Feature Enhancements in Version 23.3 (Banker Edition)

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release.

Improved Delivery of Year-End Compliance Updates

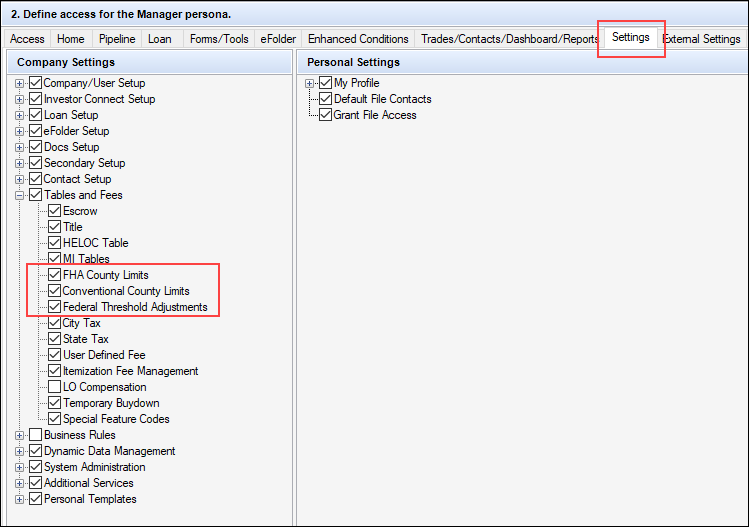

Enhancements were made in Encompass 23.2, and now in Encompass 23.3, to deliver year-end compliance updates seamlessly without the need for a critical patch update late in the year. Traditionally, a dedicated Encompass critical patch update has been required to integrate year-end compliance updates that go into effect in January of the following year into Encompass. Since the needed guidance provided by the various government agencies for new FHA county loan limits, conventional county loan limits, and QM and HOEPA threshold adjustments is not typically provided until late November, a critical patch update in December has been required to provide the new guidelines and rules in Encompass.

ICE Mortgage Technology will announce when the new limits provided by the government agencies is available in Encompass. Use the new tools described below to synchronize the new limits with your Encompass instance. These tools are provided in Encompass Settings > Tables and Fees.

-

FHA County Limits - Manage the table that contains the maximum FHA loan amount allowed for each county. The County Limits table is used to automatically populate the county limit amount for an FHA loan on the FHA Management form and to warn the user if the loan exceeds the limit. This tool has been available prior to Encompass 23.2. (Refer to the FHA County Limits help topic.)

-

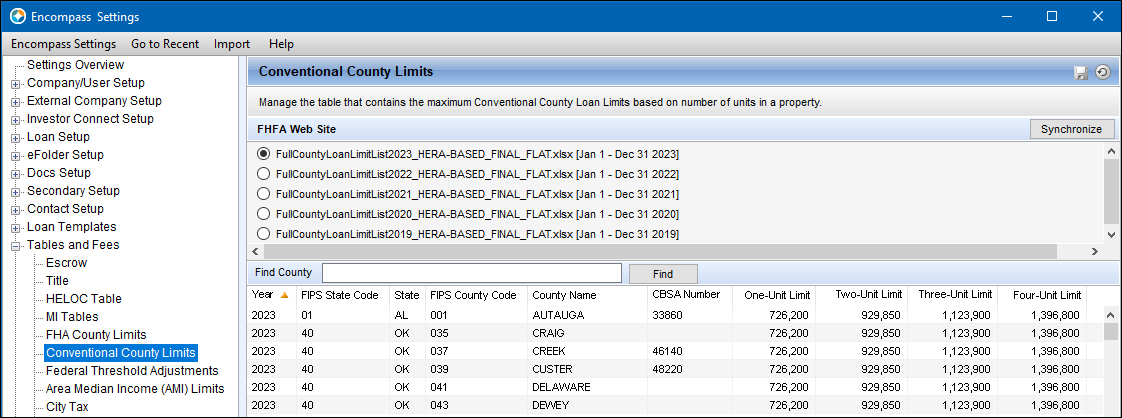

Conventional County Limits - Manage the table that contains the maximum Conventional County Limits based on the number of units in a property. Conventional county limits are the maximum loan amounts allowed based on the number of units in a property. The FHFA updates county limit data annually (typically in November or December), so a mechanism is provided for quickly synchronizing the table over the Internet. This tool is being introduced in Encompass 23.3. For more information on this new table, refer to the New Conventional County Limits Settings Screen entry later in these release notes.

-

Federal Threshold Adjustments - View and synchronize the annually adjusted thresholds for Qualified Mortgages (QM) and High-Cost Mortgages (HOEPA). Each year the new ATR/QM guidelines will be available to synchronize. This tool was introduced in Encompass 23.2. (Review the 23.2 release notes entry.)

Administrators can manage user access to these settings via the Personas settings. Navigate to Encompass Settings > Company/User Setup > Personas, and then click the Settings tab. Here you can select the checkbox for the table that you are granting access to. To remove access, clear the checkbox.

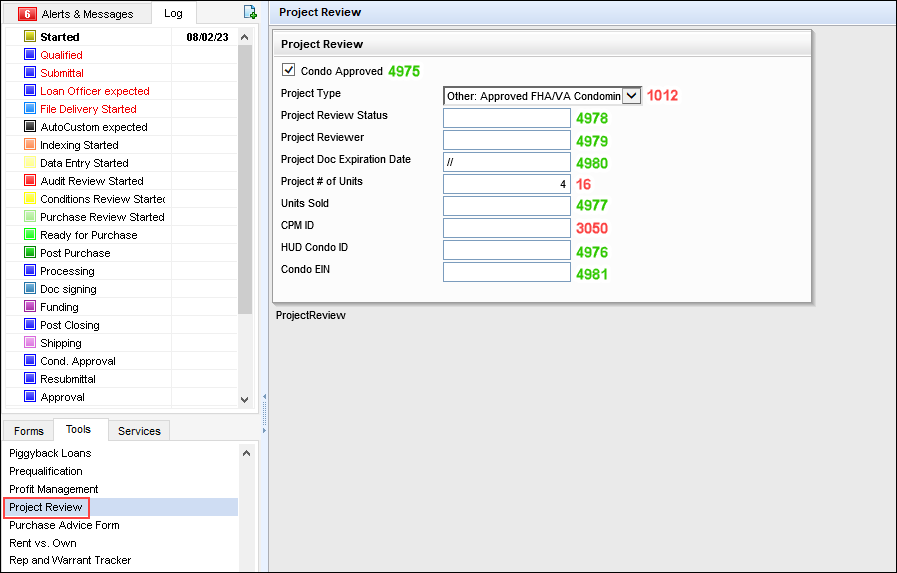

Project Review Tool for Condominiums

The new Project Review tool is now available in Encompass. Use this tool to capture condominium details for a subject property that can then be used for the project approval process. The tool consists of existing fields (in red below) and new fields (in green below) that are all editable.

To access this tool, open a loan file, click the Tools tab, and then select Project Review.

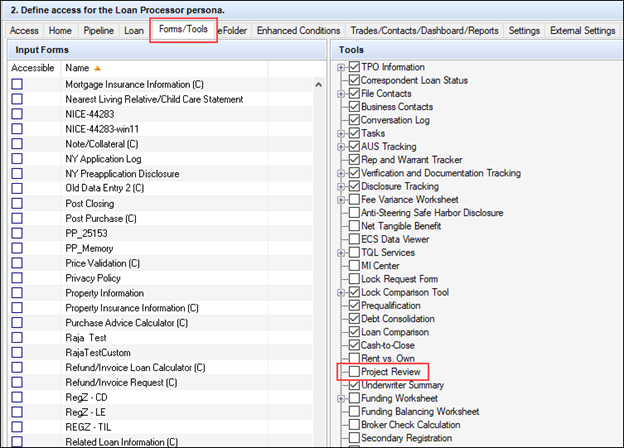

Administrators can manage user access to this new Project Review tool via the Personas setting. To provide a persona with access to the tool, navigate to Encompass Settings > Company/User Setup > Personas, and then select the Forms/Tools tab. Select the Project Review checkbox to provide access to the tool.

CBIZ-53750, CBIZ-51203, CBIZ-53717, CBIZ-53719

Supplemental Insurance Updates

Some input forms and modal windows in previous versions of Encompass that display insurance values were missing the Supplemental Insurance field. Depending on the form purpose, the present supplemental insurance (field ID URLA.X212) and/or the proposed supplemental insurance (field ID URLA.X144) have been added to display on some input forms. For some input forms, new supplemental insurance fields were created to correspond with the field types on those forms.

To provide additional visibility into the supplemental insurance value being used on each form and to ensure that the correct value for supplemental insurance is populated to the appropriate Encompass input and output forms, the following updates have been made in Encompass 23.3:

-

To clearly display supplemental insurance amounts where needed, existing present and proposed supplemental insurance fields have been added to some forms.

-

A new supplemental insurance field has been created and added to some forms to display supplemental insurance separately from hazard insurance. This field is populated with the present or proposed supplemental insurance based on whether the subject property is a primary, secondary, or investment property.

-

A new supplemental insurance field for AUS tracking purposes has been added to the AUS Tracking tool to display the supplemental insurance value needed for AUS tracking purposes.

The following input forms are affected:

-

Transmittal Summary

-

ATR/QM Qualification

-

AUS Tracking

-

HUD-92900LT FHA Loan Transmittal

-

Loan Submission

-

FHA Management

-

USDA Management

-

Prequalification Tool

The supplemental insurance updates are provided only in loans using the Forms > URLA Form Version > URLA 2020 input forms.

Detailed information about the fields that have been added to each form are provided in the following entries. Additionally, supplemental insurance has been added to the HUD928005b Conditional Commitment input form to address an issue with how the insurance displayed for loans using the URLA 2020 input forms.

CBIZ-52714

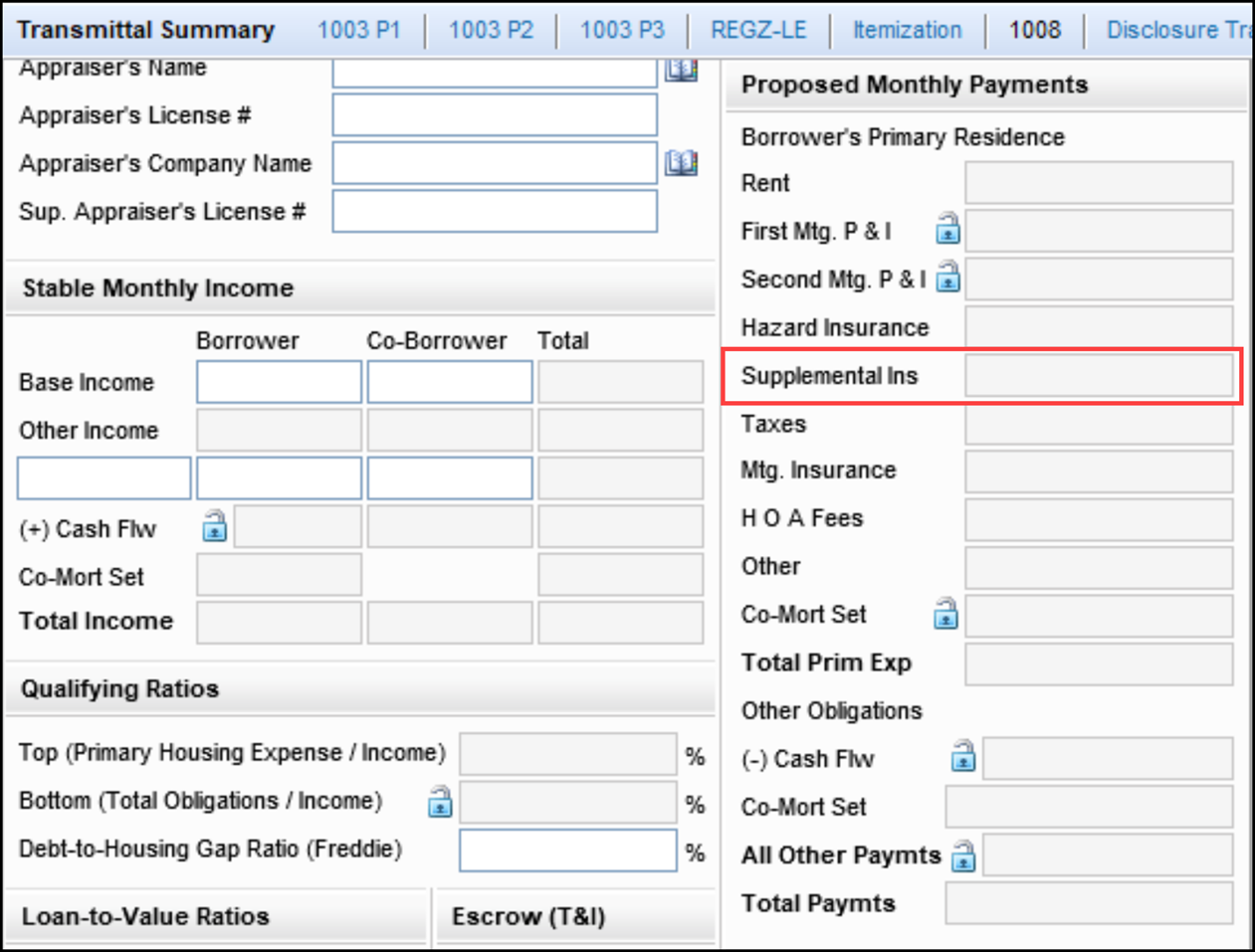

A new two-decimal Supplemental Ins field (field ID 4947) has been added to the following input forms:

-

Transmittal Summary

-

HUD-92900LT FHA Loan Transmittal

-

Prequalification Tool

The new field is dynamically populated based on the selection made for the Property Will Be (field ID 1811) for the loan:

-

When Primary is selected for the Property Will Be, the new Supplemental Ins field is populated with the proposed monthly supplemental insurance (URLA.X144).

-

When Secondary or Investment is selected for the Property Will Be (field ID 1811), the field is populated with the present supplemental insurance (URLA.X212).

-

When neither Primary, Secondary, or Investment is selected for the Property Will Be (field ID 1811), the field is left blank.

Transmittal Summary Input Form

Previously, when processing a loan on an investment or second home property, the values in the present column of the Monthly Housing Expenses pop-up window (accessed by clicking the Edit icon for Housing in the Current Address section of the 1003 URLA Part 1) were populated to the Transmittal Summary (field IDs 1724, 1725, 1726, 1727, 1728, 1729, 1730) and were used in the front end DTI calculation. The Supplement Ins. (field ID URLA.X212) was added to the calculation for the Total field (field ID 737) in the Present column in the Monthly Housing Expenses, but the value did not flow to the Transmittal Summary, which used a different field for the Total (field ID 1731). To address this issue, the new two-decimal Supplemental Ins field (field ID 4947) has been added to the Transmittal Summary.

The following calculation updates have been made to the Transmittal Summary form:

-

The calculation for Total Primary Expenses (field ID 1731) has been updated to include the new supplemental insurance field.

-

The following mapping is now being used for Hazard Insurance (field ID 1726):

-

When Primary is selected for the Property Will Be (field ID 1811), the field is populated with the proposed Hazard Insurance (field ID 230). Previously hazard insurance and supplemental insurance were added together and populated to the Hazard Insurance field.

-

When Secondary or Investment is selected for the Property Will Be (field ID 1811), only the value for the present Hazard Insurance (field ID 122) is populated to the Hazard Insurance field.

-

Updates to the Hazard Insurance field affect only loans using the URLA 2020 forms. The hazard insurance calculation does not change for loans using the URLA 2009 forms.

When updating to Encompass 23.3, there will be no data migration for loans existing prior to the update. You may see changes on Investment and Second Home DTI because the supplemental insurance will now be included in the Transmittal Summary calculation of Total Primary Expenses (field ID 1731).

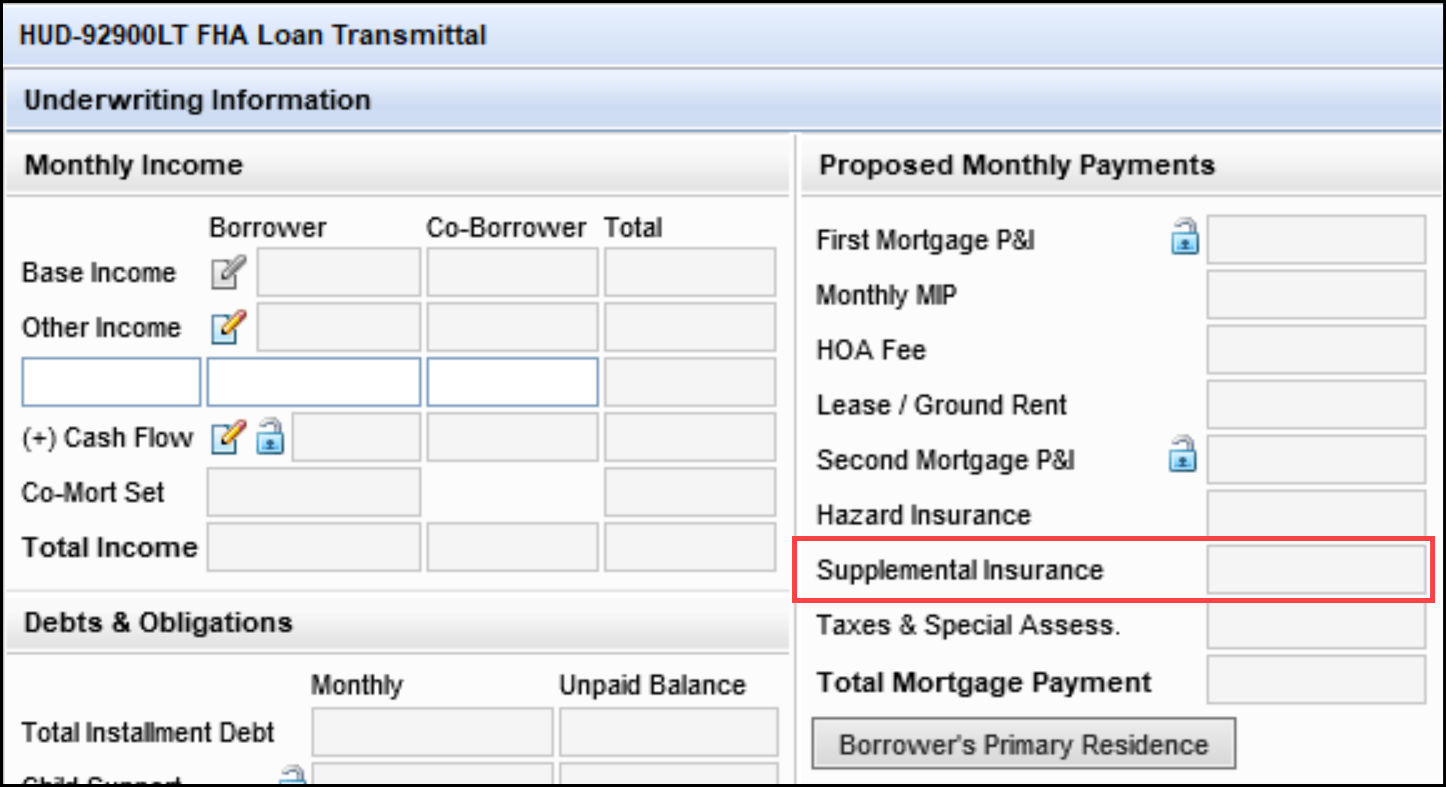

HUD-92900LT FHA Loan Transmittal

The new Supplemental Insurance field (field ID 4947) has also been added to the Proposed Monthly Payments section on the HUD-92900LT FHA Loan Transmittal input form and the calculation for the Total Mortgage Payment (field ID 739) has been updated to include the new Supplemental Insurance field.

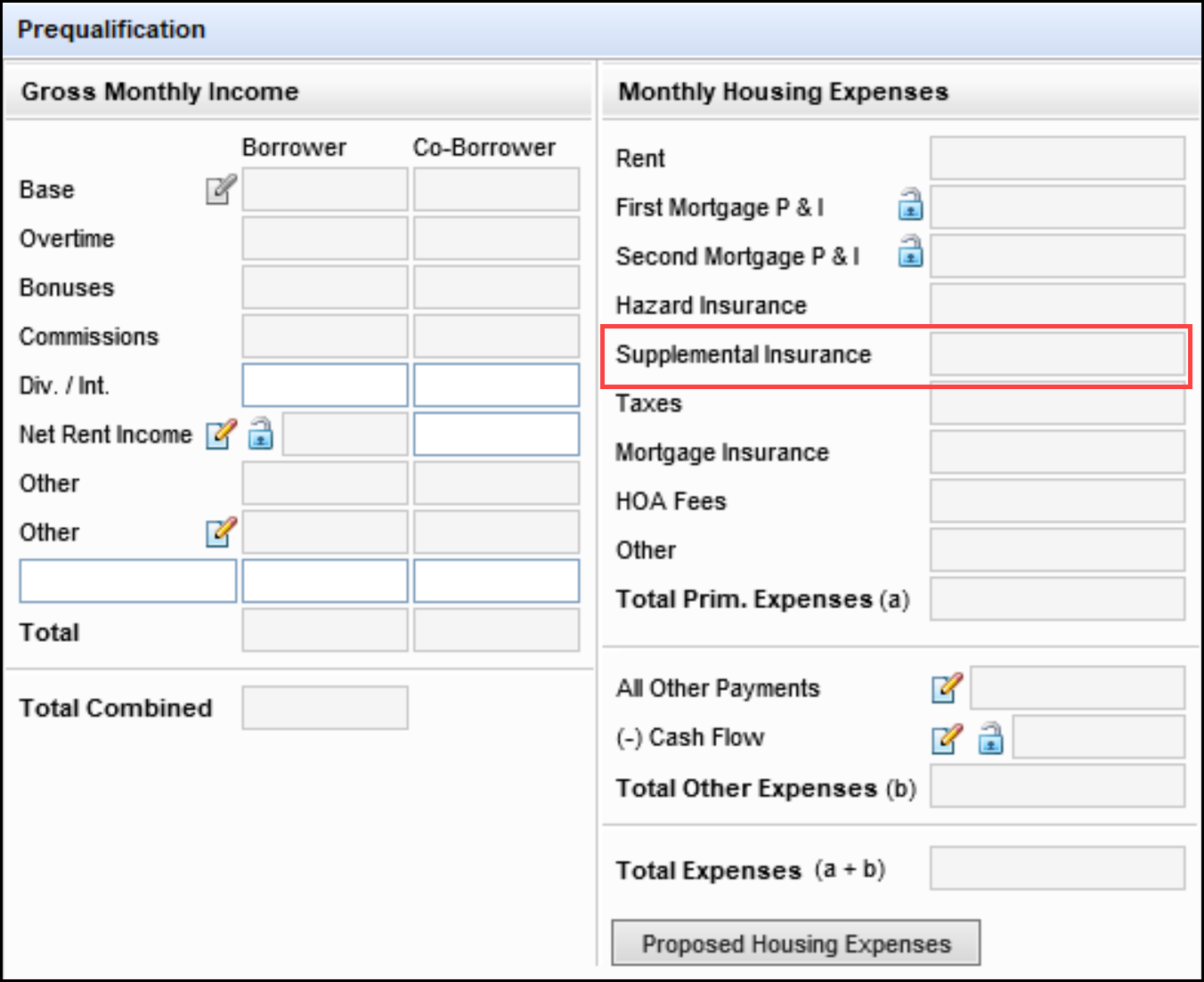

Prequalification Tool

The new Supplemental Insurance field (field ID 4947) has also been added to the Monthly Housing Expenses section on the Prequalification Tool.

