Use the buttons below to view general role definition guidelines for each persona.

Encompass Persona Functional Definition

Closer / Funder

The content contained in the Encompass Persona-Based Release Notes are aligned to the Closer / Funder persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Because closers often act as funders and vice versa, the roles are combined for the purpose of Persona Release Notes. Basic responsibilities of the Closer / Funder include, but are not limited to, the following:

- Manage the closing process

- Completes and audits the closing information

- Orders closing documents

- Reviews, prints, and reorders returned closing documents

- They also manage the funding process

Encompass Persona Functional Definition

Loan Officer

The content contained in the Encompass Persona-Based Release Notes are aligned to the LOan Officer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Loan Officer include, but are not limited to, the following:

- Develops business and initiates loans

- Develops new client relationships and manages relationships over time

- Initiates the loan process

- Gathers basic client info

- Orders services for prequalification and preapproval

- Communicates with processor

- Monitors loans in the Pipeline by tracking milestones and items requiring attention

Encompass Persona Functional Definition

Loan Processor

The content contained in the Encompass Persona-Based Release Notes are aligned to the Loan Processor persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Loan Processor include, but are not limited to, the following:

- Coordinates people and information to construct and finalize loans

- Uses tools such as forms documents, and communication logs

- Monitors own Pipeline by tracking milestones and items requiring action

Encompass Persona Functional Definition

Manager

The content contained in the Encompass Persona-Based Release Notes are aligned to the Manager persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Manager include, but are not limited to, the following:

- Manages the business

- Monitors the Pipelines of loan team members

- Manages the bottom line, such as resource assessment and management, and financial forecasting

Encompass Persona Functional Definition

Post Closer

The content contained in the Encompass Persona-Based Release Notes are aligned to the Post Closer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Post Closer include, but are not limited to, the following:

- Confirms all documents are completed and generated

Encompass Persona Functional Definition

Quality Control

The content contained in the Encompass Persona-Based Release Notes are aligned to the Quality Control persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Quality Control include, but are not limited to, the following:

- Inspects the loan for quality

Encompass Persona Functional Definition

Reporting

The content contained in the Encompass Persona-Based Release Notes are aligned to the Reporting persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Reporting include, but are not limited to, the following:

- Pulls, creates, and manages reports in Encompass

- Manages Encompass Reporting Database

Encompass Persona Functional Definition

Secondary Marketing / Lock Desk

The content contained in the Encompass Persona-Based Release Notes are aligned to the Secondary Marketing / Lock Desk persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Because Secondary Marketing often acts as Lock Desk and vice versa, the roles are combined for the purpose these Persona Release Notes. Basic responsibilities of the Secondary Marketing / Lock Desk include, but are not limited to, the following:

- Determines pricing strategies and develops / implements loan programs

- They also receive and process lock requests

Encompass Persona Functional Definition

Servicer

The content contained in the Encompass Persona-Based Release Notes are aligned to the Servicer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Servicer include, but are not limited to, the following:

- Services the loan

Encompass Persona Functional Definition

Shipper

The content contained in the Encompass Persona-Based Release Notes are aligned to the Shipper persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Shipper include, but are not limited to, the following:

- Assists with inventory control and provides input to secondary marketing functions

- Ships loans to document custodians and the investor

Encompass Persona Functional Definition

Underwriter

The content contained in the Encompass Persona-Based Release Notes are aligned to the Underwriter persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Underwriter include, but are not limited to, the following:

- Verifies loan accuracy

- Provides conditions to be met

- Verifies that conditions are met

To learn about another persona, select a persona from the options above; otherwise, to view or print the release notes, select Close ("X") at the top of the window and chose one or more options from the Filter by Persona or Print by Persona menu by selecting a button at the top of the page.

Encompass 24.3 Persona-Based Release Notes

The Encompass Persona-Based release notes are broken down by common Encompass personas. We realize every organization may have slightly different functional definitions for these personas. As such, you may want to review each persona's release note segments before forwarding to ensure they match personas / roles within your organization.

How to Navigate Persona-Based Release Notes

To use the Persona-Based Release Notes page, use the navigation buttons described below:

-

Filter by Persona: Create and view a customized on-screen version of the release notes by selecting one or more persona checkboxes. To remove one or more personas, clear the corresponding checkbox for the persona being removed.

-

Persona Definitions: View general role definition guidelines for each persona.

-

Print by Persona: View a dedicated PDF version of the release notes aligned to each of the available Encompass persona by selecting a persona one at a time. A new window will open and display the selected PDF file.

Encompass 24.3 Persona-Based Release Notes

The Encompass 24.3 Persona-Based Release Notes include a high-level overview of new features, feature and form enhancements, and fixed issues applicable to the each Encompass persona, followed by more detailed information and instructions where appropriate.

Refer to the online help and the Guides & Documents page for additional information and related documents.

Your customized on-screen version of the Persona-Based release notes include the following personas:

Closer / Funder

Loan Officer

Loan Processor

Manager

Post Closer

Quality Control

Reporting

Secondary Marketing / Lock Desk

Servicer

Shipper

Underwriter

To create a new customized on-screen version of the Persona-Based release notes, click Filter by Personas, and then select or clear the corresponding checkbox for the persona being added or removed.

New Features & Forms in Version 24.3 (Banker Edition)

This section discusses the new features being introduced in this Encompass release.

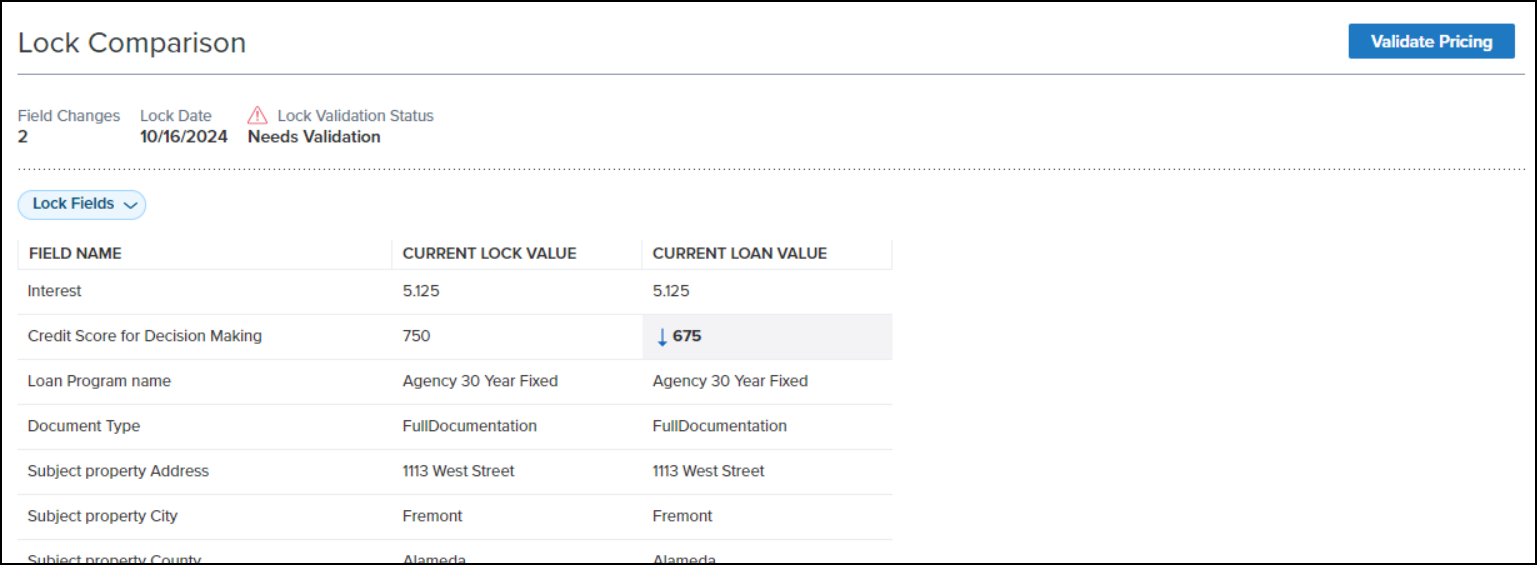

A new Lock Comparison Tool has been added to Encompass. This new tool displays pairs of fields that are monitored for changes made after the loan is locked. When loan data in a loan with an active lock is changed, the lock must be validated again. You can validate the loan using the Validate Pricing button on the Lock Comparison Tool or the Validate Pricing menu option on the Pipeline.

Currently, Validate Pricing only works with ICE PPE. For all other providers, additional configuration for field ID 5029 and 4788 are required in the APIs before pricing can be validated.

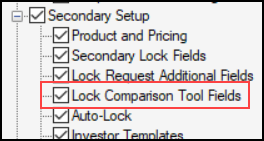

New Lock Comparison Tool persona options have been added to the Personas Setting tab and the Personas Forms/Tools tab.

Settings Tab

The Lock Comparison Tool Fields option in the Secondary Setup section of the Settings tab provides authorized users with the ability to customize the fields on the Lock Comparison Tool.

-

Personas with Access to All Features selected prior this release will not inherit access to this option automatically. It will need to be manually configured.

-

Personas created with Access to All Features selected after this release will have this option selected automatically.

Forms/Tools Tab

The Lock Comparison Tool option on the Forms/Tools tab provides access to the tool and the Compare Lock Fields option on the Pipeline when a rate lock validation status icon is selected.

-

Personas with Access to All Features selected prior this release will not inherit access to this option automatically. It will need to be manually configured.

-

Personas created with Access to All Features selected after this release will have this option selected automatically.

The Validate Pricing child option on the Forms/Tools tab provides access to the Validate Pricing button on the Loan Comparison Tool and the Pipeline when a rate lock validation status icon is selected.

-

The Lock Comparison Tool persona option must be selected before this child option can be selected.

-

Personas with Access to All Features selected prior this release will not inherit access to this option automatically. It will need to be manually configured.

-

Personas created with Access to All Features selected after this release will have this option selected automatically.

SEC-21909, SEC-22311

(Updated on 12/4/2024)

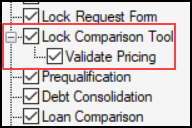

A new Lock Comparison Tool Fields setting has been added under Secondary Setup. This setting enables authorized users to customize the fields displayed on the Lock Comparison Tool.

To Configure the Lock Comparison Tool Fields Setting:

-

On the menu bar, click Encompass and then click Settings.

-

On the left panel, click Secondary Setup and then click Lock Comparison Tool Fields.

-

If the user does not have the right to access this setting, an error message is displayed stating the user does not have access to the setting.

-

The fields displayed on the screen are the default fields that will be displayed in the Lock Comparison Tool.

-

To reorder the fields in the list, click and hold the Move (

) icon next to the

field you want to move and then drag that field to its new

place on the screen.

) icon next to the

field you want to move and then drag that field to its new

place on the screen. -

To delete a field from the list, click the Delete (

)

icon next to the field you want to delete.

)

icon next to the field you want to delete.

-

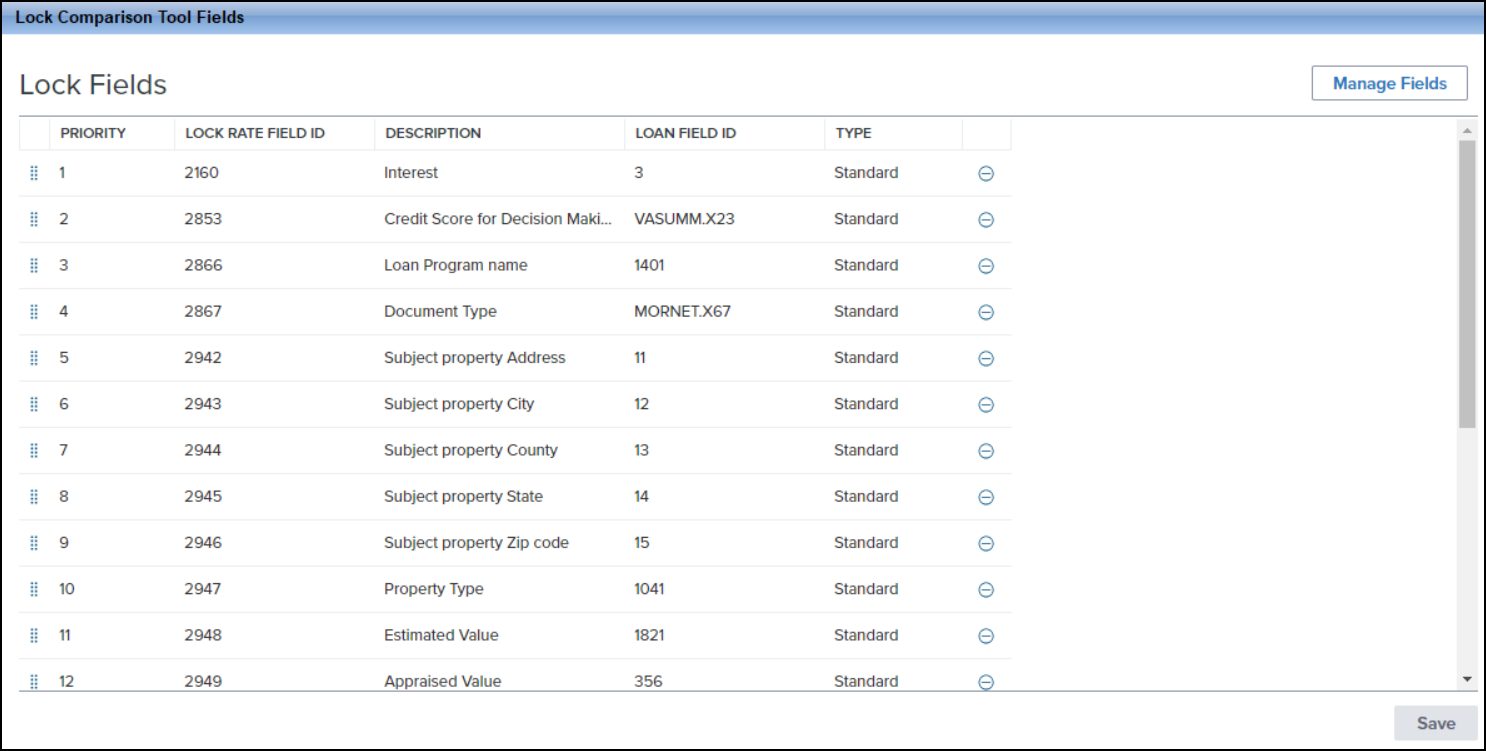

To customize the fields in the tool, click Manage Fields .

