Fixed Issues for Version 23.1 (Banker Edition)

This section describes the issues that have been fixed in this release.

Why we fixed these issues: These issues were fixed to improve usability and to help ensure Encompass is operating as expected. The issues that are chosen to be fixed are based on the severity of their impact to clients and client feedback.

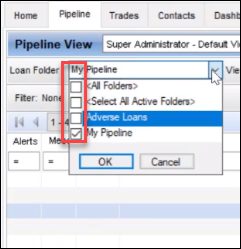

Encompass Pipeline

An issue occurred when users opened the Loan Folder drop-down list from the Pipeline, and then selected a folder from the list. After selecting a check box for a loan folder, the last software application the user was working with would open in front of Encompass, resulting in the user having to close or minimize the other application before proceeding with Encompass. This issue has been resolved.

NICE-31595

Encompass Forms and Tools

An issue was resolved that caused the Does Not Apply check boxes to be disabled for editing (grayed out) on the Current/ Self Employment and Income section on the 1003 URLA Part 2 input form in the following scenario:

-

The Does Not Apply check box (field ID URLA.X199) was selected.

-

On the VOE input form, two new entries were created for the borrower with Current selected from the Employment is drop-down list (field ID BE0109) and details entered in the VOE fields.

-

On the 1003 URLA Part 2 input form, the VOE Quick entry pop-up window was opened and one of the Current entries was changed to Prior.

In the scenario described above, the Does Not Apply check box on the Current/ Self Employment and Income section on the 1003 URLA Part 2 input form would be disabled, but the check box would remain selected and Encompass users would be unable to clear the check box on the 1003 URLA - Part 2.

This issue has been resolved and the employment check boxes are now cleared and disabled for editing under the scenario described above.

CBIZ-43133

The following issues have been resolved when using the Tab key to move from one field to another on the Quick Entry - VOE pop-up window:

-

Tabbing from the Date Hired field (field ID BE0151) now correctly takes the user to the Date Terminated field (field ID BE0114). Previously, tabbing from the Date Hired field would incorrectly take the user to the Seasonal Income check box (field ID BE0176).

-

Tabbing from the year field (field ID BE0116) for the Years in Line of Work now takes the user to the month field (field ID BE0152) for the Years in Line of Work. Previously, tabbing from the Year field would incorrectly take the user to the Base pay field (field ID BE0119).

The Quick Entry - VOE pop-up window is accessed by clicking the Show all VOE button on input forms such as the 1003 URLA Part 2.

Workaround Information:

The following workaround was provided for this production issue and is no longer required for Encompass 23.1 and later.

-

Instead of tabbing out of the affected fields, use the mouse to click the next field.

CBIZ-40172

An issue was resolved that caused the Up and Down arrows in the table at the top of the VOR input form to not work under some scenarios when there was more than one entry with a residence type of Current. This issue has been resolved and the Up and Down arrows now work for Current residence entries when there is more than one Current residence listed on the VOR table.

CBIZ-40565

An issue was resolved that caused the Initial TIL Sent Date (field ID 3152) and the Borrower Received Date (field ID 3153) on the Disclosure Tracking Tool to clear when the Property Will Be (field ID 1811) option is changed from Primary to Second in a HELOC loan using the RESPA 2010 GFE and HUD-1 forms. This issue has been resolved and the date fields no longer clear in the scenario described above.

Workaround Information:

The following workarounds were provided for this production issue and is no longer required for Encompass 23.1 and later.

-

On the Disclosure Tracking tool, in the Disclosure History section, open the disclosure tracking entry and then click the Lock icon for the Send Date.

CBIZ-47356

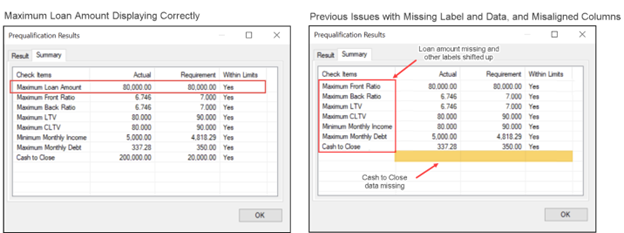

An issue was resolved that affected the pop-up window that opens when you click the Prequalification Results button at the bottom of the Prequalification tool.

