Use the buttons below to view general role definition guidelines for each persona.

Encompass Persona Functional Definition

Closer / Funder

The content contained in the Encompass Persona-Based Release Notes are aligned to the Closer / Funder persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Because closers often act as funders and vice versa, the roles are combined for the purpose of Persona Release Notes. Basic responsibilities of the Closer / Funder include, but are not limited to, the following:

- Manage the closing process

- Completes and audits the closing information

- Orders closing documents

- Reviews, prints, and reorders returned closing documents

- They also manage the funding process

Encompass Persona Functional Definition

Loan Officer

The content contained in the Encompass Persona-Based Release Notes are aligned to the LOan Officer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Loan Officer include, but are not limited to, the following:

- Develops business and initiates loans

- Develops new client relationships and manages relationships over time

- Initiates the loan process

- Gathers basic client info

- Orders services for prequalification and preapproval

- Communicates with processor

- Monitors loans in the Pipeline by tracking milestones and items requiring attention

Encompass Persona Functional Definition

Loan Processor

The content contained in the Encompass Persona-Based Release Notes are aligned to the Loan Processor persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Loan Processor include, but are not limited to, the following:

- Coordinates people and information to construct and finalize loans

- Uses tools such as forms documents, and communication logs

- Monitors own Pipeline by tracking milestones and items requiring action

Encompass Persona Functional Definition

Manager

The content contained in the Encompass Persona-Based Release Notes are aligned to the Manager persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Manager include, but are not limited to, the following:

- Manages the business

- Monitors the Pipelines of loan team members

- Manages the bottom line, such as resource assessment and management, and financial forecasting

Encompass Persona Functional Definition

Post Closer

The content contained in the Encompass Persona-Based Release Notes are aligned to the Post Closer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Post Closer include, but are not limited to, the following:

- Confirms all documents are completed and generated

Encompass Persona Functional Definition

Quality Control

The content contained in the Encompass Persona-Based Release Notes are aligned to the Quality Control persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Quality Control include, but are not limited to, the following:

- Inspects the loan for quality

Encompass Persona Functional Definition

Reporting

The content contained in the Encompass Persona-Based Release Notes are aligned to the Reporting persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Reporting include, but are not limited to, the following:

- Pulls, creates, and manages reports in Encompass

- Manages Encompass Reporting Database

Encompass Persona Functional Definition

Secondary Marketing / Lock Desk

The content contained in the Encompass Persona-Based Release Notes are aligned to the Secondary Marketing / Lock Desk persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Because Secondary Marketing often acts as Lock Desk and vice versa, the roles are combined for the purpose these Persona Release Notes. Basic responsibilities of the Secondary Marketing / Lock Desk include, but are not limited to, the following:

- Determines pricing strategies and develops / implements loan programs

- They also receive and process lock requests

Encompass Persona Functional Definition

Servicer

The content contained in the Encompass Persona-Based Release Notes are aligned to the Servicer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Servicer include, but are not limited to, the following:

- Services the loan

Encompass Persona Functional Definition

Shipper

The content contained in the Encompass Persona-Based Release Notes are aligned to the Shipper persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Shipper include, but are not limited to, the following:

- Assists with inventory control and provides input to secondary marketing functions

- Ships loans to document custodians and the investor

Encompass Persona Functional Definition

Underwriter

The content contained in the Encompass Persona-Based Release Notes are aligned to the Underwriter persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Underwriter include, but are not limited to, the following:

- Verifies loan accuracy

- Provides conditions to be met

- Verifies that conditions are met

To learn about another persona, select a persona from the options above; otherwise, to view or print the release notes, select Close ("X") at the top of the window and chose one or more options from the Filter by Persona or Print by Persona menu by selecting a button at the top of the page.

Encompass 25.1 Persona-Based Release Notes

The Encompass Persona-Based release notes are broken down by common Encompass personas. We realize every organization may have slightly different functional definitions for these personas. As such, you may want to review each persona's release note segments before forwarding to ensure they match personas / roles within your organization.

How to Navigate Persona-Based Release Notes

To use the Persona-Based Release Notes page, use the navigation buttons described below:

-

Filter by Persona: Create and view a customized on-screen version of the release notes by selecting one or more persona checkboxes. To remove one or more personas, clear the corresponding checkbox for the persona being removed.

-

Persona Definitions: View general role definition guidelines for each persona.

-

Print by Persona: View a dedicated PDF version of the release notes aligned to each of the available Encompass persona by selecting a persona one at a time. A new window will open and display the selected PDF file.

Encompass 25.1 Persona-Based Release Notes

The Encompass 25.1 Persona-Based Release Notes include a high-level overview of new features, feature and form enhancements, and fixed issues applicable to the each Encompass persona, followed by more detailed information and instructions where appropriate.

Refer to the online help and the Guides & Documents page for additional information and related documents.

Your customized on-screen version of the Persona-Based release notes include the following personas:

Closer / Funder

Loan Officer

Loan Processor

Manager

Post Closer

Quality Control

Reporting

Secondary Marketing / Lock Desk

Servicer

Shipper

Underwriter

To create a new customized on-screen version of the Persona-Based release notes, click Filter by Personas, and then select or clear the corresponding checkbox for the persona being added or removed.

New Features & Forms in Version 25.1 (Banker Edition)

This section discusses the new features being introduced in this Encompass release.

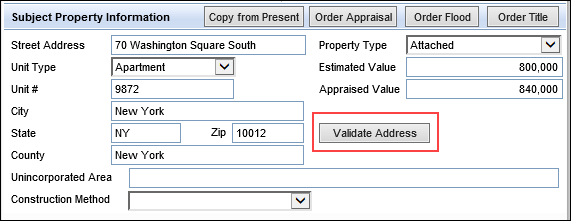

A new Validate Address button (validateuspsaddress) is now provided on the Borrower Summary - Origination and Borrower Summary - Processing input forms to enable users to validate the user-entered subject property address. This is a new feature that uses address information from the US Postal Service (USPS) to validate the following subject property information:

-

Street Address (URLA.X73)

-

City (12)

-

State (14)

-

ZIP Code (15)

The Unit Type (URLA.X74) and Unit # (URLA.X75) fields are not included in this validation.

Use this new feature to help ensure the subject property information provided for the loan matches the address information used by the USPS and reduce the possibility of loan processing issues.

This address validation feature is available only for Encompass 25.1 (and future versions).

Prerequisites

The following prerequisites must be completed using the Encompass web interface to ensure successful use of this feature. The instructions for completing these prerequisites are provided in the following knowledge articles: KA #000115834 - for manual setup or KA #000115835 for automated setup.

-

Sign up for a USPS Developer Portal Account: Sign up for a free account with the USPS Developer Portal. When you sign up you are provided with a Client ID and Client Secret that are required for configuring your company credentials in the Encompass web interface. For more information about setting up your USPS developer account and the Client ID and Secret, please refer to the Steps to obtain Credentials from USPS section of the Using USPS Address Validation in Encompass user guide.

-

Set up the USPS Address Validation service - Administrators must add the USPS Address Validation service to their Encompass instance. There are two options for setup: manual to enable users to manually verify the address or automated to automatically verify the address once conditions are met.

-

Refer to the Set Up the USPS Address Validation Service (Manual Service) information for the steps to set up this service.

-

Refer to the Set Up the USPS Address Validation Service (Automation Service) information for the steps to set up this service.

-

-

User access - When using the manual service option, users must be authorized to access the Validate Address button in Encompass that is used to validate the address. Users can be authorized by the administrator when setting up the USPS Address Validation service.

-

Refer to the Set Up the USPS Address Validation Service (Manual Service) information for the steps to set up this service.

-

If using the automation service option, the address validation service will run automatically based on conditions you define in workflow rules.

-

-

Configure company credentials for USPS - Valid company credentials are required to authenticate with the USPS Address Validation service.

-

Refer to the Configure Company Credentials for USPS Service (Manual Service) information for instructions.

-

Refer to the Configure Company Credentials for USPS Service (Automation Service) information for instructions.

-

-

Activate the Service - The service must be manually activated before it can be utilized by users.

-

Refer to theActivate the Service (Manual Service) information for instructions.

-

Refer to the Activate the Service Rule and Service Order (Automation Service) information for instructions.

-

Validating the Subject Property Address

Once all of the prerequisites have been completed for the manual service option, authorized users can use the Validate Address button on the Borrower Summary input forms to validate the subject property address in a loan file.

If using the automation service option, the USPS Address Validation pop-up window displays automatically when the workflow rule conditions are met. Proceed to step 2 below if using the automation service option.

To Validate the Subject Property Address:

-

After entering the address information in the Subject Property Information section of the Borrower Summary - Origination or Borrower Summary - Processing input form, click the Validate Address button.

-

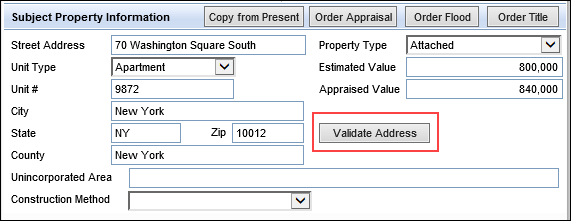

The USPS Address Validation pop-up window displays. Click the Verify Address button to run the validation.

