Release Notes Change Log for Version 22.1

This Change Log lists each release notes entry that has been added, deleted, or modified since the initial preview version was first published. These items are listed in reverse chronological order (most recent change is listed first).

| Change Type: Updated entry Change Date: 4/8/2022 Details: The Net Income / Loss Not Calculated for VOMs on Pending Sales That Close Prior to Closing Date entry on in the Feature Enhancements page was updated. In this table, the highlighted portion in the second row (in red) was added:

|

||||||||||||||||||||

| Change Type: New section added Change Date: 4/4/2022 Details: The following new section was added to the release notes to describe the 22.1.0.1 Server Patch 1 update currently planned for April 9, 2022.

|

||||||||||||||||||||

| Change Type: New entry

Change Date: 4/1/2022 Details: The following new entry was added to the Fixed Issues page to describe an update to the initial Encompass 22.1 release to address an issue discovered during testing. Issue Resolved: ‘Invalid Character’ Error Returned when Using Create Loan API (Available on 4/2/2022) In Encompass 22.1 an issue occurred for users when creating loans through an API where an ‘Invalid character in the given encoding’ error was returned. This issue was introduced in Encompass 22.1 due to a change to the encoding type from ‘default’ (the encoding type indicated in the loan settings XML file) to UTF-8. This caused the ‘invalid character’ issue in loan settings files using the UTF-16 encoding type, which has some special characters that are valid in UTF 16 but not in UTF-8. Updates to Encompass and the relevant APIs in Encompass Developer Connect have been made to resolve this issue and recognize these special characters in the XML. This update is scheduled to be applied to Encompass 22.1 on April 2, 2022. |

||||||||||||||||||||

| Change Type: Updated entry

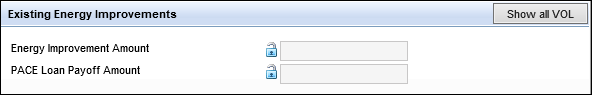

Change Date: 3/23/2022 Details: The following entry on the Feature Enhancements page was updated. Current Entry: Energy Improvement and PACE Loan Payoff Amounts Values for the Energy Improvement Amount and the PACE Loan Payoff Amount are populated to the Existing Energy Improvements section of the Fannie Mae Additional data input form when importing a PACE loan or Energy Efficient loan that is a liability for the subject property and is marked as Paid Off.

Because iLAD loan files do not designate a liability as a PACE or Energy Improvement loan, Encompass users must perform the following steps after the import to have the PACE or Energy Improvement amounts populate correctly: open the VOL record for the liability, select the Subject Property and Will be paid off checkboxes, and then select the PACE or Energy Improvement checkbox. Previous Entry: Energy Improvement and PACE Loan Payoff Amounts Values for the Energy Improvement Amount and the PACE Loan Payoff Amount are populated to the Existing Energy Improvements section of the Fannie Mae Additional data input form when importing a PACE loan or Energy Efficient loan that is a liability for the subject property and is marked as Paid Off.

|

||||||||||||||||||||

| Change Type: New and updated entries

Change Date: 3/11/2022 Details: The following entries on the Feature Enhancements page have been updated.

The following new entries were added to the Feature Enhancements. |

||||||||||||||||||||

| Change Type: Updated information Change Date: 3/4/2022 Details: With the addition of the new and updated entries detailed below, the Encompass 22.1 Release Preview has been updated and converted to the Encompass 22.1 Release Notes. These release notes are subject to change prior to the official Encompass 22.1 major release. Please review the entries in the row below for the new and updated items added to these release notes. In addition, the following links to new Encompass 22.1 Release Rundown videos have been added to the applicable entries on the Features Enhancements page: |

||||||||||||||||||||

|

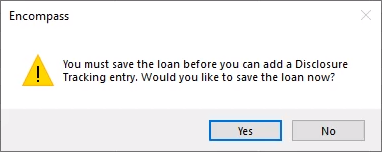

Change Type: Updated entry Change Date: 3/4/2022 Details: The following entry on the Feature Enhancements page was updated. Current Entry: New Setting to Enable Encompass to Validate Dynamic Data Management Rules and Business Rules Before Sending eDisclosures or Ordering Closing Documents A new Admin Tools policy, Validate all system rules prior to Ordering Docs, is now available to enable Encompass to validate business rules and Dynamic Data Management (DDM) rules when a loan team member is sending an eDisclosure request or ordering closing documents. This setting helps ensure that users cannot proceed with sending eDisclosures or ordering closing documents when a DDM rule or business rule should be restricting the user from proceeding. By default, the setting is turned off. When this setting is turned on, the loan team member is presented with this pop-up window each time they click the eDisclosures, Order Docs, Audit, View, or eClose button in the loan file:

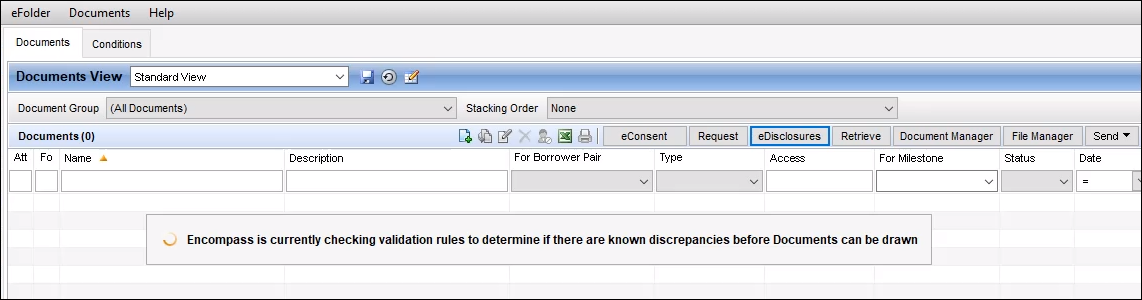

When the loan team member clicks Yes to proceed with the loan save, the following message displays and the rule validation begins:

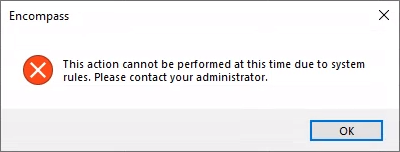

During this validation, Encompass saves the current loan data, validates the DDM rules, and then validates applicable business rules. Once the validation is complete, the loan team member can click the eDisclosures, Order Docs, Audit, View, or eClose button again to proceed. However, if there is a rule applied during the validation that results in a restriction of the eDisclosures, Order Docs, Audit, View, or eClose button, then the button is disabled (grayed out) and the user will not be able to proceed with the sending or ordering of documents. The following message is also provided:

Please note that when this policy is enabled, the loan save that is performed may take longer than a typical loan save due to the evaluation of DDM and business rules that is performed during the loan save. When enabling this policy, a pop-up message informing the administrator of this potential performance impact is provided.

Previous Entry: New Setting to Enable Encompass to Validate Dynamic Data Management Rules and Business Rules Before Sending eDisclosures or Ordering Closing Documents A new Admin Tools policy, Validate all system rules prior to Ordering Docs, is now available to enable Encompass to validate business rules and Dynamic Data Management (DDM) rules when a loan team member is sending an eDisclosure request or ordering closing documents. This setting helps ensure that users cannot proceed with sending eDisclosures or ordering closing documents when a DDM rule or business rule should be restricting the user from proceeding. By default, the setting is turned off. When it is turned on, the loan team member is presented with a pop-up window when they click the eDisclosures or Order Docs or eClose button in the loan file: Encompass is currently checking validation rules to determine if there are known discrepancies before Documents can be drawn. During this validation, Encompass saves the current loan data, validates the DDM rules, and then validates applicable business rules. Once the validation is complete, the loan team member can click the eDisclosures or Order Docs or eClose button again to proceed. However, if there is a rule applied during the validation that results in a restriction of the eDisclosures, Order Docs, or eClose button, then the button is disabled (grayed out) and the user will not be able to proceed with the sending or ordering of documents. Please note that when this policy is enabled, the loan save that is performed may take longer than a typical loan save due to the evaluation of DDM and business rules that is performed during the loan save. When enabling this policy, a pop-up message informing the administrator of this potential performance impact is provided. |

||||||||||||||||||||

|

Change Type: New and Updated entries Change Date: 3/4/2022 Details: The following new entries and designated sections were added to the Feature Enhancements page.

The following new entries were added to the Fixed Issues page. |

||||||||||||||||||||

| Change Type:New information added

Change Date: 2/25/2022 Details:The following links to new Encompass 22.1 Release Rundown videos have been added to the applicable entries on the New Features and Forms and Features Enhancements page: |

||||||||||||||||||||

| Change Type:New entries added

Change Date: 2/25/2022 Details:The following new entries were added to the Features Enhancements page: |

||||||||||||||||||||

| Change Type: New entries added Change Date: 2/18/2022 Details: The following entries were added to the Introduction page's "What's in This Release" section has been updated with three additional items:

The following new entry was added to the Features Enhancements page: The following new entry was added to the Fixed Issues page: |

||||||||||||||||||||

| Change Type: Updated entries Change Date: 2/18/2022 Details:

|

|

Previous Section: Fixed Issues |