Use the buttons below to view general role definition guidelines for each persona.

Encompass Persona Functional Definition

Closer / Funder

The content contained in the Encompass Persona-Based Release Notes are aligned to the Closer / Funder persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Because closers often act as funders and vice versa, the roles are combined for the purpose of Persona Release Notes. Basic responsibilities of the Closer / Funder include, but are not limited to, the following:

- Manage the closing process

- Completes and audits the closing information

- Orders closing documents

- Reviews, prints, and reorders returned closing documents

- They also manage the funding process

Encompass Persona Functional Definition

Loan Officer

The content contained in the Encompass Persona-Based Release Notes are aligned to the LOan Officer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Loan Officer include, but are not limited to, the following:

- Develops business and initiates loans

- Develops new client relationships and manages relationships over time

- Initiates the loan process

- Gathers basic client info

- Orders services for prequalification and preapproval

- Communicates with processor

- Monitors loans in the Pipeline by tracking milestones and items requiring attention

Encompass Persona Functional Definition

Loan Processor

The content contained in the Encompass Persona-Based Release Notes are aligned to the Loan Processor persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Loan Processor include, but are not limited to, the following:

- Coordinates people and information to construct and finalize loans

- Uses tools such as forms documents, and communication logs

- Monitors own Pipeline by tracking milestones and items requiring action

Encompass Persona Functional Definition

Manager

The content contained in the Encompass Persona-Based Release Notes are aligned to the Manager persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Manager include, but are not limited to, the following:

- Manages the business

- Monitors the Pipelines of loan team members

- Manages the bottom line, such as resource assessment and management, and financial forecasting

Encompass Persona Functional Definition

Post Closer

The content contained in the Encompass Persona-Based Release Notes are aligned to the Post Closer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Post Closer include, but are not limited to, the following:

- Confirms all documents are completed and generated

Encompass Persona Functional Definition

Quality Control

The content contained in the Encompass Persona-Based Release Notes are aligned to the Quality Control persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Quality Control include, but are not limited to, the following:

- Inspects the loan for quality

Encompass Persona Functional Definition

Reporting

The content contained in the Encompass Persona-Based Release Notes are aligned to the Reporting persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Reporting include, but are not limited to, the following:

- Pulls, creates, and manages reports in Encompass

- Manages Encompass Reporting Database

Encompass Persona Functional Definition

Secondary Marketing / Lock Desk

The content contained in the Encompass Persona-Based Release Notes are aligned to the Secondary Marketing / Lock Desk persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Because Secondary Marketing often acts as Lock Desk and vice versa, the roles are combined for the purpose these Persona Release Notes. Basic responsibilities of the Secondary Marketing / Lock Desk include, but are not limited to, the following:

- Determines pricing strategies and develops / implements loan programs

- They also receive and process lock requests

Encompass Persona Functional Definition

Servicer

The content contained in the Encompass Persona-Based Release Notes are aligned to the Servicer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Servicer include, but are not limited to, the following:

- Services the loan

Encompass Persona Functional Definition

Shipper

The content contained in the Encompass Persona-Based Release Notes are aligned to the Shipper persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Shipper include, but are not limited to, the following:

- Assists with inventory control and provides input to secondary marketing functions

- Ships loans to document custodians and the investor

Encompass Persona Functional Definition

Underwriter

The content contained in the Encompass Persona-Based Release Notes are aligned to the Underwriter persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Underwriter include, but are not limited to, the following:

- Verifies loan accuracy

- Provides conditions to be met

- Verifies that conditions are met

To learn about another persona, select a persona from the options above; otherwise, to view or print the release notes, select Close ("X") at the top of the window and chose one or more options from the Filter by Persona or Print by Persona menu by selecting a button at the top of the page.

Encompass 24.2 Persona-Based Release Notes

The Encompass Persona-Based release notes are broken down by common Encompass personas. We realize every organization may have slightly different functional definitions for these personas. As such, you may want to review each persona's release note segments before forwarding to ensure they match personas / roles within your organization.

How to Navigate Persona-Based Release Notes

To use the Persona-Based Release Notes page, use the navigation buttons described below:

-

Filter by Persona: Create and view a customized on-screen version of the release notes by selecting one or more persona checkboxes. To remove one or more personas, clear the corresponding checkbox for the persona being removed.

-

Persona Definitions: View general role definition guidelines for each persona.

-

Print by Persona: View a dedicated PDF version of the release notes aligned to each of the available Encompass persona by selecting a persona one at a time. A new window will open and display the selected PDF file.

Encompass 24.2 Persona-Based Release Notes

The Encompass 24.2 Persona-Based Release Notes include a high-level overview of new features, feature and form enhancements, and fixed issues applicable to the each Encompass persona, followed by more detailed information and instructions where appropriate.

Refer to the online help and the Guides & Documents page for additional information and related documents.

Your customized on-screen version of the Persona-Based release notes include the following personas:

Closer / Funder

Loan Officer

Loan Processor

Manager

Post Closer

Quality Control

Reporting

Secondary Marketing / Lock Desk

Servicer

Shipper

Underwriter

To create a new customized on-screen version of the Persona-Based release notes, click Filter by Personas, and then select or clear the corresponding checkbox for the persona being added or removed.

Feature Enhancements in Version 24.2 (Banker Edition)

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release.

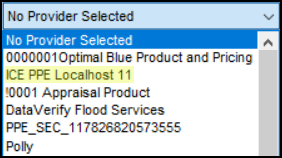

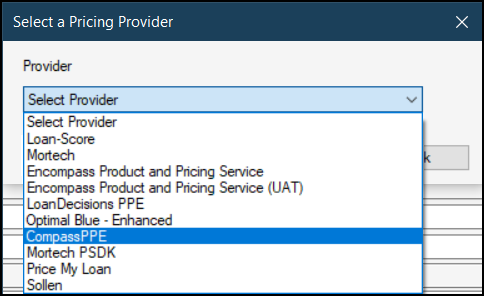

We are excited to announce the rebranding of the Encompass Product & Pricing Service to ICE PPE as we continue to bring more clarity to our solutions' capabilities and align with the ICE brand. As part of this initiative, the Provider list in the Product and Pricing Provider Integration section of the Product and Pricing setting has been updated in this release to use the new name.

For additional information about ICE PPE, visit the ICE PPE page on ice.com.

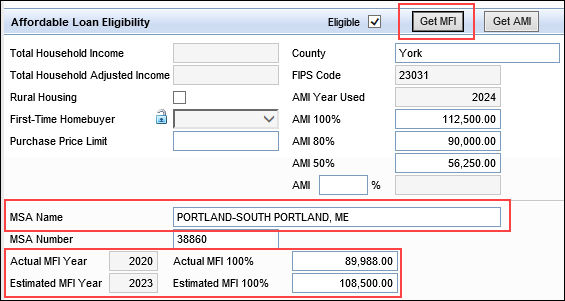

Several enhancements have been made in Encompass to facilitate users collecting and applying Median Family Income (MFI) and Area Median Income (AMI) limits and data. Lenders can use these limits to help determine income eligibility for affordable housing programs.

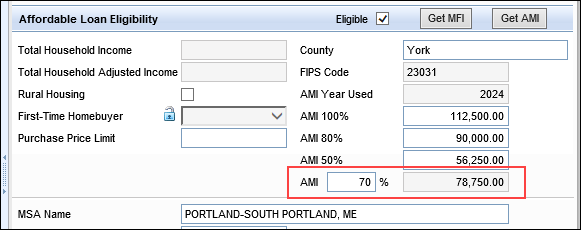

New fields have been added to the Affordable Loan Eligibility section of the Borrower Summary - Origination, Fannie Mae Additional Data, and Freddie Mac Additional Data input forms to better enable Encompass users to view factors that provide insight on whether a loan is a good candidate for an affordable loan program such as USDA. All of these new fields are populated based on the FFIEC MFI database table that is used when the user clicks the Get MFI button. Or, if the Automated Data Completion option for MFI is enabled for your Encompass instance, this information is populated automatically based on the Subject Property ZIP Code (15) entered for the loan. (Refer to the Automated Data Completion for MFI Setting entry for more information.)

-

MSA Name (5017) - This MSA name of the region based on the Subject Property ZIP Code (15).

-

Actual MFI Year (5018) - Read-only field that indicates the actual year that is used for MFI data. This year is usually a few years behind the current year. (Typically, new MFI data is provided by FFIEC every four years.)

-

Estimated MFI Year (5019) - Read-only field that indicates the estimated year used for MFI data. This is typically the current year.

-

Actual MFI 100% (5020) - The total MFI for every area in the Actual MFI Year (5018).

-

Estimated MFI 100% (5021) - The total MFI for every area in the Estimated MFI Year (5019).

Note also that the FFIEC MFI button previously provided in this section has been renamed to Get MFI.

CBIZ-56238, CBIZ-58053

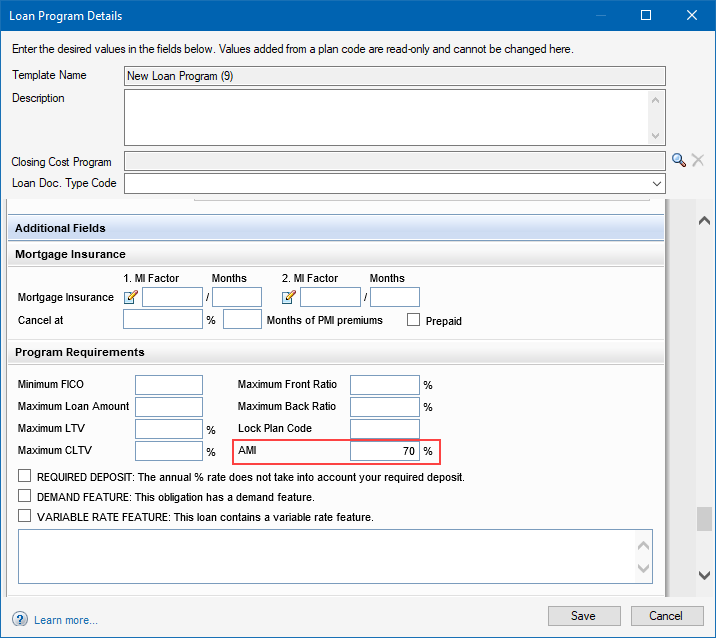

The AMI (Area Median Income) percentage field (4985) is now included in the loan program loan templates. When a loan program template with the AMI percentage defined is applied to a loan, the AMI percentage field (4985) in the Affordable Loan Eligibility section of the Borrower Summary - Origination and other forms within the loan will be populated with that value. In addition, field 4986 which calculates the AMI limit to qualify for the affordable loan program based on the AMI percentage (4985) value will then also be populated. This enables the administrator to have the AMI factored in at the time of selecting a particular loan program upfront.

CBIZ-56419

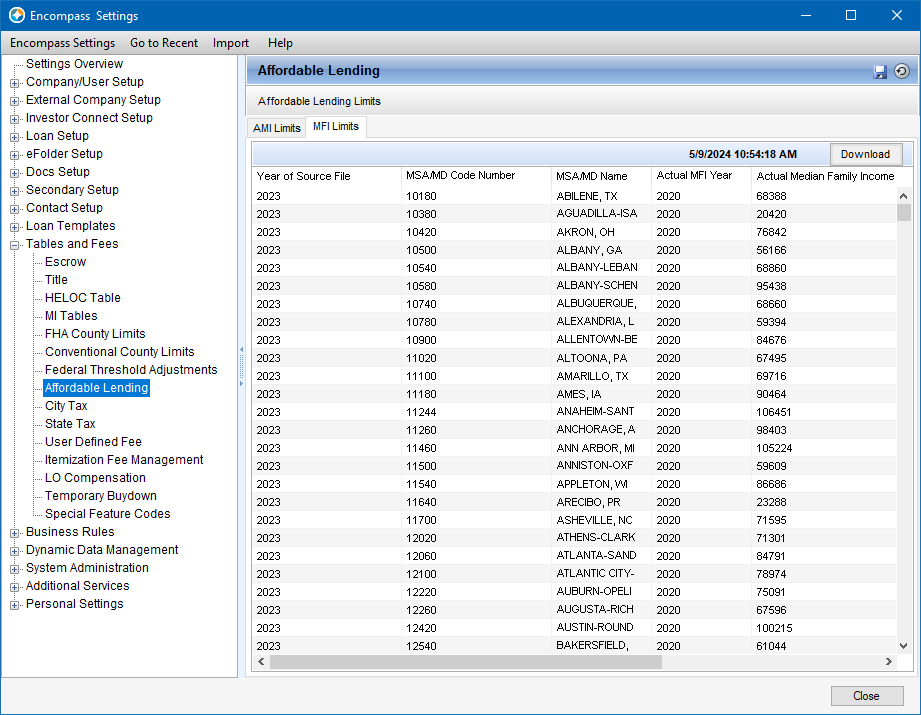

In the Encompass Settings, a new Affordable Lending setting has been added to the Tables and Fees category. This setting provides lenders with the most recent Median Family Income (MFI) data for specific geographic areas. Lenders can use these MFI limits to determine median income eligibility for affordable housing programs. Affordable loan programs like these set maximum incomes for program eligibility.

The last three years of MFI data provided by the FFIEC (Federal Financial Institutions Examination Council) are available to download here.

In previous versions of Encompass, this setting was called Area Median Income (AMI) Limits and it contained only the AMI Limits tool that provides the most recent AMI limits for specific geographic areas which lenders could download to determine income eligibility for affordable housing programs such as USDA, HomeReady® and Home Possible®. Now this data is provided on the new AMI Limits tab, while the MFI data is provided on the MFI Limits tab in this new Affordable Lending setting.

CBIZ-58047

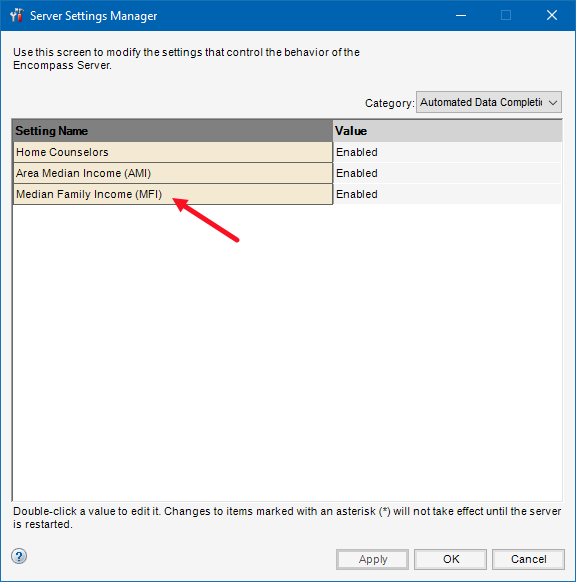

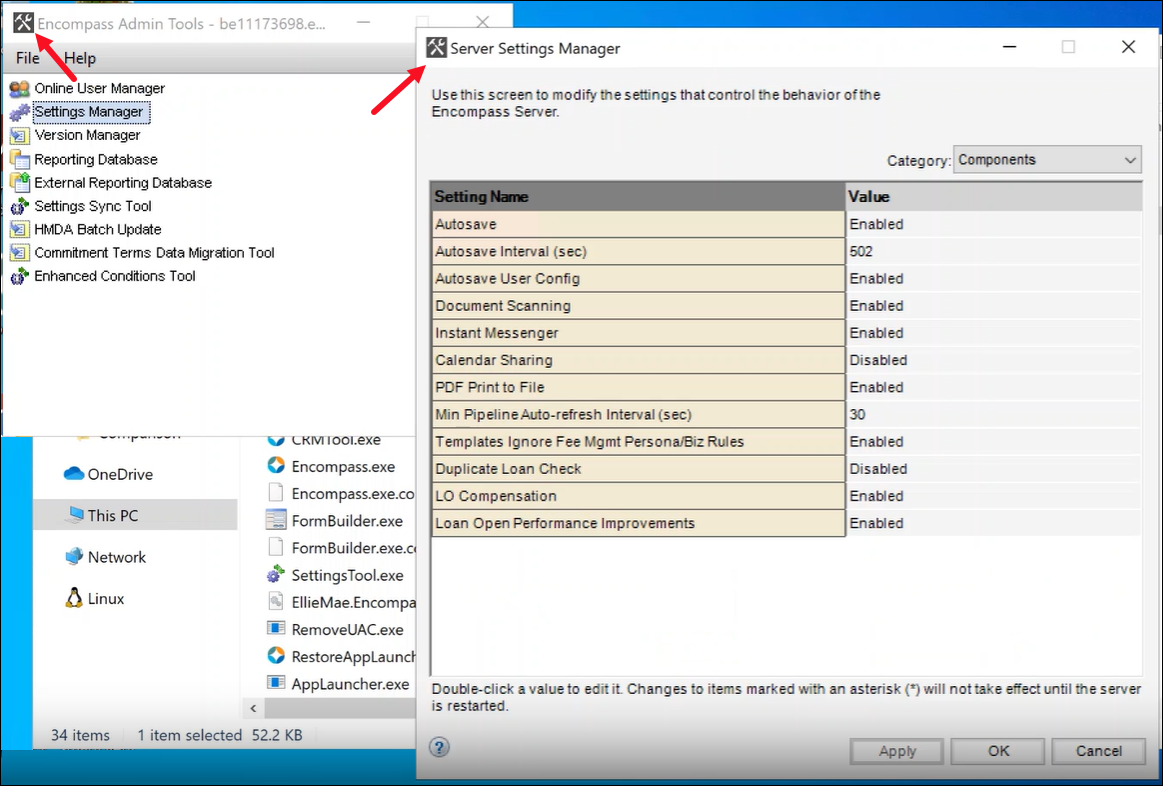

In the Encompass Admin Tools > Settings Manager, a new Median Family Income (MFI) option has been added to the Automated Data Completion category. Administrators can use this option to enable Encompass to retrieve MFI data systematically and automatically populate/complete data within the Affordable Loan Eligibility section of the Borrower Summary - Origination input form, and on the Fannie Mae Additional Data and Freddie Mac Additional Data input forms. When this option is enabled, the affordable loan data is automatically populated based on the Subject Property ZIP Code (15) entered for the loan without users having to open the form, and then manually click the Get MFI button. (Data will also be populated if only the Subject Property State (14) or County (13) are entered, though the ZIP Code provides the most accurate MFI results.)