CBIZ-40051, CBIZ-52719, CBIZ-52723

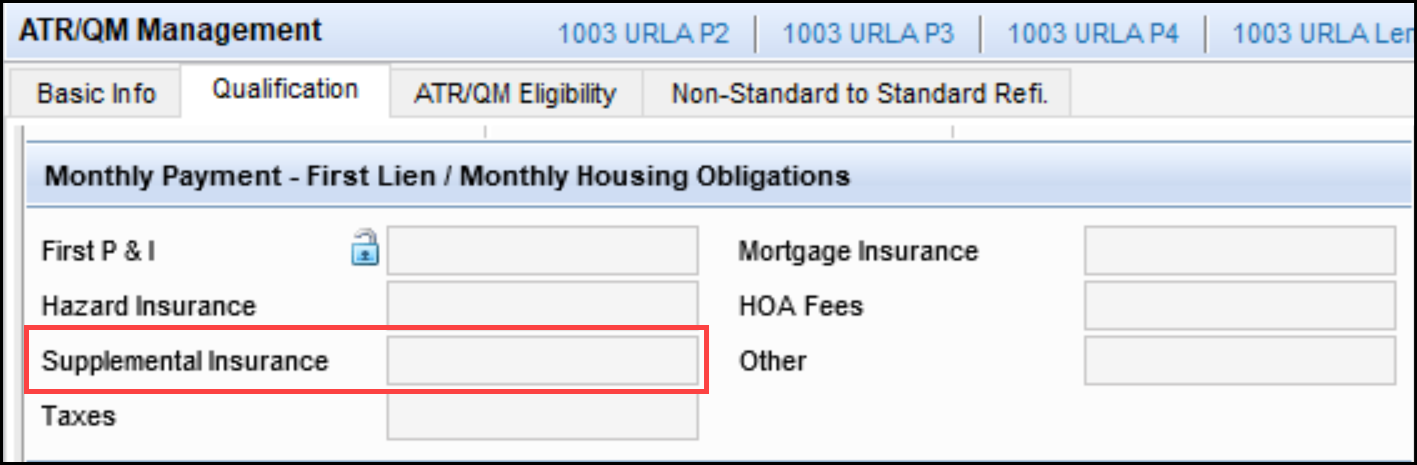

The Supplemental Insurance field on the Monthly Payment - Second Lien/Monthly Housing Obligations section on the Qualification tab on the ATR/QM Management form is now dynamically populated based on the selection made for the Property Will Be field (field ID 1811).

-

The new field is only used on the form when the Property Will Be (field ID 1811) is Primary or has not been selected.

-

The old Supplemental Ins field (field ID URLA.X144) is used on the form when the Property Will Be is Secondary or Investment.

-

When there is no value selected for the Property Will Be, field 4947 is used for the Supplemental Ins field, but no value will be entered in the field.

The following calculations have also been updated to include the new Supplemental Insurance field when the new field displays on the input form:

-

The calculation for the Initial Rate Max Total Pmt. (field ID QM.X113).

-

The calculation for the Fully Indexed Rate Max Total Pmt. (field ID QM.X114).

-

The calculation for the Max Rate During First 5 Years Max Total Pmt. (field ID QM.X117).

For existing loan created prior to upgrading to Encompass 23.3, the Max Total Pmt amounts may change based on the new Supplemental Insurance field values.

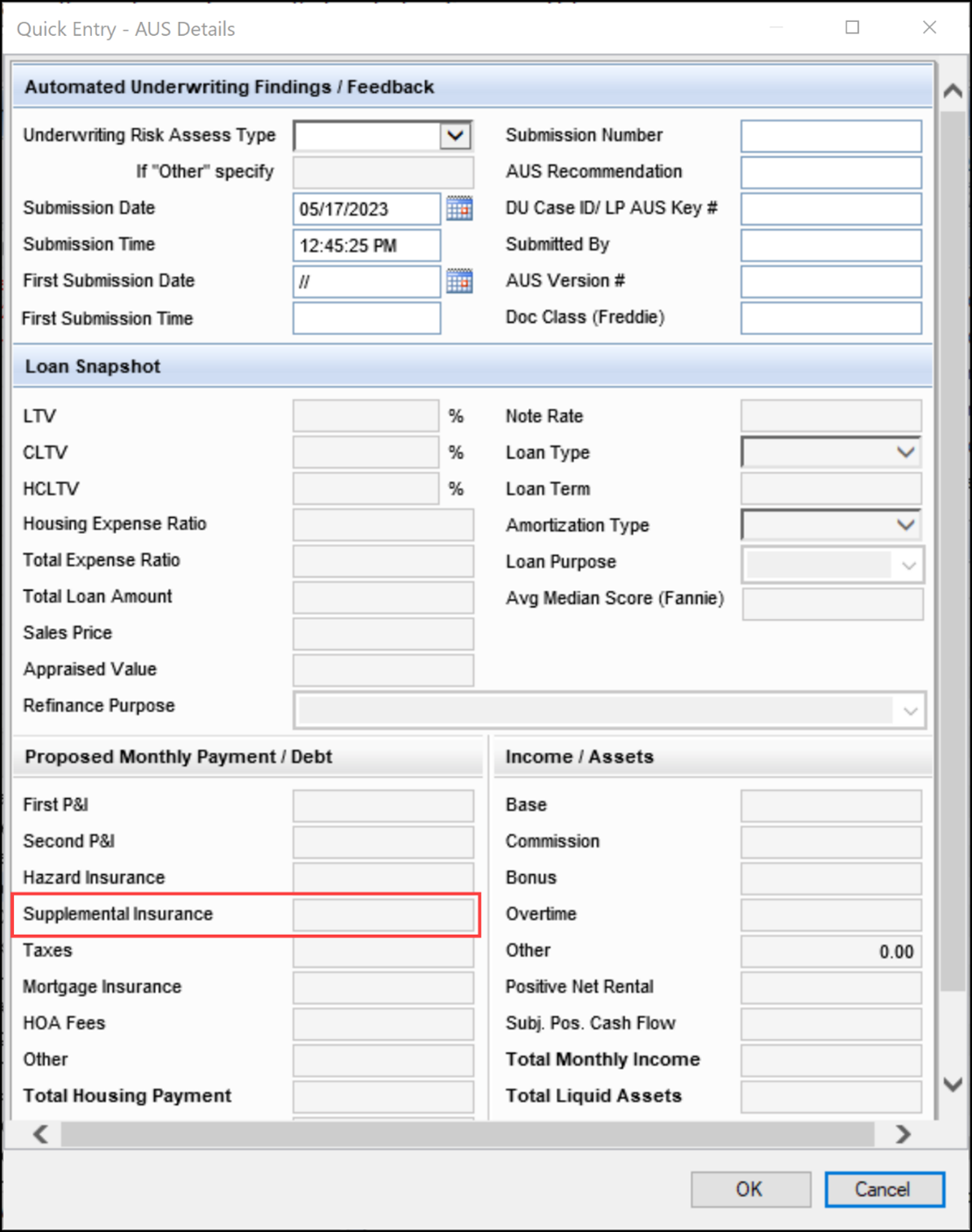

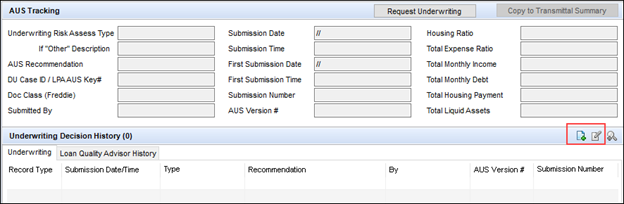

CBIZ-52715

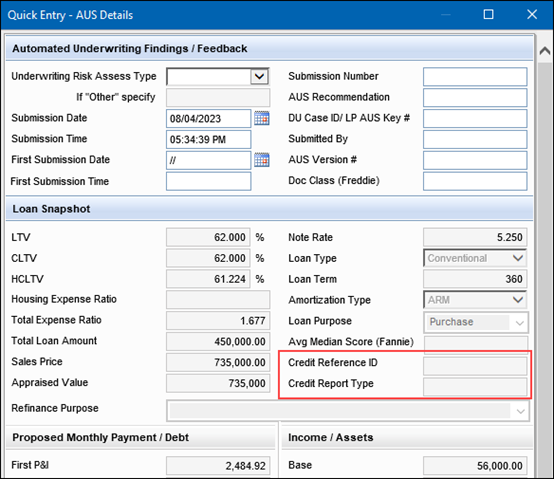

A new two-decimal Supplemental Insurance field (field ID AUS.X200) has been added to the Quick Entry - AUS Details pop-up window to be used specifically for AUS tracking purposes. The Quick Entry window is accessed by clicking the Add icon on the Underwriting Decision History section on the AUS Tracking tool. The field is a read-only field that is populated with the value from the proposed supplemental insurance (field ID URLA.X144) regardless of the option selected for Property Will Be field (field ID 1811). This field is available in the Encompass Reporting Database and can be added to reports and custom input forms.

CBIZ-52717

(Updated on 10/3/2023)

The two existing fields for Supplemental Insurance have been added to the following Encompass input forms:

-

HUD-92900LT FHA Loan Transmittal

-

Loan Submittal

-

FHA Management

-

USDA Management

HUD-92900LT FHA Loan Transmittal Input Form

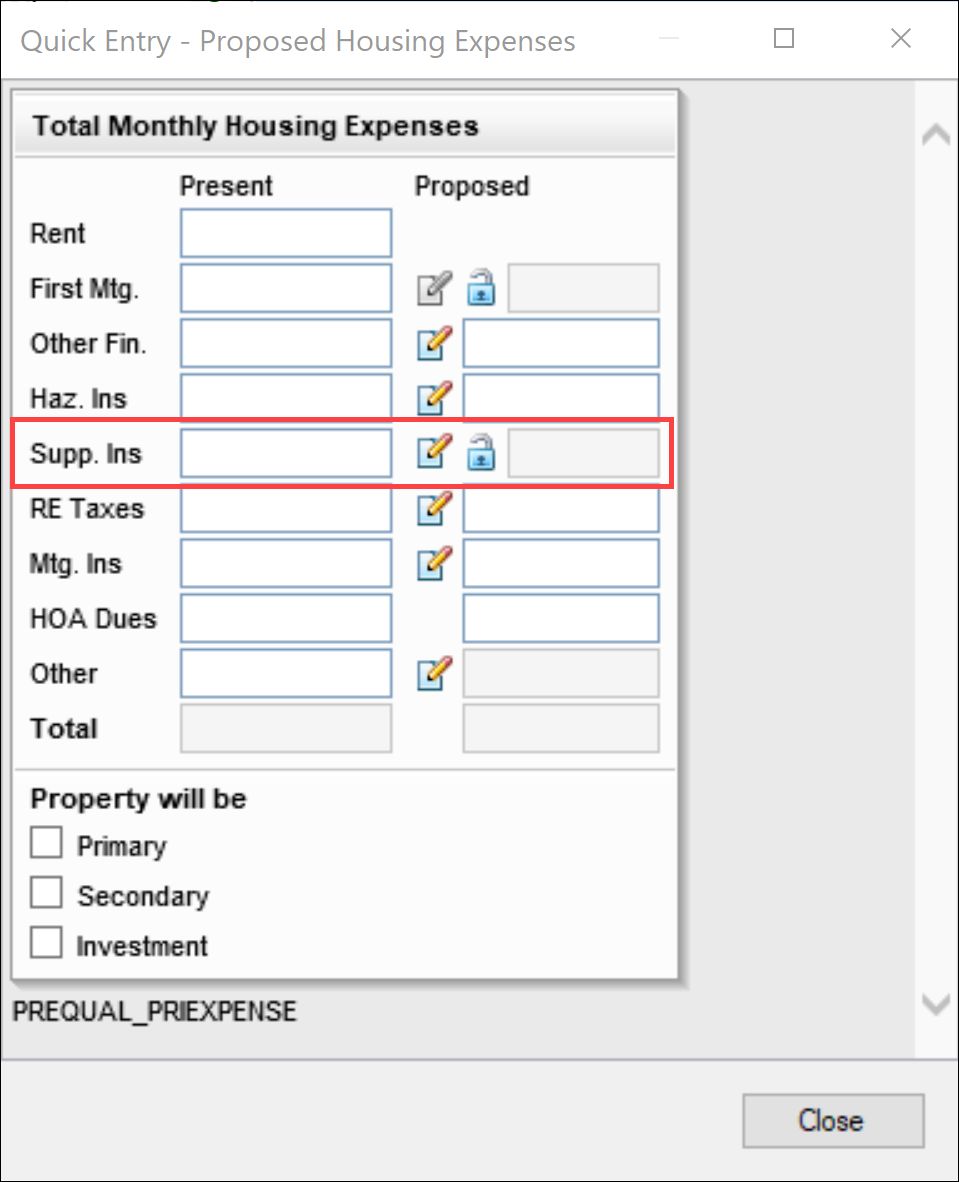

A new line containing two existing Supp. Insurance fields has been added to the Quick Entry - Proposed Housing Expenses pop-up window on the HUD-92900LT FHA Loan Transmittal input form. The quick entry window is accessed by clicking the Borrower’s Primary Residence button in the Proposed Monthly Payments section.

-

The present Supplemental Ins (field ID URLA.X212) has been added to the Present column.

-

The proposed Supplemental Ins (field ID URLA.X144) has been added to the Proposed column.

Two icons display to the left of the Proposed Supp. Ins field:

-

A Lock icon enables the user to override the calculated value populated to the field.

-

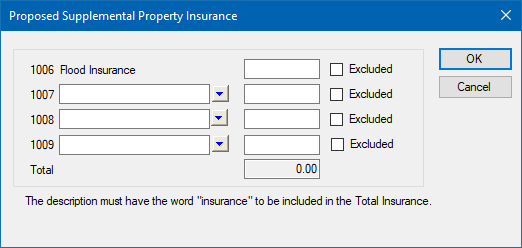

An Edit icon enables the user to open the Proposed Supplemental Property Insurance pop-up window shown here:

Users can click the Edit icon to open the Proposed Supplemental Property Insurance pop-up window and enter insurance values for lines 1006 - 1009. The total of all valid values entered in the pop-up window is populated to the Subject Property Supplemental Ins field (field ID URLA.X144). Valid values must contain the word Insurance in the description and not be indicated as Excluded.

When the Lock icon is blue, the field is unlocked. Encompass calculates and populates the field based on the valid values entered in the Proposed Supplemental Property Insurance pop-up window as described above.

If the user clicks the blue Lock icon, the icon changes to gold, and the field is locked. You can then manually enter a new value in the field to override the system calculated field. You can still click the Edit icon to open the Proposed Supplemental Property Insurance pop-up window and enter or change values, but the values entered in the pop-up window are ignored and Subject Property Supplemental Ins field (URLA.X144) does not update. To revert back to the system calculated value, click the gold Lock icon. The lock returns to a blue, unlocked state.

Loan Submission Input Form

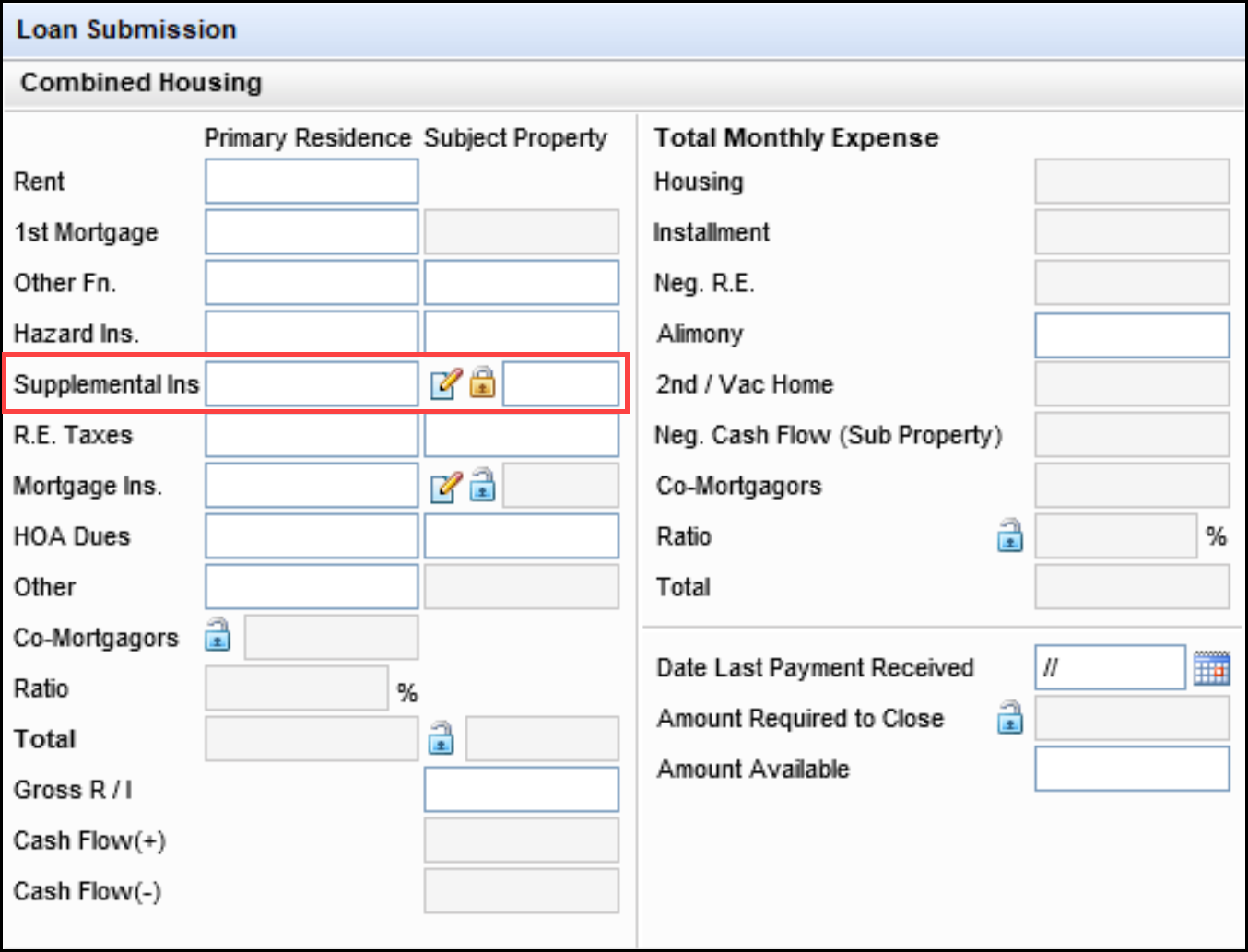

A new Supplemental Ins row has been added to the Combined Housing section on the Loan Submission input form:

-

The present Supplemental Ins (field ID URLA.X212) has been added to the Primary Residence column.

-

The proposed Supplemental Ins (field ID URLA.X144) has been added to the Subject Property column.

In the Subject Property column, two icons display to the left of the proposed Supplemental Ins field:

-

A Lock icon enables the user to override the calculated value populated to the field.

-

Users can click the Edit icon to open the Proposed Supplemental Property Insurance pop-up window and enter insurance values for lines 1006 - 1009. The total of all valid values entered in the pop-up window is populated to the Subject Property Supplemental Ins field (field ID URLA.X144). Valid values must contain the word Insurance in the description and not be indicated as Excluded.

-

When the Lock icon is blue, the field is unlocked. Encompass calculates and populates the field based on the valid values entered in the Proposed Supplemental Property Insurance pop-up window as described above.

-

If the user clicks the blue Lock icon, the icon changes to gold, and the field is locked. You can then manually enter a new value in the field to override the system calculated field. You can still click the Edit icon to open the Proposed Supplemental Property Insurance pop-up window and enter or change values, but the values entered in the pop-up window are ignored and Subject Property Supplemental Ins (URLA.X144) does not update. To revert back to the system calculated value, click the gold Lock icon. The lock returns to a blue, unlocked state.

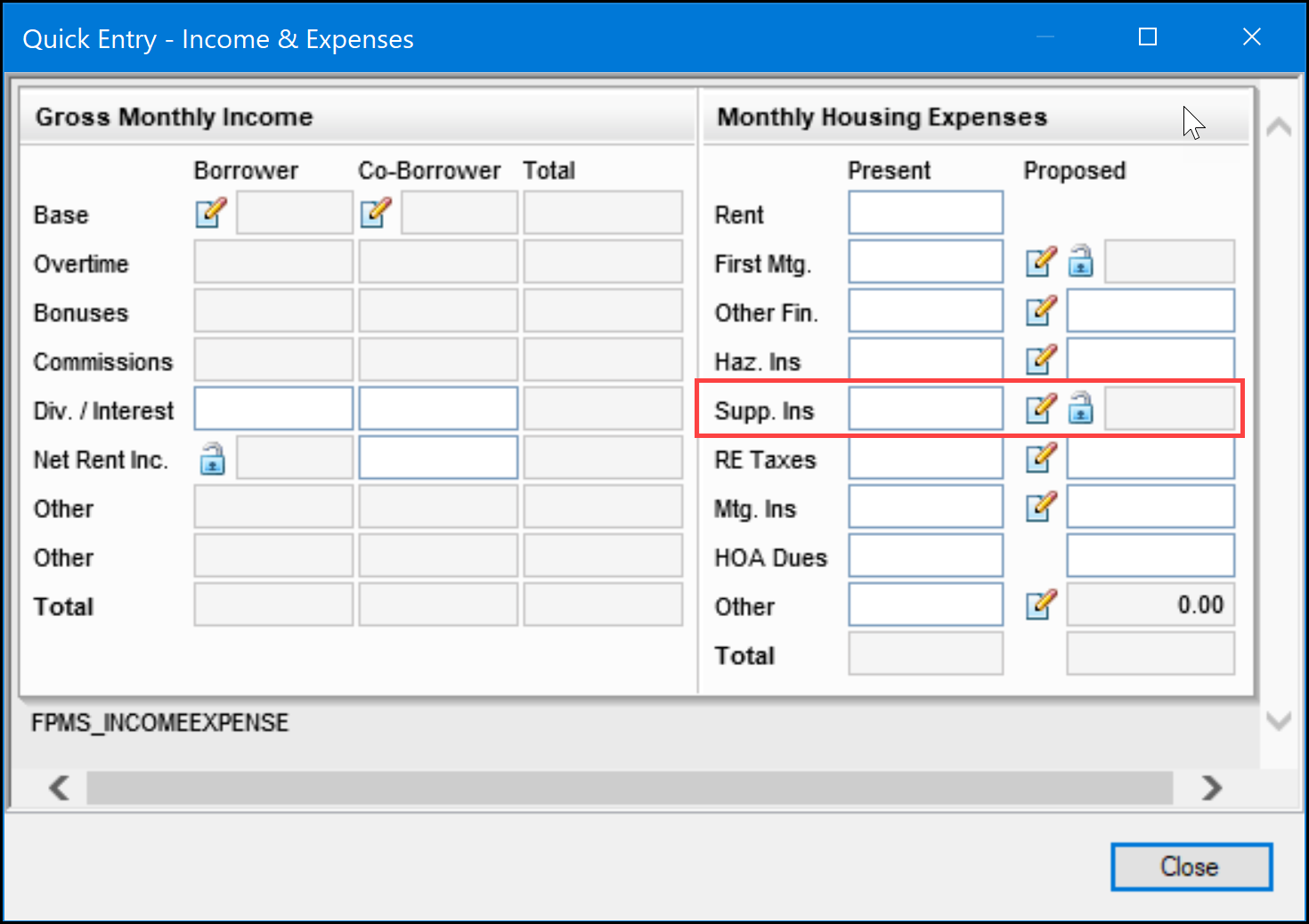

FHA Management Input Form

A new line containing two existing Supplemental Insurance fields has been added to the Quick Entry - Income & Expenses pop-up window on the Prequalification tab on the FHA Management input form. The quick entry window is accessed by clicking the Income & Expenses button in the Mortgage calculation section.

-

The present Supplemental Ins (field ID URLA.X212) has been added to the Present column.

-

The proposed Supplemental Ins (field ID URLA.X144) has been added to the Proposed column.

In the Proposed column, two icons display to the left of the Proposed Supp. Ins field:

-

A Lock icon enables the user to override the calculated value populated to the field.

