ATR/QM Management

View the "Working with HOEPA and Ability-to-Repay Regulations" White Paper

Use the ATR/QM Management tool to help document compliance with the CFPB’s amendment to Regulation Z (effective on applications on or after January 10, 2014) that implements sections 1411, 1412, and 1414 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) and prohibits creditors from making most residential mortgage loans against a closed end first or junior lien secured by a 1-4 unit dwelling unless the creditor makes a reasonable, good faith determination of the consumer's ability to repay the loan. In addition, the rule establishes certain protections for creditors who make a “Qualified Mortgage”.

Creditors must assess the consumer’s ability-to-repay for virtually all closed-end residential mortgage loans and it is now presumed that all Qualified Mortgages (QM) comply with these CFPB requirements. A loan that meets the following product feature requirements can be a QM under any of the three main

categories:

(1) the General QM definition

(2) the “Agency/GSE-eligible” QM provision

(3) the small creditor QM provision

The ATR/QM Management tool provides a convenient, central location for recording the information you obtain to determine the borrower’s ability to repay the loan and to help you document compliance with general ability-to-repay standards or eligibility for qualified mortgage status.

Before you open the ATR/QM Management form, complete the Borrower Summary

Before you open the ATR/QM Management form, complete the Borrower Summary and 1003 URLA input forms. As you begin working on the ATR/QM Management form, complete any fields that are not already populated from the Borrower Summary and the 1003 Loan Application. Click the links on the title bar on the upper-right to access information from related forms such as the 1003 URLA, 2015 Itemization, and RegZ-LE.

2021 Updates

Effective March 1, 2021, under the Final Rule issued by the CFPB, the general QM loan definition has been amended under Reg Z. The mandatory compliance date for this new definition is October 1, 2022. Lenders have the option to begin using the new definition between the effective date of the new rule and the mandate, but can leverage the prior QM definition during this time.

General QM Final Rule amends the General QM definition as follows:

-

Replaces the existing 43% DTI limit with a price-based limit.

-

Removes Appendix Q as well as any requirements to use Appendix Q for General QM loans.

-

Retains the ATR/QM Rule's consider and verify requirements and clarifies how they apply under the revised General QM definition.

-

Retains the existing product-feature and underwriting requirements and limits on points and fees.

![]() Agency/GSE Eligible Provision Sunset

Agency/GSE Eligible Provision Sunset

In Lender Letter 2021-09, Fannie Mae announced:

The PSPA requires that we acquire loans that meet the revised General Qualified Mortgage (QM) loan definition in the CFPB's rule1 that became effective Mar. 1, 2021 (Revised QM Rule). As a result, and in accordance with the dates below, we will no longer acquire loans that are GSE Patch loans that do not meet the Revised QM Rule. To be eligible for purchase, such loans must

-

have application dates on or before Jun. 30, 2021, and

-

be purchased as whole loans on or before Aug. 31, 2021, or in MBS pools with an issue date on or before Aug. 1, 2021.

![]() Mandatory product feature requirements for all QMs

Mandatory product feature requirements for all QMs

-

Points and fees do not exceed 3% of the Regulation Z-defined Total Loan Amount (for lower loan amounts, higher percentage thresholds are allowed).

-

No risky features like negative amortization, interest-only, or balloon loans.

-

Balloon loans originated until January 10, 2016 that meet the other product features are Qualified Mortgages if originated and held in portfolio by small creditors.

-

-

Maximum loan term is less than or equal to 30 years.

-

General definition category of QMs

-

Option 1: Current definition, including 43% DTI cap and other product feature requirements. Can be used for loans with an application date on or before 9/30/2022

-

Option 2: Revised definition including price-based test, no DTI cap. Other feature requirements remain the same with Option 1. Can be used for loans with an application date on or after 3/1/2021, but must be used for loans with an application date on or after 10/1/2022.

-

-

“Agency/GSE-eligible” category of QMs (Sunset 6/30/2021) - Any loan that meets the product feature requirements and is eligible for purchase, guarantee, or insurance by a GSE, FHA, VA, or USDA is a Qualified Mortgage regardless of the debt to income ratio.

-

Small Creditor category of QMs - If you have less than two billion dollars in assets and originate 500 or fewer mortgages per year, loans you make and hold in portfolio are Qualified Mortgages as long as you have considered and verified a consumer’s debt-to-income ratio (though no specific debt-to-income ratio limit applies).

Use the Basic Info tab to record information about the consumer, subject property, and loan. Most fields in the Borrower Information, Property Information, and Loan Information sections should already be completed based on entries in the Borrower Summary and 1003 URLA. Complete any missing information in these sections.

-

Select the Subject Property is in a Rural/Underserved Area checkbox (field ID 3850) to indicate that the property is in either a rural or underserved area. This field is used as part of the Small Creditor Qualified Mortgage assessment. According to Regulation Z, 12 CFR § 1026.35(b)(2)(vi):

-

A county is 'rural' during a calendar year if it is neither in a metropolitan statistical area nor in a micropolitan statistical area that is adjacent to a metropolitan statistical area, as those terms are defined by the U.S. Office of Management and Budget and as they are applied under currently applicable Urban Influence Codes (UICs), established by the United States Department of Agriculture's Economic Research Service (USDA-ERS). A creditor may rely as a safe harbor on the list of counties published by the [CFPB] to determine whether a county qualifies as 'rural' for a particular calendar year.

-

A county is 'underserved' during a calendar year if, according to Home Mortgage Disclosure Act (HMDA) data for the preceding calendar year, no more than two creditors extended covered transactions, as defined in § 1026.43(b)(1), secured by a first lien, five or more times in the county. A creditor may rely as a safe harbor on the list of counties published by the [CFPB] to determine whether a county qualifies as 'underserved' for a particular calendar year.

-

Identify factors necessary to make an ability-to-repay/qualified mortgage (ATR/QM) assessment based on the loan term, lien position, note amount, points and fees, monthly payments, and underwriting factors considered for the loan.

The left column of the Loan Summary is the general loan terms. Complete any loan details that are not already populated from the Borrower Summary - Origination and 2010 Itemization or 2015 Itemization input forms. The right column provides the loan features and most of these fields are populated based on the entries you provided on the Transmittal Summary (form 1008), RegZ-LE, and RegZ-CD input forms.

