Encompass Updates and Enhancements to Features - 23.3 Major Release

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release.

User Interface

Forms & Tools Enhancements

The Closing Vendor input form is now available in the web version of Encompass. This form contains vendors associated with the closing process for a specific loan. The form also provides a convenient means of viewing and maintaining a loan's closing vendor information from one location.

To Enter of Change Vendor Information:

-

From a loan in the web version of Encompass, select the Closing Vendor Information form from the left navigation menu.

-

For all vendors except the Trustee, select the Address Book

icon to select a vendor from your business contacts.

icon to select a vendor from your business contacts. -

Or, type vendor information to add a new contact to your business contacts.

-

Complete loan-specific information (such as Line Item Number, Reference Number, Relationship, and Comments) as required.

Note: Vendor details entered on the Closing Vendor Information input form will be copied over to the relevant record in the Business Contacts tool (and vice versa) when the Link this loan with the selected contact checkbox is selected on the Business Contacts tool. This checkbox is selected by default. If you do not want the vendor details to be copied to or from the Business Contacts, clear this checkbox.

Trustee

To enter or change information in the Trustee section, type the information or click the Find ![]() button to select a trustee from the Trustee List.

button to select a trustee from the Trustee List.

ENCW-91160

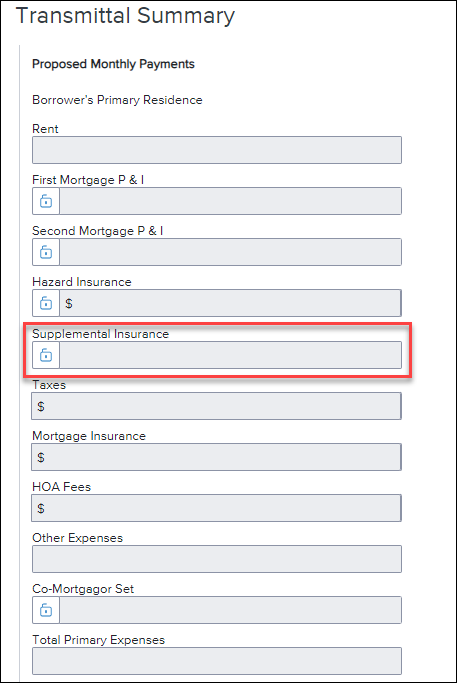

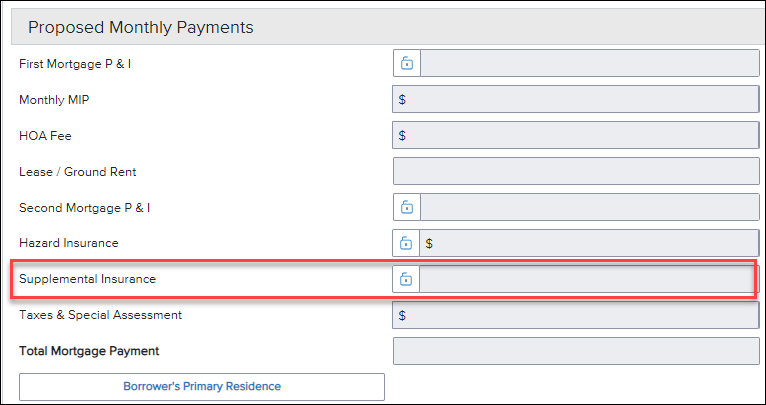

A new two-decimal Supplemental Insurance field (field ID 4947) has been added to the following input forms:

-

Transmittal Summary

-

ATR/QM Qualification

-

HUD-92900LT FHA Loan Transmittal

The new field is dynamically populated based on the selection made for the Property Will Be (field ID 1811) for the loan:

-

When Primary is selected for the Property Will Be, the new Supplemental Insurance field is populated with the proposed monthly supplemental insurance (URLA.X144).

-

When Secondary or Investment is selected for the Property Will Be (field ID 1811), the field is populated with the present supplemental insurance (URLA.X212).

-

When neither Primary, Secondary, or Investment is selected for the Property Will Be (field ID 1811), the field is left blank.

Transmittal Summary Form

Previously, when processing a loan on an investment or second home property, the values in the present column of the Monthly Housing Expenses pop-up window (accessed by clicking the Edit icon for Housing in the Current Address section of the 1003 URLA Part 1) were populated to the Transmittal Summary (field IDs 1724, 1725, 1726, 1727, 1728, 1729, 1730) and were used in the front end DTI calculation. The Supplement Ins. (field ID URLA.X212) was added to the calculation for the Total field (field ID 737) in the Present column in the Monthly Housing Expenses, but the value did not flow to the Transmittal Summary, which used a different field for the Total (field ID 1731). To address this issue, the new two-decimal Supplemental Ins field (field ID 4947) has been added to the Transmittal Summary.

The following calculation updates have been made to the Transmittal Summary form:

-

The calculation for Total Primary Expenses (field ID 1731) has been updated to include the new Supplemental Insurance field.

-

The following mapping is now being used for Hazard Insurance (field ID 1726):

-

When Primary is selected for the Property Will Be (field ID 1811), the field is populated with the proposed Hazard Insurance (field ID 230). Previously hazard insurance and supplemental insurance were added together and populated to the Hazard Insurance field.

-

When Secondary or Investment is selected for the Property Will Be (field ID 1811), only the value for the present Hazard Insurance (field ID 122) is populated to the Hazard Insurance field.

-

Updates to the Hazard Insurance field affect only loans using the URLA 2020 forms. The hazard insurance calculation does not change for loans using the URLA 2009 forms.

For existing non-active loans (based on the loan's Current Status (field ID 1393)) created prior to Encompass 23.3, the new Supplemental Insurance field (4947) will be locked, and the field will be blank/empty. The Hazard Insurance field (field ID 1726) will also be locked, and it will retain the value that was entered in the field prior to Encompass 23.3. By retaining this value and using a blank value for Supplemental Insurance, the loan's debt-to-income (DTI) (field ID 742) will remain unchanged in these loans. Select the field's Lock icon if you elect to un-lock these fields in the future.

HUD-92900LT FHA Loan Transmittal

The new Supplemental Insurance field (field ID 4947) has also been added to the Proposed Monthly Payments section on the HUD-92900LT FHA Loan Transmittal input form and the calculation for the Total Mortgage Payment (field ID 739) has been updated to include the new Supplemental Insurance field.

ATR/QM Management Qualification Form

The new Supplemental Insurance field has been added to the Risk Assessment section on the ATR/QM Management - Qualification form. The following calculations have also been updated to include the new Supplemental Insurance field when the new field displays on the input form:

-

The calculation for the Initial Rate Max Total Pmt. (field ID QM.X113).

-

The calculation for the Fully Indexed Rate Max Total Pmt. (field ID QM.X114).

-

The calculation for the Max Rate During First 5 Years Max Total Pmt. (field ID QM.X117).

For existing loan created prior to updating to Encompass 23.3, the Max Total Pmt amounts may change based on the new Supplemental Insurance field values.

ENCW-90152, ENCW-96503

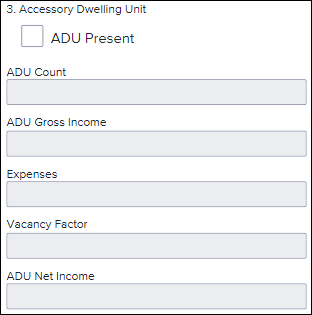

A new Accessory Dwelling Unit (ADU) section has been added to the Application View > Property, Title & Trust form to enable users to enter ADU information on the loan. Use this section to capture ADU details for a subject property. An ADU is an additional living area that includes a kitchen, bathroom, and a separate entrance.

The following new fields are available in this section:

-

ADU Present (field ID URLA.X309)

-

ADU Count (field ID URLA.X310)

-

ADU Gross Income (field ID URLA.X311)

-

Expenses (field ID URLA.X312)

-

Vacancy Factor (field ID URLA.X313)

-

ADU Net Income (field ID URLA.X314)

All of the text fields are disabled (grayed-out) until the ADU Present checkbox is selected.

Additionally, ADU fields have been added to the Property, Title & Trust > Subject Property Information form in the mobile view of the web version of Encompass.

