Feature Enhancements in Version 18.2

Know Before You Owe 2 Updates for Loan Terms and Projected Payments for Construction-to-Permanent Loans

Why we made these updates: These updates are being made to implement clarifications in the Know Before You Owe 2 mortgage disclosure rule that are effective as of October 1, 2018.

Updates were made to the Calculating Cash to Close section on the Loan Estimate Page 2 and the Closing Disclosure Page 3 to comply with Know Before You Owe 2 guidance for construction-to-permanent loan scenarios.

The updates listed below were made to the Down Payment/Funds from Borrower and Funds for Borrower fields in the Calculating Cash to Close sections on the Loan Estimate Page 2 and Closing Disclosure Page 3 input forms to comply with Know Before You Owe 2 guidance for construction-to-permanent loan scenarios.

-

For construction scenarios where the lot is being refinanced, the payoff amount is now included as a liability to be paid off in the Third Party Payments Not Otherwise Disclosed (field ID LE2.X29).

-

For construction scenarios where the lot is being purchased, Encompass continues to synchronize the Purchase Price to the Disclosed Purchase Price.

-

For construction scenarios where the lot is owned free and clear, and the borrower is not using the equity in the lot to finance the purchase, no purchase price or payoff is documented for the lot cost.

-

For all construction scenarios, the lender has the option to document the cost to build as a liability, which updates the Third Party Payments Not Otherwise Disclosed (field ID LE2.X29), or to include the cost to build in the Third Party Payments Not Otherwise Disclosed without adding a liability.

-

There are no additional updates to calculations for the alternate disclosure.

The following logic is now being used to determine the Downpayment/Funds from Borrower (field IDs LE2.X2 and CD3.X105) and Funds for Borrower (field IDs LE2.X3 and CD3.X107) on the Loan Estimate Page 2 and Closing Disclosure Page 3 when the Purpose of Loan (field ID 19) is Construction or Const - Perm:

Downpayment/Funds from Borrower:

The funds required to cover the total of payoffs to be paid out of loan proceeds is determined by adding the disclosed purchase price and any personal property included in the sale, and then subtracting the loan amount and financed closing costs.

Example Construction-to-Permanent Loan:

-

Cost to Build: $200,000 (Documented as Payoff)

-

Lot Cost: $100,000

-

Personal Property: $0

-

Loan Amount $270,000

-

Financed Closing Costs: $0

Funds from Borrower: $30,000

Funds for Borrower: $0

Funds for Borrower:

The funds remaining after the total of payoffs are paid out of loan proceeds are determined by starting with the loan amount and subtracting the disclosed purchase price, personal property included in the sale, and the financed closing costs.

Example Construction-to-Perm Loan:

-

Cost to Build: $200,000 (Documented as Payoff)

-

Lot Cost: $100,000

-

Personal Property: $0

-

Loan Amount $305,000

-

Financed Closing Costs: $0

Funds from Borrower: $0

Funds for Borrower: $5,000

When upgrading to Encompass 18.2, the values for fields LE2.X2, LE2.X3, CD3.X105, and CD3.X107 are locked in existing loans. Click the Lock icon next to a field to trigger a recalculation of the value using the new calculations.

When triggering a recalculation, an Encompass user must click the Lock icons for all field in the Calculating Cash to Close section to ensure that the resulting values are consistent across the fields.

CBIZ-12987

When the Purpose of Loan (field ID 19) is Construction or Const – Perm, the cost to build is now considered a liability to be paid off. This applies to both lot acquisition and refinance scenarios. Updates have been made to include the liability in the calculation for the Third Party Payments Not Otherwise Disclosed (field ID LE2.X29) in the Calculating Cash to Close sections on the Loan Estimate Page 2. To ensure that the amount is included, Encompass users need to create a VOL (verification of liability) for the Costs of Improvement (field ID 23), mark it as a payoff, and make sure that the Include checkbox is selected for the VOL on the Payoffs and Payments pop-up window accessible from the Loan Estimate Page 2.

To Create a VOL and Include It in the Payoffs and Payments:

-

In the loan file, click the Forms tab on the lower-left and then click VOL.

-

Click the Add icon on the upper-right.

-

Complete the VOL, making sure you:

-

Enter the Cost of Improvements amount in the Balance field.

-

Select the Will be paid off checkbox.

-

Select the Mortgage Loan option from the UCD Payoff Type dropdown list. This option is required when running AUS.

-

On the Forms tab, click Loan Estimate Page 2 or Closing Disclosure Page 3.

-

In the Calculating Cash to Close section on the Loan Estimate Page 2, click the Payoffs & Payments button.

-

On the Payoffs and Payments pop-up window, make sure the Include checkbox is selected for the VOL.

-

Click OK to close the pop-up window, and then click OK when the confirmation messages asks if you want to copy the total Payoffs and Payments to line K-04.

CBIZ-12965

Other Know Before You Owe 2 Disclosure Updates

To comply with new Know Before You Owe 2 guidelines, the following updates have been made to the Closing Costs Expiration Date information that displays on the Loan Estimate output form. These updates affect Loan Estimate output forms generated from all versions of Encompass, even those released prior to Encompass 18.2 (for example, versions 18.1, 17.4, 17.3, and earlier).

-

The sentence "All other estimated closing costs expire on {date} at {time}{time zone}" containing field IDs LE1.X28, LE1.X8, and LE1.X9 will no longer display after the sentence "Before closing, your interest rate, points, and lender credits can change unless you lock the interest rate." on the output form when the Intent to Proceed checkbox (field ID 3164) is selected in Encompass.

-

If the checkbox is then cleared in Encompass, the sentence “All other estimated closing costs expire on {date} at {time}{timezone}.” will once again display on the output form.

-

The date, time, and time zone for the Closing Costs Estimate Expiration Date continue to display on the Loan Estimate Page 1 input form even when the Intent to Proceed checkbox is selected.

When the Intent to Proceed checkbox is selected in Encompass, clicking the Lock icon for the Closing Cost Estimate Expiration Date (field ID LE1.X28) and then manually entering the date will not cause the Closing Cost Estimate Expiration Date information to populate on the Loan Estimate output form.

CBIZ-14188

New Know Before You Owe 2 rule guidance has been released for rounding amounts in 12 fields used with the Loan Estimate and Closing Disclosure output forms. The guidance states that the values for these fields must either be rounded to three decimals, have trailing zeroes removed, or be truncated to a single digit if the original value was a whole number with trailing zeros (for example, 4.000 would be truncated to 4).

To comply with the rounding rules:

-

Ten fields on the Loan Estimate, RegZ-LE, Closing Disclosure, and RegZ-CD input forms have had new field IDs created for purposes of populating the rounded values to output forms.

- Eight of these fields can be edited directly or by clicking the Lock icon. The existing field IDs and the existing rounding logic for these fields continue to display on the input forms. The new field IDs are used only to calculate the rounded amounts and populate them to the output forms.

-

If your company has created custom disclosure input forms, you may need to add the new field IDs to custom forms that use these fields.

- Two of the new fields — Interest Rate (field ID KBYO.XD4113) and Maximum Rate (field ID KBYO.XD2625) — are read-only. The existing field IDs have been replaced with the new field IDs on the Loan Estimate and Closing Disclosure input forms, and the new rounding rules are applied. The values from the original fields on other forms in Encompass are not affected by the rounding rules.