By default, the Median Family Income (MFI) option is set to Disabled.

To Enable MFI Automated Data Completion:

-

Go to the Encompass Admin Tools > Settings Manager.

-

Select Automated Data Completion from the Category list.

-

Double-click the Median Family Income (MFI) value, and then select Enabled.

-

Click Apply or OK.

CBIZ-57726, CBIZ-58053, CBIZ-58441

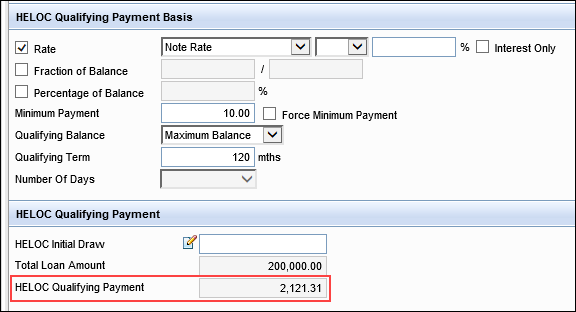

A new read-only HELOC Qualifying Payment loan-level field (5025) is now provided on the HELOC Management input form. The value populated to this field is based on the loan amount (1109) and the selections made in the HELOC Qualifying Payment section of the form.

As part of this update, fields 1724 (used for the proposed monthly first mortgage payment) and 1725 (used for the proposed monthly second mortgage payment) have been removed from the HELOC Qualifying Payment section. Those fields (which are still provided on the Transmittal Summary and other input forms) are calculated based on the monthly first mortgage payment (120) and other monthly mortgage payments (121) and not the HELOC Qualifying Payment Basis. Even though fields 1724 and 1725 have logic to calculate the HELOC Qualifying Payment, there was no standalone field to reflect the calculated qualifying payment based on the Qualifying Payment Basis data. Fields 1724 and 1725 were also not including investment and second home HELOCs.

The new HELOC Qualifying Payment field (5025) will use the existing calculation logic for HELOC qualifying payment basis, but now the actual qualifying payment is shown here. This field will be used for all HELOC loans only, regardless of lien position. This gives users an easy way to refer to the HELOC qualifying payment for HELOCs only. Please note, when processing a HELOC loan, the Qualifying Rate field (1014) should not be used. For the HELOC Qualifying Payment field to calculate as expected, the Qualifying Rate field (1014) must be empty.

In addition, the positive and negative cash flow fields (462, 1169) were previously using the HELOC Initial Payment for their calculation instead of the HELOC Qualifying Payment. These cash flow fields have been updated to now use the HELOC Qualifying Payment. The borrower’s gross rental income (106) and the expected net monthly rental income (URLA.X81) calculations have also been updated to use the HELOC Qualifying Payment.

Migration Notes:

There is no migration of data from existing loans to field 1725 in Encompass 24.2. For existing loans, the new field 5025 will be empty in Encompass 24.2 until a user changes a dependent field in the HELOC Qualifying Payment Basis section of the form.

For non-active (i.e., the Action Taken field (1393) is not empty) HELOC loans, investment loans, and loans for second homes where the qualification rate (1014) is not provided, the positive and negative cash flow fields (462, 1169), borrower's gross income from rental properties field (106), and the expected net monthly rental income for the loan field (URLA.X81) are locked to retain their current values (i.e., the fields are not updated based on system calculations).

CBIZ-46434, CBIZ-46435

In previous versions of Encompass when processing a loan for a HELOC in 2nd position for a primary home, the payment for the 1st lien VOL (Verification of Liabilities) was not populating to field 1724 (first monthly mortgage P& I payment) on the Transmittal Summary. This resulted in the DTI (debt to income) being understated since it did not include this payment. In addition, for HELOCs in 3rd position for a primary home, the payment for the 1st lien VOL was not populating to field 1725 (proposed monthly second mortgage payment). This too resulted in incorrect DTI.

In Encompass 24.2, the payment for the 1st lien from the VOL is now included in field 1724 2nd lien HELOC loans and 1725 for 3rd lien HELOC loans.

Migration Notes:

For existing non-active (1393) HELOC loans (1172), if users had manually entered data for fields 1724 and 1725, these fields will be locked to retain the values and preserve data integrity. If Fields 1724 and 1724 for existing non-active (1393) HELOC loans (1172) are not locked, they will be locked to retain user input values.

CBIZ-44660, CBIZ-53155

When processing a VA refinance loan, Encompass was utilizing the HELOC high credit limit (CASASRN.X168) to calculate the CLTV (combined loan-to-value) instead of the initial draw or balance of the HELOC (CASASRN.X167) that is used by Freddie Mac's Loan Prospector (LP) and Fannie Mae's Desktop Underwriter (DU) to calculate the CLTV. To address the variance in the CLTV between Encompass and LP/DU for VA refinance loans, Encompass now uses CASASRN.X167 to calculate the CLTV for VA refinance loans.

This update applies only to the Freddie Mac and Fannie Mae CLTV fields:

- Freddie Mac Additional Data input form's CLTV (CASASRN.X218)

- Freddie Mac tab on ULDD/PDD input form's CLTV / TLTV (ULDD.FRD.CASASRN.X218)

- Fannie Mae Additional Data input form's CLTV (MORNET.X76)

- Fannie Mae tab on ULDD/PDD input form's CLTV (ULDD.FNM.MORNET.X76)

CBIZ-35792

An issue occurred where the HELOC Initial Payment (5) was calculated incorrectly when the Collect Interim Interest (4665) checkbox was selected to indicate that interim interest (if any) will be collected at Closing. The cause of this issue (which was related to date and other associated fields that were empty being calculated as a blank value instead of a 0 value) was identified and corrected. The HELOC Initial Payment field now calculates correctly and reflects the monthly P & I payment (less the interim interest) when field 4665 is selected.

CBIZ-59602

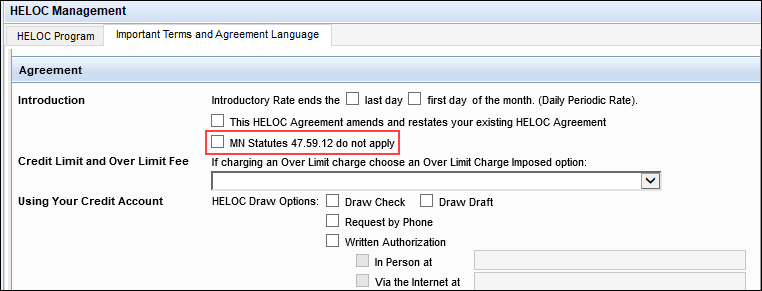

A new checkbox field (5026) for Minnesota (MN) Statutes 47.59.12 is now available on the Important Terms and Agreement Language tab on the HELOC Management input form. Use this field to indicate that the loan is not subject to these MN statutes. When this checkbox is selected, the following language will be omitted from the Home Equity Line of Credit Agreement printed output form:

If this box is checked, you have been assessed finance charges, or points, which are not included in the annual percentage rate. These charges may be refunded, in whole or in part, if you do not use your line of credit or if you repay your line of credit early. These charges increase the cost of your credit.

This field always displays on this input form. It is not dependent on the Subject Property State (14) being Minnesota.

Please note, by design this language will also be omitted from the Home Equity Line of Credit Agreement printed output form if the Mortgage Lien Type (420) = First Lien AND the Loan Amount (2) is greater than $100,000.

CBIZ-53093

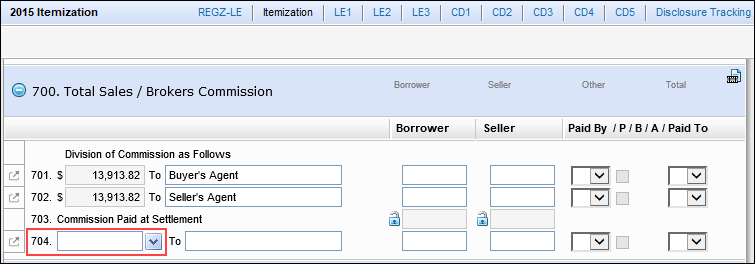

Users managing the data on the 2015 Itemization input form can now select from a predefined list of fee descriptions for line 704. This list is determined by the fees configured in the Encompass Settings > Tables and Fees > Itemization Fee Management settings.

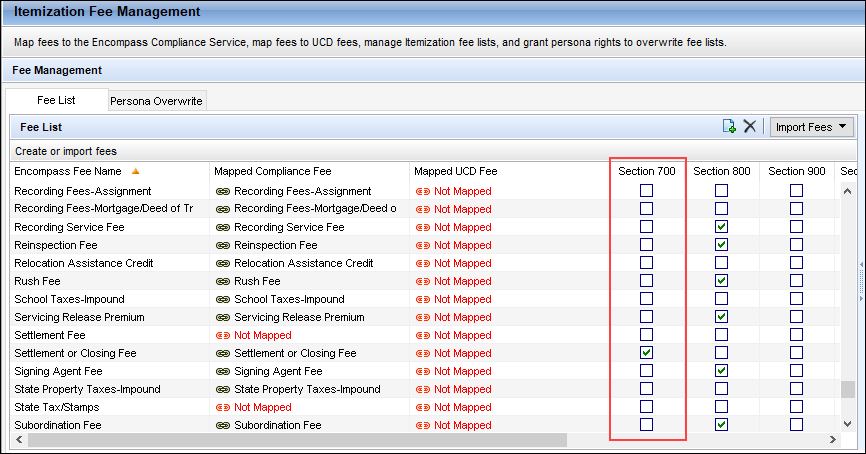

Administrators can use the Itemization Fee Management setting to create a list of predefined closing costs that users can select when completing the 2015 Itemization form (when using the 2015 RESPA-TILA forms) or the 2010 Itemization and 2010 HUD-1 forms (when using the 2010 RESPA forms). These fields can then be mapped to the appropriate fee fields in the Encompass Compliance Service. Users can then order a compliance report without requiring an administrator to map manually entered closing fees as they are added to the system. In Encompass 24.2, a new Section 700 column is now provided on the Fee List tab. Use this column to map fees to the real estate fields on line 704 of the Itemization or 2010 HUD-1 input forms. By default, none of the checkboxes in the Section 700 column are selected. Select the checkbox for the fees to provide on the line 704 dropdown list that users can then select from on the input form.

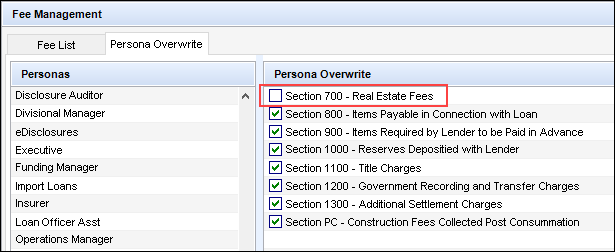

In addition, a Section 700 option has been added to the Persona Overwrite tab. You can use the options on the Persona Overwrite tab to give permission (based on persona) to users to manually enter their own fee descriptions or overwrite existing fee descriptions in these fields. (Note that the Persona Overwrite tab is accessible only to administrators who log into Encompass using the admin user ID.)

CBIZ-32081, CBIZ-58391

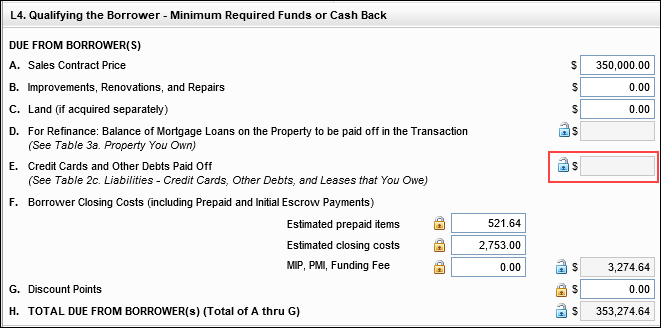

A field lock icon has been added to field URLA.X145 on Line E. Credit Cards and Other Debts Paid Off on the 1003 URLA Lender input form and 2015 Itemization input form. Prior to Encompass 22.3, this field on the 2015 Itemization input form had a field lock icon, but the field on the 1003 URLA Lender form did not, which could result in different values in the fields between the two forms. (In Encompass 22.3, the field lock was removed from field URLA.X145 on the 2015 Itemization.) Now that field URLA.X145 has a field lock icon on both forms in Encompass 24.2, the values remain consistent.

CBIZ-38567

A field Lock that authorized users can utilize to override the system-calculated value used in the field has been added to the HOEPA Status field (HMDA.X13) on the following input forms and screens:

- The Fannie Mae tab and Freddie Mac tab on the ULDD/PDD input form

- NMLS pop-up window accessed from the HMDA Information input form

- HMDA Information form in the Data Templates settings

A field lock had already been provided on the HOEPA Status field on the HMDA Information input form in earlier versions of Encompass, so this update ensures a consistent user experience on the additional input forms/screens where this field is provided.

CBIZ-38949

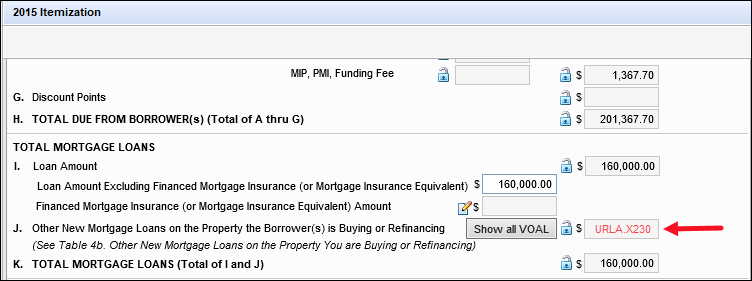

The Other New Mortgage Loans on the Property the Borrower(s) is Buying or Refinancing calculation (URLA.X230) has been updated to include the entire Loan Amount(s) (URLARAL0020) on the VOAL (Verification of Additional Liabilities) for mortgages (URLARAL0016) (i.e., not HELOCs) instead of only the amount applied to the down payment (URLARAL0022). This update has been made to help users clearly see the total loan amount, initial draw, the amount applied to the down payment, and the monthly payment.

Migration Notes:

-

For active loans (1393), the new calculation is applied to field URLA.X230.

-

For non-active loans (1393), field URLA.X230 will be locked/retained to preserve data integrity since the data may have already been reported to HMDA.

CBIZ-59784

When a HMDA repurchase date is added to the Repurchase Date field (3312) on the HMDA information input form, the year of this date is now populated to the repurchase HMDA Reporting Year field (HMDA.X92) on the HMDA Information input form's Repurchase Loans tab for data consistency.

If HMDA.X92 is locked and the user has manually entered a year, this field will not be automatically populated with the year from field 3312.

CBIZ-60739

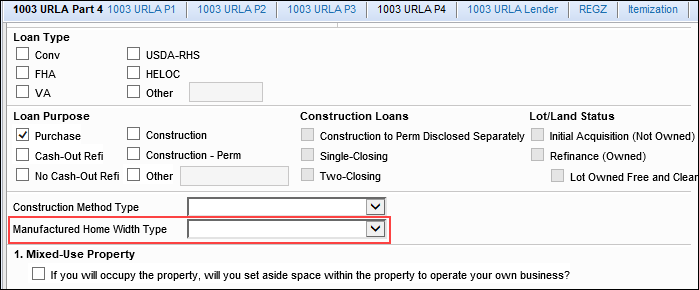

The Manufactured Home Width Type field (ULDD.ManufacturedHomeWidthType) is now available on the 1003 URLA Part 4 input form. The field was added to provide easy access to this data when submitting loans to Freddie Mac's Loan Product Advisor underwriting system. Previously this field was only provided on the ULDD/PDD input form. (It remains available on the form in Encompass 24.2.)

