Alerts Overview

An alert is a notification that indicates an event has occurred, is pending, or is due. Alert information displays on the Pipeline and in the loan file. To view details of the alerts associated with a loan, click the Alert icon on

your Pipeline. The alert remains in effect until the required action is

taken. When you clear an alert, the entry is removed from both your Pipeline and the Alerts & Messages tab in the Log.

An alert is a notification that indicates an event has occurred, is pending, or is due. Alert information displays on the Pipeline and in the loan file. To view details of the alerts associated with a loan, click the Alert icon on

your Pipeline. The alert remains in effect until the required action is

taken. When you clear an alert, the entry is removed from both your Pipeline and the Alerts & Messages tab in the Log.

The timing of when an alert displays, and whether or not it displays on the Pipeline, is defined by your system administrator on the Alerts settings tool. If a loan has

an adverse status, existing alerts are not shown on the

Pipeline.

To reduce loading time and improve performance, Alert icons do not display when multiple loan folders are selected in the Loan Folder dropdown list, or when <Select All Active Folders> or the <Trash> folder is selected from the Loan Folder dropdown list.

At App Disclosure Requirements

At App Disclosure Requirements

The At App Disclosure Requirements disclosure compliance alerts can help ensure loans are compliant with all applicable state and federal regulations, including those applicable to timing and content of disclosures to maintain good faith with the consumer. This alert helps ensure that when the required fields are populated based on the information provided on the loan application, the Loan Estimate is provided to the borrower. The alert displays on the Pipeline, the Alerts & Messages tab in the Log, and in a pop-up window when you save the loan. When these alerts are triggered in the loan file, the required completion fields are listed. Once these fields are populated, the Disclosure Ready Date on the alert screen in the loan file will be populated. (Until then, this date field is blank.) When the date is added, a scheduler will then send out the disclosures for the loan. (The disclosures may also be sent manually prior to the scheduler sending them.) Note that the administrator needs to set up a scheduler and a workflow rule for the Disclosure Ready Date field in the web version of Encompass in order for the disclosures to be sent automatically when the date field is populated.)

Three-Day Disclosure Requirements

Three-Day Disclosure Requirements

The Three-Day Disclosure Requirements disclosure compliance alerts can help ensure loans are compliant with all applicable state and federal regulations, including those applicable to timing and content of disclosures to maintain good faith with the consumer. This alert helps ensure the required fields are populated so that the Closing Disclosure can be sent within the required three business days before closing. The alert displays on the Pipeline, the Alerts & Messages tab in the Log, and in a pop-up window when you save the loan. When these alerts are triggered in the loan file, the required completion fields are listed. Once these fields are populated, the Three-Day Disclosure Ready Date on the alert screen in the loan file will be populated. (Until then, this date field is blank.) When the date is added, a scheduler will then send out the disclosures for the loan. (The disclosures may also be sent manually prior to the scheduler sending them.) Note that the administrator needs to set up a scheduler and a workflow rule for the Three-Day Disclosure Ready Date field in the web version of Encompass in order for the disclosures to be sent automatically when the date field is populated.)

Milestone Expected

Milestone Expected

Milestone Expected alerts notify users of pending milestones. These alerts display on the Pipeline, Log, and the top of the milestone worksheet (the top of the worksheet displays in red). When you record the achievement of a milestone on the milestone worksheet or update the Days to Finish field, the corresponding entry in the Log reflects the completion or update. The completion date is used to calculate the expected completion of future milestones.

Milestone Finished

Milestone Finished

Milestone Finished alerts are generated when a milestone is completed, notifying the loan team member responsible for completing the next milestone that the milestone has been completed. These alerts display on the Pipeline, Log, and the top of the milestone worksheet (the top of the worksheet displays in red). The alert is cleared when the loan team member clicks the Accept File (Clear Alert) button on the milestone worksheet.

Document Expected and Document Expired

Document Expected and Document Expired

Document alerts notify users of the status of ordered and received documents. When you begin managing a document you can change the default dates if needed.

Document alerts display on the Pipeline and in the Log. In the Log, an entry is created showing the expected receipt date. This entry changes to red text if the document becomes past due. If a received document expires, a new entry replaces the expected receipt date in the Log.

eFolder Update

eFolder Update

eFolder Update alerts notify specific loan team members about updates made to documents or conditions. When managing a document in the Document Details window or a condition in the Condition Details window, loan team members can add comments (in the Tracking section) related to the document or condition. When adding a comment, they can also send an eFolder Update alert to the loan officer, loan processor, or closer assigned to the loan file to notify them of the update. eFolder Update alerts display in the Pipeline and on the Alerts & Messages tab in the Log for the selected loan team

member. Clear these alerts by opening the document or condition related to the alert, click the Comments tab located in the Tracking section of the Document Details or Condition Details window, and then click to view the comment entered by the loan team member who sent the alert.

Conversation Follow Up

Conversation Follow Up

Conversation Log alerts notify loan team members of required follow-up

actions. These alerts are based on information entered in the Follow

Up section on the Conversation Log

worksheet. Conversation Log alerts display on the Pipeline,

Log, and the top of the Conversation Log list for the selected loan team

members.

Task Expected and Task Follow Up

Task Expected and Task Follow Up

Task alerts notify the loan team member of required expected and follow-up actions. These alerts are based on information entered in the Status and Follow Up sections on the Task worksheet. The alert entry displays in the Log for the selected loan team member as appropriate. When the follow-up date is reached, the entry changes to red text and the alert also displays on the Pipeline. Clear the alert by selecting a Followed up on date or by updating the to follow up on date.

Preliminary Condition Expected

Preliminary Condition Expected

These alerts are generated when a preliminary condition is pending. Preliminary Condition alerts are based on information entered in the Tracking section of the Preliminary Condition Details window (specifically, the Days to Receive field in the eFolder). The alerts display on the Pipeline, Log, and the top of the milestone worksheet with which the condition is associated (the top of the worksheet displays in red).

Underwriting Condition Expected

Underwriting Condition Expected

These alerts are generated when an underwriting condition is pending. Underwriting Condition alerts are based on information entered in the Tracking section of the Underwriting Condition Details window (specifically, the Days to Receive field in the eFolder). The alerts display on the Pipeline, Log, and the top of the milestone worksheet with which the condition is associated (the top of the worksheet displays in red).

Post Closing Condition Expected

Post Closing Condition Expected

These alerts are generated when a post closing condition is pending. Post Closing Condition alerts are based on information entered in the Tracking section of the Post-Closing Condition Details window (specifically, the Days to Receive field in the eFolder). The alerts display on the Pipeline, Log, and the top of the milestone worksheet with which the condition is associated (the top of the worksheet displays in red).