-

Users can click the Edit icon to open the Proposed Supplemental Property Insurance pop-up window and enter insurance values for lines 1006 - 1009. The total of all valid values entered in the pop-up window is populated to the Subject Property Supplemental Ins field (field ID URLA.X144). Valid values must contain the word Insurance in the description and not be indicated as Excluded.

-

When the Lock icon is blue, the field is unlocked. Encompass calculates and populates the field based on the valid values entered in the Proposed Supplemental Property Insurance pop-up window as described above.

-

If the user clicks the blue Lock icon, the icon changes to gold, and the field is locked. You can then manually enter a new value in the field to override the system calculated field. You can still click the Edit icon to open the Proposed Supplemental Property Insurance pop-up window and enter or change values, but the values entered in the pop-up window are ignored and Subject Property Supplemental Ins field (URLA.X144) does not update. To revert back to the system calculated value, click the gold Lock icon. The lock returns to a blue, unlocked state.

These updates affect only loans using the URLA 2020 forms. Loans using the URLA 2009 forms are not affected by these updates.

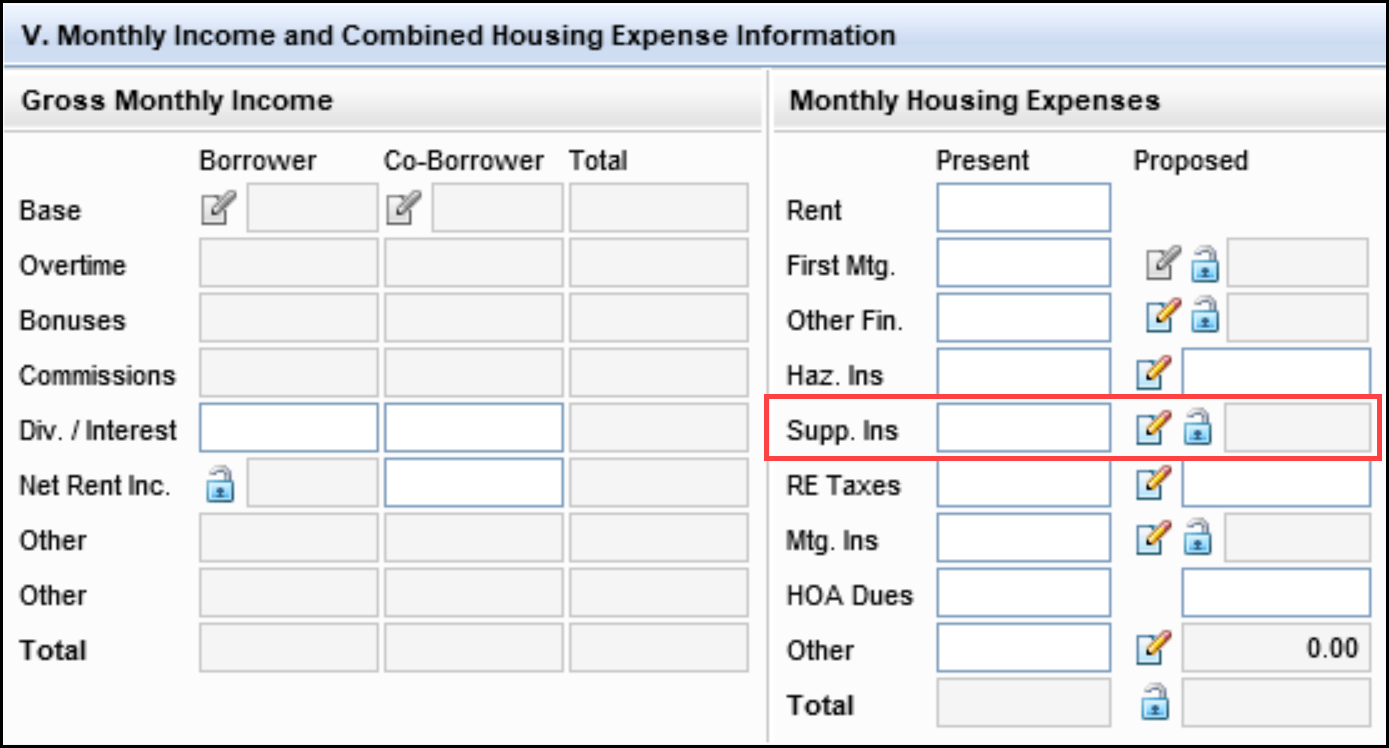

USDA Management Input Form

A new Supp. Ins row has been added to Page 2 of the Rural Assistance URLA tab of the USDA Management input form in section V. Monthly Income and Combined Housing Expenses Information.

-

The present Supp. Ins (field ID URLA.X212) has been added to the Present column.

-

The proposed Supp. Ins (field ID URLA.X144) has been added to the Proposed column.

In the Proposed column, two icons display to the left of the Proposed Supp. Ins field:

-

A Lock icon enables the user to override the calculated value populated to the field.

-

Users can click the Edit icon to open the Proposed Supplemental Property Insurance pop-up window and enter insurance values for lines 1006 - 1009. The total of all valid values entered in the pop-up window is populated to the Subject Property Supplemental Ins field (field ID URLA.X144). Valid values must contain the word Insurance in the description and not be indicated as Excluded.

-

When the Lock icon is blue, the field is unlocked. Encompass calculates and populates the field based on the valid values entered in the Proposed Supplemental Property Insurance pop-up window as described above.

-

If the user clicks the blue Lock icon, the icon changes to gold, and the field is locked. You can then manually enter a new value in the field to override the system calculated field. You can still click the Edit icon to open the Proposed Supplemental Property Insurance pop-up window and enter or change values, but the values entered in the pop-up window are ignored and Subject Property Supplemental Ins field (URLA.X144) does not update. To revert back to the system calculated value, click the gold Lock icon. The lock returns to a blue, unlocked state.

These updates affect only loans using the URLA 2020 forms. Loans using the URLA 2009 forms are not affected by these updates.

CBIZ-52976, CBIZ-52721, CBIZ-53574, CBIZ-53579

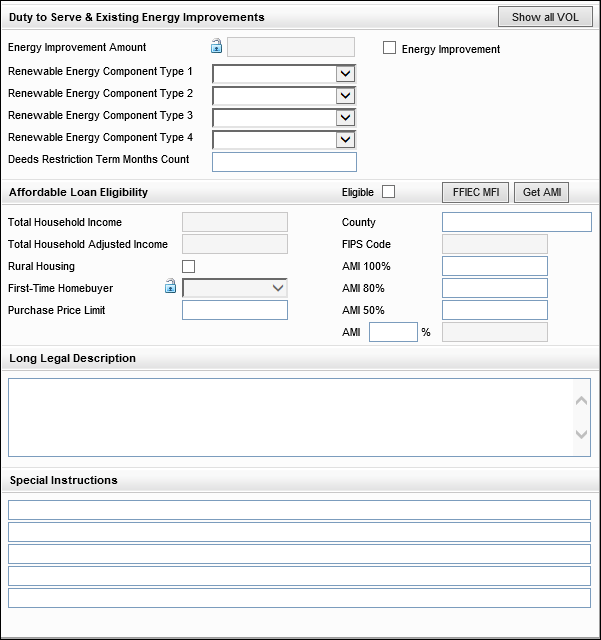

Affordable Loan Enhancements

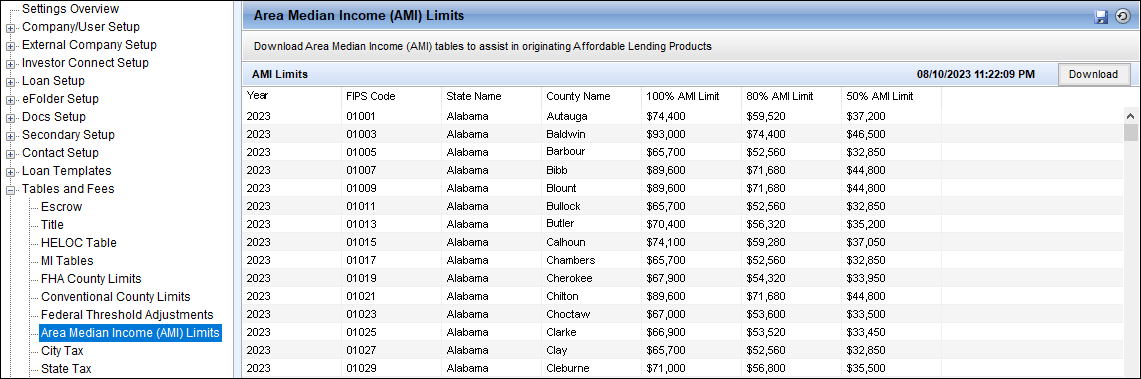

Beginning in this Encompass 23.3 release, a new Encompass setting called Area Median Income (AMI) Limits is being introduced to provide lenders with the most recent AMI for specific geographic areas. The last two years of AMI data provided by Fannie Mae and Freddie Mac is available to download to the Encompass Settings > Tables and Fees > Area Median Income (AMI) screen.

The table provides the Year, FIPS Code, State, County, and AMI Limits (100%, 80%, 50%). Click the Download button to update the table with the latest data. This data is typically updated every June by Fannie Mae and Freddie Mac.

CBIZ-54461

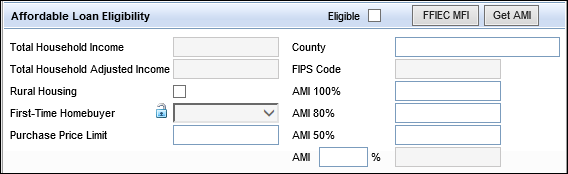

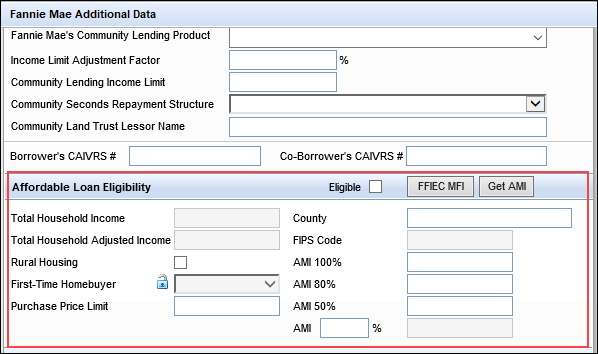

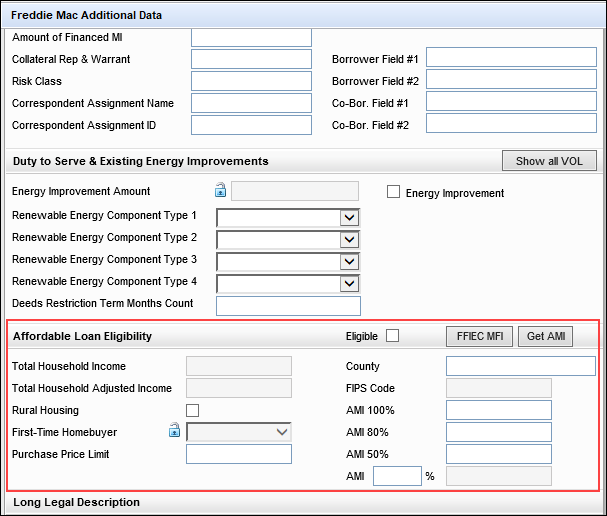

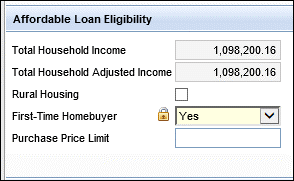

A new Affordable Loan Eligibility section has been added to the Borrower Summary - Origination, Fannie Mae Additional Data, and Freddie Mac Additional Data input forms to enable Encompass users to view factors that help determine whether a loan is a good candidate for an affordable loan program such as USDA, HomeReady® and Home Possible®.

The Affordable Loan Eligibility section includes two new buttons:

-

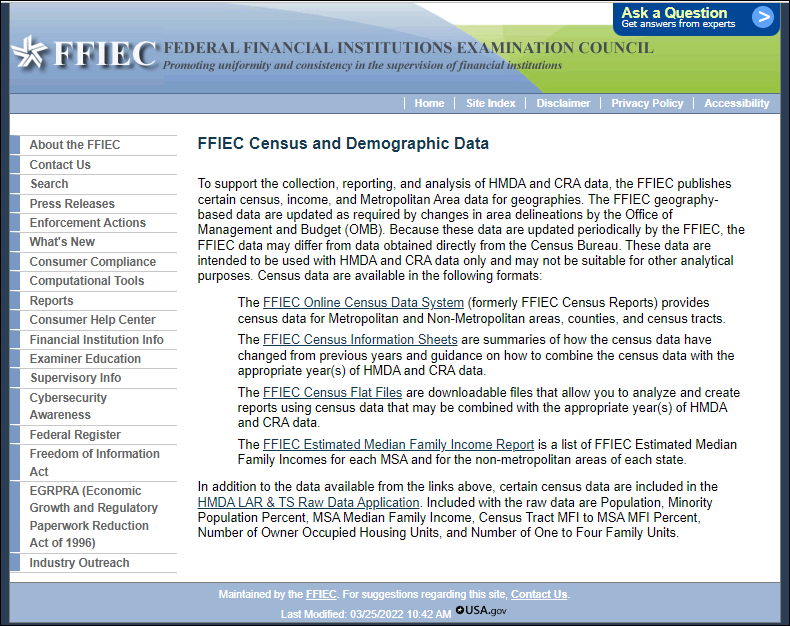

Click the new FFIEC MFI button to be taken to the FFIEC Census and Demographic Data website and manually look up census, income and metropolitan area data for different areas.

-

Click the new Get AMI button to populate the fields in this section with the Area Median Income (AMI) values for the area where the subject property is located. These values are based on the AMI Limits provided in the Area Median Income (AMI) Limits table in Encompass Settings. This data is provided by Fannie Mae and Freddie Mac.

The Get AMI and FFIEC buttons are disabled within Data Templates.

The Affordable Loan Eligibility section includes the following fields:

-

Eligible (field ID 4968) - Editable checkbox. Select this checkbox to indicate the loan is eligible for an affordable loan program based on FFIEC data and total household income amounts.

-

Total Annual income for the household (field ID USDA.X222) - This new read-only field calculates the total of household annual income reported in lines 1-6 on the Rural Assistance URLA input form on the USDA management tool.

-

Total Adjusted income for the household (field ID USDA.X223) - This read-only field is calculated by subtracting the Total Household Deduction from the Total Household Annual Income (line 7 minus line 13) on the Rural Assistance URLA input form on the USDA Management tool.

-

Rural Housing (field ID 3850) - An existing editable checkbox. Select this checkbox if the subject property is located in a rural and/or underserved area as designated by the CFPB.

-

First-Time Homebuyer - An existing field (field ID 934) to indicate that the borrower has not had any form of ownership in any home in the last 3 years. A new field lock icon has been added to this field in Encompass 23.3. Authorized users can utilize this lock icon to control if Encompass will populate this field or override the calculated value with a manual entry.

-

Purchase Price Limit (field ID 4969) - A new editable field that is blank by default. The purchase price limit is set by the investor providing the affordable loan program.

-

County (field ID 13) - An existing editable field populated with the county the subject property is located in (based on the subject property ZIP code (field ID 15).

-

FIPS Code (field ID HMDA.X111) - An existing field for the HMDA County Code consisting of the state code field (field ID 1395) and the County Code (field ID 1396).

-

AMI 100% (field ID MORNET.X30) - An existing editable field populated when the Get AMI button is clicked.

-

AMI 80% (field ID 4971 - A new editable field populated when the Get AMI button is clicked.

-

AMI 50% (field ID 4972) - A new editable field populated when the Get AMI button is clicked.

-

AMI % (field ID 4985) - A new editable field for the AMI percentage.

-

AMI [Limit] (field ID 4986) - A new read-only field that calculates the AMI limit to qualify for the affordable loan program

For existing loans created prior to Encompass 23.3, if you click the Get AMI button when the Zip Code field (field ID 15) is populated but the FIPS Code or HMDA County Code field (field ID HMDA.X111) is not, an error message displays that explains you must first provide the ZIP code for the subject property in order to proceed. You must manually re-enter the ZIP code in field 15. This will then auto-populate field ID HMDA.X111 with the applicable code. You can then click the Get AMI button again and the AMI fields will be updated accordingly.

Additional Information About the New Total Annual Income and Total Adjust Annual Income Fields

In addition to the input forms discussed above, the new Total Annual income for the household (field ID USDA.X222) and Total Adjusted income for the household (field ID USDA.X223) fields are now also provided on the Req for SFH Loan Guarantee/Resv. of Funds input form in the USDA Management tool and on the 1003 URLA Part 2. These fields have replaced the previous fields used on these forms to calculate Annual Household Income (field ID USDA.X16) and Adjusted Annual Income (field ID USDA.X17).

Previous versions of Encompass support USDA Income Worksheets that are structured by borrower pair. To ensure Encompass continues to calculate an accurate total household income assessment without disrupting these worksheets, the Rural Assistance URLA input form in the USDA Management tool will continue to use field USDA.X16 (Annual Household Income) and field USDA.X17 (Adjusted Annual Income) in Encompass 23.3, calculating these values at the borrower-level.

Data Migration

When an existing loan is opened, Encompass performs a one-time field calculation for field USDA.X222 (i.e., it calculates the total of household annual income reported in lines 1-6 on the Rural Assistance URLA input form on the USDA management tool) and for field USDA.X223 (i.e., it subtracts the Total Household Deduction from the Total Household Annual Income (line 7 minus line 13) on the Rural Assistance URLA input form on the USDA Management tool).

Fields USDA.X16 and USDA.X17 are not recalculated and retain their current values.

CBIZ-52187, CBIZ-52896, CBIZ-51391, CBIZ-53401, CBIZ-52898, CBIZ-54047, CBIZ-54459

Freddie Mac 5.3 Updates

(Updated on 9/18/2023)

