the version of the forms a loan is using, go to Forms > RESPA-TILA Forms Version. “2015 loans” use the RESPA-TILA 2015 LE and CD forms. “2010 loans” us the RESPA 2010 GFE and HUD-1 forms.)

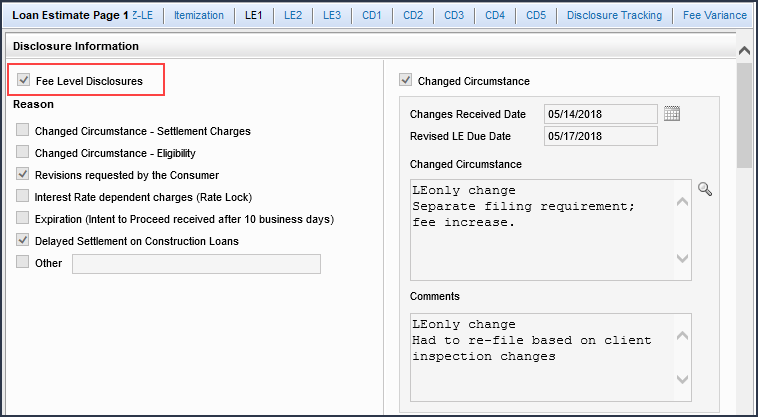

A new Fee Level Disclosures checkbox (field ID 4461) is now provided above the list of changed circumstance reasons on the Loan Estimate (LE) Page 1 and Closing Disclosure (CD) Page 1 input forms. By default, this checkbox is NOT selected which indicates that loans will be disclosed at a disclosure level (just as they were in earlier versions of Encompass). When this checkbox IS selected, fees must be redisclosed at the fee level (i.e., users must send revised disclosures when a fee is changed). In addition, when this checkbox is selected, the disclosure reasons and Changed Circumstance information on the LE Page 1 and CD Page 1 are grayed out (i.e., inactive). These sections will instead be populated with data entered in the Good Faith Fee Variance Violated alert details.

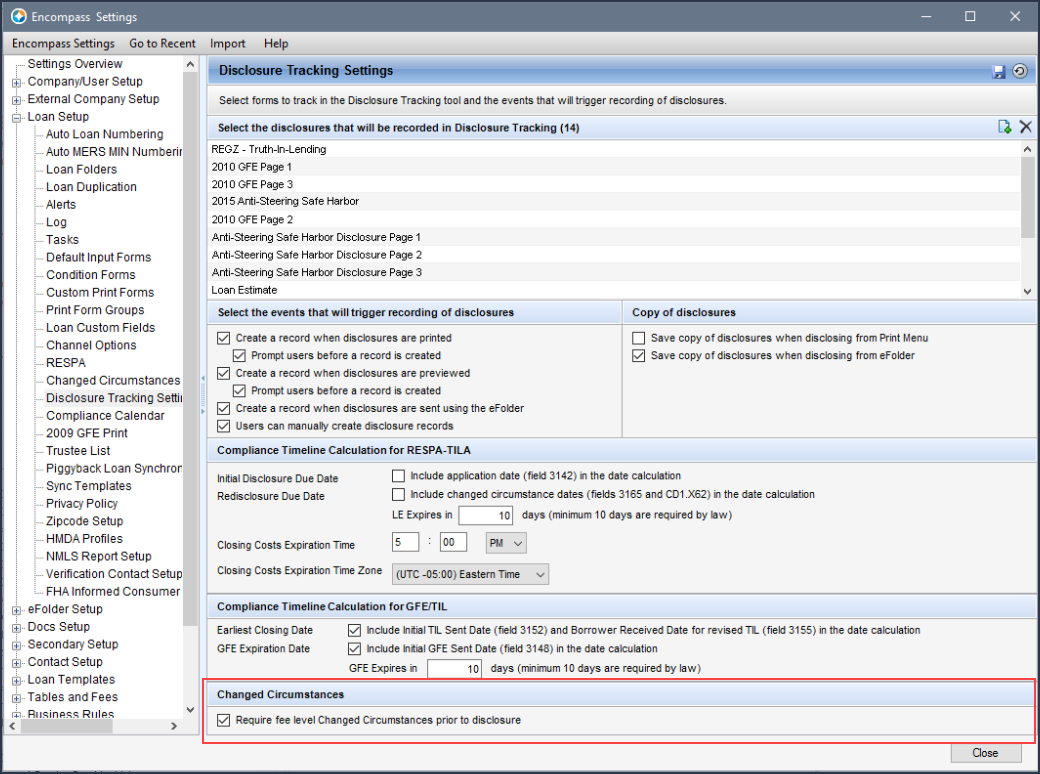

Note that administrators can use the new Changed Circumstances section of the Disclosure Tracking Settings screen to control if this checkbox is selected or not. If the administrator configures this checkbox to be selected, users will not be permitted to change it. Please refer to the Changed Circumstances Option Added to Disclosure Tracking Settings entry below.

It is important to consider that the disclosure level that is set with the Fee Level Disclosures checkbox is established once the initial disclosure (typically the LE) is sent. Once this initial disclosure has been sent, you cannot change the Fee Level Disclosures checkbox. Once you have disclosed at a fee level, you must continue to redisclose at a fee level for the remainder of the loan’s lifecycle (and vice versa if you have initially disclosed at a disclosure level). The Fee Level Disclosures checkbox will no longer be editable (i.e., it will be grayed out) once the loan is disclosed. For loans started in earlier versions of Encompass before this checkbox was available, the checkbox will not be selected.

The Good Faith Fee Variance Violated alert is generated when there is a variance between the LE and the 2015 Itemization in the Total Good Faith Amount section (field ID FV.X345) of the Fee Variance Worksheet or when there is a variance between the CD and 2015 Itemization in the Total Good Faith Amount section (field ID FV.X347) on the worksheet. These alerts display on the Pipeline and the Alerts & Messages tab in the Log, as well as in a pop-up window when you save the loan. Click the alert icon or indicator to view the alert details, including each applicable fee that was changed, and clear the alert. When viewing the alert details, a new Fee Details section is displayed (below the Trigger Fields section) that provides the following information. Here you can enter fee change details about each fee at a granular level:

- Applies To - At the top of this section, select LE or CD from the Applies To dropdown list to indicate the form (LE or CD) where these fee change details will be applied.