![]() Monthly Payment - First Lien/Total

Monthly Payment - First Lien/Total

Part of making an ATR or QM assessment is quantifying the monthly mortgage payment while taking into account not only the subject loan, but also any known subordinate liens and all mortgage-related obligations. The ATR/QM Monthly Payment ratios sections are populated based on your entries on the 1008 Transmittal Summary and can be analyzed when making an ATR or QM assessment. The actual payment ratio used in making the assessment varies between the General ATR standard and across the different QM types. For example:

When originating a General QM, lenders want to use the Total Debt Ratio payment that reflects the maximum rate that would apply during the first five years of the loan (field ID QM.X119). Yet, when originating a General ATR loan that does not contain an interest only payment feature, balloon payment, or negative amortization, lenders are advised to assess debt to income ratios based on either the initial rate (field ID 742) or fully indexed rate (field ID QM.X116), using the higher rate of the two.

Please note that using the higher rate of the two does not apply to all types of ATR Standard loans.

-

When originating a General ATR with an interest only payment period, lenders are advised to assess a DTI ratio based on the maximum payment amount using substantially equal, monthly payments of principal and interest based on the fully indexed rate or the introductory rate, whichever is greater, that will repay the maximum loan amount over the term of the loan that remains as of the date the loan is recast.

-

When originating a General ATR non-Higher-Priced Covered Transaction with a balloon payment, lenders are advised to assess a DTI ratio based on the maximum payment amount scheduled during the first 60 months after the date on which the first regular periodic payment will be due. When originating a General ATR Higher-Priced Covered Transaction with a balloon payment, lenders are advised to assess a DTI ratio based on the maximum payment in the payment schedule, including any balloon payment.

-

When originating a General ATR Higher-Priced Covered Transaction with negative amortization, lenders are advised to assess DTI ratios based on the maximum payment amount using substantially equal, monthly payments of principal and interest based on the fully indexed rate or the introductory rate, whichever is greater, that will repay the maximum loan amount over the term of the loan that remains as of the date the loan is recast.

-

When originating a General ATR Higher-Priced Covered Transaction with negative amortization, lenders are advised to assess DTI ratios based on the maximum payment amount using substantially equal, monthly payments of principal and interest based on the fully indexed rate or the introductory rate, whichever is greater, that will repay the maximum loan amount over the term of the loan that remains as of the date the loan is recast.

There is no specific DTI ratio threshold for General ATR or Small Creditor QM loans. Agency/GSE QM loan DTI limits are based on each specific agency’s or investor’s guidelines.

![]() Monthly Payment - Second Lien/Monthly Housing Obligations

Monthly Payment - Second Lien/Monthly Housing Obligations

Second lien and monthly housing payment fields are calculated based on values entered on page 2 of the 1003 URLA Part 2 input form.

-

If the Occupancy Status of the loan is Secondary Home or Investment Property, the values in the Proposed Monthly Payment section are derived from the Present expenses on Page 2 of the 1003 Loan Application.

-

If the Occupancy Status is Primary Residence, the values are derived from the Proposed expenses on the 1003 Loan Application.

Many of these fields are already completed based on data on the 1003 Loan Application and the Risk Assessment fields on the Transmittal Summary input form.

The CFPB’s final rule states that lenders can rely upon an automated underwriting system (AUS) response of Approve/Eligible, Accept/Eligible, Approve Eligible, or Accept Eligible (for DU) or Accept, Approve, Approve/Eligible, ApproveEligible, Approve Eligible, AcceptEligible, Accept/Eligible, or Accept Eligible (for LP) as evidence that the loan conforms to Agency/GSE standards so long as the information relied upon in making the AUS decision is accurate.

Ensure that an Approve/Eligible, Accept/Eligible, Approve Eligible, or Accept Eligible for DU or Accept, Approve, Approve/Eligible, ApproveEligible, Approve Eligible, AcceptEligible, Accept/Eligible, or Accept Eligible for LP or the Manual Underwriting type is selected here.

-

Select the type of underwriting provided for the loan file: manual, DU, LP, or other.

-

If Other is selected, enter a description of the underwriting provided.

-

-

Enter the recommendation returned from Freddie Mac, such as Approved or Caution.

-

Enter the identification ID/Key returned by Fannie Mae or Freddie Mac with the loan recommendation.

-

Enter the class of documentation provided with the loan package to Freddie Mac's Loan Prospector (LP). Examples are No DV (no deposit verification) and Full Documentation.

-

The APOR section uses fields from the Section 32 HOEPA and Section 35 HPML input forms to show the loan’s annual percentage, QM annual percentage rate, and average prime offer rates.

-

When applicable, you can click the blue Lock icon to lock a field, enabling you to enter a value that will not be overridden by data pulled from the other input forms.

-

QM Annual Percentage Rate - Encompass calculates and populates a value to this field when a loan meets the criteria for a QM Loan. Otherwise, Encompass populates the value from the APR field (field ID 799). By default, the field is disabled for editing, but a user can click the Lock icon to manually edit the value.

-

QM Higher-Priced Covered Transaction - Encompass will select one of these checkboxes (field ID QM.X382) to indicate whether a loan is a QM higher-priced covered transaction based on the criteria described in 12 CFR 1026.43(b)(4).

![]() To Determine the Average Prime Offer Rate (APOR)

To Determine the Average Prime Offer Rate (APOR)

-

To find the APOR (field ID 3134), open the Section 35 HPML input form, and then click the View Rate button.

-

When the FFIEC APOR tables screen displays, click the appropriate link to view the Average Prime Offer Rates table provided by the FFIEC. (Based on the loan’s amortization type, click the link for the Fixed Rate or Adjustable Rate tables.)

-

In the top row of the table (Term of Loan in Years), locate the applicable loan term column header.

-

Notice the dates (xx/xx/xxxx) listed in the far-left column in the table. Locate the row with the date that matches (or directly precedes) the loan’s rate set date (i.e., the rate lock date (field ID 2089) or the last rate set date (field ID 3254)).