ENCW-92556, ENCW-92814

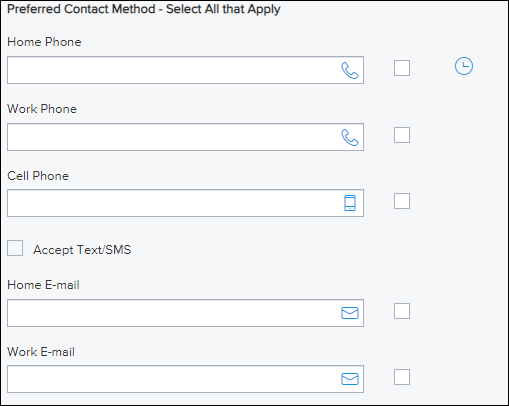

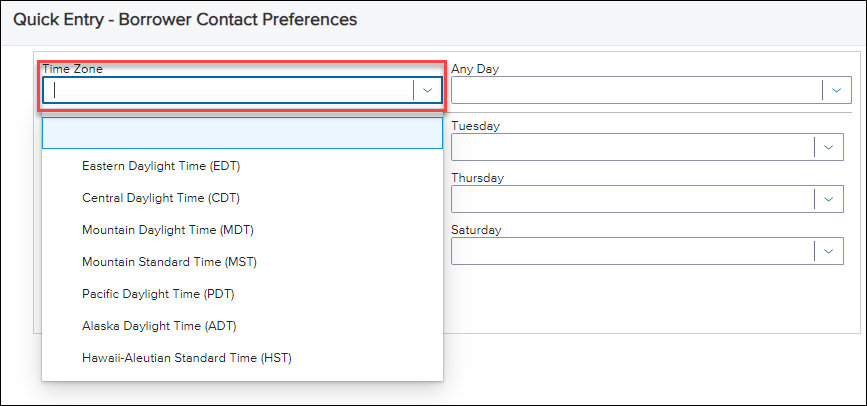

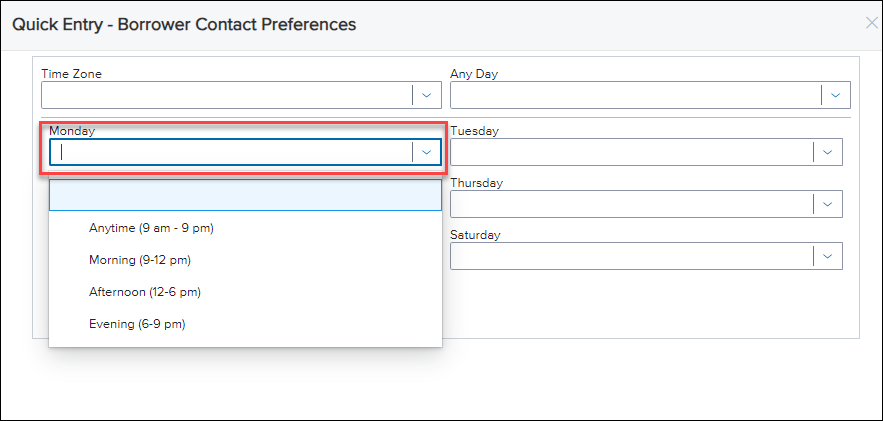

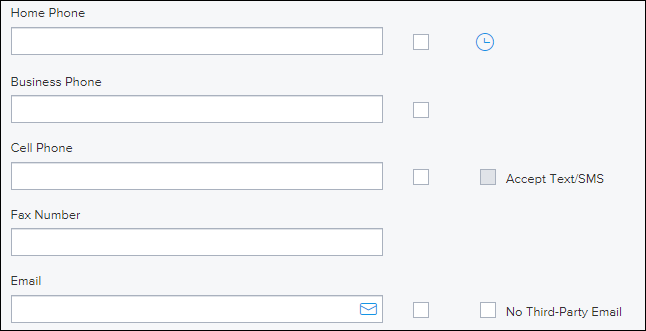

New fields have added to the Borrower Origination - Summary input form, the Application View > Borrower Information form, and to the Non-Borrowing Owner entries in the File Contacts tool to enable Encompass user to enter information about the preferred methods for contacting a borrower or co-borrower. (email, phone, text, etc.) along with the best time to reach them:

-

Home Phone

-

Work Phone

-

Cell

-

Accept Text/SMS (this field is only enabled when a Cell number has been entered)

-

Home E-mail

-

Work E-mail

-

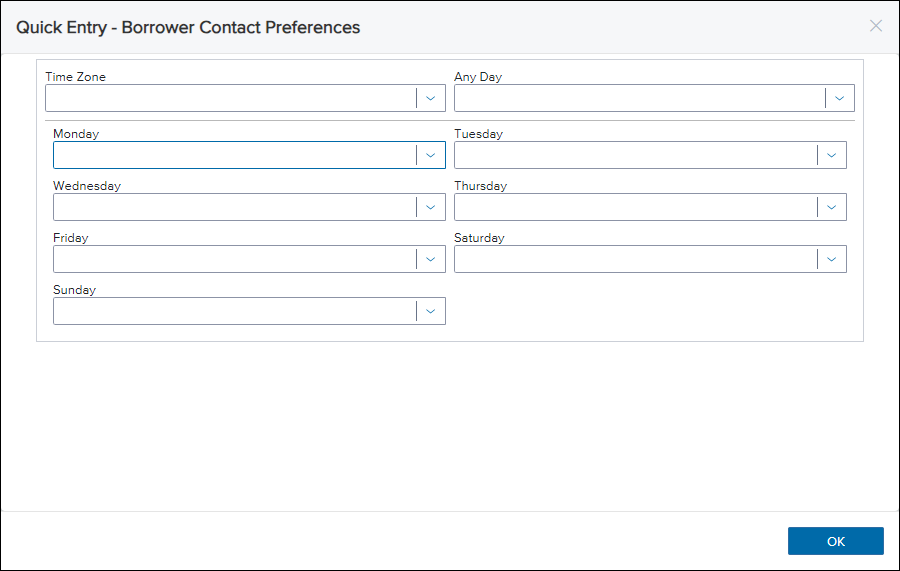

Time Fields - These drop-down lists display in a pop-up window that opens when you click the Clock

.

.

Users can then select a borrower Time Zone and the preferred day and time for contacting the borrower:

The image below shows the new fields in a non-borrowing owner entry in the File Contacts tool:

ENCW-81741, ENCW-91307, ENCW-91308

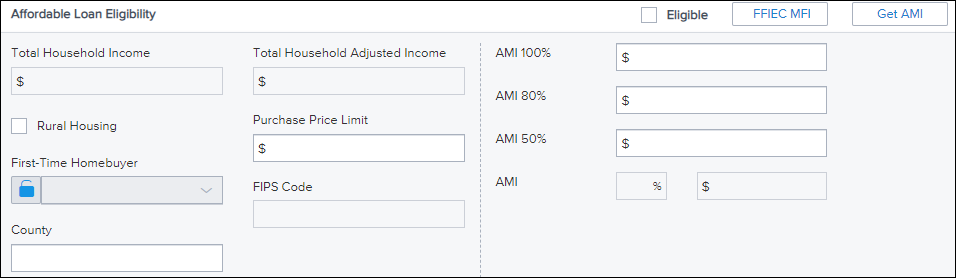

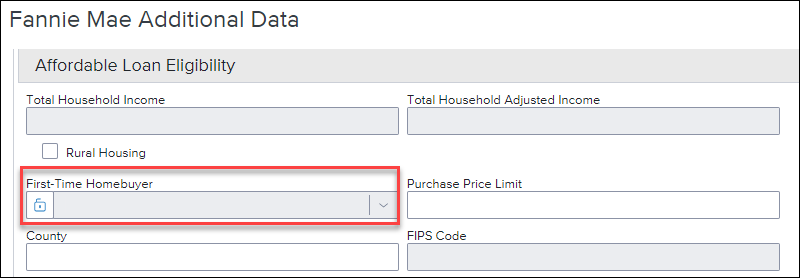

A new Affordable Loan Eligibility section has been added to the Borrower Summary - Origination, Fannie Mae Additional Data, and Freddie Mac Additional Data forms. This section enables lenders to determine if potential borrowers are eligible for affordable loan programs.

The Affordable Loan Eligibility section includes two new buttons:

-

Select the new FFIEC MFI button to be taken to the FFIEC Census and Demographic Data website and manually look up census, income and metropolitan area data for different areas.

-

Select the new Get AMI button to populate the fields in this section with the Area Median Income (AMI) values for the area where the subject property is located. These values are based on the AMI Limits provided in the Area Median Income (AMI) Limits table in Encompass Settings.

The Affordable Loan Eligibility section includes the following fields:

-

Eligible (field ID 4968) - Editable checkbox. Select this checkbox to indicate the loan is eligible for an affordable loan program based on FFIEC data and total household income amounts.