-

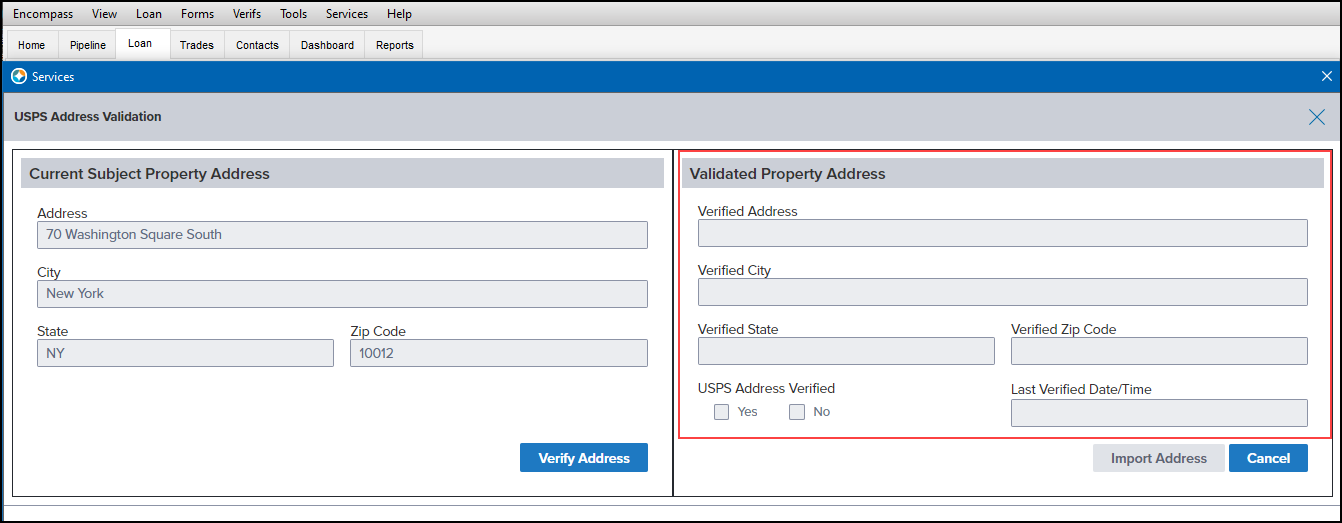

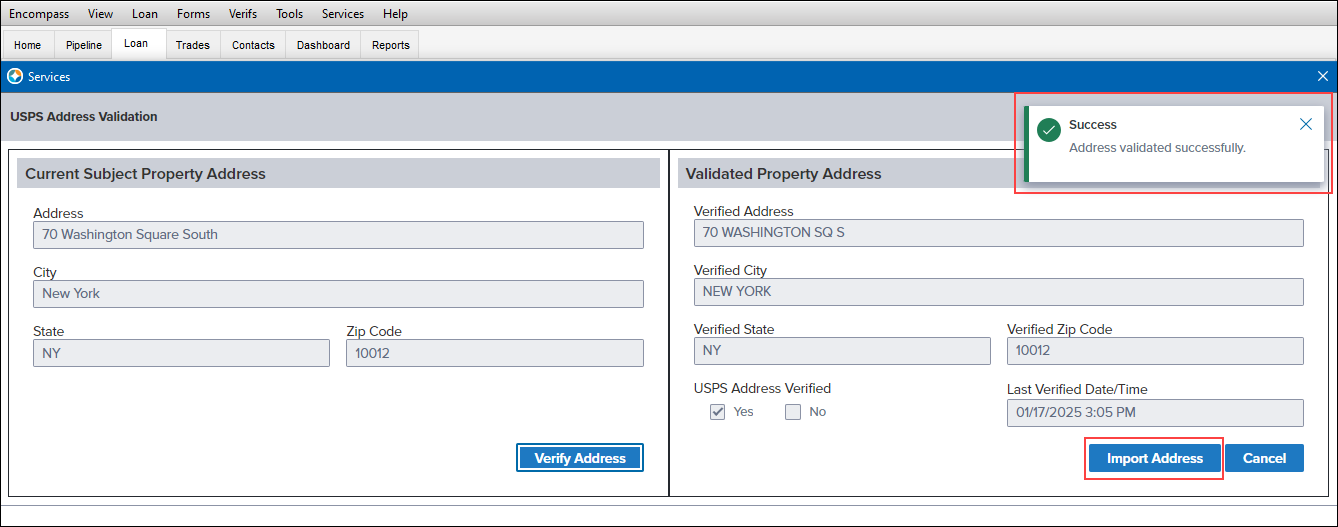

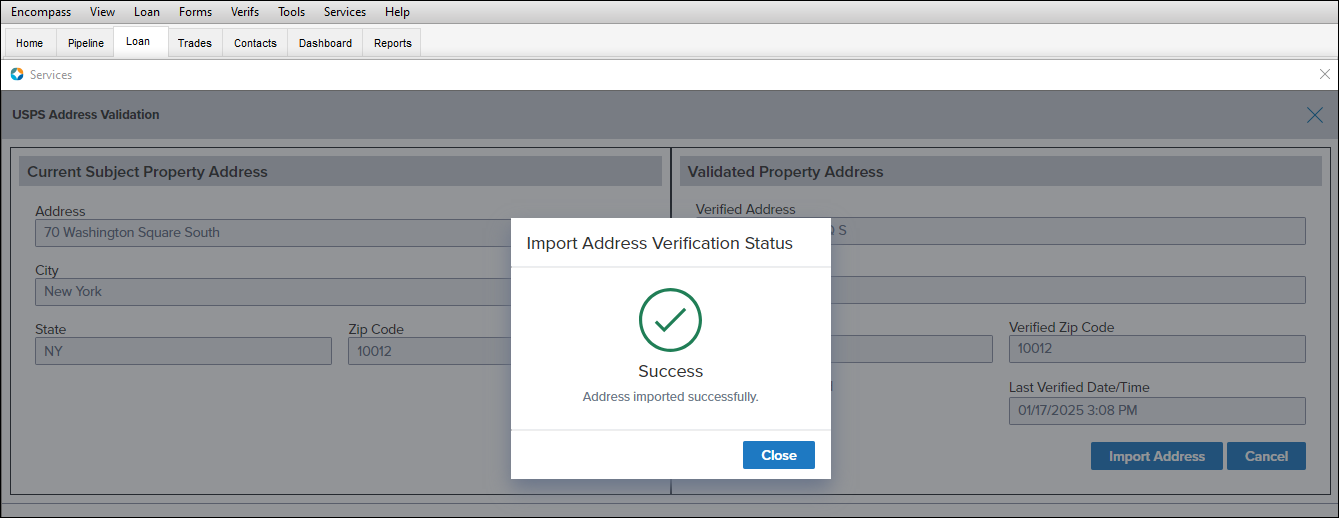

If the address is successfully validated by the USPS, a message confirming the address has been validated successfully is displayed and the Import Address button is activated. Click the Import Address button to import the validated USPS address information to the applicable fields in the loan.

-

Click Close to close the confirmation message and return to the loan file.

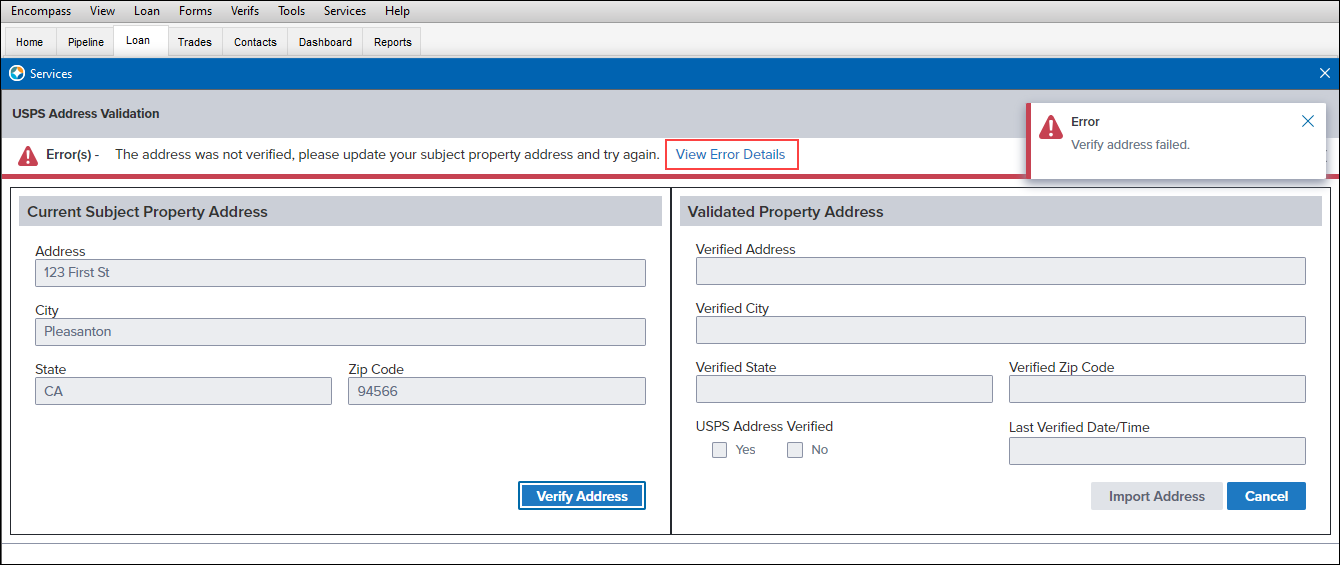

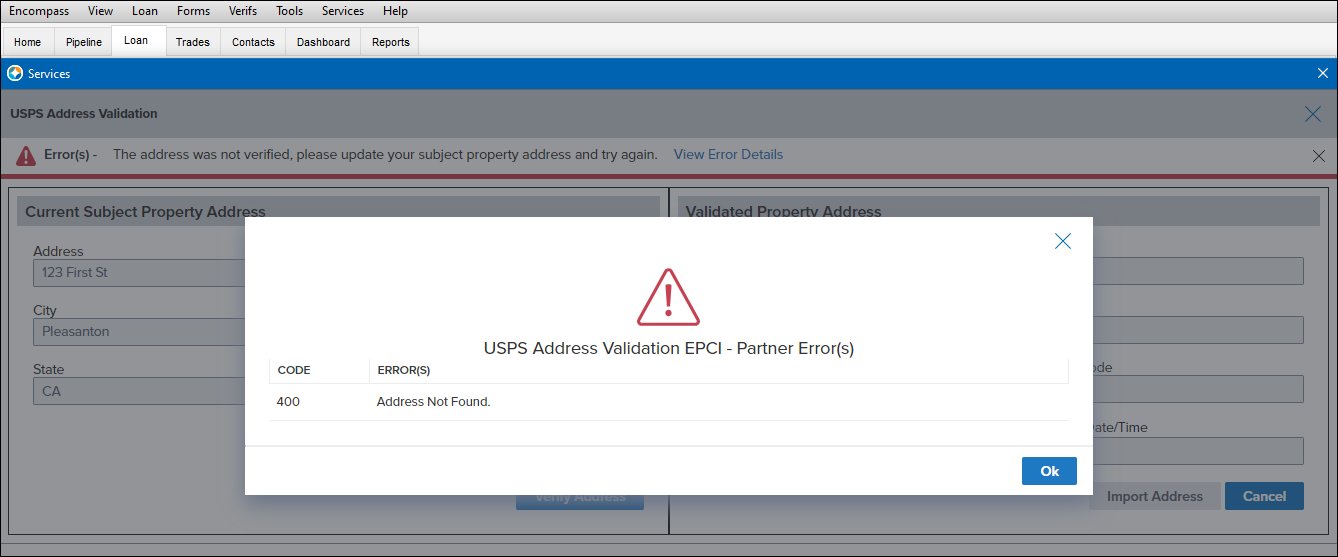

If the address cannot be validated, an error message is returned. Click View Error Details to view more information about why the validation failed.

Click Ok to close the error details pop-up window, and then click the Cancel button to return to the loan file.

Error messages will also be returned if any of the required subject property information is missing from the loan file or if the company credentials for the service are missing

As part of this feature, the new Validated Property Address read-only fields that are displayed when validating the address have been added to the Encompass Reporting Database.

-

USPS Validated Street Address (5048)

-

USPS Validated City (5049)

-

USPS Validated State (5050)

-

USPS Validated ZIP Code (5051)

-

USPS Address Validated Checkbox (5047)

-

USPS Validation Date/Time (5046)

CBIZ-63407

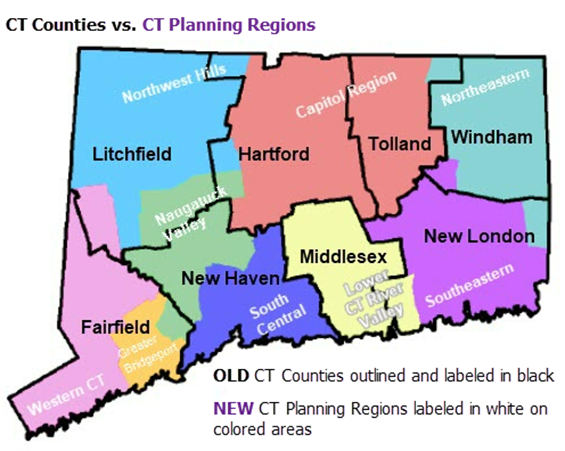

In 2022, the state of Connecticut (CT) announced the U.S. Census Bureau-approved proposal for Connecticut’s Planning Regions to become County Equivalents. Starting in this Encompass 25.1 release, support for the new planning regions is provided for Connecticut loans as described below.

Working with ZIP Codes

The ZIP Code data available in Encompass has been refreshed to include the most current data available for all US cities. This update includes the new planning regions for Connecticut. For users managing loan files, the new planning regions will be available to add to the County field (13) on the Borrower Summary - Origination, 1003 - Lender, and other input forms. The preexisting Connecticut counties used in previous versions of Encompass are also still provided for use with loan files.

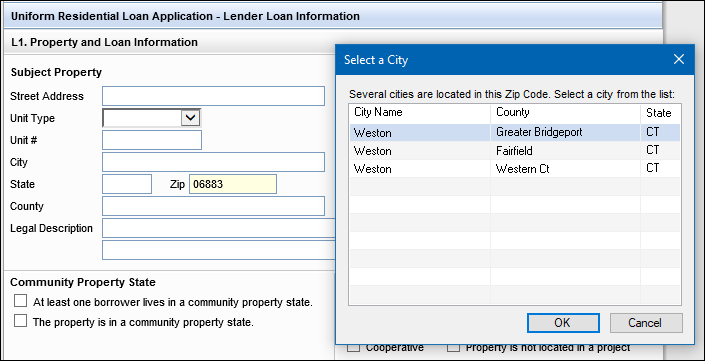

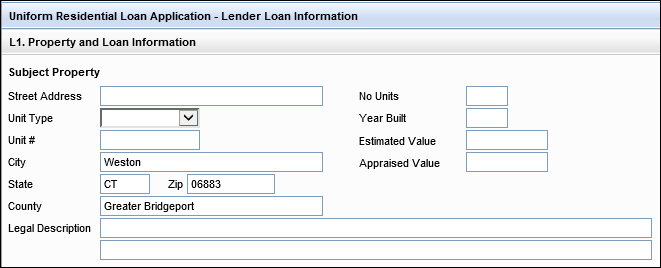

Based on the subject property ZIP Code (15) that is entered for the subject property, the City field (12) is then populated. (This is existing behavior for all loans.) When a ZIP Code for CT is entered, a pop-up window is displayed where users can then select the city and county or the city and planning region to use for the loan.

Based on the city that is selected, the State (14) and County (13) fields are then populated. If the city and planning region was selected from pop-up window, the planning region is populated to the County field.

Conventional County Limits

The new Connecticut planning regions and the preexisting Connecticut counties are available in the Encompass Settings > Tables and Fees > Conventional County Limits table for 2024. Once this data is downloaded and synchronized in your Encompass instance, if a user selects a subject property city and county in Connecticut, the conventional loan limits for the county will be used. If a user selects a subject property city and new Connecticut planning region, the new conventional loan limits for the new planning regions will be used.

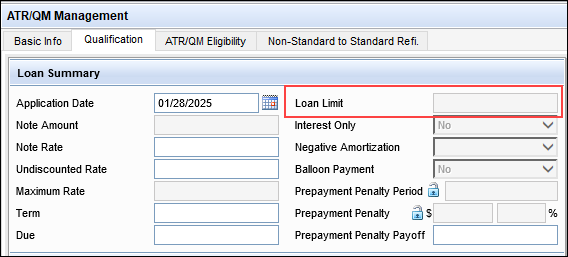

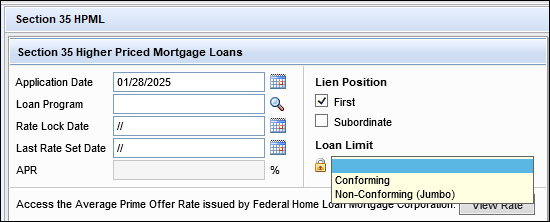

For 2025, the new Connecticut planning regions are not included in the 2025 Conventional County Limits table. The conventional county limits were not the same as they were for 2024, therefore, the new Connecticut planning regions do not have a loan limit value for 2025 loans. If a user selects a subject property city and new Connecticut planning region, the Loan Limit field (3331) on the ATR/QM Management > Qualification tab will be blank. It is recommended that users open the Section 35 HPML input form and manually update the Loan Limit field (3331) to either Conforming or Jumbo, based on what they determine to be the correct loan limit for the new Connecticut planning regions.