-

From the predefined list of fields, select the fields you want to display in the tool and deselect the fields you do not want to display in the tool.

The fields available for selection are either from the Lock Request Form and/or Lock Request Additional Fields. Currently borrower paired fields (e.g., 2950 --> 1811) are not supported.

-

A minimum of 1 field must be selected and the maximum number of fields allowed is 50.

-

Click Apply to save your changes.

-

The number next to “Apply” indicates the number of fields being applied to the tool.

SEC-21981

(Updated on 11/12/2024)

The new Lock Comparison Tool monitors the fields configured in the Lock Comparison Tool Fields setting for loan data changes made after a loan is locked. When data in a loan with an active lock is changed, that loan must be validated again, using the Validate Pricing button on the tool or using the Validate Pricing menu option on the Pipeline.

-

To use the Lock Comparison Tool, you must be assigned a persona with the right to access the tool.

-

To validate pricing, you must be assigned a persona with the right to validate pricing.

-

The Validate Pricing button and menu option will not be displayed under the following circumstances:

-

The loan is not locked

-

The lock has expired

-

No Provider ID is populated in field ID 5029

-

Field ID 4788 is empty

-

Loan is in Correspondent bulk trade

-

No Provider ID is available in the lock snapshot (Validate Pricing button)

To Use the Lock Comparison Tool:

-

On the Pipeline, locate a loan displaying a status in the Rate Lock Validation Status column.

-

If the column is not displayed, right-click any column header and then select Customize Columns. In the Search field, enter “Rate Lock Validation” and then click Find. Select the Rate Lock Validation Status checkbox and then click OK.

-

When adding the Rate Lock Validation Status column (i.e., field 4788) to the Pipeline, be sure that the field is also added to the Encompass Reporting Database. If you do not add it to the Selected Fields section of the database, errors may be triggered when you attempt to add the column to the Pipeline.

-

Click on the status icon and then select Compare Lock Fields.

-

Alternatively, you can open the loan and then click on Lock Comparison Tool in the Tools panel or click on the Lock icon in the loan header and then click on Lock Comparison Tool.

-

The read-only fields at the top of the screen display the number of field changes, the date the loan was locked, and the lock validation status.

-

The Lock Fields dropdown field enables you to either display “All Fields” or “Only Fields with Changes”.

-

The grid provides the field name, the current lock value, and the current loan value.

-

The Current Loan Value column displays any changed field values or the existing lock field value if there are no changes.

-

The increase or decrease of a changed field value is indicated with an upward or downward arrow.

-

If the loan needs validation, the Validate Pricing button is displayed.

-

Click Validate Pricing.

-

Alternatively, you can click on the loan’s status icon on the Pipeline and then select Validate Pricing.

-

You are directed to the pricing provider’s website (indicated in field ID 5029).

-

Any unsaved changes are saved to the loan before the provider’s website is launched.

SEC-22508, SEC-26489

Feature Enhancements in Version 24.3 (Banker Edition)

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release

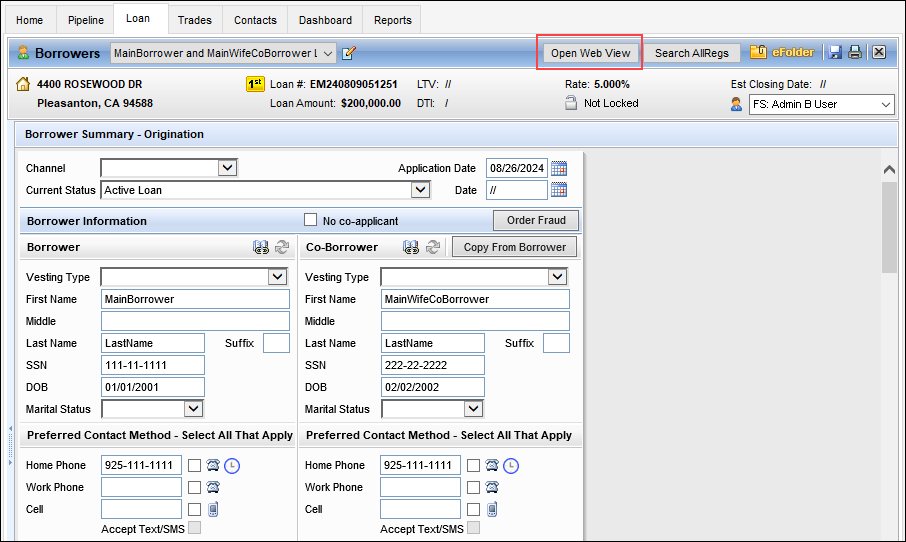

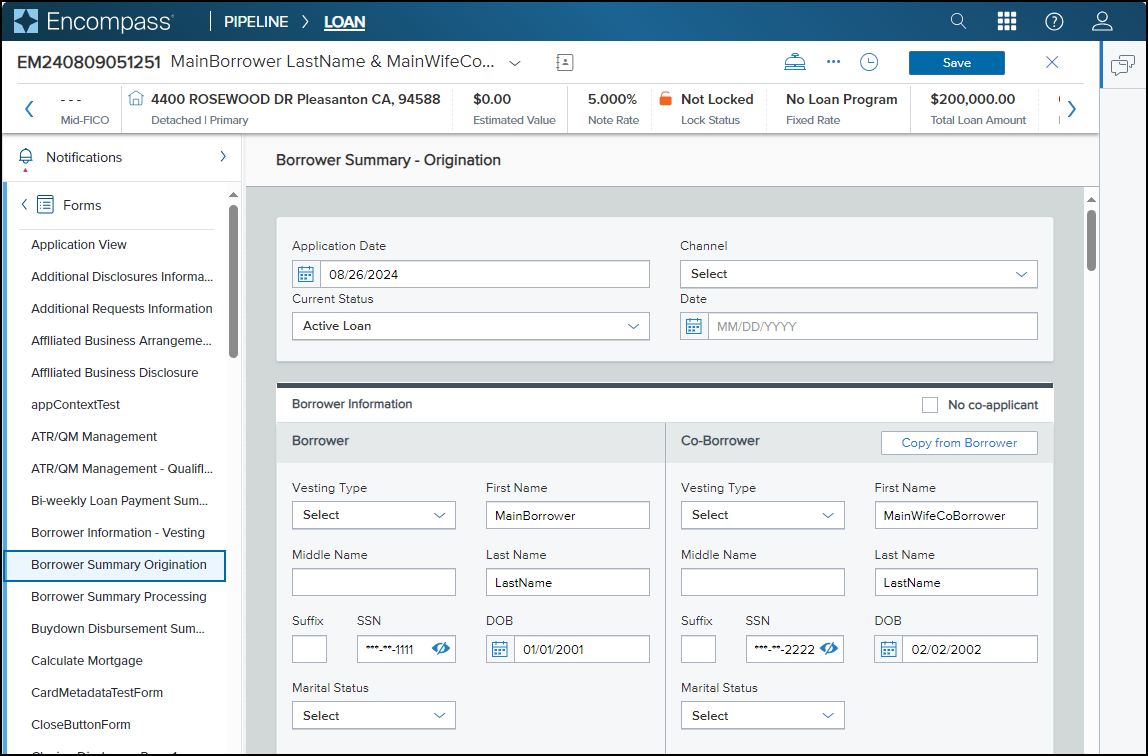

Using the new Open Web View button provided in the loan toolbar, users can now jump to the loan inside the web version of Encompass from the desktop version. This enables users to access the loan in web version of Encompass more efficiently and skip the steps of manually opening a web browser, navigating to the Encompass log in screen, providing log in credentials, and then navigating to the loan in the Pipeline.

After opening a loan file, authorized users can click the Open Web View button.

The web version of Encompass will then be launched in the user’s default web browser, with the loan opened to the user's default landing page. The user is not prompted to log into the web version of Encompass since they were already logged into the desktop version of Encompass.

-

When the user clicks the Open Web View button, the loan screen in desktop version of Encompass is automatically closed and the Pipeline is displayed.

-

Regardless of the screen that is displayed in the loan file when the Open Web View button is clicked, the loan is opened to the user's default landing page in the web version of Encompass.

-

If there are un-saved changes to the loan when the user clicks the Open Web View button, they are prompted to save or cancel these changes. After saving or discarding these changes, the loan will then be opened in the web version of Encompass.

-

When the loan is already open in the web version of Encompass, the user will not be able to make edits to the loan in the desktop version of Encompass. They are permitted to open the loan in read-only mode.

-

Each time the Open Web View button is clicked, a new web version of Encompass session is launched. For example, if a web version of Encompass session is already open in a web browser, and then the user clicks the Open Web View button, a new browser window is launched (and the loan is opened in a new web version of Encompass session).

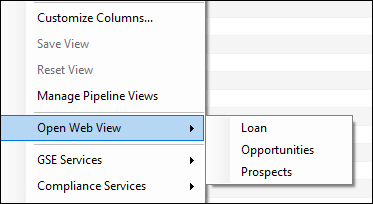

Alternatively, you can also select the loan in the Encompass Pipeline, and then select the Pipeline menu > Open Web View > Loan to open the loan in the web version of Encompass. The system treats the loan the same way it does when using the Open Web View button. The user can select this option from Pipeline whether the loan is open or not in the desktop version of Encompass

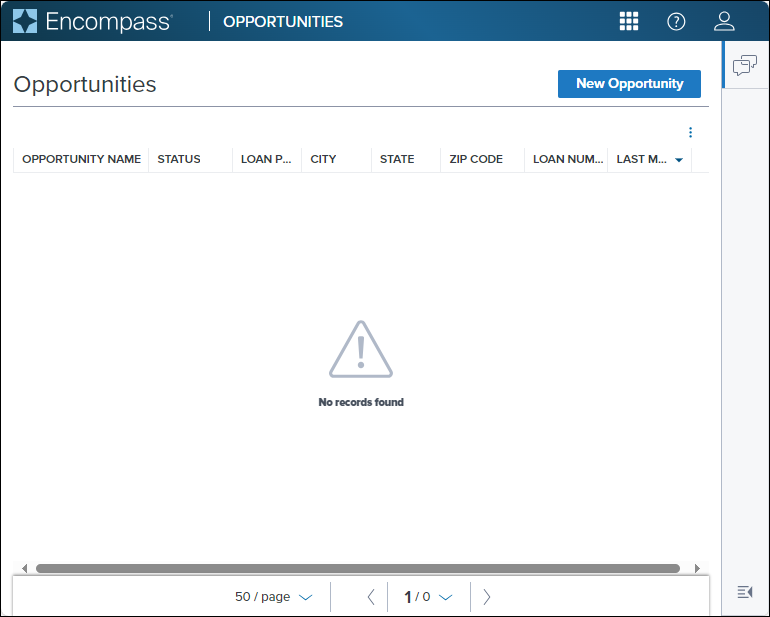

In addition, from the Encompass Pipeline you can launch the Opportunities and Prospects screens in the web version of Encompass. From the Pipeline menu, select Open Web View > and then select the Opportunities or Prospects option.

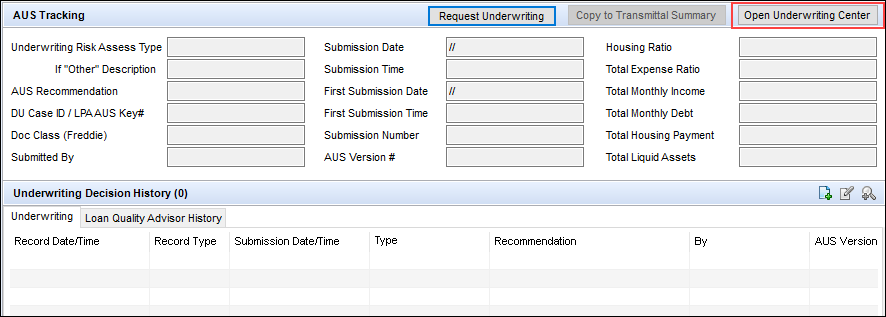

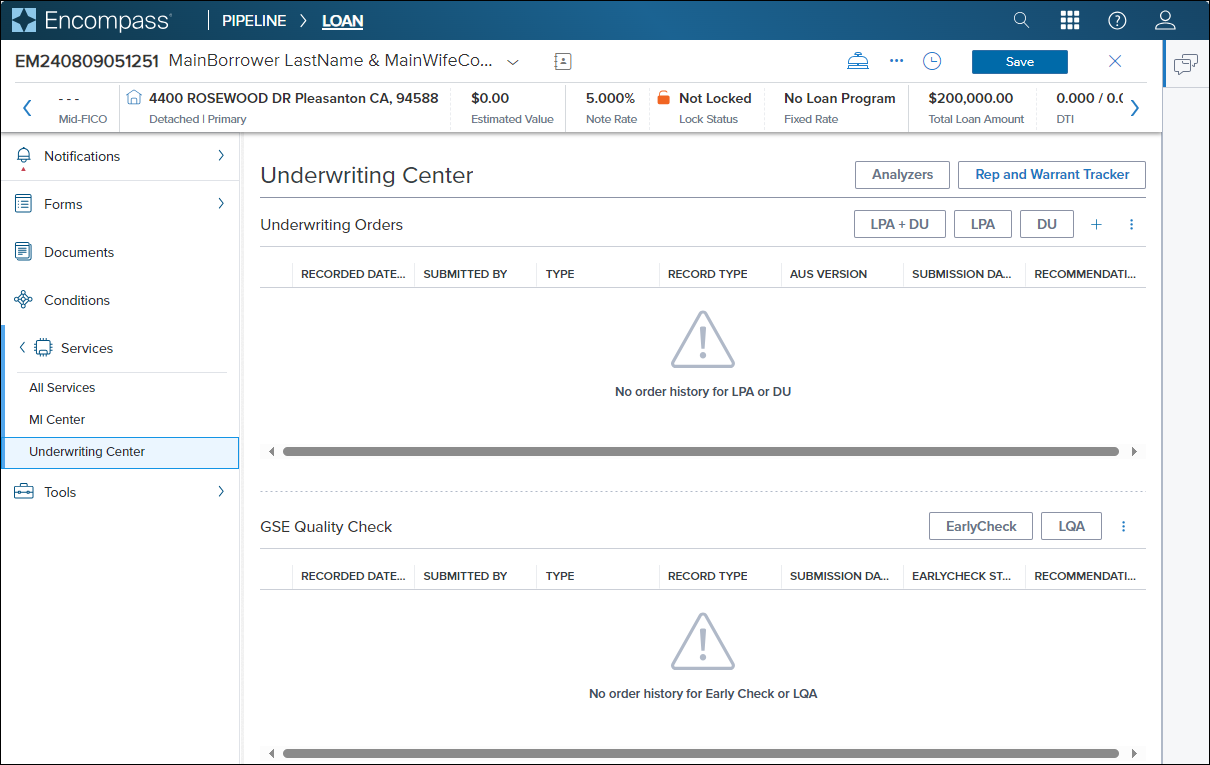

In addition to the Open Web View button provided in the loan toolbar, a similar Open Underwriting Center button is provided within the loan file. On the AUS Tracking and Rep and Warrant Tracker tools in the loan file, authorized users can click the Open Underwriting Center button.