-

Total Annual income for the household (field ID USDA.X222) - This new read-only field calculates the total of household annual income reported in lines 1-6 on the Rural Assistance URLA input form on the USDA management tool.

-

Total Adjusted income for the household (field ID USDA.X223) - This read-only field is calculated by subtracting the Total Household Deduction from the Total Household Annual Income (line 7 minus line 13) on the Rural Assistance URLA input form on the USDA Management tool.

-

Rural Housing (field ID 3850) - An existing editable checkbox. Select this checkbox if the subject property is located in a rural and/or underserved area as designated by the CFPB.

-

First-Time Homebuyer - An existing field (field ID 934) to indicate that the borrower has not had any form of ownership in any home in the last 3 years. A new field lock icon has been added to this field in Encompass 23.3. Authorized users can utilize this lock icon to control if Encompass will populate this field or override the calculated value with a manual entry.

-

Purchase Price Limit (field ID 4969) - A new editable field that is blank by default. The purchase price limit is set by the investor providing the affordable loan program.

-

County (field ID 13) - An existing editable field populated with the county the subject property is located in (based on the subject property ZIP code (field ID 15).

-

FIPS Code (field ID HMDA.X111) - An existing field for the HMDA County Code consisting of the state code field (field ID 1395) and the County Code (field ID 1396).

-

AMI 100% (field ID MORNET.X30) - An existing editable field populated when the Get AMI button is clicked.

-

AMI 80% (field ID 4971 - A new editable field populated when the Get AMI button is clicked.

-

AMI 50% (field ID 4972) - A new editable field populated when the Get AMI button is clicked.

-

AMI % (field ID 4985) - A new editable field for the AMI percentage.

-

AMI [Limit] (field ID 4986) - A new read-only field that calculates the AMI limit to qualify for the affordable loan program. This field is calculated by multiplying AMI 100% (field ID MORNET.X30) by AMI % (field ID 4985).

ENCW-83363, ENCW-92987, ENCW-91487

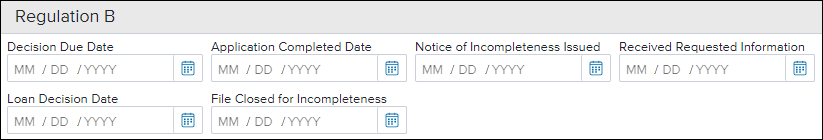

When a lender receives a loan application, they have 30 days to accept the application. This deadline is the Regulation B Date. If there is missing documentation or the process is put on hold, the timeline pauses.

When all documentation is received, the timeline resumes. To enable users to document any changes to the timeline, a new Regulation B section has been added to the Underwriter Summary Page 2 input form. This section includes the following new free-entry date fields, which users can manually edit:

-

Decision Due Date (field ID 4984)

-

Application Completed Date (field ID 4948)

-

Notice of Incompleteness Issued (field ID 4949)

-

Received Requested Information (field ID 4950)

-

Loan Decision Date (field ID 4951)

-

File Closed for Incompleteness (field ID 4952)

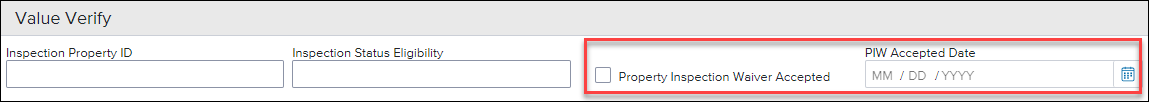

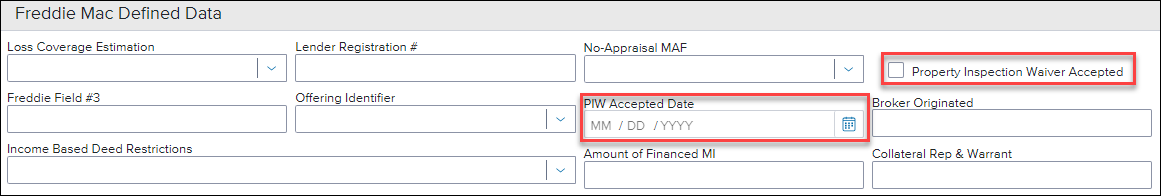

ENCW-81752, ENCW-92982

Two new fields have been added to the Fannie Mae Additional Data and Freddie Mac Additional Data input forms to enable the user to document when a Borrower acknowledges and accepts that an appraisal is not being obtained for a transaction. These are both editable fields that can be used in business rules:

-

Property Inspection Waiver Accepted (field ID 4954) - editable checkbox.

-

PIW Accepted Date (field ID 4955) - editable date field with a calendar icon.

Since Fannie Mae Desktop Underwriter (DU) and Freddie Mac Loan Product Advisor (LP) do not provide data for these Property Inspection Waiver fields, Encompass users must complete the fields manually as needed. These fields are not included in loan exports or imports.

Fannie Mae Additional Data

Freddie Mac Additional Data

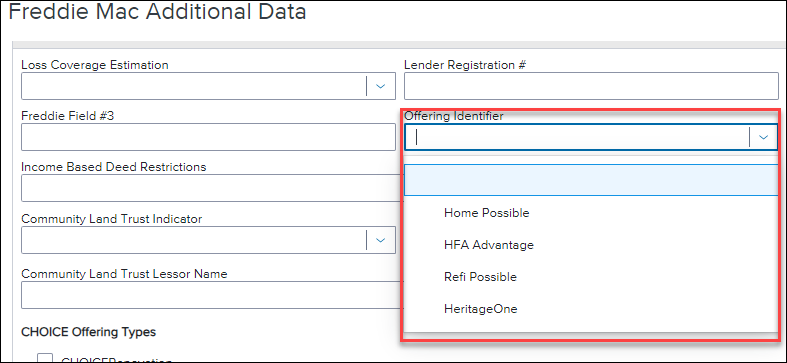

ENCW-81746

On the Freddie Mac Additional Data input form, HeritageOne is now available to select from the Offering Identifier drop-down list (CASASRN.X209). For more information about Freddie Mac’s HeritageOne™ mortgage product that was introduced on June 7, 2023, refer to the HeritageOne Mortgage page and FAQ page on Freddie Mac’s website.

ENCW-92985

To help ensure the logic to populate the Counseling Confirmation and Counseling Format type information on the Fannie Mae ULDD XML adheres to Fannie Mae’s Appendix D requirements, the loan-level First- Time Homebuyer field (field ID 934) on the ULDD/PDD input form has been replaced with two new borrower-level fields:

-

Borrower First-Time Homebuyer (field ID 4973)

-

Co-Borrower First Time Homebuyer (field ID 4974)

These two new fields have replaced the loan-level First-Time Homebuyer field (field ID 934) on the ULDD/PDD Fannie Mae and Freddie Mac forms. These new fields have also been added to the ULDD/PDD Ginnie Mae form.

Replacing the singular loan-level field with these two new borrower-level fields enables Encompass to capture separate values for the borrower and co-borrower as opposed to capturing just one value for first- time borrower status.

Data Migration Notes:

-

Field 934 is still provided on other Encompass input forms, such as the Borrower Summary - Origination, Property Information, Fannie Mae Additional Data, and Freddie Mac Additional Data input form forms.

-

Field 934 on the ULDD/PDD input form was not a calculated field, so other input fields are not impacted by its removal from this form.

-

If Field 934 on the ULDD/PDD input form contained a value (not blank), that value is retained in field 934 on other input forms.

-

A new field Lock icon has been added to field 934 on the remaining input forms where this field is provided. Authorized users can utilize this Lock to control if Encompass will populate this field or override the calculated value with a manual entry.

ENCW-92983

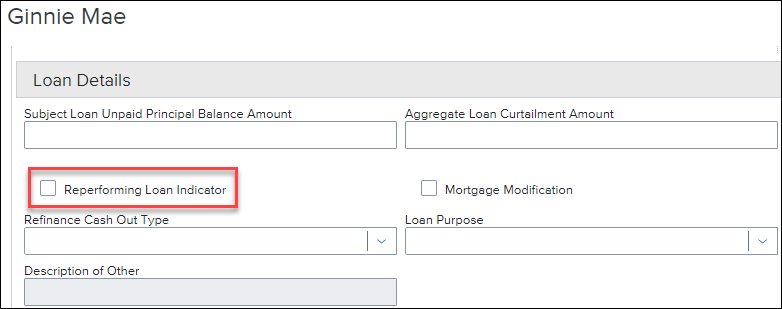

A new Reperforming Loan Indicator checkbox (field ID ULDD.X199) has been added to the ULDD/PDD Ginnie Mae form which enables users to indicate that the loan meets the requirements to be considered a re-performing loan.