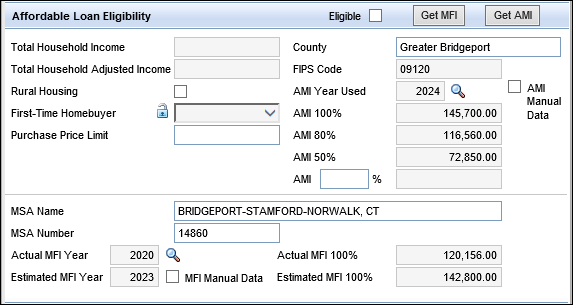

Affordable Lending Income Limits

The new Connecticut planning regions and the preexisting Connecticut counties are available in the Encompass Settings > Tables and Fees > Affordable Lending > AMI Limits table. Administrators can download the latest Area Median Income (AMI) limits to determine income eligibility for affordable housing programs such as USDA, HomeReady® and Home Possible®. The new CT planning regions and the preexisting counties are both included in the AMI Limits table.

The new Connecticut planning regions and the preexisting Connecticut counties are also available in the Encompass Settings > Tables and Fees > Affordable Lending > MFI Limits table. Administrators can download the latest Median Family Income (MFI) limits to determine median income eligibility for affordable housing programs. However, the Federal Housing Finance Agency (FHFA) uses the Metropolitan Statistical Areas (MSA), not counties or planning regions, and the MSA FIPS codes have remained the same. Some MSA names in various states have changed, but there is no major impact to the MFI data in Encompass due to the addition of the new CT planning regions.

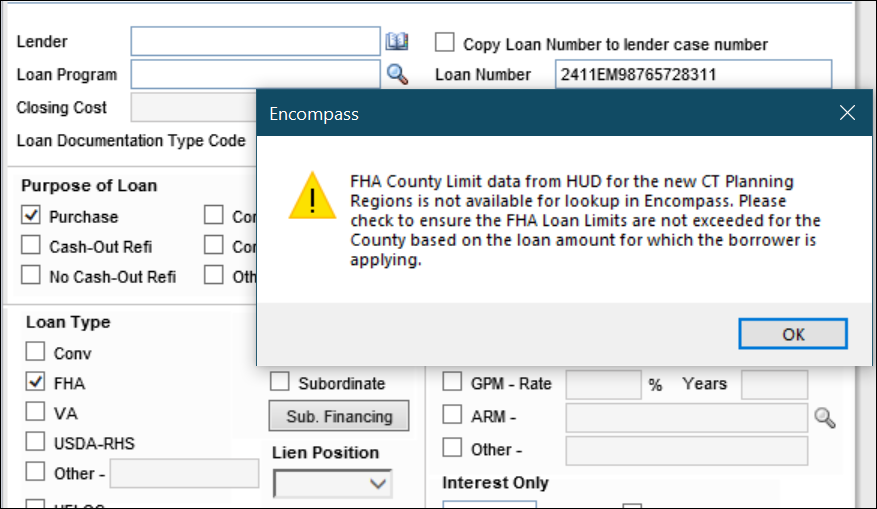

FHA Loan Limits

The Department of Housing and Urban Development (HUD) is not using the new CT planning regions for their 2025 FHA county loan limits. Since this data is not available from HUD, it is not available in the Encompass Settings > Tables and Fees > FHA County Limits tables to apply to loans. To address this, a new pop-up warning message is provided to users when they are working with FHA loans in Connecticut. After the County field (13) for the subject property is populated with a new CT planning region, this pop-up message below is then displayed. As stated in this message, it is the responsibility of the lender to ensure the FHA loan limits do not exceed the loan limits for the specific subject property address. Please refer to the FFIEC's: FRB Census Geocoder website for limit information.

Feature Enhancements in Version 25.1 (Banker Edition)

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release

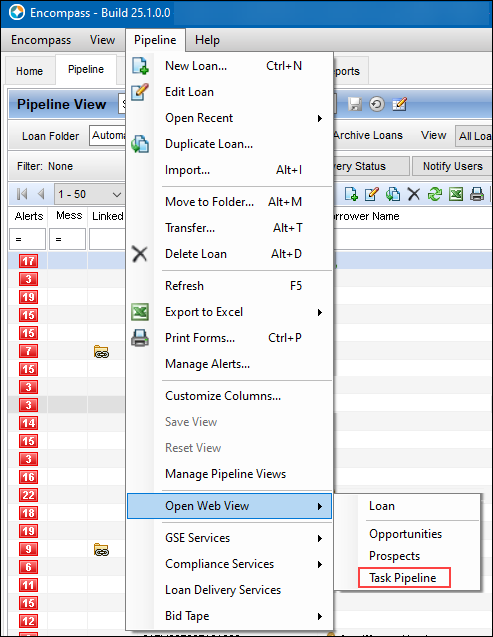

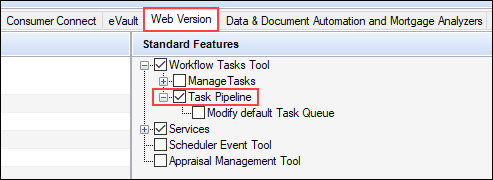

Using the new Task Pipeline option provided in the Pipeline menu, users can now jump to the Tasks Pipeline inside the Encompass web interface from the desktop interface. The Tasks Pipeline enables users to quickly identify, sort, and access their tasks from one central location. Users can view all tasks assigned to the user or assigned to a user group that the user belongs to.

By providing access to the Tasks Pipeline from the desktop interface, users can access the Tasks Pipeline in the Encompass web interface more efficiently and skip the steps of manually opening a web browser, navigating to the Encompass log in screen, providing log in credentials, and then navigating to Tasks Pipeline.

To access the Tasks Pipeline from the desktop interface, click the Pipeline tab, and then click Pipeline > Open Web View > Task Pipeline.

The Task List in the Encompass web interface will then be launched in the user’s default web browser. The user is not prompted to log int the Encompass web interface since they were already logged into the Encompass desktop interface.

Alternatively, you can also right-click inside the Encompass Pipeline, and then select the Open Web View > Task Pipeline to open the Tasks Pipeline in the Encompass web interface.

Please note, this Open Web View > Task Pipeline option will only be displayed for users with the required Persona access rights. Users must have the Both desktop and web versions of Encompass access and the Task Pipeline access rights in their assigned persona to access the Open Web View > Task Pipeline menu option.

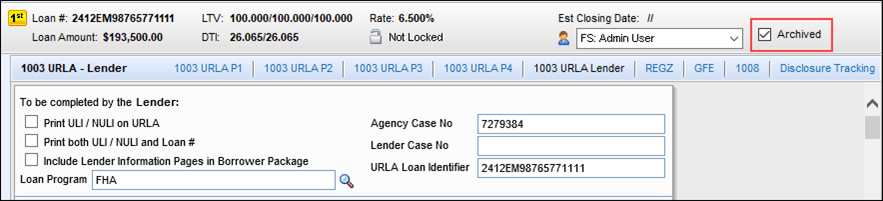

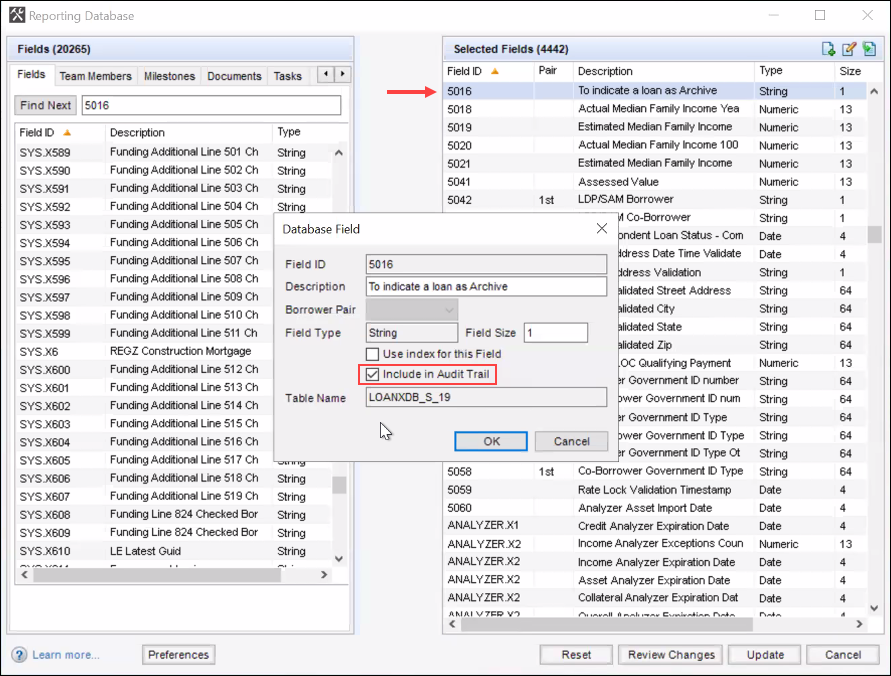

The Archived checkbox (also known as the To indicate a loan as Archive field) provided in each loan file in Encompass can now be included in the Tools > Audit Trail. Use the Audit Trail tool to view and export a history of the changes made to this field in the loan file, including who updated the field and when.

To make the Archived checkbox data available in the Audit Trail tool, add field 5016 to the Selected Fields panel in the Encompass Reporting Database. When adding the field, select the Include in Audit Trail checkbox. Please refer to the Important Notes below for more details.

Important Notes

-

If field 5016 has already been in the Selected Fields column in the Encompass Reporting Database and it was set to Include in Audit Trail since Encompass 24.2 or earlier, no action is needed. Starting in Encompass 25.1, up-to-date and accurate information will now be available in the Encompass Pipeline, Reports, and Dashboards and previous Audit Trail data will be retained.

-

If you removed field 5016 from the Encompass Reporting Database prior to Encompass 24.3, you can now add field 5016 to Encompass Reporting Database and set it to Include in Audit Trail in Encompass 25.1 if you want to include this field in the Audit Trail.

-

Field 5016 only needs to be in the Selected Fields column in the Encompass Reporting Database if you want to include it in the Audit Trail. Even if you do not add the field there, the data for field 5016 will still be available in the Encompass Pipeline, Reports, and Dashboards starting in Encompass 25.1.

-

Audit Trail data will only account for manual updates to field 5016. It will exclude updates from the ICE Job that automatically sets the field status if the loan has not been modified in the past three years and updates to the field that are logged when moving loans into an Archive folder.

Refer to KA 000115710 - Updates to field 5016 (loan Archive indicator) in 24.3 & 25.1 for more information.

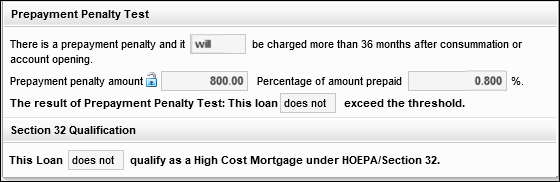

To ensure consistency with Encompass Compliance Service review logic for prepayment penalty points and fees for Hight Cost loans, termination fees for HELOC loans are now included in the Total Section 32 points and fees in the loan (S32DISC.X48). Starting in Encompass 25.1, when a HELOC loan has a termination fee (1986) that value is copied to the Prepayment Penalty field (RE88395.X315). The Total Section 32 points and fees in the loan (S32DISC.X48) and the Percentage of amount prepaid (S32DISC.X178) fields are then recalculated for this fee. Finally, the Prepayment Penalty Test is run and the results are updated (S32DISC.X179) on the Section 32 HOEPA input form.

For existing non-active HELOC loans, the Termination Fee field (1986) is not updated. The Prepayment Penalty field (RE88395.X315) is locked with its current value.

In each of the four HELOC Example Payment Schedules (Historical, Minimum, Maximum, and Worst-Case), the calculations used for the beginning year of the payment schedules have been updated as follows:

-

If the Disclosure Date (363) is after the Index Date (or if it’s the same date (i.e., the same year)), then the Index Date minus 14 years is used to determine the payment dates in the payment schedule.

-

If the Disclosure Date (363) is prior to the Index Date, then the Disclosure Date minus 14 years is used to determine the payment dates in the payment schedule.

Please note, the Index Date in these calculations is the most recent year indicated in the HELOC Historical Index Table that is set up in the Encompass Settings > Tables and Fees > HELOC Table. This is not the loan-level Index Date (4898).

This update has been made to address two scenarios that could result in incorrect payment dates:

-

When a user generates a HELOC Historical Schedule on a month/day that is prior to the month/day when the HELOC Table in Encompass Settings is created. For example, the Disclosure Date (363) is March 5th, while the Historical Table in the Encompass Settings is July 1st. In previous versions of Encompass, the Historical Schedule would generate based on the Index Date for the year as of July 1st, which is a date in the future from March 5th. Since this payment schedule is for "historical" dates, the Historical Schedule should be generated based on the earlier March 5th date (363), not the July 1st date in the future.