On the Summary tab in the pop-up window, the label for the Maximum Loan Amount was missing. The label should have displayed at the top of the list of items in the Check Items column. This resulted in the labels for the remaining entries shifting up in the Check Items column so that they did not align with the entries in the Actual, Requirements, and Within Limits columns. Additionally, the numbers and results for the Cash to Close entry were missing from the bottom of the table. This issue has been resolved. The label for the Maximum Loan Amount now displays correctly at the top of the column, all the labels now align correctly with the entries in the other columns, and the Cash to Close entry displays.

Despite the issues that previously displayed in the pop-up window, the summary numbers were displaying correctly on the output form.

CBIZ-48667

An issue was resolved that cause the # of Days field (field ID 432) to be disabled for editing (grayed out) when a user cleared the Secondary Registration check box (field ID 3941) on a custom input form. This issue has been resolved and the # of Days (field ID 432) is now enabled for editing after clearing the Secondary Registration check box (field ID 3941) on a custom input form.

CBIZ-37557

(Updated on 2/23/2023)

When the Itemize Credits check box (field ID 4796) is selected, Earnest Money amounts are no longer doubled in the calculation that populates the Total Credits (field ID URLA.X152) and Cash from/to borrower (field ID 142).

This issue occurred when the Itemize Credits check box (field ID 4796) was selected in the Total Credits section on the 1003 URLA - Lender input form because earnest money was included in the calculation for M6. Cash Deposit On Sales Contract (Earnest Money) (field ID L128) and M4. Total of Other Assets Applied to Loan (field ID URLA.X151), which caused the earnest money amount to be doubled.

The following updates have been made to address this issue:

-

M6. Cash Deposit On Sales Contract (Earnest Money) now displays the sum of all Verification of Other Assets (VOOA) entries where Earnest Money is selected for the Description (field ID URLAROA0102).

-

M4. Total of Other Assets Applied to Loan no longer includes amounts from Verification of Other Assets (VOOA) entries where Earnest Money is selected for the Description.

-

Lock icons have been added to M6. Cash Deposit On Sales Contract (Earnest Money) and M4. Total of Other Assets Applied to Loan to enable user to adjust the amounts or trigger a recalculation if needed.

Migration

If the Itemize Credits check box was selected in a loan created prior to updating to Encompass 23.1, the updated calculations will not be applied to M6. Cash Deposit On Sales Contract (Earnest Money) and M4. Total of Other Assets Applied to Loan. Users can click the Lock icons or click the Itemize Credits check box to trigger the new calculations.

Please note, this update is provided with the Encompass 23.1 release on March 18, 2023. This update is not provided in Encompass 23.1 test environments. This update will not be available to Encompass 23.1 users until the release on March 18, 2023.