When clicked, the web version of Encompass will then be launched in the user’s default web browser, with the loan file opened to the Underwriting Center. (As described above, the system treats the loan file in the web version of Encompass the same way it does when the Open Web View button is used.)

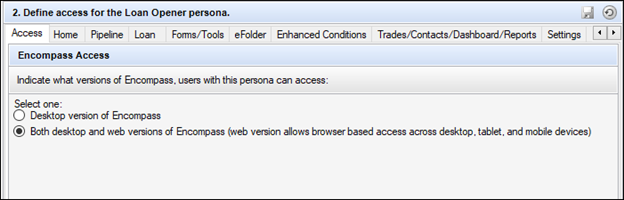

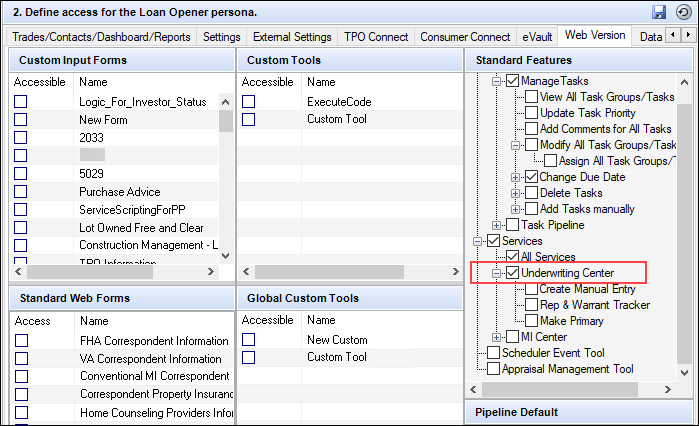

The permission to access these buttons and Pipeline menu options is determined by the Personas settings on the Access and Web Version tabs.

The Open Web View button and the Open Web View > Loan, Opportunities, and Prospects options in the Pipeline menu are only displayed for users with personas that include the Both desktop and web versions of Encompass… permission (as shown below).

The Open Underwriting Center button displays only for users with assigned personas that include this Both desktop and web versions of Encompass… permission and the Underwriting Center permission provided on the Web Version tab in the Personas setting (as shown below).

NICE-47476, PSS-76444, NICE-49483, NICE-49481, NICE-50328, NICE-49439

(Updated on 11/5/2024)

To enable users to view current and accurate loan-level archival status in the Pipeline, Reports, and Dashboards, field 5016 (loan-level archival status) can now be added to these areas in Encompass. Users can then directly determine- without the need to add this or other fields to the Reporting Database- which loans are currently archived and which are not at a glance.

For example, to add a column to a Pipeline view to display the status of field 5016, right-click a column header, and then select To indicate a loan as Archive. The resulting column then indicates Yes for loans that are archived or No for loans that are not archived.

For users who already included the To indicate a loan as Archive column in their Pipeline, Reports, or Dashboard in previous versions of Encompass it is important to note the following:

-

Field 5016 was previously included in the Encompass Reporting Database. However, in Encompass 24.3, field 5016 is not available in the Encompass Reporting Database (unless you had added it to your list of Selected Fields in the database in a previous version of Encompass).

-

If you want to continue to include the To indicate a loan as Archive column in the Pipeline, Reports, or Dashboard after upgrading to Encompass 24.3, you must remove field 5016 from the database (i.e., remove it from the list of Selected Fields in the Reporting Database) after upgrading to Encompass 24.3. Only after removing field 5016 from the database should you then add the new To indicate a loan as Archive column to the Pipeline, Reports, or Dashboard.

-

When you remove field 5016 from the database, the historical loan-level data previously stored in the Audit Trail tool for this field will also be removed. If you do not want to lose this data stored in the Audit Trail tool, then do not remove field 5016 from the database. This ensures your historical data in field 5016 will continue to be retained and audited, but the To indicate a loan as Archive column in the Pipeline may contain inaccurate or stale archive status data.

-

DO NOT remove the previous To indicate a loan as Archive column from the Pipeline, Reports, or Dashboard directly, as this may result in Encompass application errors. Removing field 5016 from the database will automatically remove the previous To indicate a loan as Archive column from the Pipeline, Reports, or Dashboard.

-

DO NOT add the new To indicate a loan as Archive column to the Pipeline, Reports, or Dashboard before removing field 5016 from the database. If you add the column beforehand you will see two To indicate a loan as Archive columns with conflicting data.

Currently the sort option for this column does not sort the data as expected. This functionality will be updated in a future release.

NICE-48923, NICE-50830

New Fields in Encompass

New fields that have been added to the Encompass Reporting Database and/or to various forms and tools are described below.

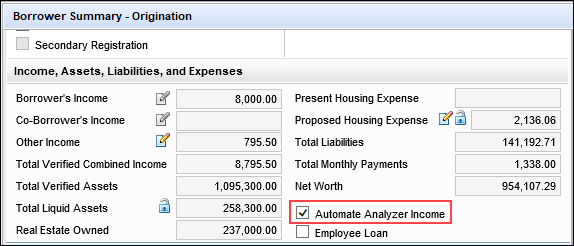

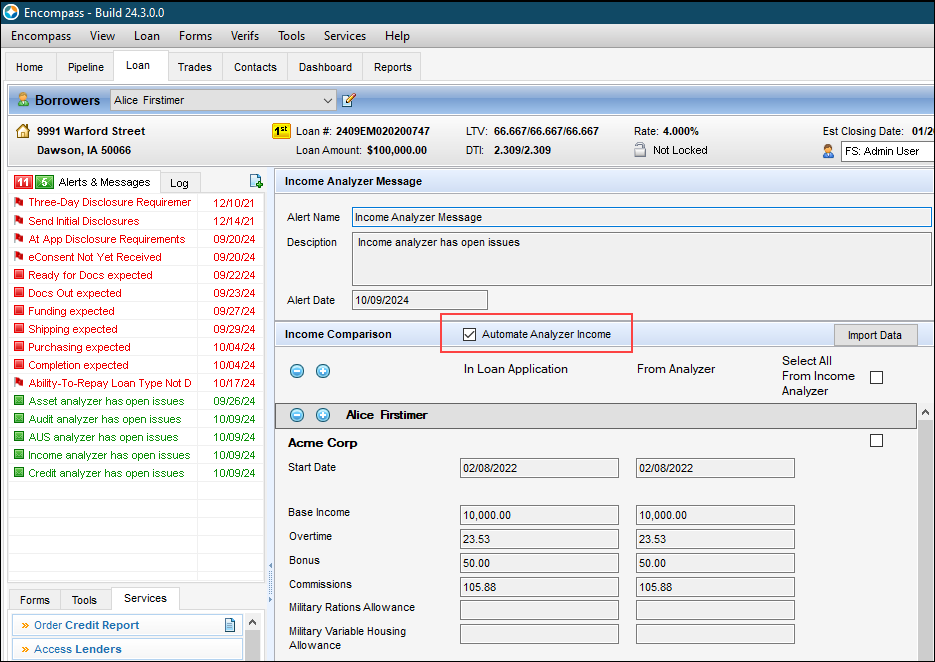

A new Automate Analyzer Income checkbox (ANALYZER.X18) is now provided on the Borrower Summary - Origination input form and the Income Analyzer Message screen to indicate that the income data from the Income Analyzer is automatically imported into the Verification of Employment input form in the loan file.

In addition, a new Status of Document Validation for all Analyzers field (ANALYZER.X17) to capture the status of the data analysis is now provided. This field is needed for the system to determine when the Income Analyzer has completed analyzing the document and can then import the data into the loan if the Automate Analyzer Income option is selected. Users can utilize this new field to understand when the next income automation import has occurred. This status field is not visible on any forms or tools in Encompass. It is in the Encompass Reporting Database and may be added to custom input forms.

CBIZ-60951

In preparation for the integration of Audit Analyzers in Encompass (currently targeted to be available in Encompass in 2025), the following new fields have been added to store data for the analyzer that can then be added to the loan when the user is ready:

-

Correspondent Loan Purpose Type (CORRESPONDENT.X560) - Data for field 19.

-

Correspondent Loan Amortization Term Months (CORRESPONDENT.X561) - Data for field 4.

-

Correspondent Loan Amortization Type (CORRESPONDENT.X562) - Data for field 608.

-

Correspondent Loan Maturity Date (CORRESPONDENT.X563) - Data for field 78.

-

Correspondent GSE Refinance Purpose Type (CORRESPONDENT.X564) - Data for field 299.

These fields are not currently visible on any forms or tools in Encompass. They are in the Encompass Reporting Database and may be added to custom input forms.

In addition, the following new editable loan-level fields have been added to enable users to track Mortgage Analyzer data for Asset, Audit, AUS, Credit, Document Validation, and Income analyzers:

-

Income Analyzer Eligible (ANALYZER.X1)

-

Income Analyzer Exceptions (ANALYZER.X2)

-

Income Analyzer Status (ANALYZER.X3)

-

Credit Analyzer Eligible (ANALYZER.X4)

-

Credit Analyzer Exceptions (ANALYZER.X5)

-

Credit Analyzer Status (ANALYZER.X6)

-

Asset Analyzer Eligible (ANALYZER.X7)

-

Asset Analyzer Exceptions (ANALYZER.X8)

-

Asset Analyzer Status (ANALYZER.X9)

-

AUS Analyzer Eligible (ANALYZER.X10)

-

AUS Analyzer Exceptions (ANALYZER.X11)

-

AUS Analyzer Status (ANALYZER.X12)

-

Audit Analyzer Eligible (ANALYZER.X13)

-

Audit Analyzer Exceptions (ANALYZER.X14)

-

Audit Analyzer Status (ANALYZER.X15)

-

Doc Validation Analyzer Exceptions (ANALYZER.X16)

These fields are not currently visible on any forms or tools in Encompass. They are in the Encompass Reporting Database and may be added to custom input forms.

CBIZ-59513, CBIZ-60673

Two new virtual fields are now available to facilitate passing the Last Completed Milestone name from Encompass to Mortgage Analyzers:

-

Log.MS.LastCompletedName

-

Log.MS.StageName

With the addition of these fields, the Last Completed Milestone value for loans is reflected in the loan data when using the Mortgage Analyzers integrated with Encompass to analyze the loan data. These fields are not visible on Encompass input forms, but they are available in the Encompass Reporting Database.

CBIZ-62600

In preparation for enhanced functionality in Mortgage Analyzers in Encompass (targeted for 2025), the following new expiration date fields have been added to the Encompass Reporting Database. These fields will provide users with document expiration dates for loans based off the information provided to the Mortgage Analyzers. The analyzer will use extracted dates, compile those dates, and then send back the oldest document expiration date to set the document expiration date for a file.

Documents reviewed will include paystubs, bank statements, credit reports, and other documents used for the loan decision making process.

These date fields will be compiled by the Mortgage Analyzers and sent back to the Encompass database.

-

Credit Expiration Date (ANALYZER.X19)

-

Income Expiration Date (ANALYZER.X20)

-

Asset Expiration Date (ANALYZER.X21)

-

Collateral Expiration Date (ANALYZER.X22)

-

Overall Expiration Date (ANALYZER.X23)

-

Income Analyzer Document Processing Status (ANALYZER.X24)

-

Credit Analyzer Document Processing Status (ANALYZER.X25)

-

Asset Analyzer Document Processing Status (ANALYZER.X26)

-

Business Association Exception Count (ANALYZER.X27)

These fields are not currently visible on input forms, but they are in the Encompass Reporting Database and may be added to custom input forms.

CBIZ-59937, CBIZ-61015

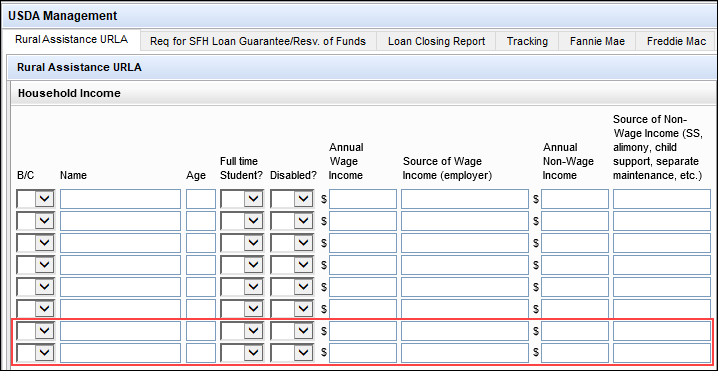

Two additional rows of loan-level, editable fields have been added to the Household Income table on the USDA Management input form’s Rural Assistance URLA > Page 6. The additional rows were added to allow for more household members’ income data to be provided.