Refer to APM 23-03: Revised Requirements for Re-Performing Loans (2/1/2023) on Ginnie Mae’s website for more information on Re-Performing Loans.

ENCW-92994

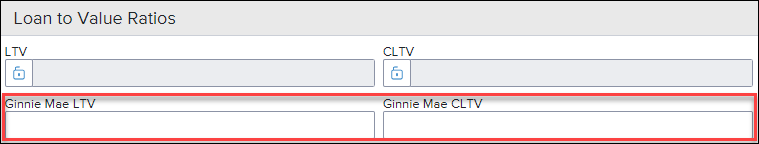

Two new Ginnie Mae-specific fields for LTV and CLTV have been added to the Ginnie Mae tab on the ULDD/PDD form to enable lenders to write their own business rules to calculate these fields according to the logic needed for Ginnie Mae.

-

Ginnie Mae LTV (field ID ULDD.GNM.GinnieMaeLtv)

-

Ginnie Mae CLTV (field ID ULDD.GNM.GinnieMaeCltv

ENCW-93834

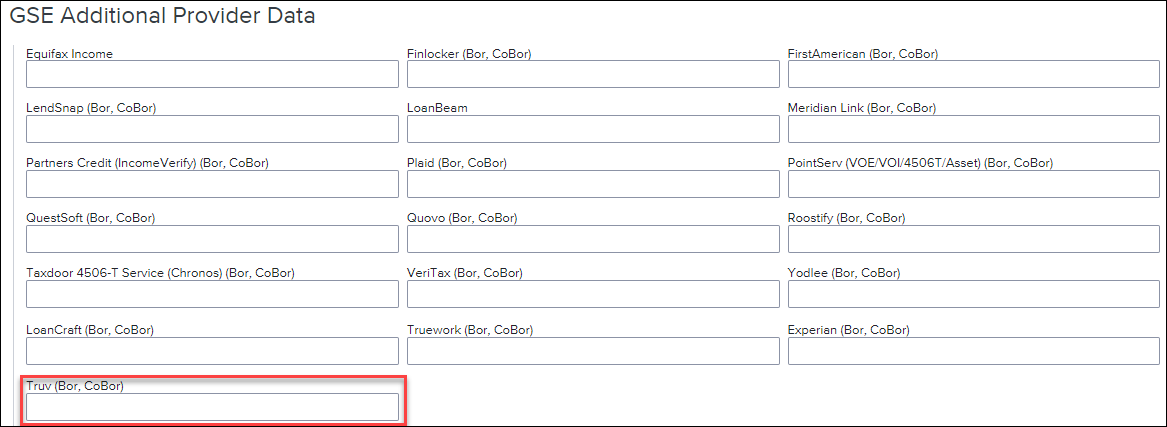

A new field for Truv (field ID GSEVENDOR.X50) has been added to the GSE Additional Provider Data form. Users leveraging Freddie Mac’s Asset and Income Modeler (AIM) through the Loan Product Advisor® (LPA) may use this new AIM for income and employment service provider starting in Q3 2023.

ENCW-93258

Additional Payoff and Payment lines have been added to the Closing Disclosure Page 3 when users are utilizing the Use Alternate option in the Calculating Cash to Close section on the Loan Estimate Page 2. This change accommodates situations where there are more than 15 VOL (Verification of Liabilities) records created with the Will Be Paid Off checkbox selected. The total number of supported Payoff and Payment lines is now 25.

ENCW-84913

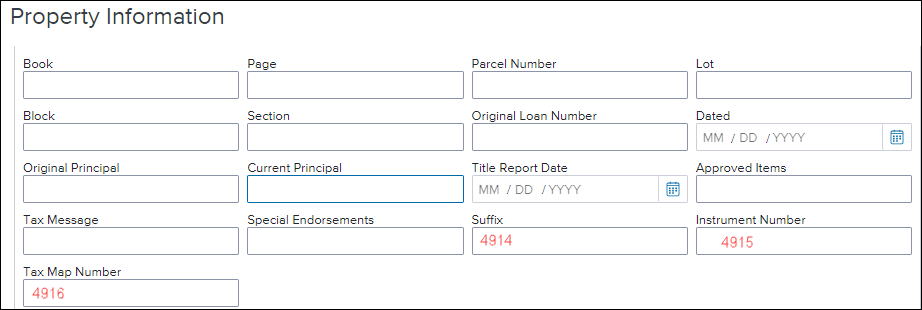

To meet state compliance requirements for the data needed on the District of Columbia (DC) Security Affidavit - Class 1 (DCSECAFF) printed output form, one new field has been added to the Property Information input form:

-

Suffix (field ID 4914) - The data entered in this field is printed Suffix box on the DC Security Affidavit - Class 1 form.

To meet state compliance requirements for the data needed on the Virginia (VA) Land Record Cover Sheet (VACOVER) that is attached and recorded with the VA Deed of Trust printed output form, two new input fields have been added to the Property Information input form:

-

Instrument Number (field ID 4915) - The data entered in this field is printed to the Instrument Number line on the Virginia Land Record Cover Sheet.

-

Tax Map Number (field ID 4916) - The data entered in this field is printed to the Parcel Identification Number/Tax Map Number line on the Virginia Land Record Cover Sheet.

ENCW-83812

New WSJ Prime Rate and Freddie Mac PMM rate options are now provided in the ARM Index Type drop-down field (field ID 1959).

The WSJ rate options are provided as an alternative to the LIBOR monthly index options that are also provided in these drop-down lists as LIBOR reached its final retirement on June 30, 2023.

In addition, a (Retired) label has been added to the retired Freddie Mac 30Y/30D, 30Y/60D, and 30Y/90D indices in these same drop-down fields lists.

ENCW-91589, ENCW-91649

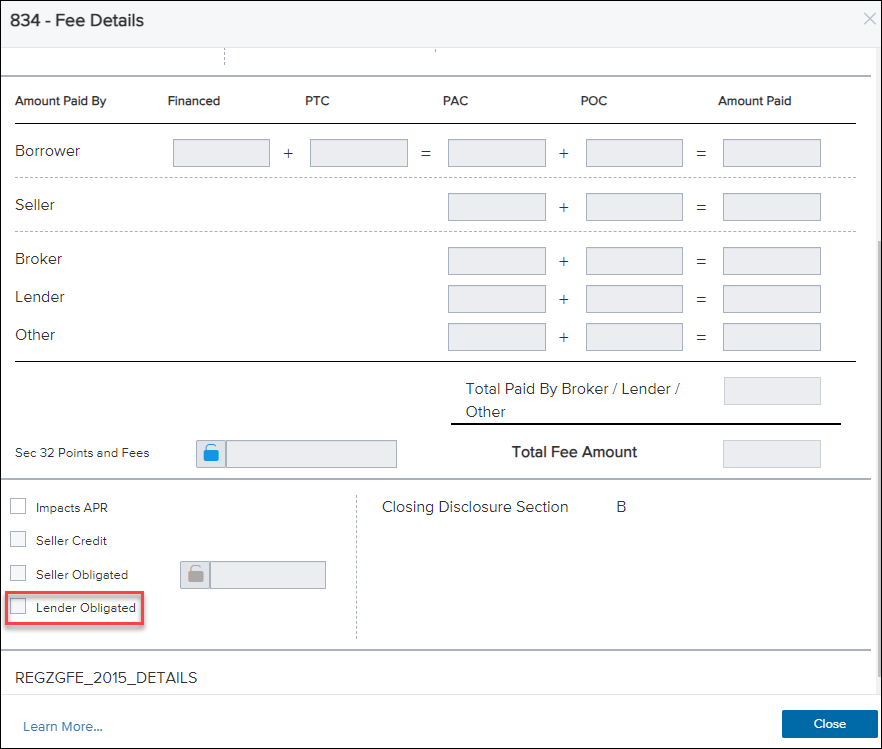

A Lender Obligated checkbox has been added to the Fee Details pop-up windows on the Fee Itemization form for the existing Lender Obligated lines 834, 835, 1115, 1116, 1209 and 1210. This checkbox clearly indicates that fees entered in these lines are not the responsibility of the borrower. These fees are automatically identified as Lender PAC fees, will not impact Fee Variance, will not be represented as Lender Credits, and will not impact the total closing costs fields. They will continue to be disclosed on the Closing Disclosure as Paid By Lender.