-

Two fields — the % of Loan Amounts (field ID OriginationCharges1A1) and the Prepaid Interest Rate (field ID Prepaids3A5) — are virtual fields that do not display on the Loan Estimate, RegZ-LE, Closing Disclosure, or RegZ-CD input forms. No new field IDs have been created for these fields.

The rounding rules applied to these fields are described in the table below.

| Field Name | Existing Field ID | New Field ID | Update |

|---|---|---|---|

| Interest Rate | 4113 | KBYO.XD4113 | Trailing zeroes removed and truncated to a single digit if a whole number |

| Can Go as High As | NEWHUD.X555 | KBYO.NEWHUDXD555 | Trailing zeroes removed |

| % of Loan Amounts (Points) | OriginationCharges1A1 | NA | Trailing zeroes removed |

| Prepaid Interest Rate | Prepaids3A5 | NA | Trailing zeroes removed |

| APR | 799 | KBYO.XD799 | Trailing zeroes removed and truncated to a single digit if a whole number |

| Total Interest Percentage (TIP) | LE3.X16 | KBYO.LE3XD16 | Rounded to three decimals |

| Margin | 689 | KBYO.XD689 | Trailing zeroes removed |

| Interest Rate | 3 | KBYO.XD3 | Trailing zeroes removed |

| Minimum Rate | 1699 | KBYO.XD1699 | Trailing zeroes removed |

| Maximum Rate | 2625 | KBYO.XD2625 | Trailing zeroes removed |

| First Change | 697 | KBYO.XD697 | Trailing zeroes removed |

| Subsequent Change | 695 | KBYO.XD695 | Trailing zeroes removed |

When upgrading to Encompass 18.2, values will be copied to the new fields without rounding or truncating the existing values.

CBIZ-12556

To comply with Know Before You Owe 2 rule guidance provided in 12 CFR 1026.37(h)(1)(vii) comment 37(h)(1)(vii)-1; Comment 38(j)(2)(vi)-5; Comment 38(t)(5)(vii)(B)-1, the following updates are being made to the way Encompass handles gift funds:

-

Gift fund amounts are no longer listed on the Non-UCD tab in the Adjustments and Other Credits pop-up window (accessible by clicking the Edit icon in the Calculating Cash to Close section on the Closing Disclosure Page 3).

-

The calculation for the Total amount (field ID CD3.X1505) on the Non-UCD tab on the Adjustments and Other Credits pop-up window has been updated to exclude gift funds (field ID 220) for a loan file that has not been previously disclosed. If at least one Disclosure Tracking Tool log has been created, the gift funds (field ID 220) will continue to be included in the calculation for CD3.X1505.

CBIZ-14107

The escrow descriptions provided on the Loan Estimate (LE) Page 1 and Closing Disclosure (CD) Page 1 have been updated from Yes, some to Some for partially escrowed scenarios. For example, if the loan featured partially escrowed property taxes, the In escrow? field description (field ID CD1.X4) on the CD would be Yes, Some. Starting in Encompass 18.2, this field description will now be Some. The following fields on the LE Page 1 and CD Page 1 will now feature this new verbiage when applicable:

- LE1.X30

- LE1.X31

- LE1.X32

- CD1.X4

- CD1.X5

- CD1.X6

Compliance Updates

The FHA Management form is now accessible when making selections for fields and forms to include in the following business rules:

-

Field Trigger Business Rules – When creating, duplicating, or editing a Field Trigger rule, the FHA management form is accessible when an Encompass user clicks the Add button in the Add and apply field events section, and then clicks the Find button to locate and select a Trigger Field ID.

-

Field Data Entry Rules – When creating, duplicating, or editing a Field Data Entry rule, the FHA management form is accessible when an Encompass user clicks the Add button in the Add and apply field rules section, and then clicks the Find button to locate and select a Field ID.

-

Input Form List – When creating, duplicating, or editing an Input Form List business rule, the FHA management form is accessible when an Encompass user clicks the Add button in the Define Input Form to Add section, and then clicks the Find button to locate and select an input form.

CBIZ-12329

A new Chargeable Costs and Expenses section has been added to the State-Specific Disclosure Information input form for North Dakota. This section contains one free entry field (field ID DISCLSOURE.X1173) to enable lenders to properly disclose non-refundable charges pursuant to North Dakota regulations 13-05-01-08 and 13-05-01-05.

The North Dakota Loan Agreement Disclosure requires disclosure of the total charges that are not refundable (flagged as POC) if the loan does not close or if no lender is found to approve the financing. The North Dakota Loan Agreement Disclosure was previously mapping the total for fees that are financed if the application fee, appraisal fee, or credit report fee were flagged as financed.

CBIZ-12328

The following 12 new fields have been added to the Additional Provider Data section on the FNMA Streamlined 1003 input form to enable Encompass users to submit loans to additional Day 1 Certainty vendors when submitting a loan to Desktop Underwriter:

-

BankVOD (Bor,CoBor) (field ID GSEVENDOR.X25)

-

LendSnap (Bor,CoBor) (field ID GSEVENDOR.X26)

-

Quovo (Bor,CoBor) (field ID GSEVENDOR.X27)

-

Roostify (Bor,CoBor) (field ID GSEVENDOR.X28)

-

CoreLogic (VOE/VOI) (Bor,CoBor) (field ID GSEVENDOR.X29)

-

Advanced Data Income Tax Verification (Bor,CoBor) (field ID GSEVENDOR.X30)

-

Partners Credit (IncomeVerify) (Bor,CoBor) (field ID GSEVENDOR.X31)

-

Taxdoor 4506-T Service (Chronos) (Bor,CoBor) (field ID GSEVENDOR.X32)

-

ComplianceEase IRS Tax Transcript (Bor,CoBor) (field ID GSEVENDOR.X33)

-

Private Eyes (4506-Transcripts.com) (Bor,CoBor) (field ID GSEVENDOR.X34)

-

BankVOD IRS (Bor,CoBor) (field ID GSEVENDOR.X35)

-

QuestSoft (Bor,CoBor) (field ID GSEVENDOR.X36)

CBIZ-14727

The following new logic has been implemented to populate the loan Purpose (field ID LE1.X4) for loans with the Construction or Construction - Perm option selected for the Purpose of Loan (field ID 19):

-

The loan Purpose (field ID LE1.X4) is populated with Refinance when the Initial Acquisition of Land checkbox (field ID 1964) is not selected and the Refinance checkbox (field ID Constr.Refi) is selected.

In additional to the new logic, the following existing logic will continue to be used to populate the loan Purpose (field ID LE1.X4) for loans with the Construction or Construction - Perm option selected for the Purpose of Loan (field ID 19):

-

The loan Purpose (field ID LE1.X4) is populated with Purchase when both the Initial Acquisition of Land checkbox (field ID 1964) is selected and the Refinance checkbox (field ID Constr.Refi) is not selected.

-

The loan Purpose (field ID LE1.X4) is populated with Construction when the Initial Acquisition of Land checkbox (field ID 1964) is not selected and the Refinance checkbox (field ID Constr.Refi) is not selected.

When upgrading to Encompass 18.2, the loan Purpose (field ID LE1.X4) will be locked for existing loans to maintain the data integrity of closed loans and disclosed loans. Click the gold Lock icon to trigger a recalculation of the amount using the new logic.