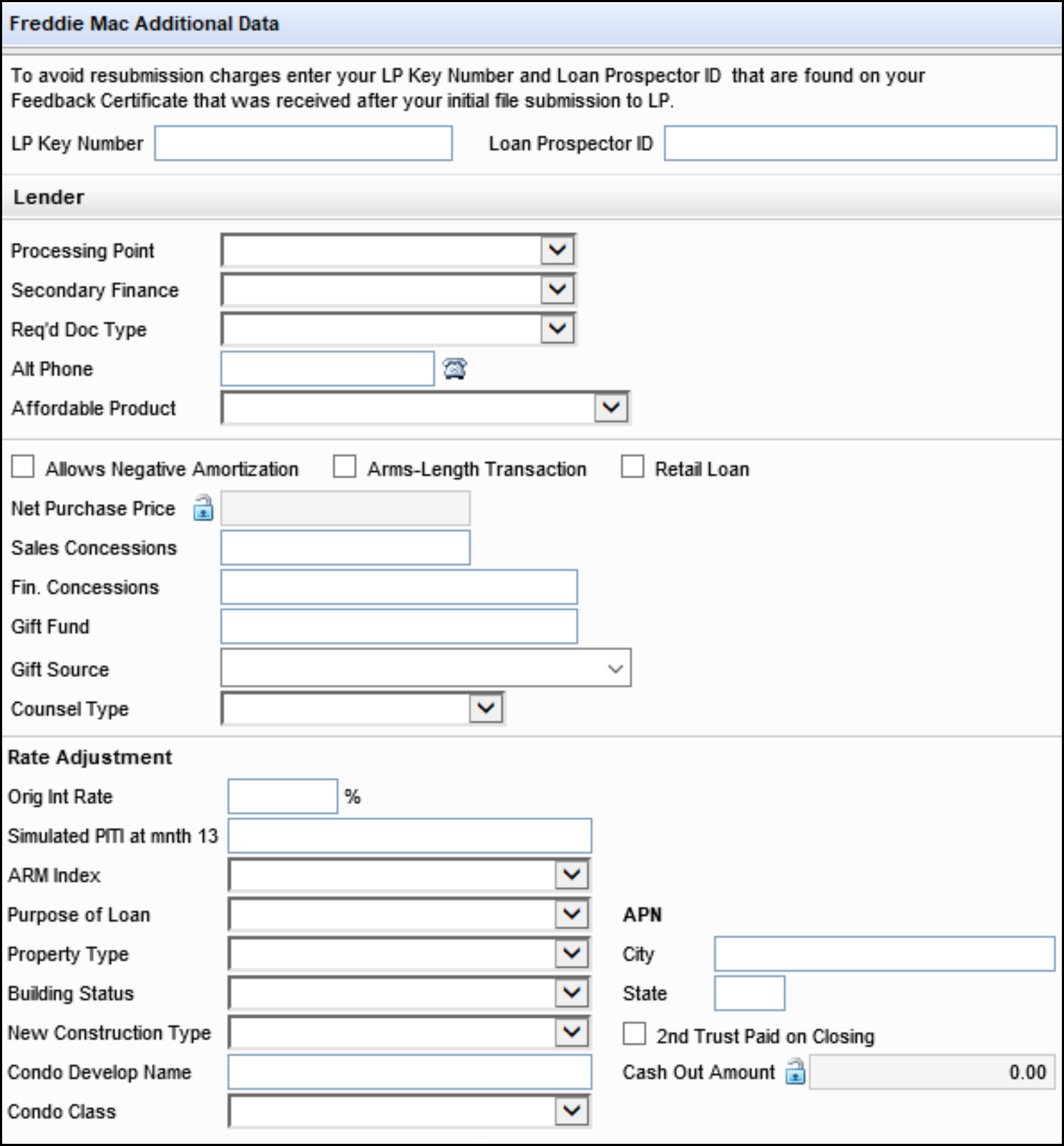

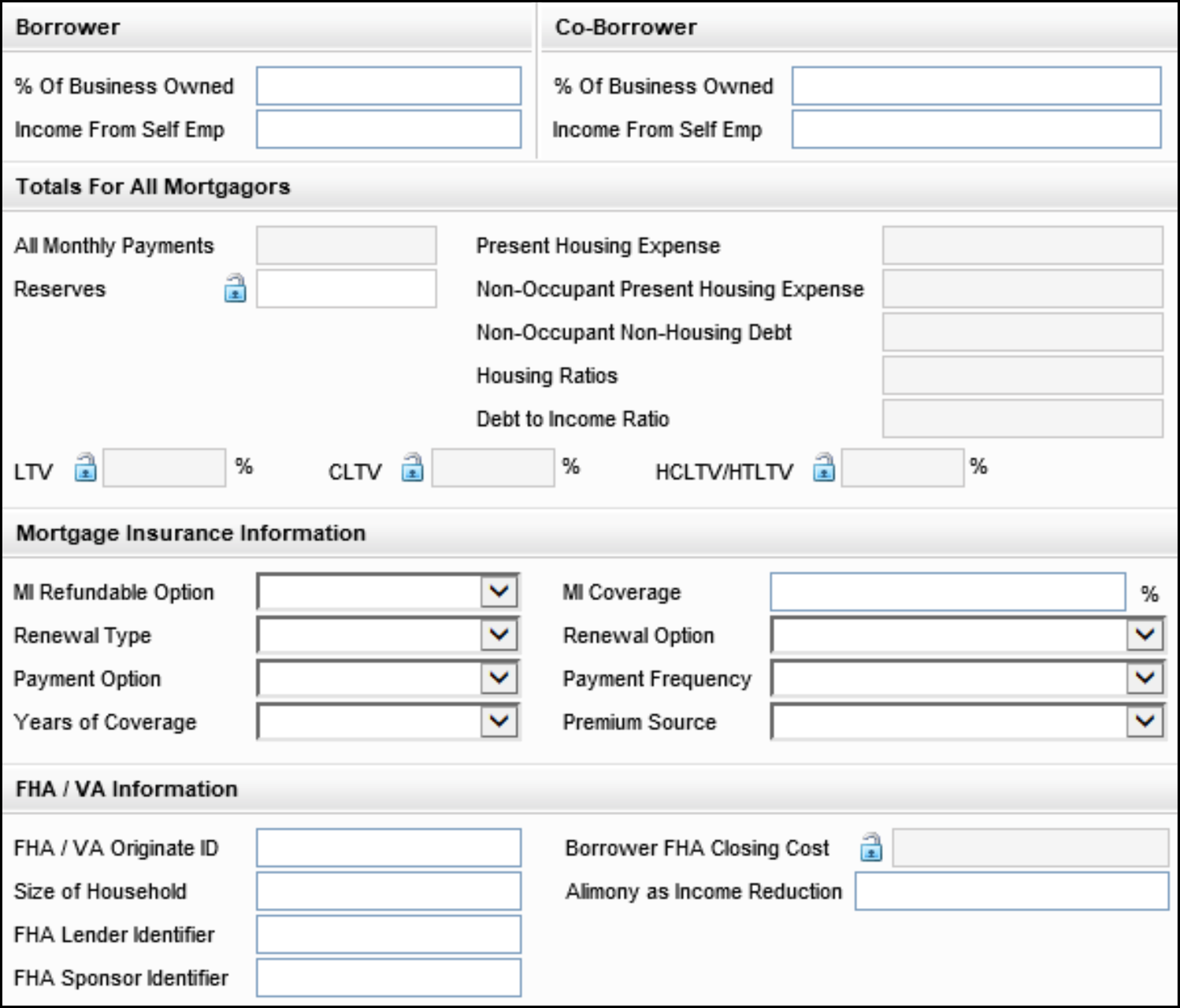

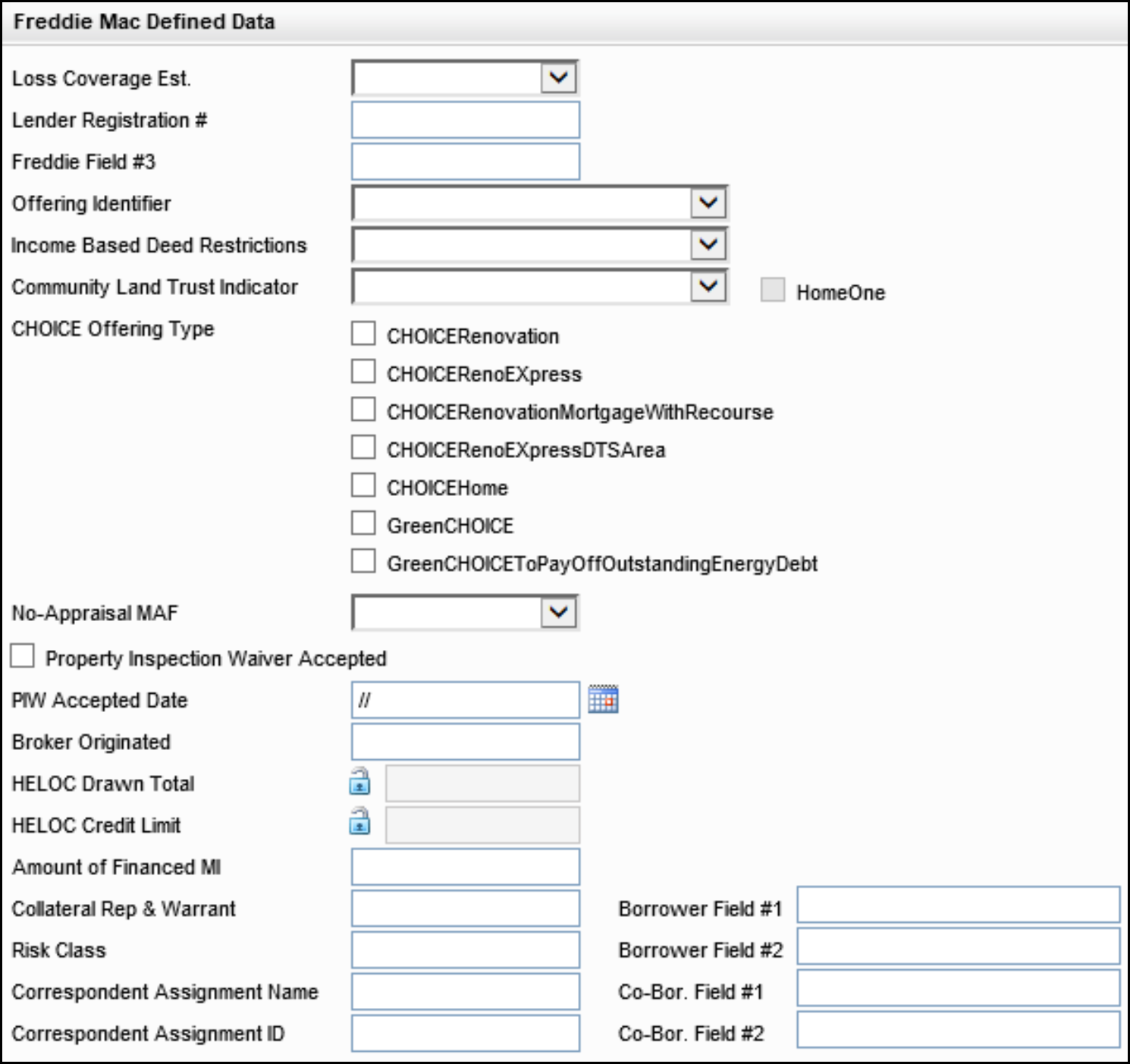

As part of an initiative that has been ongoing for the past few years (and per Freddie Mac's guidance), updates have been made to the Freddie Mac Additional Data input form to remove fields that are no longer needed because they are available on other input forms. As part of the update, various sections have been reorganized and the Purchase Credit Source section has been removed entirely since the fields in that section are no longer on the form. The following images show the new layout of the form.

Fields Removed from Freddie Mac Additional Data Input Form

Per Freddie Mac’s guidance, the following fields have been removed the Freddie Mac Additional Data input form. As noted below, most of these fields are still provided on other Encompass input forms.

| Field Name | Field ID | Provided on Other Encompass Input Forms |

|---|---|---|

| Contact | 1256 | Yes |

| Loan # | 364 | Yes |

| Phone | 1262 | Yes |

| Fax | 1263 | Yes |

| 1st Pmt Date | 682 | Yes |

| Appraised Value | 356 | Yes |

| Sub. Financing | 428 | Yes |

| Down Payment | 1335 | Yes |

| First Time Home Buyer | 934 | Yes |

| 1st Adj Cap | 697 | Yes |

| 1st Change | 696 | Yes |

| Adj Cap | 695 | Yes |

| Adj Period | 694 | Yes |

| Life Cap | 247 | Yes |

| Margin | 689 | Yes |

| Index | 688 | Yes |

| Pmt Adj Cap | 691 | Yes |

| Max Balance | 698 | Yes |

| Convertible Indicator | 1290 | Yes |

| Buydown Indicator | 425 | Yes |

| Contributor | CASASRN.X141 | Yes |

| Buydown Type | 4645 | Yes |

| Rate | 4535 | Yes |

| Rate | 4536 | Yes |

| Rate | 4537 | Yes |

| Rate | 4538 | Yes |

| Rate | 4539 | Yes |

| Rate | 4540 | Yes |

| Term | 4541 | Yes |

| Term | 4542 | Yes |

| Term | 4543 | Yes |

| Term | 4544 | Yes |

| Term | 4545 | Yes |

| Term | 4546 | Yes |

| County (APN) | 977 | No |

| Gross Monthly Income | 1389 | Yes |

| Subject PITI | 912 | Yes |

| FHA / VA Case # | 1040 | Yes |

| FHA Underwriter CHUMS ID | 980 | Yes |

| MIP/VA Funding Fee Financed | 1045 | Yes |

| MI Premium Refund | 1134 | Yes |

| One or more borrowers qualifies as a veteran | 156 | Yes |

| VA Residual Income | 1325 | Yes |

| M3 | 202 | Yes |

| M4 | 1091 | Yes |

| M5 | 1106 | Yes |

| M6 | 1646 | Yes |

| $ | 141 | Yes |

| $ | 1095 | Yes |

| $ | 1115 | Yes |

| $ | 1647 | Yes |

| Source | 4667 | Yes |

| Source | 4668 | Yes |

| Source | 4669 | Yes |

| Source | 4670 | Yes |

CBIZ-52693

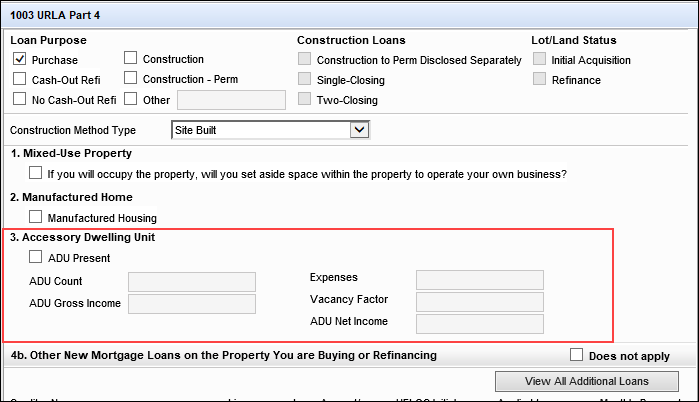

A new Accessory Dwelling Unit section has been added to the Section 4a: Loan and Property Information portion of the 1003 URLA Part 4 input form. Use this section to capture ADU details for a subject property. An ADU is an additional living area that includes a kitchen, bathroom, and a separate entrance.

The following new fields are available in this section:

-

ADU Present (field ID URLA.X309)

-

ADU Count (field ID URLA.X310)

-

ADU Gross Income (field ID URLA.X311)

-

Expenses (field ID URLA.X312)

-

Vacancy Factor (field ID URLA.X313)

-

ADU Net Income (field ID URLA.X314)

All of the text fields are disabled (grayed-out) until the ADU Present checkbox is selected.

Please note the following:

-

Field mapping to the XML that is submitted to LPA is in place for ADU Count (field ID URLA.X310) at this time. Mapping for the other fields in this section will be completed in a future LPA Spec release.

-

The income derived from an ADU should still be entered as additional income, with Accessory Dwelling Unit selected as the income source, on the Verification of Other Income input form.

CBIZ-51747

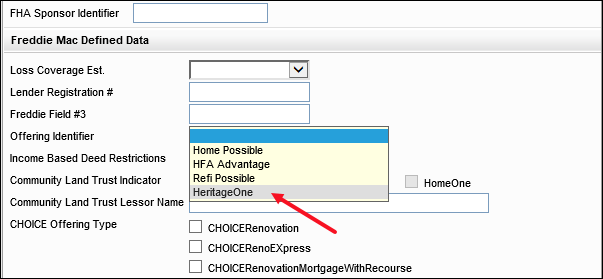

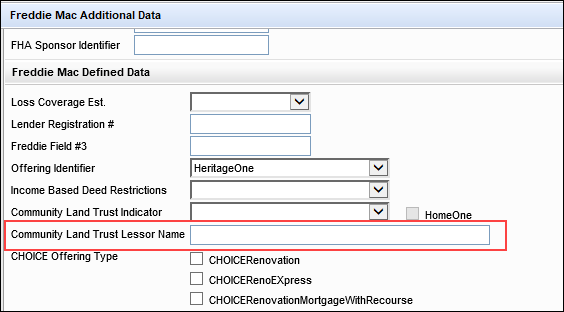

On the Freddie Mac Additional Data input form, HeritageOne is now available to select from the Offering Identifier drop-down list (CASASRN.X209). For more information about Freddie Mac’s HeritageOne℠ mortgage product that was introduced on June 7, 2023, refer to the HeritageOne Mortgage page and FAQ page on Freddie Mac’s website.

CBIZ-51745

Additional Fannie Mae and Freddie Mac Input Form Updates

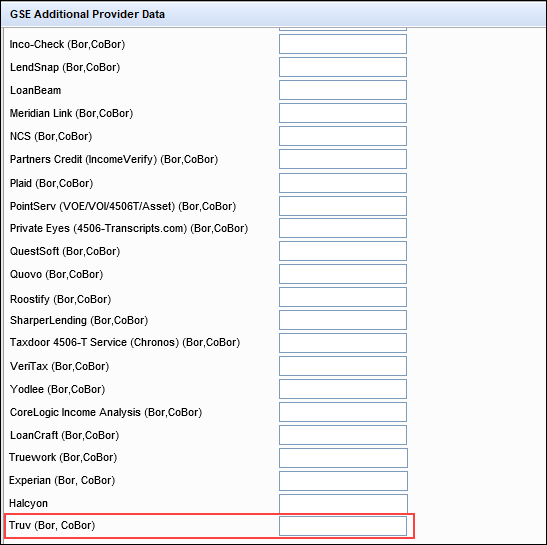

A new field for Truv (field ID GSEVENDOR.X50) has been added to the Universal Credit 4506T section of the GSE Additional Provider Data input form. Users leveraging Freddie Mac’s Asset and Income Modeler (AIM) through the Loan Product Advisor® (LPA) may use this new AIM for income and employment service provider starting in Q3 2023.

For more information about Freddie Mac’s Asset and Income Modeler (AIM), visit the AIM website.

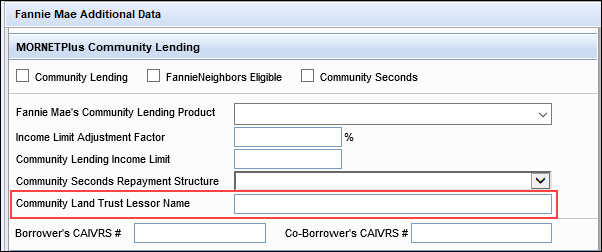

A new field called Community Land Trust Lessor Name (field ID 4988) is now provided on the Fannie Mae Additional Data and Freddie Mac Additional Data input forms. Enter the name of the Lessor in this field. The name entered here is used by Encompass when generating a Community Land Trust Ground Lease Rider printed output form.

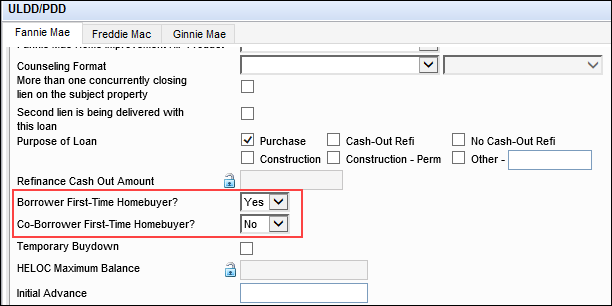

To help ensure the logic to populate the Counseling Confirmation and Counseling Format type information on the Fannie Mae ULDD XML adheres to Fannie Mae’s Appendix D requirements, two new borrower-level fields are now provided on the ULDD/PDD input form (Fannie Mae, Freddie Mac, Ginnie Mae tabs):

-

Borrower First-Time Homebuyer (field ID 4973)

-

Co-Borrower First Time Homebuyer (field ID 4974)

Previously, the loan level First-Time Homebuyer field (field ID 934) was used on the ULDD/PDD Fannie Mae and Freddie Mac tabs to collect this information. This field (934) continues to be used on other input forms.

Utilizing these two new borrower-level fields enables Encompass to capture separate values for the borrower and co-borrower as opposed to capturing just one value for first-time borrower status with the singular loan-level field.

Data Migration Notes:

-

Field 934 is still provided on other Encompass input forms, such as the Borrower Summary - Origination, Property Information, Fannie Mae Additional Data, and Freddie Mac Additional Data input form forms.

-

Field 934 on the ULDD/PDD input form was not a calculated field, so other input fields are not impacted by its removal from this form.

-

If Field 934 on the ULDD/PDD input form contained a value (not blank), that value is retained in field 934 on other input forms.

-

A new field Lock icon has been added to field 934 on the remaining input forms where this field is provided. Authorized users can utilize this Lock to control if Encompass populates this field or override the calculated value with a manual entry.

-

If the new First-Time Homebuyer field (4973 or 4974) on the ULDD/PDD input form set to Yes, then Yes will be automatically populated to field 934 if it has not been manually locked with the field lock and manually updated.

-

When a loan is duplicated, the new 4973 and 4974 fields/values are copied to the duplicated loan.

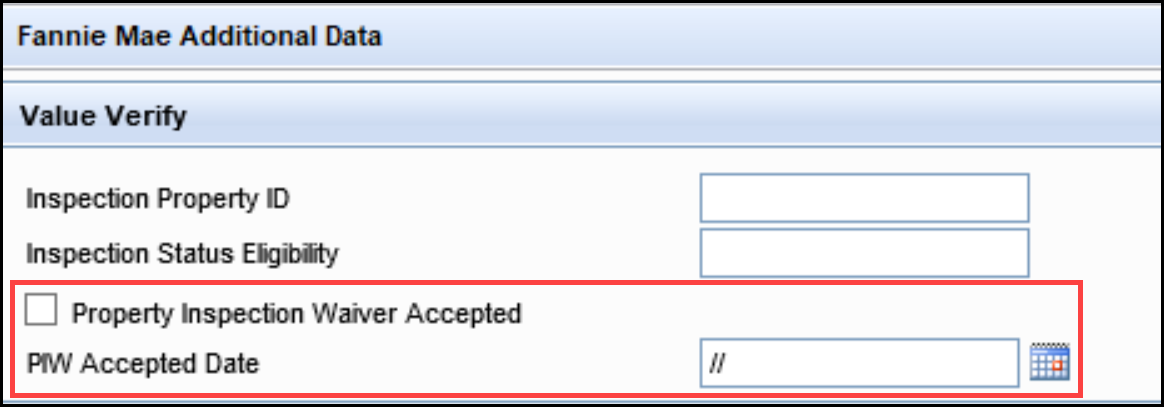

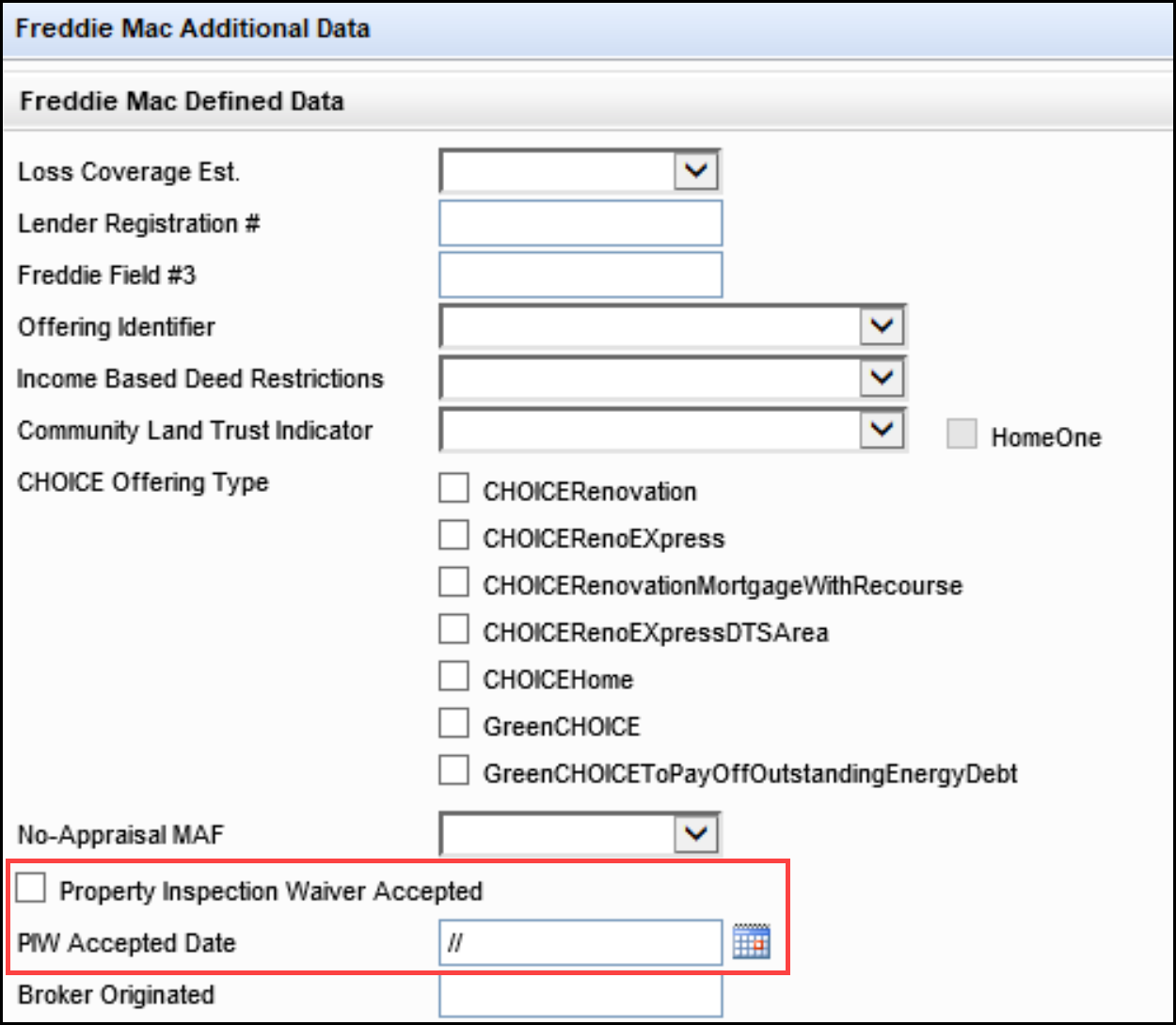

Two new fields have been added to the Fannie Mae Additional Data and Freddie Mac Additional Data input forms to enable the user to document when a Borrower acknowledges and accepts that an appraisal is not being obtained for a transaction. These are both editable fields that can be used in business rules:

-

Property Inspection Waiver Accepted (field ID 4954) - editable checkbox.

-

PIW Accepted Date (field ID 4955) - editable date field with a calendar icon.

Since Fannie Mae Desktop Underwriter (DU) and Freddie Mac Loan Product Advisor (LP) do not provide data for these Property Inspection Waiver fields, Encompass users must complete the fields manually as needed. These fields are not included in loan exports or imports.

Fannie Mae Additional Data Input Form

Freddie Mac Additional Data Input Form

Two new read-only credit fields have been added to the Quick Entry - AUS Details screen to store the credit report types and IDs that were used with the AUS order submitted to the Government Agencies.

-

Credit Reference ID (field ID AUS.X201)

-

Credit Report Type (field ID AUS.X202)

Although available with the Encompass 23.3 Major Release, these fields will remain blank after AUS results are returned to Encompass. Mapping and parsing logic, resulting in automatic update of the fields with AUS results, will be available in a future release.

To Access this Quick Entry - AUS Details Screen:

-

In a loan file, click the Tools tab.

-

Click AUS Tracking.

-

On the AUS Tracking tool, click the New icon in the Underwriting Declaration History section or select an existing Underwriting Declaration History entry, and then click the Edit icon.

(Updated on 10/3/2023)

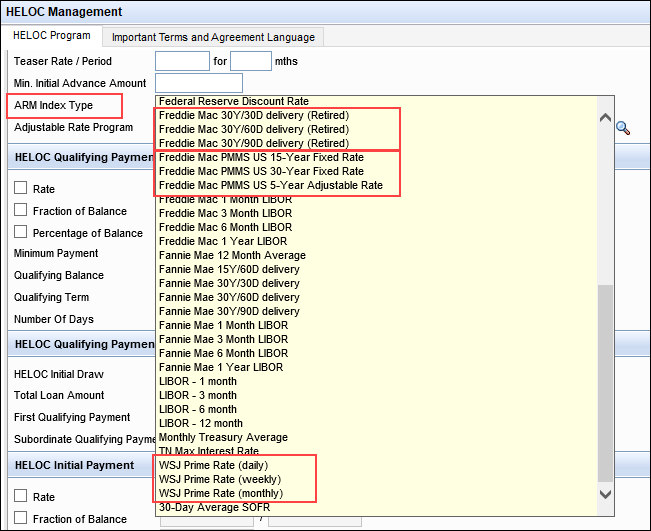

New WSJ Prime Rate and Freddie Mac PMMS rate options are now provided in the following ARM Index Rate drop-down field lists:

-

ARM Index Type (field ID 1959)

-

ARM Index Type (field ID 4512)

-

Index + Margin (field ID LE2.X96)

The WSJ rate options are provided as an alternative to the LIBOR monthly index options that are also provided in these drop-down lists as LIBOR reached its final retirement on June 30, 2023.