-

The APOR is the value where the applicable loan term and rate set date intersect. Enter this value in the APOR field (field ID 3134). Example: For a fixed loan with a term of 7 years and a Rate Lock Date of 1/4/2000, the average Prime Offer Rate is 7.47.

-

Any time an Encompass Compliance Service (ECS) review or preview is run, the Average Prime Offer Rate value (field ID 3134) is automatically calculated and updated in the loan file based on the ECS calculation. The APOR also will change if loan factors, rate set or rate lock dates change.

-

ECS reviews the loan terms (loan amount, lien position, etc.) and then selects an appropriate APOR based on the Rate Set Date. To determine the Rate Set Date, the ECS requires the following fields to be populated:

-

The Amortization Type (field ID 608)

- The Loan Term (field ID 4)

-

- In addition, ECS determines which APOR to apply based on the following fields:

-

The Last Rate Set Date field (field ID 3253)

-

If empty, it uses the Rate Lock Rate (field ID 761).

-

If both previous fields are empty, it uses the Closing Date (field ID 748) if the Closing Date is prior to the date the loan is submitted to ECS for review.

-

If the Closing Date occurs in the future or if all previous fields are blank, it uses the most recently published Index based on the Amortization Type and Loan Term.

-

The APOR value in field 3134 is not recalculated when a loan team member clicks the Lock and Confirm button on the Secondary Registration tool to lock the loan rate and confirm the lock with the lock requestor. The APOR will automatically update if a subsequent ECS review is run.

-

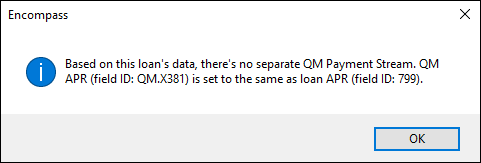

Encompass users can click the QM Payment Stream button to view the payment schedule used to calculate the value in the new QM Annual Percentage Rate field (field ID QM.X381). After clicking the button, the payment schedule opens in a new pop-up window. The payment schedule assumes a fixed interest rate at the maximum rate over the first 5 years of the loan. The payment schedule is provided for testing purposes for Encompass users. If the loan doesn't have an APR change, the following message will display when a user clicks the button:

In order for this QM Payment Stream button logic to apply as described above, the 1st Change value (field ID 696) must be 60 months or less AND the Annual Percentage Rate (field ID 799) and QM Annual Percentage Rate (field ID QM.X381) must be the same value in both fields.

-

Annual percentage rate fields are populated based on data entered on the Borrower Summary and 1003 Loan Application.

-

When applicable, you can click the blue Lock icon to lock the field, enabling you to enter a value that will not be overridden by data pulled from the Borrower Summary and 1003.

-

Use the Section 35 HPML form to determine the Average Prime Offer Rate and the Last Rate Set Date to determine whether a loan exceeds the threshold for higher priced mortgage loans.

![]() To Determine the Average Prime Offer Rate (APOR)

To Determine the Average Prime Offer Rate (APOR)

-

To find the APOR (field ID 3134), open the Section 35 HPML input form, and then click the View Rate button.

-

When the FFIEC APOR tables screen displays, click the appropriate link to view the Average Prime Offer Rates table provided by the FFIEC. (Based on the loan’s amortization type, click the link for the Fixed Rate or Adjustable Rate tables.)

-

In the top row of the table (Term of Loan in Years), locate the applicable loan term column header.

-

Notice the dates (xx/xx/xxxx) listed in the far-left column in the table. Locate the row with the date that matches (or directly precedes) the loan’s rate set date (i.e., the rate lock date (field ID 2089) or the last rate set date (field ID 3254)).

-

The APOR is the value where the applicable loan term and rate set date intersect. Enter this value in the APOR field (field ID 3134). Example: For a fixed loan with a term of 7 years and a Rate Lock Date of 1/4/2000, the average Prime Offer Rate is 7.47.

-

Click the Fee Details button to open the Quick Entry - [2010 or 2015] Itemization window and update the 2015 Itemization form as needed.

-

The Reg Z Total Loan Amount (field ID QM.X120) is automatically calculated based on the loan terms and finance charges. This value can be set up to be validated or overwritten by using ECS.

-

When applicable, you can click the blue Lock icon to manually lock the field, enabling you to enter a value that will not be overridden by data pulled from the other input forms. The system administrator may control access to this Lock icon via a Persona Access to Fields business rule.

-

-

The Current Qualified Mortgage Fee Threshold field (field ID QM.X121) is automatically calculated. This calculation is based on the Note Amount (field ID 2) to determine which threshold to apply. The threshold is then multiplied against the Reg Z Total Loan Amount (field ID QM.X120) to determine the Current Qualified Mortgage Fee Threshold. Based on the Note Amount, the Current QM Fee Threshold is calculated as follows:

| Current QM Fee Threshold (field ID QM.X121) Calculation: (2021 Limits) | ||

|---|---|---|

|

If Note Amount (field 2) >= $110,260 |

QM.X121 = QM.X120 x 3% | (rounded to two decimal places) |

|

If Note Amount (field 2) >= $66156, but < $110,259.99 |

QM.X121 = $3,000.00 |

|

| If Note Amount (field 2) >= $22,052, but < $66,155.99 |

QM.X121 = QM.X120 x 5% |

(rounded to two decimal places) |

| If Note Amount (field 2) >= $13,783, but <$22,051.99 | QM.X121 = $1000 | |

| If Note Amount (field 2) < $13,783 | QM.X121 = QM.X120 x 8% | (rounded to two decimal places) |

| Note: Field QM.X120 = Reg Z Total Loan Amount (i.e., Reg Z Amount Financed - Financed Real Estate Related Fees Paid to Lender or Affiliate - Financed Credit Insurance Premiums - Financed Prior Prepayment Penalty Payoff (if applicable) | ||

-

The Total points and fees applicable under section 32 (field ID S32DISC.X48) is calculated by pulling information from various sources in Encompass including the following items.

Encompass uses the value in the Application Date field (field ID 745) to trigger the appropriate points and fees calculation. For purposes of the Qualified Mortgage and Federal High Cost threshold tests, Encompass uses the Application Date to apply new calculations that are expected based on the new rules' effective date. HOEPA Section 32 and ATR/QM Section 43 rules use the same methodology to calculate Reg Z total loan amount and total points and fees but each rule applies its own threshold. For Encompass clients who utilize the Encompass Compliance Service (ECS), ECS compares the Application Date(s) entered in fields 745, 3142 and 3292 and runs its calculations based on the earliest date entered in those three fields.