CBIZ-13127

Updates have been made to the logic used to populate the HOEPA Status (field ID HMDA.X13) in order to populate the HOEPA status correctly on the NMLS Mortgage Call Report per filing instruction guide (FIG) requirements. Previously, the HOEPA Status was populated with 1. Not Applicable if the loan was not subject to HOEPA and was not originated by your company. A loan identified as high cost but not originated by the lender would be reported as high cost. Additionally, the mapping did not take into account whether the loan was a reverse mortgage or was not subject to the requirements of RegZ.

The following new logic is now being applied to populate the HOEPA Status (field ID HMDA.X13):

-

The HOEPA Status is populated with 1. High-cost mortgage when both of the following conditions are true:

-

The Section 32 Qualification section on the Section 32 HOEPA input form indicates that the loan does qualify as a HOEPA/Section 32 High Cost Mortgage (field ID S32DISC.X51).

-

The Action Taken (field ID 1393) is 1. Loan Originated or 6. Loan purchased by your institution.

-

-

The HOEPA Status is populated with 2. Not a High Cost Mortgage when both of the following are true:

-

The Section 32 Qualification section on the Section 32 HOEPA input form indicates that the loan does not qualify as a HOEPA/Section 32 High Cost Mortgage (field ID S32DISC.X51).

-

The Action Taken (field ID 1393) is 1. Loan Originated or 6. Loan purchased by your institution.

-

-

The HOEPA Status is populated with 3. Not Applicable when any of the following are true:

-

The Action Taken (field ID 1393) is not 1. Loan Originated or 6. Loan purchased by your institution.

-

The Reverse Mortgage option (field ID HMDA.X56) is 1. Reverse Mortgage.

-

The Transaction is exempt from Reg. Z Ability-to-Repay requirements based on checkbox (field ID QM.X103) is selected.

-

-

The HOEPA Status is not automatically updated when none of the above conditions apply.

The HOEPA Status is not automatically populated for construction and construction-to-permanent loans, which are not subject to HMDA reporting. These loans must be evaluated by the lender.

CBIZ-14716

HMDA 2018 Updates

Why we made this update: Removing the Lock icons ensures that Encompass users no longer need to click the Lock icon to apply a business rule for the field or to select a value as part of a workflow.

During the initial implementation of 2018 HMDA features, the fields listed below were created with Lock icons and were populated with default values. The Lock icons have now been removed to enable business rules to update the fields and to enable Encompass user to enter data without clicking the Lock icons first.

-

Manufactured Secured Property Type (field ID HMDA.X39)

-

Manufactured Home Land Property Interest (field ID HMDA.X40)

-

Submission of Application (field ID HMDA.X42)

-

Initially Payable to Your Institution (field ID HMDA.X43)

-

AUS #1 (field ID HMDA.X44)

-

AUS Recommendation #1 ((field ID HMDA.X50)

-

Reason for Denial #1 (field ID HMDA.X21)

The mapping rules for populating the fields with default values are still in effect.

When upgrading to Encompass 18.2, existing loans will retain the existing field values. The Lock icons will be removed from the fields, but any logic that populates a default value or overrides an existing value in these fields will not be triggered when saving the loan.

The Interest Only dropdown list (field ID 2982) on the 2018 HMDA Information input form has been replaced with a new Interest Only dropdown list (field ID HMDA.X109) to implement new logic for recording interest only payments for construction and construction-to-permanent loans for HMDA reporting purposes. A Lock icon has been added to the new field. The new field has the same three options as field 2981: blank, Yes, and No.

Yes is populated to the new Interest Only dropdown list when:

-

The value for the Interest Only months (field ID 1177) is greater than 0

-

Or when the Loan Purpose (field ID 19) is Construction

-

Or when the Loan Purpose (field ID 19) is Construction-Perm and the value for the Period months (field ID 1176) is greater than 0.

No is populated to the field for all other scenarios.

When updating existing loan files to Encompass 18.2, the value in field 2982 is copied to field HMDA.X109.

CBIZ-12944

ARM Loans

ARM data fields have been added to the Loan Program Details section on the RegZ-LE and RegZ-CD input forms to enable Encompass users to enter all the information required to generate a complete ARM Disclosure custom form from the Encompass Print feature without having to modify the existing ARM disclosure custom form for every adjustable rate loan.

-

An Index Lookback Period dropdown list (field ID ARM.IdxLkbckPrd) now displays in the Adjustable Rate Mortgage sections on the RegZ-LE and RegZ-CD.

-

A new Conversion Option section has been added to the RegZ-LE below the Adjustable Rate Mortgage section with the following fields:

-

Convertible checkbox (field ID 1290) – Indicates whether the ARM loan contains a conversion option.

-

Conversion Option Fee $ (field ID CnvOpt.FeeAmt) – The amount paid to exercise the conversion option.

-

Conversion Option Fee % (field ID CnvOpt.FeePct) – The percentage of the loan principal balance (either original or at conversion) that the mortgagor must pay to exercise the option to convert.

-

Max Rate Adj (field ID CnvOpt.MaxRateAdj) – The factor used to calculate the maximum percentage rate to which the interest rate can increase when calculating a new interest rate for the option to convert an ARM loan to Fixed.

-

Min Rate Adj (field ID CnvOpt.MinRateAdj) – The factor used to calculate the minimum percentage rate to which the interest rate can decrease when calculating a new interest rate for the option to convert an ARM loan to Fixed.

-

Conversion Begin (field ID LE1.X96) – The ARM adjustment on which the conversion option takes effect. For example, select Second if the conversion begins on the second ARM adjustment based on the first change and adjustment periods configured in the Rate Adjustment section. This field is used to generate the Convertible ARM Disclosure output forms.

-

Conversion End (field ID LE1.X97) – The ARM adjustment on which the conversion option ends. For example, select Fifth if the conversion begins on the fifth ARM adjustment based on the first change and adjustment periods configured in the Rate Adjustment section. This field is used to generate the Convertible ARM Disclosure output forms.

-

A new Payment Change Example button has been added to the Adjustable Rate Mortgage section on the RegZ-LE and RegZ-CD input forms to enable Encompass users to adjust the information in the Interest Rate and Payment Change Example for ARM loans. The button is enabled only when the ARM option is selected for the Amortization Type (field ID 608).

The pop-up window contains the text shown below.

The amounts are populated from existing Encompass fields or are calculated based on loan values. Encompass users can click the blue Lock icons to manually modify the field values.

The pop-up window includes the following four new fields:

-

Calculated initial monthly payment for a $10,000 loan (field ID LE1.X92) – Based on the rate (field ID 3) and the loan term (field ID 4).

-

Calculated maximum monthly payment for a $10,000 loan (field ID LE1.X93) – Based on the maximum rate (field ID 2625) for the loan under the worst case scenario.

-

Calculated month when the maximum monthly payment takes effect for a $10,000 loan (field ID LE1.X94) – Based on the time it will take for the note rate to reach the fully indexed rate based upon adjustments.

-

Calculated initial monthly payment (field ID LE1.X92) for a $60,000 loan (field ID LE1.X94) – Based on the rate (field ID 3) and the loan term (field ID 4).

Additionally, when you select an option for ARM Index Type (field ID 1959), the corresponding long index description for the selected option is now populated to the description field (field ID 666) at the bottom of the Payment Schedule section, overwriting any text previously entered in the description field.

CBIZ-15444

VA Loans

An issue has been resolved that caused a negative number to populate for the Total Proposed Monthly Payment (PITI) (field ID VASUMM.X99) for VA loans under some circumstances. This resulted in the following error being returned when running Encompass Compliance Service reports:

-

Mavent Message(5000907) ERROR - PrincipalInterestTaxesInsuranceAmount - Value can not be less-than the minimum inclusive currency value.