- Changes Received Date - Will auto-populate with today's date and reflects the same date used for this field on the LE Page 1 and CD Page 1

- Revised LE Due Date or Revised CD Due Date – In the Fee Details section, you can indicate if the fee change was made on the LE Page 1 or CD Page 1. Depending on the disclosure (as indicated by the selection in the Applies To field), this field will refer to the LE due date or CD due date accordingly. This is read-only field, calculated by the Encompass system.

- Description - Description of the Changed Circumstance (click the Lookup icon (magnifying glass) to select the changed circumstance from the list).

- Comments - Comments related to the Changed Circumstance

- Reason – Select the reason for the change from the dropdown list. There can only be one reason for each fee. This dropdown list provides the same list of reasons that is provided on the LE Page 1 and CD Page 1. Some reasons apply only to the LE, some apply only to the CD, and some apply to both. If LE is selected for the Applies To field, only reasons that apply only to the LE or LE and CD will be displayed in the list. If CD is selected for the Applies To field, only reasons that apply only to the CD or the LE and CD will be displayed in the list.

All of the selections you make here are automatically populated to the Disclosure Information and Changed Circumstance sections on the LE Page 1 and CD Page 1. These sections on the LE Page 1 and CD Page 1 are grayed out (i.e., inactive).

If a loan is being disclosed at a fee level, a Change of Circumstance reason for each fee variance should be documented. Only one reason can be selected for each fee variance. If no reason is selected (reason is blank), it will be considered an invalid reason when calculating the baseline on the Fee Variance Worksheet. As part of this enhancement, the Disclosure Tracking tool has been updated to provide changed fee details.

Disclosure Details – Reasons Tab

Users can double-click an entry listed in the Disclosure History table to view information about the disclosure in the Disclosure Details window. On the Reasons tab in this window, the following updates have been made:

- New Fee Level Disclosures checkbox: If you select this checkbox on the LE Page 1 or CD Page 1, then the Fee Changes table is displayed at the bottom of the Reasons tab, and it is based on the values entered on the LE Page 1 and CD Page 1

- If you are not utilizing the fee level disclosure option, then this Reason tab is displayed as it was in earlier versions of Encompass and operates the same way as well. The difference is the Fee Level Disclosures checkbox will display at the top of the tab.

- Reasons for disclosure are now indicated (i.e., the applicable reason’s checkbox is selected) based on the reason indicated on the LE Page 1 or CD Page 1.

- All individual fee level Changed Circumstances are populated to the Changed Circumstance field (one Changed Circumstance per line)

- All individual fee level Comments are populated to the Comments field

- The date the fee changed and the date when the changes were received can be entered here. The revised LE or CD due date field is automatically populated.

- In the new Fee Changes table, the following details for each fee change are provided. (This is a read only table, and cannot be edited.):

- Fee Description

- New Amount ($)

- Description of change

- Comments (i.e., the fee level comments listed in the Comments field)

- Reason

- Changes Received Date

Note that if the loan is being disclosed at a disclosure level and not a fee level, the Fee Changes table will not display and the remaining sections of the tab will indicate the reason for the disclosure as in earlier versions of Encompass.

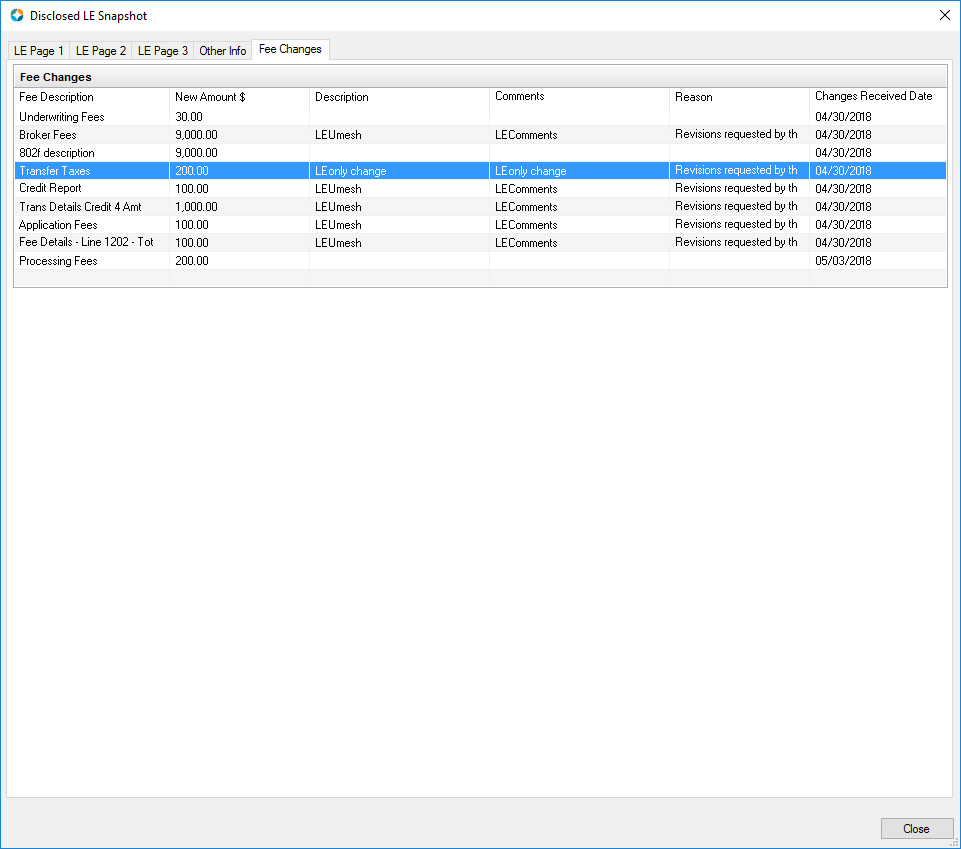

Disclosed LE or CD Snapshot

When viewing the document details for a disclosed LE or CD, you can click the LE Snapshot button or the CD Snapshot button to view a snapshot of the disclosure that includes tabs that show the content from each page of the LE or CD form. A new Fee Changes tab is now provided in the LE and CD snapshots that displays a Fee Changes table that lists the following information:

- Fee Description

- New Amount ($)

- Description (of the change)

- Comments (i.e., the fee level comments listed in the Comments field on the Disclosure Details window’s Reasons tab)

- Reason (for the Change of Circumstance)

- Changes Received Date

A new Changed Circumstances section has been added to the Disclosure Tracking Settings screen. Select the Require fee level Changed Circumstances prior to disclosure checkbox in this section to require Fee Level disclosures to indicate a changed circumstance reason for each revised fee prior to sending a revised disclosure. When this checkbox is selected, the new Fee Level Disclosures checkbox (field ID 4461 on the LE Page 1 and CD Page 1 input forms) will be selected and then cannot be changed by users.