-

When an administrator creates a HELOC Table in Encompass Settings but fails to keep the dates in the table current. In previous versions of Encompass, the system would use the most current data available to generate the HELOC Historical Schedule to account for the missing payment data. However, due to the updates described above, starting in Encompass 25.1 only the current data provided by the administrator in the HELOC Table will be used and no automatic adjustments will be made by the Encompass system.

-

Please note that a scenario where the HELOC Table in Encompass Settings does not include a starting year of at least 14 years prior to the earlier of the Disclosure Date or the Index Date as described above, and also does not include the most current year(s) relative to the Disclosure Date or Index Date, is not a scenario which is supported by the Encompass system.

-

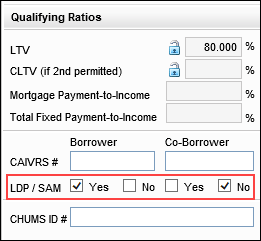

New LDP / SAM checkboxes (5042, 5043) have replaced the previous LDP / SAM checkboxes (3026, 3027) on the FHA Management input form and the HUD-92900LT FHA Loan Transmittal input form. The new version of these checkboxes are borrower-level fields, while the older checkboxes were loan-level fields. This means that the selections made in these Yes/No fields are now specific to each borrower within the loan rather than being specific to the loan.

This update was made to resolve issues that occurred in past versions of Encompass in loans with multiple borrower pairs when different selections were made for these checkboxes for different borrowers and co-borrowers. Now that these fields are borrower-level, when selections are made for borrower pair 1, those selections are not carried over to borrower pair 2.

For existing loans (all loan statuses) created prior to Encompass 25.1, the selections made in the loan-level 3026 and 3027 checkboxes are retained and copied to the new 5042 and 5043 checkboxes for borrower pair 1 borrower and the borrower pair 2 co-borrower.

The Product and Pricing Provider ID field (5029), which was introduced in Encompass 24.3 to capture and validate the pricing provider used for the loan when product and pricing is ordered, has been updated so that the ID in the field is not copied over to a new loan when the loan is duplicated. If field 5029 is populated with a provider ID in the original loan, and then that loan is duplicated, field 5029 will be empty in the new duplicated loan.

Note, this field is not visible on any Encompass input forms or tools. It has been added to the Encompass Reporting Database and may be added to custom input forms.

New Fields in Encompass

New fields that have been added to the Encompass Reporting Database and/or to various forms and tools are described below.

To support FDIC’s requirements for lenders to gather specific information relating to Government Identification, the following new fields have been added to the Borrower Summary - Origination and Borrower Summary - Processing input forms:

-

Government ID (5053) [borrower]

-

Government ID Type (5055) [borrower]

-

Other Description (5057) [borrower]

-

Government ID (5054) [co-borrower]

-

Government ID Type (5056) [co-borrower]

-

Other Description (5058) [co-borrower]

New document expiration date fields have been added to the Underwriter Summary Page 2 input tool:

-

Credit Expiration Date (ANALYZER.X19)

-

Income Expiration Date (ANALYZER.X20)

-

Asset Expiration Date (ANALYZER.X21)

-

Collateral Expiration Date (ANALYZER.X22)

-

Overall Expiration Date (ANALYZER.X23)

By default these fields can be updated manually. Alternatively, some of these fields can be updated automatically by the system based on information provided by ICE Mortgage Analyzers.

To make these fields read-only so users cannot make manual updates, administrators can set up and activate Persona Access to Fields business rules for these fields. If the fields are not set to read-only, data that is manually entered may be overwritten by system data from analyzers.

For users utilizing analyzer data for these fields, the analyzers will use extracted dates, compile those dates, and then provide the oldest document date to set the document expiration date for a file. Documents reviewed will include paystubs, bank statements, credit reports, and other documents used for the loan decision making process.

These dates will be compiled by the ICE Mortgage Analyzers and sent back to the fields (as described below) on the Underwriter Summary Page 2.

-

Credit Expiration - Analyzers will update

-

Income Expiration - Analyzers will update

-

Asset Expiration - Analyzers will update

-

Collateral Expiration - This field will not be updated by analyzers

-

Overall Expiration - This field will not be updated by analyzers

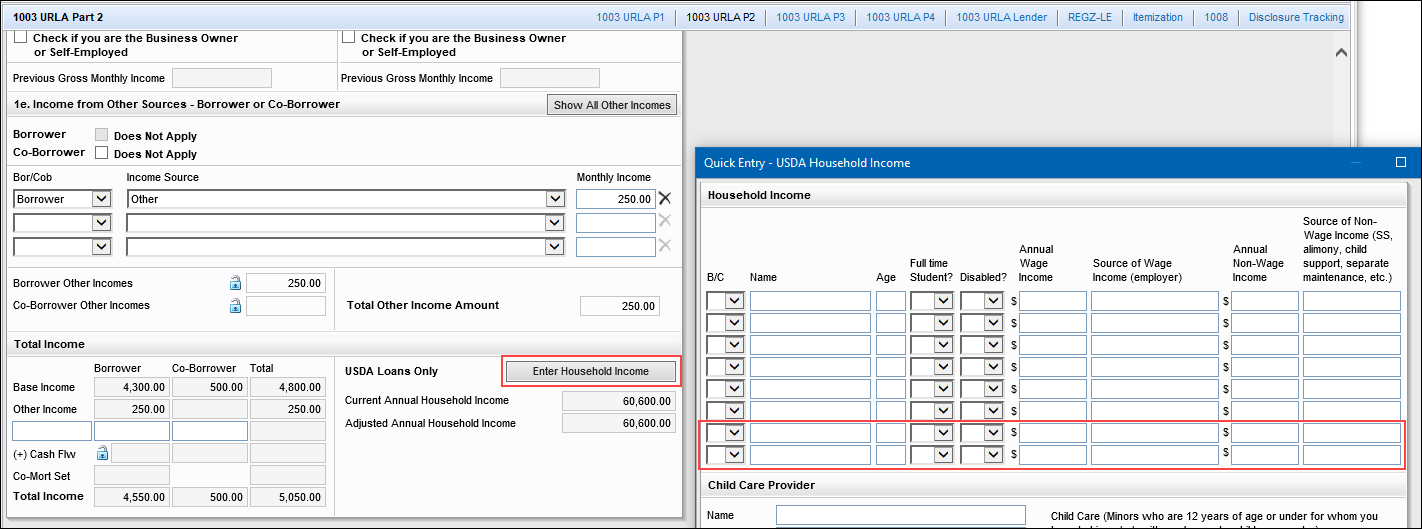

In Encompass 24.3, two additional rows of loan-level, editable fields were added to the Household Income table on the USDA Management input form’s Rural Assistance URLA > Page 6 to provide additional rows for more household members’ income data to be provided. In Encompass 25.1, these same fields have been added to the Quick Entry - USDA Household Income pop-up window.

Row 7: USDA.X240, USDA.X224, USDA.X225, USDA.X226, USDA.X227, USDA.X228, USDA.X229, USDA.X230, USDA.X231

Row 8: USDA.X241, USDA.X232, USDA.X233, USDA.X234, USDA.X235, USDA.X236, USDA.X237, USDA.X238, USDA.X239

This quick entry window is accessible by clicking the Enter Household Income button for USDA loans on the 1003 URLA Part 2 input form.

New Employer Alias fields have been added to the Employer Information section of the Verification of Employment (VOE) input form to provide fields where the company’s alternate name or AKA can be entered. This helps ensure users receive the employment rep and warrants since it will be easier to match the borrower’s employer to the correct business.

-

Employer Alias 1 (BE0082) [for borrower]

-

Employer Alias 2 (BE0083) [for borrower]

-

Employer Alias 1 (CE0082) [for co-borrower]

-

Employer Alias 2 (CE0083) [for co-borrower]

A new loan-level Qualifying Payment field (5052) for non-HELOC properties has been added to the Transmittal Summary input form. This field was added to provide better visibility to the non-HELOC qualifying P&I payment for subject properties that are second homes or investment properties (1811).

For HELOC loans, the HELOC Qualifying Payment field (5025) captures this payment. For non-HELOC loans for primary homes (1811), this payment is captured in the First Mortgage P&I (1724) or Second Mortgage P&I (1725), but for non-HELOC secondary/investment properties, this payment is only calculated as part of the negative Rental Cash Flow field (462) and it’s added with the Taxes, Insurance, and any Rental Income that is entered. Now this qualifying P&I payment for secondary/investment properties is provided in this new Qualifying Payment field (5052).

Note that this new Qualifying Payment field is provided for loans for all occupancy types, not just secondary or investment properties.

The following fields have been added to the State-Specific Disclosure Information input form for Mississippi:

-

Lock-in Terms and Conditions (DISCLOSURE.X277)

-

Lock-in Refund Conditions (DISCLOSURE.X189)

These fields were added to ensure that lenders can provide refundable condition information for rate locks and disclose the Rate Lock Agreement correctly for loans in Mississippi.

Note that these fields already existed in previous versions of Encompass and were (and continue to be) provided on other State-Specific Disclosure Information input forms for other states.

A new Investor Cure by Date field (5045) is now provided on the Shipping Detail input form. Use this field to store the cure by date for the loan sent by an investor (via Encompass Investor Connect) back to Encompass.

A new lock validation timestamp field (5059) is now provided to capture the date/time when the Rate Lock Validation Status field (4788) is updated to Needs Validation.

-

The current server date and time in UTC format will populate field 5059.

-

If field 4788 is cleared, field 5059 is also cleared.

This new field (5059) is not visible on any Encompass input forms or tools, but it is available in the Encompass Reporting Database.

For more GSE Integrations and Services 25.1 updates, see the GSE Release Notes.

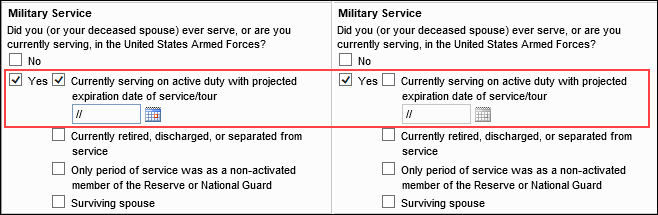

On the 1003 URLA Part 1 input form, the verbiage for the checkbox that users select to 1) indicate the borrower or co-borrower (or their deceased spouse) is currently serving on active military duty and 2) to activate the date field where the user can then enter the projected expiration date of service or tour has been updated to help clarify what the date field is intended for. The updated verbiage for fields URLA.X123 and URLA.X126 is shown here:

Previously the verbiage used here was Currently serving on active duty Expiration Date of Service/Tour.

This new verbiage now aligns better with the verbiage provided for these military service checkboxes and fields on the 1003 Part 1 printed output form. This update to the input form is intended to make it clear that this date field should only be activated/populated if the individual is currently actively serving and NOT currently retired, discharged, or separated from the service. In previous versions of Encompass, some users incorrectly entered an expiration date for active service when the borrower, co-borrower, or deceased spouse was retired, discharged, or separated from the service, which led to data quality errors (DQC0590) being returned by Freddie Mac during underwriting.

New fields have been added to Encompass to support the Freddie Mac Asset and Income Modeler (AIM) and Fannie Mae’s Income Calculator respectively. These fields are not currently visible on existing Encompass input forms, but they are included in the Encompass Reporting Database and can be added to custom input forms that are available in the Encompass Reporting Database.

-

Freddie Mac AIM Check Integrator (FAC0001)

-

Freddie Mac Verification Report Identifier (FAC0002)

-

Fannie Mae Income Calculator Belongs To (FANNIEIC0001)

-

Fannie Mae Verification Report Identifier (FANNIEIC0002)

These fields are targeted to be provided on the GSE Additional Provider Data input form in a future Encompass release.

As part of an initiative that has been ongoing for the past few years (and per Freddie Mac's guidance), updates have been made to the Freddie Mac Additional Data input form to remove fields that are no longer needed because they are available on other input forms. The remaining fields on the form have been reorganized in the remaining sections.

