Release Notes Change Log for Version 18.4

This Change Log lists each release notes entry that has been added, deleted, or modified since the initial preview version was first published.

|

Change Type: New entry Change Date: 8/21/2018 Details: The following entry was added to the Fixed Issues page. An issue occurred where the Access to all loans in the same level setting in the User Details setting was not functioning correctly. If an internal Encompass user was listed as a “TPO Sales Rep” or “Account Executive” on an External Organization, that user had access to all loans associated with that TPO company. If another Encompass user account was placed within the same internal company Organization folder, the second user had access to the same TPO company loans even though that user was not a “TPO Sales Rep” or “Account Executive” with any TPO company and the Access to all loans in the same level setting was disabled. This issue has been resolved and if the Access to all loan in the same level setting is disabled, a user cannot access TPO company loans associated with the other Encompass user accounts within the same Organization folder. SEC-13490

|

|

Change Type: Entry updated Change Date: 8/21/2018 Details: More detailed information has been added to the Enhancements to Support HELOC Loans section on the Feature Enhancements page. |

| Change Type: Entry updated Change Date: 8/29/2018 Details: The Added New TPO Global Lender Contacts Setting entry was updated on the New Features and Forms page. All references to "Company Contacts page" has been updated to "Lender Key Contacts widget". |

| Change Type: Entry updated Change Date: 8/29/2018 Details: The Added New Lender Contacts Tab to the Company Details Setting entry was updated on the New Features and Forms page. All references to "Company Contacts page" has been updated to "Lender Key Contacts widget". |

| Change Type: The Encompass 18.4 Release Preview has been converted to the Encompass 18.4 Release Notes. These release notes are subject to change prior to the official Encompass 18.4 major release which is currently scheduled to start in October 2018. Change Date: 9/7/18 |

|

Change Type: Entries added and updated Change Date: 9/7/2018 Details: The following entries were added or updated. The following new entries were added to the Feature Enhancements page:

The following entries were updated on the Feature Enhancements page:

The following new entries were added to the Fixed Issues page:

|

| Change Type: Entry updated Change Date: 9/11/2018 Details: The following update was made to the wording in the last sentence in the first paragraph of the Electronic Document Management entry for Configurable eSigning Order for eDisclosures : Previous wording:

Current wording:

|

| Change Type: Entry updated Change Date: 9/11/2018 Details: The following update was made to the description of the HCLTV calculation in the Government (FHA, VA, or USDA) section in the Calculating Combined Loan-to-Value Ratios (CLTV, HCLTV) with Subordinate Financing entry on the Feature Enhancements page. Previous entry:

Current entry:

|

| Change Type: Entry updated Change Date: 9/11/2018 Details: The following note was added to the Total Ratios for Subject Property section in the Updates to the Subordinate Mortgage Loan Amounts Pop-up Window entry on the Feature Enhancements page. For clients using the Encompass Product and Pricing Service (EPPS) to price HELOC loans, Ellie Mae recommends that the loan be priced within EPPS, but manually locked in Encompass due to a potential conflict with CLTV on HELOC loans imported into Encompass from EPPS. This issue is scheduled to be addressed in the Encompass Product and Pricing Service 19.1 release.

|

| Change Type: Entry removed Change Date: 9/13/2018 Details: The following entry was removed from the Feature Enhancements page in these release notes. This feature enhancement will not be included in the Encompass 18.4 major release. System Performance Enhancements The following updates have been applied to Encompass to help ensure improved system performance on users’ client workstations:

The Persona settings have been updated to include a new Include Archive Folders option that administrators can select to grant user access to this checkbox on the Pipeline. To access this option, navigate to Encompass > Settings > Company User/Setup > Personas, and then select the Pipeline tab. The Include Archive Folders option is listed at the bottom the Pipeline Tasks option list. NICE-11278 |