The field IDs for these new fields (from left to right) are:

Row 7: USDA.X240, USDA.X224, USDA.X225, USDA.X226, USDA.X227, USDA.X228, USDA.X229, USDA.X230, USDA.X231

Row 8: USDA.X241, USDA.X232, USDA.X233, USDA.X234, USDA.X235, USDA.X236, USDA.X237, USDA.X238, USDA.X239

CBIZ-4356

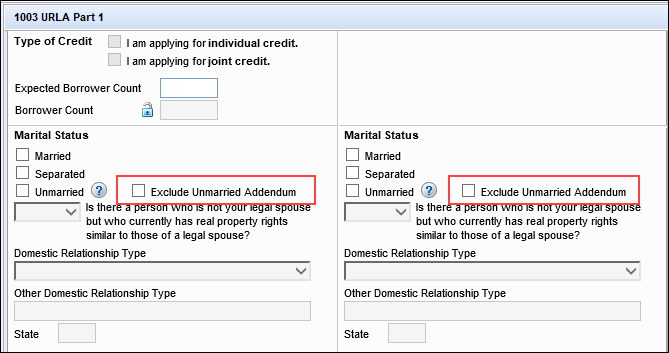

Two new Exclude Unmarried Addendum checkboxes have been added to the 1003 URLA Part 1 input form to give users an option to suppress the URLA-Unmarried Addendum form from disclosure packages.

-

Exclude Unmarried Addendum [Borrower] (5036)

-

Exclude Unmarried Addendum [Co-Borrower] (5037)

CBIZ-40447

The calculation logic for the RegZ Total Loan Amount (QM.X120) has been updated for HELOC loans. For HELOC loans (1172), the RegZ Total Loan Amount field is now populated with the Total Loan Amount field value (2) used on the Loan Estimate, Closing Disclosure, and more. In previous versions of Encompass, the RegZ Total Loan Amount was the loan amount (2) minus the pre-paid finance amount (949) for HELOCs.

CBIZ-61955

The calculation logic for the HMDA Prepayment Penalty Period (HMDA.X82) field has been updated. When the Business or Commercial Purpose field (HMDA.X58) is set to 1. Primarily for a business or commercial purpose, then NA [not applicable] is automatically populated to the HMDA Prepayment Penalty field. This update has been made based on HMDA prepayment penalty term requirements (Section 1003.4(a)(22).)

CBIZ-61585

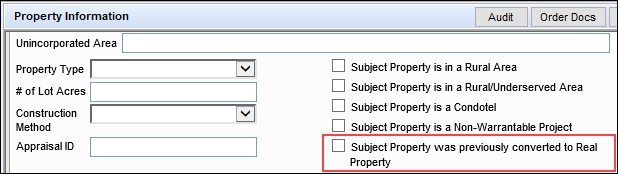

To accommodate Fannie Mae's recent change in policy for the Affidavit of Affixture (GMANARDU/GMANARLU), a new checkbox field has been added to the Property Information screen: Subject Property was previously converted to Real Property (5039).

Select this checkbox to confirm if the subject property was previously converted to real property when the subject property is a manufactured home. Fannie Mae will no longer require the Affidavit of Affixture form if the manufactured home was previously converted to real property.

If this checkbox is not selected, the Affidavit of Affixture will be included in the package when the subject property is a manufactured home. If the checkbox is selected, the Affidavit of Affixture will not be included in the package when the subject property is a manufactured home.

CBIZ-60766

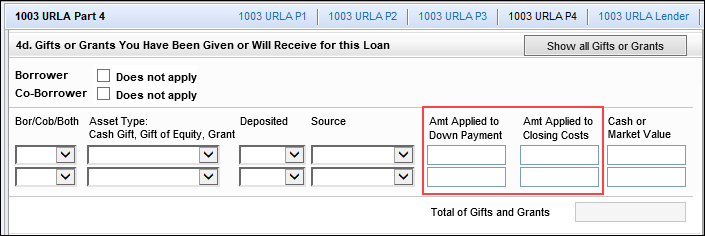

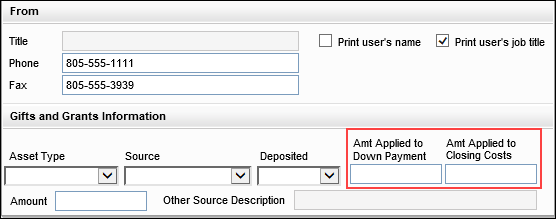

(Updated on 12/4/2024)

Two new collection fields have been added to Encompass to collect the amount of gifts and grants that are applied to the down payment and to closing costs.

The fields are provided on the 1003 URLA Part 4:

-

Amount Applied to Down Payment (URLARGG0023)

-

Amount Applied to Closing Costs (URLARGG0024)

The amounts applied to the down payment and closing costs entered on the 1003 URLA Part 4 are populated to the corresponding fields that have been added to the Verification of Gifts and Grants input form.

These new down payment and closing costs fields are for manual entry and there is no calculation logic applied to these fields. These fields were added to support the new Freddie Mac ULAD 5.4.00 requirements and enable the data points for the down payment and closing costs amounts to be sent accurately to LPA. Refer to the Support for New Attributes entry in the GSE Integrations and Services 24.3 release notes for more information.

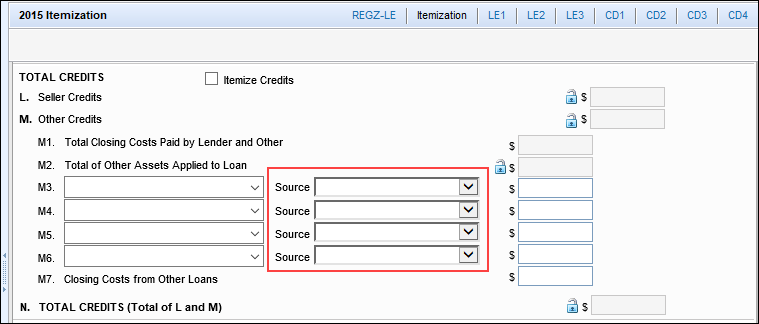

In addition, the Source field (URLARGG0119) on the Verification of Gifts and Grants and 1003 Part 4 input forms and the Source fields (4667, 4668, 4669, 4670) on the 1003 URLA Lender and 2015 Itemization input forms have been updated with additional enumerations that can be selected from the dropdown list:

-

In the Source field (URLARGG0119) on the Verification of Gifts and Grants and 1003 Part 4 input forms, the new enumeration added is Non-Originating Lender (FRE).

-

In the Source fields (4667, 4668, 4669, 4670) on the 1003 URLA Lender and 2015 Itemization input forms, the new enumeration added is Closing Agent (FRE).

CBIZ-59928

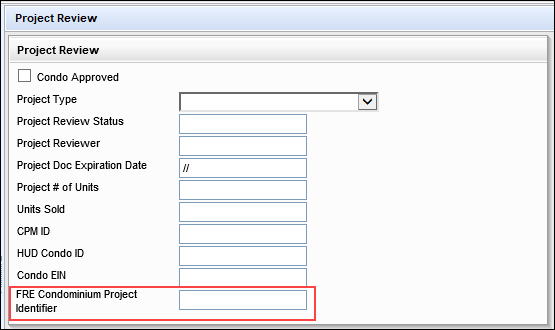

A new FRE Condominium Project Identifier field (CASASRN.X221) is now provided on the Project Review tool to enable users to enter the CPI (Condominium Project Identifier) number that can be submitted to Freddie Mac’s Loan Product Advisor (LPA) to assess the condominium’s liability.

CBIZ-60424

The following new fields have been added to the Freddie Mac Additional Data input form to support the new Loan Program Identifiers (LPI) published by Freddie Mac in July 2024:

-

Assumption FRE Owned Loan (CASASRN.X222) - New option to select the new LPI enumeration to be used by loan servicers to assess creditworthiness for mortgage assumptions.

-

CHOICERenoEXpressInProgress (CASASRN.X223) - New option to select this new CHOICE LPI while also being able to select additional CHOICE products (CASASRN.X212).

-

CHOICERenovationInProgress (CASASRN.X224) - New option to select this new CHOICE LPI while also being able to select additional CHOICE products (CASASRN.X212).

In addition, the following field labels have been updated to more closely align the field label with the expected property ID users should enter in this field and include in the loan data submitted to Freddie Mac’s Loan Product Advisor (LPA):

-

The Loan Prospector ID field (CASASRN.X200) is now labeled Loan Product Advisor ID.

-

The Inspection ID field (CASASRN.X220) is now labeled Property Data Identifier.

-

The Building Status field (601) is now labeled Construction Status.

-

The Offering Identifier field (CASASRN.X209) is now labeled Program Identifier.

-

The Correspondent Assignment Name field (CASASRN.X35) is now labeled Loan Assignment Name.

-

The Correspondent Assignment ID (CASASRN.X203) is now labeled Loan Assignment ID.

Finally, the following verbiage previously displayed at the top of the input form has been removed:

To avoid resubmission charges enter your LP Key Number and Loan Prospector ID that are found on your Feedback Certificate that was received after your initial file submission to LP.

CBIZ-61485, CBIZ-60246

New fields have been added to the ULDD/PDD input form for Phase 5 updates:

Fannie Mae tab:

-

CPM Certification Identifier (ULDD.FNM.X1)

-

CPM Phase Identifier (ULDD.FNM.X2)

-

MERS Registration Status Type (ULDD.X215)

-

MI Premium Plan Type (ULDD.X216)

-

MI Interest Rate Adjustment Percent (ULDD.X217)

-

Deeds Restriction Term Months Count (ULDD.FNM.X3)

-

Lender Target Funding Date (ULDD.FNM.X4)

-

Wire Instruction Reference Identifier (ULDD.FNM.X5)

-

Government Bond Finance Indicator (ULDD.FNM.X6)

Freddie Mac tab:

-

MERS Registration Status Type (ULDD.X215)

-

CPA Project Assessment Request Identifier (ULDD.FRE.X1)

-

CPA Project Waiver Request Identifier (ULDD.FRE.X2)

-

MI Premium Plan Type (ULDD.X216)

-

MI Interest Rate Adjustment Percent (ULDD.X217)

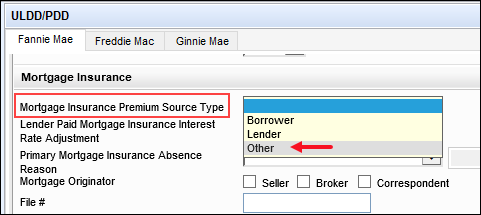

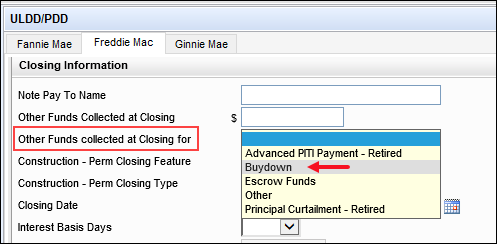

In addition, new enumerations that can be selected from the following dropdown fields have been added to the following fields. (These are not new fields.):

On the Fannie Mae tab, a new Other enumeration was added to the Mortgage Insurance Premium Source Type field (ULDD.X49).

On the Freddie Mac tab, a new Buydown enumeration was added to the Other Funds collected at Closing for field (ULDD.X111).

CBIZ-60715

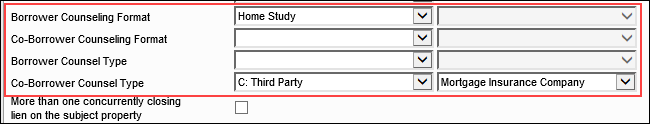

New borrower-level fields for Counseling Format and Counsel Type have been added to the Fannie Mae and Freddie Mac tabs of the ULDD/PDD input form.

-

Borrower Counseling Format (ULDD.X207)

-

Borrower Counseling Format Other Description (ULDD.X209)

-

Co-Borrower Counseling Format (ULDD.X208)

-

Co-Borrower Counseling Format Other Description (ULDD.X210)

-

Borrower Counsel Type (ULDD.X211)

-

Borrower Counsel Type Other Description (ULDD.X213)

-

Co-Borrower Counsel Type (ULDD.X212)

-

Co-Borrower Counsel Type Other Description (ULDD.X214)

As part of this update, the loan-level Counseling Format fields (ULDD.X24, ULDD.X25) and Counsel Type fields (2847, ULDD.X152) previously provided on this form were removed.

CBIZ-59544, CBIZ-60011

Fields have been added to capture valuation data used by correspondent lenders to provide support for multiple appraisals, ordering, and data persistence at an order level and workflow support at an order level. The following new fields are now part of the existing Correspondent Appraisal Valuation collection that enables Encompass Partner Connect to support this workflow. These fields are not visible on existing Encompass forms but can be added to custom input forms and are available in the Encompass Reporting Database.

-

Number of Stories in Building (VAL00A033)

-

Special Assessments (VAL00A034)

-

Appraisal Review Status (VAL00A035)

-

Digital Appraisal Viewed (VAL00A036)

-

Digital Appraisal ID (VAL00A037)

CBIZ-60764, CBIZ-61817

For users working with correspondent loans, a new field is now available in Encompass where correspondent lenders can indicate that the property is a PUD (Planned Unit Development). This field (CORRESPONDENT.X565) is not provided on any standard Encompass input forms, but it is in the Encompass Reporting Database and the field can be added to a custom input form. Users can compare this field to the PUD (Planned Unit Development) checkbox (URLA.X207) provided in the loan and determine if they want to select the correspondent PUD field or leave it clear (via a business rule, for example).

CBIZ-62758

Additional Rep and Warrant Tracker fields have been added to the tool in Encompass to support additional rep and warrants and income/employment verifications.