The Lender Obligated checkboxes will not be selected for loans existing prior to the Encompass 23.3 release. For an existing loan with non-zero amounts in all 6 fee line items (lines 834, 835, 1116, 116, 1209, 1210), if a user updates one of the fees, the new calculations to select or clear the Lender Obligated checkbox are triggered only for the updated fee.

ENCW-90961

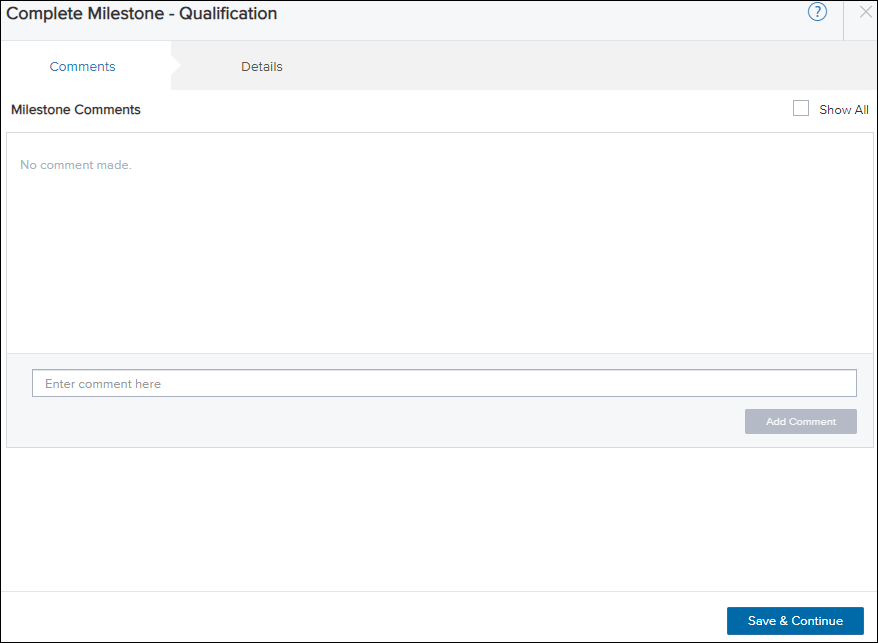

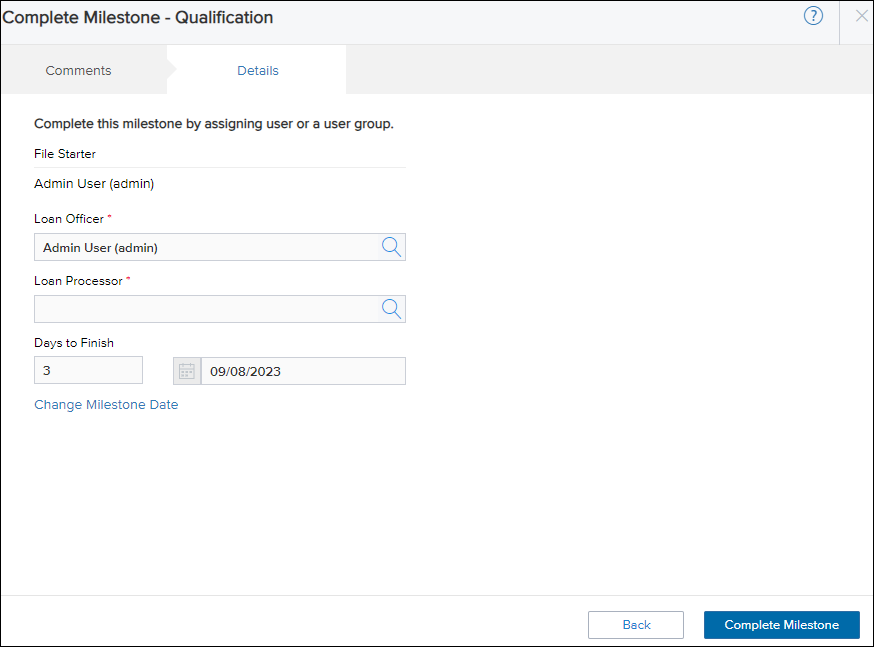

The Milestone Details window has been updated to provide users with more information and functionality that was missing from the desktop version of Encompass. Users can now make comments on milestones, view the days to finish the milestone, change milestone dates, accept the loan file, or return the file to the sender. When the user selects a milestone, the Complete Milestone window displays.

Comments Tab:

Users can view any comments on for the milestone and can add their own comments. To view all comments associated with all milestones, select Show All.

Details:

The Details tab enables users to view who the loan is currently assigned to, assign loans to other users, view the expected days and date to finish the milestone, and more.

Recording Milestone Activities:

This section describes how to use the options on the milestone details window. The information you see on a milestone details window, and the activities you are permitted or required to complete, is based on the configuration of each milestone and your individual user settings.

To View the Milestone Details:

-

From a loan, select the Milestone Timeline

icon and then select Milestone Details

icon and then select Milestone Details  .

. -

On the Comments tab, select Show All to view all comments on all milestones.

-

To add a comment, enter the comment and then select Add Comment.

-

To move to the Details tab, select Save & Continue.

-

To assign a new loan officer, select the Search

icon in the Loan Officer field.

icon in the Loan Officer field. -

Select the loan officer from the drop-down list, and then select Apply.

-

To assign to a User Group, select Assign to User Group and then select the user group from the drop-down list.

-

-

To assign a new loan processor, select the Search

icon in the Loan Processor field.

icon in the Loan Processor field. -

Select the loan processor from the drop-down list, and then select Apply.

-

To assign to a User Group, select Assign to User Group and then select the user group from the drop-down list.

-

-

To change the milestone date, select Change Milestone Date.

-

On the Change Milestone Dates, window, select or enter the updated date for one or more milestones, and then select Apply.

To Accept or Reject a Loan File:

When a loan is assigned to a new loan officer or loan processor, the new assigned user can choose to accept the loan file or return the file to the original sender. The newly assigned user can then either accept or reject the loan file.

-

From the loan that has been assigned, navigate to the Details tab on the Milestone Details window.

-

To accept the loan file select Accept File.

-

To reject the loan file, select Return to Sender to return the loan to the originally assigned user.

ENCW-76666

A search option has been added for the Country field for foreign addresses which enables users to search for a specific country to populate to the field. The search option has been added to the following addresses on the Loan Information and Credit Information forms:

-

Current Address

-

Former Address

-

Mailing Address

To Search for a Country:

-

From a loan in the mobile view of the web version of Encompass, navigate to the applicable address section, and then select Foreign Address.

-

Select the Search

button next to the Country field.

button next to the Country field. -

To search for a country, enter the name of the country. The list is filtered as you type.

-

Select the country you want to populate to the field from the list, and then select Apply.

ENCW-83210, ENCW-85194

Workflow Automation Enhancements

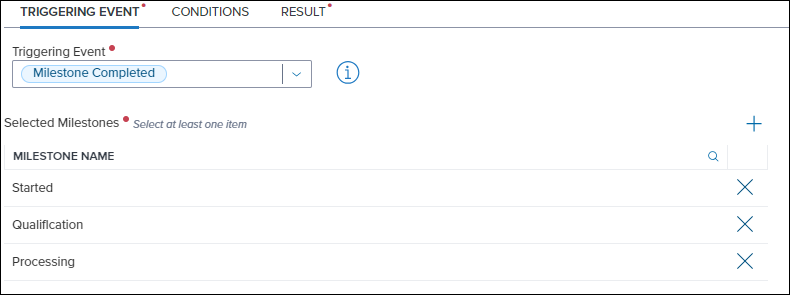

A change has been made to the Milestone Completed triggering event option which enables administrators to select more than one milestone that will trigger the workflow rule when the milestone is completed. Previously, administrators were only able to select one milestone that would trigger a workflow rule.

To Configure the Milestone Completed Triggering Event:

-

From a Workflow Rule, select the Triggering Event tab.

- In the Triggering Event field, select Milestone Completed.

- In the Selected Milestones section, select the Add

icon.

icon. - Select the check box in front of each milestone you want to add to the triggering event, and then select Apply.

- To remove any milestones that were added to the rule, select the Remove

icon next to the milestone name.

icon next to the milestone name.