|

Change Type: Entry removed Change Date: 9/21/2018 Details: The following entry was removed from the Feature Enhancements page in these release notes. When users open loans in Encompass, the system checks the status of the borrowers’ eConsent acceptance. Previously, the system checked only within Encompass for the eConsent. In Encompass 18.4, updates have been made so that the system now checks for external eConsent data located in Encompass Developer Connect first. If the system detects external eConsent is available, it will then retrieve the external eConsent data from Encompass Developer Connect and provide it within Encompass when the loan file is opened. For example, when viewing the eConsent Status window in a loan, users can click the View Form link to view the eConsent Agreement PDF file. If the loan has external eConsent data available, Encompass will display the eConsent Agreement PDF that is stored in Encompass Developer Connect. If external eConsent data other than the eConsent PDF is available from Encompass Developer Connect, but the PDF is not available, and the user selects the View Form link to view the PDF, the system will display a message that states that the form is not available at this time. Otherwise, the message will not display. With these updates, developers using Encompass Developer Connect can also update the eConsent details and these updates will be provided in Encompass when the loan file is opened. Note that Encompass Developer Connect support loan level eConsent only. It does not support eDisclosure package level eConsent. If there is no external eConsent data available, the system will check within Encompass for the eConsent status just as it did in previous versions of Encompass. Encompass and Encompass Developer Connect rely on field 4499 to determine if external eConsent data is available. This field is not visible on any forms or within the Encompass user interface, but it can be added to Encompass reports as required. This checkbox field will be selected if external eConsent data is available for the loan. NICE-11531, NICE-12186, NICE-12164, NICE-12169

|

|

Change Type: Link to related documentation added to entry. Change Date: 9/21/2018 Details: The following link was added to the Enhancements to Support HELOC Loans section on the Feature Enhancements page. This link points to the new Working with HELOC Loans guide. View the Working with HELOC Loans guide for more information about managing HELOC loans in Encompass, including recommended best practices, steps to configure HELOC loan templates, and working through specific HELOC loan scenarios. |

| Change Type: Link to related documentation added to entry. Change Date: 9/21/2018 Details: The following links were added to the end of the Dynamic Data Management (DDM) section of the New Features & Forms page. These links point to the new Dynamic Data Management User Guide and the Top Use Cases for Dynamic Data Management guide. View the Dynamic Data Management User Guide for more detailed information about setting up fee rules, field rules, data tables, and the global DDM settings in Encompass. You can also review the Top Use Cases for Dynamic Data Management guide to learn about typical use cases where utilizing the Dynamic Data Management options provides a more efficient way to automate fee data rather than templates (especially when the number of templates increase) and a simpler way to set field values instead of field triggers business rules. |

| Change Type: Entry updated Change Date: 10/1/2018 Details: The following updates were made to the To Add a New Contact and To Edit a Contact sections in the Added New TPO Global Lender Contacts Setting entry was updated on the New Features and Forms page. Previous wording for the bullet items under step 9 and step 5, respectively:

Current wording for the bullet items under step 9 and step 5, respectively:

New bullet item added to step 4 of the To Edit a Contact entry.

This manual update is saved into the Global Contacts table. However, it is not updated in the existing Encompass User profile. |