Registration Expiration

Registration Expiration

Registration Expiration alerts notify loan team members of the expiration of a loan that was registered with an investor (Field ID 2824). Registration Expiration alerts display on the Pipeline and the Log.

Rate Lock Requested

Rate Lock Requested

Rate Lock Request alerts are generated using the Lock Request tool. When a loan officer submits a lock request for an unlocked loan to the lock desk, a Lock Request icon  displays on the Pipeline. When the loan rate is locked and the loan officer is notified, the Lock Request icon is replaced by a blue Lock icon

displays on the Pipeline. When the loan rate is locked and the loan officer is notified, the Lock Request icon is replaced by a blue Lock icon  . When a loan officer submits a lock request for a loan that is already locked, a Locked Loan Lock Request icon

. When a loan officer submits a lock request for a loan that is already locked, a Locked Loan Lock Request icon  displays on the Pipeline. The alerts also display on the Log and in the header above the work area in the loan file.

displays on the Pipeline. The alerts also display on the Log and in the header above the work area in the loan file.

Rate Lock Confirmed

Rate Lock Confirmed

Rate Lock Confirmation alerts are generated when a loan rate is locked by the lock desk, and confirmation is sent to the requestor (typically the loan officer). The Lock Request icon is replaced by a blue Lock icon  . The alert displays on the Pipeline, Log, and in the header above the work area in the loan file.

. The alert displays on the Pipeline, Log, and in the header above the work area in the loan file.

Rate Lock Request Denied

Rate Lock Request Denied

Rate Lock Request Denied alerts are generated when a rate lock request is denied by the lock desk. When a request is denied, the Buy Side and Sell Side components of the request are cleared and the Lock Request icon is removed. The alert displays on the Pipeline and the Log. When the lock desk denies a lock request, one or more loan team members receive a notification.

Rate Lock Expired

Rate Lock Expired

Rate Lock Expiration alerts notify loan team members of the expiration of a rate lock. When the alert is created, the blue Lock icon changes

to red  , and the number of days remaining (if any) displays beneath the icon. Rate Lock Expiration alerts display on the Pipeline, Log, and in the header above the work area in the loan file.

, and the number of days remaining (if any) displays beneath the icon. Rate Lock Expiration alerts display on the Pipeline, Log, and in the header above the work area in the loan file.

Rate Lock Extension Requested

Rate Lock Extension Requested

Rate Lock Extension Request alerts are generated using the Lock Request tool. When a loan officer submits a request to extend a rate lock, a Lock Extension Request icon  displays on the Pipeline.

displays on the Pipeline.

When a lock is extended and then re-locked, a different icon  displays on the Pipeline to distinguish between a pending new lock request on extended loans and a pending lock extension request.

displays on the Pipeline to distinguish between a pending new lock request on extended loans and a pending lock extension request.

When the loan rate is locked and the loan officer is notified, the Lock Extension Request icon is replaced by a blue Lock icon  . The alerts also display on the Log and in the header above the work area in the loan file.

. The alerts also display on the Log and in the header above the work area in the loan file.

Rate Lock Cancellation Request

Rate Lock Cancellation Request

Rate Lock alerts are generated using the Lock Request Tool. When a loan officer submits a request to cancel a lock, a Lock Cancellation Request alert displays on the Log.

Rate Lock Cancelled

Rate Lock Cancelled

Rate Lock Cancelled alerts are generated using the Secondary Registration tool. When the lock desk cancels a lock, a Lock Cancellation icon displays on the Pipeline. The alert also displays on the Log and in the header above the work area in the loan file.

Borrower Payment Past Due

Borrower Payment Past Due

Payment Past Due alerts notify loan team members that an interim-servicing payment is pending or due (field ID SERVICE.X14 on the Interim Servicing Worksheet). The alerts displays on the Pipeline and the Interim Servicing Worksheet.

Statement Printing/Mailing Due

Statement Printing/Mailing Due

These alerts notify loan team members of the requirement to send an interim-servicing statement to the borrower (based on the number of days setting on the Servicing screen on the Settings tab). The alerts displays on the Pipeline and the Interim Servicing Worksheet.

Escrow Disbursement Due

Escrow Disbursement Due

These alerts are generated when an escrow disbursement is pending or due (based on the dates in the disbursement Due Date fields on the Interim Servicing Worksheet). The alerts displays on the Pipeline and the Interim Servicing Worksheet.

Purchase Advice Form Does Not Balance

Purchase Advice Form Does Not Balance

These alerts are generated when the value in the Reconciled Difference field (field ID 2629) on the Purchase Advice Form is not 0. The alerts display on the Pipeline and the Purchase Advice Form.

Shipping Due

Shipping Due

Shipping Due alerts notify loan team members of a pending or past due investor delivery date (field ID 2012 on the Shipping Detail form). The alerts display on the Pipeline.

Compliance Review

Compliance Review

Compliance Review alerts notify loan team members when a compliance review report has been ordered for a loan and includes the results of the review, Pass or Did Not Pass. The alerts display on the Pipeline and on the Alerts & Messages tab and the Log tab in the Loan Log. Click the alert on the Alerts & Messages tab to view the compliance review report. Click the alert on the Log tab to open the report using the eFolder where you can view and modify the report and report details.

Rate Lock Removed from Correspondent Trade

Rate Lock Removed from Correspondent Trade

When a loan is removed from a correspondent trade, a confirmation entry is added to the Loan Log along with a Rate Lock Removed from Correspondent Trade alert on the Alerts & Messages tab in the Log. The Log entry provides the date and time of the request and completion, and basic loan information. To view alert details, click the alert on the Log's Alerts & Messages tab. To clear the alert after viewing alert details, click the Clear Alert button in the upper-right of the alert screen.

LIBOR Index

LIBOR Index

Since the LIBOR index will no longer be supported in GSE pools after 10/1/2020 (due to the transition to the SOFR index announced by the FHFA on February 5, 2020), this informational alert is triggered for loans with an application date (field ID 745 and 3142) after 9/30/2020 that use any LIBOR for the ARM Index Type (field ID 1959). This alert is intended to notify loan team members for loans that will not be eligible for purchase by the GSEs. Since this alert is informational only, loan team members can still proceed with the loan. The alert displays on the Alerts & Messages tab in the Log only.