Click the Discount Points button to open the Bona Fide Discount Point Assessment quick entry window and document whether or not discount points can be excluded from Section 32 Points & Fees by meeting the standards used to determine whether or not the discount points are bona fide. For more information, see Bona Fide Discount Point Assessment Tool.

Click the Fee Details button to open the Quick Entry - 2015 Itemization window and update the 2015 Itemization form as needed.

-

Identify the description and amount of fees being charged.

-

Identify who they are being paid by, and to whom (including if they are being paid to broker, lender, affiliate, unaffiliated provider (other), etc.)

-

Show which fees are being paid by the borrower, seller, lender, etc.

-

Identify if the item is a Prepaid Finance Charge (i.e., the APR checkbox is selected for the fee).

-

Identify if certain charges have special handling (i.e., discount points, daily interest charges, and mortgage insurance premiums)

-

You can also use the 2015 Itemization to open the Manage Adjusted Origination Charge Details window and indicate if you claim Discount Points as bona fide. Under the Section 32 points and fees calculation, up to two bona fide discount points may be excluded from the total points and fees if specific conditions are met.

-

Under the Section 32 Total Points and Fees calculation, all fees paid to a lender, broker, or affiliate are included in the Points & Fees test. This also includes compensation paid to mortgage brokers.

-

Total Loan Amount is auto-populated from entries in the 1003 Loan Application and Borrower Summary forms.

-

If you are an Encompass Compliance Service Customer:

-

Enter the Family Size.

-

Click the Get Residual Income button. The Residual Income Guidelines field is populated.

- If you are not an Encompass Compliance Service Customer:

-

Enter the Family Size.

-

Click the Country Region field’s Lookup icon (magnifying glass).

-

Using the residual income by region tables provided, locate the appropriate table based on the loan amount ($79,999 and below or $80,000 and above), and then locate the region and family size of the borrower.

-

Enter the dollar amount from the table in the Residual Income Guidelines field.

-

Select the Yes or No checkbox to indicate whether the veteran has been more than 30 days late on a payment in the last 6 months.

According to the interim final rule defining a qualified mortgage for VA loans, in order for a VA IRRRL to be considered a safe harbor QM the loan must meet several conditions including the veteran has not been more than 30 days past due during the 6 months preceding the new loan's closing date.

-

This tab provides a matrix to help identify the factors and eligibility used to determine compliance with general ability-to-repay standards, eligibility for Qualified Mortgage status, or exemption from the CFPB ATR/QM requirements. In addition, the matrix assesses Qualified Mortgage Safe Harbor eligibility and also provides a section to document the reasons a loan may be exempt from ATR/QM requirements.

The ATR/QM Recommendation indicates the type of ATR/QM loan the current loan is eligible for. The values populated here are based on the total assessment made in the ATR/QM Eligibility matrix. This section supports both QM and Non-QM loan types. Non-QM loans are those that meet general ability-to-repay requirements or are exempt from ATR/QM regulations. Feedback on Safe Harbor eligibility for QM loans also is provided.

Based on the loan file’s data and calculations provided in the Qualification form, the ATR/QM Eligibility matrix provides indicators to show the ATR/QM requirements that have or have not been met.

-

A green check mark indicates that the factor is consistent with ATR/QM expectations.

-

A red flag indicates that the factor is not consistent with ATR/QM expectations.

-

A blue flag indicates that the data relied upon in making the ATR/QM assessment is missing from the loan file.

Ability-to-Repay Loan Type Options:

-

Exempt - You would select this option if the loan is exempt from ATR/QM requirements. You would indicate this by selecting the Transaction is exempt from Reg. Z Ability to Repay requirements based on checkbox (field ID QM.X103) and then selecting the reason why the loan qualifies for exemption.

-

General ATR - This option is selected if the loan is not eligible to be a Qualified Mortgage (QM), but is eligible for General Ability-to-Repay (ATR) as indicated by a green check mark displayed above the General Ability-to-Repay column in the ATR/QM Eligibility matrix and no other column indicates that the loan also is eligible to be a Qualified Mortgage). Green check marks are displayed only when the underwriter marks the underwriting factors that have been considered and evaluated for the loan on the Underwriter Summary.

-

Non-Standard to Standard Refinance - You may select this option if the creditor for the refinance transaction is the current holder of the non-standard mortgage or servicer acting on behalf of the current holder. This option may give more flexibility in refinancing a non-standard mortgage (which includes various types of mortgages that can lead to payment shock and can result in default) into a standard mortgage without having to meet the General ATR requirements or the General QM DTI requirements.

-

Qualified Mortgage - This option is selected when a loan is determined to have met all of the requirements for one of the Qualified Mortgage types (General, Agency/GSE, FHA, or Small Creditor) as indicated by a green check mark displayed above any one of the Qualified Mortgage columns in the ATR/QM Eligibility matrix.

Qualified Mortgage Loan Type Options - This field is populated with one of the following options only if the Ability-to-Repay Loan Type (field ID QM.X23) is Qualified Mortgage.

-

General QM - Selected if the General Qualified Mortgage eligibility standard is met. (This is indicated in the ATR/QM Eligibility matrix.) The following requirements must be met in order to qualify for General QM. When all are met, all the factors under the General Qualified Mortgage column header will display a green check mark.

-

Loan Term - The Loan Term (field ID 4) is less than or equal to 360 months.

-

Loan Features:

-

Interest Only - The loan cannot feature any interest-only payments. The Transaction Details Interest Only Months field (field ID 1177) must be empty or 0 may be entered.

-

Negative Amortization - The ARM Recast Period/ Stop fields (field IDs 1712 and 1713) are both empty (i.e., no values entered).

-

Balloon Payment - The loan cannot feature a balloon payment. The Loan Term (field ID 4) and the Loan Due In (field ID 325) values must be equal. If the Loan Due In value is less than the Loan Term value, a red flag will display for the Balloon Payment factor in the ATR/QM Eligibility matrix and the loan will not meet General QM standards.