The negative number would populate when an Encompass user entered HOA dues in the HOA Dues field (field ID 233) in the Proposed Monthly Housing Expenses section on forms such as the 1003 Page 2 and also entered the dues as a disclosure item on the 2015 Itemization input form. A negative Total Proposed Monthly Payment would display when the sum of the doubled HOA dues and other housing expenses exceeded the principal and interest on the loan.

This issues has been resolved. Encompass now calculates the VA payment as the principal and interest plus the related tax and insurance line items. Other proposed housing costs are not included in the calculation. The calculation for Total Proposed Monthly Payment now includes:

-

First Mortgage P&I (field ID 228)

-

Hazard Insurance (field ID 230)

-

Real Estate Taxes (field ID 1405)

-

MI Premium (field ID 232)

-

Flood Insurance (field ID 235)

-

Miscellaneous Escrow if Taxes or Insurance (from lines 1007, 1008, and 1009 on the 2015 Itemization)

Entries in lines 1007, 1008, and 1009 are included in the calculation only when the word "taxes" or "insurance" is included in the fee description (field IDs 1628, 660, and 661) for these lines.

When upgrading to Encompass 18.2, the Total Proposed Monthly Payment (PITI) (field ID VASUMM.X99) will be locked for existing loans to maintain the data integrity of closed loans and disclosed loans. Click the gold Lock icon to trigger a recalculation of the amount using the new calculation.

CBIZ-12455

Encompass Forms and Tools

Two new ARM disclosures are now provided in the Print window in Encompass:

- Convertible ARM Disc (Name printed on form: Important Adjustable Rate Mortgage Loan Information)

- Non-Convertible ARM Disc (Name printed on form: Important Adjustable Rate Mortgage Loan Information)

It is important to note that while these disclosures are being provided for your convenience, the regulation is specific regarding the timing in which these disclosures need to be made to the consumer:

1026.19(b) Certain variable-rate transactions.

Except as provided in paragraph (d) of this section, if the annual percentage rate may increase after consummation in a transaction secured by the consumer's principal dwelling with a term greater than one year, the following disclosures must be provided at the time an application form is provided or before the consumer pays a non-refundable fee, whichever is earlier (except that the disclosures may be delivered or placed in the mail not later than three business days following receipt of a consumer's application when the application reaches the creditor by telephone, or through an intermediary agent or broker):

(1) The booklet titled Consumer Handbook on Adjustable Rate Mortgages published by the Board and the Federal Home Loan Bank Board, or a suitable substitute.

(2) A loan program disclosure for each variable-rate program in which the consumer expresses an interest. The following disclosures, as applicable, shall be provided: ...

Currently in Encompass 18.2, these disclosures are listed in the Selected Forms list in the Print window by default when users print from the RegZ – LE or RegZ – CD input form screens. Otherwise, these disclosures are listed in the left panel of the Print window on the Standard Forms tab (Look In > General Forms) where they can be selected and then moved to the Selected Forms list to be printed. Please note that the “pre-selection” of these disclosures to the Selected Forms list from the RegZ-LE or RegZ-CD screens was done in error. This issue will be resolved in a future Encompass release currently targeted for May 2018.

These disclosures will only print (or be included in eDisclosure packages and/or Closing Documents) if the loan is an ARM loan (i.e., the Amortization Type indicated is ‘ARM’ (field ID 608)). Ellie Mae is reminding you of the timing requirements stated above so you can adjust when this disclosure is generated based on the manner in which the application was received (in other words, if you have taken a retail face-to-face application for an ARM loan providing this disclosure in a closing package only would not meet this requirement). In addition, there is also the obligation to provide a disclosure for each program in which the consumer expresses an interest so you should be aware of the obligation to potentially provide multiple ARM type disclosures as needed. Please contact your Legal Counsel or Compliance professionals to use these disclosures appropriately.

In order to make these new forms available in your Encompass system(s), the administrator or other authorized user must use the Documents tool in Encompass Settings to add the forms as new forms. For instructions to add a new form, refer to the Documents topic in the Encompass online help.

To enable users to identify when to use a lender fee waiver or not when pricing from EPPS, a new Lender Fee Waiver field (field ID 4459) has been added to the Lock Request Form and the Lock Request Snapshot tab on the Secondary Lock Tool. A lender fee waiver enables the standard lender fees charged to a borrower to be removed and a calculated loan level price adjustment is added to the product pricing in an equivalent amount.

Lock Request Form

Secondary Lock Tool – Lock Request Snapshot

This field has been added to the Encompass Reporting Database.

SEC-12924

When the Good Faith Fee Variance Violated alert is triggered, authorized users can view the alert details and click the Cure Variance button in the alert to enter the tolerance cure amount and other details to clear the alert and cure the tolerance violation. The pop-up window that is provided when they click the Cure Variance button has been updated to include all of the data fields that are provided in the Tolerance Cure section of the Closing Disclosure Page 1 and Fee Variance Worksheet.

Previously, the Good Faith Fee Variance Resolution Window contained the Date Resolved, Applied Cure Amount, and comments fields.

Starting in Encompass 18.2, this window contains the Required Cure Amount, Applied Cure Amount, Date, Resolved by, and Comments field.

Two new fields have been added to the Underwriter Summary tool to record the date and status of counter offers on loan amounts to comply with 12 CFR 1003.4(a)(7)(i); comment 4(a)(7)-1:

-

Counter Offer Date (field ID 4457) – The date when a counter offer was made.

-

Counter Offer Status (field ID 4458) – A dropdown list with the following options: blank, Pending, Accepted, Declined, or Withdrawn. The default value for the field is blank. The dropdown is enabled only after the Counter Offer Date field is populated.

Per 12 CFR 1003.4(a)(7); comment 4(a)(7)-1, when an applicant accepts a counteroffer for an amount different from the amount for which the applicant applied, the financial institution reports the covered Loan Amount (field ID HMDA.X31) granted. If an applicant does not accept a counteroffer or fails to respond, the institution reports the amount initially requested.

The following logic has also been implemented to populate the appropriate Loan Amount (field ID HMDA.X31) based on the counter offer status:

-

The Loan Amount (field ID HMDA.X31) is populated with the Initial Application Amount (field ID NMLS.X11) from the NMLs Report Information pop-up window (accessible by clicking the NMLS button on the HMDA Information input form) when the loan’s Current Status (field ID 1393) is blank or Active Loan.

If the Initial Application Amount (field ID NMLS.X11) is blank, the Loan Amount (field ID HMDA.X31) is populated with the Total Loan Amount (field ID 2). If the Total Loan Amount is also blank, the Loan Amount (field ID HMDA.X31) is left blank.

-

The Loan Amount (field ID HMDA.X31) is populated with the Total Loan Amount (field ID 2) when all the following conditions are true:

-

The loan’s Current Status (field ID 1393) is not Loan Originated or Purchased Loan.

-

The Open-end line of credit option is not selected for the Open-End Line of Credit field (field ID HMDA.X57).

-

The Reverse mortgage option is not selected for the Reverse mortgage field (field ID HMDA.X56).

-

The Accepted option is selected for Counter Offer Status (field ID 4458).

-

-

The Loan Amount (field ID HMDA.X31) is populated with the Initial Application Amount (field ID NMLS.X11) when all the following conditions are true:

-

The loan’s Current Status (field ID 1393) is not Loan Originated or Purchased Loan.