CBIZ-49421

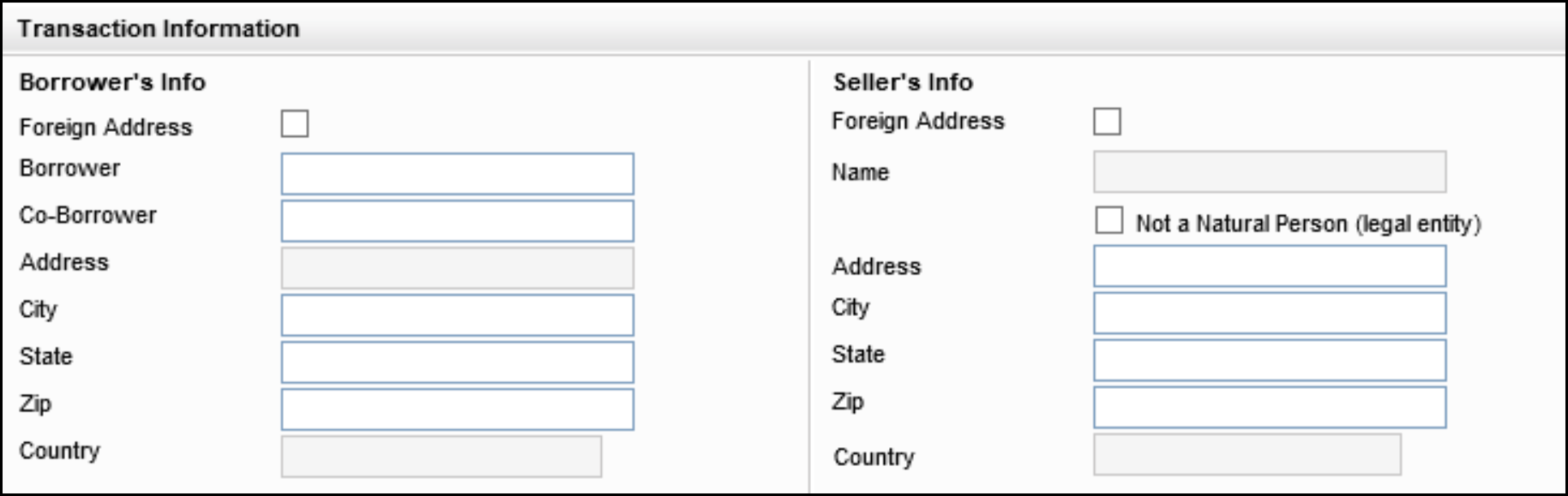

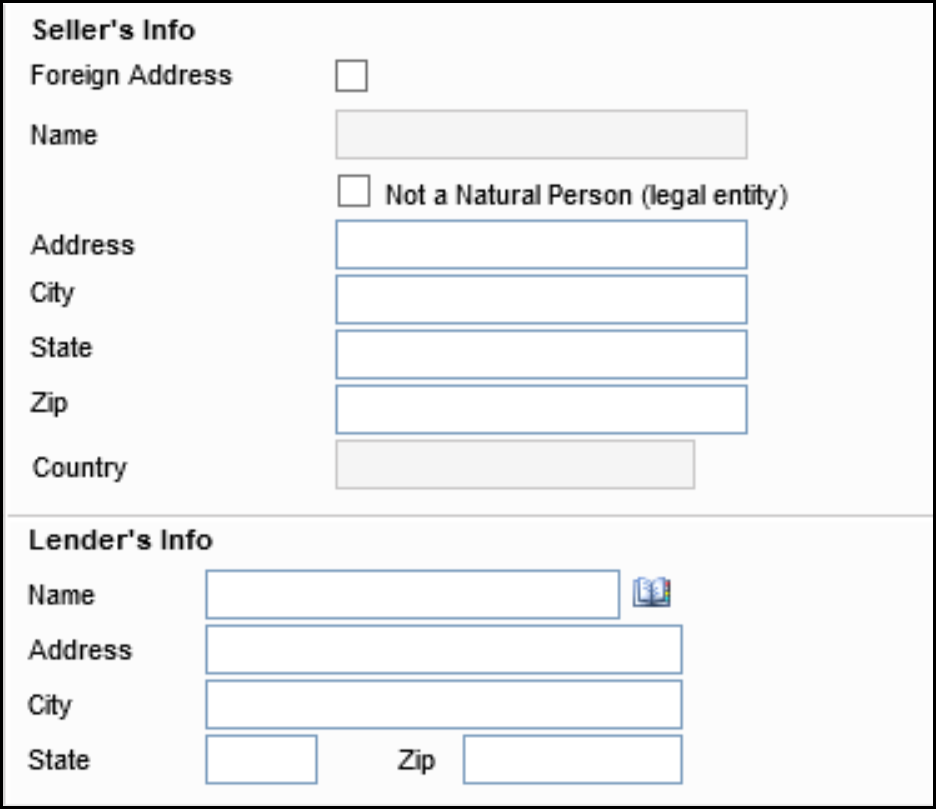

The following issues have been resolved when using the Tab key to move from one field to another on the Transaction Information section on the Closing Disclosure Page 1 Input form:

-

In the Borrower’s Info section, when a user tabs out of the State field (field ID 1418), the cursor now moves to the Zip field (field ID 703) in the Borrower’s Info section. Previously the cursor would jump to the Foreign Address check box (field ID 4680) in the Seller’s Info section.