CBIZ-58103

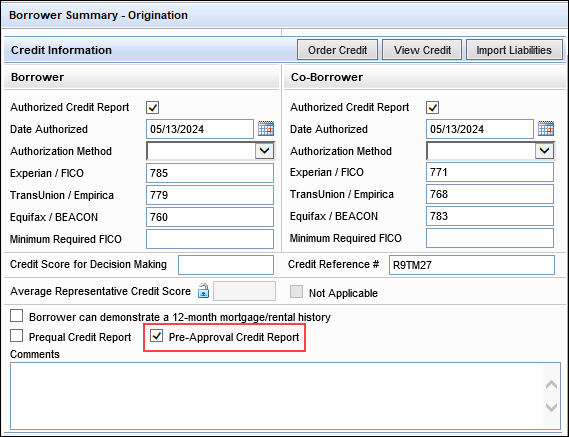

A new Pre-Approval Credit Report checkbox (5006) has been added to the Credit Information section of the Borrower Summary - Origination input form. Only the Prequal Credit Report (4750) or the new Pre-Approval Credit Report checkbox can be selected, not both. If one of these checkboxes is selected and then the other is selected, the original checkbox selection is cleared.

This new pre-approval option has been added since the prequal report cannot be used for underwriting purposes, while a preapproval can be used for underwriting and other purposes, all the way up to about 10 days before closing. This option enables lenders to use the new value to track/report on credit report information and control credit report behavior via business rules in Encompass accordingly.

CBIZ-58965

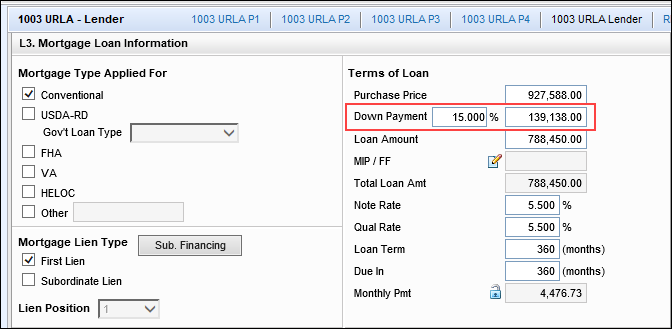

The Down Payment % (1771) and down payment dollar amount (1335) fields have been added to the 1003 URLA - Lender input form. Previously, these fields were only provided on the Borrower Summary - Origination input form. (These fields remain available on the form in Encompass 24.2.) This update was made to make the 1003 URLA - Lender form consistent with the corresponding fields provided on the Borrower Summary - Origination form.

CBIZ-58519

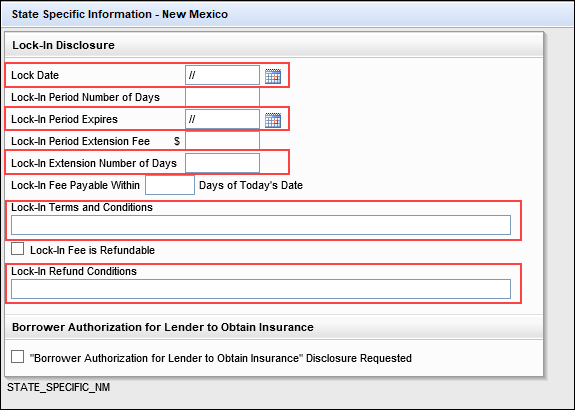

The following fields have been added to the New Mexico State Specific Information input form to enable users to fully populate the New Mexico Rate Lock disclosure included in some disclosure packages.

- Lock Date (761)

- Lock-In Period Expires (762)

- Lock-In Extension Number of Days (5002) - This is a brand-new field added to Encompass.

- Lock-In Terms and Conditions (DISCLOSURE.X277)

- Lock-In Refund Conditions (DISCLOSURE.X189)

CBIZ-57260

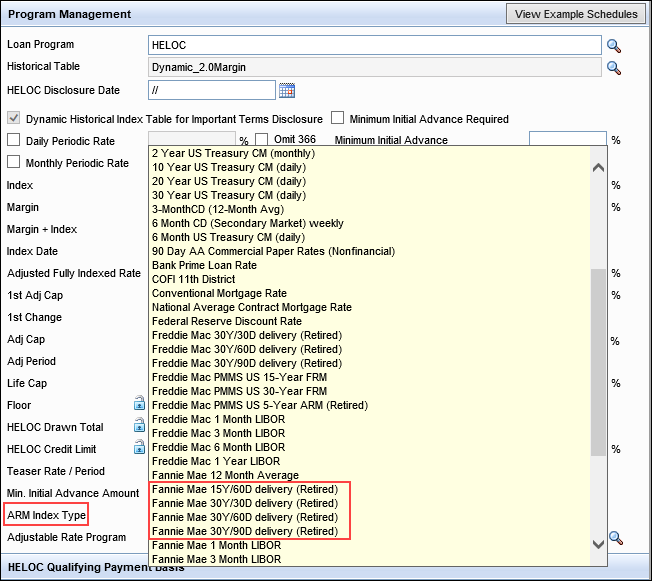

The following ARM Index options listed for field 1959 have been updated with a (Retired) indicator since Fannie Mae will no longer be supporting them. This update has also been made in the applicable ARM Index dropdown lists (LE2.X96, 4512) where these fields are provided including the RegZ-CD, RegZ-LE, HELOC Management, Closing Disclosure Page 4, and Lock Request Form input forms.

CBIZ-57059

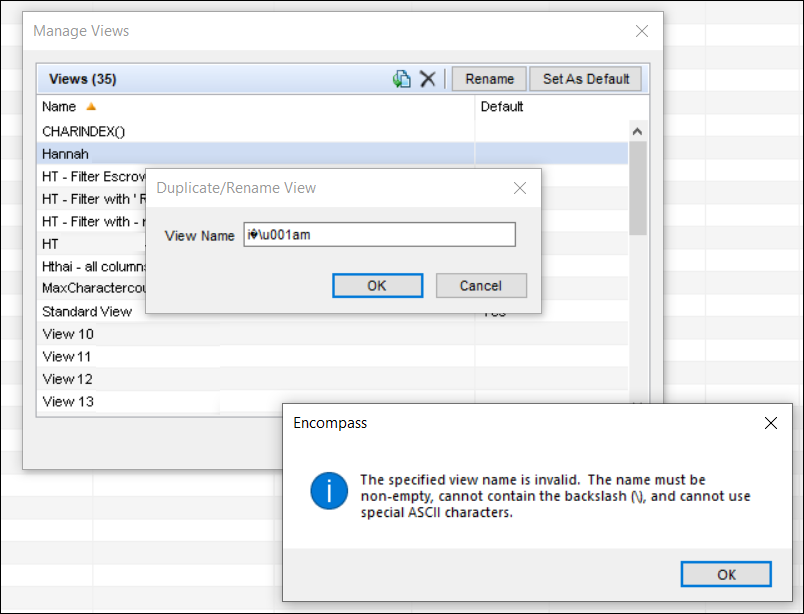

When renaming eFolder document views in the Manage Views pop-up window where a unique name may be entered, an updated error message is now provided if the document view uses ASCII characters for the name. Encompass does not support ASCII characters for eFolder document view names and this is now referenced in the error message to provide more direction for the user.

NICE-47665

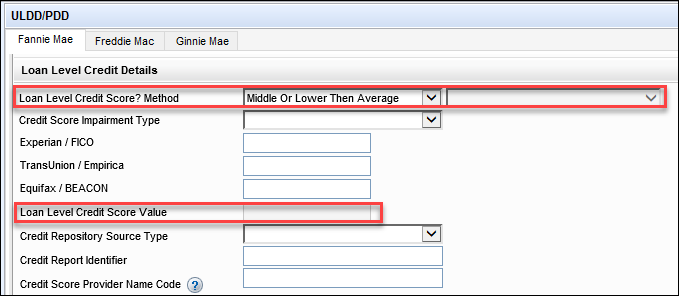

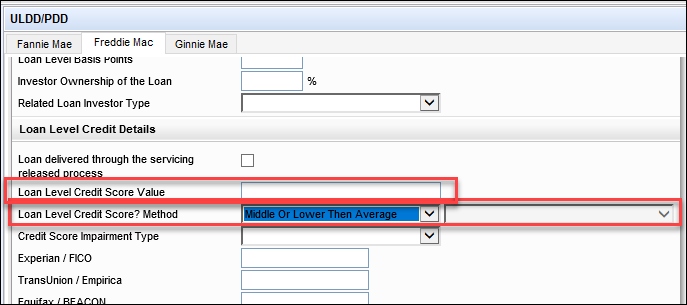

For users leveraging the iLAD import, the following fields have been added to the import file to help ensure the loan level credit score is imported:

| iLAD Data Point | Encompass Import Field | Encompass Field ID |

|---|---|---|

| LoanLevelCreditScoreSelectionMethodType | Loan Level Credit Score Method | ULDD.X102 |

| LoanLevelCreditScoreSelectionMethodTypeOtherDescription | Loan Level Credit Score “Other” Method Description | ULDD.X103 |

| LoanLevelCreditScoreValue | Loan Level Credit Score Value | VASUMM.X23 |

The iLAD is a collection of loan application data based on MISMO v3.4 that includes all the data in the ULAD Mapping Document and the GSE AUS Specifications. iLAD also includes additional origination data points requested by the industry that may be needed for exchange of loan information.

CBIZ-59691

(Added on 7/23/2024)

In previous versions of Encompass, the Document Custodian ID field (ULDD.X114) and the Servicer ID field (ULDD.X116) were provided on both the Fannie Mae and Freddie Mac tabs of the ULDD/PDD form. In Encompass 24.2, new Freddie Mac-specific versions of each of these fields are now used on the Freddie Mac tab instead: the Document Custodian ID field (ULDD.FRE.DocumentCustodianId) and the Servicer ID field (ULDD.FRE.ServicerId). Having GSE-specific versions of these fields benefits users submitting to both Early Check and LQA as now they won't have to update the field for Document Custodian ID and Servicer ID each time they submit an order.

CBIZ-58970

The Validate Export button has been removed from the Ginnie Mae tab on the ULDD/PDD input form. The button provided outdated functionality and was no longer valid for this form.

CBIZ-57327

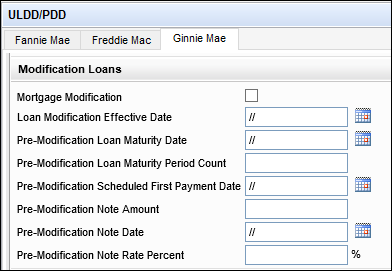

A new Modification Loans section has been added to the Ginnie Mae tab on the ULDD/PDD input form. In addition, the following pre-modification fields have been added to this section:

- Pre-Modification Loan Maturity Date (ULDD.X201)

- Pre-Modification Loan Maturity Period Count (ULDD.X202)

- Pre-Modification Scheduled First Payment Date (ULDD.X203)

- Pre-Modification Note Amount (ULDD.X204)

- Pre-Modification Note Date (ULDD.X205)

- Pre-Modification Note Rate Percent (ULDD.X206)

CBIZ-59226

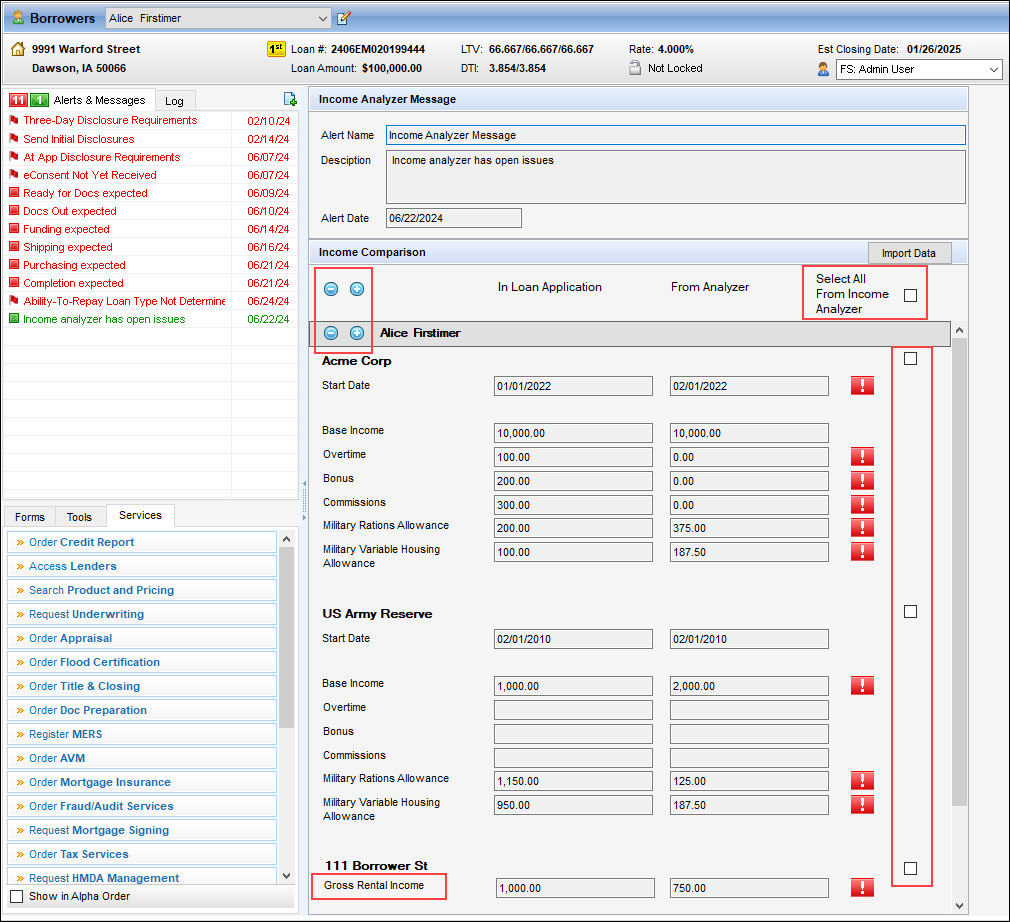

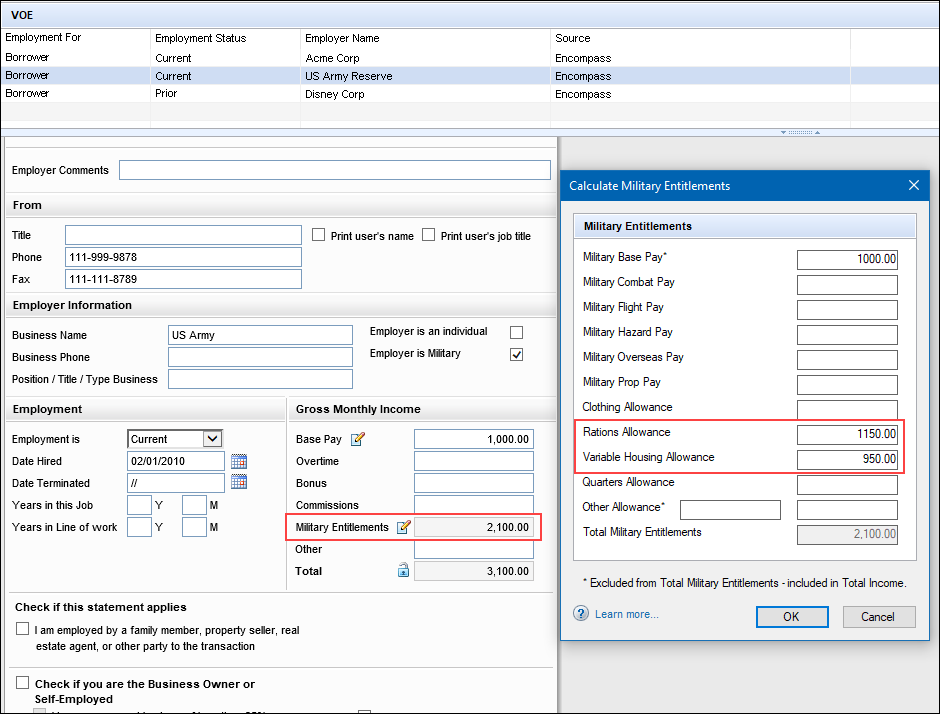

For ICE Mortgage Analyzers users, when file attachments for income-related documents are imported into a loan the Income Analyzer scans the data in the attachments and compares it to the data in the Verification of Employment (VOE) income records in the loan. A green message notification is generated when the Income Analyzer has finished analyzing the data. Encompass users can click the green Income Analyzer message to open the message details shown below where they can compare and reconcile any income data differences between the document attachments and the VOE records. In Encompass 24.2 several enhancements have been made to the Income Comparison section of the Income Analyzer Message screen:

-

The three columns of data have been updated to display employment and other income (new) in column one, the corresponding Encompass loan data in column two, and the corresponding data from Income Analyzer in column three.

-

The tabs options to display income information for each borrower has been replaced with dedicated expandable panels for each borrower, co-borrower, and both (for combined income).