If this checkbox is not selected, authorized users will be permitted to select or clear the Fee Level Disclosures checkbox on the LE Page 1 and CD Page 1 as needed. Note that once the loan’s initial disclosure has been sent, you cannot change the Fee Level Disclosures checkbox. Once you have disclosed at a fee level, you must continue to redisclose at a fee level for the remainder of the loan’s lifecycle (and vice versa if you have initially disclosed at a disclosure level).

This setting will apply going forward for new loans and for loans that do not have a disclosure yet. For loans that already have a disclosure, they will continue to be disclosed at the set disclosure level.

The Fee Variance Worksheet has been enhanced with new logic that determines fee by fee (instead of the current disclosure level method) whether a fee variance will impact the LE and CD baseline calculations based on if the changed circumstance occurred for a valid reason or invalid reason. If the reason is valid, the fee amount will be included in the applicable baseline calculation. If the reason is invalid, the fee amount will not be included.

The LE and CD baseline fields are provided in each section of the Fee Variance Worksheet and calculated accordingly for each section:

- Variance between LE and Itemization

- Difference between LE and CD (Disclosed)

- Variance between CD and Itemization

As part of the new Change of Circumstance workflow, each fee variance will be captured with a reason code. There can be only one reason code per fee. If multiple fees make up one line item on the 2015 Itemization, each fee within the line item will be evaluated individually. The reasons that are considered valid or invalid have not changed from earlier versions of Encompass.

Note if a reason for the change of circumstance is not provided, it is considered an invalid reason. This new fee by fee logic is applied only when the new Fee Level Disclosures checkbox (field ID 4461) above the changed circumstance reasons on the Loan Estimate (LE) Page 1 and Closing Disclosure (CD) Page 1 input forms is selected.

NICE-7201

Compliance Updates

Updates have been made in Encompass to support a final rule change in the Consumer Financial Protection Bureau (CFPB) Know Before You Owe (KBYO) limitations on resetting fee tolerances when redisclosing on a Closing Disclosure relative to the consummation date. Previously, the system would allow a lender to use a Closing Disclosure to reset fee tolerances only if the initial Closing Disclosure’s Closing Date was no more than seven (7) business days later than the CD Issue Date (field ID 3977). This period of time has been referred to as a “gap” or “black hole” by industry participants. The final rule, effective as of June 1, 2018, provides that lenders may use the Closing Disclosure to reflect changes in costs if an estimated closing cost was disclosed in good faith, regardless of when the Closing Disclosure was provided relative to consummation. Encompass will apply this updated rule to all loans that have a Closing Date (field ID 748) of 6/1/2018 or later.

Based upon the final rule, Encompass and the Encompass Compliance Service (ECS) have been updated to remove the seven-day requirement from the Closing Disclosure (re-baselining) tests. (Read the ECS May 2018 Critical Patch release notes for more information.) Encompass and the ECS continue to require that the Initial CD Sent Date (field ID 3977) or Revised CD Sent Date (field ID 3979) cannot be more than three business days after the Changes Received Date in order for the initial or revised Closing Disclosure to reset fee tolerances. Additionally, if the increase in fees causes the APR to become inaccurate, Encompass and ECS continue to require that the revised CD be received by the consumer no later than three business days prior to consummation.

To support the new rule change, a new Use CD to Rebaseline Data option has been added to the Policies category in the Settings Manager in the Encompass Admin Tools. The setting is set to 06/01/2018 by default. Administrators can adjust the setting to a later date, but cannot set it to a date earlier than 06/01/2018.

To Adjust the Use CD to Rebaseline Data Setting:

- On your Windows task bar, click the Start menu or Start icon, navigate to the Ellie Mae Encompass program folder, and then click Admin Tools.

- Double-click Settings Manager.

- If you are prompted to log in to the server, type the User ID, Password, and Server that you use to log in to Encompass as the Admin user.

- Select Policies from the Category list.

- Double-click the date in the Value column for Use CD to Rebaseline Date option, select the appropriate date, and then click OK.

CBIZ-17342

Updates have been made to the calculations for APR (field ID 799) , Finance Charge (field ID 1206) , and Prepaid Finance Charge (field ID 949) for construction-only and construction-to-permanent loans to comply with Regulation Z requirements for disclosing post-consummation charges for these loan types. Post-consummation finance charges are identified as the sum of all borrower-paid, broker-paid, and other-paid amounts in the new PC1, PC2, PC3, and PC4 lines that were added to the 2015 Itemization input form with the Encompass 18.3 release.

Finance charge calculations for post-consummation fees (such as inspection fees, required credit life insurance premiums, or mortgage guarantee insurance premiums along with any estimated interest or prepaid finance charges) are treated differently when calculating the APR, depending on whether the loan is construction-only or construction-to-permanent.

-

The APR (field ID 799) calculation for construction-only loans now includes the post-consummation finance charges.

-

The current Finance Charge (field ID 1206) calculation for construction-only loans now includes the post-consummation charges

-

Post-consummation finance charges are not included in the Amount Financed (field ID 948).

-

Post-consummation finance charges are not included in the Prepaid Finance Charge (field ID 949).

-

The Prepaid Finance (field ID 949) calculation for construction-to-permanent loans now includes the post-consummation finance charges.

-

The Amount Financed (field ID 948) is reduced in the amount of the post-consummation finance charges.

-

The current Finance Charge (field ID 1206) is now increased by the amount of the post-consummation finance charges

Because the post-consummation finance charges are now included in the prepaid finance charge, lenders no longer need to include the subsequently paid finance charges separately when testing against APRWin.