-

Prepayment Penalty - The Amortization Type (field ID 608) is Fixed

AND

the Prepayment Penalty Period (field ID RE88395.X316) is less than or equal to 36

AND

the Prepayment Penalty entered as a percentage (field IDs 1948, 1973, 1976, 1979, 1982) or the Maximum Prepayment Penalty entered as a percentage (field ID QM.X112) are all less than or equal to 2.000% or all of these fields are blank.

-

-

Points and Fees Limit - The Total points and fees applicable under section 32 (field ID S32DISC.X48) is less than or equal to the Current Qualified Mortgage Fee Threshold (field ID QM.X121).

-

Price Limit - Conventional First Lien Loans will be evaluated per the defined price-based limit.

Loan Amount Price Based Limit >= $110,260 QM APR (QM.X381) < 2.25 + APOR (3134) >=$66,156 and < $110,260 QM APR (QM.X381) < 3.5 + APOR (3134) < $66,156 QM APR (QM.X381) < 6.5 + APOR (3134) -

All Conventional first lien loans having sufficient information to be evaluated under the price-based rule will have a result of either Meets or Does Not Meet ATR/QM standard based on the calculated QM APR.

-

Conventional Subordinate lien loans will receive an evaluation of Does Not Meet ATR/QM standard.

-

If the loan is evaluated under the price-based rule, the result will be captured and will be used in combination with the other required loan attributes to evaluate the loan for General QM eligibility.

-

-

Debt to Income Ratio - This test is included in General QM assessment if the Price Limit is not being used on the loan (available between 3/1/2021 and 10/1/2022). The following checkboxes on the Underwriter Summary are selected to indicate that they have been assessed by the underwriter AND the total debt ratio is less than or equal to 43.000%.

-

Monthly Covered Loan Payment (field ID QM.X338)

-

Monthly Simultaneous Loan Payment (field ID QM.X339)

-

Monthly Mortgage Related Obligations (field ID QM.X340)

-

Debt Obligations (field ID QM.X341)

-

Child Support Obligations (field ID QM.X342)

-

Alimony Obligations (field ID QM.X343)

-

Current or Expected Income (field ID QM.X345)

-

Debt to Income Ratio (field ID QM.X348)

-

-

Residual Income - The Residual Income checkbox (field ID QM.X348) on the Underwriter Summary is selected to indicate that this factor has been assessed. Note that this factor is not required to qualify for General QM. If the factor is not assessed, a blue flag indicator displays in the matrix.

-

Monthly Payment and Consider and Verify Factors - All of these factors are required. In order for green check marks to display for each factor, the corresponding checkbox on the Underwriter Summary must be selected. To view the field mapping between the checkboxes on the Underwriter Summary and these factors in the matrix, refer to the Field Mapping Between Underwriter Summary Evaluation Fields and ATR/QM Eligibility Matrix section on the Underwriter Summary help topic.

The Underwriter Summary is available in Encompass Banker Edition only. Encompass Broker Edition is unable to provide an automated assessment of the ATR and QM types on the ATR/QM Management tool’s ATR/QM Eligibility form due to the absence of the Underwriter Summary, however all other ATR/QM functionality is available.

![]() Agency/GSE QM (Sunset 6/30/2021)

Agency/GSE QM (Sunset 6/30/2021)

Selected if the Agency/GSE Qualified Mortgage eligibility standard is met. This is also known as a Temporary QM. (This is indicated in the ATR/QM Eligibility matrix.) The following requirements must be met in order to qualify for Agency/GSE QM. When all are met, all of the factors under the Agency/GSE Qualified Mortgage column header will display a green check mark.

-

Loan Term - The Loan Term (field ID 4) is less than or equal to 360 months

-

Loan Features:

-

Interest Only - The loan cannot feature any interest only payments. The Transaction Details Interest Only Months field (field ID 1177) must be empty or 0 may be entered.

-

Negative Amortization - The ARM Recast Period/Stop fields (field IDs 1712 and 1713) are both empty (i.e., no values entered).

-

Balloon Payment - The loan cannot feature a balloon payment. The Loan Term (field ID 4) and the Loan Due In (field ID 325) values must be equal. If the Loan Due In value is less than the Loan Term value, a red flag will display for the Balloon Payment factor in the ATR/QM Eligibility matrix and the loan will not meet General QM standards.

- Prepayment Penalty - The Amortization Type (field ID 608) is Fixed

AND

the Prepayment Penalty Period (field ID RE88395.X316) is less than or equal to 36 (or blank)

AND

the Prepayment Penalty entered as a percentage (field IDs 1948, 1973, 1976, 1979, 1982) or the Maximum Prepayment Penalty entered as a percentage (field ID QM.X112) are all less than or equal to 2.000% or all of these fields are blank.

-

-

Points and Fees Limit - The Total points and fees applicable under section 32 (field ID S32DISC.X48) is less than or equal to the Current Qualified Mortgage Fee Threshold (field ID QM.X121).

-

Debt to Income Ratio - The following checkboxes on the Underwriter Summary are selected to indicate that they have been assessed by the underwriter AND the AUS Recommendation (field ID 1544) must be Approve/Eligible, Accept/Eligible, Approve Eligible, or Accept Eligible (for DU) or Accept, Approve, Approve/Eligible, ApproveEligible, Approve Eligible, AcceptEligible, Accept/Eligible, or Accept Eligible (for LP). Encompass also accepts one of the three manual underwriting methods as an alternative to AUS results.

-

Monthly Covered Loan Payment (field ID QM.X338)

-

Monthly Simultaneous Loan Payment (field ID QM.X339)

-

Monthly Mortgage Related Obligations (field ID QM.X340)

-

Debt Obligations (field ID QM.X341)

-

Child Support Obligations (field ID QM.X342)

-

Alimony Obligations (field ID QM.X343)

-

Current or Expected Income (field ID QM.X345)

-

Debt to Income Ratio (field ID QM.X348)

-

-

Residual Income - The Residual Income checkbox (field ID QM.X348) on the Underwriter Summary is selected to indicate that this factor has been assessed. Note that this factor is not required to qualify for Agency/GSE QM. If the factor is not assessed, a blue flag indicator displays in the matrix.