Fields Removed from Freddie Mac Additional Data Input Form

Per Freddie Mac’s guidance, the following fields have been removed the Freddie Mac Additional Data input form. These fields remain in the Encompass Reporting Database, so they can be added to custom input forms if needed.

| Field Name | Field ID |

|---|---|

| Lender | |

| Fin. Concessions | CASASRN.X20 |

| Purpose of Loan | CASASRN.X29 |

| Property Type | CASASRN.X14 |

| Rate Adjustment | |

| Orig Int Rate | CASASRN.X142 |

| Simulated PITI at mnth 13 | CASASRN.X15 |

| Mortgage Insurance Information | |

| MI Refundable Option | CASASRN.X146 |

| Renewal Type | CASASRN.X148 |

| Payment Option | CASASRN.X152 |

| Years of Coverage | CASASRN.X156 |

| MI Coverage | 430 |

| Renewal Option | CASASRN.X150 |

| Payment Frequency | CASASRN.X154 |

| Premium Source | CASASRN.X158 |

| Loss Coverage Est. | CASASRN.X160 |

| Lender Registration # | CASASRN.X161 |

| Duty to Serve & Existing Energy Improvements | |

| Show all VOL [button] | |

| Affordable Loan Eligibility | |

| Eligible | 4968 |

| FFIEC MFI [button] | |

| Get AMI [button] | |

| Total Household Income | USDA.X222 |

| Total Household Adjusted Income | USDA.X223 |

| Rural Housing | 3850 |

| First-Time Homebuyer | 934 |

| Purchase Price Limit | 4969 |

| County | 13 |

| FIPS Code | HMDA.X111 |

| AMI Year Used | 4970 |

| AMI 100% | MORNET.X30 |

| AMI 80% | 4971 |

| AMI 50% | 4972 |

| AMI Percent | 4985 |

| AMI Amount | 4986 |

| Manual Year | 5027 |

| MSA Name | 5017 |

| MSA Number | 699 |

| Actual MFI Year | 5018 |

| Estimated MFI Year | 5019 |

| Actual MFI 100% | 5020 |

| Estimated MFI 100% | 5021 |

| MFI Manual Data | 5028 |

| Non-Occupant Present Housing Expense | CASASRN.X131 |

| Non-Occupant Non-Housing Debt | CASASRN.X174 |

| FHA/VA Originate ID | CASASRN.X27 |

| Size of Household | CASASRN.X145 |

| FHA Lender Identifier | 1059 |

| FHA Sponsor Identifier | 1060 |

| Alimony as Income Reduction | CASASRN.X159 |

| Special Instructions | CASASRN.X100 |

| Special Instructions | CASASRN.X101 |

| Special Instructions | CASASRN.X102 |

| Special Instructions | CASASRN.X103 |

| Special Instructions | CASASRN.X104 |

| Freddie Field #3 | CASASRN.X162 |

| Broker Originated | CASASRN.X165 |

| Amount of Financed MI | CASASRN.X169 |

| Borrower Field #1 | CASASRN.X170 |

| Borrower Field #2 | CASASRN.X171 |

| Co-Bor. Field #1 | CASASRN.X180 |

| Co-Bor. Field #2 | CASASRN.X181 |

| Long Legal Description | CASASRN.X41 |

| All Monthly Payments | CASASRN.X99 |

| Present Housing Expense | CASASRN.X16 |

| No-Appraisal MAF | CASASRN.X164 |

| Collateral Rep & Warrant | CASASRN.X33 |

| Risk Class | CASASRN.X34 |

| HELOC Drawn Total | CASASRN.X167 |

| HELOC Credit Limit | CASASRN.X168 |

| CHOICERenoEXpressInProgress | CASASRN.X223 |

Updates to ULDD/PDD Input Form

A new MI Interest Rate Adjustment Percent field (ULDD.FNM.X7) has been added to the Fannie Mae tab on the ULDD/PDD input form. This new field replaces the MI Interest Rate Adjustment Percent field (ULDD.X217) that was added to the Freddie Mac and Fannie Mae tabs on the ULDD/PDD input form in Encompass 24.3. Since Fannie Mae has special requirements for the MI Interest Rate Adjustment Percent value, a unique field for this value was needed for the Fannie Mae tab on the ULDD/PDD input form.

For existing loans, the value from the Fannie Mae tab (ULDD.X217) is copied to the new field on the Fannie Mae tab (ULDD.FNM.X7) in Encompass 25.1. The value is rounded to two decimals. If a value greater than 10.00 was in ULDD.X217, the value in the new ULDD.FNM.X7 field will be updated to 0.00.

Negative values are now permitted in the Rate Spread field (ULDD.FNM.HMDA.X15) on the Fannie Mae ULDD input form. In previous versions of Encompass, if the rate spread (HMDA.X15) for the loan was a negative amount, the rate spread on the Fannie Mae ULDD input form would populate to 0.00 rather than the negative value.

The value in the FRE Condominium Project Identifier field (CASASRN.X221) on the Project Review tool is now automatically populated to the CPA Project Assessment Request Identifier field (ULDD.FRE.X1) on the Freddie Mac ULDD/PDD input form. Any time a value is entered, modified, or deleted from the FRE Condominium Project Identifier field, that value is updated (or deleted) in the CPA Project Assessment Request Identifier field on the ULDD/PDD input form.

Note that if a value is entered, modified, or deleted from the CPA Project Assessment Request Identifier field on the ULDD/PDD input form, the value in the FRE Condominium Project Identifier field on the Project Review tool is not updated (or deleted).

This update helps ensure that users utilizing Fredde Mac’s Condominium Project Advisor Platform can capture the Project Identifier number accurately on the ULDD/PDD input form and send it to LSA/LQA for delivery.

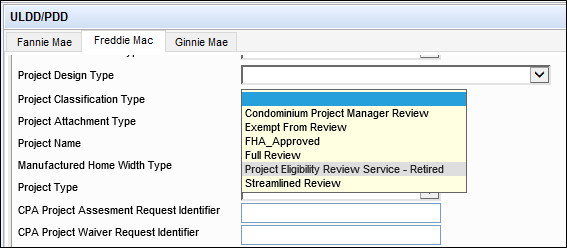

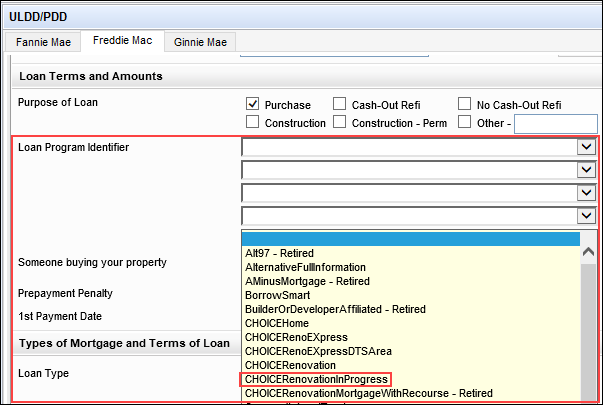

Per ULDD Phase 4a and 5 specifications, the following enumerations provided in dropdown lists on the ULDD/PDD input form are now indicated as Retired. The enumerations are still provided in these dropdown lists, but a Retired indicator is now displayed next to it.

| Field Label | Field ID | Retired Enumeration |

|---|---|---|

| Project Classification Type [Freddie Mac] | ULDD.X141 | Project Eligibility Review Service |

| Loan Program Identifier [Freddie Mac] |

ULDD.FRE.LoanProgramIdentifier ULDD.FRE.LoanProgramIdentifier2 ULDD.FRE.LoanProgramIdentifier3 ULDD.FRE.LoanProgramIdentifier4 ULDD.FRE.LoanProgramIdentifier5 |

Alt97 BuilderOrDeveloperAffiliated CHOICERenovationMortgageWithRecourse DisasterReliefProgram FREOwnedCondoProject HomePossible3PercentCash HomePossible97 HomePossibleAdvantage HomePossibleMCM3PercentCash HomePossibleMCM97 HomePossibleNeighborhoodSolution3PercentCash HomePossibleNeighborhoodSolution97 HomePossibleNeighborhoodSolutionMCMCS3PercentCash HomePossibleNeighborhoodSolutionMCMCS97 HomePossibleNeighborhoodSolutionMortgage Negotiated97PercentLTVLoanProgram NeighborhoodChampions NewlyBuiltHomeMortgage RecourseGuaranteedByThirdParty ShortTermStandBy SolarInitiative |

| Investor Collateral Program ID [Freddie Mac] | ULDD.X95 |

Form 2070 Form 2075 Property Inspection Alternative |

| Investor Collateral Program ID [Fannie Mae] | ULDD.X38 |

DU Refi Plus Property Fieldwork Review Level 1 Property Inspection Waiver Property Inspection Waiver |

| Property Valuation Method Type [Freddie Mac] | ULDD.X29 | Prior Appraisal Used |

| Property Estate Type [Fannie Mae] | ULDD.X197 | Other |

Example:

CBIZ-56297

A new enumeration, CHOICERenovationInProgress, has been added to the five Loan Program Identifier dropdown fields on the Freddie Mac tab in the ULDD/PDD input form:

-

ULDD.FRE.LoanProgramIdentifier

-

ULDD.FRE.LoanProgramIdentifier2

-

ULDD.FRE.LoanProgramIdentifier3

-

ULDD.FRE.LoanProgramIdentifier4

-

ULDD.FRE.LoanProgramIdentifer5

This update was made to support the new Loan Program Identifier that supports the updates to CHOICERenovation Mortgages announced by Freddie Mac on October 2, 2024.

In addition to this new enumeration, updates were made to these five dropdown fields as needed to ensure that each of these dropdown lists provide the same list of enumerations.

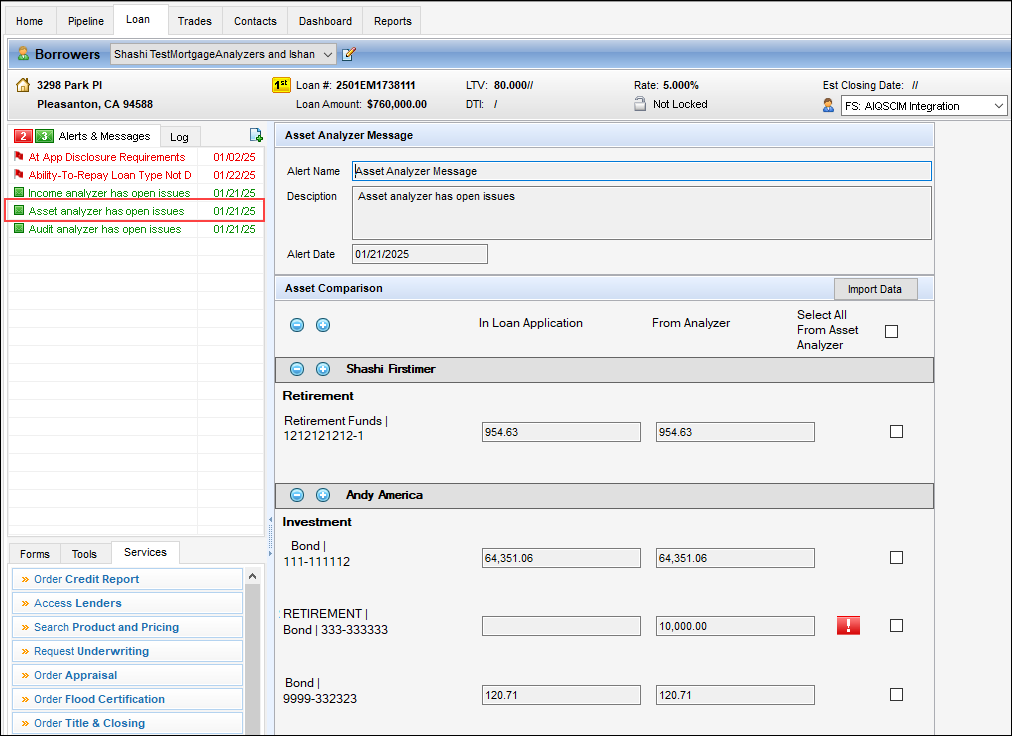

For companies that have purchased the ICE Mortgage Analyzers, updates for asset analyzers are now available on the Alerts & Messages tab on the top-left of the Loan Workspace in an Encompass loan file. An Encompass user who has access to the service can view a green Asset Analyzer message and click the message to open the Asset Analyzer Message window.

When file attachments for asset-related documents are imported into a loan, the asset analyzer scans the data in the attachments and compares it to the data in the Verification of Deposit (VOD) records in the loan. The green message is generated when the asset analyzer has finished analyzing the data. Encompass users can use the information in the alert to compare and reconcile any data differences between the document attachments and the VOD records.

When you click the Asset analyzer has open issues message, the window shown below opens in the Loan Workspace.

The top section of the window displays the message name, description, and date.

The three columns of data display depository accounts (checking, savings, money market fund, Certificate of Deposit (COD)), investment (mutual funds, stocks, stock options, bonds), and retirement assets in column one, the corresponding Encompass loan data from the VOD in column two, and the corresponding data from asset analyzer in column three.

A red Exclamation Point icon displays to the right of the From Analyzer column for any fields that do not match.

Information for each borrower is provided in dedicated expandable panels for each borrower and co-borrower. Expand and collapse icons are provided which users can click to expand (+) and collapse (-) each borrowers' income panel displayed on the screen. Use the icons provided at the very top of the Income Comparison section to expand and collapse all the borrowers' income panels that are listed.

A checkbox is provided to the right of each asset category. Select the checkbox for the category to import. You can select all categories at once by selecting the Select All From Asset Analyzer checkbox at the top of the section.

Click the Import Data button to import the selected asset data from the asset analyzer into the loan file.

When data is copied from the asset analyzer:

-

Blank fields in From Analyzer column will clear the value in a corresponding Encompass field when a VOD has existing data in the field.

-

When an Encompass field does not have a corresponding field in the asset analyzer, the Encompass value is retained.

-

Additional existing Encompass VOD records are not replaced when data is copied. They must be deleted manually by a user.

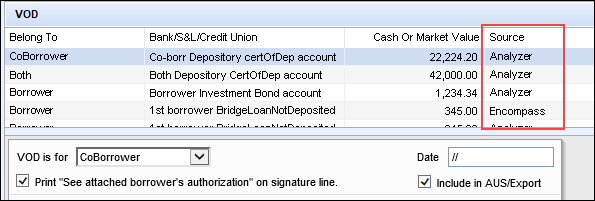

In addition, a new Source column is provided on the VOD input forms to indicate if the record was manually added by a user (Encompass) or if the record was imported to Encompass through the asset analyzer (Asset Analyzer). Records for VOD are used to populate the In Loan Application data in the Asset Analyzer Message's Asset Comparison section.