CBIZ-14301

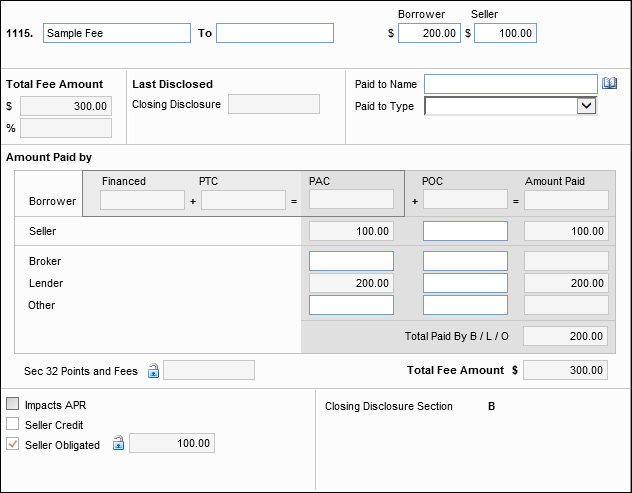

Updates have been made to the Fee Details window on the 2015 Itemization input form for six lines that customarily are paid by the lender or are an obligation to the seller in a purchase transaction. Because these fees are not managed as consumer-obligated fees, they are not disclosed on the Loan Estimate and are not treated as subject to tolerance violation. To prevent lenders from inadvertently using these lines to document consumer charges, the following updates have been made in the behavior of the Fee Details windows for lines 834, 835, 1115, 1116, 1209, and 1210:

- The Borrower row in the Amount Paid By section is no longer editable. Borrower amounts entered on the 2015 Itemization form are populated in the Lender PAC field on the Fee Details window.

-

Increasing or decreasing the Lender POC amount results in an adjustment to the Lender PAC amount and does not affect the Borrower amount.

-

Increasing or decreasing amounts paid by Broker or Other results in an adjustment to the Lender PAC amount.

-

The Seller Credit checkbox is now disabled. All Seller amounts are treated as Seller Obligated: the Seller Obligated amount on the lower-left equals the total of the Seller PAC and POC amounts.

-

Increasing or decreasing the Seller POC amount results in an adjustment to the Seller PAC amount.

-

Increasing or decreasing the total Seller amount on the upper-right results in an adjustment to the total fee amount without affecting the Borrower amount.

After updating to Encompass 18.3, the new behavior in these six Fee Details windows will apply only to new and undisclosed loans. The old behavior is retained for loans that were disclosed prior to updating to Encompass 18.3.

CBIZ-11077

VA Loans

Updates have been made to the method used for rounding the Recoup Closing Costs Month(s) (field ID VASUMM.X27) to comply with the VA Refinance Loans and the Economic Growth, Regulatory Relief and Consumer Protection Act guidance set forth in V.A. Circular 26-18-13, published May 25, 2018. The number of months are now rounded up to the nearest integer. For example, 23.2 months would be rounded up to 24 months. The act requires lenders to certify that all fees and incurred costs referenced in previous V.A. Circular 26-18-1 will be recouped on or before 36 months after the date of the loan note. Loan applications taken on or after May 25, 2018 that do not meet the requirements defined in the act will not be eligible for guaranty by the VA.

It is recommended that lenders review all VA loans with an application date later than May 25, 2018 and VA recoupment months of 36 to determine whether the loans were rounded down. These loans require additional intervention (either a reduction in closing costs or an increase in monthly payment savings) to qualify for guaranty by the VA. This can be accomplished by creating and running a report in Encompass to identify loans with Recoupment Months equal to 36, and then creating a spreadsheet with a calculated field that determines whether the field was rounded up to 36 or down to 36. Loans that were rounded down to 36 would require additional intervention. For detailed instructions, refer to Identify Loans with a 36-Month VA Recoupment Period.

CBIZ-18040

Encompass Pipeline

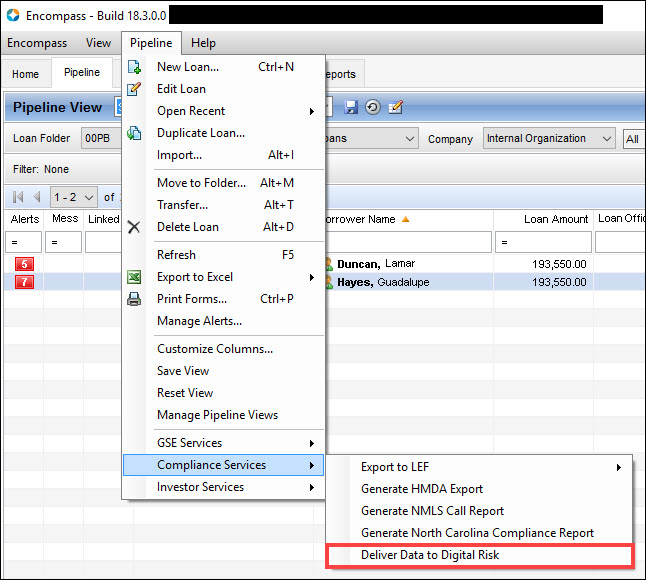

The name of the Investor Services menu option on the Pipeline menu in Encompass has been changed to GSE Services. All of the export options that previously existed under the Investor Services category prior to Encompass 18.3 continue to exist under the new GSE Services category. (The Deliver Data to Wells Fargo Funding option is no longer provided in this GSE Services category.) Users who were previously granted persona rights to the Investor Services category in prior versions of Encompass will now continue to have the same access rights under the new GSE Services category.

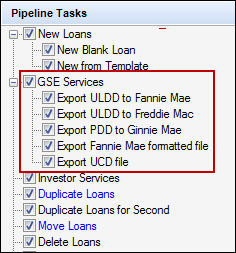

In the Pipeline Tasks section on the Pipeline tab in the Personas setting, the Investor Services checkbox used in prior versions of Encompass has been renamed to GSE Services. All export options that were previously listed under the Investor Services checkbox prior to Encompass 18.3 are now listed under the GSE Services checkbox in the Personas setting.

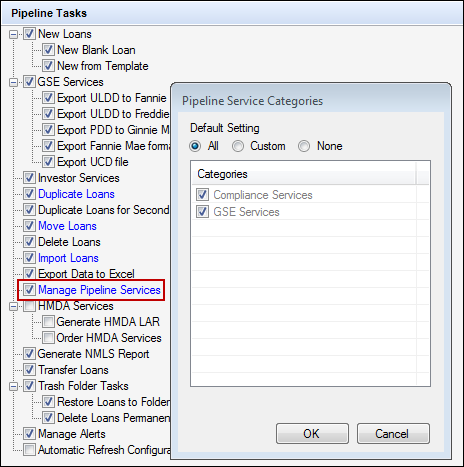

When you click the Manage Pipeline Services link in the Pipeline Tasks section to open the Pipeline Services Categories pop-up window, the Investor Services checkbox that was used in prior versions of Encompass has also been renamed to GSE Services. This option now controls access to the GSE Services category on the Pipeline menu.