The Underwriter Summary is available in Encompass Banker Edition only. Encompass Broker Edition is unable to provide an automated assessment of the ATR and QM types on the ATR/QM Management tool’s ATR/QM Eligibility form due to the absence of the Underwriter Summary, however all other ATR/QM functionality is available.

-

Monthly Payment and Consider and Verify Factors - All of these factors are required. In order for green check marks to display for each factor, the corresponding checkbox on the Underwriter Summary must be selected. To view the field mapping between the checkboxes on the Underwriter Summary and these factors in the matrix, refer to the Field Mapping Between Underwriter Summary Evaluation Fields and ATR/QM Eligibility Matrix section in the Underwriter Summary help topic.

-

FHA QM - Selected if the FHA Qualified Mortgage eligibility standard is met. For the most part, the FHA QM assessment considers the same factors as the Agency/GSE QM eligibility assessment, except that the FHA has a unique threshold for FHA Qualified Mortgage Safe Harbor. This option is automatically selected when you select FHA for the Loan Type (field ID 1172), the Case Assignment Date (field ID 3042) is on or after January 10, 2014 (or blank), and the loan meets all Agency/GSE Qualified Mortgage requirements.

-

Small Creditor QM - Selected only if the administrator has indicated that your company is a small creditor (using the ATR/QM section of the Organization Details setting) and if the loan meets the following requirements. When all are met, all of the factors under the Small Creditor Qualified Mortgage column header will display a green check mark.

In order to qualify for Small Creditor QM, the loan must not meet the standards for General Qualified Mortgage, Agency/GSE, or FHA Qualified Mortgage.

![]() Small Creditor QM Requirements

Small Creditor QM Requirements

-

Loan Term - If the loan does not feature a balloon payment, the Loan Term (field ID 4) must be less than or equal to 360 months. If the loan does feature a balloon payment, the Loan Term must be between 60 - 360 months.

-

Loan Features:

- Interest Only - The loan cannot feature any interest-only payments. The Transaction Details Interest Only Months field (field ID 1177) must be empty or 0 may be entered.

- Negative Amortization - The ARM Recast Period/Stop fields (field IDs 1712 and 1713) are both empty (i.e., no values entered).

- Balloon Payment - If the loan does not feature a balloon payment, the Loan Term (field ID 4) must be less than or equal to 360 months. If the loan does feature a balloon payment, the Loan Term must be between 60 - 360 months.

-

Prepayment Penalty - The Amortization Type (field ID 608) is Fixed

AND

the Prepayment Penalty Period (field ID RE88395.X316) is less than or equal to 36 (or blank)

AND

the Prepayment Penalty entered as a percentage (field IDs 1948, 1973, 1976, 1979, 1982) or the Maximum Prepayment Penalty entered as a percentage (field ID QM.X112) are all less than or equal to 2.000% or all of these fields are blank.

-

Points and Fees Limit - The Total points and fees applicable under section 32 (field ID S32DISC.X48) is less than or equal to the Current Qualified Mortgage Fee Threshold (field ID QM.X121).

-

Debt to Income Ratio - The following checkboxes on the Underwriter Summary are selected to indicate that they have been assessed by the underwriter:

-

Monthly Covered Loan Payment (field ID QM.X338)

-

Monthly Simultaneous Loan Payment (field ID QM.X339)

-

Monthly Mortgage Related Obligations (field ID QM.X340)

-

Debt Obligations (field ID QM.X341)

-

Child Support Obligations (field ID QM.X342)

-

Alimony Obligations (field ID QM.X343)

-

Current or Expected Income (field ID QM.X345)

-

Debt to Income Ratio (field ID QM.X348)

-

Residual Income - The Residual Income checkbox (field ID QM.X348) on the Underwriter Summary is selected to indicate that this factor has been assessed. Note that this factor is not required to qualify for Agency/GSE QM. If the factor is not assessed, a blue flag indicator displays in the matrix.

-

Monthly Payment and Consider and Verify Factors - All of these factors are required. In order for green check marks to display for each factor, the corresponding checkbox on the Underwriter Summary must be selected. To view the field mapping between the checkboxes on the Underwriter Summary and these factors in the matrix, refer to the Field Mapping Between Underwriter Summary Evaluation Fields and ATR/QM Eligibility Matrix section on the Underwriter Summary help topic.

-

The Underwriter Summary is available in Encompass Banker Edition only. Encompass Broker Edition is unable to provide an automated assessment of the ATR and QM types on the ATR/QM Management tool’s ATR/QM Eligibility form due to the absence of the Underwriter Summary, however all other ATR/QM functionality is available.

-

Small Creditor Rural QM - Selected only if the administrator has indicated that your company is a rural small creditor (using the ATR/QM section of the Organization Details setting) AND the Subject Property is in a Rural/Underserved Area checkbox (field ID 3850) is selected in the loan file AND the loan meets the following requirements (as indicated by a green check mark in the ATR/QM Eligibility matrix).

In order to qualify for Rural Small Creditor, the loan must not meet the standards for General Qualified Mortgage, Agency/GSE Qualified Mortgage or FHA Qualified Mortgage.

![]() Small Creditor Rural QM Requirements

Small Creditor Rural QM Requirements

-

Loan Term - If the loan does not feature a balloon payment, the Loan Term (field ID 4) must be less than or equal to 360 months. If the loan does feature a balloon payment, the Loan Term must be between 60 - 360 months.

-

Loan Features:

-

Interest Only - The loan cannot feature any interest-only payments. The Transaction Details Interest Only Months field (field ID 1177) must be empty or 0 may be entered.

-

Negative Amortization - The ARM Recast Period/Stop fields (field IDs 1712 and 1713) are both empty (i.e., no values entered).

-

Balloon Payment - If the loan does not feature a balloon payment, the Loan Term (field ID 4) must be less than or equal to 360 months. If the loan does feature a balloon payment, the Loan Term must be between 60 - 360 months.

-

Prepayment Penalty - The Amortization Type (field ID 608) is Fixed

AND

the Prepayment Penalty Period (field ID RE88395.X316) is less than or equal to 36 (or blank)

AND

the Prepayment Penalty entered as a percentage (field IDs 1948, 1973, 1976, 1979, 1982) or the Maximum Prepayment Penalty entered as a percentage (field ID QM.X112) are all less than or equal to 2.000% or all of these fields are blank.