-

In the Seller’s Info section, when a user tabs out of the State field (field ID 1249), the cursor now moves to the Zip field (field ID 703) in the Seller’s Info section. Previously the cursor would jump to the Name field (field ID 1264) in the Lender’s Info section.

Workaround Information:

The following workaround was provided for this production issue and is no longer required for Encompass 23.1 and later.

-

Instead of tabbing out of the affected fields, use the mouse to click the next field.

CBIZ-48997

A recalculation for the Net Income / Loss (field ID FM0132) on the VOM input form is now triggered when the Homeowner’s Insurance amount (field ID 230) is updated. Previously the Net Income / Loss Amount was not automatically recalculating when the Homeowner’s Insurance Premium changed.

Workaround Information:

The following workarounds were provided for this production issue and are no longer required for Encompass 23.1 and later.

-

Click the Lock icon for the Net Income/Loss (field ID FM0X32), and then click it again.

-

Or, on the 2015 Itemization input form:

-

Delete the Property Tax amount (field ID 231) and re-enter the value.

-

Or delete the City Property Tax amount (field ID L268) and reenter the value.

-

CBIZ-49204

The Validate Export button has been removed from the Fannie Mae and Freddie Mac tabs on the ULDD/PDD input form. The button provided outdated functionality that was no longer valid for these tabs. The button is still available on the Ginnie Mae tab.

CBIZ-48745

An issue has been resolved that caused the Title drop-down list (field ID IR0128) on the Request for Transcript of Tax input form to not retain an updated value under certain conditions. When the Use IRS 4506-Ccheck box (field ID IRS4506.X67) was cleared and the selection in the Title field was changed, the new selection would display initially, but the field would revert to the previous selection as soon as the Encompass user moved out of the field. This issue has been resolved. The Title field now retains the most recent selection under the scenario described above.

CBIZ-49899

The calculation used to populate the Prepaid Expenses (field ID 61) on the FHA Maximum Mortgage and Cash Needed Worksheet has been updated so that the Aggregate Adjustment (field ID 558) amount is no longer added twice to the Prepaid Expense. This issue occurred because the Aggregate Adjustment amount and the borrower’s Initial Deposit for Your Escrow Account (field ID NEWHUD.X1719) were both included in the field calculation. The calculation for the borrower’s Initial Deposit for Your Escrow Account already included the Aggregate Adjustment amount, which resulted in the amount being included twice in the calculation for Prepaid Expenses. This issue has been resolved and the calculation has been adjusted to include the Aggregate Adjustment amount only once.

Workaround Information:

The following workaround was provided for this production issue and is no longer required for Encompass 23.1 and later.

-

Click the Lock icon next to the Prepaid Expenses field to manually update the amount.

CBIZ-48278

The MH CHOICEHome option is now included in the Price Limit Test Comparison Logic for Manufactured Homes. The MH CHOICEHome option can be selected from the Property Type drop-down list (field ID 1041) on input forms such as the 1003 URLA - Lender, the Borrower Summary - Origination, and the Property Information forms.

CBIZ-50752

(Added on 1/31/2023)

An issue infrequently occurred where all Secondary Registration log information was missing from a loan. This issue has been resolved and the log information is no longer missing going forward. For missing logs prior to this release, please contact IMT Technical Support to have the logs restored.

HELOC Loans

When the Maximum Balance option is selected for the Qualifying Balance (field ID 4473) on a HELOC subordinate loans for a primary residence, the DTI (field ID 742) and the total expenses for the primary residence (field ID 1731) are now recalculated when the value for the Loan Amount Excluding Financed Mortgage Insurance (field ID 1109) is changed. Previously the DTI ratio and total expenses for the primary residence were not recalculated until the loan file was saved.