NICE-7682

Starting with the TQL Services 18.3 Major Release, Pipeline menu> Compliance Services has been updated with a Deliver Data to Digital Risk option enabling authorized users to submit multiple loans to Digital Risk from within Encompass. This is supported on Encompass 17.4 and later versions.

Prior to this release, loans could be submitted to Digital Risk from the Services tab> Order Fraud/Audit Services option only, and one at a time.

Additional Encompass Forms and Tools

On the eDisclosure Tracking tab of the Disclosure Tracking tool’s Disclosure Details window, the ePackage ID is now provided. Each disclosure record listed in the Disclosure History list is assigned with its own ePackage ID.

This ePackage ID is now captured to help address issues that occurred in earlier versions of Encompass where the ePackage ID was not captured by Encompass when users ordered eDisclosures or there was a delay in the system capturing the ePackage ID. Now that this ID is provided on the eDisclosure Tracking tab it is easier to identify a valid eDisclosure package that has been ordered.

The eDisclosure Tracking tab only displays when you have selected an eDisclosure package entry in the Disclosure History list. This tab provides the dates when the borrower and co-borrower take action on the selected eDisclosure package and details about the latest eDisclosure Fulfillment Service package that was printed and sent to the borrower (if applicable).

A different set of fields are now being used for the lender name, address, and phone information in item 25a on the VA 26-1820 Loan Disbursement input form. The previous fields have been replaced with the fields from section 15 of the HUD 1003 Addendum input screen. The following table lists the previous and current field IDs for the fields in section 25a.

| Field Name | Previous Field ID |

New Field ID |

|---|---|---|

| Lender Name | 315 | 3632 |

| Address | 319 |

3633 |

| City | 313 |

3634 |

| State | 321 |

3635 |

| Zip | 323 | 3636 |

| Phone | 324 |

1262 |

When upgrading to Encompass 18.3, data in existing loan files is copied from the previous fields to the new fields. This is a one-time copy that occurs during the upgrade process. Data is not copied into any new fields that already contain data. Encompass users can then edit the new fields in section 25a without affecting the data in the fields previously used in section 25a.

According to VA Pamphlet 26-7, when the loan is closed and funded in an agent’s name pursuant to an agency agreement, the agent must complete sections 25 and 26. Section 25a must include the agent’s name followed by the words “agent for [insert lender’s name]” and the agent’s address.

CBIZ-12396

The following printed output forms have been migrated to the Encompass Docs Solution. The Encompass Docs Solution team started a project in 2015 where they began "migrating" Encompass forms from their current location in Encompass into the Encompass Docs Solution. The purpose of this project is twofold. First, having these documents generated from the Encompass Docs Solution will provide us the ability to ensure ALL of our documents are kept current in a timely manner. Second, the migration will bring consistency to our document library and allow us to leverage additional form level flexibility that the Encompass Docs Solution enjoys today.

Visit the Encompass Docs Solution Help site for more information on forms, this migration, and the Encompass Docs Solution FAQs.

Note that there were no content changes to any of these forms and the existing form is current and up to date.

- Underwriting Condition Detail – To print this form in Encompass:

- Open the loan file, and then click the eFolder icon to open the eFolder.

- Click the Underwriting Conditions tab, and then click to select a condition listed on the tab.

- Click the Print icon.

- In the Print Conditions window, select Print condition details, and then click OK.

- Underwriting Condition List – To print this form in Encompass:

- Click the Print icon in Encompass.

- In the Print window, click the Standard Forms tab.

- Select Tools from the Look In list.

- Click to select Underwriting Condition List in the list, and then click the Add button to move the form to the Selected Forms list.

- Click Print.

In order to make these newly migrated versions of the forms available in your Encompass system(s), the administrator or other authorized user must use the Documents tool in Encompass Settings to add the form as a new form. For instructions to add a new form, refer to the Documents topic in the Encompass online help.

Two-place decimal amounts can now be entered in the Value column (field IDs 1605, 1607, and 1609) in the Stocks and Bonds section on the 1003 Page 2. Previously only whole numbers without decimals were enabled for these fields. When upgrading to Encompass 18.3, a decimal and two zeros (.00) will be added to existing values in these fields.

CBIZ-12758

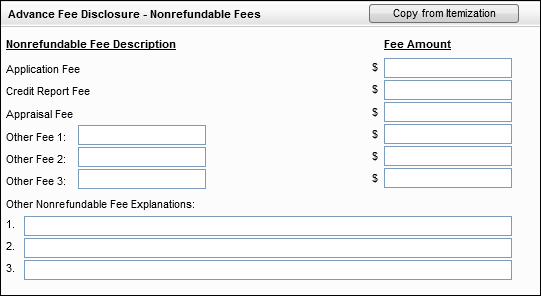

A new Advance Fee Disclosure – Nonrefundable Fees section has been added to the Connecticut State-Specific Disclosure Information input form to enable the entry of nonrefundable fees that will be disclosed on the revised Connecticut Agreement Concerning Nonrefundability of Advance Fee.

The new section includes the following information:

-

Predefined entries for Application Fee, Credit Report Fee, and Appraisal Fee. Each entry includes a field for entering the fee amount. These fields can be entered manually or can be copied using the Copy from Itemization button (see below).

-

Three user-defined Other Fee entries. Each entry includes a field for entering the fee name and amount. These fields are entered manually.

-

Three Other Nonrefundable Fee Explanations fields for entering conditions under which the advanced fees will be retained by the mortgage lender, mortgage correspondent lender or mortgage broker. These fields are entered manually.

Copy from Itemization

When a user clicks the Copy from Itemization button, the following three fields are populated as described below. These fields can also be entered or edited manually. No other fields in this section are copied over when a user clicks the Copy from Itemization button.

-

Application Fee – For loans using the 2015 Itemization, the amount is copied from the borrower paid POC amount (field ID NEWHUD2.X342) in the Fee Details window for line 801b on the 2015 Itemization. For Loans using the 2010 Itemization, the amount is copied from the POC amount (field ID NEWHUD.X822) in the POC/PTC popup window for line 801b on the 2010 Itemization.