Key Pricing Fields

Key Pricing Fields

Using the Key Pricing Fields alert, the administrator can create a list of key pricing fields and then set up the alert to trigger any time a loan is saved and the value in one of these fields has been updated since the loan’s rate was locked. By default, the key pricing fields are: Total Loan Amount (field ID 2), Subject Property Estimated Value (field ID 1821), Subject Property Appraised Value (field ID 356), Subject Property State (field ID 14), Subject Property County (field ID 13), Credit Score for Decision Making (VASUMM.X23), Loan Term (field ID 4), Amortization Type (field ID 608), Loan Purpose (field ID 19), Loan Type (field ID 1172). These alerts display on the Pipeline and the Alerts & Messages tab in the Log, as well as in a pop-up window when you save the loan. To view alert details, click the alert in the Log. To clear the alert after viewing alert details, click the Clear Alert button in the upper-right of the alert screen. If the alert triggers, it will be automatically cleared the next time a lock confirmation occurs.

Redisclose REGZ-TIL (APR Change) (Mortgage Disclosure Improvement Act (MDIA))

Redisclose REGZ-TIL (APR Change) (Mortgage Disclosure Improvement Act (MDIA))

In accordance with MDIA provisions, Redisclose REGZ-TIL (APR Change) alerts are generated when there is a difference between the value in the Disclosed APR (field ID 3121 on the REGZ-TIL and Closing RegZ forms) and the Current APR field (field ID 799 on the REGZ-TIL and Closing RegZ forms) greater than .125% (for regular loans; for irregular loans this alert is generated when the difference between the two APR values is greater than .25%). The alert notifies loan team members that the new APR should be disclosed to the borrower. The alert displays on the Pipeline, the Alerts & Messages tab in the Log, and both REGZ forms, as well as in a pop-up window when you save the loan.

Note: The admin can use the Alerts tool to configure these alerts to generate when the APR differs by more than 0.125% for regular and irregular loans.

Closing Date Violation (MDIA)

Closing Date Violation (MDIA)

To comply with MDIA provisions, a Closing Date Violation alert is generated when the loan's Estimated Closing Date (field ID 763 on the Borrower Summary) precedes the loan's Earliest Closing Date (field ID 3147 on the Disclosure Tracking tool). The alert displays on the Pipeline and the Alerts & Messages tab in the Log, as well as in a pop-up window when you save the loan.

Send Initial Disclosures (Real Estate Settlement Procedures Act (2010 RESPA) and Integrated Mortgage Disclosures Rule (2015 RESPA-TILA))

Send Initial Disclosures (Real Estate Settlement Procedures Act (2010 RESPA) and Integrated Mortgage Disclosures Rule (2015 RESPA-TILA))

2010 RESPA - The loan originator must provide the initial GFE (for 2010 RESPA forms) or the initial Loan Estimate (for 2015 RESPA-TILA forms) to the borrower within three days of receiving the loan application. The Send Initial Disclosure alerts are generated when all of the alert's trigger fields have been populated. By default, these fields include Borrower First Name (field ID 4000), Subject Property Address (field ID 11), Loan Amount (field ID 1109), and other fields used to complete the loan application. View the Send Initial Disclosures alert in the Alerts settings tool for a full list of Field Triggers. These alerts display on the Pipeline and the Alerts & Messages tab in the Log, as well as in a pop-up window when you save the loan. Initial disclosures must be sent no later than three business days after the alert has been generated. (Business days are determined by the Our Company Calendar settings.) This alert can also be triggered when the borrower is allowed to shop for third-party settlement services and the Settlement Service Providers List is required to be disclosed along with the Loan Estimate.

2015 RESPA-TILA - This alert operates with the Loan Estimate (LE) the same way in which the alert operates with the 2010 GFE form. According to RESPA-TILA, the loan originator must provide the initial LE to the borrower within three days of receiving the loan application. The Send Initial Disclosures alerts are generated when all of the alert's trigger fields have been populated. By default, these fields are: Borrower First Name (field ID 4000), Borrower Last Name (field ID 4002), Borrower SSN (field ID 65), Total Monthly Income (field ID 736), Subject Property Address (field IDs 11, 12, 14, 15), Subject Property Estimated Value (field ID 1821), and Loan Amount (field ID 1109). These alerts display on the Pipeline and the Alerts & Messages tab in the Log, as well as in a pop-up window when you save the loan. Initial disclosures must be sent no later than three business days after the alert has been generated. (Business days are determined by the Our Company Calendar settings.) To clear this alert, the LE Sent Date (field ID 3152) must be populated. This field is populated automatically when the LE is initially disclosed.

Send Initial Disclosures Alert for Settlement Service Providers List

Send Initial Disclosures Alert for Settlement Service Providers List

In addition to the triggers for the 2015 RESPA-TILA alert discussed above, the Send Initial Disclosures Alert may be triggered if the Loan Estimate and the Settlement Services Provider List (SSPL) are required to be disclosed. The alert is cleared when the SSPL Sent Date (field ID 4014) is populated. This field is automatically populated when the SSPL is disclosed and a tracking entry is included in the Disclosure Tracking tool’s Disclosure History table.

eConsent Not Yet Received (2015 RESPA-TILA)

eConsent Not Yet Received (2015 RESPA-TILA)

This alert is intended to notify you when you have not yet received consent to receive electronic disclosures (eConsent) from all applicable parties. This helps ensure you receive eConsent before sending the disclosures electronically. The following fields are located in the eConsent Status window accessible from the Disclosure Tracking Tool: Borrower 1 eConsent Status (field ID 3984), Co-Borrower 1 eConsent Status (field ID 3988), Borrower 2 eConsent Status (field ID 3992), Co-Borrower 2 eConsent Status (field ID 3996), Borrower 3 eConsent Status (field ID 4023), Co-Borrower 3 eConsent Status (field ID 4027), Borrower 4 eConsent Status (field ID 4031), Co-Borrower 4 eConsent Status (field ID 4035), Borrower 5 eConsent Status (field ID 4039), Co-Borrower 5 eConsent Status (field ID 4043), Borrower 6 eConsent Status (field ID 4047), Co-Borrower 6 eConsent Status (field ID 4051), Non-Borrowing Owner eConsent Status (field ID NBOC0017), File Started Date (field ID MS.START) or Application Date (field ID 3142).

These alerts display on the Pipeline and the Alerts & Messages tab in the Log, as well as in a pop-up window when you save the loan. If the eConsent Status for any borrower / co-borrower on the loan is not indicated as Accepted this alert is triggered. This alert is triggered at the same time as the Send Initial Disclosures alert. To clear the alert, the eConsent Status must be set to Accepted for all borrowers and co-borrowers on the loan.