-

The Open-end line of credit option is not selected for the Open-End Line of Credit field (field ID HMDA.X57).

-

The Reverse mortgage option is not selected for the Reverse mortgage field (field ID HMDA.X56).

-

The Accepted option is not selected for Counter Offer Status (field ID 4458).

-

-

The Loan Amount (field ID HMDA.X31) is populated with the Total Loan Amount (field ID 2) when all the following conditions are true:

-

The loan’s Current Status (field ID 1393) is Loan Originated.

-

The Open-end line of credit option is not selected for the Open-End Line of Credit field (field ID HMDA.X57).

-

The Reverse mortgage option is not selected for the Reverse mortgage field (field ID HMDA.X56).

-

-

The Loan Amount (field ID HMDA.X31) is populated with the Subject Loan Unpaid Principal Balance Amt. (field ID ULDD.X1) when all the following conditions are true:

-

The loan’s Current Status (field ID 1393) is Purchased Loan.

-

The Open-end line of credit option is not selected for the Open-End Line of Credit field (field ID HMDA.X57).

-

The Reverse mortgage option is not selected for the Reverse mortgage field (field ID HMDA.X56).

-

-

The Loan Amount (field ID HMDA.X31) is populated with (field ID CASASRN.X168) when Open-end line of credit option is selected for the Open-End Line of Credit field (field ID HMDA.X57).

-

The Loan Amount (field ID HMDA.X31) is populated with the Total Loan Amount (field ID 2) when Reverse mortgage option is selected for the Reverse mortgage field (field ID HMDA.X56).

CBIZ-14524

Encompass Pipeline

Columns can now be added to the Encompass Pipeline and TPO Connect Pipeline to display the number of external and internal open conditions (conditions that do not have Cleared or Waived selected on the condition details window) for conditions that are associated with the following milestones:

-

Prior to Approval (PTA)

-

Prior to Docs (PTD)

-

Prior to Closing (PTC) or Prior to Funding (PTF)

-

Prior to Purchase (PTP)

-

At Closing (AC) - for Post-Closing conditions only

To Add Columns to the Pipeline:

-

Make sure your Encompass administrator has added the condition fields to your Encompass Reporting Database (see the To Add the Condition Fields to the Encompass Reporting Database procedure below).

-

On the Encompass Pipeline, right-click a column header, and then click Customize Columns.

-

To add a column, select the checkbox for one or more columns.

-

When finished, click OK.

To Add the Condition Fields to the Encompass Reporting Database:

-

On your Windows task bar, click the Start menu or Start icon, navigate to the Ellie Mae Encompass program folder, and then click Admin Tools.

-

Double-click Reporting Database.

-

If you are prompted to log in to the server, type the User ID, Password, and Server that you use to log in to Encompass as the Admin user.

-

In the Fields section on the left, click the Conditions tab, and then select one or more of the open conditions fields. These fields have field IDs that are listed alphabetically from UWC.AC through UWC.WAIVEDCOUNT.

-

After selecting the fields, click the Add button to move the fields to the Selected fields section on the right.

-

Click the Update button to update the Encompass Reporting Database.

CBIZ-14142

Worst Case Pricing Tool

To enable lenders and investors to apply re-lock fees and/or custom price adjustments to a revised lock on an inactive lock, a new Re-Lock Fees section and Custom Price Adjustments section have been added to the Worst Case Pricing Tool (WCPT).

For both the Re-Lock Fees and Custom Price Adjustments sections:

-

Up to 10 fields are available.

-

Negative numbers are accepted.

-

Values up to 3 decimal places are accepted.

SEC-12582

Why we made this update: To provide support for re-lock fees and custom pricing adjustments for inactive locks (expired or cancelled locks) within the Worst Case Pricing Tool.

Currently, the Worst Case Pricing Tool only supports active locks and does not take into account non-product related price adjustments. To integrate inactive locks and non-product related price adjustments into the tool, the following updates to the tool’s behavior have been made:

![]() Non-Product Related Price Adjustments

Non-Product Related Price Adjustments

SEC-12583, SEC-12604

Currently, the Worst Case Pricing Tool includes a Delivery Type field but not a Commitment Type field. This enhancement adds a Commitment Type field to the tool. Both fields are required on a lock request for correspondent loans associated with a TPO client.

-

If the correspondent loan is part of a trade, an error message, “The Worst Case Pricing tool cannot be used with loans that are assigned to a correspondent trade. The loan must first be removed from the trade to enable Worst Case Pricing.” will be displayed.

-

The Commitment Type and Delivery Type fields are only displayed:

- If the loan is a correspondent loan.

- If the correspondent loan is associated with a TPO on the TPO Information tool.

-

The fields in both the Historical and Current Pricing columns are pre-populated from the last “confirmed” lock snapshot.

-

The Delivery Type is populated based on the selected Confirmation Type.

-

The available commitment types are based on the types specified on the External Company Details Commitments tab of the TPO client associated with the loan.

- If the Commitment Type is “Best Efforts”, then the Delivery Type will be “Individual Best Efforts”.

- If the Commitment Type is “Mandatory”, then the Delivery Type will be “Individual Mandatory”.

Extensions for Correspondent Trades

Why we made this update: To enable investors to offer extensions for loans (active or expired) that are allocated to a correspondent trade.

Currently, users can update the Delivery Expiration Date and pricing at the trade level and then apply those changes to selected loans. However, by making the changes on the Correspondent Trades Details tab, the original Delivery Expiration Date and pricing is lost. This enhancement provides a way to make the changes to selected loans, apply an extension, re-lock, and/or custom price adjustments at the trade level, and have the changes retained in the lock snapshots.

To Extend Loans in Correspondent Trades:

-

Click the Trades tab, and then click the Correspondent Trades tab.

-

Select the correspondent trade with the loans you want to extend.

-

On the Loans tab, select the loans you want to extend, and then click the Extend Selected Loans button.

-

The loan must have a Trade Assignment of “Assigned” for the Extend Selected Loans button to be enabled. Otherwise, an error message, “Loan [Loan Number] was not extended because the loan is in a Pending assignment status.” will be displayed.

-

For loans allocated to a trade, re-locks cannot be submitted for expired locks and an error message, “This loan must be removed from the Correspondent Trade [Trade Number] before it can be relocked.” will be displayed.

-

If the extension, re-lock, or custom price adjustment has exceeded the maximum number allowed, an error message, “Failed to create [Action] for loan [Field ID 364]: [Action] limit has been reached.” will be added to the Notes/History tab.

-

If changes are made that impact the loans (e.g., Commitment #, Commitment Date, Master Commitment #, Delivery Type, etc.), and the Extend Selected Loans button is clicked, an error message, “Loans cannot be extended when there are unsaved changes for the correspondent trade.” will be displayed.

-

On the Extension Request pop-up window, enter the following information:

If the Lock Extension Price Adjustments section on the Product and Pricing setting is not enabled, the Extension Request will be blank.

-

The Days to Extend field may be populated from the Lock Extension Price Adjustment section, but can also be edited. This field is required to request an extension.

-

The value is mapped if the Control option is set to “Company controls extension days and price adjustment”.

-

The Price Adjustment field may be populated from the Lock Extension Price Adjustment setting, but can also be edited.

- The value is mapped if the Control option is set to “Company controls extension days and price adjustment”.