For the three new Freddie Mac PMMS index values, clicking the Get Index button in Encompass retrieves the rate from Mavent and populates it in Encompass. However, there is additional mapping required in order for these index values to reflect accurately on the Mavent Compliance Report (PDF and XML). This mapping will be completed as soon as possible and made available in Encompass at that time. This update will not require a new Encompass installation upgrade.

In addition, a (Retired) label has been added to the retired Freddie Mac 30Y/30D, 30Y/60D, and 30Y/90D indices in these same drop-down fields lists.

Updates to Forms and Tools

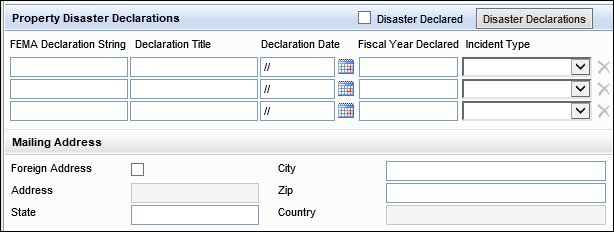

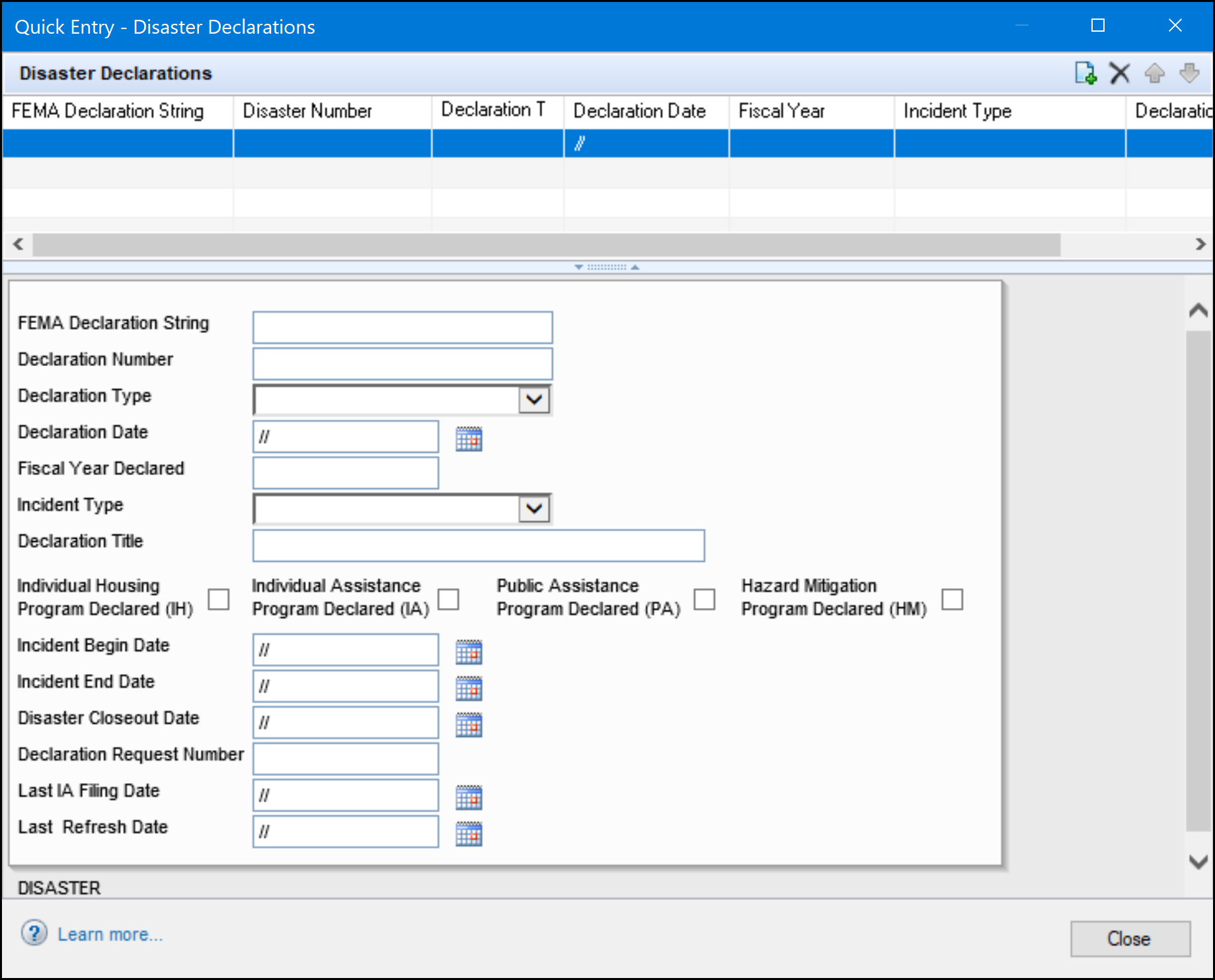

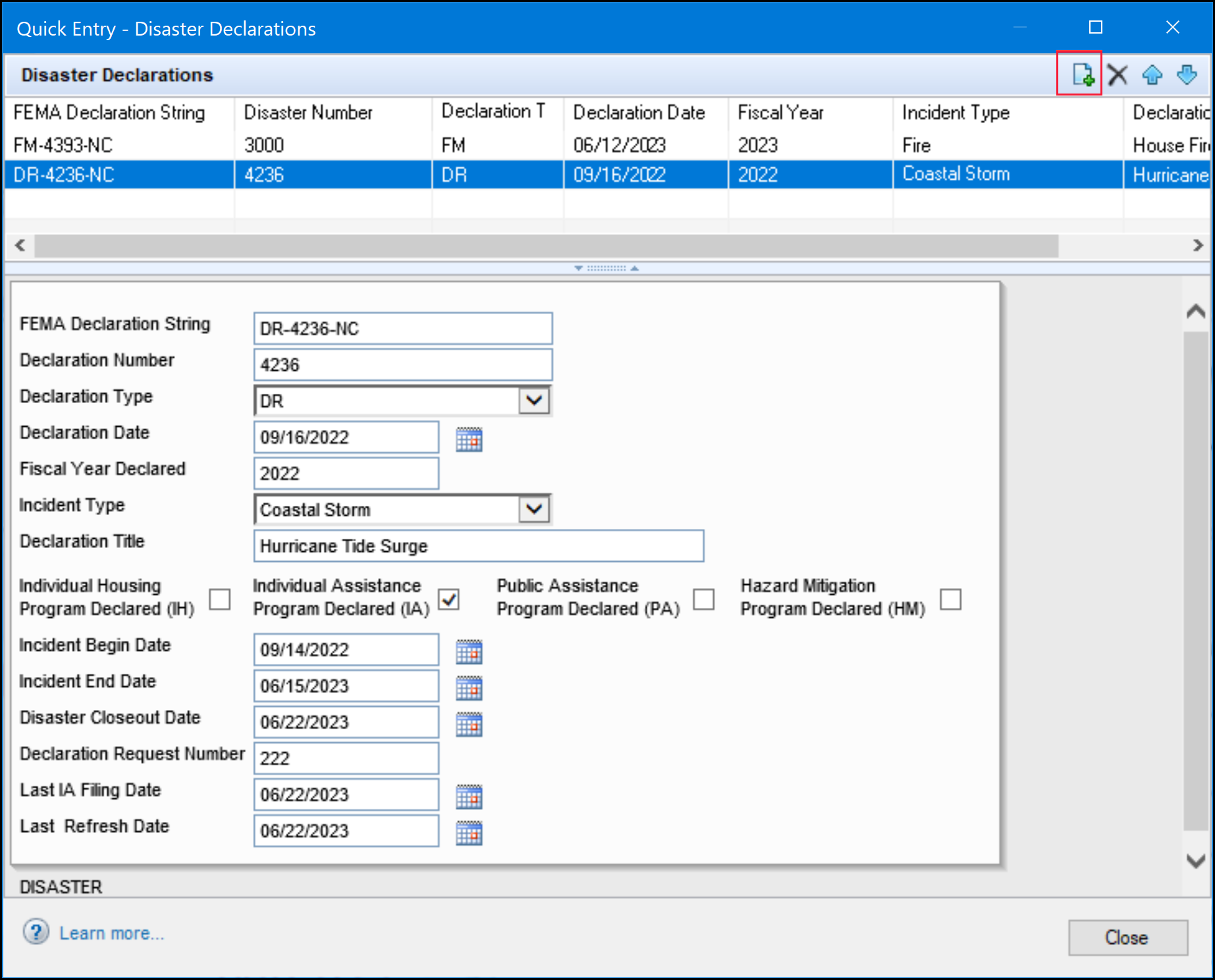

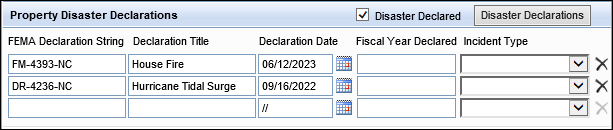

A new Property Disaster Declarations section has been added to the Property Information input form to enable users to create multiple records of disasters affecting a property on different dates if needed. Select the Disaster Declared checkbox (field ID 4953) at the top of the section to indicate that the property has been affected by a disaster.

Multiple records can be created for disasters in a manner similar to the records created for the Verification of Employment (VOE) or Verification of Liabilities (VOL) verification forms. To add records for disasters, click the Disaster Declarations button at the top of the section to open the Quick Entry - Disaster Declarations pop-up window.

The Disaster Declarations button is disabled in data templates.

On the pop-up window, click the Add icon to open a new record in the panel below the table. Each time you add an entry, it displays in a new table row at the top of the window. Each record includes a new collection of fields that are editable and do not have any logic or validations. The fields in the panel below the table are based on the FEMA Web Declaration Areas defined at: https://www.fema.gov/openfema-data-page/disaster-declarations-summaries-v2

-

FEMA Declaration String (field ID FEMA0101)

-

Disaster Number (field ID FEMA0102)

-

Declaration Type (field ID FEMA0103)

-

Declaration Date (field ID FEMA0104)

-

Fiscal Year Declared (field ID FEMA0105)

-

Incident Type (field ID FEMA0106)

-

Declaration Title (field ID FEMA0107)

-

IH Program Declared (field ID FEMA0108)

-

IA Program Declared (field ID FEMA0109)

-

PA Program Declared (field ID FEMA0110)

-

HM Program Declared (field ID FEMA0111)

-

Incident Begin Date (field ID FEMA0112)

-

Incident End Date (field ID FEMA0113)

-

Disaster Closeout Date (field ID FEMA0114)

-

Declaration Request Number (field ID FEMA0115)

-

Last IA Filing Date (field ID FEMA0116)

-

Last Refresh Date (field ID FEMA0117)

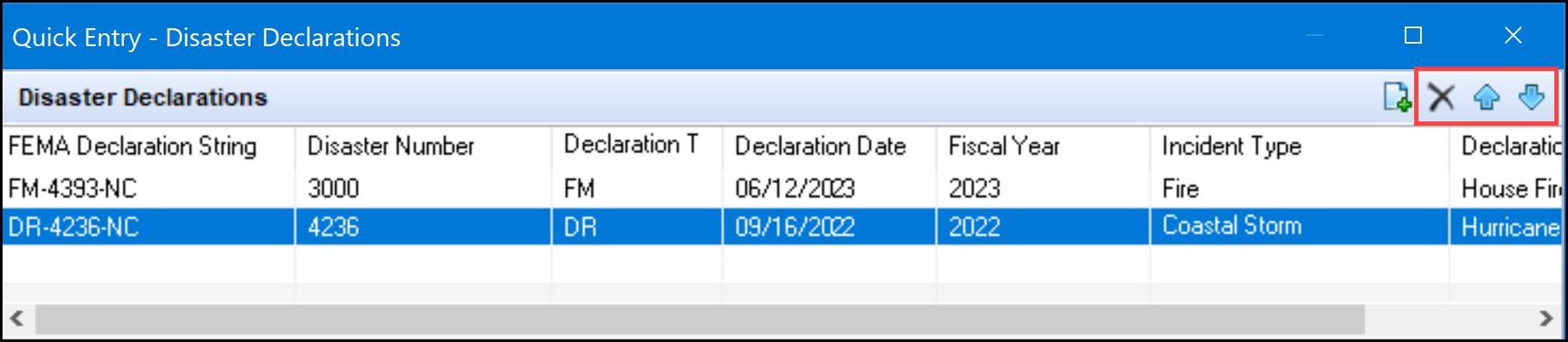

Users can delete or reposition entries using the icons on the top-right.

The top three entries on the pop-up window are copied to the Property Information form.

Users can delete an entry directly from the Property Information form by clicking the X icons on the far right.

![]()

There is no printed output form associated with the new Property Disaster Declarations section and the Disaster Declarations quick entry window fields. This information is available on the Property Information input form only.

CBIZ-51204, CBIZ-53611

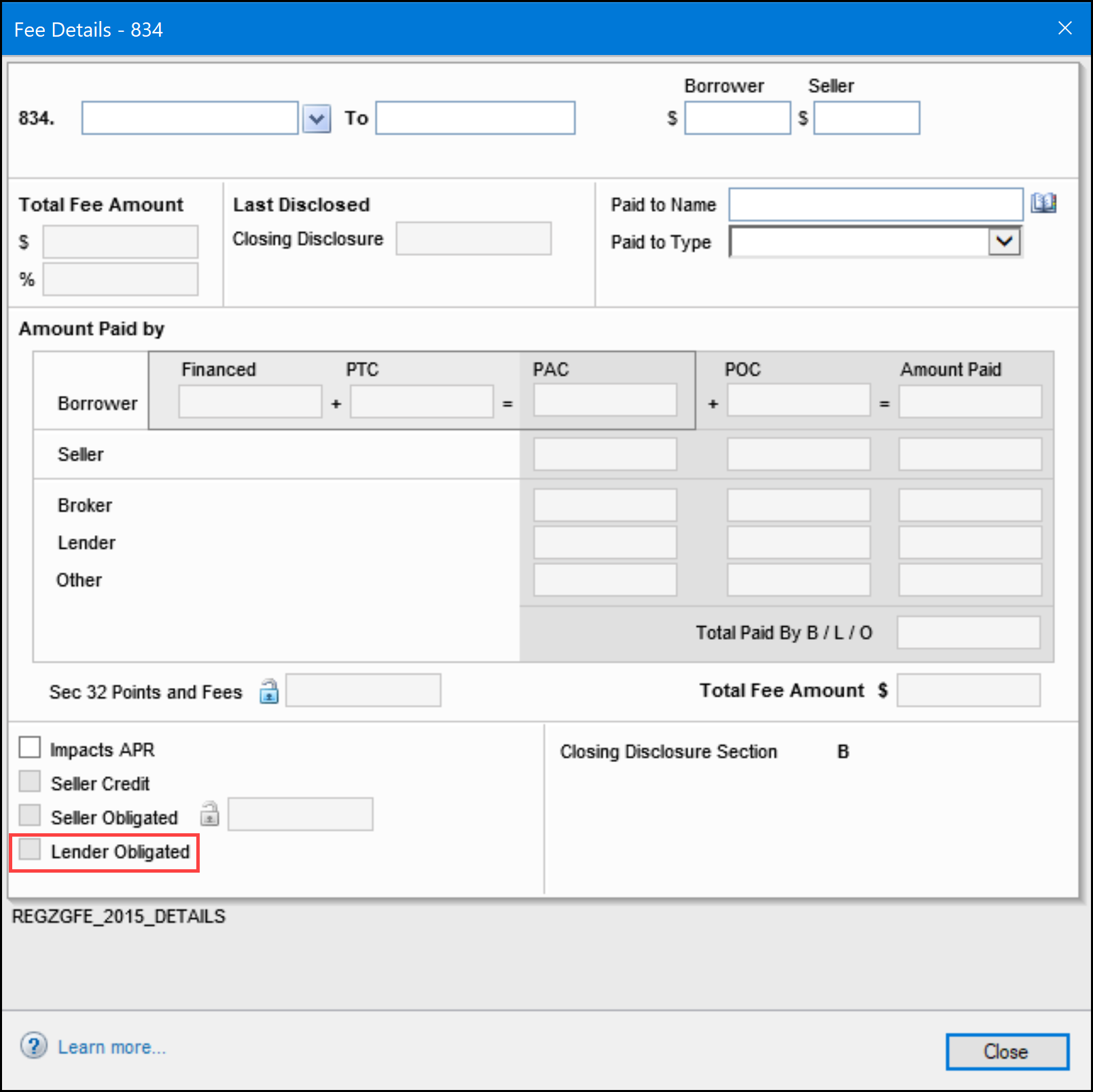

A Lender Obligated checkbox has been added to the Fee Details pop-up windows on the 2015 Itemization for the existing Lender Obligated lines 834, 835, 1115, 1116, 1209 and 1210. This checkbox clearly indicates that fees entered in these lines are not the responsibility of the borrower. These fees are automatically identified as Lender PAC fees, will not impact Fee Variance, will not be represented as Lender Credits, and will not impact the total closing costs fields. They will continue to be disclosed on the Closing Disclosure as Paid By Lender.

Fee Variance Alerts and Fee Variance Worksheet

If a lender obligated fee is listed in lines 834, 835, 1115, 1116, 1209, or 1210 and is decreased after disclosures are sent, a Good Faith Fee Variance Alert is not triggered. When calculating fields on the Fee Variance Worksheet, Encompass excludes fees from consideration if the Lender Obligated checkbox is selected. Lender obligated fees do not appear in the Itemization column of the Fee Variance worksheet.

When the Lender Obligated checkbox is selected on one of those line items, only the lender amount will be excluded from the Fee Variance worksheet. Any other amounts for those line items would still be added to the Fee Variance worksheet.

Closing Costs

The following closing cost fields exclude the Lender Obligated fees for the six fee line items when the Lender Obligated checkbox is selected. These fields appear on the 2015 Itemization, 1003 URLA-Lender, and Closing Disclosure Page 2 forms and affect Closing Costs/Qualifying the Borrower:

-

Lender Credit (field ID LENPCC)

-

Total Non-Borrower Paid CC (field ID TNBPCC)

-

Total Closing Costs (field ID TOTPCC)

-

Estimated Closing Costs (field ID 137)

-

Total Due From Borrowers (field ID 1073)

-

Total Mortgage Loans and Lines of Credit (field ID 1844)

-

Total Closing Costs Paid by Lender and Other (field ID 1852)

-

MIP, PMI. Funding Fee (field ID URLA.X146)

-

Other Credits (field ID URLA.X149)

-

Total Credits (field ID URLA.X152)

-

Lender Credits (field ID CD2.XSTLC) from the Closing Disclosure Page 2

Encompass Logic for Selecting a Lender Obligated Checkbox

-

When users open an existing template that does not have a Lender Obligated checkbox selected, but the borrower paid amount fields are not blank, Encompass will select the Lender Obligated checkbox.

-

When users apply an existing template that does not have a Lender Obligated checkbox selected, but borrower paid amount fields are not blank, Encompass will select the Lender Obligated checkbox.

-

When users apply an existing template that does not have a Lender Obligated checkbox selected and the borrower paid amount fields are blank, but the loan has borrower paid amounts in the lines, Encompass will select the Lender Obligated checkbox.

-

If borrower paid amount is not equal to 0 in an existing or new loan, the Lender Obligated checkbox is selected when:

-

The borrower paid amount is entered by users manually.

-

The borrower paid amount is not equal to 0 after applying a template no matter what borrower paid amount or new indicator value is from the template.

-

Migration

The Lender Obligated checkboxes will not be selected for loans existing prior to the Encompass 23.3 release. (The old logs will not have the checkbox values and will still use the old calculation.) For an existing loan with non-zero amounts in all 6 fee line items (lines 834, 835, 1116, 116, 1209, 1210), if a user updates one of the fees, the new calculations to select or clear the Lender Obligated checkbox are triggered only for the updated fee. The remaining lines will not be affected.

When calculating the total of the Lender Credits (Lender-Paid Fees) (field ID LENPCC) for an existing loan using Itemized Credits in the Total Credits section of the 1003 URLA-Lender, Encompass excludes any fees that were changed to a Lender Obligated fee after updating to Encompass 23.3, but includes existing fee lines that do not have the Lender Obligated checkbox selected. Encompass users will need to take action to update the fee lines.