-

FNMA DO Recommendation (TQL.X281)

-

FNMA Mission Score (TQL.X283)

-

FNMA Mission Score Comments (TQL.X284)

-

FNMA Child Support Borrower (MORNET.X163)

-

FNMA Child Support Borrower Comments (MORNET.X164)

-

FNMA Child Support Coborrower (MORNET.X165)

-

FNMA Child Support Coborrower Comments (MORNET.X166)

-

FNMA Alimony Borrower (MORNET.X167)

-

FNMA Alimony Borrower Comments (MORNET.X168)

-

FNMA Alimony Coborrower (MORNET.X169)

-

FNMA Alimony Coborrower Comments (MORNET.X170)

-

FRE LPA Risk Class Comments (TQL.X282)

-

FRE Mission Index Loan Level (TQL.X285)

-

FRE Mission Index Comments (TQL.X286)

In addition, these rep and warrant fields were also added to the Encompass Reporting Database, but they are not provided in the Rep and Warrant tool. These fields may be added to custom forms.

-

FNMA Income Rep and Warrant Loan Level (MORNET.X161)

-

FNMA Income Rep and Warrant Comments (MORNET.X162)

CBIZ-61035

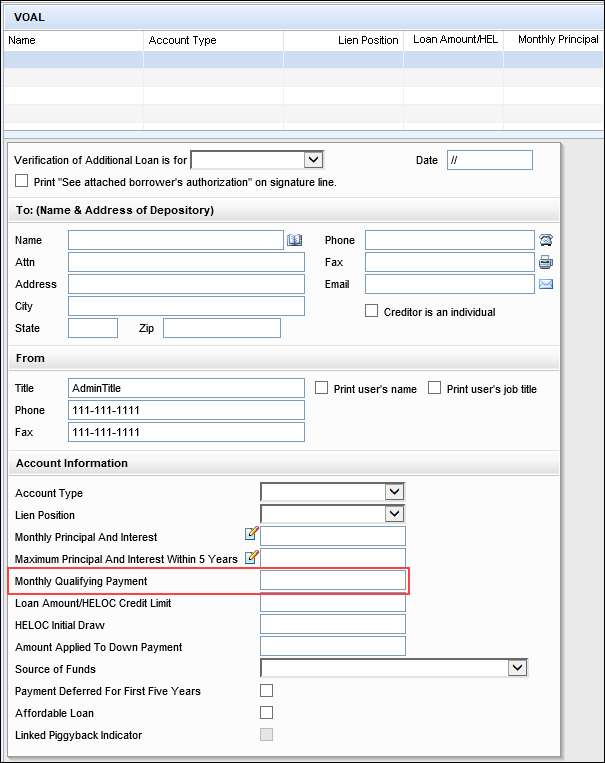

When managing a first mortgage with a new HELOC loan on a property that is financed by another lender (not a piggyback or linked loan), the maximum qualifying monthly payment for DTI is now populated to the proposed estimated monthly mortgage payments in addition to the first mortgage (229) and the proposed monthly second mortgage payment (1725).

A new Monthly Qualifying Payment (URLARAL0034) field has been added to the VOAL (Verification of Additional Loans) input form to capture the qualifying payment to be used for qualifying purposes for the DTI (debt-to-income ratio).

-

For a HELOC linked loan, this field is deactivated (grayed-out). The payment amount from the HELOC Qualifying Payment field (5025) in the linked loan is automatically populated here.

-

For a linked loan that is not a HELOC loan, or any loan financed by another lender, this field is activated by default and users can add the qualifying payment manually.

-

The calculation logic for the first mortgage P&I (1724), second mortgage P&I (1725), negative cash flow (462), positive cash flow (1169), net monthly rental income (URLA.X81), and the borrower’s gross income from rental properties (106) have been updated to use the new Monthly Qualifying Payment (URLARAL0034) if it has a value greater than 0 for VOALs. If the value is blank or 0, Monthly Principal and Interest (URLARAL0118) is used for VOALs.

-

An additional new field has been added to facilitate the HELOC Qualifying Payment (5025) value populating to the web version of Encompass: LinkedHelocQualifyingPaymentAmount (LINK_5025). This field is not provided on any input forms or tools in the desktop version of Encompass but is available in the Encompass Reporting Database.

CBIZ-38484, CBIZ-47615

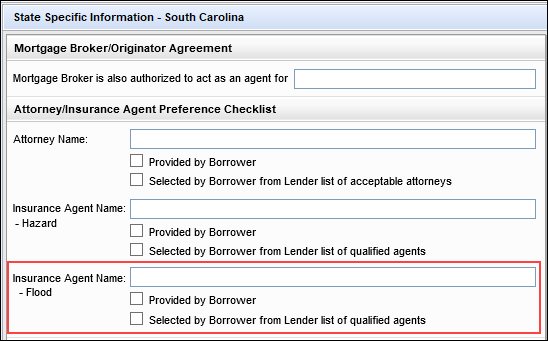

New fields are now provided on the South Carolina State Specific Information input form where the name of the Flood Insurance agent can be added, along with checkboxes to indicate if the agent was an existing agent provided by the borrower or if the agent was selected by the borrower from a list of agents. These fields are being added to enable lenders to add a flood insurance agent as an additional agent to the form so that the Attorney/Insurance Preference Form is compliant with Attorney-Insurance Preference Requirement SC SECTION 37-10-102(a).

-

Insurance Agent Name - Flood (DISCLOSURE.X1219)

-

Provided by Borrower/Selected by Borrower from Lender list of qualified agents (DISCLOSURE.X1220)

CBIZ-40922

A new Assessed Value field (5041) has been added to the Encompass Reporting Database. This loan-level field is intended to capture the correct government fees for specific states in loans. Since it is in the database, you can also include this field when setting up ICE Fee Services and automated workflows in the web version of Encompass.

This field is not visible on existing Encompass forms but can be added to custom input forms. This field will be added to applicable State Specific Information input forms in a future Encompass release.

CBIZ-61930

A new standard borrower-pair level field, Credit Report First Issued Date (5040), has been added to the Encompass Reporting Database. The purpose of this field is to capture the credit report first issued date. Administrators can then write a business rule for this field that triggers when the report is expiring. Users can then re-order the credit report if necessary.

This field is not provided on any Encompass input forms or tools but it can be added to custom input forms. However, the credit report first issued date will not be populated to this field at this time.

CBIZ-61692

A new Pricing Provider field (5029) is now provided to capture and validate the pricing provider used for the loan when product and pricing is ordered. This field has been added to the Encompass Reporting Database.

This field is not visible on any Encompass input forms or tools.

CBIZ-59792

(Updated on 12/4/2024)

A new (read only) Float Updated on field (5035) has been added to the Lock Request Form input tool to provide users with a way to view the float date and determine if a float rate lock has been requested.

-

This field will be updated by your selected product and pricing provider but is not required.

-

This field will not be cleared after the lock request is submitted or confirmed.

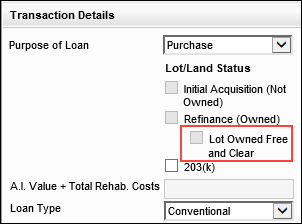

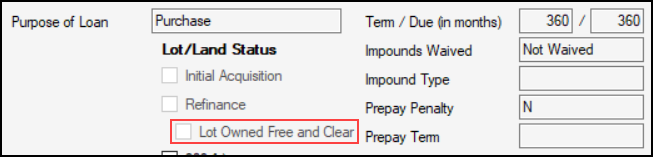

In addition, a new Lot Owned Free and Clear checkbox (5038) has been added to the Lock Request Form. By default, this field is deactivated (grayed-out). It is activated when the Refinance (Owned) checkbox (4255) on the Lock Request Form is selected.

Note that when the Lot Owned Free and Clear checkbox (5015) on the 1003 URLA Part 4 input form is selected, the new Lot Owned Free and Clear checkbox is automatically selected too.

CBIZ-61250, CBIZ-61361, SEC-28060

The Lot Owned Free and Clear checkbox has been added to the loan snapshot (field ID 5015) and lock request snapshot (field ID 5038). By default, the checkbox is deactivated.

-

When field ID 5015 is updated, field ID 5038 is updated. However, if field ID 5038 is updated, field ID 5015 is not updated.

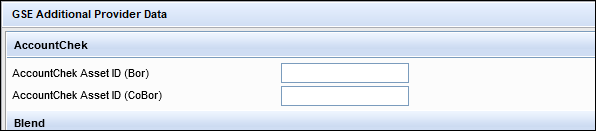

The following updates have been made to the GSE Additional Provider Data input form:

A new AccountChek section has been added to the top of the form. Two existing fields, AccountChek Asset ID (Borrower) (FANNIESERVICE.X3) and AccountChek Asset ID (Co-Borrower) (FANNIESERVICE.X4) from this form have been moved to this section.

The following fields have been removed from the form:

-

Early Warning Services (EWS) Report Id (Bor) (FANNIESERVICE.X5)

-

Early Warning Services (EWS) Report Id (CoBor) (FANNIESERVICE.X6)

-

Universal Credit 4506T (Bor) (GSEVENDOR.X12)

-

Universal Credit 4506T (CoBor) (GSEVENDOR.X13)

-

BankVOD (Bor,CoBor) (GSEVENDOR.X25)

-

BankVOD IRS (Bor,CoBor) (GSEVENDOR.X35)

-

ComplianceEase IRS Tax Transcript (Bor,CoBor) (GSEVENDOR.X33)

-

Corvious (Bor,CoBor) (GSEVENDOR.X14)

-

FirstAmerican (Bor,CoBor) (GSEVENDOR.X16)

-

Inco-Check (Bor,CoBor) (GSEVENDOR.X17)

-

QuestSoft (Bor,CoBor) (GSEVENDOR.X36)

-

Quovo (Bor,CoBor) (GSEVENDOR.X27)

-

Roostify (Bor,CoBor) (GSEVENDOR.X28)

-

Taxdoor 4506T Service (Chronos) (Bor,CoBor) (GSEVENDOR.X32)

-

Yodlee (Bor,CoBor) (GSEVENDOR.X24)

-

AccountChek Asset ID (Bor) (CASASRN.X31)

-

AccountCheck Asset ID (CoBor) (CASASRN.X32)

Note that these fields were removed from the input form but they are still available in the Encompass Reporting Database and may be added to custom input forms.

The Avantus (4506T, VOE/VOI) field (GSEVENDOR.X10) was renamed to Avantus (4506T).

CBIZ-60427

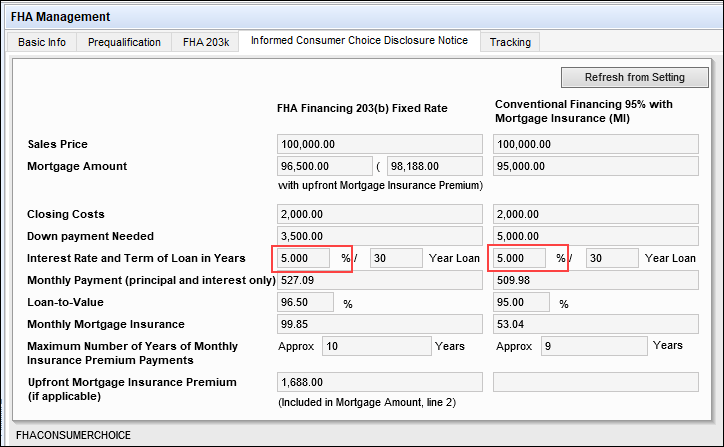

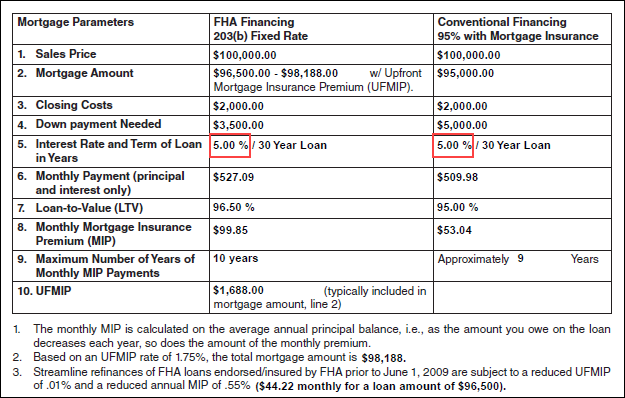

On the FHA Management > Informed Consumer Choice Disclosure Notice tab, the Interest Rate % fields (FICC.X6, FICC.X17) on the Interest Rate and Term of Loan in Years line have been updated to allow for up to three decimals. (Previously these fields allowed two decimals.) This update enables Encompass users to disclose the interest rate more accurately.

Please note the following:

-

These fields have also been updated to allow up to three decimals in the Encompass Settings > Loan Setup > FHA Informed Consumer Choice Disclosure where administrators can enter default data that is populated to the FHA Management > Informed Consumer Choice Disclosure Notice tab in the loan.

-

When a user opens an existing loan in Encompass 24.3, the value in these fields will display three decimals. For example, if the value was 5.00 in Encompass 24.2, the value will be 5.000 in Encompass 24.3.

-

When the values in FICC.X6 or FICC.X17 have a final digit that is zero (0), the value will print with two decimals on the printed Model Notice Informed Consumer Choice Disclosure Notice output form. Otherwise, the value will print with three decimals. For example, 5.000 prints as 5.00 on the form, 3.500 prints as 3.50 on the form, 3.625 prints 3.625 on the form.