This alert may not display, depending on your Alerts settings configured by your Encompass administrator.

GFE Expires (2010 RESPA)

GFE Expires (2010 RESPA)

RESPA states that if a borrower does not express intent to continue with an application within 10 days of receiving the GFE, the loan originator is no longer bound by the GFE. The GFE Expires alert notifies you that the GFE Expiration Date (field ID 3140 on the 2010 GFE) is near and the loan's rate has not been locked. The days before the expiration date value set up in the Alerts setting determines exactly when the alert displays. The GFE Expiration Date must be a minimum of 10 days from the Initial GFE Sent Date (field ID 3148) on the Disclosure Tracking tool. (Days are determined by the Our Company Calendar settings.) The alert displays in the Pipeline, the Alerts & Messages tab in the Log, and the 2010 GFE (the top of the page displays in red), as well as in a pop-up window when you save the loan.

Loan Estimate Expires (2015 RESPA-TILA)

Loan Estimate Expires (2015 RESPA-TILA)

The Loan Estimate Expires alert notifies you that the Closing Cost Estimate Expiration Date (field ID LE1.X28 on the LE Page 1) is near and the Intent to Proceed checkbox (field ID 3164) has not been selected on the Loan Estimate Page 1. The days before the expiration date value set up in the Alerts settings determines exactly when the alert displays. The LE’s expiration date must be a minimum of 10 days from the LE Sent Date (Field ID 3152 on the Disclosure Tracking tool). When the alert is generated, the Encompass user receives an alert with the following message:

The Loan Estimate has expired because the Intent to Proceed was not received within 10 business days from the LE Issued Date.

These alerts display on the Pipeline and the Alerts & Messages tab in the Log, as well as in a pop-up window when you save the loan. Clear the alert by selecting the Intent to Proceed checkbox on the Loan Estimate Page 1.

Redisclose GFE (Rate Lock) (2010 RESPA)

Redisclose GFE (Rate Lock) (2010 RESPA)

Under RESPA regulations, if a rate lock changes after the initial GFE is provided, a revised GFE must be sent to the borrower within three days of the changes. These Redisclose GFE alerts are generated when the Rate Locked Date (field ID 761) is later than the Last Sent Date (field ID 3137) on the 2010 GFE. In other words, the rate was locked after the 2010 GFE was initially disclosed. The alert displays on the Pipeline, Log, and 2010 GFE (the top of the page displays in red), as well as in a pop-up window when you save the loan. (Days are determined by the U.S. Postal Calendar settings.)

Redisclose GFE (Changed Circumstance) (2010 RESPA)

Redisclose GFE (Changed Circumstance) (2010 RESPA)

Under RESPA regulations, if circumstances have changed since the initial GFE was provided, a revised GFE must be sent to the borrower within three days of the changes. These Redisclose GFE alerts are generated when the Changed Circumstance checkbox (field ID 3168) is selected on the 2010 GFE. The Changes Received Date field (field ID 3165 on the 2010 GFE) is populated with the current date. The alert displays on the Pipeline, the Alerts & Messages tab in the Log, and 2010 GFE (the top of the page displays in red), as well as in a pop-up window when you save the loan. (Days are determined by the U.S. Postal Calendar settings.)

Redisclose Loan Estimate (Changed Circumstance) (2015 RESPA-TILA)

Redisclose Loan Estimate (Changed Circumstance) (2015 RESPA-TILA)

Under RESPA-TILA regulations, if circumstances have changed since the initial Loan Estimate was provided, a revised Loan Estimate must be sent to the borrower no more than three business days after the changed circumstance is received. The alert is triggered when the Changed Circumstance checkbox (field ID 3168) on the Loan Estimate Page 1 is selected and the current date is populated to the Changes Received Date (field ID 3165) on the Loan Estimate Page 1. By default, the alert is triggered three days before the Redisclose Due Date (field ID 3167). The alert displays on the Pipeline, the Alerts & Messages tab in the Log, and in a pop-up window when you save the loan. (Business days are determined the Our Company Calendar settings.)

HUD-1 Tolerance Violated (2010 RESPA)

HUD-1 Tolerance Violated (2010 RESPA)

To comply with RESPA tolerance regulations, these alerts are generated when there is a discrepancy between any of the GFE and HUD-1 values in the Charges that Cannot Increase section of the 2010 HUD-1 Page 3 form OR when the total of the Increase between GFE and HUD-1 Charges (field ID NEWHUD.X315) on the 2010 HUD-1 Page 3 form is more than 10%. The alerts display on the Pipeline, the Alerts & Messages tab in the Log, and at the top of the 2010 HUD-1 Page 3 page (the top of the page displays in red).

Ability-to-Repay Loan Type Not Determined (ATR/QM)

Ability-to-Repay Loan Type Not Determined (ATR/QM)

In accordance with the rule issued by the CFPB effective for applications on or after January 10, 2014 that prohibits lenders from making a loan without first considering and verifying a consumer's ability to repay the loan and establishes certain protections for creditors who make a "qualified mortgage", this alert is triggered when the Ability-to-Repay Loan Type (field ID QM.X23) has not been indicated on the ATR/QM Management form. (By default, this alert is triggered at the completion of the Approved milestone.) The alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

Qualified Mortgage Type Not Determined (ATR/QM)

Qualified Mortgage Type Not Determined (ATR/QM)

In accordance with the rule issued by the CFPB taking effective for applications on or after January 10, 2014 that prohibits lenders from making a loan without first considering and verifying a consumer's ability to repay the loan and establishes certain protections for creditors who make a "qualified mortgage", this alert is triggered when the Qualified Mortgage Loan Type (field ID QM.X24) has not been indicated on the ATR/QM Management form. (By default, this alert is triggered at the completion of the Approved milestone.) The alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

QM Safe Harbor Eligibility Not Determined (ATR/QM)

QM Safe Harbor Eligibility Not Determined (ATR/QM)

In accordance with the rule issued by the CFPB effective for applications on or after January 10, 2014 that prohibits lenders from making a loan without first considering and verifying a consumer's ability to repay the loan and establishes certain protections for creditors who make a "qualified mortgage", this alert is triggered when the Is Loan Eligible for Safe Harbor? field (field ID QM.X25) has not been populated on the ATR/QM Management form. (By default, this alert is triggered at the completion of the Approved milestone.) The alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

Residual Income Assessment Recommended (ATR/QM)

Residual Income Assessment Recommended (ATR/QM)