|

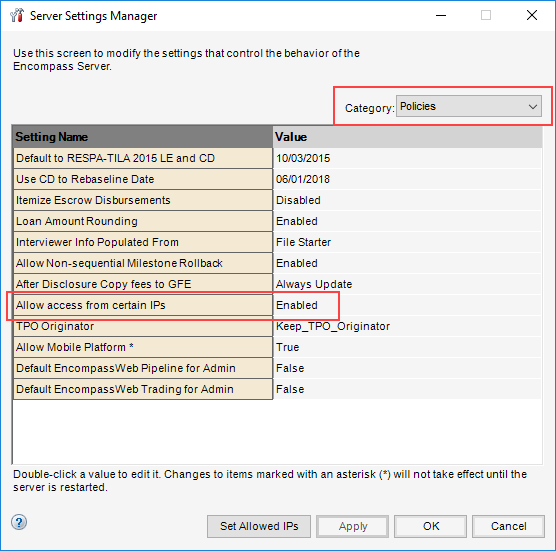

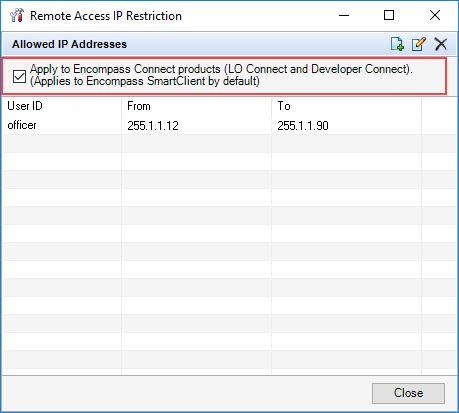

Change Type: Entry updated Change Date: 10/1/2018 Details: The following entry on the Feature Enhancements page was updated with a note to explain that the applicable portion of this new setting that is intended for use with Encompass Loan Officer Connect and Encompass Developer Connect, while provided in Encompass, will not be applied to these two products at this time. This setting will be compatible with these two products in future Encompass Loan Officer Connect and Encompass Developer Connect updates/releases. Current Entry: Using the Allow access from certain IPs option in the Encompass Admin Tools, administrators can indicate specific IP addresses from which users are allowed to access Encompass. Starting in Encompass 18.4, this option has been enhanced to enable administrators to apply this setting to Encompass Loan Officer Connect and Encompass Developer Connect as well. Please review these steps below for more information about this enhancement. Please note, this enhancement to enable this setting to be applied to Encompass Loan Officer Connect and Encompass Developer Connect, while available in Encompass 18.4, will not be applied to Encompass Loan Officer Connect nor Encompass Developer Connect at this time. The updates in these two products that are required in order for this setting to be applied to them will be implemented in a future release of Encompass Loan Officer Connect and Encompass Developer Connect. To Configure Access Based on IP Addresses:

Select Everyone to apply the same IP settings for all users.

NICE-10934

Previous Entry: Using the Allow access from certain IPs option in the Encompass Admin Tools, administrators can indicate specific IP addresses from which users are allowed to access Encompass. Starting in Encompass 18.4, this option has been enhanced to enable administrators to apply this setting to Encompass Loan Officer Connect and Encompass Developer Connect as well. Please review these steps below for more information about this enhancement. To Configure Access Based on IP Addresses:

Select Everyone to apply the same IP settings for all users.

NICE-10934

|

|

Change Type: New section Change Date: 10/05/2018 Details: A new section for Title and Closing Service Updates was added to the Feature Enhancements page to describe the updates made to the Encompass Title and Closing Service. |

|

Change Type: New entry Change Date:10/05/2018 Details: The following entry was added to the Feature Enhancements page: |

|

Change Type: New section added Change Date: 10/5/2018 Details: A new Fixed Issues for Version 18.4.0.1 Server Patch 1 section was added to the Fixed Issues page. |

|

Change Type: Entry updated. Change Date: 10/5/2018 Details: The following note was added to the Updates to the Wording on the eDisclosure Agreement entry on the Fixed Issues page to clarify the date when the new verbiage will display on the eDisclosure Agreement: The updated verbiage will display on the eDisclosure Agreement starting on October 13, 2018. |

|

Change Type: Entry updated. Change Date: 10/9/2018 Details: The second paragraph in the Enhancements to Support HELOC Loans entry on the Feature Enhancements page has been updated to provide additional details about new HELOC fields and Loan Programs templates. Current Text: Encompass users can now set up unique HELOC product configurations to qualify loan payments according to lender or investor-specific guidelines. New sections have been added to the RegZ-CD, RegZ-LE, Closing RegZ, and RegZ-TIL input forms where users can define separate bases for both the qualifying payment and the initial payment disclosed to the borrower. These new HELOC sections are also available in the Loan Program Templates setting, enabling Encompass administrators to configure Loan Program Templates for each of the HELOC loan scenarios that your company supports, and in the Loan Program Templates pop-up window that is accessible by clicking the Find icon (magnifying glass) next to the Loan Program field on the 2010 and 2015 Itemization forms. Applying a template populates the loan with most of the data needed to calculate HELOC payments. The only additional data required is the initial note rate, initial draw and total line amount. Previous Text: Encompass users can now set up unique HELOC product configurations to qualify loan payments according to lender or investor-specific guidelines. New sections have been added to the RegZ-CD, RegZ-LE, Closing RegZ, and RegZ-TIL input forms where users can define separate bases for both the qualifying payment and the initial payment disclosed to the borrower. Encompass administrators can also configure Loan Program Templates for each of the HELOC loan scenarios that your company supports. Applying a template populates the loan with most of the data needed to calculate HELOC payments. The only additional data required is the initial note rate, initial draw and total line amount. |