CBIZ-59020

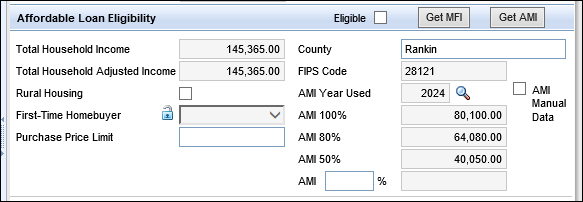

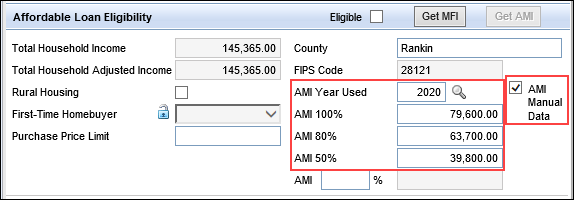

A new AMI Manual Data checkbox (5027) is now provided in the Affordable Loan Eligibility section of the Borrower Summary - Origination input form that can be used to manually enter the year and values to use for the Area Median Income (AMI) limits in the AMI % fields on the form. This option is provided to give users a way to use the AMI dataset year that is compliant with the GSE investor’s AMI dataset when that year’s data is not accessible from the loan file or from the Affordable Lending tables in Encompass Settings.

Encompass provides the current year’s dataset in the Encompass Settings > Tables and Fees > Affordable Lending > AMI Limits setting. Users can click the Get AMI button to populate the AMI Year Used and AMI 100%, 80%, and 50% fields with this data. They also have the option to click the Lookup icon (magnifying glass) to select a different year to use for the AMI limits, and the selected year’s limits are auto-populated to these fields. (Encompass stores the last three years’ AMI data. In Encompass 24.3, users can select from years 2022, 2023, and 2024.) In addition, administrators can enable the Automated Data Completion settings in Encompass Admin Tools to automatically populate these fields with the current year’s AMI limits without clicking the Get AMI button. These fields are set to read-only when they are populated.

To manually change the AMI year to use, select the AMI Manual Data checkbox. This activates the read-only fields and deactivates the automated completion calculations, the Get AMI button, and the Lookup icon. Users can then manually enter the year to use for AMI limits in the AMI Year Used field and then manually enter the AMI 100%, AMI 80%, and AMI 50% limits based on the AMI data provided by Fannie Mae and Freddie Mac.

CBIZ-60414

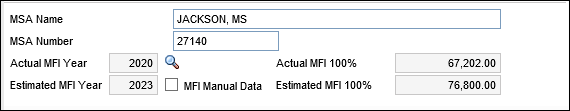

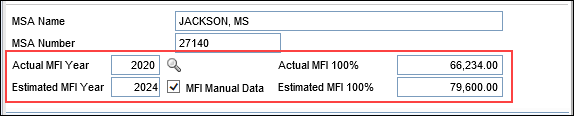

A new MFI Manual Data checkbox (5028) is now provided in the Affordable Loan Eligibility section of the Borrower Summary - Origination input form that can be used to manually enter the year and values to use for the Median Family Income (MFI) limits in the Actual and Estimated MFI % fields on the form. This option is provided to give users a way to use the MFI dataset year that is compliant with the GSE investor’s MFI dataset when that year’s data is not accessible from the loan file or from the Affordable Lending tables in Encompass Settings.

Encompass provides the most current dataset in the Encompass Settings > Tables and Fees > Affordable Lending > MFI Limits setting. Users can click the Get MFI button to populate the Actual MFI Year, Estimated MFI Year, and the Actual and Estimated MFI 100% fields with this data. They also have the option to click the Lookup icon (magnifying glass) to select a different year to use for the MFI limits, and the selected year’s limits are auto-populated to these fields. (Encompass stores the last three years’ AMI data. In Encompass 24.3, users can select from years 2021, 2022, and 2023.) In addition, administrators can enable the Automated Data Completion settings in Encompass Admin Tools to automatically populate these fields with the current MFI limits without clicking the Get MFI button. These fields are set to read-only when they are populated.

To manually change the MFI Estimated Year to use, select the MFI Manual Data checkbox. This activates the read-only fields and deactivates the automated completion calculations, the Get MFI button, and the Lookup icon. Users can then manually enter the year to use for MFI limits in the Estimated MFI Year field, and then manually enter the Actual MFI Year, Actual MFI 100%, and Estimated MFI 100% limits based on the MFI data provided by the FFIEC (Federal Financial Institutions Examination Council).

CBIZ-61103

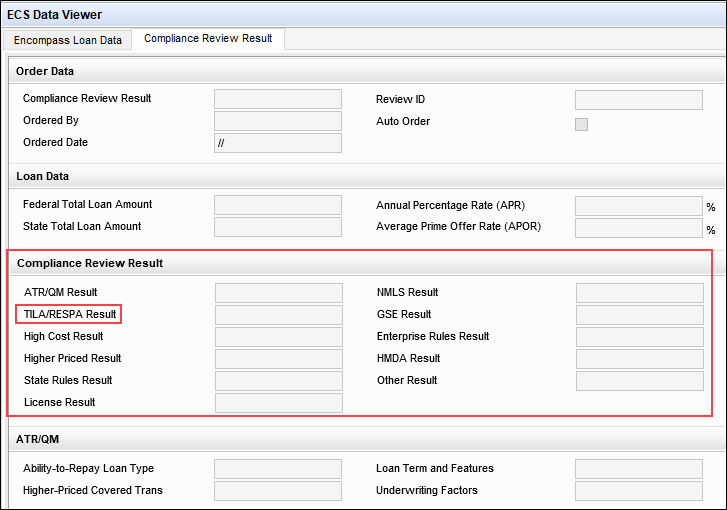

The following updates have been made to the Compliance Review Result tab in the ECS Data Viewer.

-

The TILA ROR Result field (COMPLIANCEREVIEW.X13) and the OFAC Result field (COMPLIANCEREVIEW.X10) have been removed from the Compliance Review Result section. (These values are no longer supported by the Encompass Compliance Service (ECS)).

-

The TILA Tolerance Result field (COMPLIANCEREVIEW.X14) has been renamed TILA/RESPA Result to better match the corresponding labels used in the ECS compliance report.

CBIZ-60801

(Updated on 12/4/2024)

If ICE PPE is used to price a loan, ICE PPE will save its Provider ID to the loan in field ID 5029. That ID will be saved to the lock snapshot when the loan is locked and confirmed from Encompass. The saved Provider ID in the lock snapshot will be used for the following actions:

-

Submit the lock request

-

Perform a lock update

-

Get Buy Side Pricing

-

Perform a lock extension

-

Currently in Encompass, when a lock extension is requested, the pricing provider configured in the Product and Pricing setting is used for the extension. From this release forward, field ID 5029 in the lock snapshot will be checked for the pricing provider and if ICE PPE is the provider, the ICE PPE portal will be launched.

-

The loan will be saved before the ICE PPE portal is launched.

ICE PPE will be displayed in the list of providers when Get Buy Side Pricing or Get Sell Side Pricing is performed from the Secondary Lock Tool.

Starting in Encompass 24.3, the file size of attachments and documents in the eFolder is no longer displayed. The Size column has been removed from:

-

File Manager - Unassigned section

-

File Manager - Documents section

-

Document Details window - Files section

This update was made to remove irrelevant information and refine the general look of the eFolder screens and user experience.

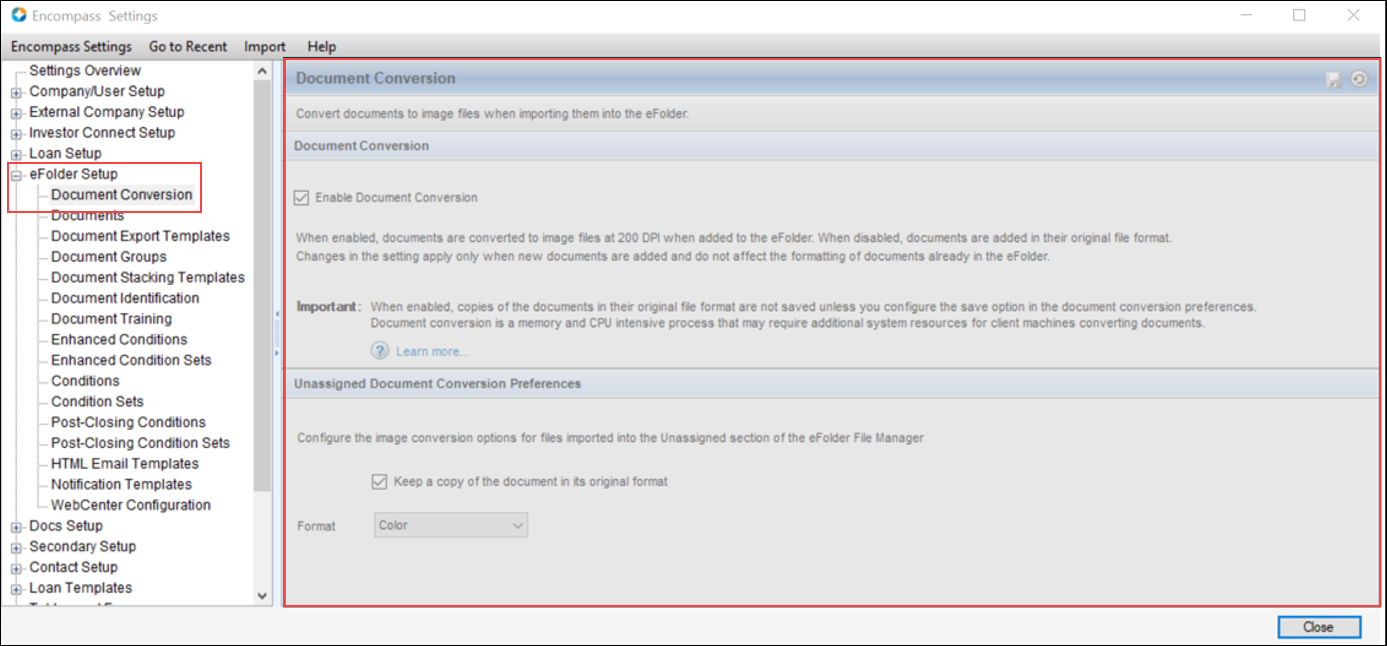

Starting in Encompass 24.3, the Encompass Settings > eFolder Setup > Document Conversion setting cannot be modified and is read-only. The configuration for this setting in the previous version of Encompass is retained in Encompass 24.3.

As we continue to make progress on delivering a web experience for Encompass, while also continuing to deliver the familiar desktop experience, we are removing the ability to change the Document Conversion settings via the Encompass Settings. Clients who wish to modify their Document Conversion settings can do so by contacting our Technical Support team. The ability to change Document Conversion settings via the Encompass Settings > eFolder Setup is targeted to be reintroduced in an early 2025 release.

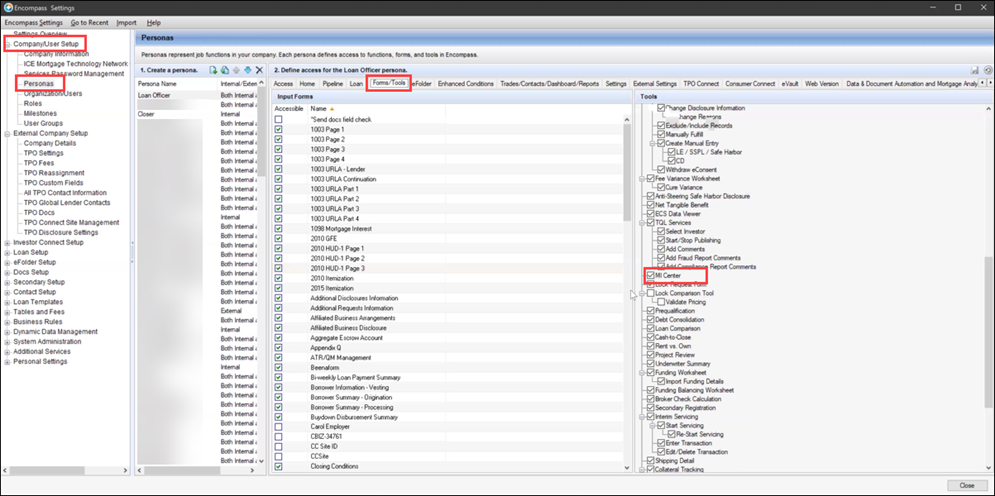

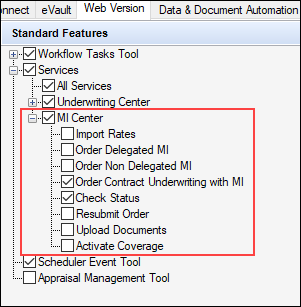

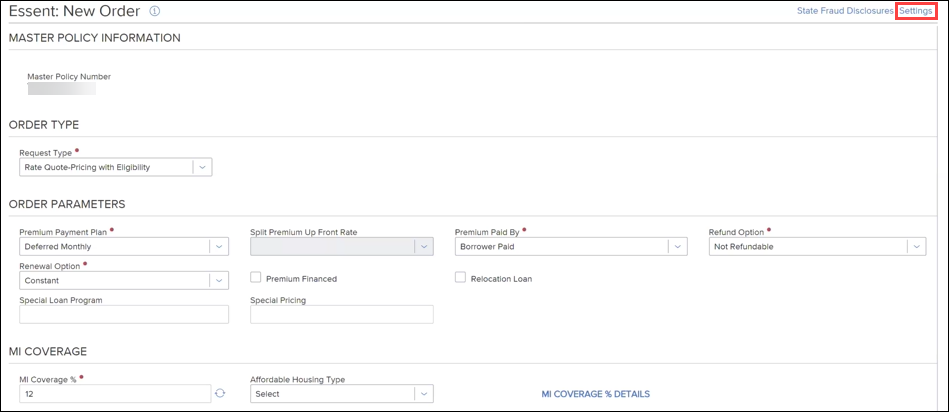

The following two tabs in Personas settings have been updated with new MI Center configuration options:

-

Forms/Tools: Use the MI Center checkbox to control access to the Desktop Version of MI Center

-

Web Version: Use the MI Center checkbox to control access to the MI Center in the web version of Encompass, and the options listed under it to manage the actions users can perform in both the desktop and web versions of Encompass. To grant permission to perform specific tasks, select the applicable options below the MI Center option:

-

Import Rates: Ability to import rates from RQC & Order Summary

-

Order Delegated MI: Ability to order delegated from RQC & Order Summary

-

Order Non Delegated MI: Ability to order non delegated from RQC & Order Summary

-

Order Contract Underwriting with MI: Ability to order CUW with MI from RQC & Order Summary

-

Check Status: Access to check status option on Order History & Order Summary

-

Resubmit Order: Access to resubmit (certs) and open quote order (quotes) on Order History and Order Summary

-

Upload Documents: Ability to upload documents

-

Activate Coverage: Ability to activate MI Coverage for a closed loan

When the MI Center checkbox in the Web Version tab is selected, MI Center is accessible to users assigned to the persona. This applies to the access to the MI Center only, and does not control access to individual MI Service provider features. Access to individual MI Service provider features continues to be controlled by the corresponding MI service provider Settings available within MI service provider pages.