CBIZ-53661, CBIZ-52608, CBIZ-53657, CBIZ-53255, CBIZ-53776

(Updated on 9/18/2023)

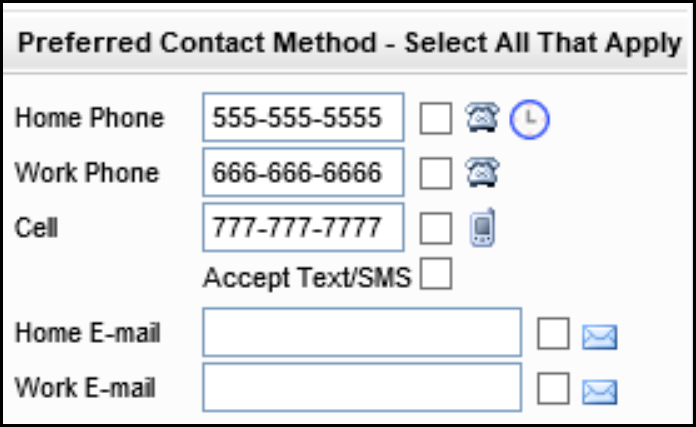

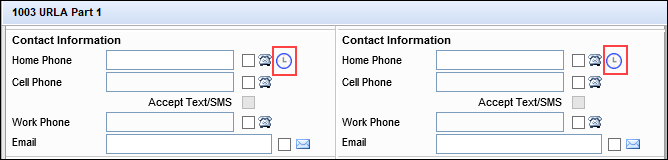

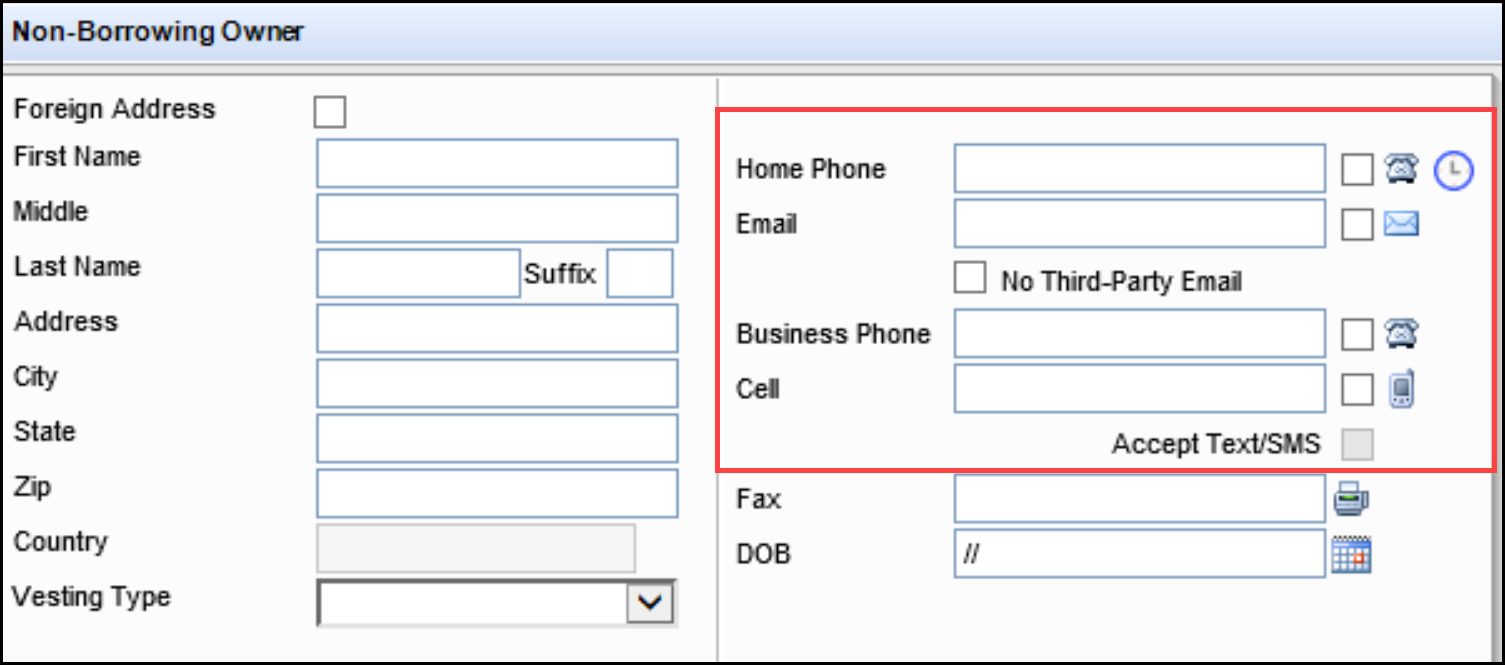

A new Preferred Contact Method section has been added to the Borrower Summary - Origination input form, the 1003 URLA - Page 1 input form, and to the Non-Borrowing Owner entries in the File Contacts tool to enable Encompass user to enter information about the preferred methods for contacting a borrower or co-borrower. (email, phone, text, etc.) along with the best time to reach them. This section contains the following fields for the borrower and co/borrower:

-

Home Phone

-

Work Phone

-

Cell Phone

-

Accept Text/SMS (this field is only enabled when a Cell number has been entered)

-

Home E-mail

-

Work E-mail

-

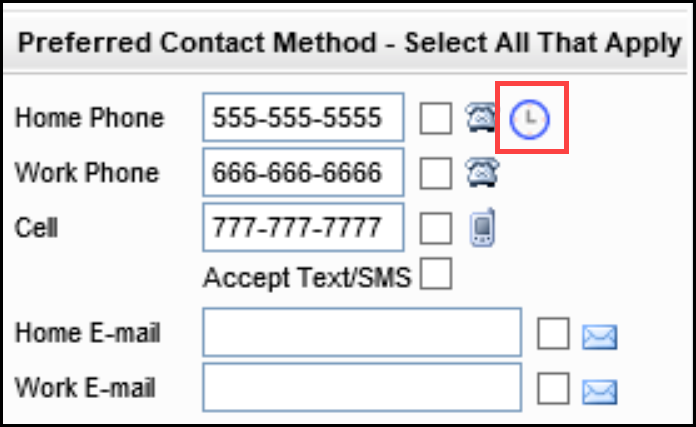

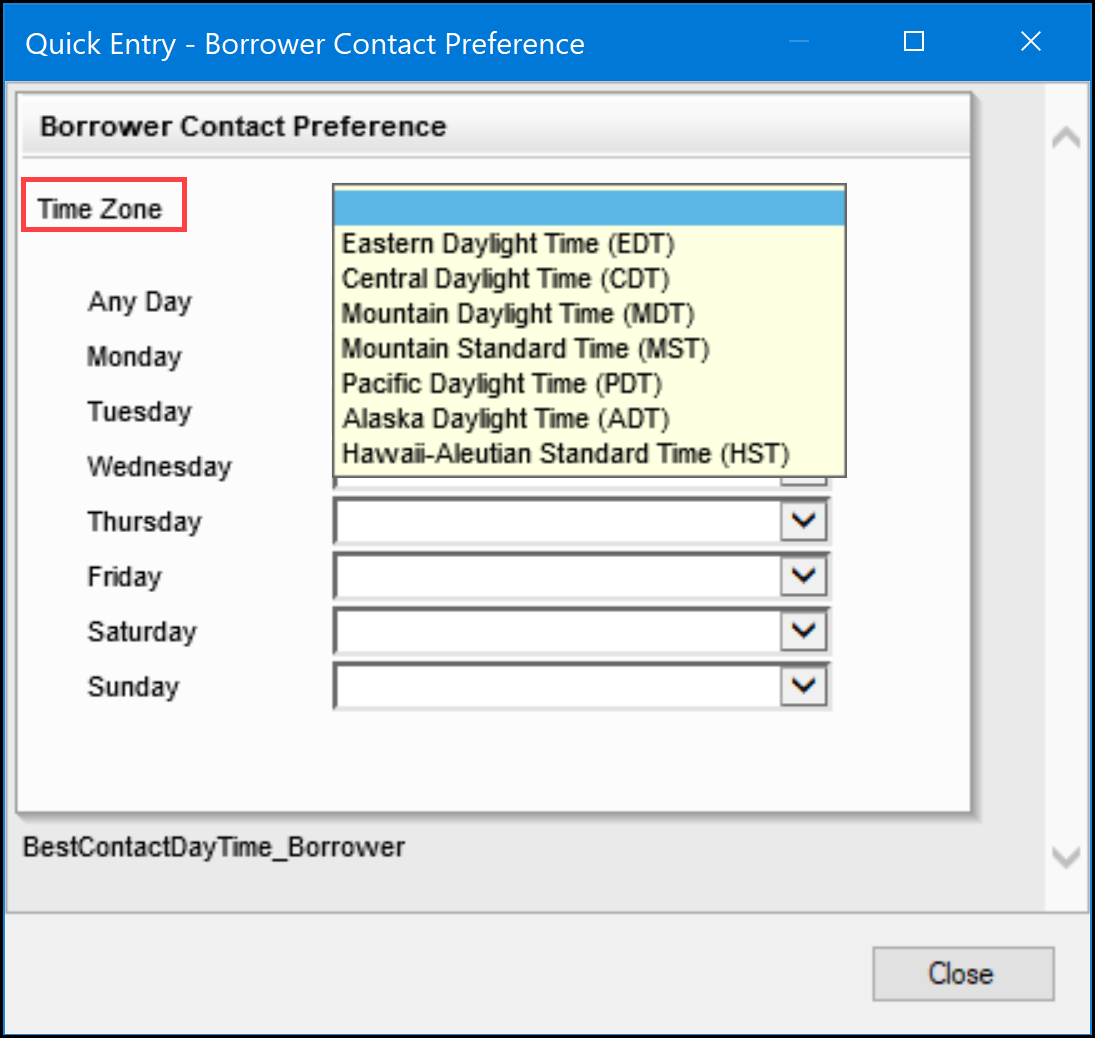

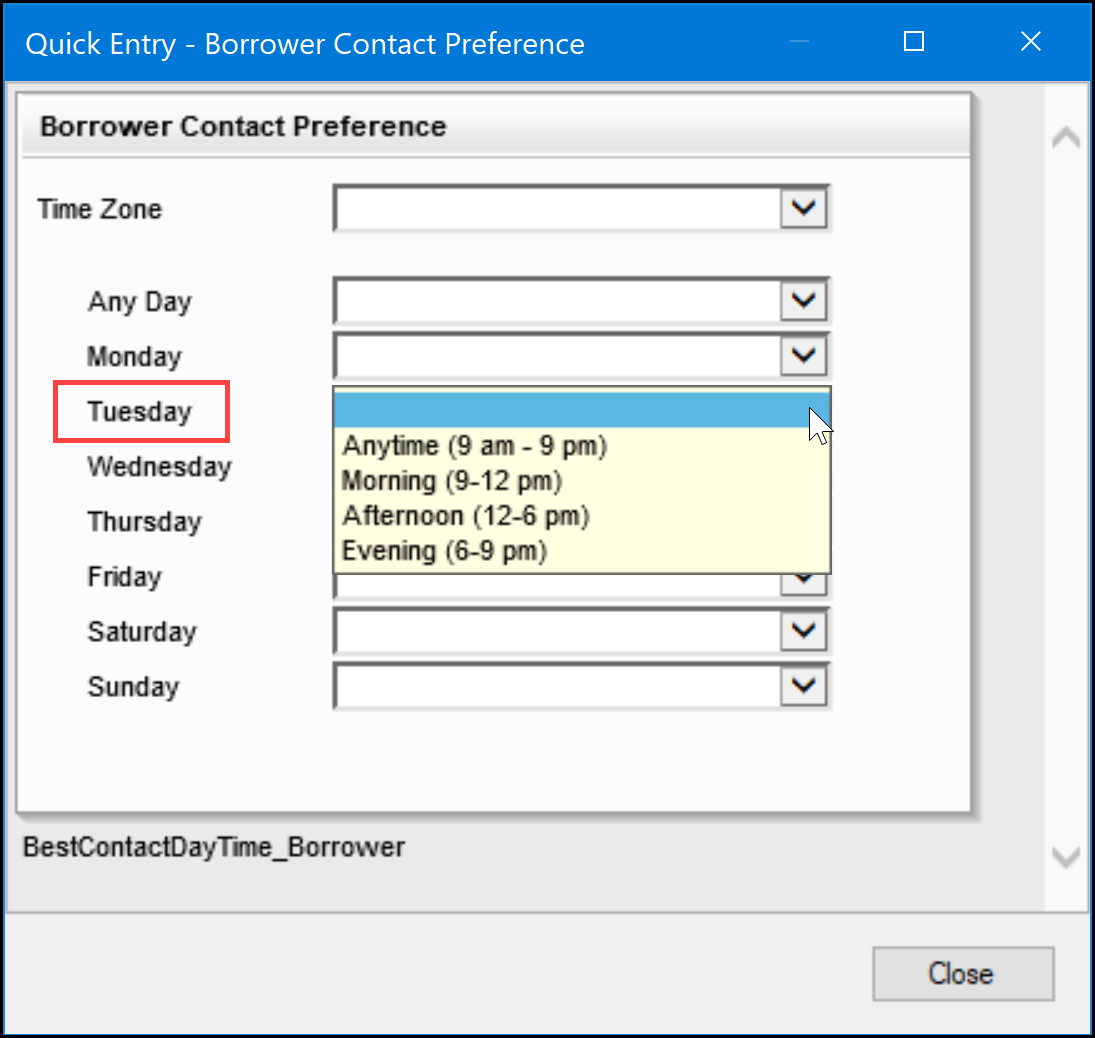

Time Fields - These drop-down lists display in a pop-up window that opens when you click the Preferred Contact icon on the forms.

Users can then select a borrower Time Zone and the preferred day and time for contacting the borrower:

The screen below shows the Preferred Contact icons on the 1003 URLA Part 1 input form.

The image below shows the preferred contact method fields in a non-borrowing owner entry in the File Contacts Tool.

The following logic is used when adding or editing data in the fields:

-

If the data is cleared from a field, the associated checkbox remains selected. The Time Zone/Day/Time information remains, as well as any preferred contact times.

-

The Best Contact Method, Time Zone, Day, and Time are copied to Piggyback Loans.

-

The Accept Text/SMS checkbox is enabled when the Cell Phone number is populated and disabled when the Cell Phone number is not populated.

CBIZ-51202, CBIZ-52429, CBIZ-52430

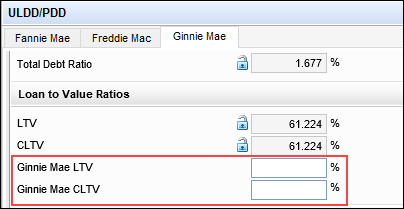

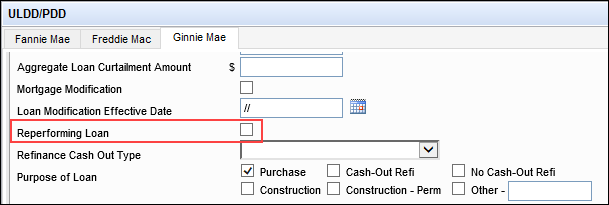

Two new Ginnie Mae-specific fields for LTV and CLTV have been added to the Ginnie Mae tab on the ULDD/PDD form to enable lenders to write their own business rules to calculate these fields according to the logic needed for Ginnie Mae.

-

Ginnie Mae LTV (field ID ULDD.GNM.GinnieMaeLtv)

-

Ginnie Mae CLTV (field ID ULDD.GNM.GinnieMaeCltv)

In addition, a new Reperforming Loan checkbox (field ID ULDD.X199) has been added to the Ginnie Mae tab per Ginnie Mae’s guidelines.

Refer to APM 23-03: Revised Requirements for Re-Performing Loans (2/1/2023) on Ginnie Mae’s website for more information on Re-Performing Loans.

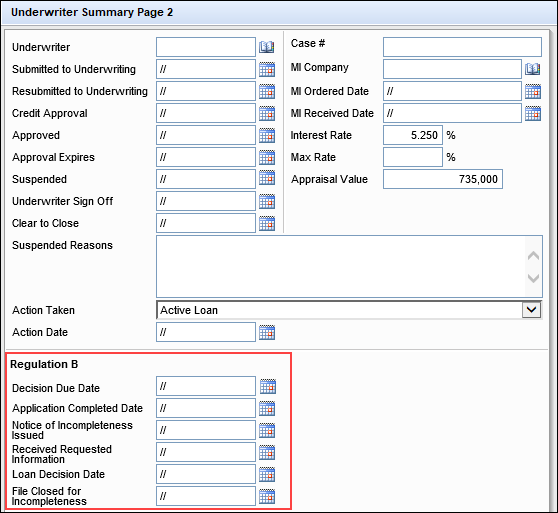

When a lender receives a loan application, they have 30 days to accept the application. This deadline is the Regulation B Date. If there is missing documentation or the process is put on hold, the timeline pauses. When all documentation is received, the timeline resumes. To enable users to document any changes to the timeline, a new Regulation B section has been added to the Underwriter Summary Page 2 input tool. This section includes the following new free-entry date fields, which users can manually edit:

-

Decision Due Date (field ID 4984)

-

Application Completed Date (field ID 4948)

-

Notice of Incompleteness Issued (field ID 4949)

-

Received Requested Information (field ID 4950)

-

Loan Decision Date (field ID 4951)

-

File Closed for Incompleteness (field ID 4952)

CBIZ-51206, CBIZ-54171

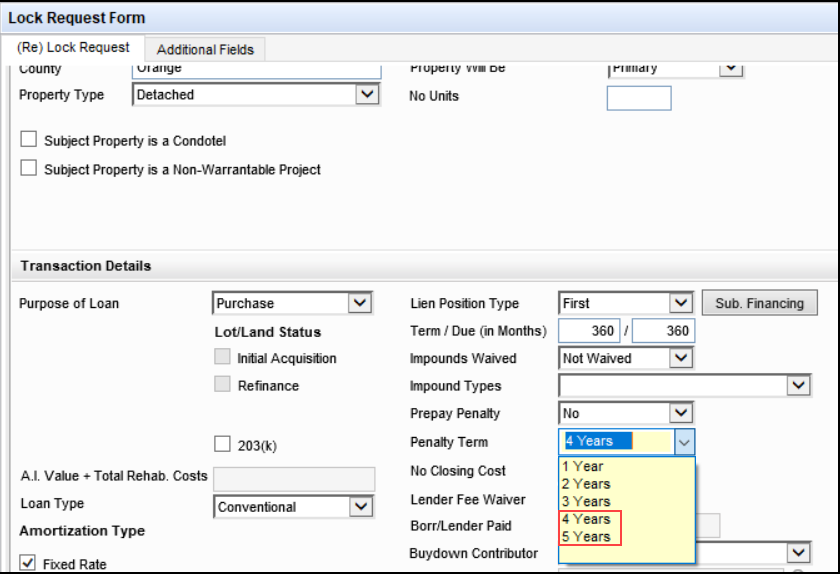

New 4 Years and 5 Years enumerations can be entered in the Penalty Term (field ID 2964) field on the Lock Request Form, and can be selected in the Penalty Term (field ID 2217) on the Secondary Registration tool.

These new enumerations must be supported by the Product & Pricing integration you utilize for the values to be mapped when you launch pricing.

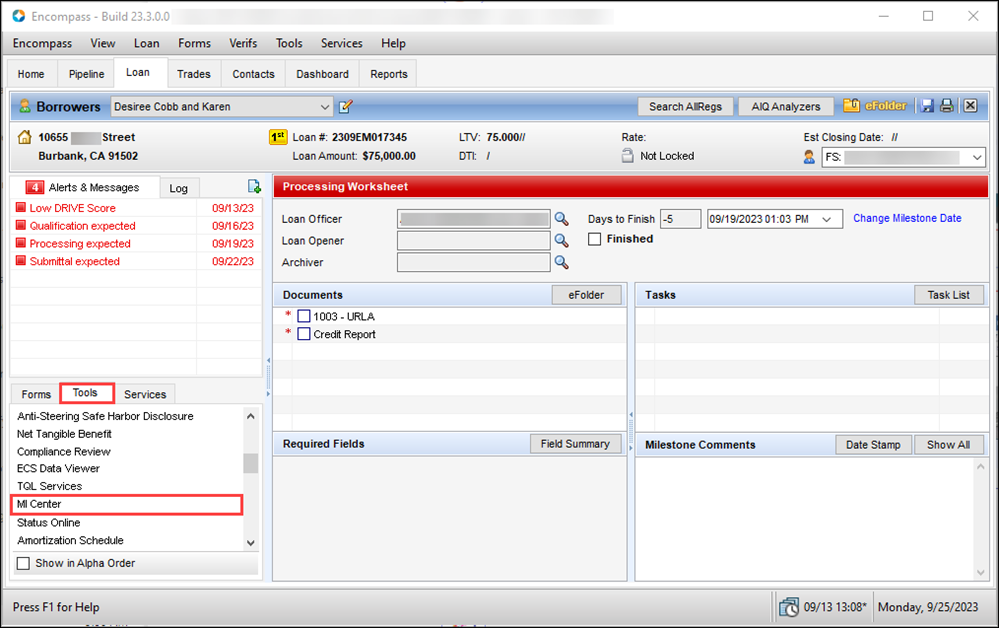

A new MI Center has been added with the Encompass 23.3 Major Release. This integration provides an enhanced integration with all supported MI providers for a more streamlined mortgage insurance ordering process. Use this feature to leverage process improvements, access to more data, and enhanced flexibility.

-

To access the MI Center, go to the Pipeline, open a loan file, click the Tools tab, and then click MI Center.

The new Encompass Partner Connect (EPC) MI integrations will be available in the MI Center in a future release. The MI Center is not intended for use until those integrations are available.

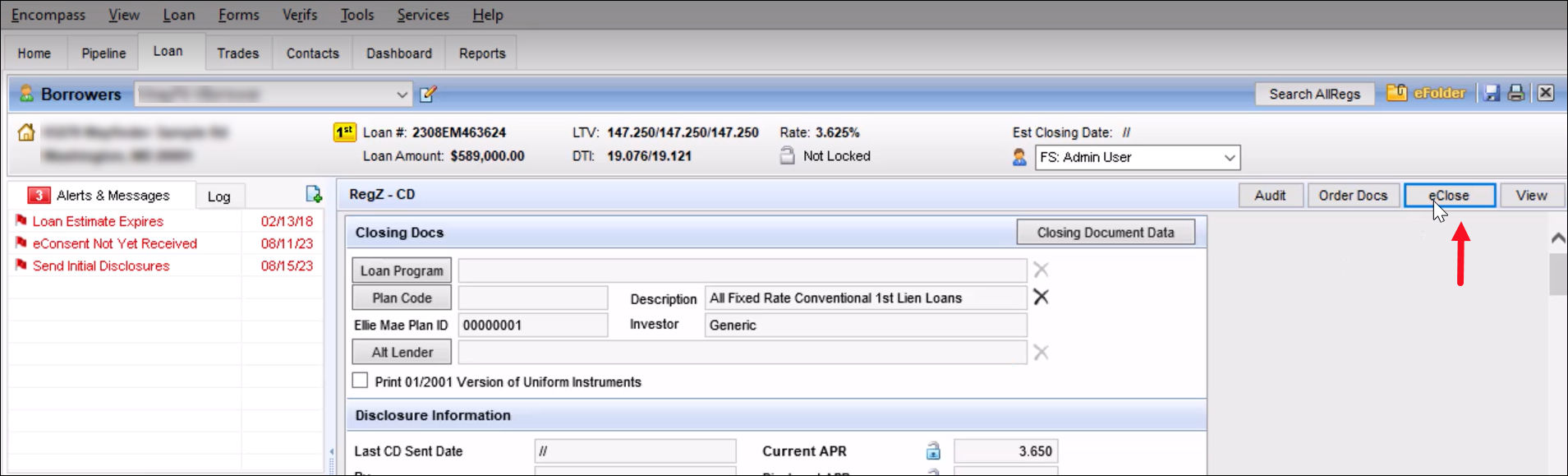

Encompass eClose

Encompass eClose now supports Partner document delivery. For lenders who have integrated and enabled document management vendors with their Encompass instance, they can send closing documents to recipients through the vendor instead of the default Encompass Docs Solution that is used with Encompass eClose.

Prerequisites:

There are no changes required to the eClose setup to send closing documents to Partners. However, the document vendor integration must be configured and enabled in Encompass Partner Connect. Refer to the Partner Documents Delivery topic in the Encompass Partner Connect Developer Hub for more information about completing this integration.

Sending Closing Documents to Partners

Once you have completed the prerequisites, follow these steps to send closing documents to integrated Partners.

To Send Closing Documents to a Partner:

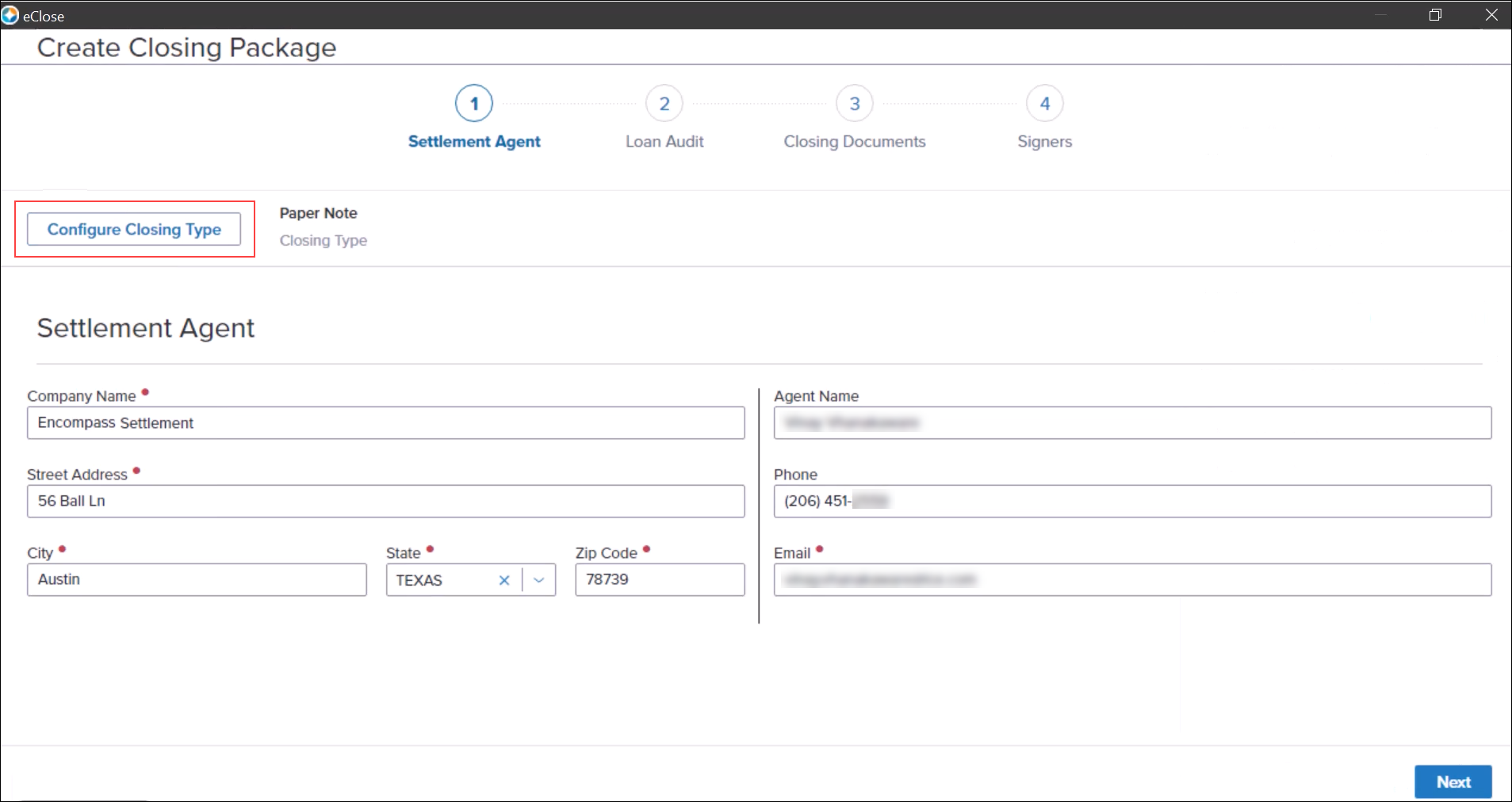

-

Open the loan file, and then click the eClose button.