|

Change Type: Entry removed. Change Date: 10/15/2018 Details: The following entry was removed from the Fixed Issues page. Deleted Entry: When a borrower’s legal name includes a hyphen, the eSigning process now inserts the hyphen in the electronic signatures that are applied to loan documents. Previously the hyphen was not displaying in the electronic signature. Example: Ramos-Estevez would display as RamosEstevez on the applied eSignature. EDM-5170 |

|

Change Type: Entry updated. Change Date: 10/15/2018 Details: An update was made to the New Financing Not Linked to Current Transaction section in the Updates to the Subordinate Mortgage Loan Amounts Pop-up Window entry on the Feature Enhancements page to correct a field name and add a field ID. Current Text: Record second through fourth lien mortgages in the New Closed End Subordinate Mortgage (field ID 4488). Previous Text: Record second through fourth lien mortgages in the New Closed End Primary Mortgage. |

| Change Type: New section added Change Date: 10/17/2018 Details: A new Fixed Issues for Version 18.4.0.2 section was added to the Fixed Issues page. |

|

Change Type: Updated entry Change Date: 10/17/2018 Details: The following entry on the Features Enhancements page has been updated to specify when this setting will be applicable Encompass Loan Officer Connect and Encompass Developer Connect. Current Entry: Using the Allow access from certain IPs option in the Encompass Admin Tools, administrators can indicate specific IP addresses from which users are allowed to access Encompass. Starting in Encompass 18.4, this option has been enhanced to enable administrators to apply this setting to Encompass Loan Officer Connect and Encompass Developer Connect as well. Please review these steps below for more information about this enhancement. Please note, this enhancement to enable this setting to be applied to Encompass Loan Officer Connect and Encompass Developer Connect, while available in Encompass 18.4, will not be applied to Encompass Loan Officer Connect nor Encompass Developer Connect until their respective 18.4 releases on November 10, 2018. The updates in these two products that are required in order for this setting to be applied to them will be provided in those releases. To Configure Access Based on IP Addresses:

Select Everyone to apply the same IP settings for all users.

Again, while this setting is provided in Encompass 18.4, it will not be applied to Encompass LO Connect nor Encompass Developer Connect until their respective 18.4 releases on November 10, 2018.

NICE-10934

Previous Entry: Using the Allow access from certain IPs option in the Encompass Admin Tools, administrators can indicate specific IP addresses from which users are allowed to access Encompass. Starting in Encompass 18.4, this option has been enhanced to enable administrators to apply this setting to Encompass Loan Officer Connect and Encompass Developer Connect as well. Please review these steps below for more information about this enhancement. Please note, this enhancement to enable this setting to be applied to Encompass Loan Officer Connect and Encompass Developer Connect, while available in Encompass 18.4, will not be applied to Encompass Loan Officer Connect nor Encompass Developer Connect at this time. The updates in these two products that are required in order for this setting to be applied to them will be implemented in a future release of Encompass Loan Officer Connect and Encompass Developer Connect. To Configure Access Based on IP Addresses:

Select Everyone to apply the same IP settings for all users.