In accordance with the rule issued by the CFPB effective for applications on or after January 10, 2014 that prohibits lenders from making a loan without first considering and verifying a consumer's ability to repay the loan and establishes certain protections for creditors who make a "qualified mortgage", this alert is triggered when the Ability-to-Repay Loan Type (field ID QM.X23) is Qualified Mortgage, but it is not eligible for Safe Harbor (field ID QM.X23) OR the Ability-to-Repay Loan Type is General ATR. This alert recommends a residual income assessment. As the CFPB has not issued official guidelines or requirements for residual income, this alert is a recommendation only and does need to be addressed or cleared in order for the loan to qualify as a qualified mortgage. (By default, this alert is triggered at the completion of the Approved milestone.) The alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

General QM DTI Exceeded (ATR/QM)

General QM DTI Exceeded (ATR/QM)

In accordance with the rule issued by the CFPB effective for applications on or after January 10, 2014 that prohibits lenders from making a loan without first considering and verifying a consumer's ability to repay the loan and establishes certain protections for creditors who make a "qualified mortgage", this alert is triggered when the loan's Debt-to-Income (DTI) ratio (field ID QM.X119) exceeds the limit for a General Qualified Mortgage. CFPB states DTI must be less than or equal to 43% to meet General QM standard. THis alert is applicable only for loans in which the Use Price-Based General QM option (field ID QM.X383) is not used. The alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

General QM Loan Feature Violation (ATR/QM)

General QM Loan Feature Violation (ATR/QM)

In accordance with the rule issued by the CFPB effective for applications on or after January 10, 2014 that prohibits lenders from making a loan without first considering and verifying a consumer's ability to repay the loan and establishes certain protections for creditors who make a "qualified mortgage", this alert is triggered when loan repayment data does not meet the standards for a General Qualified Mortgage. The data entered in the Interest Only (field ID 2982), Prepayment Penalty Period (field ID RE88395.X316), Prepayment Penalty (field ID QM.X112), and The result of Points & Fees Test does not exceed the threshold for Qualified Mortgages (field ID (QM.X124) fields on the ATR/QM Management form's Qualification tab and the Even if you make pmts on time, can your loan balance rise (field ID NEWHUD.X6) and Does your loan have a balloon payment (field ID 1659) fields on the 2010 GFE can trigger this alert. The alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

General QM Price Limit Exceeded

General QM Price Limit Exceeded

This alert is set up by default to trigger when the loan pricing exceeds the limit for General Qualified Mortgage (QM) and the Use Price-Based General QM option (field ID QM.X383) is used. The Use Price-Based General QM option is a loan-level editable checkbox that can be used to override the Use Price Based General QM Definition Date policy setting in the Encompass Admin Tools, which determines when the old DTI-based test is disabled and the new price-based QM APOR test is enabled. The checkbox enables Encompass users to clear the checkbox to use the old DTI-based test during the optional period after the date set in the Admin Tools, but prior to the mandatory date (10/1/2022) for the new price-based rule. The alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

Ability-to-Repay Exemption Reason Not Determined (ATR/QM)

Ability-to-Repay Exemption Reason Not Determined (ATR/QM)

In accordance with the rule issued by the CFPB effective for applications on or after January 10, 2014 that prohibits lenders from making a loan without first considering and verifying a consumer's ability to repay the loan and establishes certain protections for creditors who make a "qualified mortgage", this alert is triggered when an ATR/QM Exemption Eligibility option has not been indicated at the bottom of the ATR/QM Management form's ATR/QM Eligibility tab. The alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

AUS Data Discrepancy (ATR/QM)

AUS Data Discrepancy (ATR/QM)

The AUS Tracking tool is used to document and track the results received from an Automated Underwriting System (AUS) such as DU and LP and ensure that the data in the loan file matches the data analyzed by the AUS when it returned its findings. The tool’s Underwriting Decision History table is where you can create and track AUS decision records. Each record is a snapshot of the data analyzed by the AUS. The AUS Discrepancy alert is triggered when the AUS Recommendation field (field ID 1544) on the ATR/QM Management tool’s Qualification tab is populated, and the data in any of the following Encompass fields does not match the data in the AUS snapshot:

-

Field 2 does not match AUS.X16 (Details Total Loan Amount)

-

Field 1821 does not match AUS.X16 (Details Total Loan Amount)

-

Field 356 does not match AUS.X18 (Details Appraised Value)

-

Field 3 does not match AUS.X19 (Details Note Rate)

-

Field 1172 does not match AUS.X20 (Details Loan Type)

-

Field 4 does not match AUS.X21 (Details Term)

-

Field 608 does not match AUS.X22 (Details Amortization Type)

-

Field 19 does not match AUS.X24 (Details Loan Purpose)

-

Field CASASRN.X217 (Freddie Mac LTV) does not match AUS.X11 (Details LTV)

-

Field CASASRN.X218 (Freddie Mac TLTV) does not match AUS.X12 (Details CLTV)

-

Field 1389 does not match AUS.X41 (Details Total Monthly Income)

-

Field 1731 does not match AUS.X32 (Details Total Housing Payment)

-

Field 740 does not match AUS.X14 (Details Housing Expense Ratio)

-

Field 742 does not match AUS.X15 (Details Total Expense Ratio)

The alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

Redisclose Loan Estimate (Rate Lock) (2015 RESPA-TILA)

Redisclose Loan Estimate (Rate Lock) (2015 RESPA-TILA)

Under RESPA-TILA, if a rate lock changes after the initial LE is provided, a revised LE must be sent to the borrower within three days of the changes. These Redisclose Loan Estimate (Rate Lock) alerts are generated when the Rate Locked Date (field ID 761) is later than the Last Sent Date (field ID LE1.X33) on the LE. In other words, the rate was locked after the LE was initially disclosed. The alert displays on the Pipeline, Log, and LE (the top of the page displays in red), as well as in a pop-up window when you save the loan. To clear this alert, redisclose the LE.

Positive Aggregate Escrow Adjustment

Positive Aggregate Escrow Adjustment

Due to the calculations of single line analysis for biweekly escrows, certain scenarios can result in the calculation of a positive aggregate escrow adjustment. The Positive Aggregate Escrow Adjustment alert notifies the user if this scenario occurs on the loan level. While the positive aggregate adjustment calculation is technically correct, an investor or regulator might not approve purchasing a loan with a positive aggregate adjustment. The alert informs the Encompass user that a positive adjustment exists and suggests two methods for resolving the issue:

-

Move a portion of the escrow items to prepaid (section 900 on the 2015 Itemization).