-

New expand and collapse icons are now provided which users can click to expand (+) and collapse (-) each borrowers' income panel displayed on the screen. Use the icons provided at the very top of the Income Comparison section to expand and collapse all of the borrowers' income panels that are listed.

-

A checkbox is provided to the right of each income category. Select the checkbox for the category to import. You can select all categories at once by selecting the new Select All From Income Analyzer checkbox at the top of the section.

-

Additional types of income data are now listed, including military rations allowance, military variable housing allowance, gross rental income, alimony, and child support.

As part of these enhancements, the applicable verification input forms have been updated:

-

The Verification of Other Income (VOOI) input form has been updated with five new options listed in the Income Source dropdown list: Alimony, Child Support, Tip Income, Defined Contribution Plan, Pension.

-

The Verification of Employment (VOE) input form has been updated with two new military entitlements to support the new data fields added to the Income Comparison section of the Income Analyzer Message: Rations Allowance and Variable Housing Allowance.

-

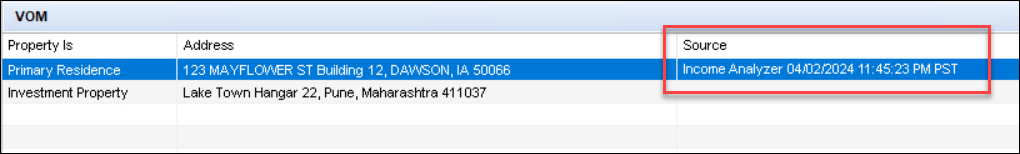

A new Source column is now provided on the VOOI and Verification of Mortgage (VOM) input forms to indicate if the record was manually added by a user (Encompass) or if the record was imported to Encompass through the Income Analyzer (Income Analyzer). Records for VOM are used to populate the Gross Rental Income data in the Income Analyzer Message's Income Comparison section.

-

A new (hidden) date/time field (5022) has been added to the Encompass Reporting Database to capture each time income data is imported to Encompass by a user or through automation. When a user clicks the Import Data button on the Income Analyzer Message, the system populates the current system UTC date and time to the field. This field is a virtual field not visible on any Encompass input screens.

CBIZ-57131, CBIZ-59165, CBIZ-59059, CBIZ-56597

(Updated on 7/12/2024)

In Encompass 24.1 we introduced the new policy of not displaying archived loans in the Encompass Pipeline by default. As part of that update, an Include Archive Loans checkbox was provided on the Pipeline and a loan-level Archived checkbox (5016) was provided for users to manage when the archived loans were displayed as well as if the loan was archived or not. In Encompass 24.2, these archive options are now available via API calls provided in Encompass Developer Connect. These options are also available in the Encompass SDK. These loan archive options are also now available in the web version of Encompass 24.2, with archived loans now hidden by default just as they are in the desktop version of Encompass.

For API and Encompass SDK users:

Starting in Encompass 24.2, all Pipeline queries will now exclude archived loans by default. In order to access archived loans through these queries, the user must have persona access to view archived loans, and the API or SDK call should contain the includeArchivedloans: query parameter (when using APIs) or excludeArchivedLoans (when using SDK). Both parameters are boolean but the API parameter is an INCLUDE true/false whereas the SDK parameter is an EXCLUDE true/false.

Please refer to KA #000115574 for more detailed information and code examples for including or excluding archive loans via API and SDK.

NICE-47116, EBSP-54758

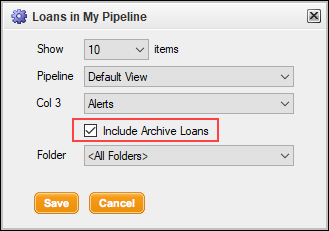

In Encompass 24.1 we introduced a new approach to help optimize Encompass Pipeline loading performance where archived loans are no longer displayed in the Pipeline by default. For users that want to view archived loans, they can select the new Include Archive Loans checkbox at the top of the screen to include these loans in the Pipeline. In Encompass 24.2, additional updates have been made so that archived loans and archive loan folders are not included in the Loans in My Pipeline and other Home page modules by default. In addition, updates have been made to the settings in Dashboards and Reports to enable users to exclude archive loans.

Home Page Modules:

Users (with the required Personas permission) can select the Include Archive Loans checkbox for the following modules to include archive loans and archive folders in these locations (since this checkbox is not selected by default).

| Home Page Modules with New Include Archive Loans Preference Option | |

|---|---|

| Average Days for Loans to be Completed | Loans with a Payment Due Soon |

| Borrowers with ARMs Due | Loans with Alerts |

| Completed Loans | Long Loans |

| Completed Loans by Type | Number of Loans at Each Milestone |

| Completed Loans by User | Pull-Through Rate by User (Highest) |

| Loans by Completion Expected Date | Pull-Through Rate by User (Lowest) |

| Loans by Date | Recently Completed Loans |

| Loans by Milestone | Recently Viewed Loans |

| Loans by Rate Lock Expiration Date | Top Loan Sources |

| Loans Completed in the Last Month | Top Referral Sources |

| Loans in My Pipeline | |

When users want to see archive loans and folders in the Loans in My Pipeline Home page module, they must select the Include Archive Loans checkbox and then re-select the archive folder from the Folder dropdown list.

Loan in My Pipeline Home Page Module Preferences screen

Note that the Include Archive Loans checkbox option on the Pipeline has no impact on whether or not archive loans/folders are included in a Home page module. For example, a user can elect to include the archive loans in the Pipeline, but not include them in the Loans in My Pipeline module. In addition, the Persona settings for the Pipeline > Access to Archive Folders and Access to Archive Loans also determines the user's access to the module's Include Archive Loans checkbox.

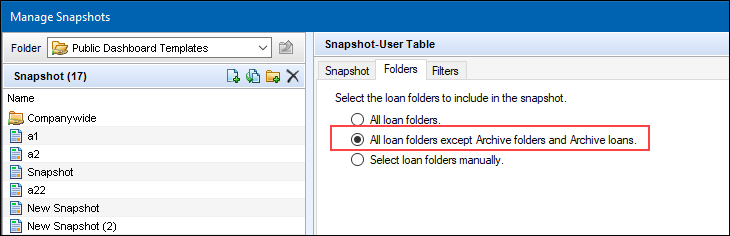

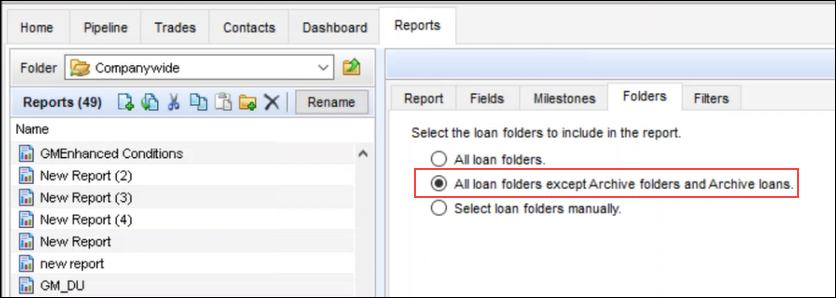

Dashboard and Reports:

When managing the queries for the Dashboard snapshot settings and the Reports settings, users can now select the All loan folders except Archive folders and Archive loans option to exclude archive folders and archive loans in active loan folders. In earlier versions of Encompass, this option only applied to archive folders. The label for this option, and the accompanying functionality to exclude archive loans, has been added in Encompass 24.2.

Manage Dashboard Snapshots

Reports Settings

Note that the Persona settings for the Pipeline > Access to Archive Folders and Access to Archive Loans are not enforced for these Dashboard settings and the Report settings. However, if the user does not have access to a loan in a folder, they will not be able to run a report on that folder. This is existing functionality.

NICE-48459, NICE-48851, NICE-48463, NICE-48782, NICE-48784

When a loan is moved from an archive folder to an active or different archive folder, Encompass now retains the state of the loan prior to when the loan was originally moved to the archive folder. The state of the loan is based on the loan-level Archived checkbox (5016). If the checkbox is selected, the loan is archived. If the checkbox is not selected, the loan is active. To help clarify this new behavior, here are two example scenarios:

Scenario 1:

You have an active loan in an active folder. You then move it to an archive folder. This changes the state of the loan from active to archived. If you then move this loan from the archive folder to an active folder, the loan will return to its original state which, in this case, is active.

In Encompass 24.1, this loan would still be considered archived when it was moved out of the archive folder. Now in Encompass 24.2, this loan is considered active when it is moved from the archive folder to an active folder.

Scenario 2:

You have an archived loan in an active folder. You then move it to an archive folder. This state of the loan remains as archived since it was moved to an archive folder. If you then move this loan from the archived folder back to an active folder, the loan remains as archived since this was the original state of the loan prior to it being moved from the active folder.

Note also that if a loan is created or saved in an archive folder, it will remain as archived when moved out to an active folder.

NICE-49457

Updates have been made to enable correspondent lenders to document loans that used a remote online notary (RON) and help them identify the loans that have specific requirements to be met before purchasing the loan. The following fields are now provided on the Correspondent Loan Status tool and ULDD/PDD input form (Fannie Mae and Freddie Mac tabs):

-

[New field] Remote Online Notary (5004) - Dropdown field to select Yes or No to indicate if loan is using remote online notary.

-

eNote Indicator (ULDD.X196) - Checkbox to indicate an eNote is used as part of the loan

-

eNote Authoritative Copy (4728) - [Added to Correspondent Loan Status tool only.] Dropdown field to select Yes or No to indicate if the loan is using the single enforceable, Authoritative Copy of an eNote and not a Non-Authoritative or retained copy of an eNote that has been stored.

CBIZ-56771

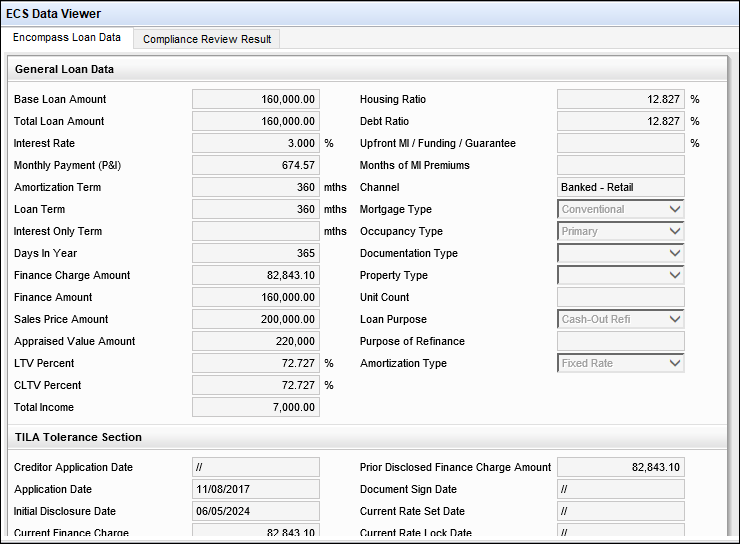

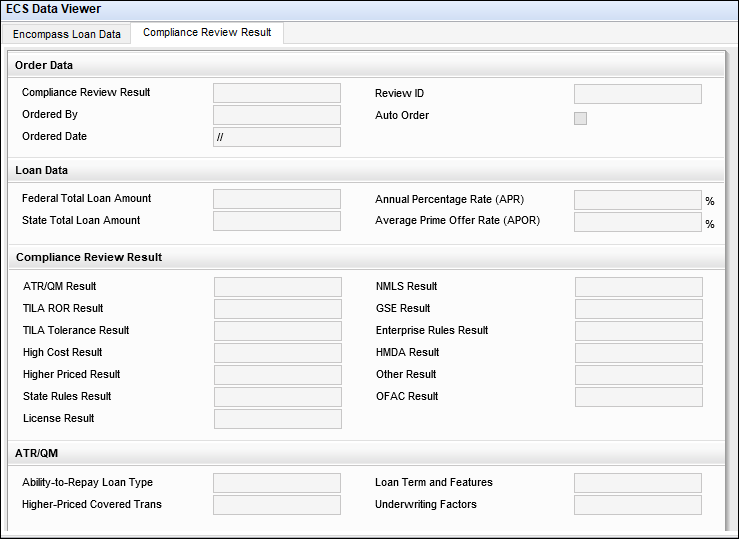

The ECS Data Viewer tool, where you can view data in fields that are sent to the Encompass Compliance Service (ECS) for compliance reviews, has been updated to also display the compliance review results imported from ECS.

The Encompass Loan Data tab displays the existing loan data that is sent to ECS (read-only). (This is the same data that was provided in this tool in previous versions of Encompass.) The Compliance Review Result tab displays the resulting data returned (imported) from the latest ECS compliance review (read-only).

The Compliance Review Result tab consists of fields that already existed in previous versions of Encompass. Equivalent versions of these fields to support correspondent lenders who may receive a compliance review result that they can import via iLAD into Encompass are being introduced in Encompass 24.2. These correspondent fields retain the iLAD data and keep the ECS review result data separate from the ECS review result data provided on the Compliance Review Result tab.

These correspondent fields are not provided on any standard Encompass forms but are available in the Encompass Reporting Database and may be added to custom input forms. The MISMO 3.4 import file has been updated with these fields as well. These new correspondent fields are listed below:

| Encompass Field Name | Field ID | Data Element for iLAD/MISMO 3.4 |

|---|---|---|

| Compliance Review Result | CORRESPONDENT.X506 | ICE:ComplianceReviewResult |

| Ordered By | CORRESPONDENT.X507 | ICE:OrderedBy |

| Ordered Date | CORRESPONDENT.X508 | ICE:OrderedDate |

| Review ID | CORRESPONDENT.X509 | ICE:ReviewID |

| Auto Order | CORRESPONDENT.X510 | ICE:AutoOrder |

| Federal Total Loan Amount | CORRESPONDENT.X511 | ICE:FederalTotalLoanAmount |

| State Total Loan Amount | CORRESPONDENT.X512 | ICE:StateTotalLoanAmount |

| Annual Percentage Rate (APR) | CORRESPONDENT.X513 | ICE:AnnualPercentageRate |

| Average Prime Offer Rate (APOR) | CORRESPONDENT.X514 | ICE:AveragePrimeOfferRate |

| ATR/QM Result | CORRESPONDENT.X515 | ICE:ATRQMResult |

| TILA ROR Result | CORRESPONDENT.X517 | ICE:TILARORResult |

| TILA Tolerance Result | CORRESPONDENT.X518 | ICE:TILAToleranceResult |

| High Cost Result | CORRESPONDENT.X519 | ICE:HighCostResult |

| Higher Priced Result | CORRESPONDENT.X520 | ICE:HigherPricedResult |

| State Rules Result | CORRESPONDENT.X521 | ICE:StateRulesResult |

| License Result | CORRESPONDENT.X522 | ICE:LicenseResult |

| NMLS Result | CORRESPONDENT.X523 | ICE:NMLSResult |

| GSE Result | CORRESPONDENT.X524 | ICE:GSEResult |

| Enterprise Rules Result | CORRESPONDENT.X525 | ICE:EnterpriseRulesResult |

| HMDA Result | CORRESPONDENT.X526 | ICE:HMDAResult |

| Other Result | CORRESPONDENT.X527 | ICE:OtherResult |

| OFAC Result | CORRESPONDENT.X528 | ICE:OFACResult |

| Ability-to-Repay Loan Type | CORRESPONDENT.X529 | ICE:ATRLoanType |

| Higher-Priced Covered Trans | CORRESPONDENT.X530 | ICE:HigherPricedCoveredTrans |

| Loan Term and Features | CORRESPONDENT.X531 | ICE:LoanTermFeatures |

| Underwriting Factors | CORRESPONDENT.X532 | ICE:UnderwritingFactors |

| QM Loan Type | CORRESPONDENT.X533 | ICE:QMLoanType |

| QM Eligible | CORRESPONDENT.X534 | ICE:QMEligible |

| QM Points and Fees Total | CORRESPONDENT.X535 | ICE:QMPointsAndFeesTotal |

| QM Points and Fees Limit | CORRESPONDENT.X536 | ICE:QMPointsAndFeesLimit |

| QM Price-Based Limit | CORRESPONDENT.X537 | ICE:QMPriceBasedLimit |

| Finance Charge Fees | CORRESPONDENT.X538 | ICE:FinanceChargeFees |

| Finance Charge Amount | CORRESPONDENT.X539 | ICE:FinanceChargeAmount |

| Real Estate Related Fees | CORRESPONDENT.X540 | ICE:RealEstateRelatedFees |

| Discount Point Fees | CORRESPONDENT.X541 | ICE:DiscountPointFees |

| Upfront PMI | CORRESPONDENT.X542 | ICE:UpfrontPMI |

| Max Prepayment Penalty | CORRESPONDENT.X543 | ICE:MaxPrepaymentPenalty |

| Prepayment Penalty Payoff | CORRESPONDENT.X544 | ICE:PrepaymentPenaltyPayoff |

| Credit Related Ins Premium | CORRESPONDENT.X545 | ICE:CreditRelatedInsPremium |

| Broker Compensation | CORRESPONDENT.X546 | ICE:BrokerCompensation |

| Fees Paid to Affiliates | CORRESPONDENT.X547 | ICE:FeesPaidToAffiliates |

Accordingly, the iLAD / MISMO 3.4 import supported by Encompass has been updated to include these new fields.