-

-

Points and Fees Limit - The Total points and fees applicable under section 32 (field ID S32DISC.X48) is less than or equal to the Current Qualified Mortgage Fee Threshold (field ID QM.X121).

-

Debt to Income Ratio - The following checkboxes on the Underwriter Summary are selected to indicate that they have been assessed by the underwriter:

-

Monthly Covered Loan Payment (field ID QM.X338)

-

Monthly Simultaneous Loan Payment (field ID QM.X339)

-

Monthly Mortgage Related Obligations (field ID QM.X340)

-

Debt Obligations (field ID QM.X341)

-

Child Support Obligations (field ID QM.X342)

-

Alimony Obligations (field ID QM.X343)

-

Current or Expected Income (field ID QM.X345)

-

Debt to Income Ratio (field ID QM.X348)

-

-

Residual Income - The Residual Income checkbox (field ID QM.X348) on the Underwriter Summary is selected to indicate that this factor has been assessed. Note that this factor is not required to qualify for Agency/GSE QM. If the factor is not assessed, a blue flag indicator displays in the matrix.

-

Monthly Payment and Consider and Verify Factors - All of these factors are required. In order for green check marks to display for each factor, the corresponding checkbox on the Underwriter Summary must be selected. To view the field mapping between the checkboxes on the Underwriter Summary and these factors in the matrix, refer to the Field Mapping Between Underwriter Summary Evaluation Fields and ATR/QM Eligibility Matrix section on the Underwriter Summary help topic.

The Underwriter Summary is available in Encompass Banker Edition only. Encompass Broker Edition is unable to provide an automated assessment of the ATR and QM types on the ATR/QM Management tool’s ATR/QM Eligibility form due to the absence of the Underwriter Summary, however all other ATR/QM functionality is available.

-

VA QM - Selected only when the loan type is VA, the Case Assignment Date field is on or after May 9, 2014 and all the factors under the Agency/GSE Qualified Mortgage column header are met (as indicated by a green check mark).

-

-

On the VA 26-0286 Loan Summary form, the Yes or No option must be selected for the Loan processed under VA recognized automated underwriting system? field (field ID VASSUM.X4).

-

If Yes is selected for the VASSUM.X4 field, options must also be selected for:

-

Which system was used? (field ID VASSUM.X17).

-

Risk Classification (field ID VASSUM.X17).

-

For VA QM eligibility, Encompass also looks to the AUS Recommendation (field ID 1544) and requires Approve/Eligible, Accept/Eligible, Approve Eligible, or Accept Eligible (for DU) or Accept, Approve, Approve/Eligible, ApproveEligible, Approve Eligible, AcceptEligible, Accept/Eligible, or Accept Eligible (for LP).

-

-

If No is selected for VASSUM.X4, complete the manual underwriting process and, as an alternative to AUS results, select one of the three manual underwriting methods on page 1 of the Underwriter Summary tool.

Encompass reviews the transaction’s eligibility for the specific QM loan types in the following order and recommends the loan type whose requirements are met first.

-

Ability-to-Repay Loan Type - Exempt

-

Qualified Mortgage Loan Type - General QM

-

Qualified Mortgage Loan Type - Agency/GSE QM

-

Qualified Mortgage Loan Type - FHA QM

-

Qualified Mortgage Loan Type - VA QM

-

Qualified Mortgage Loan Type - Small Creditor QM

-

Qualified Mortgage Loan Type - Small Creditor Rural QM

-

Ability-to-Repay Loan Type - General ATR

Encompass relies on the underwriter’s assessments indicated on the Underwriter Summary to provide an ATR/QM recommendation. The Underwriter Summary is available in Encompass Banker Edition only. Encompass Broker Edition will make assessments for the Loan Term, Loan Features, and Points and Fees Limit, but users need to click the blue Lock icons in the ATR/QM Recommendation section to lock these fields and manually select the appropriate Ability-to-Repay Loan Type, Qualified Mortgage Loan Type, and Is Loan Eligible for Safe Harbor options from the dropdown lists.

-

Is Loan Eligible for Safe Harbor? - This field is populated with one of the options below based on the following logic. Click the blue Lock icon to override this logic and select the desired option.

-

Yes - Selected if the Ability-to-Repay Loan Type (field ID QM.X23) is Qualified Mortgage, an option has been selected for Qualified Mortgage Loan Type (field ID QM.X24), and the selected QM loan type has met Safe Harbor Eligibility standards (as indicated by a green check mark in the Safe Harbor Eligibility section of the form).

-

No - Selected if the Ability-to-Repay Loan Type (field ID QM.X23) is Qualified Mortgage, an option has been selected for Qualified Mortgage Loan Type (field ID QM.X24), but the selected QM loan type has not met Safe Harbor Eligibility standards (as indicated by a red flag in the Safe Harbor Eligibility section of the form).

-

N/A - Selected if the Ability-to-Repay Loan Type (field ID QM.X23) is Exempt or General ATR.

-

What Loan Fields Does the ATR/QM Eligibility Matrix Rely On?

When assessing the Loan Term, Loan Features, and Points and Fees Limit eligibility, Encompass assesses the values entered on the related forms discussed earlier (2015 Itemization and 1003 Loan Application, MIP/PMI/Guarantee Fee Calculation window, etc.) and calculations provided on the ATR/QM Management tool’s Qualification form. These indicators are dynamic and will change as the factors change.

The Debt-to-Income Ratio assessment is based partly on the underwriter’s sign off of debt-to-income factors on the Underwriter Summary.

The underwriter must indicate that all of these factors on the Underwriter Summary have been evaluated. Current Employment Status, Assets, Credit History, and Residual Income are not required for this assessment. If one or more of the required factors have not been evaluated, blue flag indicators will display to indicate that data required for the DTI ratio assessment is missing.

-

When assessing eligibility for General QM, Encompass considers the Payment Ratio (DTI) for the maximum rate in the first five years (field ID QM.X119) on ARM loans. General QM requires that this ratio be equal to or less than 43%.