- If a price adjustment is not defined for a given number of days, the default adjustment will be “0.000”.

-

Enter a re-lock fee, if applicable.

-

Enter a custom price adjustment, if applicable.

-

Enter comments, if applicable.

-

Click Request Extension.

-

The trade is saved and the trade update process is initiated.

SEC-12505

When a loan is extended from a trade, and that trade is processed, a new “Trade Extension” Request Type is created in the snapshot. The data in the snapshot is populated as follows:

-

Original Expiration Date - Buy Side Lock Request field ID 2091 and Buy Side Lock and Pricing field ID 3358 is the previous lock expiration date.

-

Current Expiration Date - Buy Side Lock Request field ID 3369 and Buy Side Lock and Pricing field ID 2151 is the current lock expiration date.

-

Days to Extend – Buy Side Lock Request field ID 3360 and Buy Side Lock and Pricing field ID 3363.

-

New Lock Expiration Date - Buy Side Lock Request field ID 3361 and Buy Side Lock and Pricing field ID 3364 is the calculated expiration date based on the Days to Extend.

-

The calculation takes into account any relevant settings set on the Lock Desk Setup setting (e.g., Expiration Settings, Calendar, etc.).

-

Price Adjustment - Buy Side Lock Request field ID 3362 and Buy Side Lock and Pricing field ID 3365.

-

Lock Extensions – An extension description and Days to Extend value in the appropriate extension field and the Price Adjustment value.

-

Re-Lock Fees – A re-lock description in the appropriate re-lock field and the Re-Lock Fee (price) value.

-

Price Adjustments – The Custom Price Description in the appropriate CPA field and the Custom Price Adjustment value.

While in the snapshot, the following actions can be taken without having additional extensions, re-lock fees, or custom price adjustments recorded.

-

Revise Lock

-

Validate Lock (if the initial pricing was done in EPPS and the correspondent trade has an individual Delivery Type.)

If changes are made to the correspondent trade that impacts the loan (e.g., Commitment #, Commitment Date, Master Commitment #, Delivery Type, etc.), a new snapshot is created and the previous extension fee, re-lock fee, and/or custom price adjustment is cleared.

Non-product related price adjustments will not be cleared for individual correspondent trades.

SEC-12690, SEC-12691, SEC-12692

Support to Process Cancels and Withdrawals at Trade Level for Direct Trades/Assignment of Trades/Forwards

Why we made this update: To enable correspondent buyers to automatically remove loans from correspondent trades and assign either a cancelled date or withdrawn date (depending on the status of the loan) for AOT, Direct Trades and Forwards delivery types.

To enable correspondent buyers to automatically remove loans at the trade level for AOT, Direct Trades, and Forwards, the following process will be implemented:

The loan must be removed from the Correspondent Trades Loans tab and the Voided checkbox is not selected.

-

For loans removed on or after the Expiration Date:

-

If the loans have been submitted (Submitted for Review (field ID 4119) is entered), they will be removed as a withdrawn loans.

-

If the loans have not been submitted, they will be removed as cancelled loans.

-

For loans removed before the Expiration Date, they will not be treated as either cancelled or withdrawn loans.

-

The trade data will be removed from the lock snapshot.

-

After the trade update:

-

For cancelled loans, the Cancelled Date on the Correspondent Loan Status tool is updated with the date the loan was removed from the trade.

-

-

The Lock and Request Status will be “Lock Cancelled”.

- The Withdrawn Date and Voided Date on the Correspondent Loan Status tool will be cleared.

-

For withdrawn loans, the Withdrawn Date on the Correspondent Loan Status tool is updated with the date the loan was removed from the trade.

- The Lock and Request Status will be “Lock Cancelled”.

- The Cancelled Date and Voided Date on the Correspondent Loan Status tool will be cleared.

SEC-12695

Title and Closing Service Updates

To facilitate clearer communication between lenders and title agents subscribed to the Encompass Title & Closing Center, the ability for both parties to collaborate on fees together has been added to the Encompass Title and Closing Service. When the title agent sends you a fee quote, you can import their fees and modify them, and then save the loan to send the modified fees back to the agent. The agent can then accept or modify your fees and send their modified fees back to you. You can then import their newly modified fees and repeat this collaboration as many times as necessary

The Import Fee Quote Data From Agent window has been updated to display two panels of fees:

- New Title / Recording Fees: The title agent's fees that are available to import.

- Current Title / Recording Fees: The fees that are currently in Encompass. These fees will be overridden by new fees, if they are imported.

To Import Fees from Agent:

- From an open loan, click the Services tab, and then click Order Title & Closing.

- On the Order Status tab, click the Import link in the Orders section to open the Import Fee Quote Data From Agent window to view the fees that are available to import.

- Select a checkbox to import the fee or clear a checkbox to exclude the fee.

- Click Import to import the selected fees to the 2015 Itemization input form

To Modify Fees and Collaborate with Agent:

- From an open loan, click the Forms tab, select the Show All checkbox, and then click 2015 Itemization.

- In section 1100 title charges and section 1200 government recording and transfer charges, modify any fees, and then click the Save icon.

- (Optional) Send a message to the title agent:

- On the Services tab, click Order Title & Closing, and then click the Order Status tab.

- From the Send Message to Title Agent section, enter a message to the title agent regarding fees, and then click Send Message.

The title agent will receive the modified fee request upon save. They can then accept or modify the fees and send them back to you.

Encompass Settings

Why we made this update: This enhancement was implemented as part of the Ellie Mae Idea Center initiative.

A new Notes/Comments field has been added to the following business rules in Encompass Settings. Administrators can enter details and helpful notes about the rule in this field, such as changes they have made to the rule and why.

- Loan Action Completion

- Milestone Completion

- Field Data Entry

- Field Triggers

- Automated Conditions

- Persona Access to Fields

- Persona Access to Loans

- Persona Access to Loan Actions

- Input Form List

- Loan Form Printing

- Print Auto Selection

In order for a user to have edit access to the following fields in the Disclosure Tracking tool, their assigned persona must be configured with the Change Disclosure Information access right. If this option is not configured in their persona, these fields will be inactive (grayed out) for the user.

- In the Compliance Timeline section:

- Application Date

- Estimated Closing Date

- In the Other Tracking Section:

- Affiliated Business Disclosure Provided

- CHARM Booklet Provided

- HELOC Brochure Provided

- 1st Appraisal Provided

- Subsequent Appraisal Provided

- AVM Provided

- Home Counseling Disclosure Provided

- High Cost Disclosure

Note that existing logic to auto-populate these fields are not affected by this new persona requirement.

Additional permission rights have been applied to the Cure Variance option in the Personas tool. For users assigned with a persona that does not grant permission to cure variance issues on the Fee Variance Worksheet (i.e., the Cure Variance option is not selected in the Personas tool), they will see the following new behavior on the Fee Variance Worksheet and Closing Disclosure Page 1 in Encompass:

-

All of the fields in the Tolerance Cure section of the Closing Disclosure Page 1 will be inactive (grayed out), including the Lock icon for the Required Cure Amount field.

-

All of the fields in the Tolerance Cure section of the Fee Variance Worksheet will be inactive (grayed out), including the Lock icon for the Required Cure Amount field.

-

The Cure Variance button provided in the Good Faith Fee Variance Violated alert message will be inactive (grayed out). Note that this is existing behavior that was in place in prior versions of Encompass.

These cure variance options are enabled for users with personas where this Cure Variance option is selected in the Personas tool.