CBIZ-56915, CBIZ-57286, CBIZ-57560

Fields have been added to capture valuation data used by correspondent lenders to provide support for multiple appraisals, ordering, and data persistence at an order level and workflow support at an order level. The following new fields are now part of the existing Correspondent Appraisal Valuation collection that enables Encompass Partner Connect to support this workflow. These fields are not visible on existing Encompass forms but can be added to custom input forms and are available in the Encompass Reporting Database.

| Encompass Field Name | Field ID |

|---|---|

| Effective Age | VAL00A001 |

| Acreage Area Description | VAL00A002 |

| Acreage Value | VAL00A003 |

| Certification License Type | VAL00A004 |

| CMS GAAR Score | VAL00A005 |

| COOP Number of Shares | VAL00A006 |

| COOP Monthly Maintenance Fee or Assessment | VAL00A007 |

| COOP Shares Issued and Outstanding | VAL00A008 |

| COOP Pro Rata Share of Each Lien | VAL00A009 |

| COOP Pro Rata Share Financing | VAL00A010 |

| CU Score | VAL00A011* |

| Estimated Cost Amount | VAL00A012 |

| Gross Building Area Square Feet Count | VAL00A013 |

| HOA Dues Amount | VAL00A014 |

| HOA Dues Period | VAL00A015 |

| Improvement or General Description | VAL00A016 |

| LCA Score | VAL00A017 |

| Leasehold Indicator | VAL00A018 |

| Lender/Client Name | VAL00A019 |

| License State | VAL00A020 |

| Occupancy Data | VAL00A021 |

| Project Design Type | VAL00A022 |

| Property Value Trend Type | VAL00A023 |

| Rural Property Neighborhood Location Type | VAL00A024 |

| Supervisor License Type | VAL00A025 |

| Tax Amounts | VAL00A026 |

| Appraisal Is Made | VAL00A027 |

| Valuation Received by Customer | VAL00A028 |

| Valuation Received by LOS | VAL00A029 |

| Valuation Sent to Customer | VAL00A030 |

| Customer Price | VAL00A031 |

| Vendor Fee | VAL00A032 |

*The CU Score field (VAL00A011) is currently an integer field. This field will be converted to a decimal field (where the number entered in the field will be rounded to two decimal places) in a future Encompass release.

CBIZ-59218, CBIZ-60608

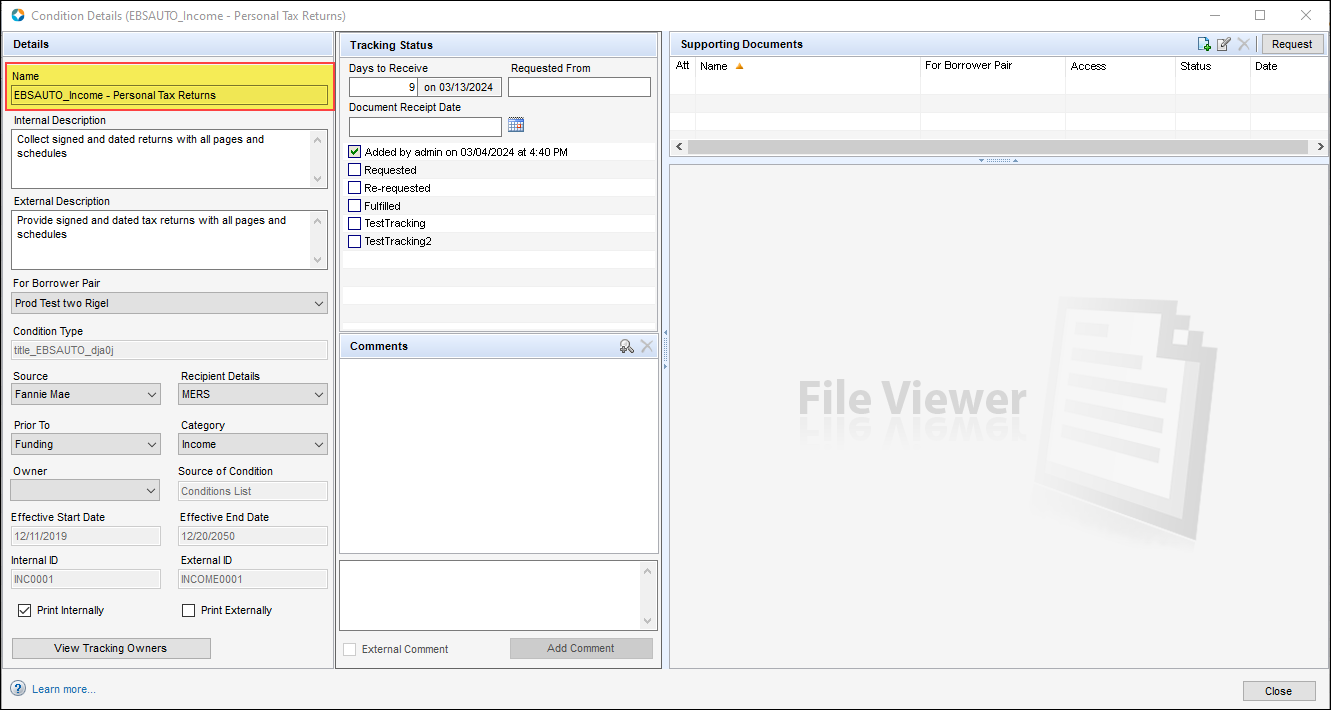

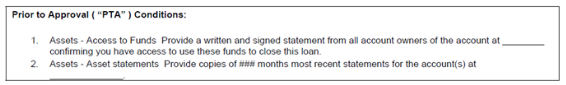

For enhanced conditions, the Condition Name field's character limit has been increased from 128 to 255 characters. This field has been updated to use this limit in the following locations:

- Conditions View screen (eFolder)

- Condition Details pop-up (eFolder)

- Add Conditions: Conditions List pop-up (eFolder)

- Add Conditions From Condition Set pop-up (eFolder)

- Add Blank Condition pop-up (eFolder)

- Condition Sets pop-up (Closing Conditions form)

Sample: Condition Details modal (eFolder)

CBIZ-58978, NICE-45898

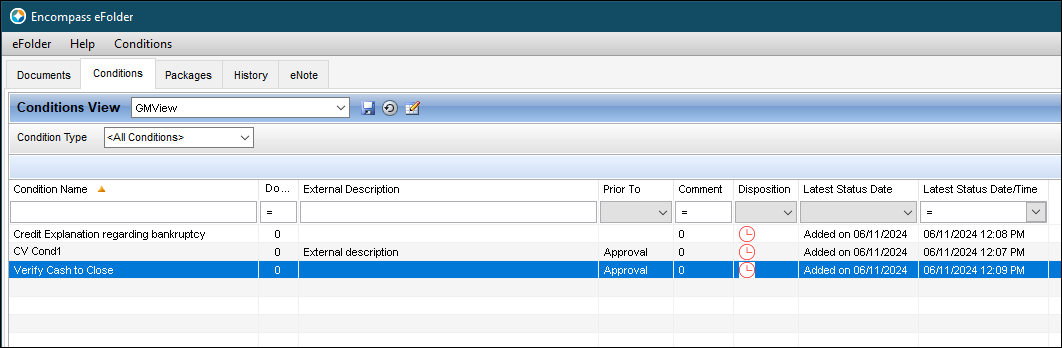

To make it easier to locate a new enhanced condition that's been added to the Conditions tab in the eFolder, the condition is now highlighted in blue. Previously, only newly added standard conditions were highlighted.

CBIZ-58903

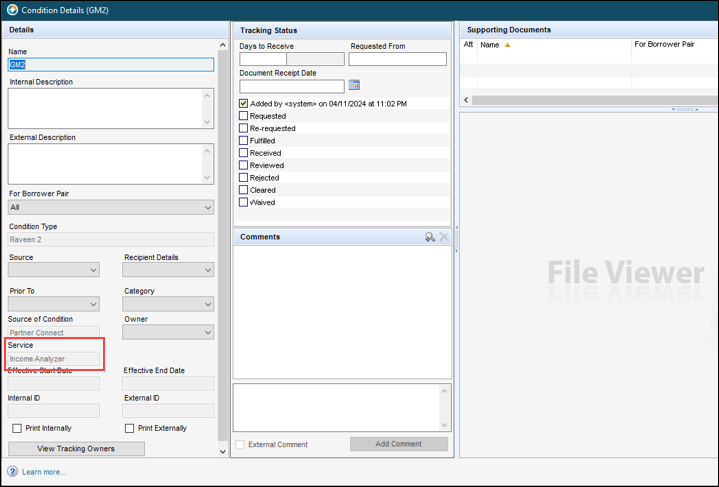

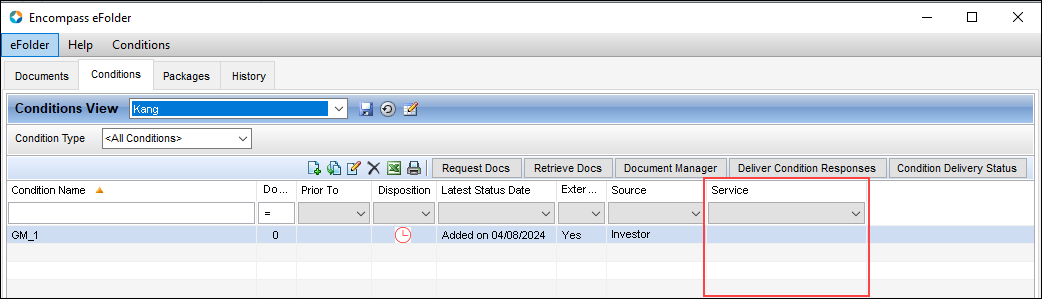

The read-only Partner field on the Enhanced Condition Details pop-up window has been renamed to Service. Note that this field is only visible when the source of the enhanced condition is Partner Connect, and there is a value populated for the partner as configured in Encompass Partner Connect.

In addition, the corresponding column name in the Conditions View screen in the eFolder has been updated. Note that this column is not part of the standard view, but it can be added by right-clicking a column header, selecting Customize Columns, and then selecting the Service column.

CBIZ-59440

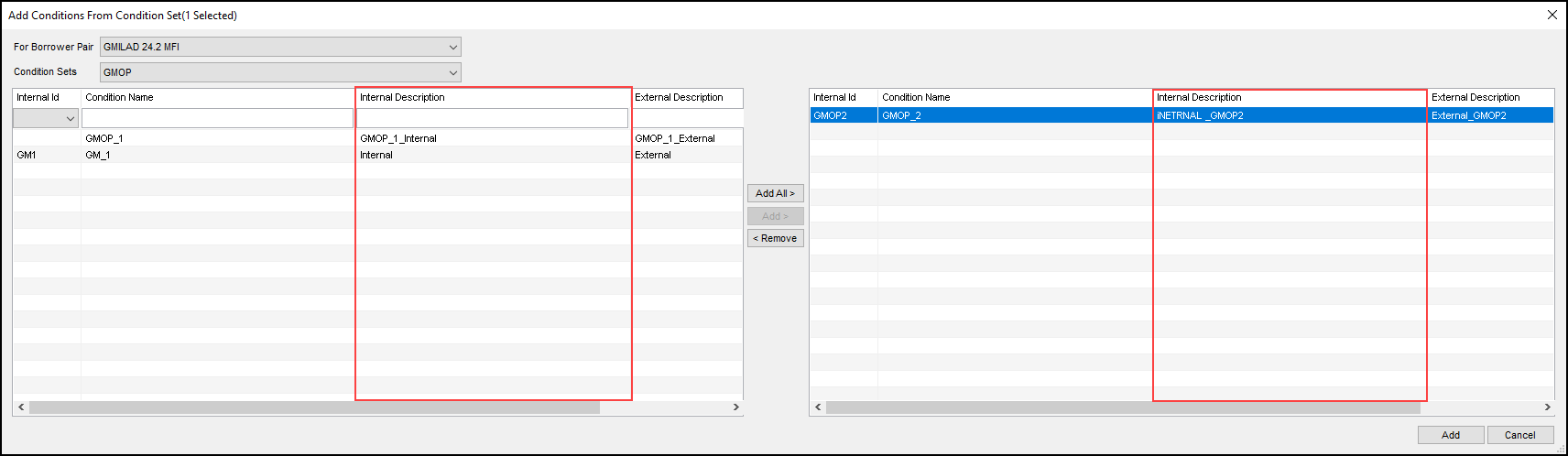

A new Internal Description column has been added to the following enhanced condition pop-up windows:

- Add Conditions: Conditions List pop-up (eFolder)

- Add Conditions From Condition Set pop-up (eFolder)

- Condition Sets pop-up (Closing Conditions form)

The internal description verbiage is managed in the eFolder Setup > Enhanced Conditions setting in Encompass Settings.

Sample: Add Conditions From Condition Set

CBIZ-59436

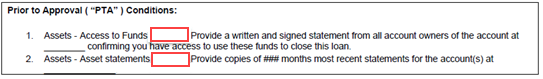

The space between the condition name and external description for enhanced conditions that are printed on output forms has been reduced to help improve readability and reduce the number of form pages that are printed.

Before:

After:

CBIZ-57344

When viewing enhanced condition information in the Condition Details screen, the tabbing order (i.e., the fields where the cursor goes each time the user presses the Tab button) has been updated to proceed in a logical order (top to bottom, left to right). Users can click the Tab button to advance from the top to the bottom of the Details section of the Conditions Details screen, over to the Tracking Status section, and then the Comments section.

CBIZ-59637

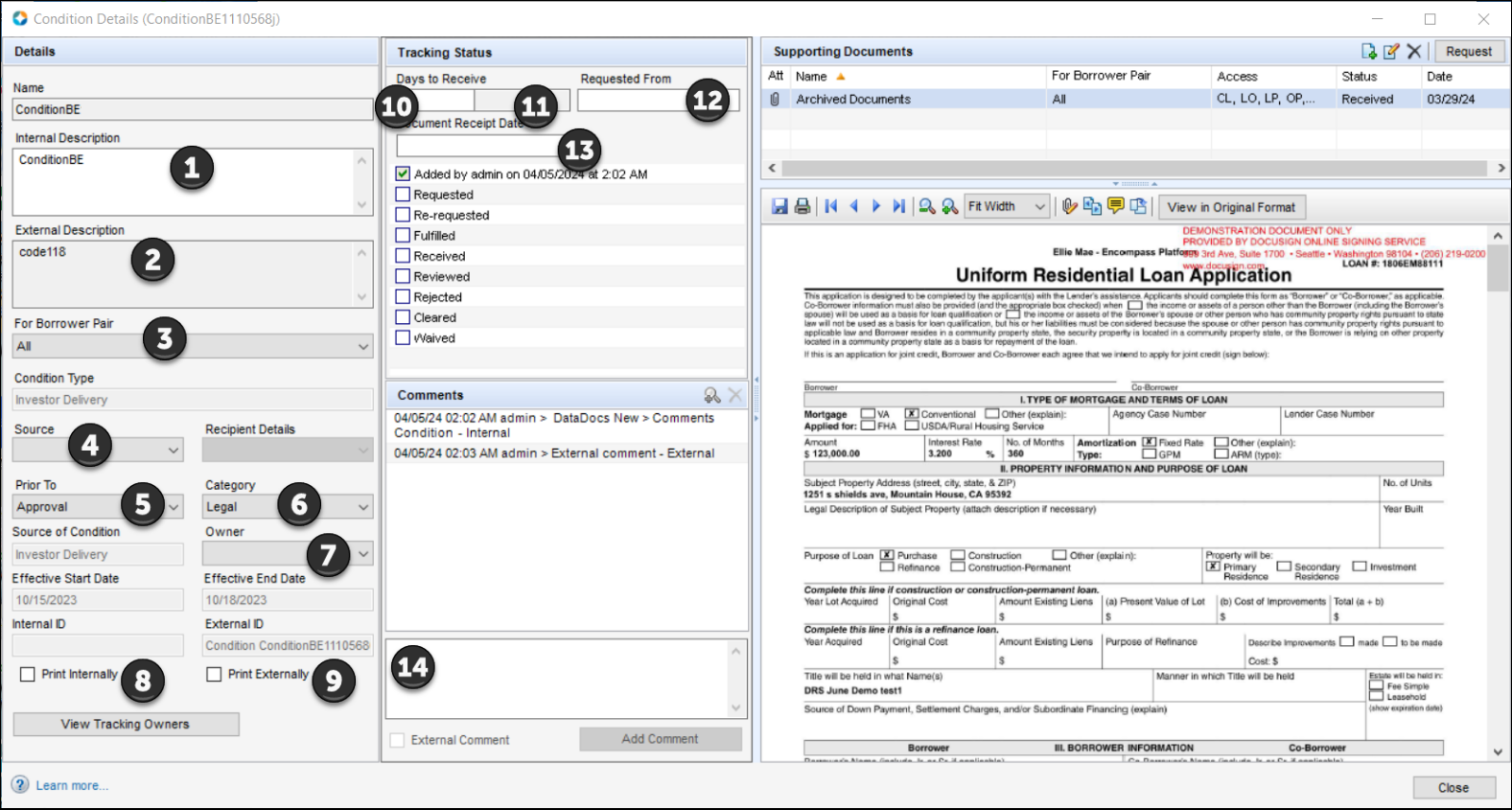

In Encompass 22.1.0.1 Server Patch 1, the formatting used when populating data from enhanced condition virtual fields to custom printed output forms was updated to use the following formatting:

sequence number + log.status + internal/external description

Example:

1. Added External Description for Prior To Close ID1

In addition, Encompass is configured to not add a number to every single line of the resulting output on the printed form. A new sequential number is added only for each condition, not each line in each condition. For example:

-

Deductible must be no greater than 5% of the property insurance coverage amount. Coverage amount must be equal to the lesser of: 100% of the replacement cost value of the improvements; or the unpaid principal balance of the loan, provided it equals no less than 80% of the replacement cost of the improvements.