NICE-10934

|

|

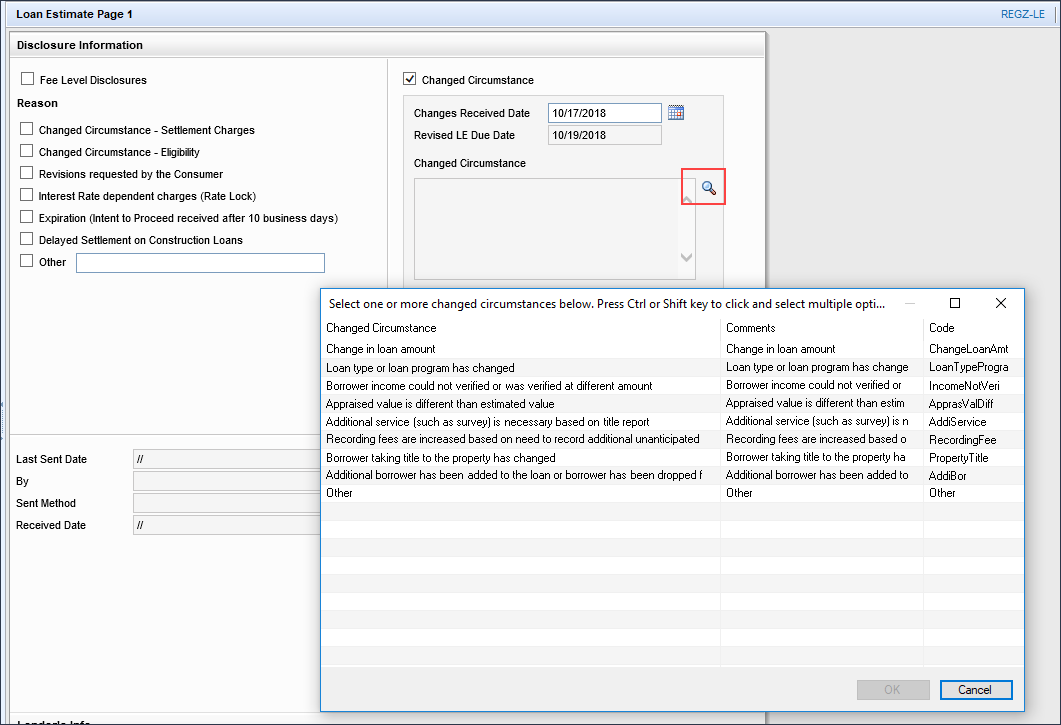

Change Date: 10/17/2018 Details: The following entry was removed from the release notes' Feature Enhancements page. Originally, this new section of the User Groups setting was included in the 18.4 major release. However, it was determined that its inclusion resulted in issues for users where they were unable to view and select a Changed Circumstance reason to add to field 3169 on the Loan Estimate Page 1. Therefore this new section of the User Groups setting was rolled back and removed from Encompass with the Encompass 18.4.0.2 release. The User Groups setting has been updated with a new Change of Circumstance Options section where administrators can set up and control user access to different Change of Circumstance options accessible from the Alerts page, LE Page 1, and CD Page 1 based on User Groups. When a user selects the Changed Circumstance checkbox (field ID 3168 on the LE, CD1.X61 on the CD) on one of these forms, and then clicks the Lookup icon to pick from a list of options to populate the Changed Circumstance description field (field ID 3169 on the LE, CD1.X64 on the CD), only the options selected by the administrator in this User Groups setting will be available for the user to select.

To Define Group Member Access to Change of Circumstance Options:

NICE-5506, NICE-9807

|

|

Change Type: New entry added Change Date:10/18/2018 Details: The following new entry was added to the Fixed Issues for Version 18.4.0.2 section on the Fixed Issues page. An issue occurred where the Changed Circumstance options in the Lookup window on the Loan Estimate (LE) Page 1 (and the Closing Disclosure (CD) Page 1) were missing for non-admin users (i.e., any user assigned with a persona that was not Administrator or Super Administrator). Therefore, users were unable to indicate the reason for a Changed Circumstance that required a redisclosure of a loan in field 3169 on the LE Page 1. This issue has been resolved so that the Changed Circumstance options are now listed in the Lookup window for all authorized users as expected.