-

On the Create Closing Package screen, click the Configure Closing Type button.

-

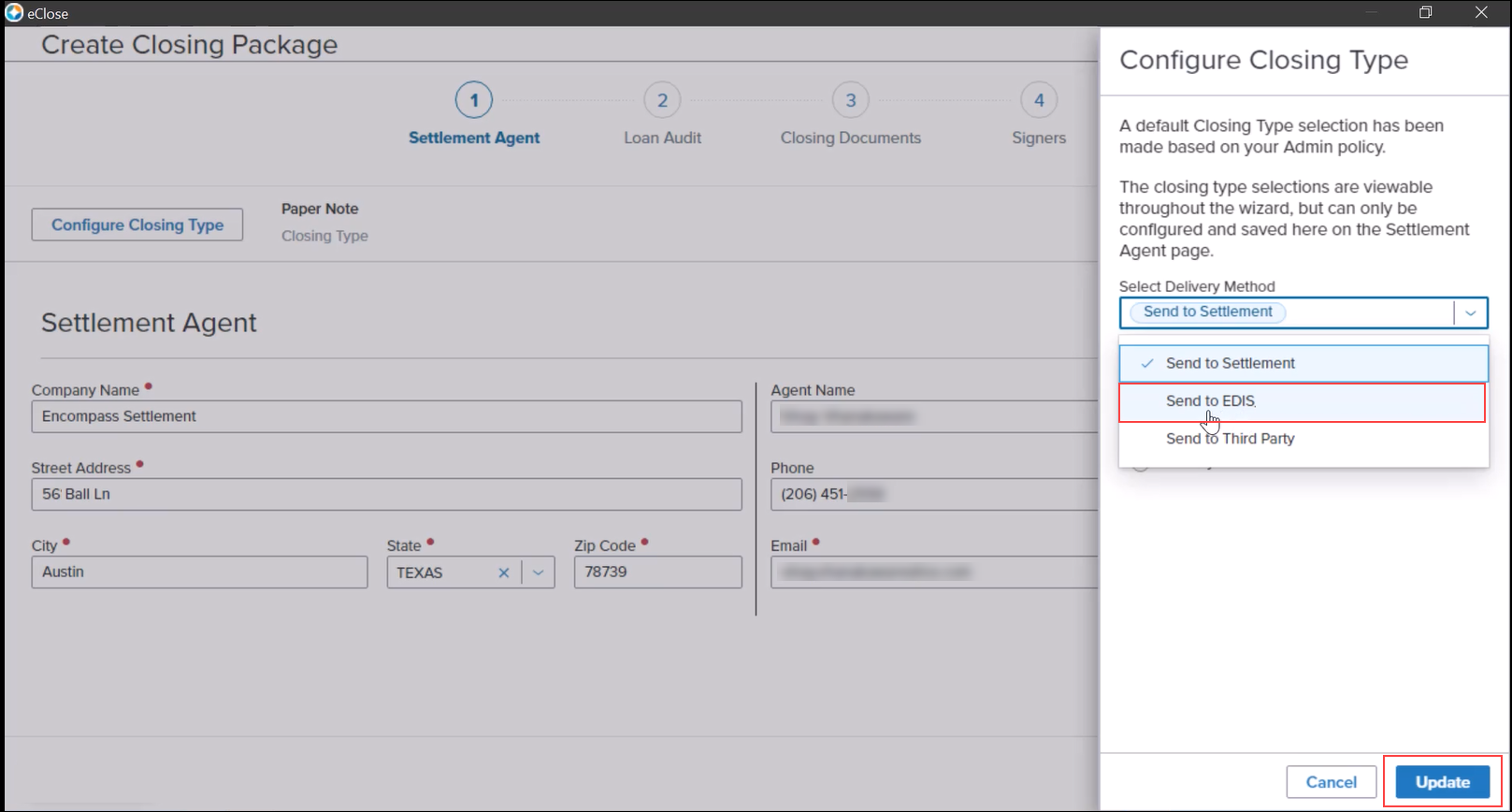

The Configure Closing Type slide-out panel displays. Here you can select the delivery method for the closing documents.

-

Select the integrated Partner that will send the closing documents to the borrowers or other recipients from the Select Delivery Method drop-down list, and then click the Update button.

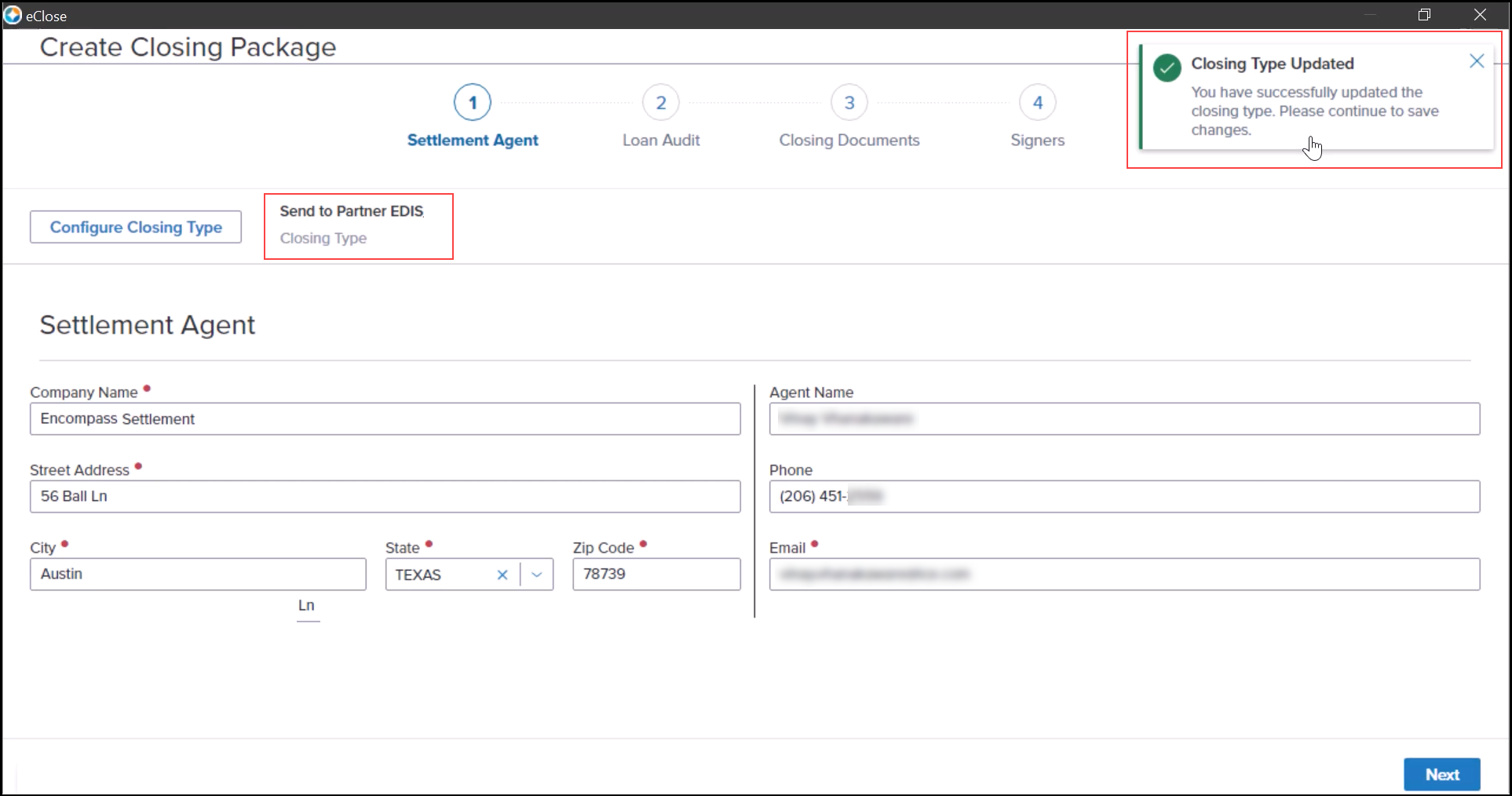

-

-

Review the confirmation message and the Partner now indicated for the closing type, and then click Next.

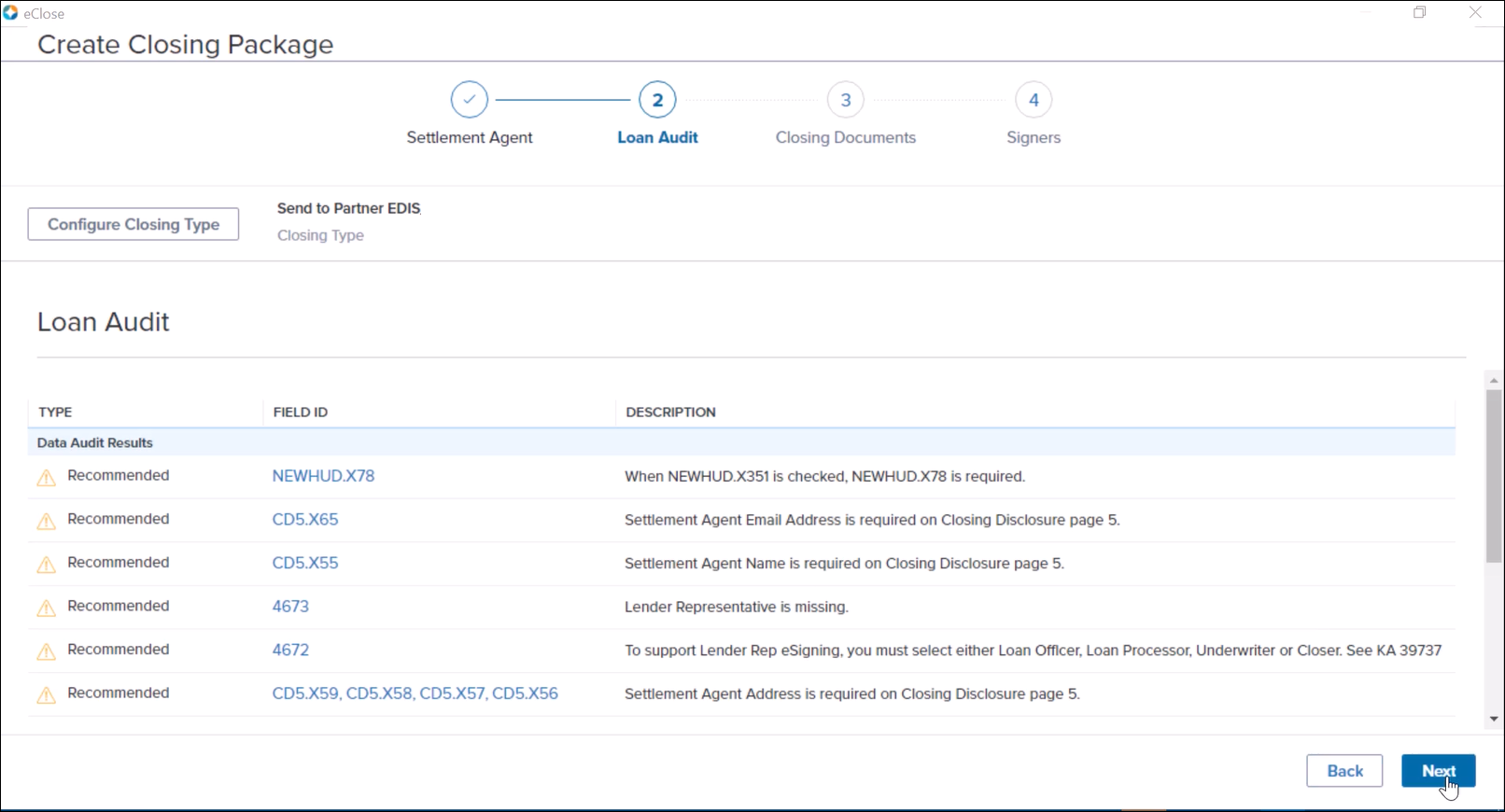

-

A loan audit is performed, and the results display on the Loan Audit screen. Before sending the closing package to the Partner, you must resolve any Required audit issues that display as red text. Review the Loan Audit screen, and then click Next.

-

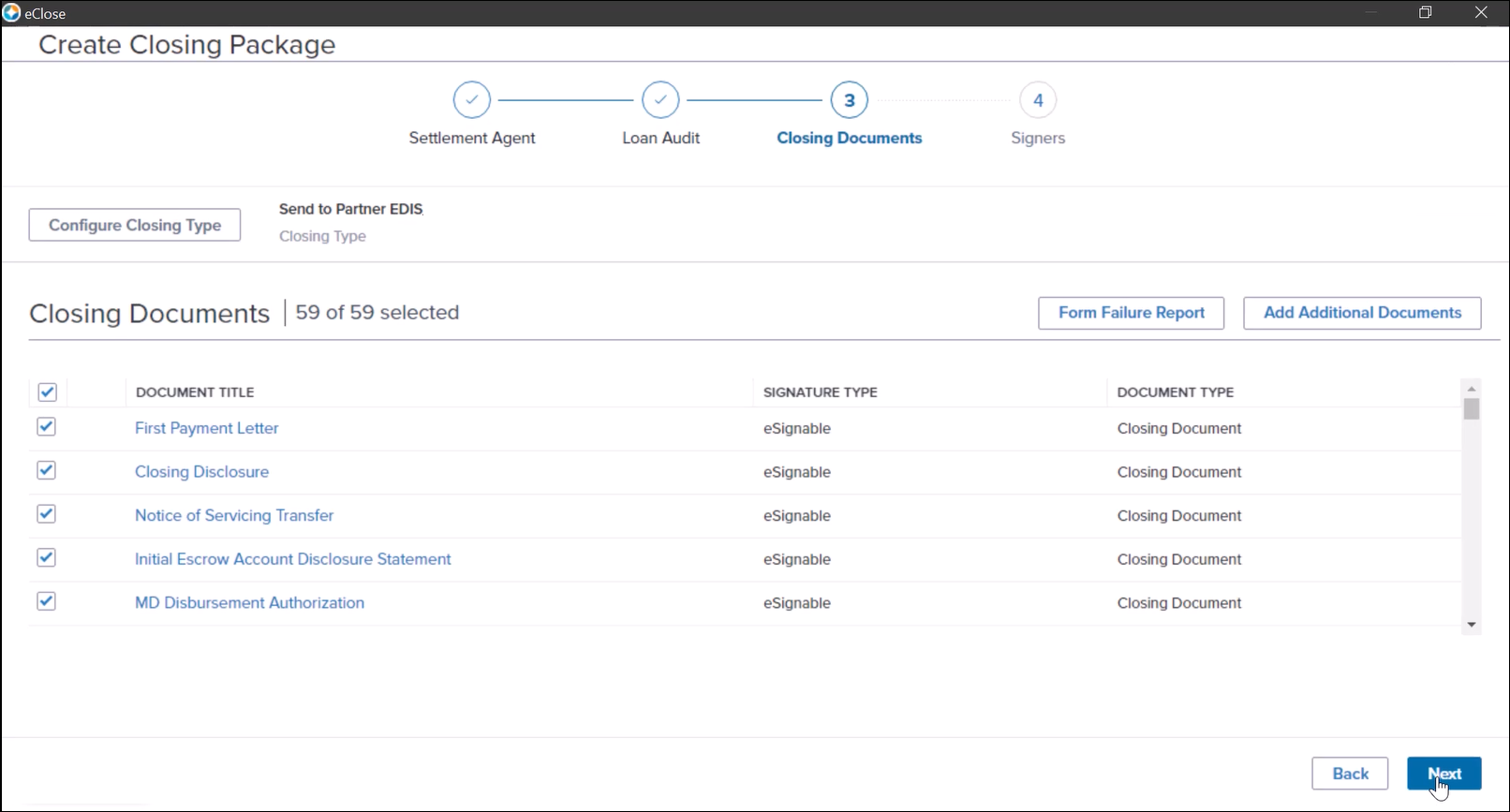

On the Closing Documents screen, select the docs to send, and then click Next.

-

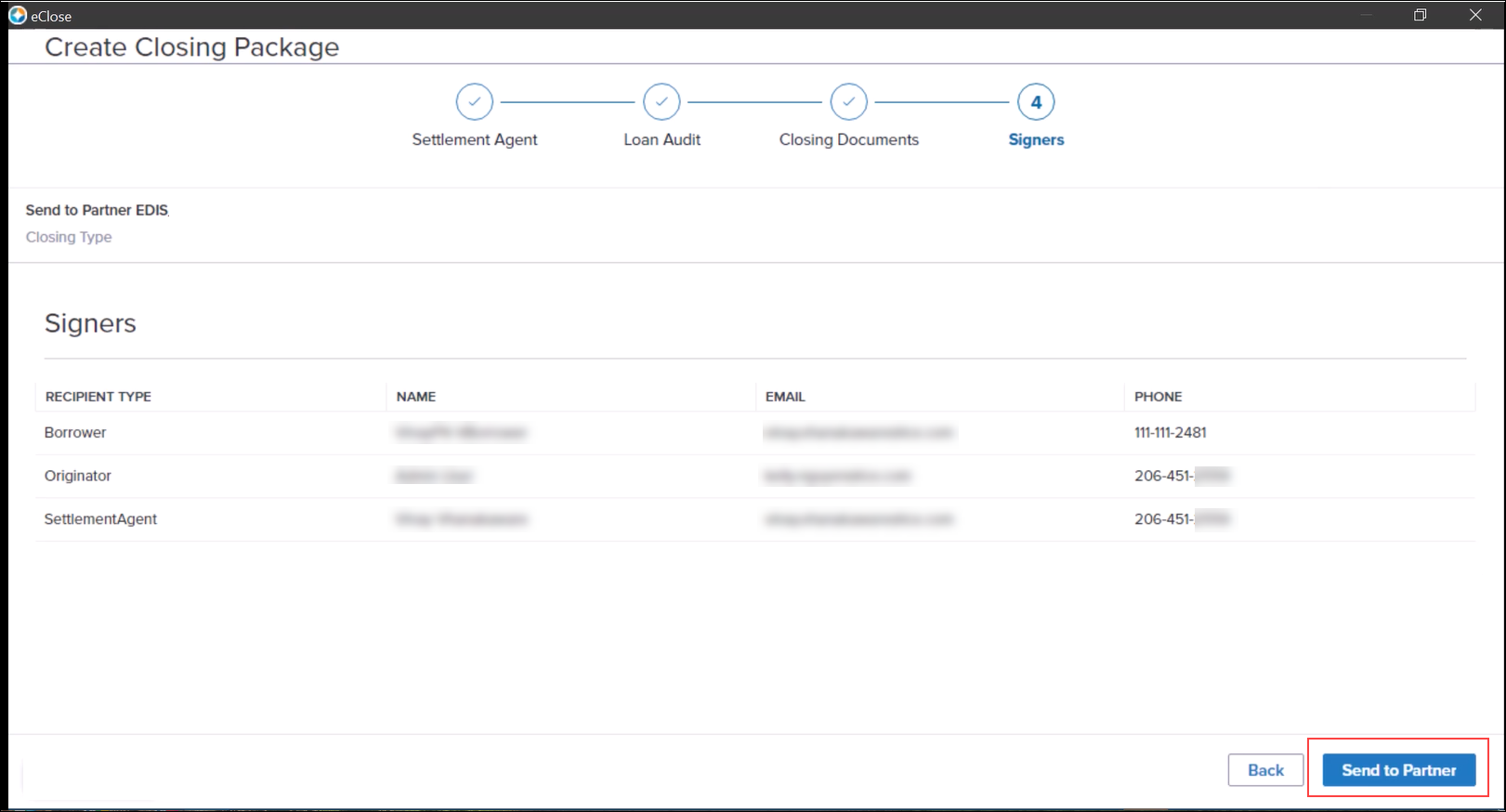

On the Signers screen, verify the individual document signers’ contact information, and then click Send to Partner.

-

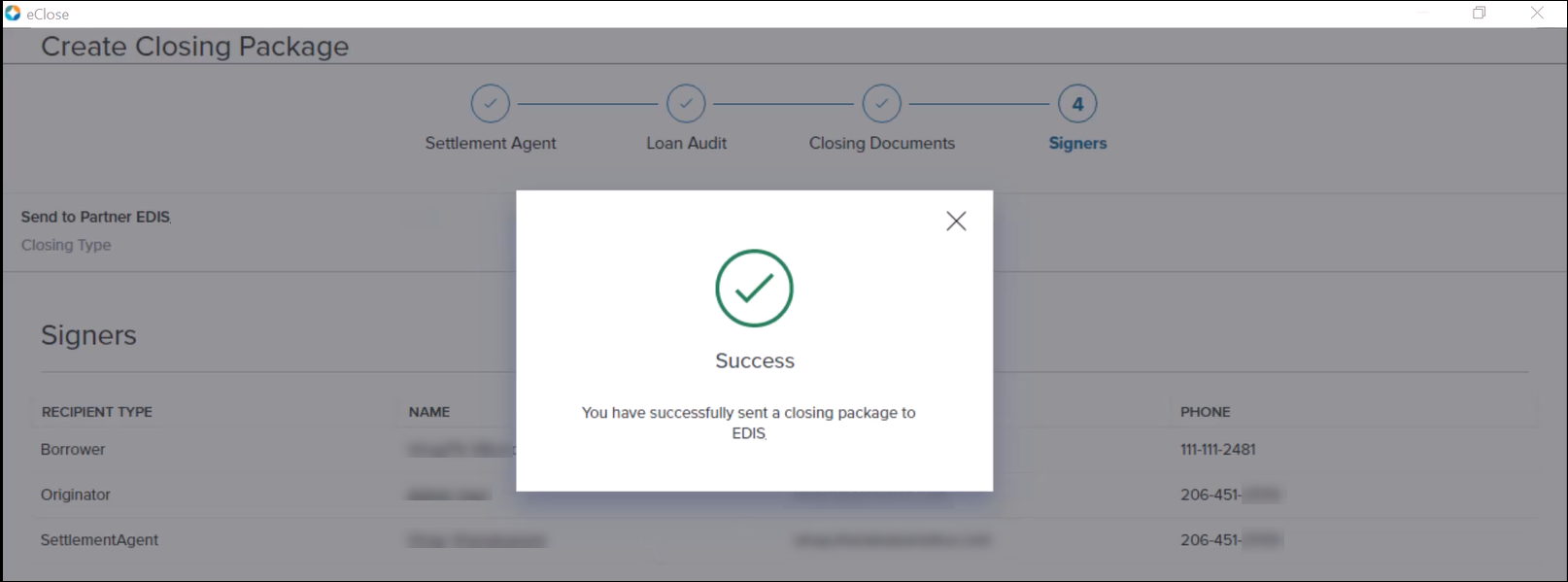

Review, and then close, the confirmation message.