Workaround Information:

The following workaround was provided for this production issue and is no longer required for Encompass 23.1 and later.

-

After changing the Loan Amount Excluding Financed Mortgage Insurance (or Mortgage Insurance Equivalent), click the Save icon to save the loan and trigger the calculation.

CBIZ-47320

The Payment Total (field ID 1731) and DTI ratio for a standalone HELOC loan now update immediately when the loan amount excluding any funds for PMI/MIP financing (field ID 1109) is updated. Previously, the Payment Total would not update just by saving the loan. Users would have to use one of the workarounds described below to update the Payment Total and trigger a recalculation of the DTI ratio.

Workaround Information:

The following workarounds were provided for this production issue and is no longer required for Encompass 23.1 and later.

-

Save, close, and reopen the loan.

-

Or, open the RegZ-CD or RegZ-LE input form.

-

Or, click the Lock icon next to the First Mtg P&I (field ID 1724) and then click it again.

CBIZ-47509

When a value is entered for the Total Open End (HELOC) Draw Amounts (field ID CASASRN.X167) on the Subordinate Mortgage Loan Amounts pop-up window, the field retains the decimal formatting after the e pop-up window is closed and reopened. Previously the field initially displayed in two-decimal formatting (dollars and cents) but would display as an integer (dollars only without the cents) after the Subordinate Mortgage Loan Amounts pop-up window was closed and then reopened.

The Subordinate Mortgage Loan Amounts pop-up window is accessed by clicking the Sub. Financing button on forms such as the 1003 URLA - Lender and the RegZ-LE.

Workaround Information:

The following workaround was provided for this production issue and is no longer required for Encompass 23.1 and later.

-

On the HELOC Management input form, enter a value for the HELOC Drawn Total (field ID CASASRN.X167) in decimal format.

CBIZ-49607

ARM Loans

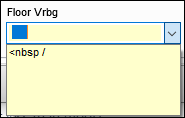

An issue was resolved that affected the Floor Vrbg drop-down list (field ID ARM.FlrVerbgTyp) for ARM loans using the RESPA 2010 GFE and HUD-1 forms. Previously, the drop-down list contained only a single entry for </nbsp> for these types of loans.

This issue has been resolved and the following options now display on the Floor Vrbg list:

-

My interest rate will never be less than the start rate or (floor).

-

or less than (floor).

-

My Interest rate will never be less than the margin or (floor).

-

or less than the Margin.

CBIZ-35818

An issue was resolved that caused the RegZ Payment Schedule to be cleared the first time the Get Index button was clicked on the RegZ-CD or RegZ-LE input form. The payment schedule would temporarily remain blank but would be repopulated after the loan was saved or after a user closed and then reopened the RegZ-LE or RegZ-CD input forms.

Workaround Information:

The following workaround was provided for this production issue and is no longer required for Encompass 23.1 and later.

-

Save the loan or reload the RegZ-CD or RegZ-LE input form.

CBIZ-38915

To provide users with the ability to manually enter a value of their own choosing, the Index Lookback Period drop-down (field ID ARM.IdxLkbckPrd) for ARM loans is now an editable field. Users can select an option from the drop-down list or they can type their own value in the field. This field displays in the following locations:

-

REGZ-LE input form

-

REGZ-CD input form

-

The Loan Programs setting (Encompass > Settings > Loan Templates > Loan Programs)

-

The Details section of the Select Loan Program Template window when you apply a loan program template to a loan.

CBIZ-48534

Piggyback Loans

An issue was resolved that occurred after opening a conventional loan and using the Piggyback Loans tool to create a new second lien loan that was linked to and synchronized with the conventional first lien loan. When the Purchase Price (field ID 136) on the conventional loan was updated, the Down Payment % (field ID 1771), Down Payment Amount (field ID 1335), and Loan Amount (field ID 1109) were not updating on the linked second lien loan.

Workaround Information:

The following workaround was provided for this production issue and is no longer required for Encompass 23.1 and later.