A new (hidden) date/time field (5060) has been added to the Encompass Reporting Database to capture each time asset data from the asset analyzer is imported to Encompass. When a user clicks the Import Data button on the Asset Analyzer Message, the system populates the current system UTC date and time to the field. This field is a virtual field not visible on any Encompass input screens.

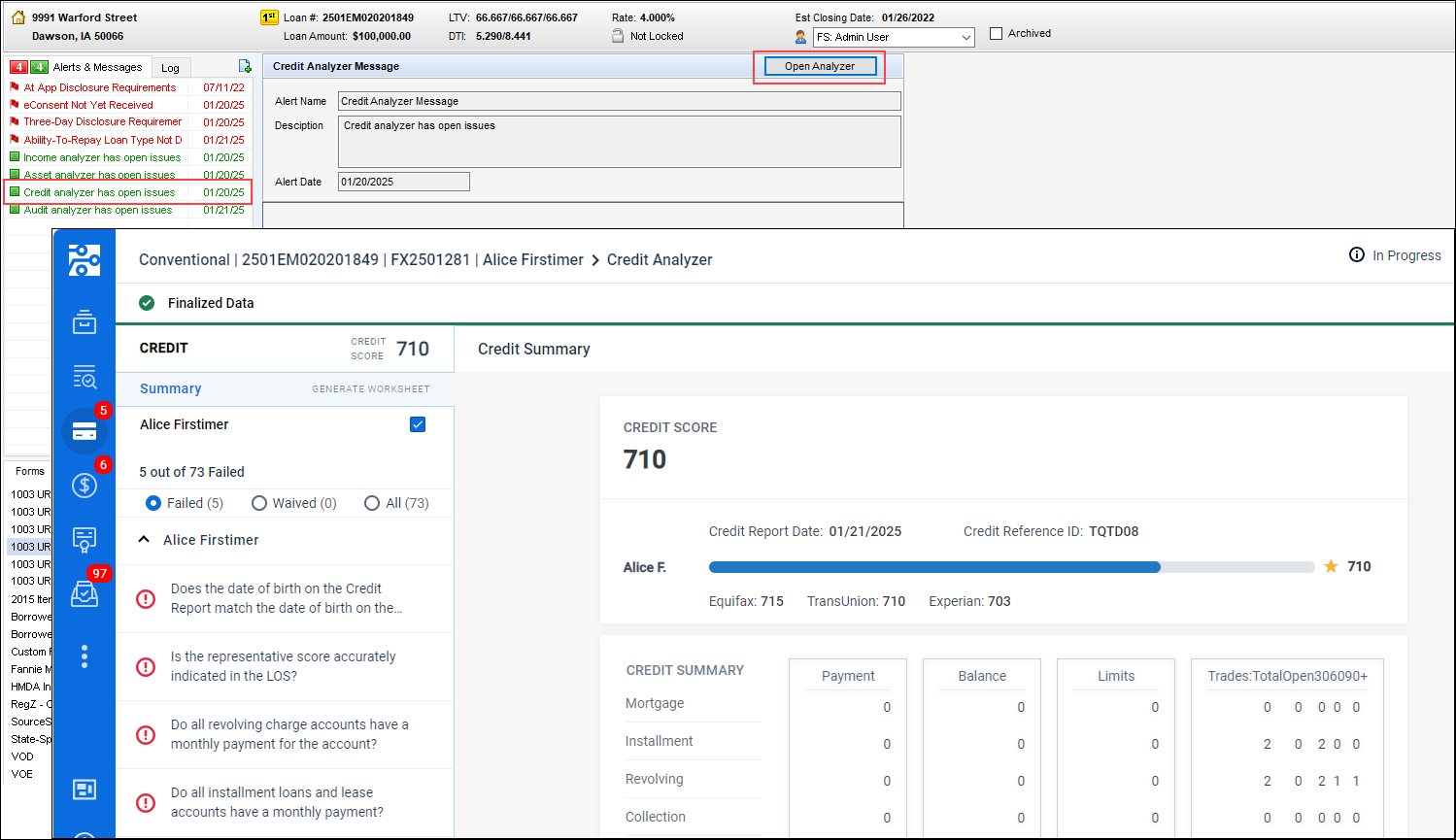

For companies that have purchased the ICE Analyzers service, a new Credit Analyzer message is now available on the Alerts & Messages tab on the top-left of the loan workspace in Encompass loan files. An Encompass user who has access to the service can click the Credit Analyzer has open issues green message to open the Credit Analyzer Message window and review the message details.

There, you can click the Open Analyzer button to open the credit analyzer in a web browser to review the analyzer results and address issues as needed.

CBIZ-62883

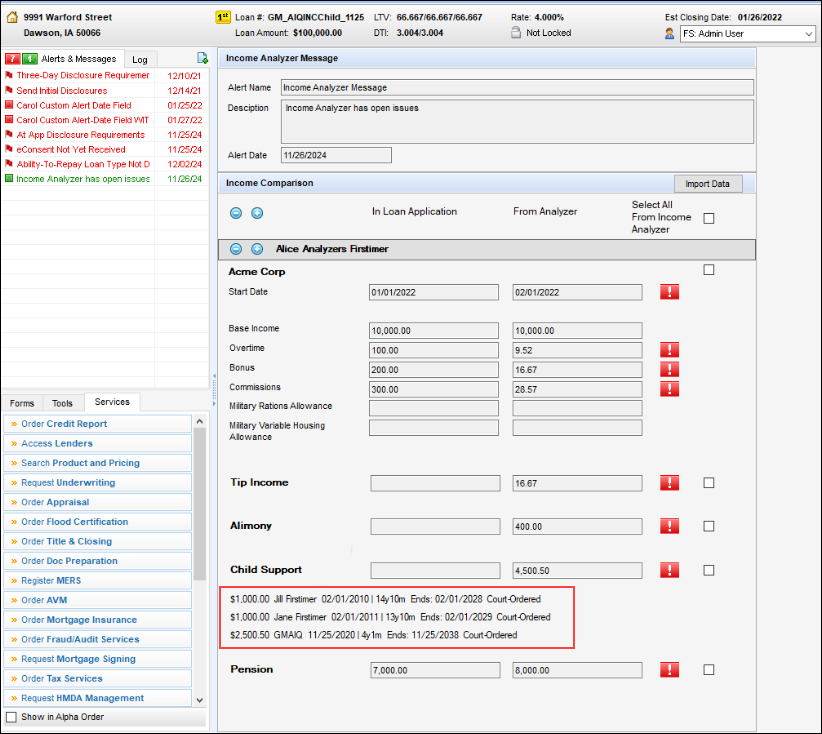

For ICE Mortgage Analyzers users, updates have been made to the Income Analyzer Message where the Income Comparison section compares the data in the Verification of Employment (VOE) income records with the associated income data generated by the income analyzer. These updates for child support data have been made to match the information provided in the Income Analyzer message in the Encompass web interface:

-

New child support information was added to indicate the monthly support amount, child’s name, child’s birthdate, child’s age, the date the support ends, and documented as (i.e., court-ordered).

-

This information is provided below the Child Support income comparison fields, with a separate line for each child receiving child support.

For companies that have purchased the ICE Mortgage Analyzers, new fields are being introduced in the Encompass Reporting Database that are intended to be used with advanced business rules for analyzer fields so that lenders can exclude loans from analyzers based on specific conditions and provide a reason for the exclusion.

Please note:

-

These fields are not available on any standard Encompass input forms or tools. They are provided in the Encompass Reporting Database only. They may be added to custom input forms.

-

These fields may be added to business rules in Encompass 25.1, but the rules will not be enforced until additional functionality is added in a future Encompass release.

| Field Description | Field ID |

|---|---|

| AUS Analyzer Exclusion Indicator | ANALYZER.X28 |

| AUS Analyzer Exclusion Reason | ANALYZER.X29 |

| Audit Analyzer Exclusion Indicator | ANALYZER.X30 |

| Audit Analyzer Exclusion Reason | ANALYZER.X31 |

| Credit Analyzer Exclusion Indicator | ANALYZER.X32 |

| Credit Analyzer Exclusion Reason | ANALYZER.X33 |

| Income Analyzer Exclusion Indicator | ANALYZER.X34 |

| Income Analyzer Exclusion Reason | ANALYZER.X35 |

| Asset Analyzer Exclusion Indicator | ANALYZER.X36 |

| Asset Analyzer Exclusion Reason | ANALYZER.X37 |

| Collateral Analyzer Exclusion Indicator | ANALYZER.X38 |

| Collateral Analyzer Exclusion Reason | ANALYZER.X39 |

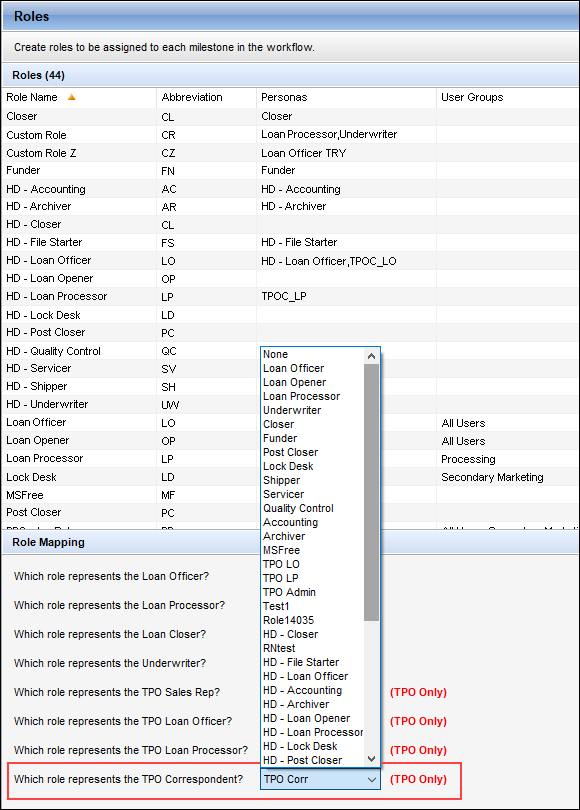

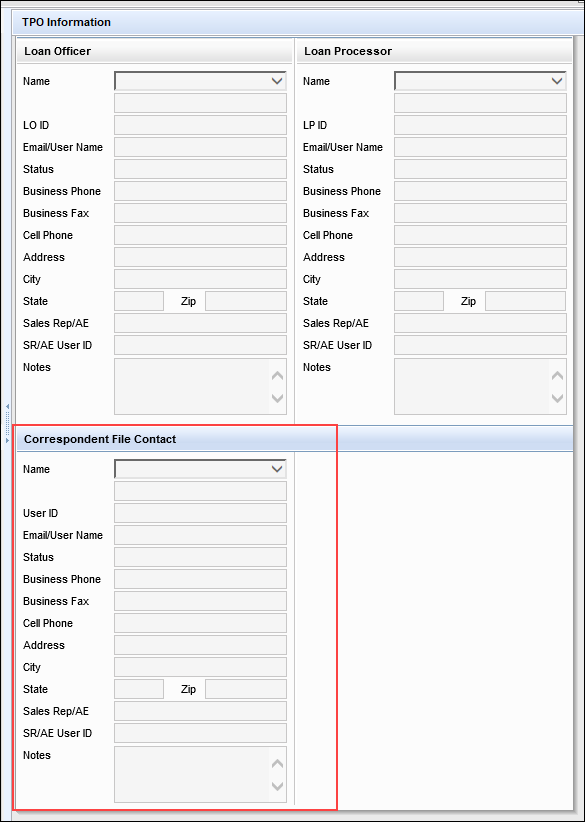

In the Encompass Settings > Company/User Setup > Roles setting, a new TPO Correspondent option is now provided in the Role Mapping section. Here you can select the role in the external TPO company that will carry out TPO Correspondent tasks. Once a role is selected, users will then be able to select a TPO Correspondent user on the TPO Information tool.

When the loan channel (2626) for the loan is Correspondent, users can select a company from the Name dropdown (TPO.X14) in the Company Information section of the TPO Information tool. Once the company is selected, users can then select contact information for the loan officer, loan processor, and now, a correspondent file contact on the tool. When a new TPO Correspondent role has been selected in the Roles setting, the Name dropdown list in the Correspondent File Contact section of the TPO Information tool is populated with the list of users assigned to personas for the mapped TPO Correspondent role under the selected TPO organization.

A new field, Commitment Rate Set Date (5044), has been added to the Encompass Reporting Database. While this field is available in the Encompass Reporting Database, it is intended for future functionality that will be provided in an upcoming Encompass release. At that time, this field will be added to the Correspondent Loan Status tool where it will capture the date when the interest rate for a correspondent loan was last set without changing the last rate set date (3253) for the borrower. More information will be provided when this field is made available on the the Correspondent Loan Status tool.

In Encompass 24.2 fields were added to capture valuation data used by correspondent lenders to provide support for multiple appraisals, ordering, and data persistence at an order level and workflow level. These fields are part of the existing Correspondent Appraisal Valuation collection that enables Encompass Partner Connect to support this workflow. One of the fields added to the collection at that time was the Correspondent LCA Score field (VAL00A017).