To prevent confusion for Encompass TPO Connect customers over which management settings to use, the TPO WebCenter Site Management setting will only be displayed if:

-

Encompass TPO Connect has not been provisioned

and

-

Encpompass TPO WebCenter is provisioned

SEC-12671

The Log.MS.TPOConnectStatus field has been added to the Milestones tab in the Encompass Reporting Database. When this field is included in reports, Encompass TPO Connect users can view the status of their loans at each milestone and their current stage in the loan process. (However, this field does not provide the status for the loan’s current milestone. This will be provided in the Log.MS.CurrentTPOConnectStatus field discussed below.) This field is a virtual field (which means it is not visible to a user in the Encompass user experience), and in order to add this field to the Selected Fields list in the database, you must first select a milestone to be associated with the field. Administrators can add this field for every unique milestone that is available in your Encompass system.

To Add the Log.MS.TPOConnectStatus Field to Your Encompass Reporting Database:

- On your Windows task bar, click the Start menu or Start icon, navigate to the Ellie Mae Encompass program folder, and then click Admin Tools.

- Double-click Reporting Database.

- In the Fields panel on the left, click the Milestones tab.

- Click to select Log.MS.TPOConnectStatus in the list, and then click Add.

- When you click Add, you will be prompted with the Select Milestone Name pop-up window. Click to select the milestone that you want to associate with the Log.MS.TPOConnectStatus field, and then click Select.

The field is added to the Selected Fields panel on the right. Notice that the field name is updated to include the selected milestone, and the Log.MS.TPOConnectStatus field remains in the Fields panel on the left.

- Repeat steps 4 -5 to add associate this field with additional milestones and add them to the database.

- When all selections and changes have been made, click Update to update your database.

- Follow the prompts to complete the update.

Once this field is selected and added to the Reporting Database, when a user opens a new loan and applies a milestone template, the Log.MS.TPOConnectStatus field as appropriate to the loan’s current milestone is assigned to the loan. (For example, if the current milestone is Processing, the Log.MS.TPOConnectStatus.Processing field is assigned to the loan.) As the loan progress through the loan process, the Log.MS.TPOConnectStatus field as applicable for the current milestone will be updated accordingly. The Log.MS.TPOConnectStatus field will be updated only when the loan is opened or when there is an update to the milestone template applied to the loan. If a different milestone template is applied later in the loan process, the Log.MS.TPOConnectStatus field will not be updated for completed milestones. It will only be updated for the current milestone and yet to be started milestones.

Once this field is selected and added to the Reporting Database, authorized users can also add a column for this field to their Pipeline views.

In addition, the Log.MS.CurrentTPOConnectStatus field has been added to the Milestones tab in the Encompass Reporting Database. When this field is included in reports, Encompass TPO Connect users can view the status of their loans at its current milestone. This field is also a virtual field.

To Add the Log.MS.CurrentTPOConnectStatus Field to Your Encompass Reporting Database:

- In the Fields panel on the left, click the Milestones tab.

- Click to select Log.MS.CurrentTPOConnectStatus in the list, and then click Add.

- The field is added to the Selected Fields panel on the right. Notice that the Log.MS.CurrentTPOConnectStatus field remains in the Fields panel on the left.

- Click Update to update your database.

- Follow the prompts to complete the update.

Once this field is selected and added to the Reporting Database, authorized users can also add a column for this field to their Pipeline views.

Electronic Document Management (EDM)

Why we made this update:This update allows the recipient’s full name to be inserted into email notifications sent to co-borrowers who share an email address. These co-borrowers will now receive email notifications that dynamically insert the name of each co-borrower, rather than inserting the borrower’s name in both emails. This update applies to borrowers using an Encompass Consumer Connect website to send and receive loan documents and status updates.

Updates have been made to the email templates used when sending email notifications from the eFolder and for Status Online updates. The changes enable the recipient’s full name to be inserted into templates use for loans originated via an Encompass Consumer Connect website. Previously templates were limited to fields that displayed either the borrower or co-borrower name. This change enables co-borrowers who utilize an Encompass Consumer Connect website, and who share an email address, to receive email notifications that dynamically insert the name of each borrower, rather than inserting the same borrower name in both emails.

These updates affect the following three settings:

-

HTML Email Templates (Encompass > Settings > eFolder Setup > HTML Email Templates)

-

Company Status Online (Encompass > Settings > Additional Services > Company Status Online > Email Templates)

-

Personal Status Online (Encompass > Settings > Personal Settings > Personal Status Online > Email Templates)

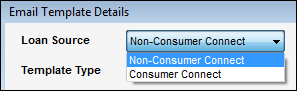

To support this features, a new Loan Source dropdown list has been added to the HTML Email Templates, Company Status Online, and Personal Status Online settings. Administrators can select the Consumer Connect or Non- Consumer Connect option from the dropdown list.

-

Templates created with the Consumer Connect option selected will have the Recipient Full Name field available in the list of Commonly Used Fields that can be inserting into a template.

-

Templates created with the Non-Consumer Connect option selected will not have the Recipient Full Name field available in the list of Commonly Used Fields.

-

The remaining Commonly Used Fields are available in both types of templates.

After upgrading to Encompass 18.2, all existing templates are maintained in the HTML Email Templates, Company Status Online, and Personal Status Online settings. A duplicate template specifically for use with Encompass Consumer Connect is created for each of the default templates that are provided by Encompass. In the newly created Encompass Consumer Connect templates, the fields that define the borrower name and co-borrower name are replaced with the Recipient Full Name field. Duplicate templates are also created for any custom templates that your company has created, but no changes are made to the custom fields in these templates. Review your templates and create new templates for use with Encompass Consumer Connect loans as needed.

Two new columns (Consumer Connect and Non-Consumer Connect) have been added to each of the settings and a check mark displays in the appropriate column to differentiate between Consumer Connect and Non-Consumer Connect templates.

When email notifications are sent, Encompass verifies whether the loan is a Consumer Connect or Non-Consumer Connect loan. Encompass then displays only the appropriate templates for the loan. Only Consumer Connect templates are available for Consumer Connect loans; only Non-Consumer Connect templates are available for Non-Consumer Connect loans. When applying a Consumer Connect template, the email text displays the words Recipient Full Name. When the email is sent, the recipient’s name is populated in the appropriate email as it is sent to each recipient.

If you insert the Recipient Full Name field into a Consumer Connect template and then try to change it to a Non-Consumer Connect template, a warning message states that you cannot change the Loan Source to Non-Consumer Connect when the template contains the Recipient Name Field.

EDM-17845, NGCC-1148

To conform to current compliance requirements, updates have been made to the verbiage on the eConsent agreement (the eDisclosure Agreement Form) that borrowers must review and accept before they can receive loan documents electronically. The updated version of the form is used on new loans created on or after April 7, 2018. Loans created prior to the April 7 update will continue to use the older version of the form.

This new version of the eConsent agreement will also be used with new loans created in earlier versions of Encompass including versions 18.1 and 17.4.

The update affects the following bullet point on page 2 of the agreement.

Current bullet point:

- If the software or hardware requirements change in the future, and You are unable to continue receiving eDisclosures, paper copies of such Loan Documents will be mailed to You once You notify Us that You are no longer able to access the eDisclosures because of the changed requirements. We will use commercially reasonable efforts to notify You before such requirements change. If You choose to withdraw Your consent upon notification of the change, You will be able to do so without penalty.