-

Manually update field 1771 or field 1109 on the linked loan

CBIZ-47321

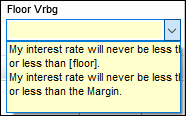

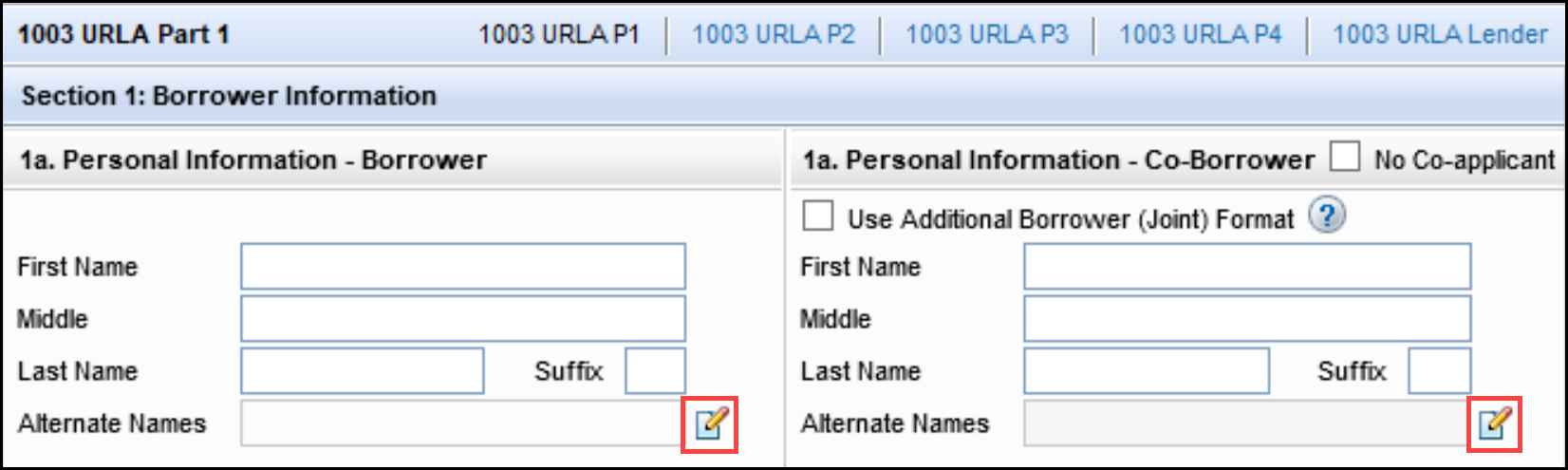

An issue was resolved that cause the borrower and co-borrower Alternate Names to not synchronize correctly in the pop-up windows for Alternate Names - Borrower and Alternate Names - Coborrower for loans that were linked and synchronized using the Piggyback Loans tool. The pop-up windows are accessible by clicking the Edit icons

When the fields for the borrower Alternate Names (field ID URLA.X195) and co-borrower Alternate Names (field ID URLA.X196) were included in the Piggyback Loan Synchronization setting in the Encompass Settings, the fields were being correctly synchronized between linked piggyback loans in fields for the borrower Alternate Names (field ID URLA.X195) and co-borrower Alternate Names (field ID URLA.X196), but the pop-up windows for Alternate Names - Borrower and Alternate Names - Coborrower were blank. This issue has been resolved and the alternate names are now synchronized correctly to the pop-up windows.

CBIZ-47757

The following updates have been made to the Closing Costs from Linked Loan field (field ID 1851) on the 2015 Itemization input form:

-

When loans have been linked via the Piggyback Loans Tool, a Lock icon now displays next to the field and the field is not editable (grayed out). Click the Lock icon to edit the field.

-

When loans have not been linked via the Piggyback Loans Tool, a Lock icon does not display, and the field is editable.

-

The label for the field has been changed to Closing Costs from Other Loans.

-

When a user enters data in the field and then uses the Piggyback Loan tool to link the loan to another loan, the field retain the data that the user manually input.