ENCW-83983

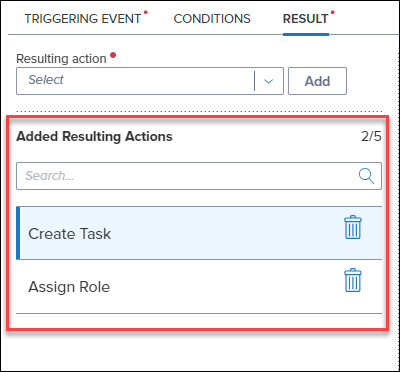

A change has been made to the Result tab for workflow rules which enables administrators to configure multiple resulting actions for a single workflow rule. Previously, administrators were only able to configure one action per triggering event. This new change enables administrators to create more efficient workflow rules that accomplish multiple actions when a single triggering event occurs.

Note: Administrators can configure up to five resulting actions per rule.

To Add Multiple Resulting Actions to a Workflow Rule:

-

From a Workflow Rule, select the Result tab.

- In the Resulting action field, select the resulting action you want to add and then select Add.

- Configure the Resulting Action in the Resulting Action Configuration section.

- Use the description field for quick references in the Added Resulting Actions list.

- To add an additional resulting action, select the action from the Resulting action field and then select Add.

- Repeat steps 3-4 to add the desired number of resulting actions.

- To edit any of the added resulting actions, select the resulting action from the Added Resulting Actions list to view the configuration details in the right panel.

ENCW-82157

A new Order Service resulting action has been added which enables administrators to configure a rule that, when triggered, orders the specific services. This action works in conjunction with the new Services Management configuration space and can be used to place orders for any automated rule with the rule type of Workflow Engine. For information on configuring service rules that can be invoked by the Workflow Engine, see the Using and Configuring Services Management guide.

Configuring Automated Service Ordering through process automation rules with the Workflow Engine rule type allows for repeated service ordering via a single rule and eliminates the five minute cool off period that is required for automated rules with the ASO Bot rule type.

To Add an Order Service Resulting Action:

-

From a Workflow Rule, select the Result tab.

- In the Resulting action field, select the Order Service resulting action and then select Add.

- In the Resulting Action Configuration section, enter a description for the resulting action.

- In the Select Service Rule section, select the service rule to use for this resulting action from the list of configured automated rules with the Workflow Engine rule type.

ENCW-81946

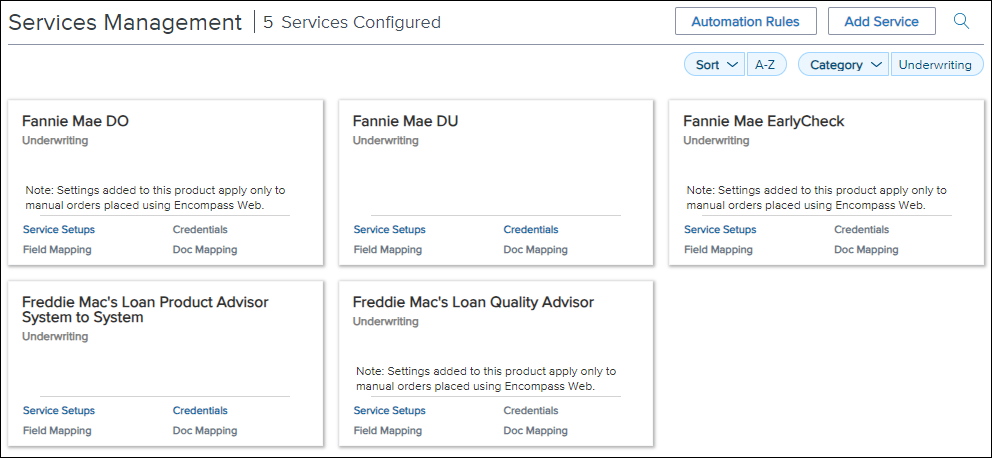

Services Management

The Services Management page has been redesigned to provide a better user experience. The following items have changed with this update:

-

Services Management has moved from the Company/User Setup section to a new Services section in the Encompass Admin settings.

-

One-Click renamed to Easy Order

-

Existing service setups for Manual and Easy Order now displayed as cards and organized by vendor rather than service type.

-

Automated Ordering now moved to an Automated Rules section

-

Introduction of a new rule automation engine. The new Workflow Engine for automated rules provides the same functionality as the original Automation Bot, but also has additional functionality. The Workflow Engine will continue to receive new functionality going forward. It is recommended that all new rules be created utilizing the new Workflow Engine.

For information on how to use the Services Management feature, see the Using and Configuring Services Management guide.

All existing service setups and credentials are retained with this update.

ASO-11739, ASO-12415, ASO-12934

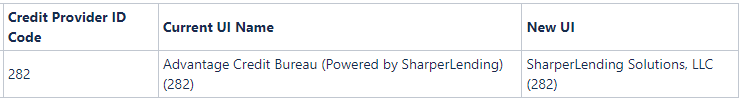

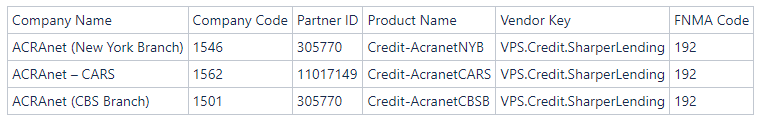

The following Fannie Mae credit provider updates are included in this release:

-

SettlementOne Company Codes: Updates for SettlementOne Company Codes 1532, 1878, & 1883

-

Fannie Mae Company Code: 1532: FNMA Code 290 updated from NMR-SettlementOne to Settlement One

-

Fannie Mae Company Code: 1878: SettlementOne (281) removed from the credit provider list

-

Fannie Mae Company Code: 1883: SettlementOneData, LLC (307) added to the credit provider list

-

-

New Credit Provider: Support for new Credit Provider, Factual Data UAT (918)

-

Name Change: Advantage Credit Bureau (Powered by SharperLending) (282) renamed to SharperLending Solutions, LLC (282)

-

ACRANet Update: Fannie Mae Affiliate Code and details listed in the table below removed from ACRANet Credit Provider

-

Desktop Underwriter Early Assessment Support: As part of ICE Mortgage Technology's support for Fannie Mae Desktop Underwriter Early Assessment, Desktop Underwriter users participating in Early Assessment can now access credit details for the following credit providers:

-

Corelogic Credco

-

Factual Data by CBC

-

Xactus Report

Credit history from these providers now saves all credit orders, not the tri-merge report only

-

GSE-29381, EVP-32128, EVP-32684, EVP-32480, EVP-32490, EVP-32489, EVP-32483

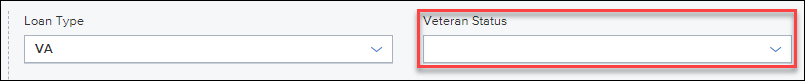

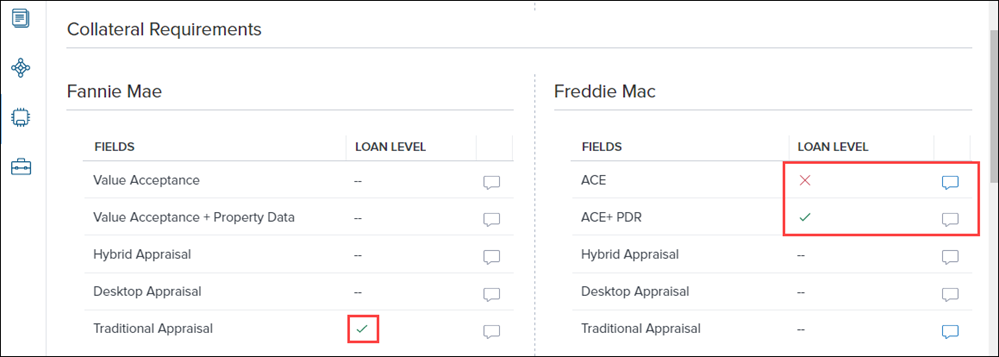

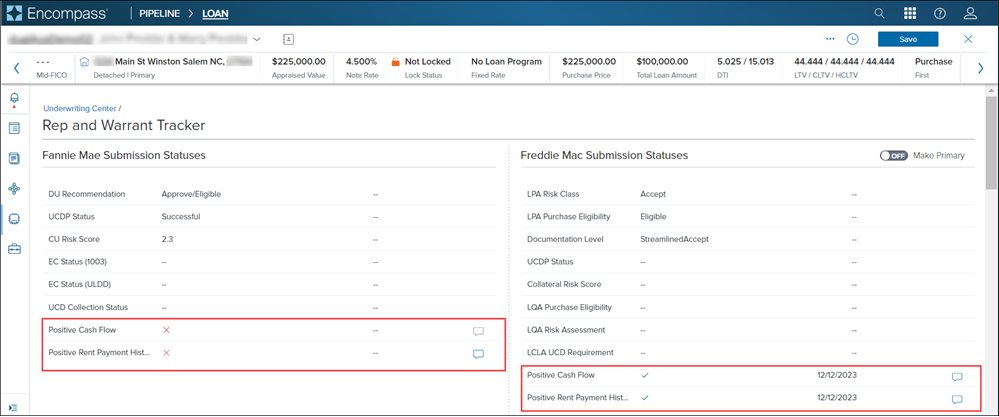

New fields have been added to the Rep & Warrant Tracker tool to support new appraisal options, credit, positive cash flow and positive rent payment history.