-

Existing personas that were initially created as 'All Access' personas, will have all new MI Center features selected by default. For existing personas that were initially created as 'No Access' personas, the new MI Center features are not selected by default.

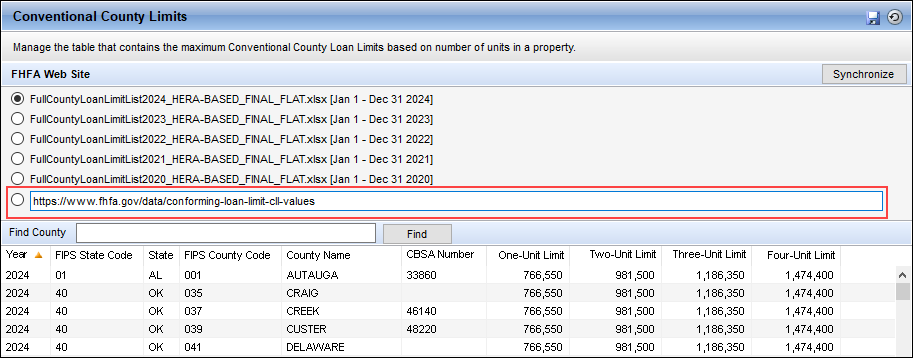

In the Conventional County Limits setting, a new URL field is now provided that defaults to the FHFA’s current Conforming Loan Limit Values download site: https://www.fhfa.gov/data/conforming-loan-limit-cll-values. Select this option to synchronize the Conventional County Limits table in Encompass with the most current FHFA data.

Administrators can manually override the default URL provided and enter a new URL as needed. For example, if the FHFA changes the URL for their download site, the updated URL could be manually entered in this field and enable you to continue to access the most recent FHFA data.

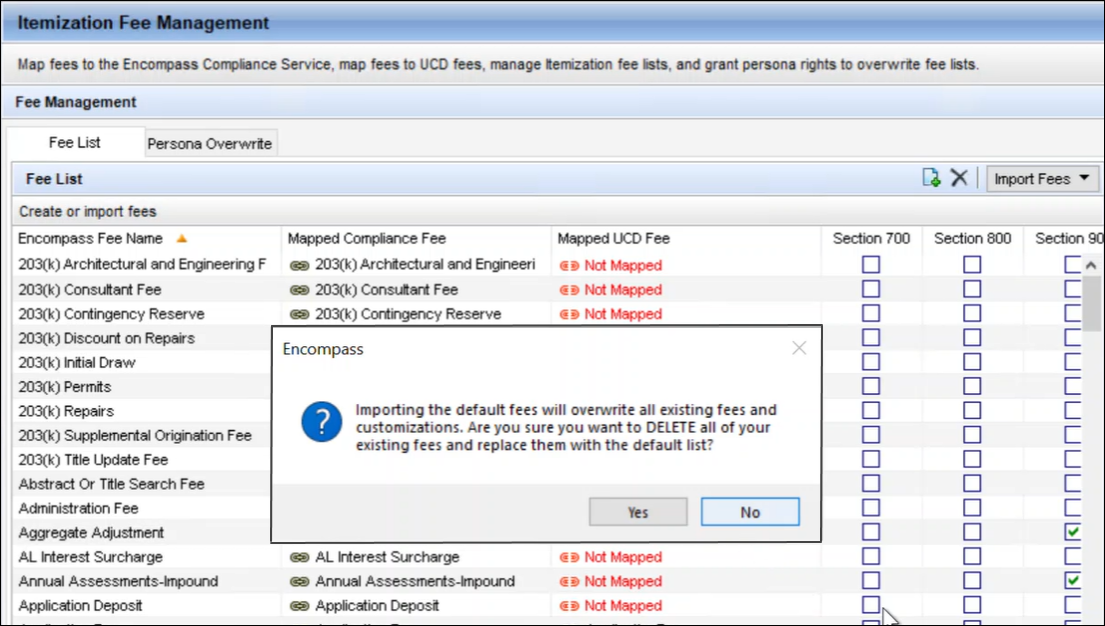

When administrators elect to import the compliance default fees into the Fee Management tool’s fee list, the default fees overwrite all data in the Fee List and any custom fees that were in this list are deleted/overwritten. To help reinforce the impact of importing these fees to the administrator or authorized user, the warning message previously provided before completing the import has been updated as shown below. Previously, the warning message stated The current list will be cleared. Are you sure you want to import the default list?

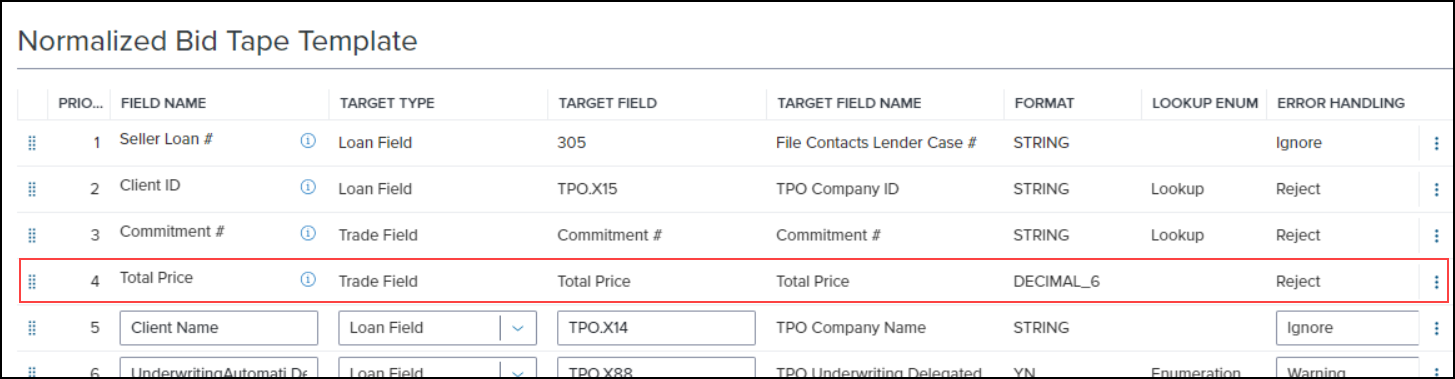

The Total Price field in the Normalized Bid Tape Template has been changed to a required field and an “i” icon has been added to indicate that it is required. In addition, the entire row is now read-only and the row has been moved to the 4th position in the default template

-

If a client already has Total Price in their template, its current position in the template will not change.

-

If a client does not have Total Price in their template, its position will be 4th by default.

The Normalized Bid Tape Template now accepts loan and snapshot collection fields. When a Bid Tape Registration job with loan and/or snapshot collection fields is processed, that data is mapped to the appropriate loan and/or snapshot collection fields.

When an Encompass Partner Connect v2 integration is selected as the pricing provider on the Product and Pricing setting, the More Info link will launch that Partner’s Administration guide. If the Partner does not have a guide available, the More Info link is disabled.

When an EPPS integration is selected as the pricing provider on the Product and Pricing setting, the More Info link will launch the ICE PPE (Product and Pricing Engine) page.

SEC-28834, SEC-28836

The Microsoft .NET Framework 4.7.2 previously required for Encompass has not been supported since 2022. Since Encompass 23.1, the .NET Framework 4.8 has been required for Encompass. Therefore, the .NET Framework 4.7.2 has been removed from the Encompass installation package. In addition, when launching Encompass 24.3, the system no longer checks for .NET Framework 4.7.2 or prompts the user to install it.

The Data Replication tool that was previously provided in the Encompass SmartClient installation package has also been removed from the package. This tool was sunset in the Encompass 24.2 release and is no longer supported.

Please note: This sunset does NOT impact the Data Warehouse toolkit, nor does it impact the Encompass Reporting Database, Encompass SDK, or Encompass Data Connect Replication. All of these items will continue to operate as expected. Encompass Data Connect is the recommended alternative to the Data Replication tool. Contact your ICE Mortgage Technology relationship manager for more information.

NICE-48597, NICE-48703

In the Encompass 24.2 release notes, we proudly announced the rebranding of the Encompass Product & Pricing Service to ICE PPE. In support of this product naming update, references to the Encompass Product & Pricing Service and EPPS in the Encompass user experience have now been updated to ICE PPE.

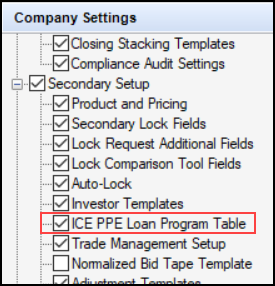

References to Encompass Product & Pricing Service and EPPS on the Encompass Settings screens have been replaced with ICE PPE. For example, the EPPS Loan Program Table persona option under Company Settings has been updated to ICE PPE Loan Program Table.

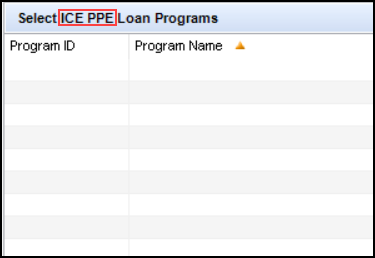

References to EPPS in Correspondent trades have been replaced with ICE PPE. For example, the Select EPPS Loan Programs section on the Correspondent Trade Details tab has been replaced with Select ICE PPE Loan Programs.

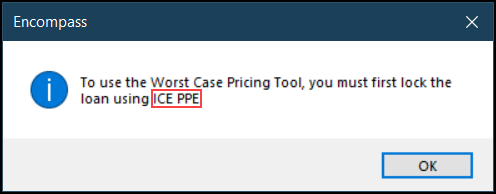

The reference to EPPS in the Worst Case Pricing tool warning message has been updated to ICE PPE.

SEC-28355

Fixed Issues for Version 24.3 (Banker Edition)

This section describes the issues that have been fixed in this release.

Why we fixed these issues: These issues were fixed to improve usability and to help ensure Encompass is operating as expected. The issues that are chosen to be fixed are based on the severity of their impact to clients and client feedback.

An issue occurred where the Redisclose Closing Disclosure (NBO Updated) alert was not being triggered like it should have been when an NBO (non-borrowing owner) was added to a loan file with multiple borrower pairs where the Initial Closing Disclosure had already been disclosed to the borrower and co-mortgagor. This issue has been resolved and this alert is now triggered as expected when an NBO is added after the initial CD has already been disclosed.

CBIZ-60781

When Fannie Mae’s EarlyCheck was run in Encompass, AUS Data Discrepancy alerts were being triggered in error, preventing user from viewing the order in the AUS Tracking Tool or the Underwriting Center. This issue has been addressed and these alerts can no longer be trigged in EarlyCheck orders.

CBIZ-49565

On Construction-Only loans that are using the Full Loan (Method B) amount to calculate the interest amount (SYS.X6), the qualifying payment used to calculate the proposed monthly first mortgage payment (1724) is now using the full loan amount. Previously, the qualifying payment was using only half of the loan amount. The calculation for field 1724 is now based on the number of days value (1962) that is used to calculate the repayment schedule when a qualification rate (1014) is not provided in the loan file.

This update ensures the calculation for the proposed monthly first mortgage payment for (1724) Construction-Only loans using the Full Loan amount is calculated using the full loan amount just like the proposed monthly first mortgage payment on the (228) 2015 Itemization and 1003 Page 2 is calculated.

Migration Notes:

For existing Construction-Only loans for a primary residence (1811) where the qualification rate has been disclosed and for existing non-active loans (1393), fields 1724 and 1725 (proposed monthly second mortgage payment) are locked in Encompass 24.3 to retain the current values.

CBIZ-47514, CBIZ-60160

In Encompass 24.1, Encompass started treating Construction Only and Construction-Perm loans as irregular for the purposes of APR tolerance, regardless of the amortization type. This update ensured these Construction loans had an APR tolerance of 0.25%. However, even when the initial APR tolerance was increased or decreased by less than 0.25% in these loan types, a red exclamation alert to indicate that a redisclosure was now required due to this new APR was incorrectly displayed next to the Annual Percentage Rate field (799). This issue has been resolved and the alert icon is no longer displaying when the APR tolerance is less than 0.25%.

CBIZ-59551

An issue occurred in loans for second loans and investment properties (1811) or subordinate liens (420) where Encompass was including the proposed monthly mortgage payment (228) twice in the calculation for the maximum total payment at the initial rate (QM.X113). This issue has been resolved and this payment amount is now included only once.

CBIZ-51505

Prior to Encompass 24.3, the Fannie Mae Refinance Cash Out Amount (ULDD.RefinanceCashOutAmount) was not calculating correctly for cash-out refinance loans because it was not taking all lender credits into account. This could result in an incorrect cash out amount being sent to Fannie Mae. Starting in Encompass 24.3, for cash-out refinance loans (19), Encompass now includes (adds) all credits (URLA.X152) and includes (adds) the Payoff Amount (FL0016) from the Verification of Liabilities when a second mortgage is being paid off when calculating the Refinance Cash Out Amount field.

For the Freddie Mac [Refinance] Cash Out Amount (CASASRN.X79), the calculation was not including (adding) the closing costs paid by the lender. When cash-out refis were submitted to Freddie Mac, the cash out amount would be short the amount of any lender-paid fees. Starting in Encompass 24.3, for cash-out refinance loans (19), Encompass now includes (adds) all credits (URLA.X152) and includes (adds) the Payoff Amount (FL0016) from the Verification of Liabilities when a second mortgage is being paid off when calculating the Refinance Cash Out Amount field.