-

For Agency/GSE QM eligibility, Encompass looks to the AUS Recommendation (field ID 1544) and requires Approve/Eligible, Accept/Eligible, Approve Eligible, or Accept Eligible (for DU) or Accept, Approve, Approve/Eligible, ApproveEligible, Approve Eligible, AcceptEligible, Accept/Eligible, or Accept Eligible (for LP). Encompass also accepts one of the three manual underwriting methods as an alternative to AUS results.

The Residual Income factor is not required, but a recommendation to review this factor will be triggered under General ATR and under General QM if Safe Harbor requirements are not met.

A blue flag indicator for Residual Income will not prevent a loan from being eligible for any of the QM loan types.

The indicators for the Monthly Payment and Consider and Verify factors are triggered by the factors on the Underwriter Summary. If one or more of the factors have not been evaluated, blue flag indicators will display to indicate that data required for the Monthly Payment or Consider and Verify assessment is missing.

After the underwriter assesses the required factors, it is recommended that they enter their name (or the AUS) in the Approved By field (field ID 2984) and an Approval Expires date (field ID 2302) on the Underwriter Summary. For Encompass Compliance Service users, a warning may be triggered when a review is run and these fields are missing data.

This section supports both QM and Non-QM loan types. Non-QM loans are those that meet general ability-to-repay requirements or are exempt from ATR/QM regulations. Feedback on Safe Harbor eligibility for QM loans also is provided.

Based on the loan file’s data and calculations provided in the Qualification form, the ATR/QM Eligibility matrix provides indicators to show the ATR/QM requirements that have or have not been met.

-

A green check mark indicates that the factor is consistent with ATR/QM exceptions.

-

A red flag indicates that the factor is not consistent with ATR/QM expectations.

-

A blue flag indicates that the data relied upon in making the ATR/QM assessment is missing from the loan file.

If the loan file is exempt from ATR/QM requirements, select the Transaction is exempt from Reg. Z Ability-to-Repay requirements based on checkbox in the ATR/QM Exemption Eligibility section and then indicate the reason why the loan qualifies for exemption.

-

A loan’s eligibility for QM Safe Harbor is based on the QM type, lien position, and APR and APOR values.

-

Encompass follows the guidance provided by the CFPB, and the applicable Agency, (as shown in the table below) when determining QM Safe Harbor eligibility.

| Safe Harbor | First Lien | Second Lien |

|---|---|---|

|

General QM |

APR < 1.5% plus APOR | APR < 3.5% plus APOR |

| General QM w/Price Based | QM APR < 1.5% plus APOR | QM APR < 3.5% plus APOR |

|

Agency/GSE QM |

APR < 1.5% plus APOR |

APR < 3.5% plus APOR |

| Small Creditor QM |

APR < 3.5% plus APOR |

APR < 3.5% plus APOR |

| Agency/GSE Small Creditor Balloon QM | APR < 3.5% plus APOR | APR < 3.5% plus APOR |

| Small Creditor Rural Balloon QM | APR < 3.5% plus APOR | APR < 3.5% plus APOR |

The Exemption Eligibility section provides lenders with an area to document why a transaction is exempt from Reg Z ATR requirements. Multiple exemption elections may be indicated here.

If the loan file is exempt from ATR/QM requirements, select the Transaction is exempt from Reg. Z Ability-to-Repay requirements based on checkbox and then indicate the reason why the loan qualifies for exemption.

![]() Non-Standard to Standard Refi. tab

Non-Standard to Standard Refi. tab

Many consumers have adjustable rate, interest only or negative amortization loans that they may not be able to afford when the loan recasts. To give lenders more flexibility to help these homeowners refinance, the ATR/QM rule gives some lenders the option to refinance a current non-standard mortgage (which includes various types of mortgages that can lead to payment shock and can result in default) into a standard mortgage without having to meet the rule’s ATR requirements including considering the eight underwriting factors required for ATR.

This non-standard to standard refinance option applies only to mortgages that the lender currently holds or services.

Use the Non-Standard to Standard Refi tab to determine if the loan meets the Non-Standard to Standard Refinance exemption from the Regulation Z Ability-to-Repay requirements.

While this option only applies to mortgages the lender currently holds or services, the following conditions must be met in order for a loan to qualify for the Non-Standard to Standard Refinance exception to ATR requirements:

-

Payments under the new Refinance loan will not cause the principal to increase (field ID QM.X6).

-

Consumer uses the proceeds to pay off the original mortgage and for closing or settlement charges and the consumer is not receiving cash out at closing (field ID NTB.X30).

-

The consumer’s monthly payment will materially decrease (field ID QM.X18)

-

The consumer has no more than one 30-day late payment in the past 12 months and no late payments within the past six months (field IDs QM.X3 and QM.X4).

-

The consumer’s written application is received no later than two months after the non-standard mortgage has recast (field ID QM.X5).

-

The lender has considered whether the standard mortgage is likely to prevent the consumer from defaulting on the non-standard mortgage once the loan is recast (field IDs QM.X16 and QM.X22).

In addition to those eligibility conditions, there are additional guidelines the new standard mortgage must follow:

-

The new mortgage cannot have deferred principal (field ID QM.X20), negative amortization (field ID NTB.X25), nor a balloon payment (field ID 1659).

-

The points and fees must fall within the thresholds for QM (field ID QM.X21).

-

The loan term cannot exceed 40 years (field ID 4).

-

The interest rate must be fixed for at least the first five years of the loan (field ID QM.X17).

Based on the completion of the data in this eligibility assessment (and if the required conditions and guidelines have been met), you can document that the loan is eligible for the Non-Standard to Standard Refinance exception from Regulation Z Ability-to-Repay requirements.

Non-Standard to Standard Refinance Disclosure

Encompass provides a printed output form for the Non-Standard to Standard Refinance form. The data from the input form is printed to the output form and may be included in disclosure packages as needed.

![]() To Print the Non-Standard to Standard Refinance Disclosure

To Print the Non-Standard to Standard Refinance Disclosure

-

On the Non-Standard to Standard Refinance input form, click the Print icon.

-

The Non-Standard to Standard Refinance Eligibility form is listed in the Selected Forms list on the Print window. Click Print to print the form.

See Also

Printing Ability-to-Repay Output Forms