-

Closing: Closing Protection Letter

Closing Protection Letter from title company:

AAA Bank

PO Box 4444

Orange, CA 92857

However, when the custom print forms are printed, Microsoft's numbering function adds a number to each separate line because of the carriage return and line break in the condition description. It functions similarly to when you use numbering for each item; upon hitting return, Word automatically adds the next number for the next line. Microsoft's MailMerge feature will also add the next sequential number whenever there is a separate line if users add a number with the virtual field. This would result in an extra/duplicate number being added to each enhanced condition output item.

To prevent the Microsoft auto-numbering from applying a number, there is nothing to change in Encompass. Instead, the AutoCorrect Options in Microsoft Word must be modified.

To prevent the Microsoft auto-numbering from applying a number, in Microsoft Word, navigate to File > Options > Proofing > AutoCorrect Options. There, select the AutoFormat As You Type tab, and then clear the Automatic numbering lists option as shown below. When finished, click OK.

CBIZ-59463

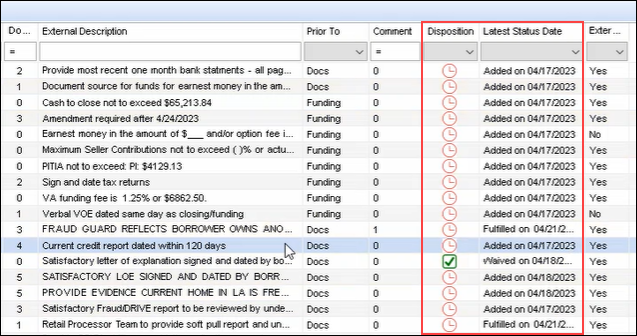

An issue occurred when using the enhanced conditions where, after updating the Tracking Status section of a condition with a new status, the Latest Status Date column on the Conditions tab in the eFolder was then not always reflecting the latest status. As a result, the Disposition status was also not reflected accurately. This issue occurred intermittently, typically after changing the tracking status multiple times in a short period of time. This issue has been addressed, and the information in the Latest Status Date and Disposition columns now refreshes to display the correct status consistently as expected.

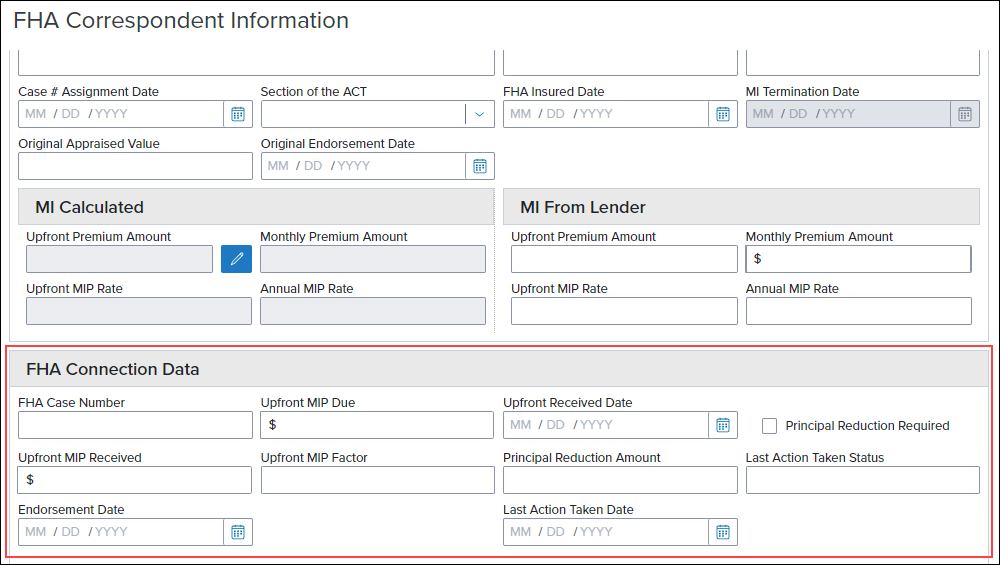

The following new FHA Correspondent fields have been added to the Encompass Reporting Database. These fields are not displayed on any forms or tools in the desktop version of Encompass. They have been added to the Encompass Reporting Database only to support functionality in the web version of Encompass where these fields are provided on the FHA Correspondent Information input form.

- FHA Case Number (CORRESPONDENT.X433)

- Upfront MIP Due (CORRESPONDENT.X548)

- Upfront MIP Received (CORRESPONDENT.X549)

- Upfront MIP Factor (CORRESPONDENT.X13)

- Upfront MIP Factor Other (CORRESPONDENT.X550) - This field does not display on the form.

- Upfront Received Date (CORRESPONDENT.X551)

- Principal Reduction Required (CORRESPONDENT.X552)

- Principal Reduction Amount (CORRESPONDENT.X553)

- Last Action Taken Status (CORRESPONDENT.X554)

- Endorsement Date (3432)

- Last Action Taken Date (CORRESPONDENT.X555)

Web Version of Encompass

Two new mortgage insurance (MI) fields have been added to the Encompass Reporting Database. These fields are not displayed on any forms or tools in the desktop version of Encompass. They have been added to the Encompass Reporting Database only to support functionality of the MI Center in the web version of Encompass. This integration provides an enhanced integration with all supported MI providers for a more streamlined mortgage insurance ordering process.

- MI Rate Quote ID (5023)

- Product Description (5024)

CBIZ-58884

eFolder Updates

(Added on 7/23/2024)

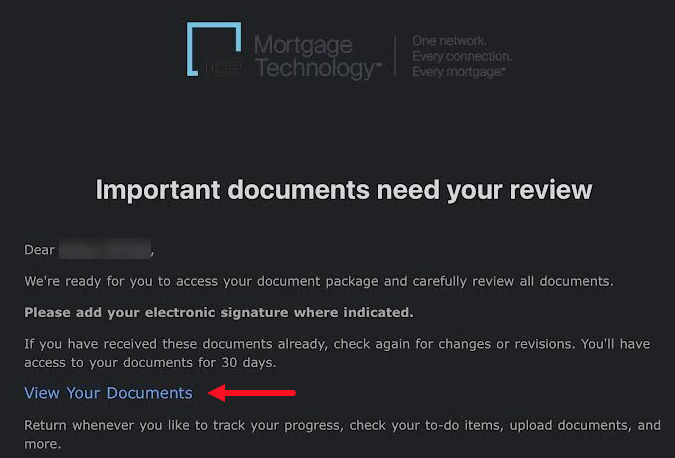

To help improve the visibility of the View Your Documents hyperlink that is provided in email messages sent to borrowers when there are electronic loan documents available for them to review or other requested actions are needed, the default email template in Encompass has been updated to remove the 'button' attribute from this link so that it displays in plain text instead of against a blue button.

(Added on 7/23/2024)

The eFolder's Document Viewer now supports hyperlinks. Hyperlinks contained in attachments presented in the Document Viewer can be clicked to navigate within the attachment or external to the attachment. Previously, the hyperlinks were displayed as plain text and could not be clicked. Internal links (i.e., links that take you to a location within the same file) and external links (i.e., links that take you to a location outside of the file, like a website) are both supported.

(Added on 8/8/2024)

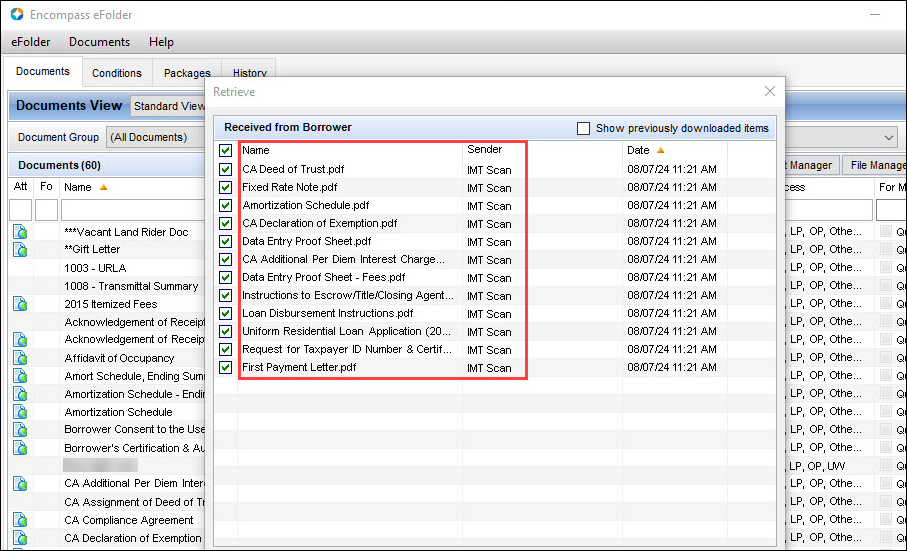

After retrieving fax documents or scanned files imported from the Scan Document Uploader into the eFolder, the following updates have been introduced to the Retrieve pop-up window in Encompass 24.2:

-

Automatic delivery recognition is applied to the documents (for both manual and auto retrieve) and the name of the associated document is displayed in the Name column. Previously, a generic name like 2 pages of Scanned Document was displayed in the Name column.

-

The documents are split into distinct groups of documents based on delivery recognition.

-

The Sender of the documents is now indicated as IMT Scan. Previously, the borrower name was displayed in this column.

DOCP-55533, DOCP-63747

(Added on 8/16/2024)

ICE Mortgage Technology is continually upgrading systems and applications to adhere to current industry security standards and protocols to protect our clients' data. As such, a new file size limit of 6MB will now be enforced for HTML files in Encompass.

Any HTML file being uploaded to Encompass by any means (for example, borrower returned documents, via a Partner integration, as part of an Encompass Consumer Connect loan application, etc.) cannot exceed 6MB or the upload will fail.

Encompass eClose

(Added on 7/23/2024)

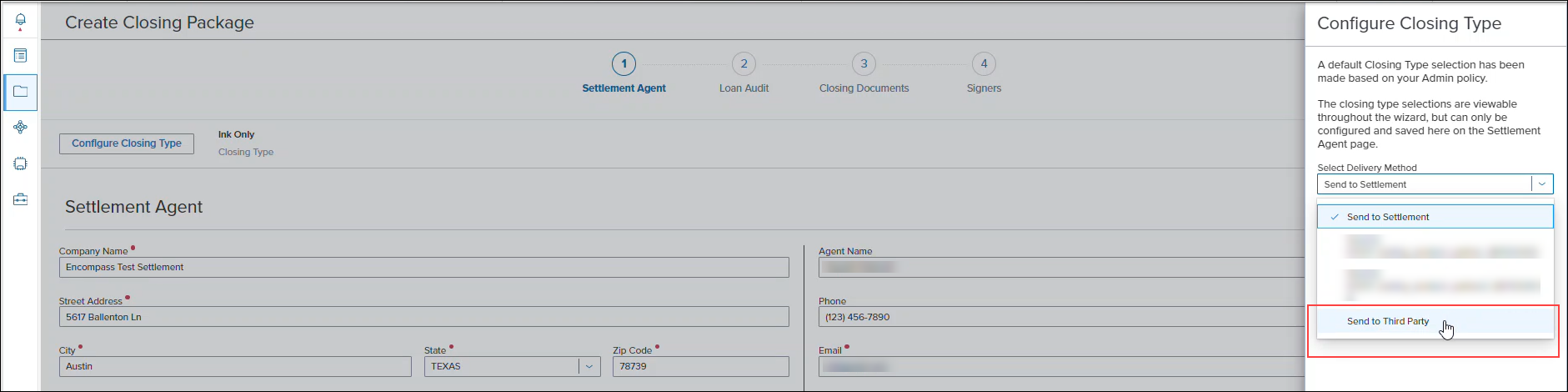

When utilizing Encompass eClose, users with the required permission (via persona) can now send documents to Loan Connect where it can be retrieved by a third party within the eClose workflow.

In the desktop version of Encompass, the eClose button and Order Docs button are provided separately, with Order Docs being used for a traditional closing (i.e., the disclosure package is emailed to a third party and all documents are wet signed). In the web version of Encompass 24.2, the Order Docs and eClose functionality is merged, giving clients the ability to utilize the original closing package and eClose workflows within a single application in the eFolder in Encompass.

Now as you are eClosing a loan, authorized users can use the Send to 3rd Party option to send documents to a third party (i.e., on to Loan Connect where the recipient can retrieve the documents). The other Send Delivery Method options provided in earlier versions of Encompass are still provided along with this new option.

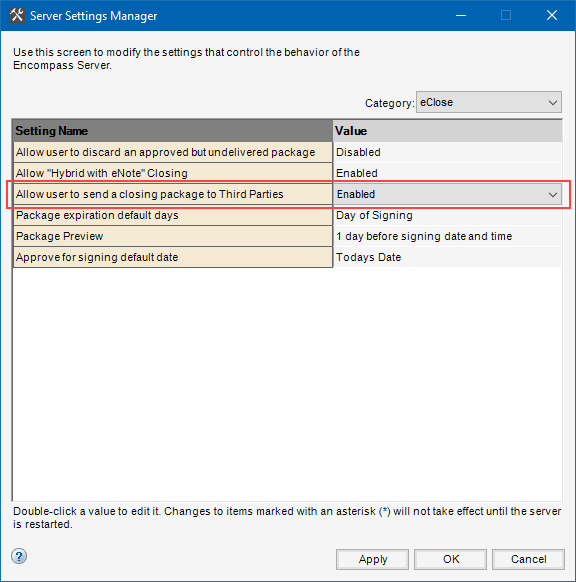

Please note, the Allow user to send a closing package to Third Parties option in the Encompass Admin Tools > Settings Manger must be enabled in order for Encompass eClose to support Encompass Loan Connect. Your business partners such as realtors, appraisers, attorneys, and other non-Encompass third party users can contribute to a loan file using Encompass Loan Connect. Instead of mailing or faxing document packages to your business partners, you can store electronic copies of the documents on Loan Connect where your contacts can access them. For more information, refer to the Lender's Guide to Encompass Loan Connect for Business Partners.

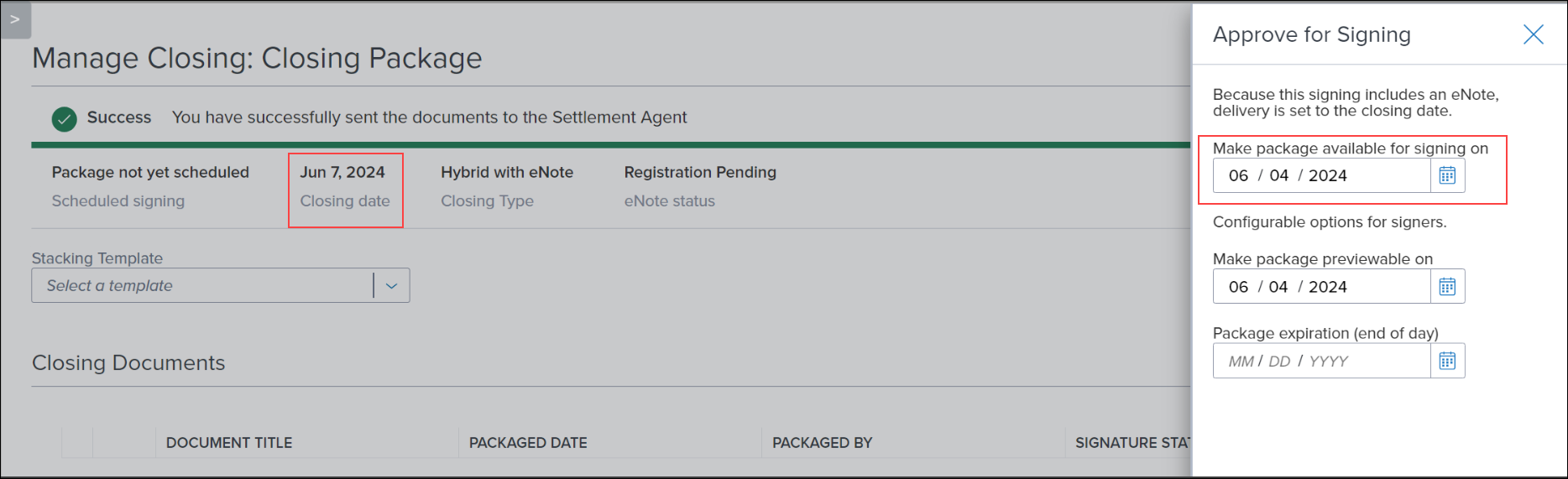

(Added on 7/23/2024)

Fannie Mae has removed the requirement that an eNote be signed only on the closing date. While eClose supported the ability to select a signing date after the closing date as long as the package is active in previous versions of Encompass, it did not permit signing to occur prior to the closing date. This restriction has been removed in Encompass 24.2. Authorized users (i.e., users with persona permissions enabled for Closing Package Management and Approve for Signing > Package Signing Date actions) can now select a signing date that occurs before the closing date on the Approve for Signing panel.