CBIZ-38893, CBIZ-39406

In previous versions of Encompass, the Prepayment Penalty Payoff amount (NTB.X16) was being included in the Section 32 Points and Fees Threshold (S32DISC.X48) and the RegZ Total Loan Amount (QM.X120) when:

-

The Refinance with Original Creditor (QM.X2) checkbox was selected, OR

-

The Purpose of Refinance (299) was Cash-Out with Original Lender or No Cash-Out with Original Lender, OR

-

Any value was populated in the Existing Loan was field (NTB.X34).

In Encompass 24.3, the Prepayment Penalty Payoff (NTB.X16) is only included in the Section 32 Points and Fees Threshold (S32DISC.X48) and the RegZ Total Loan Amount (QM.X120) when:

-

The Refinance with Original Creditor (QM.X2) checkbox was selected, OR

-

The Purpose of Refinance (299) was Cash-Out with Original Lender or No Cash-Out with Original Lender, OR

-

The Originated by the same broker and is funded by the same creditor or the Made or is currently held by the same creditor or an affiliate of the creditor option is selected for the Existing Loan was field (NTB.X34).

This update helps prevent the threshold for Section 32 Points and Fees being exceeded due to the prepayment penalty payoff amount being included.

CBIZ-61635

In loans where fields 2864 (Transaction Details Form List Template File Applied) and 2865 (Transaction Details Miscellaneous Data Template File Applied) were used, applying multiple loan templates resulted in the values for these two fields being cleared out. After applying one template to the loan, the values remained on the input form (typically the Custom Fields input form) as expected. But when a different loan template was applied later, the values for these fields were cleared out when the second loan template did not contain any data for these fields.

Starting in Encompass 24.3, if a loan template does not have any data for fields 2864 and/or 2865, and the Append template data checkbox provided on the Apply Loan Template pop-up window when applying the loan template is selected, then the values in fields 2864 and/or 2865 are not cleared from the input form.

The only time these values will be cleared from the form is if the loan template does not have any data for the fields and the Append template data checkbox is not selected.

CBIZ-61491

Users submitting construction loans to Encompass Compliance Service (ECS) received warning messages in the compliance review due to the proposed monthly payment (first principal and interest payment) in the loan being one cent less than the calculated payment expected by ECS. This discrepancy was due to Encompass calculating and then rounding the amount slightly differently than ECS did. This calculation in Encompass 24.3 has been updated to match the calculation used by ECS to address this discrepancy.

This update impacts only Construction-Only and Construction-to-Perm loans using Method A.

CBIZ-48434

When a value is provided in the Veteran Information for field (VASUMM.X31) (which would be Borrower or Co-Borrower) the VAELIG.X66 (VA Veteran Is Borr/Co-Borr (VA Cert of Eligibility)) and VAVOB.X51 (VA Vet Status Veteran Is Borr/Co-Borr on VA 26-8261A Veteran Status) fields are updated accordingly. However, if VASUMM.X31 is modified by a business rule instead of directly on the input form, the other two fields were not updated accordingly. This issue has been resolved the now the fields are updated accordingly whenever the VASUMM.X31 field is modified.

CBIZ-60488

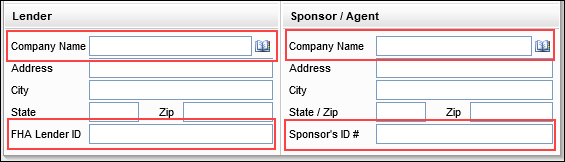

When choosing a business contact for the Lender Company Name (1264) and Sponsor/Agent Company Name (1111) on the FHA Management input form by clicking the Address Book icon and then selecting the contact, Encompass was populating and/or overwriting the FHA Lender ID (1059) and the Sponsor’s ID # (1060) with the Company License number data from the Business Contacts tool for the selected contact. Starting in Encompass 24.3, the FHA Lender ID (1059) and Sponsor’s ID # (1060) will not be populated with the company license number from the business contact, nor will existing data be overwritten.

CBIZ-20194

An issue occurred where an error message “Unable to find a map file for the current URL.(Code:80040213)” was displayed when certain product and pricing providers were used to lock and confirm a loan. When OK was clicked on the error message, a successful lock message “The lock has been successfully confirmed.” was displayed. This issue has been resolved and the error is no longer displayed when the following providers are selected.

-

LoanNEX Qualifier

-

SmartPricer

-

Lender Price

-

LoanPass

-

Loansifter for Encompass

-

Optimal Blue for Encompass

An issue occurred where if any payment method except “Automated Clearing House” (ACH) was entered on the Interim Servicing Worksheet for a Correspondent loan with buydown data, that payment was not applied correctly (i.e., the Difference amount was blank instead of the same amount as the buy down amount). This issue has been resolved and all payment methods are now applying the payment correctly.

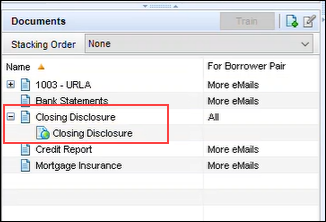

Users utilizing the Auto Assign feature in eFolder (and using the new document viewer) experienced an issue where the file auto assigned to a document was not reflected correctly in the File Manager Document Viewer, giving the impression that the file had not been attached to the document folder or, where applicable, had not been attached to a condition. This issue has been resolved and the file is now clearly indicated as attached to the document or condition when attached via Auto Assign.

DOCP-65721

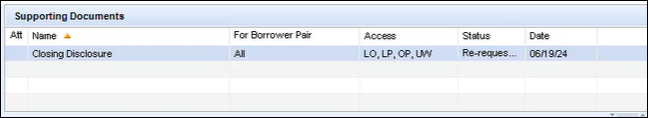

In OTP (one-time password)-enabled Encompass Consumer Connect borrower portals, the expected branch contact information was not provided on the eConsent Agreement sent to borrowers. The contact information provided here is determined by the Encompass Settings > Docs Setup > eDisclosure Packages settings, where administrators can elect to use their company’s branch address in the borrower consent agreement for electronic document requests and eDisclosure packages, but this setting was not being applied in the OTP-enabled borrower portals. Instead the organization’s address and phone number was provided on the eConsent Agreement. This issue has been resolved the Consents setting for eDisclosure Packages is now being applied as expected and the branch address and phone number is used for the agreement.

DOCP-56973

The Status Online Tool is used to publish loan status updates to a secure website (Encompass Consumer Connect, Loan Connect, or TPO Connect ) for viewing by your borrowers and partners. When you use the Status Online tool to publish updates, you can also edit any notification emails that are sent with the updates. An issue occurred with loans originated from a TPO Connect site where Encompass was not sending notification emails after a TPO Connect file was saved and the user exited the loan even though the Status Online tool was set to automatically send TPO notifications after updating the loan. This issue has been resolved. Status Online is now working as expected for TPO Connect loans. After updating the loan and then exiting, Encompass users will see the Status Online pop-up window indicating Publishing... and once completed, the emails would be sent and could be viewed on the TPO Connect site by TPO contacts.

DOCP-68733

When adding, editing or deleting fields in the Encompass Reporting Database, the changes were sometimes failing to be saved due to Invalid column name errors. These errors occurred due to the database and the cache files that are automatically generated to store subsets of the data being out of sync. The cause of this issue was identified and addressed so that administrators can save updates to the database successfully.

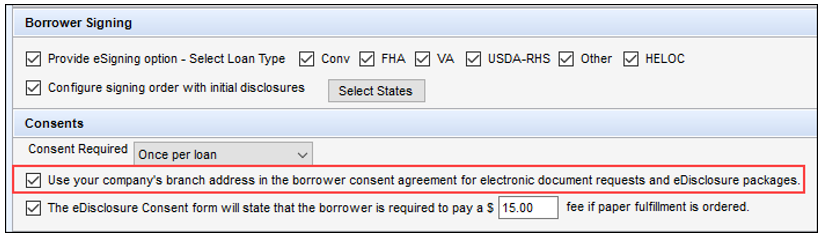

Some users experienced an issue where the Login Access setting for users in sub-organizations were being changed to match the settings of the parent organization erroneously. Any time a change was saved to a parent organization, its Login Access setting was applied to the users in its sub-organizations even though the Use Parent Info option was not selected, and the sub-organizations should not have been updated. As a result, scenarios occurred where users assigned with Restricted Access (login supported only through SSO) were being changed to Full Access (login supported via SSO or user ID/password) any time a change was saved to their parent organization (since the parent organization was set up with Full Access). This issue has been resolved and users in sub-organizations now retain their Login Access settings as expected when the Use Parent Info option is not being used for their organization.

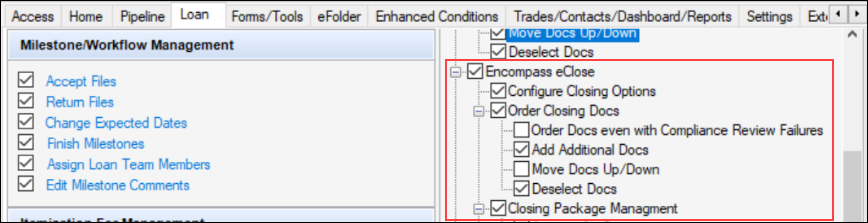

An issue occurred where the selections for the Encompass eClose (and related) options in the Personas setting were not retained when upgrading from Encompass 24.1.0.x to 24.2.0.x. For example, in Encompass 24.1, the Encompass eClose option was not selected for a specific persona, but after upgrading to Encompass 24.2, the Encompass eClose option was selected. This issue has been resolved and the Personas settings for Encompass eClose are now retained when upgrading Encompass.

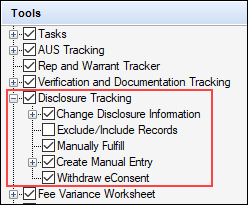

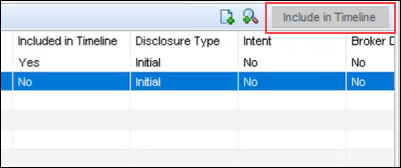

When using the Personas tool in Encompass Settings to manage access to the Disclosure Tracking tool and its features, administrators can select the Exclude/Include Records option (Encompass Settings > Company/User Setup > Personas > Forms/Tools tab) to grant access to the Include in Timeline button in the Disclosure Tracking Tool’s Disclosure History panel. However, after clearing the Exclude/Include Records option, the Include in Timeline button was still available to the persona. This issue has been resolved and the button is now deactivated (grayed-out) for users with personas where the Exclude/Include Records option in Personas is not selected.

Persona access to fields business rules set up to manage user access to the Base Price field (2101) on the Lock Request Form were working correctly in terms of users navigating to the form and being able to view the field or enter or modify data in the field based on their persona rights and the rule, but the business rule was not being enforced in lock request alerts. When a lock request alert was triggered, a user could open the alert and view or update the Base Price field in the alert screen even though the business rule should have restricted the user from being able to perform these tasks based on their persona. This issue has been resolved and the persona access to fields business rules for the Base Price field are now enforced in alerts and all areas where this field is used in a loan file.

CBIZ-62326

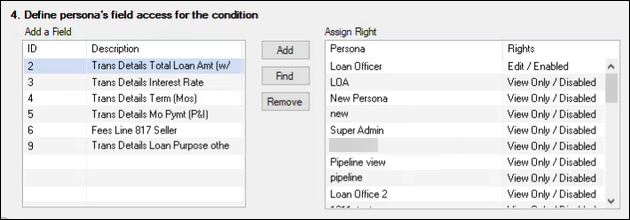

When defining the persona’s field access for a selected condition in the Persona Access to Fields business rule, an issue occurred where the value at the top of the Rights list persisted at the top of the list when the administrator sorted the values in the Description list. When sorting the Description list, the rights in the right panel would change positions based on the Description, except for the topmost item in the Rights column which never moved. This could result in the wrong right being assigned to the persona. This issue has been resolved and now the rights stay with the assigned persona as expected when the list order changes based on the Description in the left panel.

CBIZ-49285

Using the Encompass Admin Tools > Settings Manager, administrators can use the TPO Originator policy to determine the Loan Originator name the system will populate to field 1612 on the 1003 Page 3 (along with the originator’s contact information in applicable fields). When Keep_TPO_Originator is selected for the policy, the name and associated information of the TPO that originated the loan from an Encompass TPO Connect website should be populated to the Loan Originator and related fields. However, in previous versions of Encompass, when a loan officer imported a MISMO 3.4 file, this policy was not being applied and the current data from the MISMO file was being overwritten with the name and information belonging to the loan officer who imported the MISMO file instead of the retaining the data from the original TPO like it should have. This issue has been resolved. The fields that were being overwritten (State License ID # (3629), Phone (1823), and Unit Type (URLA.X189)) are no longer overwritten and the original TPO information is retained as expected based on the Keep_TPO_Originator policy.

CBIZ-58448

An issue occurred with TPO Branch LO comp plans with the Use Parent Info checkbox selected. When a change was made to the Parent company, a duplicate of the current comp plan was created. This issue has been resolved and a duplicate of the comp plan is no longer created when a change is made to the Parent company.

(Added on 11/5/2024)

Starting in Encompass 24.3, the buydown rates and term at the lock request level is now used when creating or updating loans via API instead of using the buydown data at the loan level. Previously, when buydown data at both the rate lock level and loan data were modified, the buydown data at the lock request level was being overwritten by the data at the loan level.

Fixed Issues for Version 24.3.0.1 Server Patch 1

(Added on 12/4/2024)

This update contains an update to users' Encompass client machines (24.3.0.1) and a Server Patch (server patch 1) that is applied to the Encompass server. The fixed issues below are included in this update.

The client-side update can be controlled manually via the Encompass Version Manager tool. If the tool has been configured to always apply new releases to users' computers automatically, users will receive this update upon their initial log in of Encompass following the release. The Server Patch included with this release will be applied to the Encompass Server automatically and cannot be controlled manually via the Encompass Version Manager tool.