-

Click the Lock icon for the Aggregate Adjustment amount (field ID 558) to accept and retain the positive number.

-

If the fields is locked, it will not recalculate if additional changes are made to the escrow analysis.

The alert triggers when the Aggregate Adjustment amount (field ID 558) is greater than 0. A link on the alert opens the 2015 Itemization input form at the Aggregate Escrow field on line 1011. The alert clears when the Aggregate Adjustment amount (field ID 558) is locked or when the field recalculates to be equal to or less than 0.

Credit Limit Required

Credit Limit Required

This alert is triggered when the Credit Limit (field ID FLxx31) is blank, the Account Type (field ID FLxx08) is HELOC and the Will be Paid Off checkbox (field ID FLxx18) is not selected.

Credit Analyzer Alerts

Credit Analyzer Alerts

For companies that have purchased the ICE Data & Document Automation service and ICE Mortgage Analyzers, Credit Analyzer alerts are available. When file attachments for credit-related documents are imported into a loan, the Credit Analyzer scans the data in the attachments and compares it to data in the Encompass loan file. A Credit Analyzer alert may be generated in the Encompass Log when the Credit Analyzer has finished analyzing the data. Users can click the AIQ Analyzers button in the loan header to access the Mortgage Analyzers to view details about the alert.

Income Analyzer Alerts

Income Analyzer Alerts

For companies that have purchased the ICE Data & Document Automation service and ICE Mortgage Analyzers, Income Analyzer alerts are available. When file attachments for income-related documents are imported into a loan, the Income Analyzer scans the data in the attachments and compares it to the data in the Verification of Employment (VOE) income records in the loan. The alert is generated when the Income Analyzer has finished analyzing the data. Encompass users can click an Income Analyzer alert to open a window where they can compare and reconcile any incomes data differences between the document attachments and the VOE records. The alert clears after the user reconciles the data. For detailed information, refer to the Income Analyzer Alert help topic.

Current and Proposed Lien position required if Resubordinated

Current and Proposed Lien position required if Resubordinated

This alert is triggered when the Current Lien Position (field ID FLxx28) or Proposed Lien Position (field ID FLxx29) are blank, but the Resubordinated Indicator checkbox (field ID FLxx26) is selected.

Current and Proposed Lien position required if Subject Property

Current and Proposed Lien position required if Subject Property

This alert is triggered when the Current Lien Position (field ID FLxx28) or Proposed Lien Position (field ID FLxx29) are blank, the Subject Property checkbox (field ID FLxx26) is selected, and the Will be Paid Off checkbox (field ID FLxx18) is not selected (regardless of resubordinated).

Redisclose Closing Disclosure (Changed Circumstance) (2015 RESPA-TILA)

Redisclose Closing Disclosure (Changed Circumstance) (2015 RESPA-TILA)

Under RESPA-TILA regulations, if circumstances have changed since the initial Closing Disclosure was provided, a revised Closing Disclosure must be sent to the borrower. The revised Closing Disclosure must be sent within three days of the changes. These Redisclose Closing Disclosure alerts are generated under the following conditions: when the CD Changed Circumstance checkbox (field ID CD1.X61) is selected, the Changes Received Date field (field ID CD1.X62) is populated (which occurs automatically when the Changed Circumstance checkbox is selected), and Change in Settlement Charges (field ID CD1.X55), Changed Circumstance - Eligibility (field ID CD1.X68), Revisions requested by the Consumer (field ID CD1.X66), Interest Rate dependent charges (Rate Lock) (field ID CD1.X67), Tolerance Cure (field ID CD1.X57), Clerical Error Correction (field ID CD1.X58), or Other (field ID CD1.X59) is then selected as the reason for the changed circumstance. The alert displays on the Pipeline, the Alerts & Messages tab in the Log, and in a pop-up window when you save the loan. (Business days are determined by the Our Company Calendar settings.)

Redisclose Closing Disclosure (APR, Product, Prepay) (2015 RESPA-TILA)

Redisclose Closing Disclosure (APR, Product, Prepay) (2015 RESPA-TILA)

This alert will be generated when a prepayment penalty is added, the loan product is changed, or the current APR differs from the Disclosed APR by more than 0.125% (0.25% for irregular loans) and the Closing Disclosure (CD) may need to be redisclosed as a result. The trigger fields are:

-

Trans Details Disclosed APR (field ID 3121) - Alert is triggered when the Current APR (field ID 799) differs from the Disclosed APR (field ID 3121) by more than 0.125% (0.25% for irregular loans) or custom percentage

-

Product Description (LE1.X5) - Alert is triggered when the current Loan Product (LE1.X5) on the CD Page 1 is different than the Loan Product indicated on the last disclosure

-

Prepayment Penalty (675) - Alert is triggered if Yes is currently indicated for this field on the CD Page 1 and No was indicated in the last disclosure

-

Last CD Sent Date (CD1.X47) - The date the CD was last disclosed.

These alerts display on the Pipeline and the Alerts & Messages tab in the Log, as well as in a pop-up window when you save the loan. To clear this alert, redisclose the CD or resolve the data in the trigger fields.

Redisclose Closing Disclosure (NBO Updated)

Redisclose Closing Disclosure (NBO Updated)

This alert is triggered when a non-borrowing owner file contact or non-borrowing owner vesting is added after the initial Closing Disclosure is issued. The following message display on the alert:

A non-borrowing owner has been added after the CD was issued. Please redisclose the CD, allowing at least 3 business days after presumed receipt for closing.

The alert is cleared when the user manually clears the alert or when a new Closing Disclosure with the NBO is issued.