-

Credit Report Fee – For loans using the 2015 Itemization, the amount is copied from the borrower paid POC amount (field ID NEWHUD2.X1134) in the Fee Details window for line 805. For Loans using the 2010 Itemization, the amount is copied from the POC amount (field ID NEWHUD.X833) in the POC/PTC popup window for line 805 on the 2010 Itemization.

-

Appraisal Fee – For loans using the 2015 Itemization, the amount is copied from the borrower paid POC amount (field ID NEWHUD2.X1101) in the Fee Details window for line 804b. For Loans using the 2010 Itemization, the amount is copied from the POC amount (field ID NEWHUD.X832) in the POC/PTC popup window for line 805 on the 2010 Itemization.

CBIZ-13006

A new Application of Payment Disclosures section has been section has been added to the State-Specific Disclosure Information input form for New Hampshire. It includes two new free entry fields that are used to enter text that will populate on the Other and HELOC sections on the Application of Payments Disclosure output form:

-

Other (field ID DISCLOSURE.X1203)

-

HELOC (field ID DISCLOSURE.X1204)

CBIZ-15959

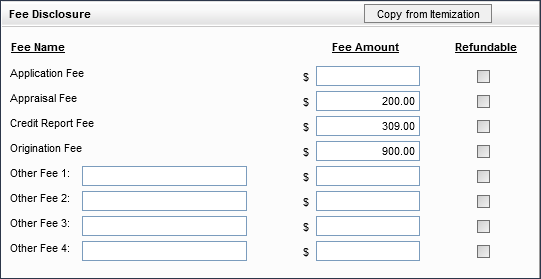

A new Fee Disclosure section has been added to the Pennsylvania State Specific Disclosure Information input form to ensure that the PA Fee Disclosure document is compliant with Pennsylvania statutes (Section 6121(10) of the Mortgage Licensing Act).

The new section includes the following information:

-

Predefined entries for Application Fee, Appraisal Fee, Credit Report Fee, and Origination Fee. Each entry includes a field for entering the fee amount and a checkbox for indicating whether the fee is refundable. These fields can be entered manually. The amount fields can also be copied using the Copy from Itemization button (see below).

-

Four user-defined Other Fee entries (field IDs DISCLOSURE.X1195–DISCLOSURE.X1198). Each entry includes fields for entering the fee name and fee amount, and a checkbox for indicating whether the fee is refundable. These fields are entered manually.

Copy from Itemization

When a user clicks the Copy from Itemization button, the following fields are populated as described below. These fields can also be entered or edited manually. No other fields in this section are copied over when a user clicks the Copy from Itemization button.

-

Application Fee amount – For loans using the 2015 Itemization, the amount is copied from the Total Fee Amount (field ID NEWHUD2.X333) in the Fee Details window for line 801b on the 2015 Itemization. For Loans using the 2010 Itemization, the amount is copied from the total fee amount (field ID NEWHUD.X702) in the POC/PTC popup window for line 801b on the 2010 Itemization.

-

Appraisal Fee amount – For loans using the 2015 Itemization, the amount is copied from the Total Fee Amount (field ID NEWHUD2.X1092) in the Fee Details window for line 804. For Loans using the 2010 Itemization, the amount is copied from the Appraisal Fee amount (field ID NEWHUD.X609) in the GFE (section #) column on the 2010 Itemization.

-

Credit Report Fee amount – For loans using the 2015 Itemization, the amount is copied from the Total Fee Amount (field ID NEWHUD2.X1125) in the Fee Details window for line 805. For Loans using the 2010 Itemization, the amount is copied from the Appraisal Fee amount (field ID NEWHUD.X610) in the GFE (section #) column on the 2010 Itemization.

-

Origination Fee amount – For loans using the 2015 Itemization, the amount is copied from the Total Fee Amount (field ID NEWHUD2.X300) in the Fee Details window for line 801a. For Loans using the 2010 Itemization, the amount is copied from the total fee amount (field ID NEWHUD.X770) for line 801a on the 2010 Itemization.

CBIZ-13018

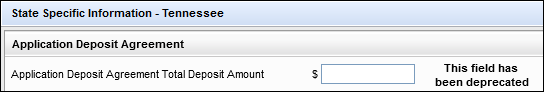

As a result of revisions to the Tennessee Application Deposit Agreement disclosure form, the Application Deposit Agreement section on the Tennessee State-Specific Disclosure Information input form is no longer needed. This section of the input form includes a single entry for the Application Deposit Agreement Total Deposit Amount (field ID DISCLOSURE.X358). The input form has now been updated to display the text This field has been deprecated to the right of the Application Deposit Agreement Total Deposit Amount field.

CBIZ-13340

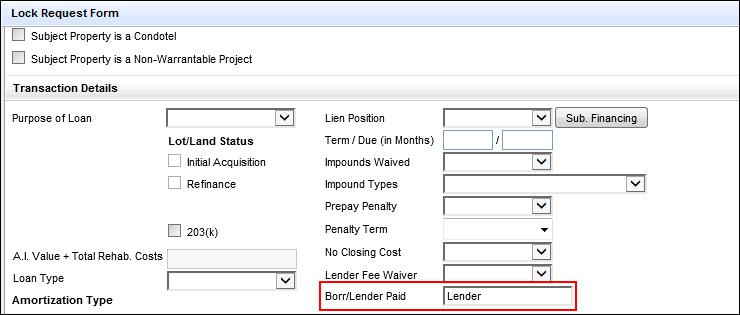

To enable lenders to know whether a loan has LO compensation that is Lender Paid or Borrower Paid, a new Borr/Lender Paid (field ID 4463) has been added to the Lock Request Form and the Lock Request Snapshot. This field is populated from the Borrower/Lender Paid (field ID LCP.X1) on the LO Compensation tool, and can receive updated values from the Encompass Product and Pricing Service (EPPS) that can be used by Encompass and Encompass TPO Connect.

The available options in the dropdown list are:

-

Lender (default)

- Borrower

- Exempt

The field on the Lock Request Snapshot is read-only. For Retail channel loans that already have compensation plans assigned from Encompass, the compensation model cannot be edited from EPPS.

In addition, the new Borr/Lender Paid field has been added to the Encompass Reporting Database.