The Rep & Warrant Tracker tool in the Underwriting Center has been updated with the following:

-

New Collateral Requirements section

-

Updated Submission Statuses section

After DU and/or LPA results are returned to Encompass, fields in these sections are updated with red crosses (X) and green checkmarks (ü), based on the results. For fields with green checkmarks, you can click the corresponding Info icon to view the messages returned from Fannie Mae and/or Freddie Mac.

For more information on the field parsing and mapping, see the Rep and Warrant Tracker Mapping Document.

![]() New Collateral Requirements section

New Collateral Requirements section

![]() Updated Submission Statuses section

Updated Submission Statuses section

GSE-28754

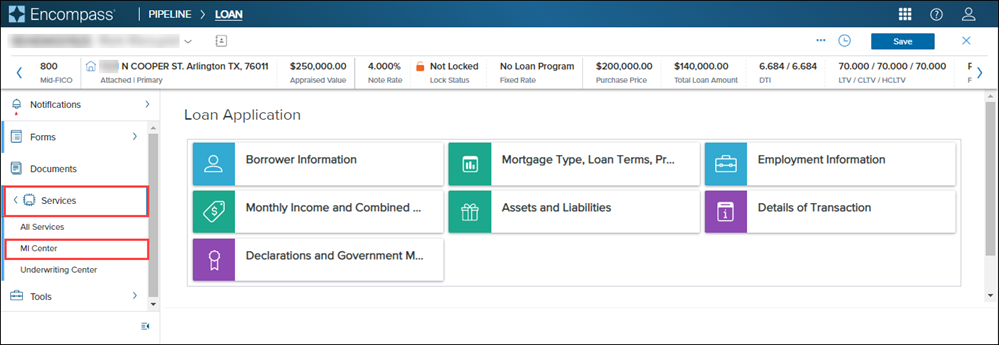

A new MI Center has been added with the Encompass 23.3 Major Release. This integration provides an enhanced integration with all IMT-supported MI providers for a more streamlined mortgage insurance ordering process. Use this feature to leverage process improvements, access to more data, and enhanced flexibility.

-

To access the MI Center, go to the Pipeline, open a loan file, click the Services menu to expand it, and then click MI Center.

-

The new Encompass Partner Connect (EPC) MI integrations will be available in the MI Center in a future release.

TQL-31279

Enhanced Conditions Update

A new View Original button has been added for documents and conditions which enables users to view a file attachment in it's original uploaded state when the New Encompass Document Viewer is enabled. When a user selects the View Original button, the original version of the document is displayed in a new tab.

To View an Original Version of the Document:

-

From the Documents or Enhanced Condition, view an assigned document.

-

Select the View Original button. The document displays in a new tab.

ENCW-92082

The header for attaching unassigned files to an enhanced condition has been updated to Move Unassigned File(s) to Document. Additionally, the Attachments link used to select unassigned uploaded files has been updated to Unassigned Files. Users can also drag and drop files onto the document folder from the expanded condition view.

To Assign an Unassigned File to an Enhanced Condition:

-

From a condition on a loan, select Unassigned Files.

-

On the Move Unassigned Files to Document Folder window, select the document that you want to assign to the condition and then select Attach.

ENCW-84741, ENCW-84743, ENCW-63362

When a condition is added from a condition template, and the condition has a document associated with it, an empty document folder is created on the loan. Previously, when a condition was added from a template which had a document folder associated with it, the document folder was not created. This required that users manually add the document folders subsequently. With this update, the extra steps to add document folders is no longer necessary.

ENCW-84412

Feature Enhancement

The following two template options have been added to the Apply Loan Template menu for loans:

-

Apply Affiliated Business Arrangements Template - This option enables users to apply pre-populated business affiliate information to the loan.

-

Apply Settlement Service Provider Template - This option enables users to apply pre-populated settlement service provider information to the loan.

To Use the Apply Loan Template:

-

From an existing loan, select the ... menu.

-

Select Apply Loan Templates, and then select the template type you want to apply.

-

Select the new template that you want to apply.

-

You can navigate between Public and Personal template folders by selecting the folder on the left side. The templates in each folder display on the right.

-

-

To append the data from that template, select Append.

-

To overwrite existing data on the loan with the data from the template, select Overwrite.

ENCW-84538

Fixed Issues

Why we made these updates: The following issues were fixed to improve usability and to help ensure the web version of Encompass and the Web Input Form Builder is operating as expected. The issues that are chosen to be fixed are based on the severity of their impact to clients and client feedback.

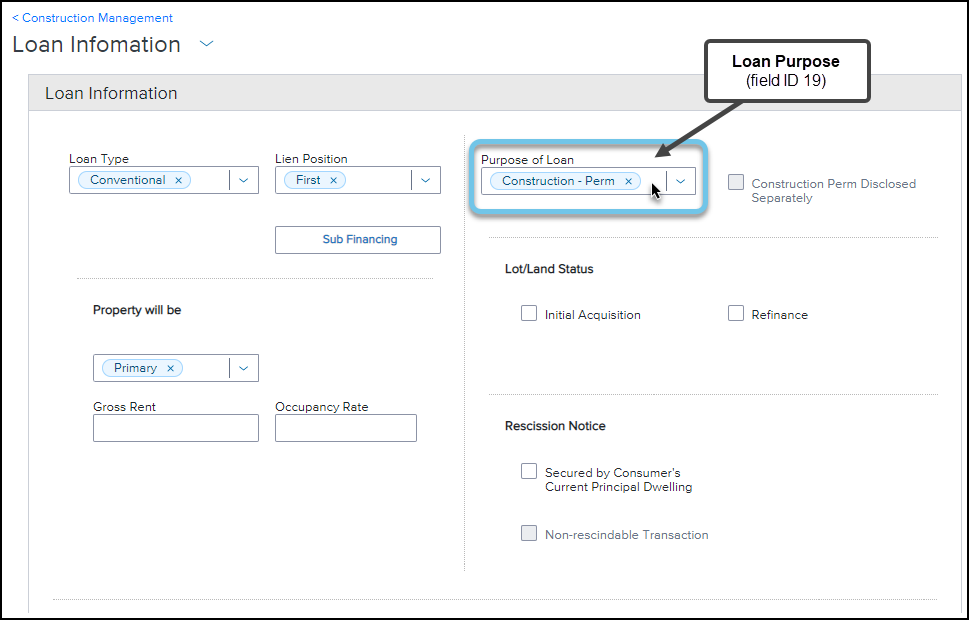

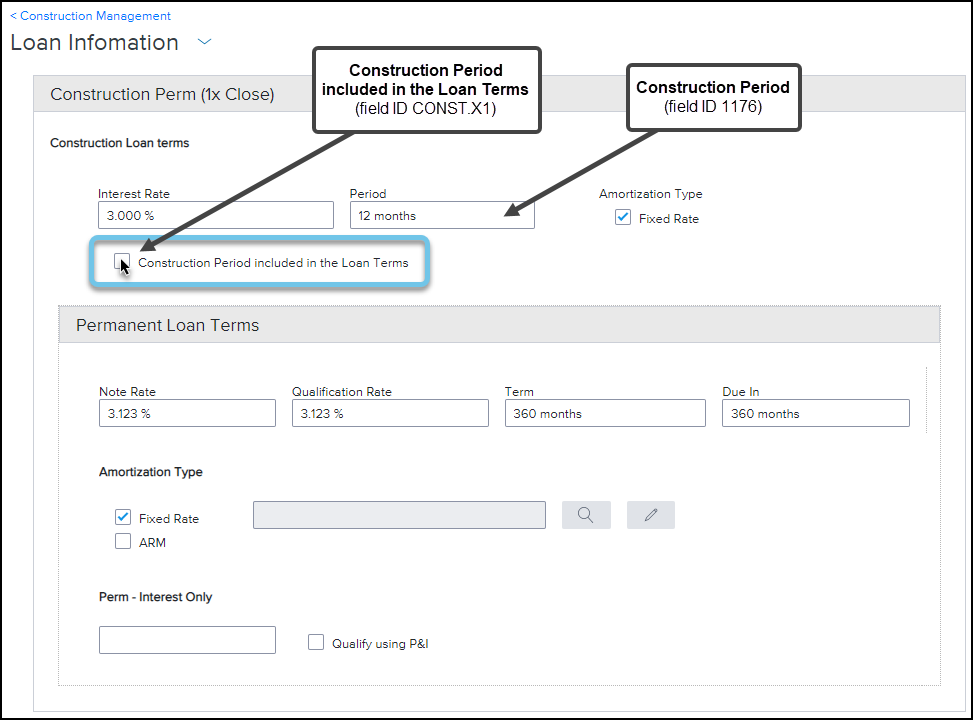

ECS has been updated for the web version of Encompass to no longer include the construction period (field ID 1176) in the calculation for construction loan terms when the Construction Period Included in the Loan Terms checkbox (field ID CONST.X1) is selected for loans where the loan purpose (field ID 19) is set to Construction – Perm.