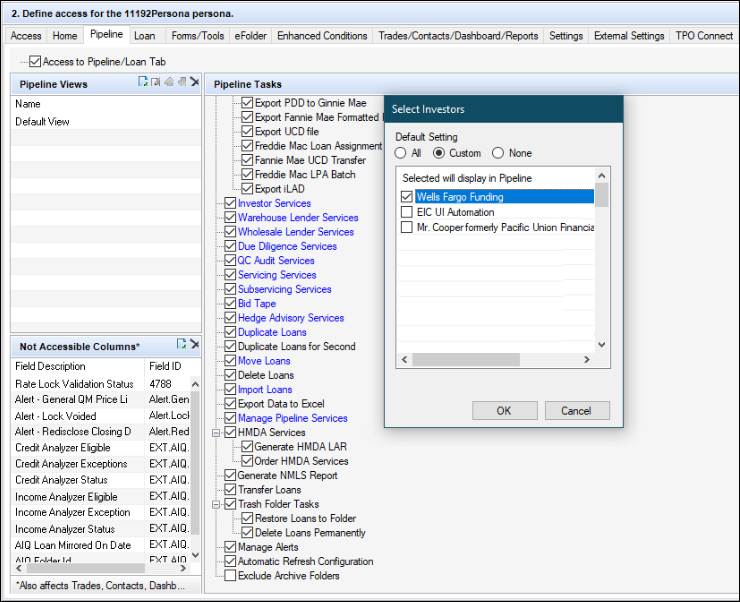

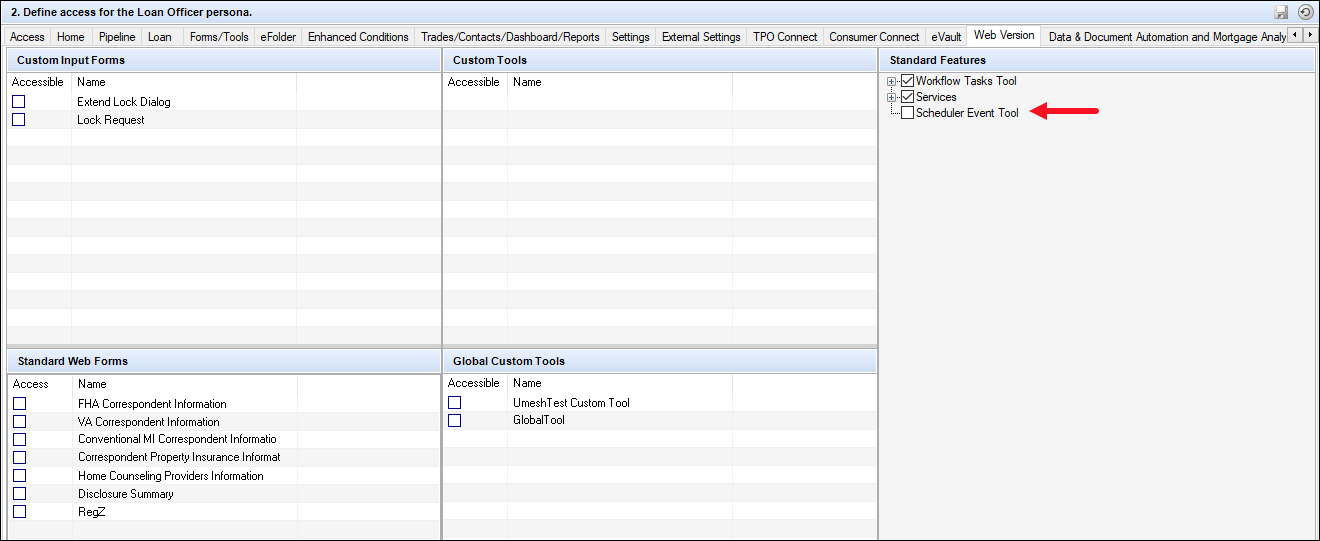

Personas Settings Updates

A new option that enables the administrator manage access to the Scheduler Events in the web version of Encompass has been added to the Encompass Settings > Company/User Setup > Personas > Web Version tab. For information about the new Scheduler Events being introduced in Encompass 24.2, refer to the web version of Encompass 24.2 release notes.

Additional Enhancements

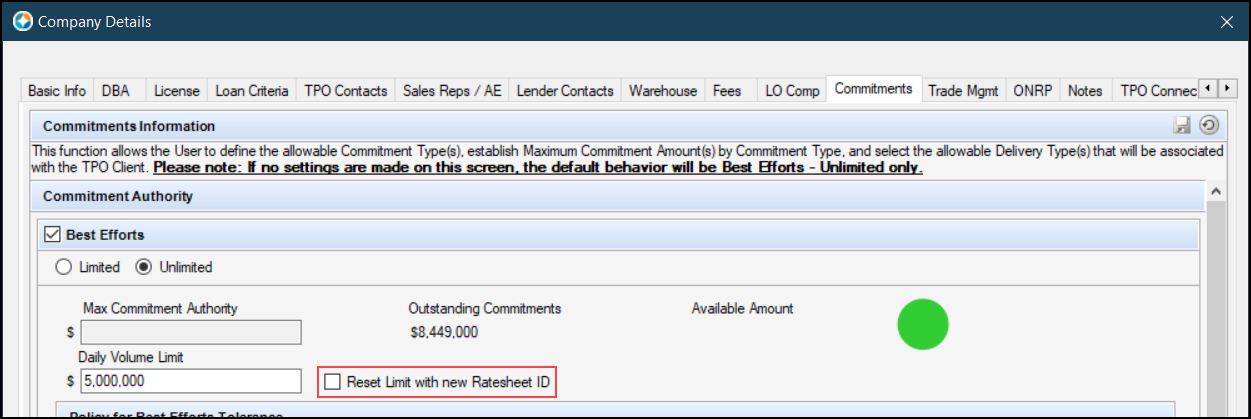

A new Reset Limit with new Ratesheet ID checkbox has been added to the Commitments tab under the External Company Setup - Company Details setting. This option enables the Lock Desk to reset the daily lock limit when there is a price change to offer the full daily limit and allow a seller to take advantage of the new pricing.

-

When the Reset Limit with New Ratesheet ID checkbox is selected:

-

For a lock request, update, relock, or a lock request with an old lock or old request in the loan, the daily limit is validated but the Accrued Amount is not updated at the time of request, but will be updated upon lock confirmation.

-

For updated buy side lock date or rate sheet ID with lock confirmed, updated, or relocked, the daily limit is validated before the lock is confirmed and the Accrued Amount is updated after the lock is confirmed using the buy side data.

-

For updated loan amount or copy to snapshot and the loan is locked and confirmed, the daily limit is validated and the Accrued Amount is updated.

-

For a confirmed new lock, the daily limit is validated and the Accrued Amount is updated using the buy side data.

-

For a cancelled, denied, or voided lock, the loan amount is subtracted from the Accrued Amount.

-

When a lock is denied or voided, the loan returns to its latest confirmed lock state.

-

When a lock is voided, the daily limit is validated before the void is allowed. If the limit is exceeded, the configured message is displayed and the void is rejected.

-

For Individual Best Effort delivery type, the best efforts daily limit is validated and the Accrued Amount is updated whether or not the Best Efforts checkbox on the Commitments tab is selected.

(Updated on 7/23/2024)

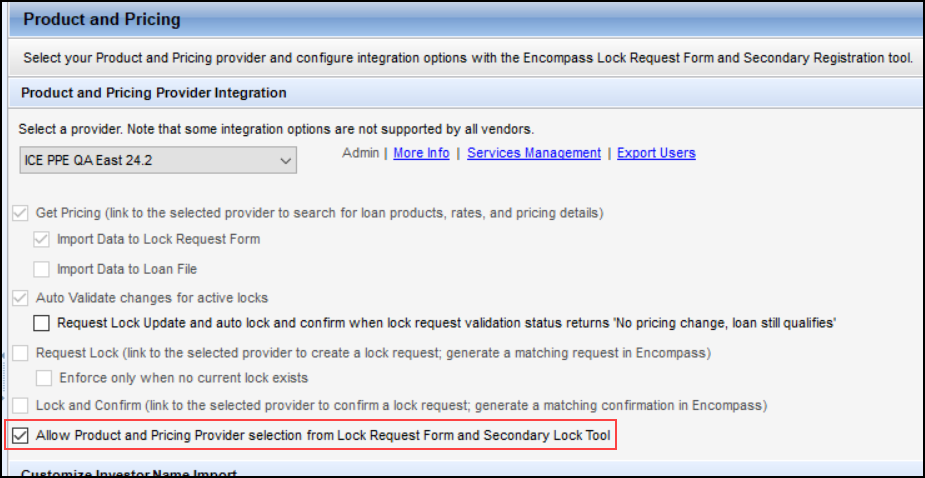

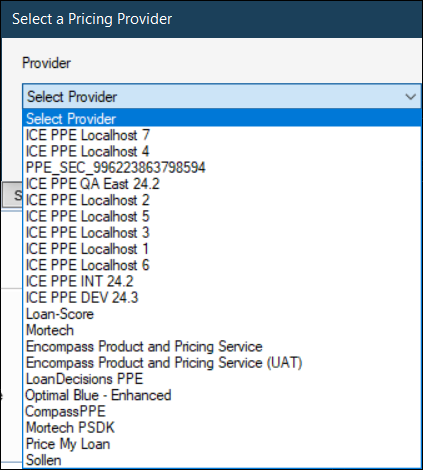

A new Allow Product and Pricing Provider selection from Lock Request Form and Secondary Lock Tool checkbox has been added to Product and Pricing Provider Integration section of the Product and Pricing setting. This option enables a user to select a different provider on the Lock Request Form and the Secondary Lock Tool than what is configured on the Product and Pricing setting.

If "No Provider" is selected in the dropdown list, the Allow Product and Pricing selection from Lock Request Form and Secondary Lock Tool checkbox is not displayed.

In order for an ICE PPE provider to be displayed in the dropdown list and on the Lock Request Form/Secondary Lock Tool, that provider must first be set up as a Manual Service via the web version of Encompass Services Management setting.

To Select a Product and Pricing Provider on the Lock Request Form or the Secondary Lock Tool:

-

Create or select a loan to price.

-

Open the Lock Request Form or the Secondary Lock Tool.

-

Click Get Pricing on the Lock Request Form or Get Buy Side Pricing/ Get Sell Side Pricing on the Secondary Lock Tool.

Get Pricing Get Buy Side Pricing/Get Sell Side Pricing

-

Select a Provider from the dropdown list.

-

Click OK.

-

You will be directed to the provider's website.

A new icon, shown below, is now used for the Encompass Admin Tools and the following related tools. This icon is displayed in the application list displayed under the Start menu > Ellie Mae Encompass Folder for users opening Encompass and other related Encompass tools, as well as within the individual tools:

- Encompass Admin Tools

- Online User Manager

- Settings Manager

- Version Manager

- Reporting Database

NICE-49208

The External Reporting Database legacy tool that could be used to create a database of loan fields used most often in your reports has been officially sunsetted with the release of Encompass 24.2. The tool was designed to enable administrators to pull real time Encompass loan data into a reporting database located on a computer separate from where the Encompass Server application and the Encompass Database are installed.

The option in the Encompass Admin Tools > Settings Manager to enable the External Reporting Database has been removed and the option to access the database from the Encompass Admin Tools has also been removed.

In addition, the Data Replication tool that was previously provided in the Encompass SmartClient installation package has been removed. This Encompass SDK application could be used to automate an export of all qualifying loan fields to a local SQL database where the data could then be used for lenders' business reports. This tool is now sunsetted. Encompass Data Connect is the recommended alternative. Contact your ICE Mortgage Technology relationship manager for more information.

Please note: This sunset does NOT impact the Data Warehouse toolkit, nor does it impact the Encompass Reporting Database, Encompass SDK, or Encompass Data Connect Replication. All of these items will continue to operate as expected.

NICE-49450, NICE-48703

(Updated on 9/6/2024)

A new pop up window, “There are unsaved changes, do you wish to continue?”, is displayed when a user attempts to navigate away from or close the Secondary Lock Tool without saving their changes.

-

If the user clicks Yes, no changes are saved and the user is navigated away from the Secondary Lock Tool or it is closed.

-

If the user clicks No, the pop up window is closed and the user remains on the Secondary Lock Tool to save their changes.

(Added on 8/8/2024)

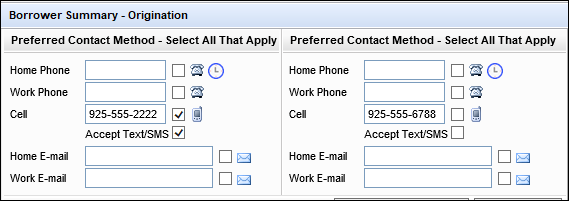

In the Preferred Contact Method section for borrowers and co-borrowers on the Borrower Summary - Origination input form (and others), users can utilize the Accept Text/SMS checkbox (4920 and 4935) to indicate that the borrower or co-borrower will accept or not accept text/sms messages on their cell phone. Selecting this checkbox for the borrower or co-borrower indicates they do accept these messages. When leads are imported into Velocify's LeadManager or LoanEngage from Encompass, those applications will now honor this Accept Text/SMS checkbox selection to determine if text messages are or are not sent to these borrowers from Velocify. Velocify users continue to have the option opt out or opt in leads in LeadManager and LoanEngage for text/sms messages using the settings in Velocify.

VEL-64212

Updates have been made to help improve system performance when saving changes to loans (i.e., loan save). A new approach to managing the impacted fields in the Encompass Reporting Database has resulted in improved system performance upon loan save.

NICE-39272

(Updated on 7/12/2024)

A new installer for the desktop version of Encompass is now available. Use this installer to install the Encompass SmartClient components that are required before a user can log into Encompass for the first time. This is an installation procedure performed by a user logged on to the computer using a Microsoft Windows account and login with the admin user ID and password. This new installer supports silent installation and also installs Encompass much faster than the legacy Encompass installer.

Please note the following:

-

Administrators are NOT required to uninstall and reinstall Encompass for existing users. We are simply making the new installer available to use when needed.

-

The new installer is intended to be used for brand new installations or when an existing Encompass installation needs to be uninstalled and then reinstalled.

-

While utilizing the new Encompass installer is not required, it is recommended to use it for any new installations to experience the benefits mentioned above. The legacy Encompass installer will be deprecated in the future.

Please visit KA #000115575 - New Encompass Installer Functions for more information about silent and passive installations, uninstallations, and more.

The new Encompass installer can be downloaded here.

Feature Enhancement for Version 24.2.0.1 Server Patch 1

The following client-side update is applied to users' Encompass client machines (24.2.0.1). This client update can be controlled manually via the Encompass Version Manager tool. If the tool has been configured to always apply new releases to users' computers automatically, users will receive this update upon their initial log in of Encompass following the release.

(Added on 8/8/2024)

The Nationwide Mortgage Licensing System (NMLS) recently released an update Version 6 of the Mortgage Call Report where Brokered loan amounts and counts are no longer included in any calculations under Section II of the report. Accordingly, Encompass has been updated to exclude the data for Brokered loans (i.e., loan files where the loan channel (field 2626) is set to Brokered (field 3) from the calculations used to populate Section II section of the generated version 6 NMLS report (Amount ($) and Loan Count (#) columns).

-

Versions 1 - 5 of the report still include Brokered loan data.

-

Section I of the version 6 report still includes Brokered loan data.

-

Version 6 of the report is used to capture data for periods on or after January 1, 2024. Q2 data (April 1 - June 30, 2024) is due August 14.

-

Refer to the NMLS Reports online help topic for instructions for generating the NMLS report data in Encompass.

(Added on 8/19/2024)

To help facilitate the inclusion of repurchase loans in the Encompass HMDA data export, a new standard field to capture the Repurchased Action Date (HMDA.X122) has been added to the Encompass Reporting Database. The HMDA Action Date (HMDA.X96), if valid, is copied to this new field and used for repurchased loans in the report.