SEC-13689

When the lock is confirmed or auto-locked, the system will now compare the value in the Borr/Lender Paid field (field ID 4663) on the Lock Request snapshot with the Borrower/Lender Paid field (field ID LCP.X1) on the LO Compensation tool. If the value in the two fields are different, the value from the Borr/Lender Paid field (field ID 4663) on the Lock Request snapshot will be:

-

Added to the Compare with Current Loan Data pop-up window.

-

Populated into the Borrower/Lender Paid field (field ID LCP.X1) on the LO Compensation tool.

If the Borr/Lender Paid field (field ID 4663) is blank, the system will not take any action.

SEC-13726

A new Loan Estimate Issued By dropdown list has been added to the TPO Loan Status section on the TPO Information tool to enable Encompass TPO Connect lenders to indicate whether a TPO broker is issuing the Loan Estimate or the lender is issuing the Loan Estimate on the broker's behalf. The dropdown list includes three options:

-

blank

-

Broker

-

Lender

The default dropdown list selection is blank.

CBIZ-17268

HMDA 2018 Updates

Updates have been made to map HMDA 2018 DI (demographic information) data between Encompass loan files and FNMA 3.2 loan files for non-primary borrower pairs. This enables HMDA 2018 DI data to be captured correctly when importing FNMA loan files into Encompass. For detailed information about the logic used when mapping HMDA 2018 DI data between Encompass and FNMA 3.2 files, refer to the HMDA 2018 Demographic Information for FNMA 3.2 File Format guide.

CBIZ-13085

To enable customers to generate a Reporting LEI even when they do not use the correspondent channel to process HMDA for their loans, the following items have been added to the 2018 HMDA Originated/Adverse Action Loans tab on the HMDA Information input form (2018 version):

-

Reporting LEI (field ID HMDA.X106)

-

Calculate ULI button.

Administrators can use the Persona Access to Fields business rule to prevent unauthorized users from accessing the features.

Using these features is not recommended for most retail use cases. These features are primarily available for lenders who have a retail channel or who want to generate an investor LEI for their loans.

CBIZ-16480

Electronic Document Management

Updates have been made to the Send windows for eConsent requests, document requests, and eDisclosure packages. These windows display during the workflows used with the Consent, Request, and eDisclosures buttons in the eFolder. The following issues were addressed in the update:

-

The user interface for selecting the sender and recipient has been redesigned.

-

The Borrower Signing Options section has been moved to the top of the Send Request and Send eDisclosure windows.

Details descriptions of the changes in each window are provided below.

EDM-18918

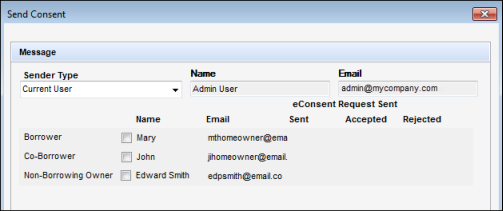

To Complete the Redesigned Section of the Send Consent Window:

-

On the Send Consent window, select the sender from the Sender Type list. You can choose from the following:

-

Current User

-

File Starter

-

Loan Officer

The Name and Email fields are populated based on your selection.

-

-

Select or clear the checkboxes to send the emails to the Borrower, Co-Borrower, or a Non-Borrowing Owner contact. The addresses populate from the loan file and are no longer editable.

-

Dates are automatically populated in the Sent, Accepted, and Rejected columns to track the progress of the consent process.

-

The design and functionality of the remaining features on the window have not changed.

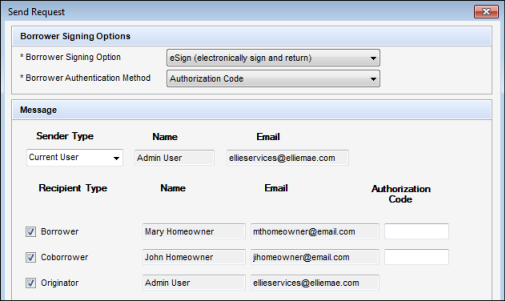

To Complete the Redesigned Section of the Send Request Window:

-

On the Send Request window, select a Borrower Signing Option:

-

eSign (electronically sign and return) - Borrowers access the documents from a secure website and, after consenting to receive electronic disclosures, review the documents online, and then sign the documents electronically (known as eSigning). You receive an email notification that the signed documents are available. Click the Retrieve button in the eFolder to retrieve the documents. If the eDisclosure package contains documents that can be eSigned and documents that must be wet signed, the eSign option is replaced with an eSign + Wet Sign (for wet sign documents only) option. Borrowers will sign and return eSign documents electronically as described above, and print, sign, and return the wet sign documents as described below.

-

Wet Sign (print, sign, and fax) - Borrowers retrieve the documents from a secure website, print, sign, and then return the documents by fax or by mail.

If you select eSign (electronically sign and return) and the request includes custom forms that require a signature, be sure you have inserted eSigning signature points in the form.

-

-

Select a Borrower Authentication Method, if applicable.

-

If you select the Authentication Code option, type a 4-to-10-digit numerical code in the Authentication Code field for each recipient, and make sure you send the authentication code to the recipient. The code is not automatically sent to the recipient. The authentication code is different from the password the recipient uses to access the site.

-

If you select the Answer Security Questions option, the borrower is asked security questions related to the information in the loan file.

-

-

Select the Sender type:

-

Current User

-

File Starter

-

Loan Officer

-

-

The Name and Email fields are populated based on your selection. If no name or email is listed in the File Contacts tool for the Encompass user associated with the option selected, the fields are blank and editable. Data entered in a blank field is then saved back to the File Contacts tool.

For Wet Sign packages, additional recipients can be added as needed by clicking the Add icon at the upper right of the Recipient section.

-

The design and functionality of the remaining features on the window have not changed.

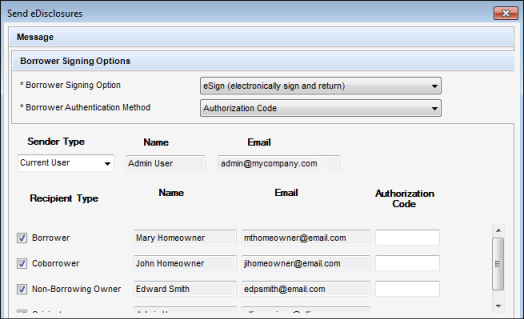

To Complete the Redesigned Section of the Send eDisclosures Window:

-

On the Send eDisclosures window, select a Borrower Signing Option:

-

eSign (electronically sign and return) - Borrowers access the documents from a secure website and, after consenting to receive electronic disclosures, review the documents online, and then sign the documents electronically (known as eSigning). You receive an email notification that the signed documents are available. Click the Retrieve button in the eFolder to retrieve the documents. If the eDisclosure package contains documents that can be eSigned and documents that must be wet signed, the eSign option is replaced with an eSign + Wet Sign (for wet sign documents only) option. Borrowers sign and return eSign documents electronically as described above, and print, sign, and return the wet sign documents as described below.