In this Encompass 25.1 release, the Correspondent LCA Score field has been updated from an integer field to a decimal field. The number entered in the field will now be rounded to two decimal places.

Please note that these Correspondent Appraisal Valuation collection fields are not visible on existing Encompass input forms, but they can be added to custom input forms and are available in the Encompass Reporting Database.

For clients who already added field VAL00A017 to the Selected Fields panel in the Reporting Database in previous releases, there is additional action required after upgrading to this new Encompass release before the values in this field will be in decimal format. After upgrading, the administrator must remove field VAL00A017 from the Reporting Database’s Selected Fields panel, and then click Update to update the Reporting Database. Then, they must add field VAL00A017 back to the Selected Fields panel, and then click Update again. Only then will values in the LCA Score field be rounded to two decimal places.

ICE Mortgage Technology is discontinuing the use of ElevatedSandboxFeatures and will use an improved method to retrieve the authentication token. The new approach involves calling authObj.getAccessToken() through the SSF API. This updated token retrieval method is now used for the TPO Information and Correspondent Purchase Advice tools.

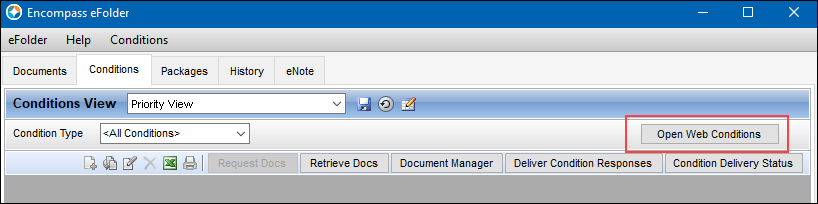

Using the new Open Web Conditions button provided on the Conditions tab in the eFolder, users can now jump to the Conditions screen for the loan inside the Encompass web interface from the Encompass desktop interface.

By providing access to the Conditions screen from the Encompass desktop interface, users can access the loan’s conditions in the Encompass web interface more efficiently and skip the steps of manually opening a web browser, navigating to the Encompass log in screen, providing log in credentials, opening the loan, and then navigating to the Conditions screen.

To access the web version’s Conditions screen from the desktop version of Encompass, open a loan file, click the eFolder icon to open the eFolder, click the Conditions tab, and then click the Open Web Conditions button.

Please note, the Open Web Conditions button will display on the eFolder’s Conditions tab only if the loan contains one or more enhanced conditions and if the user has permission (via the Personas settings) to access the Encompass web interface.

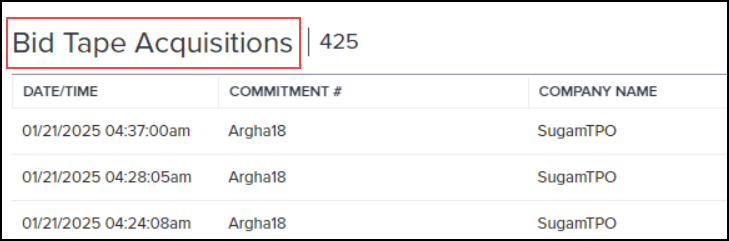

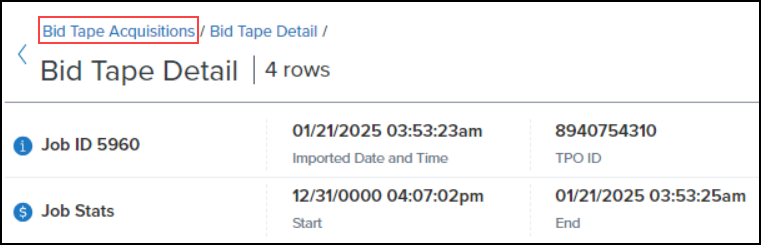

The Bid Tape Management tab has been updated with a new label/name. The Bid Tape Management label/name has been changed to Bid Tape Acquisitions throughout the tab. While the label/name has been changed, the functionality remains the same.

Tab Label

Page Header

Breadcrumb Label

Business Rules

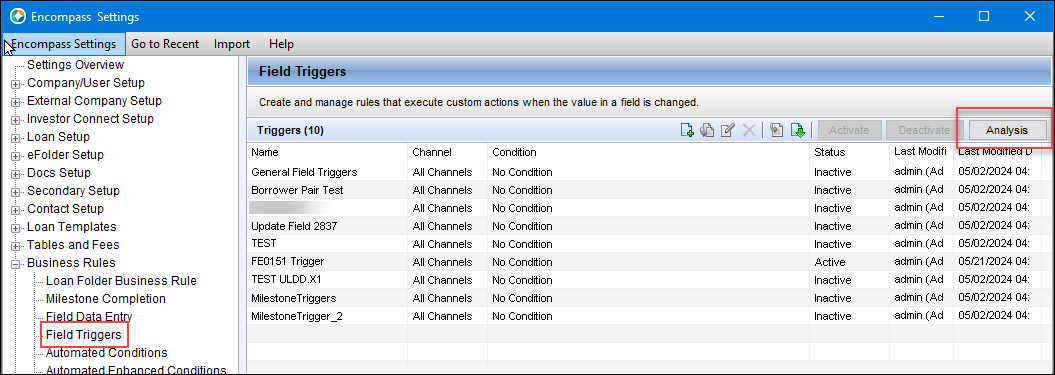

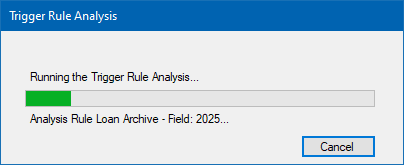

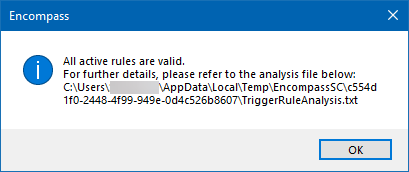

A new analysis tool is now available with the Field Triggers business rule setting. Use this tool to evaluate all active field trigger rules. The analysis performs the following actions:

-

Determine that the trigger field used in the active rule(s) is valid.

-

Calculate the time to compile each active rule.

-

Calculate the time to compile all active rules.

-

Identify the rule that takes the most time to compile

Based on the results, you can determine if rules need to be adjusted for impacts on system performance or other issues.

To Run the Analysis:

-

On the menu bar, click Encompass, and then click Settings.

-

On the left panel, click Business Rules, and then click Field Triggers.

-

Click the Analysis button.

-

The system runs the analysis.

-

-

Once the analysis is complete, a TriggerRuleAnalysis.txt file is generated with the analysis details and saved to the user Temp folder.

-

Open the file to review the analysis details.

Administrators can now set up Persona Access to Fields and Field Data Entry business rules to control access to the Archived checkbox (5016) in loan files. Previously when administrators attempted to select field 5016 for these business rules they would receive the following message and they would not be able to continue setting up the rule for the field:

The field ID ‘5016’ is a hidden field and cannot be used in this context.

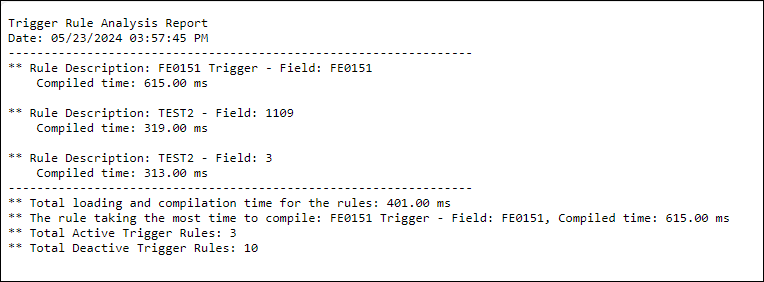

The following buttons have been added to the Buttons for Business Rule form that is provided when searching for fields to use with Persona Access to Fields business rules. These additions were added to assist administrators with managing persona access to buttons on the Secondary Registration tool via Persona Access to Fields business rules.

-

Revise Locks

-

Get Buy Side Pricing

-

Lock and Confirm

-

Update Sell/Comparison

-

Deny Lock

-

Get Sell Side Pricing

-

Validate

-

Deny Extension

-

Cancel Lock

-

Save Progress

-

Save

-

Cancel or Close

To access the Buttons for Business Rule form, open the Encompass Settings > Business Rules > Persona Access to Fields setting. Click the New icon to create a new rule or select an existing rule, and then click the Edit icon. In the Define persona's field access for the condition section, click the Find button, and then select the Buttons for Business Rule form in the left panel.

In previous versions of Encompass, when a business rule or other area where advanced code is used to trigger a system action failed to compile or otherwise failed due an exception error, there was no notification provided to the user. Since the user was unaware of the failure, the loan could potentially be saved with data integrity issues. Starting in Encompass 25.1, all exception errors that occur when compiling advanced code will trigger a user-facing error message.

-

When a failure occurs, all processes will be stopped.

-

The user will be directed to the Encompass Pipeline, where an error message explaining the issue is displayed: “Unable to open loan, error executing business rules due to insufficient memory resources. If error persists, please restart Encompass.”

-

If a user attempts to open the loan file again, the system will check for exception errors again

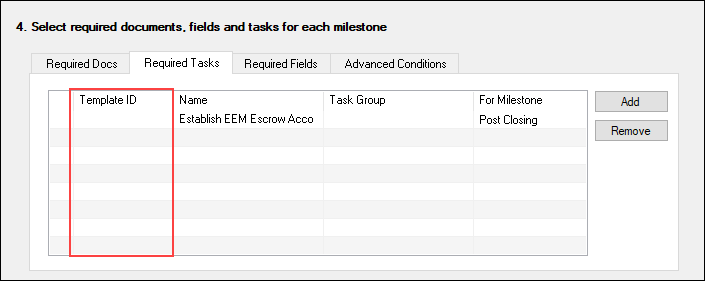

On the Milestone Completion business rules setting, the Type ID column on the Required Tasks tab has been changed to Template ID to provide a better description of the unique IDs assigned to templates associated with milestones.

Administrators use the Required Tasks tab in these business rule settings to select milestone tasks or task-based workflow tasks that will be required to be completed before associated milestone can be completed.

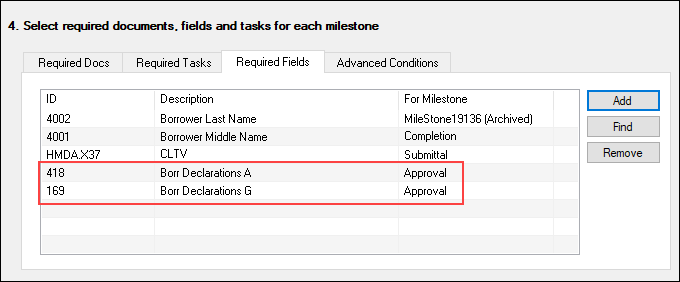

On the Milestone Completion business rules setting, administrators can use the Required Fields tab to add fields that will be required to be populated before the milestone can be completed. The descriptions of fields 418 and 169 have been updated to specify the correct line on the 1003 where the field is located.

Previously, the field 418 description was Borr Declarations L and field 169 was Borr Declarations A. Those are the 1003 line locations for these fields on the 2009 URLA forms. These new descriptions refer to the 1003 line locations on the 2020 URLA form versions (line A and line G).

Personas

(Updated on 2/28/2025)

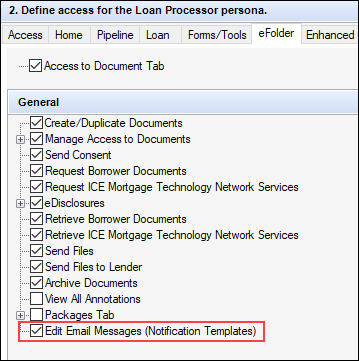

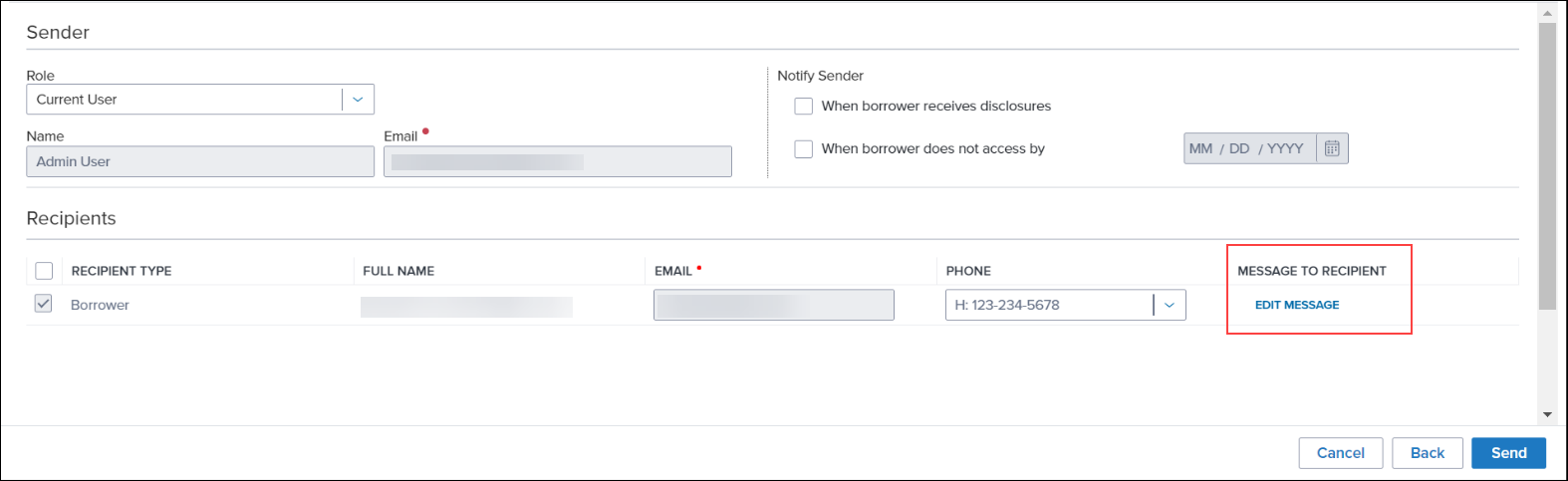

New options have been added to the Company/User Setup > Personas setting as described below.