Previously, ECS calculated the loan term by taking the sum of the values entered for Due In (field ID 325) and Construction Period (field ID 1176). The calculation extended the length of the loan by the number of months for the construction phase. In this release, ECS now calculates loan term by subtracting the number of months for the construction period from the number of months the loan is due in.

CE-47353, CE-47612

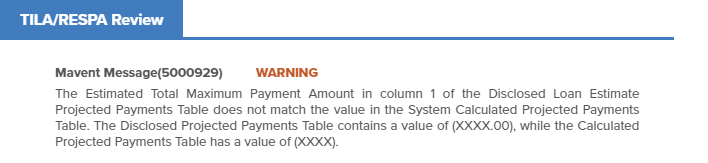

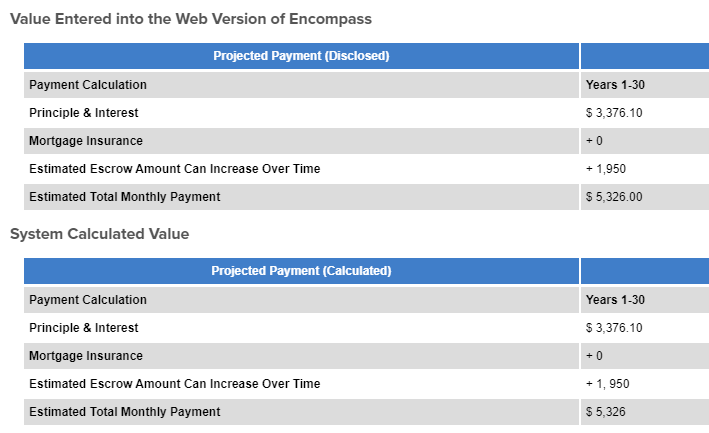

An issue occurred for users running a compliance review from the web version of Encompass where the Disclosed Projected Payments Table's Estimated Total Monthly Payment amount value included cents in the total amount even if the amount of cents was $.00 (e.g., $50.00). This caused a mismatch with the System Calculated Value which does not include cents in the total amount (e.g., $50).

ECS has been updated to not include the cents in the total loan amount when the amount of cents is $.00 (e.g., $50) and only include a value with cents when greater than $.00 (e.g., $50.25).

CE-44489

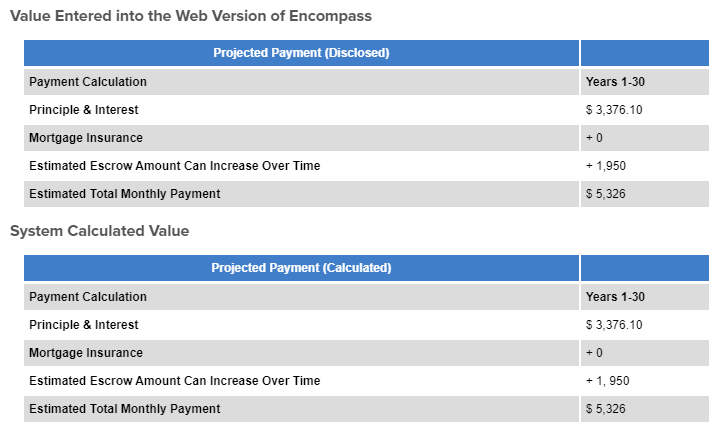

An issue with the names of Custom Applications that included a space between the words and how they were displayed to loan team members has been resolved. After clicking a custom application icon to view the application in the workspace, the name of the custom application that displays at the top of the workspace included the HTML code for a "space" (%20) rather than displaying a space as expected. This issue has been resolved and the names of custom applications that include a space now display correctly when viewed in Encompass.

HTML Code Included in Name:

Name Displays Correctly with a Space:

ENCW-91898

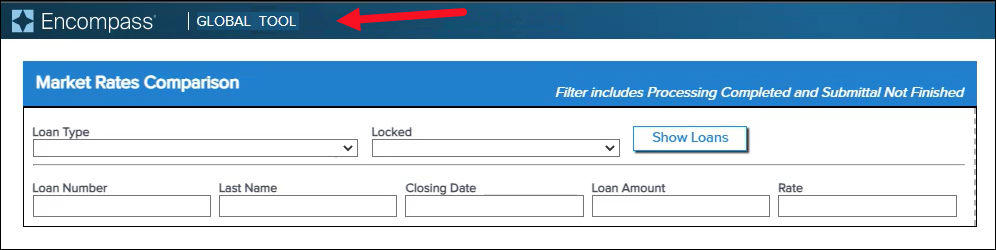

Some loan team members would intermittently receive the following error message in Encompass when they tried to navigate to a standard input form (i.e., forms listed below Forms in the left navigation panel) from a custom tool (i.e., input tools listed below Tools > Custom Tools):

Cannot set properties of undefined (setting ‘currentState’)

This prevented loan team members from navigating to needed information and from being able to save changes to the loan. This issue has been resolved and the error is no longer triggered when navigating from custom tools to standard input forms.

ENCW-83620

An issue was discovered where truncated names for the Property, Title and Trust card and the Acknowledgments & Agreements card on the application view would have an additional period displayed. Typically, when the full name of an application view card can not be displayed, the remainder of the name is truncated and three periods are displayed at the end to indicate that there is more text that is not being displayed. The two cards above were displaying four periods but have been fixed to only display three periods.

ENCW-84988

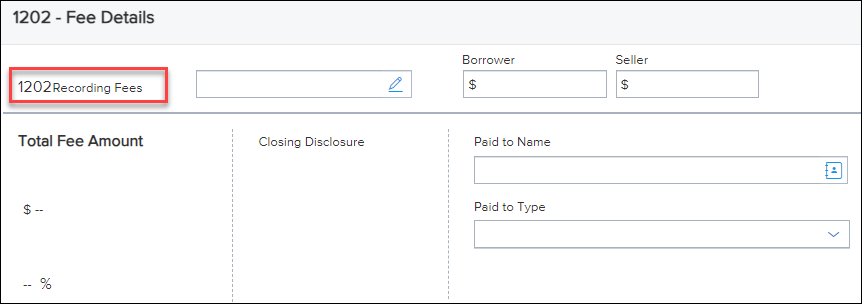

An issue was discovered where the line item number and the fee name were not spaced correctly. This issue affected the following line items:

-

801a - 801e

-

1002 - 1006

-

1102a - 1002c

-

1202 - 1205

This issue has been fixed, and a space has been added between the line number and the line item name.

Example of spacing problem

ENCW-74780

An issue was discovered where searching the pipeline by a loan number that had an extra space at the end would fail to bring up any matches. This issue has been fixed, and now the additional space is ignored to enable filtering the pipeline when an accidental space exists at the end of the loan number.

ENCW-83724

An issue was discovered where paid off liabilities for multiple borrower pairs were not being calculated properly on the Closing Disclosure Page 3 form. When a loan had multiple borrower pairs with liabilities indicated as being paid off with the loan, the total for only one borrower pair was being recorded to line K4 in the Summaries of Transactions section on the Closing Disclosure Page 3 form. This issue has been fixed, and now the paid off liabilities for all borrower pairs are totaled on like K4.

ENCW-83898

| Next Section: Updates and Enhancements to Encompass Web Input Form Builder |

|

|

|

Previous Section: Introduction |