As part of the fix for this issue, the new Change of Circumstance Options section that was added to the User Groups setting has been rolled back/removed. This section of the User Groups setting, originally included in early versions of Encompass 18.4, is no longer available starting in Encompass 18.4.0.2. Note that if you configured this Change of Circumstance Options section for a user group, these settings will no longer be honored. You can use the Loan Setup > Changed Circumstances Setup tool to manage the changed circumstance options that will be available to users to select in the loan file. To view details about this Change of Circumstance Options section of the setting that has been removed, refer to the Change Log. NICE-14908, NICE-14922 |

|

Change Type: Updated entry Change Date: 10/18/2018 Details: The following entry in the Fixed Issues for Version 18.4.0.2 section on the Fixed Issues page has been updated. Current Entry: To limit user access to the Piggyback Loans Tool, the following buttons on the new Subordinate Mortgage pop-up window can now be controlled via Persona Access to Fields business rules: Link to Loan (field ID BUTTON_Link to Loan), Add New Closed End (field ID BUTTON_Add New Closed End), Add New HELOC (field ID BUTTON_Add New HELOC), and Remove Link (field ID BUTTON_Remove Link). CBIZ-20472 Previous Entry: Personas who have not been granted access to the Piggyback Loans Tool in the Personas setting can no longer access the tool by clicking the Link to Loan, Add New Closed End, or Add New HELOC buttons on the Subordinate Mortgage Loan Amounts pop-up window that was introduced with the Encompass 18.4 release. CBIZ-20472 |

|

Change Type: New entry Change Date: 10/18/2018 Details: The following new entry was added to the Fixed Issues for Version 18.4.0.2 section on the Fixed Issues page. Initially Payable to Your Institution Field is Editable When Action Taken is 1, 2, 6, 7 or 8 An issue has been resolved that caused the Initially Payable to Your Institution field (field ID HMDA.X43) to be not editable in some Encompass user’s environments when the Action Taken option (field ID 1393) was set to any option other than 3, 4, or 5. This issue has been resolved and the Initially Payable to Your Institution field is no editable under the conditions described above. Workaround Information: The following workaround was provided for this production issue for Encompass user who were populating the Initially Payable to Your Institution field with a constant value. The workaround is no longer required for the Encompass 18.4.0.2 release and later.

CBIZ-20571 |

| Change Type: New section added Change Date: 10/20/2018 Details: A new Fixed Issues for the Server Patch 2 Update section that contains information about the issues fixed in this update was added to the Fixed Issues page. |

|

Change Type: Updated entry Change Date: 10/31/2018 Details: The Updated Logic for Populating the HMDA Reporting Year and Displaying the HMDA Information Form entry on the Feature Enhancements page has been updated. Current Entry: Updates have been made to the logic used to populate the HMDA Reporting Year (field ID HMDA.X27) and to determine which version of the HMDA Information form displays in a loan file. Previously, the HMDA Information input form used the following logic:

This logic is being updated to enable the actual reporting year to display for loans dispositioned after 2018.

Additionally, the following logic is being used to display the appropriate version of the HMDA Information input form:

CBIZ-11388 Previous Entry: Updates have been made to the logic used to populate the HMDA Reporting Year (field ID HMDA.X27) and the demographic information that displays in the Information for Government Monitoring section on the HMDA Information and 1003 Page 3 forms. Previously, the HMDA Information input form used the following logic:

This logic is being updated to enable the actual reporting year to display for loans dispositioned after 2018.

Additionally, the following logic is being used to display the appropriate demographic information in the Information for Government Monitoring section on the HMDA Information and 1003 Page 3 forms:

CBIZ-11388 |

|

Change Type: Entry removed. Change Date: 11/1/2018 Details: The following entry was removed from the Fixed Issues page. This feature was originally included in the initial Encompass 18.4 release, but was removed as part of the Encompass 18.4.0.2 update on 10/18 to address an additional production issue that was triggered by the introduction of this feature. Deleted Entry: When sending an eConsent request to borrowers, Encompass users can now enter an email address for a co-borrower in the Send Consent window if the co-borrower does not already have an email address entered in the loan file. When the user clicks the Send button on the Send Consent window, a pop-up message displays to prompt the user to enter an email address for the co-borrower. The email field for the co-borrower is now editable on the Send Consent window, enabling users to manually enter an email address.