-

On the eFolder tab in the Personas setting, a new Edit Email Messages (Notification Templates) option has been added to the General panel. When this option is selected, the Message to Recipient column and the Edit Message option is displayed for users assigned with the persona when they are sending disclosures, requesting or sending documents, requesting eConsent, or sending closing or pre-closing documents.

-

Note that the Edit Message link is used only with loans utilizing notification templates for borrower notifications. It is not used in loans when HTML email templates are used for these notifications.

-

-

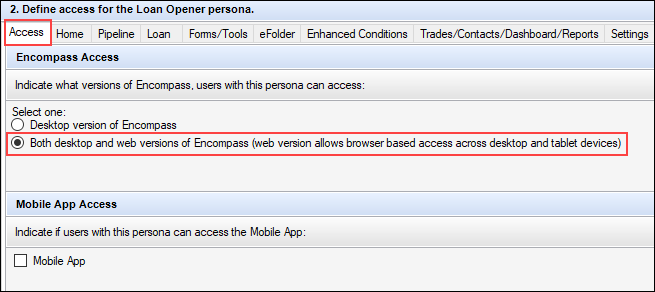

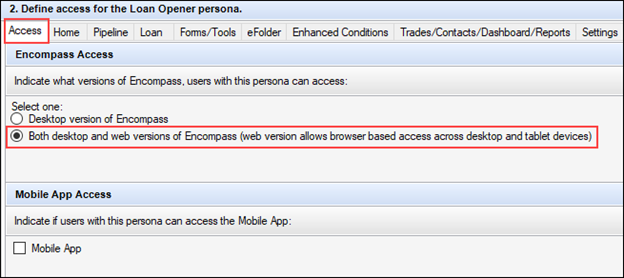

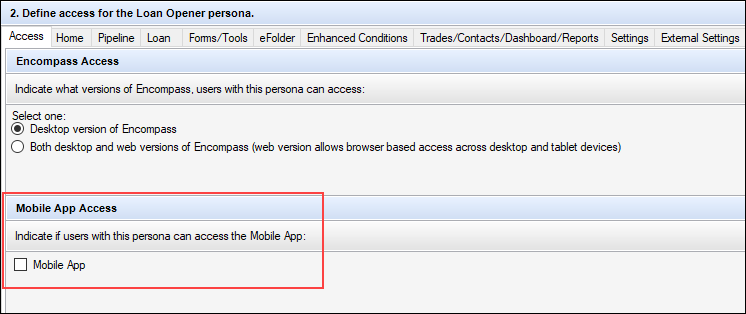

On the Access tab in the Personas setting, a new Mobile App Access section has been added, with a Mobile App option. This new persona option is not currently functional. It is planned for use with a new Encompass Consumer Connect mobile app in a future release.

-

Note that once the mobile app is fully functional, the Both desktop and web versions of Encompass... option and the Mobile App option must both be selected for the persona. If the Desktop version of Encompass option and the Mobile App option are selected, the user with this persona will not be able to access the mobile app.

-

(Updated on 2/28/2025)

F1 help is now available on the Lock Comparison Tool Fields settings screen.

As part of ongoing efforts to modernize Encompass and to further assist with our Encompass SDK Transition, ICE Mortgage Technology is releasing in limited availability a Plugins 2.0 initiative that enables clients to Integrate Encompass Web Plugins with Encompass Desktop.

This initiative enables you to

-

Run your Encompass web plugins within Encompass desktop.

At this time, not all Encompass web interface plugin features are supported in the Encompass desktop interface, and vice versa.

-

Use the modern, widely supported scripting language JavaScript for coding plugins.

-

Access a new Plugin 2.0 Trace Viewer in the Encompass desktop Help menu to view real-time messages and events to troubleshoot your plugins.

-

Augment your Encompass SDK Transition work efforts.

Contact your ICE Mortgage Technology relationship manager to learn how to participate in the Plugins 2.0 initiative.

Fixed Issues for Version 25.1 (Banker Edition)

This section describes the issues that have been fixed in this release.

Why we fixed these issues: These issues were fixed to improve usability and to help ensure Encompass is operating as expected. The issues that are chosen to be fixed are based on the severity of their impact to clients and client feedback.

Updates have been made to address issues with the MSA Number field (699). In Encompass instances set up to automatically apply/populate loans with MFI data based on the subject property ZIP code (15) that is entered, the MSA Number field was being populated with incorrect data (i.e., the wrong code) or it was being populated with a code even though the ZIP code was for a city that was considered non-metropolitan. These issues have been resolved. The MSA Number field will now be populated with the correct MSA code or it will not be populated with any data if the ZIP code is for an area that is not applicable for MFI data.

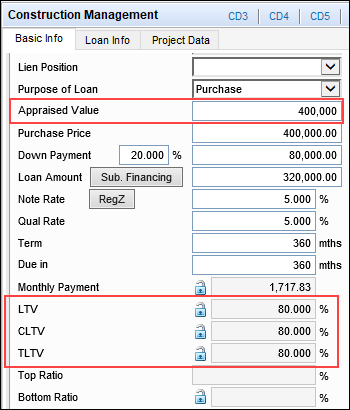

When working with data for construction loans, an issue occurred where the Loan-to-Value (LTV) fields on the Construction Management input form were not recalculating when the Appraised Value (356) was changed. Only after the loan file was saved or when the Appraised Value field was changed on a different input form would these fields recalculate to a new LTV. This issue has been resolved and now these LTV fields (353, 976, 975) are recalculated based on changes to the Appraised Value.

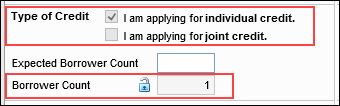

In previous versions of Encompass, after creating a HELOC loan, creating a new linked HELOC loan via the Piggyback Loans tool, and then syncing the data between the two loans, the Type of Credit checkboxes (URLA.X234) and the Borrower Count field (URLA.X194) were not recalculating (updating) in the linked loan. This issue has been resolved and these fields are now calculated and display the correct data in the linked HELOC loan.

Using the Edit icon provided for the Prepayment Penalty / Prepayment Penalty Term checkbox (675) on the 1003 URLA - Lender input form, users can enter prepayment penalty data. If the Prepayment Penalty / Prepayment Penalty Term checkbox is then cleared, the data in the Quick Entry - Prepayment Penalty pop-up window is cleared. However, if this checkbox was cleared as result of a business rule or a Loan Program template being applied to the loan, the data in the Quick Entry - Prepayment Penalty pop-up window was not cleared. This issue has been resolved and now the data is cleared as expected when the checkbox is cleared via a business rule or loan program template.

Users are now able to exclude escrow and prepaid fees from the Total Closing Costs Less Guarantee Fee (VASUMM.X124) for VA Cash-Out loans. Starting in Encompass 25.1, when the VA Loan Code (958) is set to Cash-Out Refi, the Prepaids (VASUMM.X145) and Initial Escrow Payment at Closing (VASUMM.X146) checkboxes will be cleared by default. This excludes these values from the Total Closing Costs Less Guarantee Fee calculation. Users have the option to manually update these checkboxes as needed on the VA Management input form’s Qualification tab.

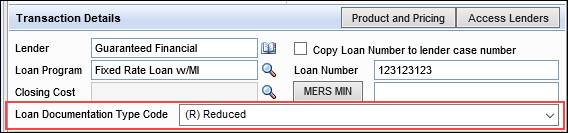

After importing a ULAD/iLAD (MISMO 3.4) file into Encompass, the supported iLAD enumeration code plus the description of the loan documentation is now populated to the Loan Documentation Type Code field (MORNET.X67) in the imported file. Previously, only the enumeration code (a single letter) was populated to this field.

For example, if the imported iLAD file included reduced documentation, the Loan Documentation Type Code field was populated with only R. Starting in Encompass 25.1, this field will be populated with (R) Reduced in the imported file.

An issue occurred where a “Confirmed” log was created when a Deny Lock request was updated using the Update Sell/Comparison button. This issue has been resolved and a “Denied” log is now created instead of a “Confirmed” log.

After un-linking a piggyback loan, a confirmation message is displayed in a pop-up window. The message in this window has been updated to correct a grammatical error.

Before Encompass 25.1: The current link information has been removed and both loan have been saved.

Encompass 25.1: The current link information has been removed and both loans have been saved.

In previous versions of Encompass, eFolder document attachments were displayed in landscape format instead of the expected portrait mode. For example, after a credit report was returned and then saved to the eFolder, the report displayed in landscape when a user viewed the report in the Document Details window. This issue resulted in portions of the document being cut off. This issue has been resolved and the documents now display in portrait format as expected.

DOCP-67436

In previous versions of Encompass, the eConsent forms returned from borrowers were displaying in landscape format when viewed from the Disclosure Tracking tool. This prevented users from printing the eConsent forms correctly. This issue has been resolved and now the eConsent forms are displayed in portrait form as expected.

DOCP-67957

For users who have set up Auto Retrieve for disclosure packages so that signed documents are automatically returned to the lender (in Encompass) when the required milestone is completed, there was an issue where not all of the signed documents were being returned. Typically, some signed documents in the package were returned, but some were not. Users would then need to manually retrieve the remaining signed documents. This issue has been resolved and all signed documents are now returned as expected when auto retrieve is enabled.

DOCP-67955

For users who have their Status Online Tool set up to automatically send notification emails when updates were made, an issue occurred where an application error message was triggered for these users when they saved and then exited a loan. The cause of this issue was identified and has been addressed. The error message is longer being triggered in this scenario.

DOCP-66444

When using the Tools > Rep and Warrant Tracker in a loan file, an issue occurred where an Application Error was triggered after the user clicked the Save to eFolder button. This issue has been resolved and now the Rep and Warrant input form can be saved to the eFolder. Once saved, a Rep and Warrant Tracker document is added to the eFolder's Documents tab.

DOCP-67285

An issue occurred where an incomplete document was displayed when an ICE PPE integration was selected as the Provider and then the More Info link was selected on the Product and Pricing setting. This issue has been resolved and a complete and relevant document will now be displayed.

The following Personas options are now included in the Personas Settings Report. These Personas options were introduced in Encompass 24.3, but they were not added to the Personas Settings Report at that time.

-

MI Center (for the Personas > Forms/Tools tab > MI Center option on the Tools panel)

-

MI Center and related options (for the Personas > Web Version tab > Services > MI Center and the related MI Center options located on the Standard Features panel)

-

Lock Comparison Tool (for the Personas > Forms/Tools tab > Lock Comparison Tool and the related Validate Pricing option located on the Tools panel)

Refer to the Settings Reports help topic for instructions for generating a Persona-based settings report.

An issue with foreign residence addresses occurred for users creating a JSON object file to create a loan using the MISMO converter API (API_SERVER/encompass/v3/converter/loans?mediaType=mismo). When the address in the XML file was a foreign address with a postal code containing alphanumeric values, the API was skipping the alpha characters in the postal code and only including the numeric characters in the loan file, resulting in incomplete/incorrect ZIP Code/post code data in the loan. This issue has been resolved and the complete postal code is now reflected in the new loan file.

The following fields were impacted by this issue and will now reflect the complete postal code:

-

[Borrower Mailing Address] Zip Code / Postal Code (1419) on the 1003 URLA Part 1 (and other input forms)

-

[CoBorrower Mailing Address] Zip Code / Postal Code (1522) on the 1003 URLA Part 1 (and other input forms)

-

[Borrower Mailing Address] Zip Code / Postal Code (BR001) on the Verification of Residence (VOR)

-

[CoBorrower Mailing Address] Zip Code / Postal Code (CR0111) on the Verification of Residence (VOR)

-

[Borrower Mailing Address] Zip Code / Postal Code (BE0107) on the Verification of Employment (VOE)

-

[CoBorrower Mailing Address] Zip Code / Postal Code (CE0107) on the Verification of Employment (VOE)

-

[Property Information] Zip Code / Postal Code (FM0108) on the Verification of Mortgage (VOM)

For V3 API users creating loans through the ‘Create Loan’ API, an internal service error was returned when the loan amortization term (loanAmortizationTermMonths) was any number other than 1, 2, 8, 9, or 10. All other numbers of months returned the service error which prevented the loan from being created. This issue has been resolved and the loan is now created successfully when any number of months is entered for the loan amortization term.

— You have reached the end of the release notes for the selected personas —

The Change Log lists each release notes entry that has been added, deleted, or modified since the initial preview version of the full release notes was first published and is not specific to any persona.