When logging into the Encompass Reporting Database for the first time after this release, you will be prompted with a pop-up message stating, In order to generate the HMDA Report, the following fields must be added to the Reporting Database: HMDA.X122 (Repurchased Action Date (Date Format)). Click Yes to add this field. If you do not add the field at this time, you will be prompted again that one or more fields required to generate the HMDA Report is missing from your Reporting Database the next time you attempt to generate the HMDA report.

It is important to note that once you have added HMDA.X122 to the Reporting Database, you will then be prompted to rebuild the database. You must perform this rebuild in order for HMDA.X122 to be used for the report going forward. This rebuild may take several minutes to complete.

This HMDA.X122 field is not displayed on any input forms or other screens in Encompass.

Fixed Issues for Version 24.2 (Banker Edition)

This section describes the issues that have been fixed in this release.

Why we fixed these issues: These issues were fixed to improve usability and to help ensure Encompass is operating as expected. The issues that are chosen to be fixed are based on the severity of their impact to clients and client feedback.

When working with interest only loans that use simple interest, an Application Error was triggered when attempting to open the Amortization Schedule tool. This error occurred because at the end of the interest only period there was not enough unpaid balance (i.e., the final payment due was greater than the unpaid balance). This issue has been addressed and the Application Error is no longer triggered in this scenario. The final payment amount is now set to the unpaid balance amount for interest only loans that use simple interest.

Tip: Encompass does not support simple interest amortization for bridge loans. Encompass supports simple interest amortization for closed end loans (including calculations updates to handle simple interest payment schedules and simple Interest P&I payment) and 0% interest payment loans for lenders originating down payment assistance loans for affordable housing, for example Habitat for Humanity and state and local housing agencies.

CBIZ-53210

In Encompass, any fee on the 2015 Itemization form’s Origination Points [line] 802e, 802f, 802g, or 802h marked as paid by Broker or Other was excluded from discount point calculations and section 32 points and fees calculations. However, the Mavent compliance review includes discount points paid by Other when running points and fees tests. This can result in the compliance review results being different than the 802e-h values in the loan file, including ATR/QM screens presenting Pass results for discount points, but the compliance review presenting Fail results. To address this, Encompass has been updated so that the amount on line 802e, 802f, 802g, or 802h that is paid by Broker or Other is included in the Section 32 Points and Fees amount in the Fee Details pop-up window. This amount is populated to the Total points and fees applicable under section 32 (S32DISC.X48) field. This field is used by Mavent for its points and fees tests.

Migration Information:

For non-active loans (1393), the current Section 32 Points and Fees value in the Fee Details pop-up window for lines 801e-f (NEWHUD2.X951. NEWHUD2.X984, NEWHUD2.X1017, NEWHUD2.X1050) will be locked/retained to preserve data integrity since the data may have already been reported to HMDA. To apply the new system calculation to this field in an existing loan, click the gold Lock icon.

CBIZ-55578

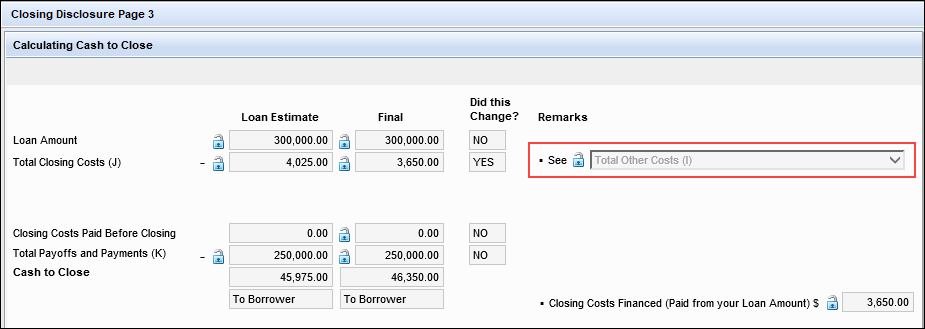

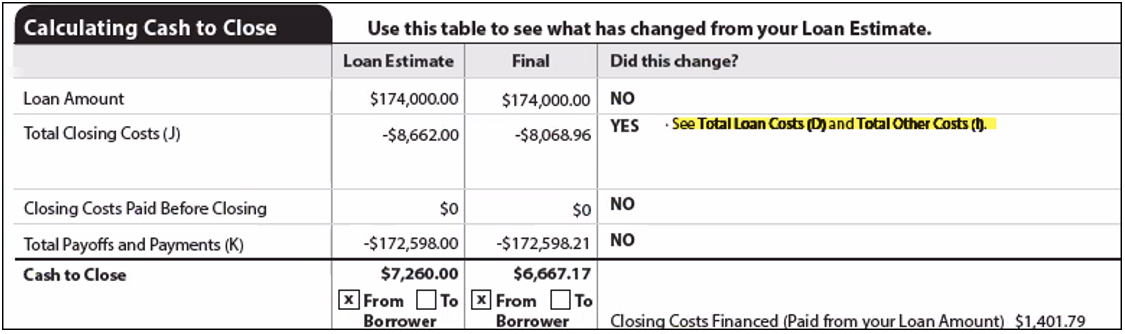

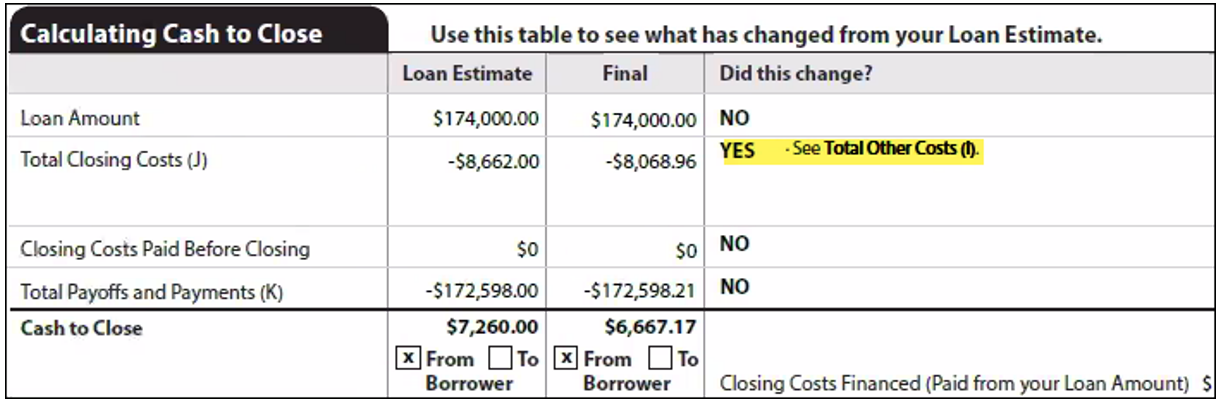

An issue was occurring intermittently with Alternate Closing Disclosures where the Total Closing Costs (J) “other charges” value on the input form was not matching the value on the printed output form. Specifically, when the Total Closing Costs (J) amount disclosed on the Alternate Loan Estimate differed from the amount disclosed on the Alternate Closing Disclosure and the resulting “other charges” field (CD3.X131) in the Remarks column was set to Total Other Costs (I), the printed output form indicated See Total Loan Costs (D) and Total Other Costs (I).

This issue has been fixed and the input form and printed output form now both display the same See Total Other Costs (I) value for in the last column in this scenario.

Before:

After:

CBIZ-58958

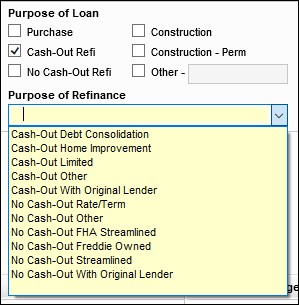

On the 2010 version of the Closing RegZ input form (i.e., the input form provided when the Forms > RESPA-TILA Form Version is set to RESPA 2010 GFE and HUD-1), the Purpose of Refinance field’s (299) dropdown list now displays the refinance options correctly. Previously this list was empty, with no options listed.

CBIZ-47092

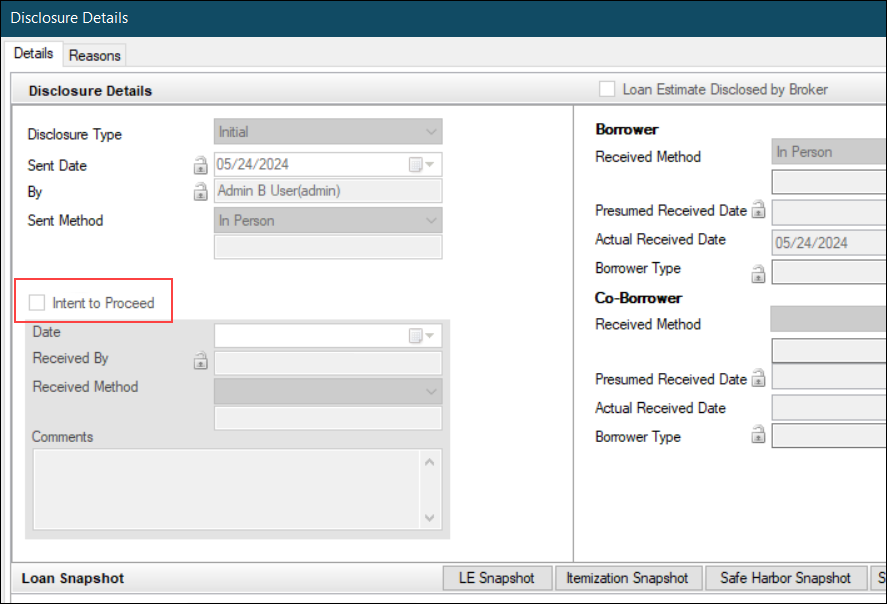

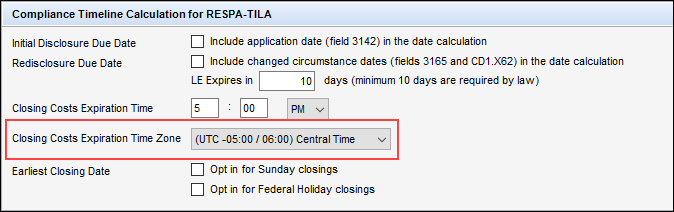

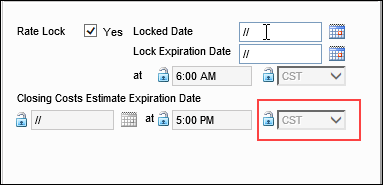

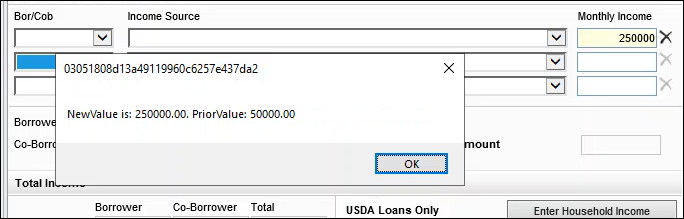

When a loan template set was applied to loans (even with the Append template data checkbox selected), the values in the Intent to Proceed (3197) and Earliest Fee Collection (3145) fields in the Compliance Timeline panel in the Disclosure Tracking Tool were being cleared out (i.e., blanked out). This issue has been resolved and the values are no longer cleared out when the loan template set is applied with the Append template data option is selected.

CBIZ-49297

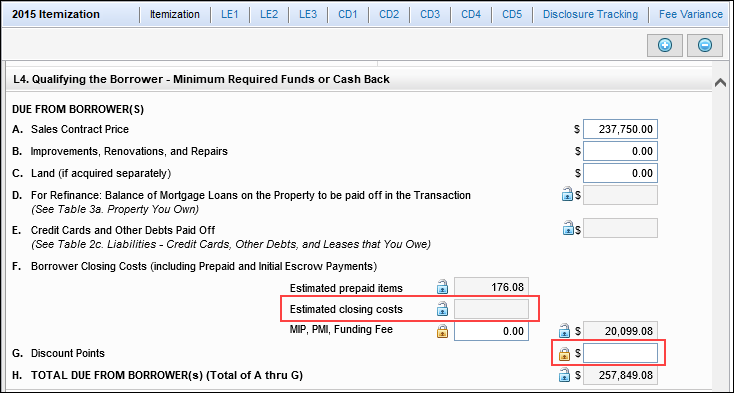

When the Discount Points field (1093) on the 1003 URLA - Lender input form is locked by the user (i.e., they click the blue lock icon to manually enter a value), the Estimated closing costs field (137) was cleared if it was unlocked as shown below. Updates have been made to ensure that when the Discount Points field is locked, the Estimated closing costs field is no longer cleared in this scenario.

CBIZ-60046

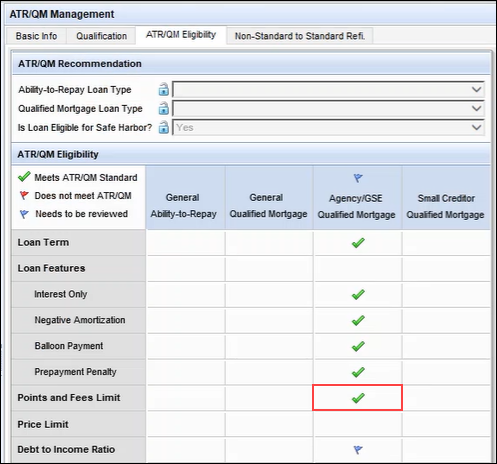

For VA Non-IRRRL (i.e., Purchase and Cash-Out) transactions in Encompass, they are not subject to the ATR/QM Points and Fees test. Regulation 1026.43 (e)(2) states that 1026.43 (e)(4) contains an exception to the general QM rules. The exception in 1026.43 (e)(4) states that loans identified as qualified mortgages by the government agencies are designated as QM regardless of the other qualifications for General QM loans.

However, these loans were failing the Agency/GSE Qualified Mortgage Points and Fees Limit testing in previous Encompass releases. (This was evidenced by the red flag displaying in field QM.X68.) Encompass 24.2 has been updated so that field QM.X68 will always display a green flag (indicating the loan meets the ATR/QM standard) regardless of the Total points and fees applicable under section 32 (S32DISC.X48). The calculations associated with the Ability-to-Repay Loan Type (QM.X121) and Qualified Mortgage Loan Type (QM.X122) are not necessary on VA Non-IRRRL loans.

CBIZ-55708

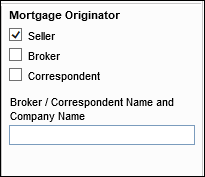

On the Transmittal Summary input form, the calculation logic for the Broker / Correspondent Name and Company Name field (1133) has been updated. This field will now be populated as follows based on the selection made for the Mortgage Originator (1149):

-

When the Seller option is selected, the field remains blank (or clears data previously entered in the field). This is new functionality.

-

When the Broker option is selected, the field is populated with the Broker Company Name (VEND.X293) if provided. If not provided, the field is populated with the Loan Originator Company Name (315) if provided. This is existing functionality.

-

When the Correspondent option is selected, the field is populated with the Loan Originator Company Name (315) if provided. This is existing functionality.

CBIZ-53689

When using a loan template set to apply a loan program that indicates the Purpose of Loan (19) as Construction - Perm, the Construction-Conversion/Construction-to-Permanent (URLA.X133) checkbox on the 1003 URLA - Lender input form was not selected as expected. (When a loan template set was not used to apply the loan program, or if no templates were applied to the loan, the URLA.X133 checkbox was automatically selected if field 19 was selected.) This issue was fixed so that when a loan program is applied with a loan template set with field 19 indicating Construction-Perm, the ULRA.X133 checkbox is selected as well.

CBIZ-55831

Issues related to Debt-to-Income DTI (740/742) for Construction to Permanent loans have been fixed in this release:

-

For Construction to Permanent - Second Home loans, the DTI was not calculating correctly. The DTI was calculated based off the interest only payment for the construction phase instead of the proposed principal and interest payment for the permanent phase. In addition, the DTI was not including the primary home payment from the Verification of Mortgage (VOM field 120).

-

For Construction to Permanent - Second Home loans with a primary home with a current mortgage, the First Mortgage P & I (1724) and Total Primary Expenses (1731) were not updating correctly, which resulted in the DTI not updating correctly.

Migration Notes:

-

For non-HELOC loans not in active status (i.e., the Action Taken field (1393) is not empty), the First Mortgage P & I (1724) and Second Mortgage P & I (1725) fields will be locked to retain the current values if they are not already locked.

-

For Construction to Permanent - Second Home (or investment) loans not in active status (i.e., the Action Taken field (1393) is not empty) and the qualified rate field (1014) is not provided, the subject property’s negative cash flow (462), positive cash flow (1169), rental income (106), and expected net monthly rental income (URLA.X81) fields for the subject property will be locked to retain the current values if they are not already locked.

CBIZ-57838

An issue occurred where the Branch Information section of the TPO Information tool was not cleared after a Branch was changed to a Company Extension under External Company Setup > Third Party Originators > Company Details. This issue has been resolved and when a Branch is changed to a Company Extension, the Branch Information section of the TPO Information tool is now cleared.

SEC-26959