To Redraw Documents:

If a redraw of documents sent to a Partner is required, the Encompass user is presented with a redraw option.

Please note, after sending documents to a Partner, you can perform a redraw and change the delivery method back to the default Send to Settlement option if needed.

Partial package redraws are not supported. You cannot send only the modified documents. You must send the full closing package. Any redraw must be a full closing package replacement.

-

From the Signers screen, click Send to Partner.

-

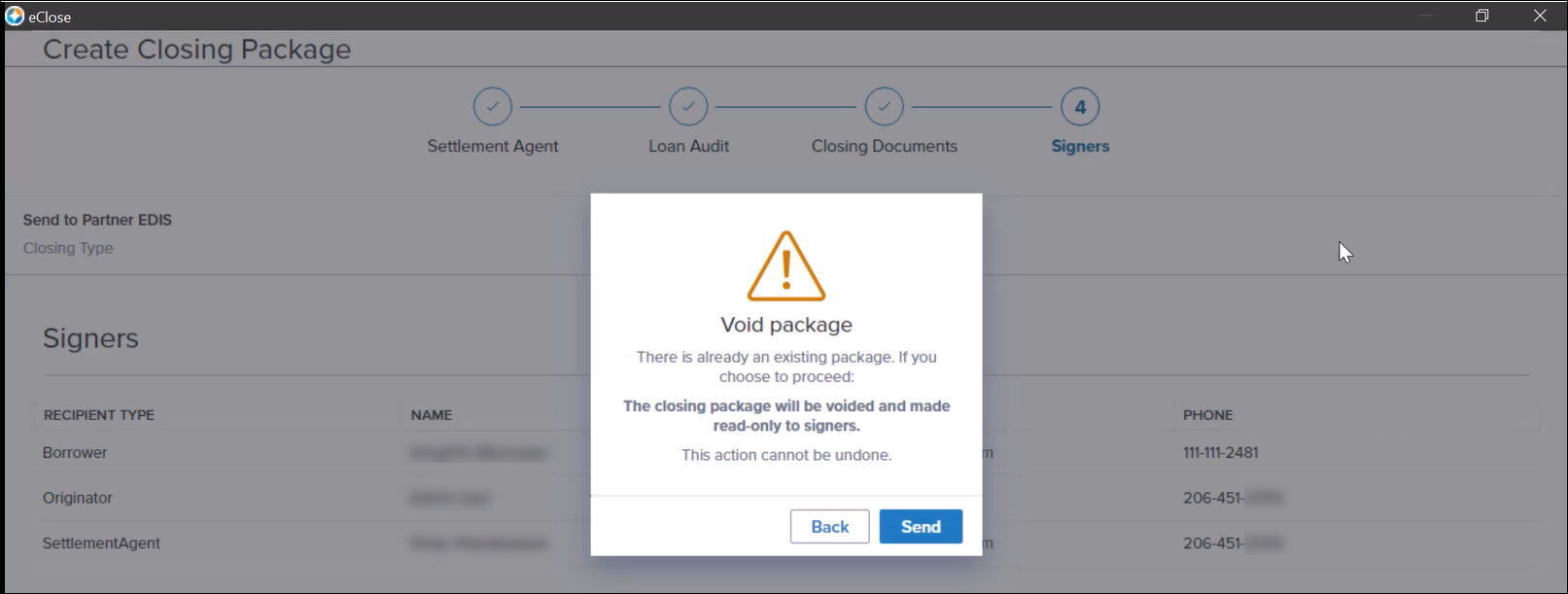

Since this same document package has already been sent to the Partner, a Void package alert is displayed. If you choose to proceed, the previous closing package will be voided and made read-only to signers.

-

Click the Back button to return to the Signers screen, OR

-

Click Send to proceed with voiding the previous document package and sending this new document package.

-

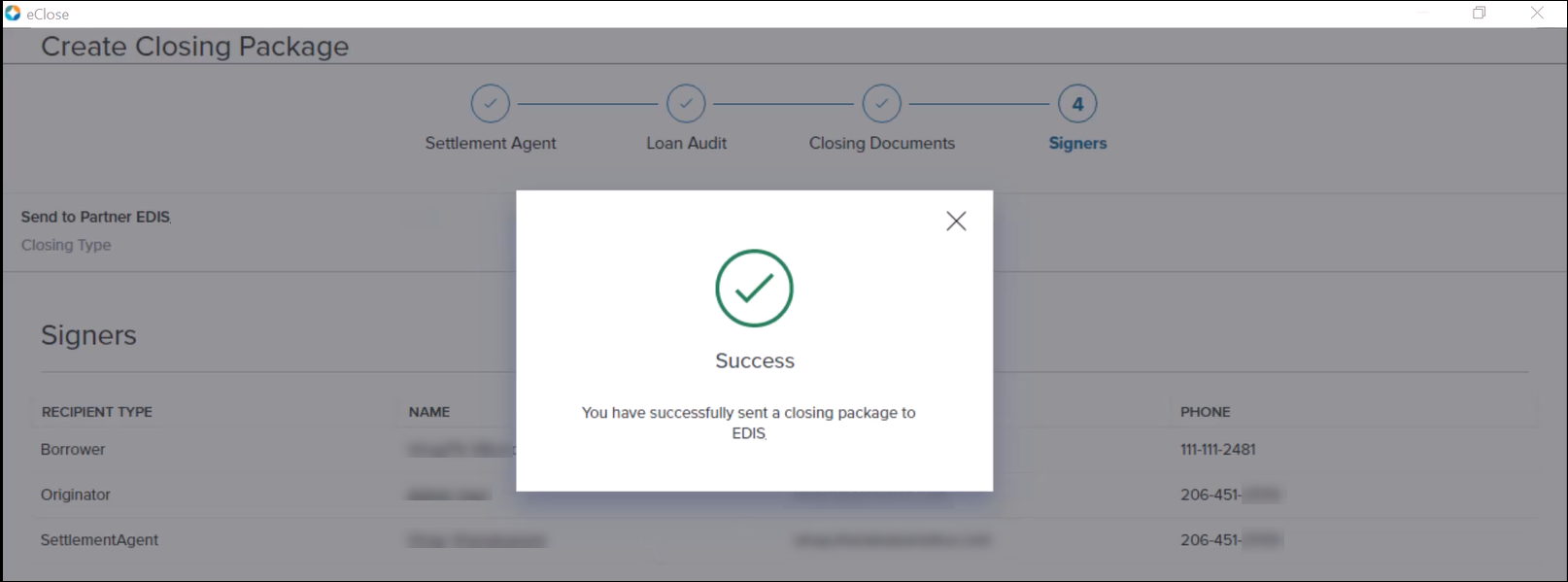

-

Review and then close the confirmation message.

Disclosure Tracking

Once the closing documents are signed through the Partner solution, the closing documents are returned to Encompass. The closing workflow remains the same as in previous versions of Encompass eClose that used the Hybrid option.

Please note, a Disclosure History entry in the Disclosure Tracking tool is generated only after the recipient has acknowledged and returned the requested documents. With the Hybrid eClose workflow, Disclosure History entries are generated when the closing documents are sent, redrawn, and returned.

New Fields for Partner ID and Partner Name

When an Encompass eClose user selects a Partner to send the closing documents, their selection needs to be saved to the loan file so that the partner information can be displayed throughout the eClose workflow. Two new fields have been added to Encompass to capture this information:

-

Partner ID (field ID 4982)

-

Partner Name (field ID 4983)

These fields are reportable, however they are not provided on Encompass input forms or tools.

DOCP-48627

Trade Management

New APIs have been created for loan trades and MBS pools.

-

Get Trade Details - This API gets the trade data to enable an investor to view the details of a loan trade or MBS pool.

-

Get Trade History - This API gets the trade data to enable an investor to view the event history of a loan trade or MBS pool.

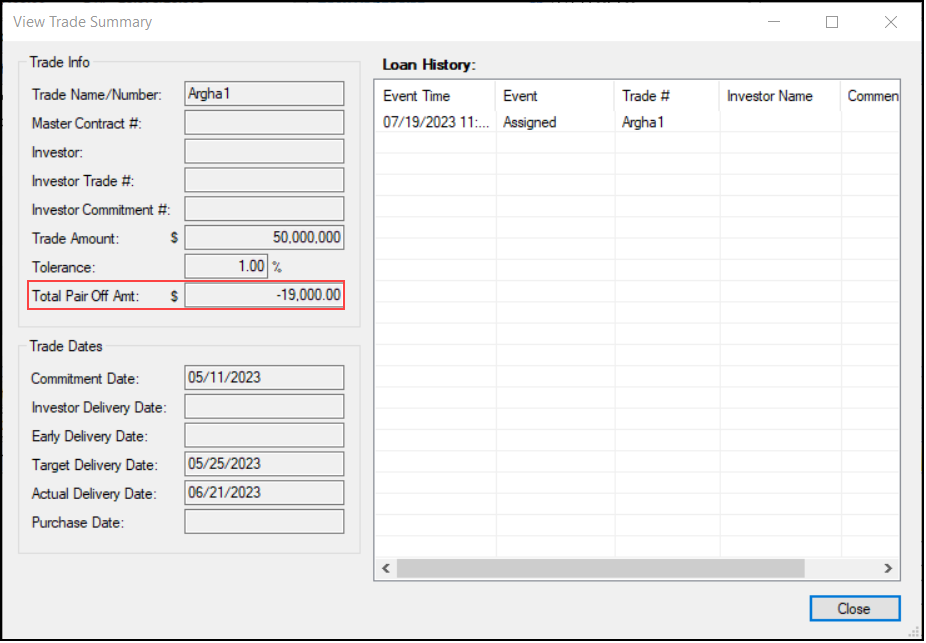

Currently in Encompass, the Total Pair Off Amt field on the View Trade Summary pop up window (select View Trade Summary button on the Current Lock tab of the Secondary Registration tool) is always blank because it is not mapped to another field.

As part of this release, the following changes have been made to that field:

-

The symbol before the text box has been changed from a % to a $.

-

The field has been mapped to the Total Pair Off Amt field on the loan trade’s Details tab.

-

The Get Trade Summary API returns the Total Pair Off Amount instead of the Pair Off Fee.

Additional Updates

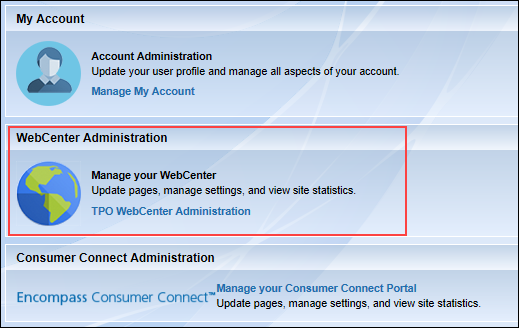

In the WebCenter Administration module on the Encompass Home page, the WebCenter Administration link is no longer available. Previously, users could click this link to be taken to their Encompass WebCenter Administration page to manage their websites. The Encompass WebCenter will be fully sunsetting on October 7, 2023, making this link irrelevant.

Just like in previous versions of Encompass, authorized users can still click the TPO WebCenter Administration link in this module to be taken to the Encompass TPO Connect Administration page to manage their TPO Connect sites.

NICE-43926

The https://archive.elliemae.com web site, known as the EDM Archive, will be decommissioned in Encompass 24.1. This is the site where users could retrieve older, archived eFolder documents. Once decommissioned, this site will no longer be available to users and they will not be able to access archived documents there. Encompass stores and retains all eFolder documents. The documents can be accessed by opening them in the eFolder itself rather than visiting the EDM Archive web site.

Some users experienced extreme latency in Encompass when creating new loans from the Pipeline when Loan Template Sets containing a large number of documents (200+) were used and Enhanced Conditions were enabled. Updates to address this latency issue were made and the resulting time to create a new loan under these conditions has been substantially improved.

Workaround Information:

The following workaround was provided and is no longer required for Encompass 23.3 and later:

-

Users can create a loan file with the Document Set not linked or disable the Enhanced Conditions setting via Settings Manager in Admin Tools.

Encompass Settings

A new Conventional County Loan Limits screen is now provided in Encompass Settings to enable administrators to view and manage the conventional loan limits that are available from the FHFA website. This setting is located in Encompass Settings > Tables and Fees > Conventional County Limits.

Conventional county limits are the maximum loan amounts allowed based on the number of units in a property. The FHFA regularly updates county limit data, so a mechanism is provided for quickly synchronizing the table over the Internet.

Review the Conventional County Limits help topic for instructions for managing this setting.

CBIZ-52881

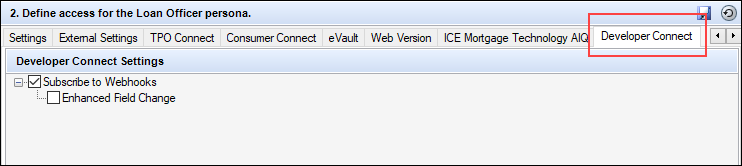

In the Encompass Settings > Company/User Setup > Personas setting, a new Developer Connect tab is now available. Use the options provided on this tab to manage user permissions for subscribing to webhooks and the Enhanced Field Change webhook.

About the Field Change Webhook

There are many use cases for needing a detailed audit trail of data changes on the loan, including but not limited to audit of intentional (and unintentional) data changes by users that may have led to saleability or other issues on the loan. Additionally, the audit of data changes provides the ability for loan team members to react specifically to changed data to trigger automation in near real time. For example, changes in the loan amount from Conforming to Jumbo or any other material change that may impact loan manufacturing and the sale are candidates for this type of automation. The Enhanced Field Change webhook provides the details of all changed data (from and to) in the loan, however, because webhooks are delivered to platforms outside of Encompass, the actual data delivered in the subscription cannot be filtered.

Use this Personas option to limit access to the data to only select users and partners who have a true business need to access the detailed change data. Since the Enhanced Field Change webhook may include Personally Identifiable Information (PII) if it changes during the course of processing a loan, this Personas option also enables administrators to control which of their users and partners should have access to the data available in the webhook.

-

Subscribe to Webhooks enables users to create, update, and delete any webhook subscription.

-

Enhanced Field Change enables users to create, update, and delete Enhanced Field Change webhook; Personas with access to Enhanced Field Change are automatically enabled to Subscribe to Webhooks as well.

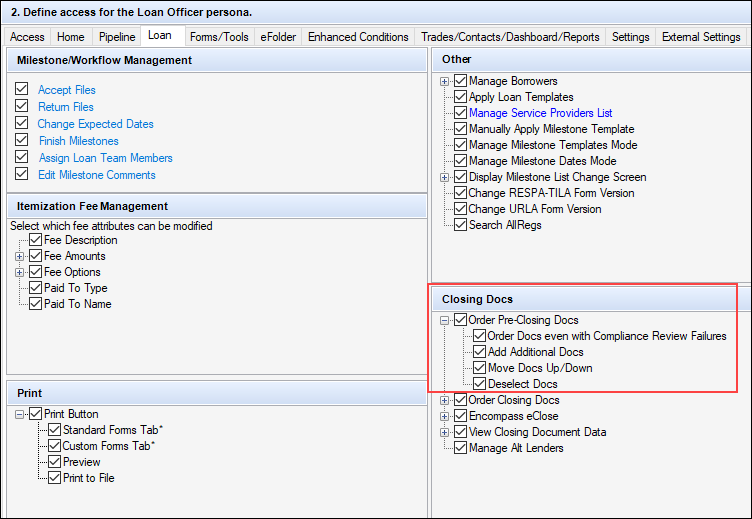

In the Encompass Settings > Company/User Setup > Personas setting, new Order Pre-Closing Docs options are available on the Loan tab. Use the options to select tasks that can be carried out during the loan’s pre-Closing process, including permissions to order pre-closing documents, order pre-closing documents even if the Audit Review includes Fail alerts, add or remove documents within the document package, and rearranging pre-closing document stacking orders.

These new Personas options are intended for use with the new Pre-Closing feature that will be introduced in a future web version of Encompass release.

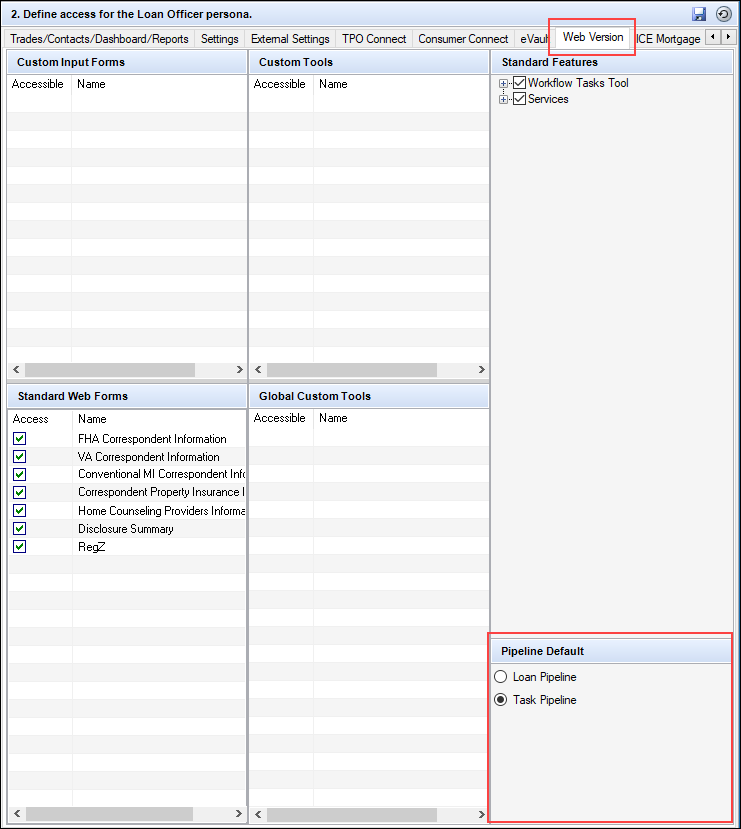

In the Encompass Settings > Company/User Setup > Personas setting, new Pipeline Default options are available on the Web Version tab. Use the options to manage the version of the Pipeline, Loan Pipeline or Task Pipeline, that will display when the user logs into the web version of Encompass. By default, this option is set to Loan Pipeline.

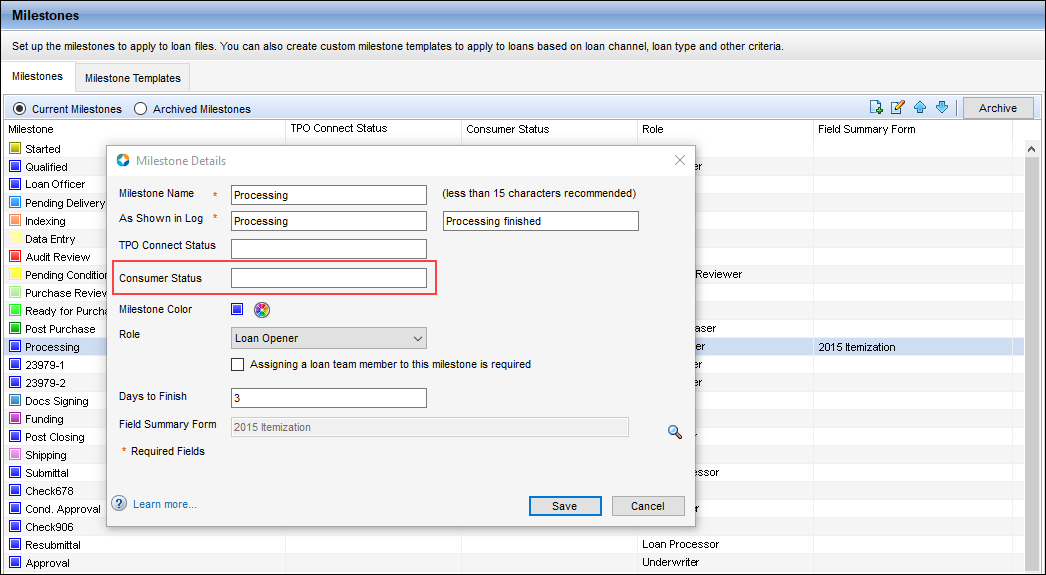

A new Consumer Status field is now available on the Milestone Details screen used to set up milestone properties. In the Consumer Status field, type a custom Encompass Consumer Connect status to be assigned to the milestone. When a Consumer Connect status is populated in the Milestone settings, that value will display in the Status column on the Consumer Connect loan pipeline when the matching milestone is current. If the Consumer Status field is not populated, the Status column of the Consumer Connect loan pipeline will be blank for that milestone.

Note that this Consumer Status field is intended for use with the configurable progress timeline that will be introduced in the borrower portal in a future Encompass Consumer Connect release.

When utilizing this field, consider the following:

-

Assign a consumer facing friendly name to any milestone within your milestone settings.

-

When the milestone template associated with the loan contains a consumer facing status, these statuses will be displayed to the borrower in the borrower portal.

-

Past and future statuses will display in chronological order with a focus on the current status.

-

If multiple milestones have the same consumer facing status, Encompass Consumer Connect sites will consolidate and display as a single status.

-

For example, let's say the File Started, Qualified, and Processing milestones all have the consumer status of In process. If all the milestones are in the same milestone template that is applied to the loan, then a single status of In process will display in the borrower portal.

-

The following strings have been added to the Encompass Reporting Database to support this new Milestones settings field:

-

Log.MS.CurrentConsumerStatus - "Current Consumer Status"

-

Log.MS.ConsumerStatus - "Milestone Consumer Status"

The Encompass ZIP Code database has been updated with the latest available ZIP Code data.

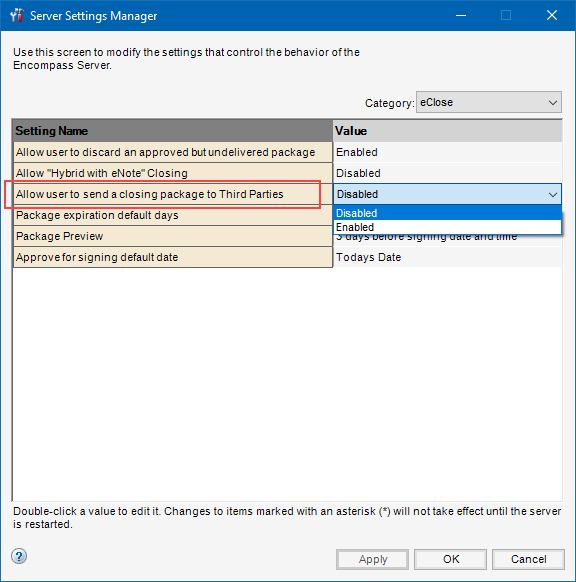

A new option to enable users utilizing Encompass eClose to send closing documents to third parties has been added to the Settings Manager in Encompass Admin Tools. This option enables Encompass eClose to support Encompass Loan Connect. Your business partners such as realtors, appraisers, attorneys, and other non-Encompass third party users can contribute to a loan file using Encompass Loan Connect. Instead of mailing or faxing document packages to your business partners, you can store electronic copies of the documents on Loan Connect where your contacts can access them. For more information, refer to the Lender's Guide to Encompass Loan Connect for Business Partners.

It is important to note that while this new Settings Manager option is provided in Encompass 23.3, it is not intended for use at this time. The corresponding updates required for Loan Connect are targeted for a future release. Until then, this option will not be applied or impactful.

To Enable Sending Closing Documents to Third Parties:

-

On your Windows task bar, click the Start menu or Start icon, navigate to the Ellie Mae Encompass program folder, and then click Admin Tools.

-

Double-click Settings Manager.

-

Select eClose from the Category list.

-

Double-click the Allow user to send a closing package to Third Parties option, and then select Enabled.

-

When finished, click Apply or OK.

Loan team members may need to log out of Encompass and then log back in if the administrator makes changes to this Admin Tools setting when the user already has the eClose page open in their instance of Encompass.

NICE-44318

| Next Section: Fixed Issues |

|

|

|

Previous Section: Introduction |