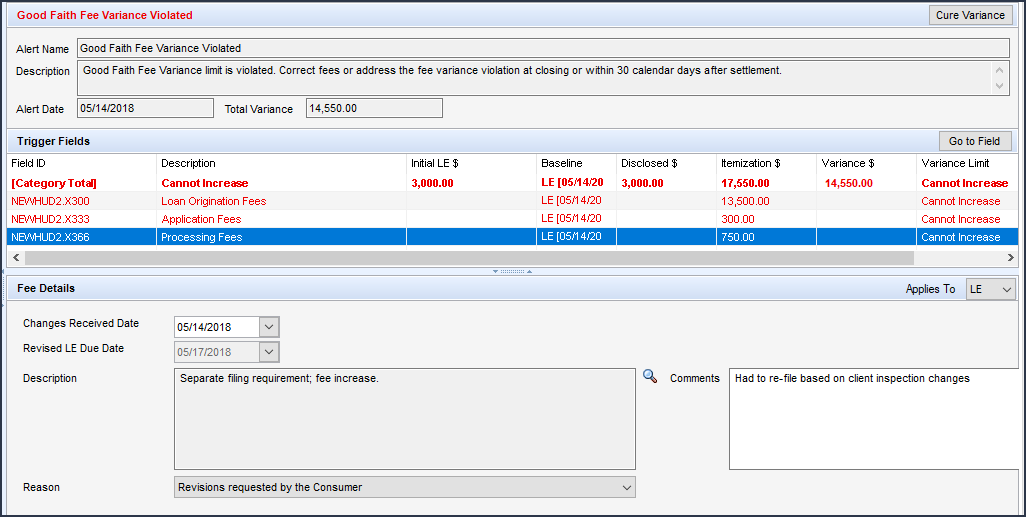

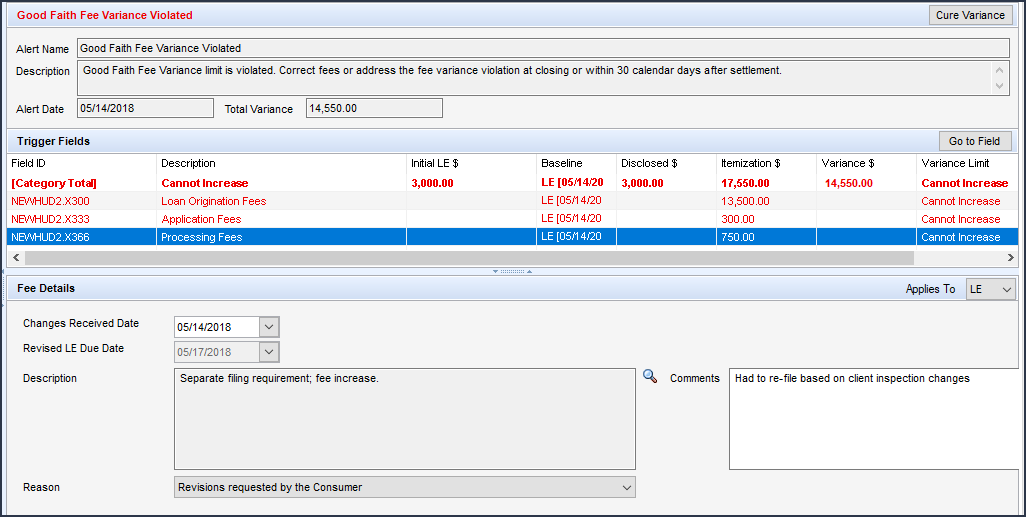

Good Faith Fee Variance Violated (2015 RESPA-TILA)

Good Faith Fee Variance Violated (2015 RESPA-TILA)

This alert is generated when there is a variance between the LE and 2015 Itemization in the Total Good Faith Amount section (field ID FV.X345) of the Fee Variance Worksheet or when there is a variance between the CD and 2015 Itemization in the Total Good Faith Amount section (field ID FV.X347) on the worksheet. These alerts display on the Pipeline and the Alerts & Messages tab in the Log, as well as in a pop-up window when you save the loan.

Click the alert icon or indicator to view the alert details, including each applicable fee that was changed, and clear the alert. When viewing the alert details, the following fee details are displayed (below the Trigger Fields section) that provide the following information. Here you can enter fee change details about each fee at a granular level:

- Applies To - At the top of this section, select LE or CD from the Applies To dropdown list to indicate the form (LE or CD) where these fee change details will be applied.

- Changes Received Date - Will auto-populate with today's date and reflects the same date used for this field on the LE Page 1 and CD Page 1

- Revised LE Due Date or Revised CD Due Date – In the Fee Details section, you can indicate if the fee change was made on the LE Page 1 or CD Page 1. Depending on the disclosure (as indicated by the selection in the Applies To field), this field will refer to the LE due date or CD due date accordingly. This is read-only field, calculated by the Encompass system.

- Description - Description of the Changed Circumstance (click the Lookup icon (magnifying glass) to select the changed circumstance from the list).

- Comments - Comments related to the Changed Circumstance

- Reason – Select the reason for the change from the dropdown list. There can only be one reason for each fee. This dropdown list provides the same list of reasons that is provided on the LE Page 1 and CD Page 1. Some reasons apply only to the LE, some apply only to the CD, and some apply to both. If LE is selected for the Applies To field, only reasons that apply only to the LE or LE and CD will be displayed in the list. If CD is selected for the Applies To field, only reasons that apply only to the CD or the LE and CD will be displayed in the list.

When a loan is utilizing fee level redisclosures, users can also indicate these Changed Circumstance details from the Good Faith Fee Variance Violated alerts that are generated when there is a variance between the Loan Estimate and 2015 Itemization in the Total Good Faith Amount section (field ID FV.X345) of the Fee Variance Worksheet or when there is a variance between the CD and 2015 Itemization in the Total Good Faith Amount section (field ID FV.X347) on the worksheet. The Changed Circumstances listed here when the user clicks the Find icon in the alert are now also filtered based on if the alert applies to the Loan Estimate or the Closing Disclosure.

When the alert applies to the Loan Estimate, the following descriptions are listed when the user clicks the Find icon in the alert:

Any Changed Circumstance that does not have a specific reason assigned to it. (Using the Changed Circumstances Setup tool in Encompass Settings, the administrator can assign a specific reason to a Changed Circumstance option. The Changed Circumstances Setup tool determines all of the eligible Changed Circumstances that are listed for the user when they click the Find icon in the Good Faith Fee Variance Violated alert.)

Other (LE and CD) reason

Changed Circumstance – Settlement Charges

Changed Circumstance - Eligibility

Revisions requested by the Consumer

Interest Rate dependent charges (Rate Lock)

Expiration (Intent to Proceed received after 10 business days)

Delayed Settlement on Construction Loans

When the alert applies to the Closing Disclosure, the following descriptions are listed when the user clicks the Find icon:

Other (LE and CD) reason

- Changed Circumstance – Settlement Charges

- Changed Circumstance - Eligibility

- Revisions requested by the Consumer

- Interest Rate dependent charges (Rate Lock)