EDM-20569 |

|

Change Type: Updated entry Change Date: 11/1/2018 Details: The Estimated Prepaid Items Now Subtracted from the Refinance Cash Out Amount entry on the Fixed Issues page has been updated. Current Entry: The calculation used to populate the Refinance Cash Out Amount (field ID CASASRN.X79) has been updated for cash-out refinance loans per the Freddie Mac Single-Family Seller/Servicer Guide. When the Purpose of Loan (field ID 19) is Cash Out Refi,the Estimated prepaid items (field ID 138) amount from the Details of Transaction is now subtracted from the amount that is populated to the Refinance Cash Out Amount (field ID CASASRN.X79). Workaround Information: The following workaround was provided for this production issue and is no longer required for Encompass version 18.4 and later:

CBIZ-13791 Previous Entry: The Estimated prepaid items amount (field ID 138) from the Details of Transaction is now excluded from the Refinance Cash Out Amount (field ID CASASRN.X79) when the Purpose of Loan (field ID 19) is Cash Out Refi. per the Freddie Mac Single-Family Seller/Servicer Guide. Workaround Information: The following workaround was provided for this production issue and is no longer required for Encompass version 18.4 and later:

CBIZ-13791 |

|

Change Type: Updated entry Change Date: 11/2/2018 Details: A sentence has been added to the end of the first paragraph in the New Calculation for Standard ARM Loans and Construction-to-Permanent Loans section of the Updates to the Introductory Rate Period Calculation for ARM and Construction-to-Permanent Loans entry on the Feature Enhancements page to clarify how the calculation update is applied. New Calculation for Standard ARM Loans and Construction-to-Permanent Loans For standard ARM loans (not construction-to-permanent), the Disbursement Date (field ID 2553) is subtracted from the 1st Payment Date (field ID 682) and the resulting number is divided by 30. For construction-to-permanent loans, the Disbursement Date (field ID 2553) is subtracted from the 1st Amortizing Payment Date (field ID 1963) and the resulting number is divided by 30. The result of this calculation is added to the 1st Change field (field ID 696). |

| Change Type: Updated entry Change Date: 11/9/2018 Details: The following entry on the Features Enhancements page has been updated to specify that this setting will be applicable Encompass Loan Officer Connect and Encompass Developer Connect in a future release of those respective products. Previously, the release notes stated that this setting would be applicable in these two products upon their respective releases on November 10, 2018. Current Entry: Using the Allow access from certain IPs option in the Encompass Admin Tools, administrators can indicate specific IP addresses from which users are allowed to access Encompass. Starting in Encompass 18.4, this option has been enhanced to enable administrators to apply this setting to Encompass Loan Officer Connect and Encompass Developer Connect as well. Please review these steps below for more information about this enhancement. Please note, this enhancement to enable this setting to be applied to Encompass Loan Officer Connect and Encompass Developer Connect, while available in Encompass 18.4, will not be applied to Encompass Loan Officer Connect nor Encompass Developer Connect until a future release of these respective products. The updates in these two products that are required in order for this setting to be applied to them will be provided in those releases. To Configure Access Based on IP Addresses:

Select Everyone to apply the same IP settings for all users.

Again, while this setting is provided in Encompass 18.4, it will not be applied to Encompass LO Connect nor Encompass Developer Connect until future releases of these respective products.

NICE-10934

Previous Entry: Using the Allow access from certain IPs option in the Encompass Admin Tools, administrators can indicate specific IP addresses from which users are allowed to access Encompass. Starting in Encompass 18.4, this option has been enhanced to enable administrators to apply this setting to Encompass Loan Officer Connect and Encompass Developer Connect as well. Please review these steps below for more information about this enhancement. Please note, this enhancement to enable this setting to be applied to Encompass Loan Officer Connect and Encompass Developer Connect, while available in Encompass 18.4, will not be applied to Encompass Loan Officer Connect nor Encompass Developer Connect until their respective 18.4 releases on November 10, 2018. The updates in these two products that are required in order for this setting to be applied to them will be provided in those releases. To Configure Access Based on IP Addresses:

Select Everyone to apply the same IP settings for all users.

Again, while this setting is provided in Encompass 18.4, it will not be applied to Encompass LO Connect nor Encompass Developer Connect until their respective 18.4 releases on November 10, 2018.

NICE-10934 |

| Change Type: Updated entries Change Date: 1/17/2019 Details: The following entries on the Features Enhancements page have been updated to provide additional information about new Lock icons and migration issues.

|