Updated bullet point:

- If the software or hardware requirements change in the future, We will use commercially reasonable efforts to notify You of the change. If You choose to withdraw Your consent upon notification of the change, You will be able to do so without penalty. Paper copies of such Loan Documents will be mailed to You if You choose to withdraw Your consent.

EDM- 18940

Additional Updates

Why we made this update: To ensure consistency between FNMA 3.2 files imported into Encompass and Encompass loan files exported to FNMA 3.2 file format.

Updates have been made to the FNMA 3.2 file import process to enable additional fields to be imported into Encompass from FNMA 3.2 format loan files. The table below lists the Fannie Code where the data is located in the FNMA 3.2 file, the corresponding Encompass field name and field ID for the imported value, and the section of the 1003 input form where the value displays.

| Fannie Code | Encompass Field ID | 1003 Section |

|---|---|---|

| 03B | 53 | Dependent ages |

| 03B | 85 | Dependent ages |

| 03C | FR0104 | VOR for borrower and co-borrower |

| 03C | FR0106 | VOR for borrower and co-borrower |

| 03C | FR0107 | VOR for borrower and co-borrower |

| 03C | FR0108 | VOR for borrower and co-borrower |

| 03C | FR0112 | VOR for borrower and co-borrower |

| 03C | FR0115 | VOR for borrower and co-borrower |

| 03C | FR0124 | VOR for borrower and co-borrower |

| 03C | FR0204 | VOR for borrower and co-borrower |

| 03C | FR0206 | VOR for borrower and co-borrower |

| 03C | FR0207 | VOR for borrower and co-borrower |

| 03C | FR0208 | VOR for borrower and co-borrower |

| 03C | FR0212 | VOR for borrower and co-borrower |

| 03C | FR0215 | VOR for borrower and co-borrower |

| 03C | FR0224 | VOR for borrower and co-borrower |

| 03C | CR0123 | VOR for borrower and co-borrower |

| 03C | BR0123 | VOR for borrower and co-borrower |

| 03C | 1819 | VOR for borrower and co-borrower |

| 03C | 1416 | VOR for borrower and co-borrower |

| 03C | 1820 | VOR for borrower and co-borrower |

| 03C | 1519 | VOR for borrower and co-borrower |

| 04B | FE0102 | VOE for borrower and co-borrower |

| 04B | FE0104 | VOE for borrower and co-borrower |

| 04B | FE0105 | VOE for borrower and co-borrower |

| 04B | FE0106 | VOE for borrower and co-borrower |

| 04B | FE0107 | VOE for borrower and co-borrower |

| 06C | DD0115 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | DD0119 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | DD0123 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | DD0215 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | DD0219 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | DD0223 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | 1605 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | 1607 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | 1609 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | 212 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | 213 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | 222 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | 224 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | 1053 | VOD for Borrower and Co-Borrower and Other Assets |

| 06C | 1055 | VOD for Borrower and Co-Borrower and Other Assets |

| 06G | FM0143 | VOM for Borrower and Co-Borrower |

| 06G | FL0125 | VOM for Borrower and Co-Borrower |

| 06G | FL0115 | VOM for Borrower and Co-Borrower |

| 06L | FL0125 | VOL for Borrower and Co-Borrower |

| 06L | 190 | VOL for Borrower and Co-Borrower |

| 07B | 1845 | Details of Transaction - Other Credits |

| 07B | 1851 | Details of Transaction - Other Credits |

| 07B | 1852 | Details of Transaction - Other Credits |

| ADS | GSEVENDOR.X1 - GSEVENDOR.X24 | NMLS & Appraiser License #s and Additional Provider Data |

| ADS | ULDD.X31 | NMLS & Appraiser License #s and Additional Provider Data |

| ADS | ULDD.TotalMortgagedPropertiesCount | NMLS & Appraiser License #s and Additional Provider Data |

| ADS | FANNIESERVICE.X3 | NMLS & Appraiser License #s and Additional Provider Data |

| ADS | FANNIESERVICE.X4 | NMLS & Appraiser License #s and Additional Provider Data |

| ADS | MORNET.X27 | NMLS & Appraiser License #s and Additional Provider Data |

| LMD | MORNET.X72 | MORNETPlus Community Lending |

| LNC | 608 | Various HMDA and Loan Information |

| LNC | 1552 | Various HMDA and Loan Information |

| LNC | 763 | Various HMDA and Loan Information |

| LNC | 1401 | Various HMDA and Loan Information |

| LNC | MORNET.X66 | Various HMDA and Loan Information |

| LNC | 677 | Various HMDA and Loan Information |

| LNC | 675 | Various HMDA and Loan Information |

CBIZ-13861

The following enhancements to the JIT Logger are being introduced in Encompass 18.2:

-

In Encompass 18.1 the new Diagnostic Mode – Just in Time option (i.e., the Encompass JIT Logger) was introduced for admin users (and other authorized users provided with access rights via their persona) to access in the Encompass Help menu and perform application logging in real time. At that time, the JIT log file (and full logging Diagnostic file) that is transferred manually to the Ellie Mae Customer Support team for them to analyze could contain sensitive Personally Identifiable Information (PII) that was displayed in plain text and not masked or otherwise obscured. Starting in Encompass 18.2, the PII information in these log files is now masked in order to keep this information (email addresses, phone numbers, and Social Security Numbers, passwords and date of birth) secure. Instead of plain text, this information is now displayed as a series of special characters.

-

Genuine Channels are now recorded in the JIT Logger log files. These logs indicate system connectivity status and are created when a GCTrace is added to your system registry (typically when Customer Support is helping you diagnose an issue).

-

A new Clear Log button has been added to the Encompass JIT Logger user interface. Click this button to clear the log (i.e., remove all data from the log) without having to restart Encompass. Assuming the JIT Logger was monitoring your system previously or if there were errors indicated in the log, clicking the Clear Log button gives you a blank log file to start logging with (and the old entries are not included).

Encompass Software Development Kit (SDK)

In the Encompass 17.3 release, the Select EPPS Loan Programs grid on the Correspondent Trades Details tab was introduced, but was not exposed to the Encompass SDK. This enhancement exposes the table to the SDK, as well as the EPPS Loan Programs Table setting, which maintains the grid on the Details tab.

SEC-9760

As discussed in the TPO Connect Status and Current TPO Connect Status Fields Added to Encompass Reporting Database entry above, the Log.MS.TPOConnectStatus field and Log.MS.CurrentTPOConnectStatus field are virtual fields that are now available for administrators to add to their Encompass Reporting Database so they can monitor the status of Encompass TPO Connect loans in terms of what milestone the loan is currently at in the loan process. The Encompass SDK has been updated to include the Log.MS.TPOConnectStatus and Log.MS.CurrentTPOConnectStatus fields as a Property and can now be applied via the SDK.

In addition, the TPOConnectStatus Property and CurrentTPOConnect Property have also been added to the MilestoneEvent object for accessibility via the SDK.

The PostSharp code previously included in the FieldChangeEventArgs in the EncompassObjects.dll has been removed. The FieldChangeEventArgs is one of the most commonly used classes in Plugins, and the CurrentLoan.FieldChange event is fired thousands of times every time a loan is opened and it was discovered that the addition of PostSharp code into the FieldChangeEventArgs slowed down plugin code significantly. The PostSharp code was in place to check the FieldChangeEventArgs properties, and it was determined that it should be removed since every client using plugins would experience improved performance immediately.