-

Wet Sign (print, sign, and fax) - Borrowers retrieve the documents from a secure website, print, sign, and then return the documents by fax or by mail.

If you select eSign (electronically sign and return) and the eDisclosure package contains custom forms that require a signature, be sure you have inserted eSigning signature points in the form.

-

-

Select a Borrower Authentication Method, if applicable.

-

If you select the Authentication Code option, type a 4-to-10-digit numerical code in the Authentication Code field for each recipient, and make sure you send the authentication code to the recipient. The code is not automatically sent to the recipient. The authentication code is different from the password the recipient uses to access the site.

-

If you select the Answer Security Questions option, the borrower is asked security questions related to the information in the loan file.

-

-

Select the Sender type. You can choose from the following:

-

Current User

-

File Starter

-

Loan Officer

A known issue with the Loan Officer option not displaying in the dropdown list for WebCenter loans is schedule to be resolved with the August Service Pack scheduled for August 18, 2018.

-

-

Select or clear the checkboxes to send the emails to the various recipients as needed.

The Name and Email fields are populated based on your selection. If no name or email is listed in the File Contacts tool for the Encompass user associated with the option selected, the fields are blank and editable. Data entered in a blank field is then saved back to the File Contacts tool.

For Wet Sign packages, additional recipients can be added as needed by clicking the Add icon at the upper right of the Recipient section.

-

The design and functionality of the remaining features on the window have not changed.

The barcodes that display on output forms generated by Encompass have been updated to store additional metadata. All forms continue to display a single barcode image, with the exception of the Loan Estimate and Closing Disclosure output forms, which now display three barcode images to enable the inclusion of the additional metadata within the limited space available at the bottom of the form.

DND-546

Beginning with the Encompass 18.3 release, alphabetic characters and special characters can no longer be used in the authentication codes used by borrowers to access document requests and document packages sent via the Encompass eFolder. Authentication codes now accept only numeric symbols.

EDM-20450

Title and Closing Service Updates

The All Title Companies tab has been updated and is now called the Search and Manage tab. In order to access the new Search and Manage tab, an administrator needs to grant Title & Closing access rights to the persona assigned to the user requesting access. The Search and Manage tab retains the same functionality as the previous All Title Companies tab.

If a user is not assigned a persona with Title & Closing access rights, the Search tab will appear instead. The Search tab is more limited than the Search and Manage tab in the following ways:

-

Cannot blacklist a specific title company

-

Cannot move a title company to the My Title Companies tab

-

The default service area is "Nationwide"

Both the Search tab and Search and Manage tab allow users to search through all title companies.

For Administrators Only

Access to the Search and Manage tab is granted by defining persona access to Title & Closing, and then assigning the persona to the user.

To Define Persona Access for Title & Closing:

-

On the menu bar, click Encompass, and then click Settings.

-

On the left panel, click Company/User Setup, and then click Personas.

-

In the left panel, select an existing persona or click the New icon to create a new persona.

-

Click the Loan tab, and in the Other section, click the Manage Service Providers List link.

-

Select Custom, and then clear the Title & Closing checkbox to remove access rights to the Search and Manage tab.

To Assign a Persona to a User:

-

On the menu bar, click Encompass, and then click Settings.

-

On the left panel, click Company/User Setup, and then click Organization/Users.

-

Select a user, then click the Edit User icon.

-

In the Personas section, click the New icon to assign the persona to the user.

To see the access rights applied, the persona assigned to the user must be the same persona that had its Title & Closing access defined.

Encompass Settings

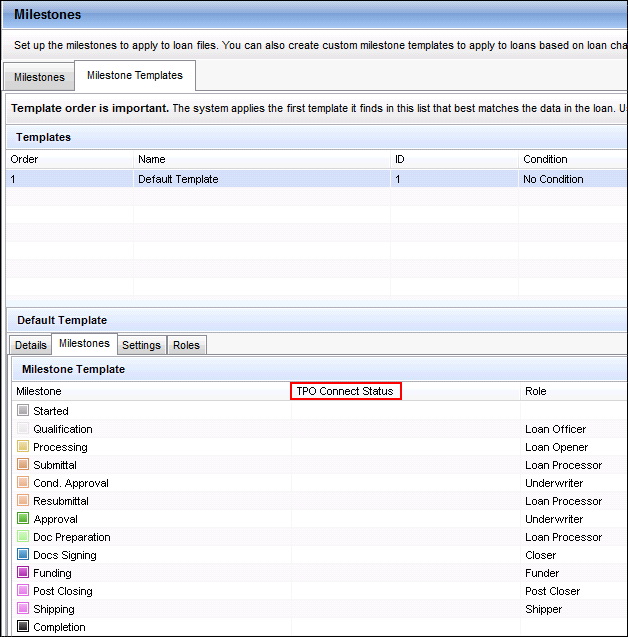

In the Encompass 18.1 release, a TPO Connect Status column was added to display the TPO loan process flow status on the Milestones tab on the Milestones setting. In this release, a similar column has been added to the Milestones sub-tab on the Milestone Templates tab to provide consistency between the two tabs.

To Access Milestone Setting:

- On the menu bar, click Encompass, and then click Settings.

- On the left panel, click Company/User Setup, and then click Milestones.

SEC-13072

In Encompass 18.1, a new API User checkbox was introduced on the User Details screen used by administrators when creating a new Encompass user. The purpose of the API User checkbox is to give Encompass administrators the means to grant a Supported Encompass Consulting Partner access to their company's Encompass instance via Encompass Developer Connect APIs. This checkbox is intended for use with Supported Encompass Consulting Partners only and should not be used for users within your organization. Note that once the consulting Partner and the Encompass administrator complete the required process (described below), the consulting Partner will be recognized as a Supported Encompass Consulting Partner and they will be able to access your company's Encompass instance via the APIs. The administrator will be able to assign the required privileges to this API user just as they would for any other Encompass user. However, this API user will not be able to log into any Encompass instances via the SmartClient.