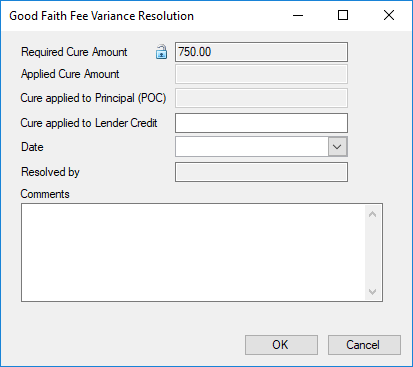

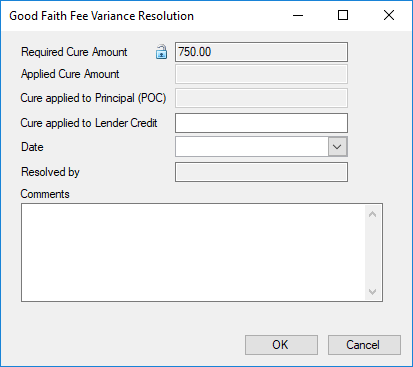

To clear this alert, click the Cure Variance button, and then enter the required fields in the pop-up window (shown below) or the amounts in the Variance between... fields (field ID FV.X345 and FV.X347) can be updated to remove the variance amount from the Fee Variance Worksheet or you can redisclose the LE or CD with a Change of Circumstance selected that causes the Variance Worksheet LE or CD Baseline to be updated, thereby removing the variance amount.

Withdrawn Loan

Withdrawn Loan

This alert is intended as a notification to the Lender Team Member that the associated Correspondent Channel - Loan has been formally withdrawn (action taken after the loan has already been delivered to the Investor). A Withdrawn Loan is no longer visible to the TPO user in the Encompass TPO Connect Pipeline.

VA Discount Charge Violation

VA Discount Charge Violation

This alert triggers when the % Discount (field ID VARRRWS.X9) on the VA 26-8923 Rate Reduction WS input form exceeds the 2% maximum allowed by the VA.

Custom Alerts

Custom Alerts

The system administrator can create custom alerts that will be triggered under the following circumstances:

-

When a date is entered in a specific date field or on a specific day before or after the date that is entered in the date field

-

When a specific value is entered in a field

-

When a value that is entered in a field falls between a specific value range

-

When a combination of the previous circumstances occurs

These alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

See Also:

Respond to and Manage Alerts

Alerts Setup

An alert is a notification that indicates an event has occurred, is pending, or is due. Alert information displays on the Pipeline and in the loan file. To view details of the alerts associated with a loan, click the Alert icon on

your Pipeline. The alert remains in effect until the required action is

taken. When you clear an alert, the entry is removed from both your Pipeline and the Alerts & Messages tab in the Log.

An alert is a notification that indicates an event has occurred, is pending, or is due. Alert information displays on the Pipeline and in the loan file. To view details of the alerts associated with a loan, click the Alert icon on

your Pipeline. The alert remains in effect until the required action is

taken. When you clear an alert, the entry is removed from both your Pipeline and the Alerts & Messages tab in the Log.![]() At App Disclosure Requirements

At App Disclosure Requirements

![]() Three-Day Disclosure Requirements

Three-Day Disclosure Requirements

![]() Document Expected and Document Expired

Document Expected and Document Expired

![]() Task Expected and Task Follow Up

Task Expected and Task Follow Up

![]() Preliminary Condition Expected

Preliminary Condition Expected

![]() Underwriting Condition Expected

Underwriting Condition Expected

![]() Rate Lock Removed from Correspondent Trade

Rate Lock Removed from Correspondent Trade

![]() Redisclose REGZ-TIL (APR Change) (Mortgage Disclosure Improvement Act (MDIA))

Redisclose REGZ-TIL (APR Change) (Mortgage Disclosure Improvement Act (MDIA))

![]() eConsent Not Yet Received (2015 RESPA-TILA)

eConsent Not Yet Received (2015 RESPA-TILA)

![]() Loan Estimate Expires (2015 RESPA-TILA)

Loan Estimate Expires (2015 RESPA-TILA)

![]() Redisclose GFE (Rate Lock) (2010 RESPA)

Redisclose GFE (Rate Lock) (2010 RESPA)

![]() Redisclose GFE (Changed Circumstance) (2010 RESPA)

Redisclose GFE (Changed Circumstance) (2010 RESPA)

![]() Redisclose Loan Estimate (Changed Circumstance) (2015 RESPA-TILA)

Redisclose Loan Estimate (Changed Circumstance) (2015 RESPA-TILA)

![]() HUD-1 Tolerance Violated (2010 RESPA)

HUD-1 Tolerance Violated (2010 RESPA)

![]() Ability-to-Repay Loan Type Not Determined (ATR/QM)

Ability-to-Repay Loan Type Not Determined (ATR/QM)

![]() Qualified Mortgage Type Not Determined (ATR/QM)

Qualified Mortgage Type Not Determined (ATR/QM)

![]() QM Safe Harbor Eligibility Not Determined (ATR/QM)

QM Safe Harbor Eligibility Not Determined (ATR/QM)

![]() Residual Income Assessment Recommended (ATR/QM)

Residual Income Assessment Recommended (ATR/QM)

![]() General QM DTI Exceeded (ATR/QM)

General QM DTI Exceeded (ATR/QM)

![]() General QM Loan Feature Violation (ATR/QM)

General QM Loan Feature Violation (ATR/QM)

![]() General QM Price Limit Exceeded

General QM Price Limit Exceeded

![]() Ability-to-Repay Exemption Reason Not Determined (ATR/QM)

Ability-to-Repay Exemption Reason Not Determined (ATR/QM)

![]() Redisclose Loan Estimate (Rate Lock) (2015 RESPA-TILA)

Redisclose Loan Estimate (Rate Lock) (2015 RESPA-TILA)

![]() Positive Aggregate Escrow Adjustment

Positive Aggregate Escrow Adjustment

![]() Current and Proposed Lien position required if Resubordinated

Current and Proposed Lien position required if Resubordinated

![]() Current and Proposed Lien position required if Subject Property

Current and Proposed Lien position required if Subject Property

![]() Redisclose Closing Disclosure (Changed Circumstance) (2015 RESPA-TILA)

Redisclose Closing Disclosure (Changed Circumstance) (2015 RESPA-TILA)

![]() Redisclose Closing Disclosure (APR, Product, Prepay) (2015 RESPA-TILA)

Redisclose Closing Disclosure (APR, Product, Prepay) (2015 RESPA-TILA)

![]() Redisclose Closing Disclosure (NBO Updated)

Redisclose Closing Disclosure (NBO Updated)

![]() Good Faith Fee Variance Violated (2015 RESPA-TILA)

Good Faith Fee Variance Violated (2015 RESPA-TILA)

. When a loan officer submits a lock request for a loan that is already locked, a

. When a loan officer submits a lock request for a loan that is already locked, a