This update enables users to submit 2nd lien closing costs to DU or LP when there is a 2nd lien loan that is not linked via the Piggyback Loan tool. Previously, starting with the Encompass 22.3 Major Release, the Closing Costs from Linked Loan field was not editable, and the amount was populated only when loans were linked via the Piggyback Loan Tool. This caused inaccurate findings to be returned from DU and LP, with the cash back not reflecting the closing costs from the other loan.

Migration

These updates will not be applied to loans created prior to updating to Encompass 23.1.

CBIZ-49724

An issue was resolved that caused the borrower and co-borrower names to not synchronize from a first-lien loan to a second-lien loan when the loans were linked via the Piggyback Loan tool using the default synchronization fields in the Piggyback Loan Synchronization setting in Encompass (Encompass > Settings > Loan Setup > Piggyback Loan Synchronization). This issue has been resolved and the borrower and co-borrower name fields (field IDs 4000, 4001, 4002, 4004, 4005 and 4006) have been added to the default list of synchronization fields in the setting.

Workaround Information:

The following workaround was provided for this production issue and is no longer required for Encompass 23.1 and later.

-

Add field IDs 4000, 4001, 4002, 4004, 4005, 4006 to the Synchronization Fields in the Piggyback Loan Synchronization setting.

CBIZ-48280

Construction Loans

An issue was resolved that resulted in an incorrect Loan Maturity Date (field ID 78) when the Est. Closing Date (field ID 763) and/or Disbursement Date (field ID 2553) were on the last day of the month for a construction loan with B (Full Loan) selected from the Est Interest On (field ID SYS.X6) drop-down list. This issue has been resolved and the Maturity Date calculated correctly in the scenario described above.

CBIZ-48265

HMDA

Updates have been made to the logic used for the following four fields on the HMDA Information input form to avoid confusion about how the fields can be edited in scenarios that result in the fields being non-calculated, user-defined fields:

-

Other Non-Amortization (field ID HMDA.X38) drop-down list

-

Multifamily No Units (field ID HMDA.X41) text field

-

Reverse Mortgage (field ID HMDA.X56) drop-down list

-

Open-End Line of Credit (field ID HMDA.X57) drop-down list

When one of the following conditions is not true, Encompass no longer displays Lock Icons next to these fields and the fields are editable by users:

-

The Loan is Partially Exempt checkbox (field ID HMDA.X113) is selected.

-

A HMDA Profile has been applied to the loan.

-

The Use Non Universal Loan Identifier (NULI) for Loans Reported as Partially Exempt checkbox has been selected in the HMDA Profile applied to the loan.

When all the conditions described above are true, Encompass displays yellow Lock icons next to the fields and users can edit the fields. If a user then clicks the Apply Partial Exemption or Recalculate HMDA button, Exempt or 1111. Exempt will be copied to the fields.

Workaround Information:

The following workarounds were provided for this production issue and are no longer required for Encompass 23.1 and later.

-

Click a Lock icon to enter the correct HMDA value for these fields.

-

Create or modify business rules for these fields to implement logic for unlocking the fields.

CBIZ-34069

eClose

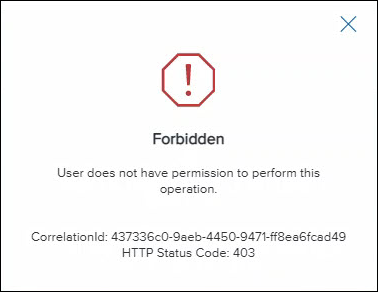

An issue was resolved that caused the following error message to display when generating document while redrawing an eClose package for a loan with a paper note.

This issue occurred when the initial eClose package included an eNote, but the Encompass user redrawing the loan did not have the eNote option enabled in the Personas settings. Even though the redraw was for a paper note, Encompass prevented the user from redrawing the package because the redraw would reverse the eNote for the initial package and the user’s persona did not have permission to work with eNotes. This issue has been resolved and the error message no longer displays when a user who does not have the eNote setting enabled redraws an eClose package previously sent with an eNote.

DOCP-46480

Electronic Document Management

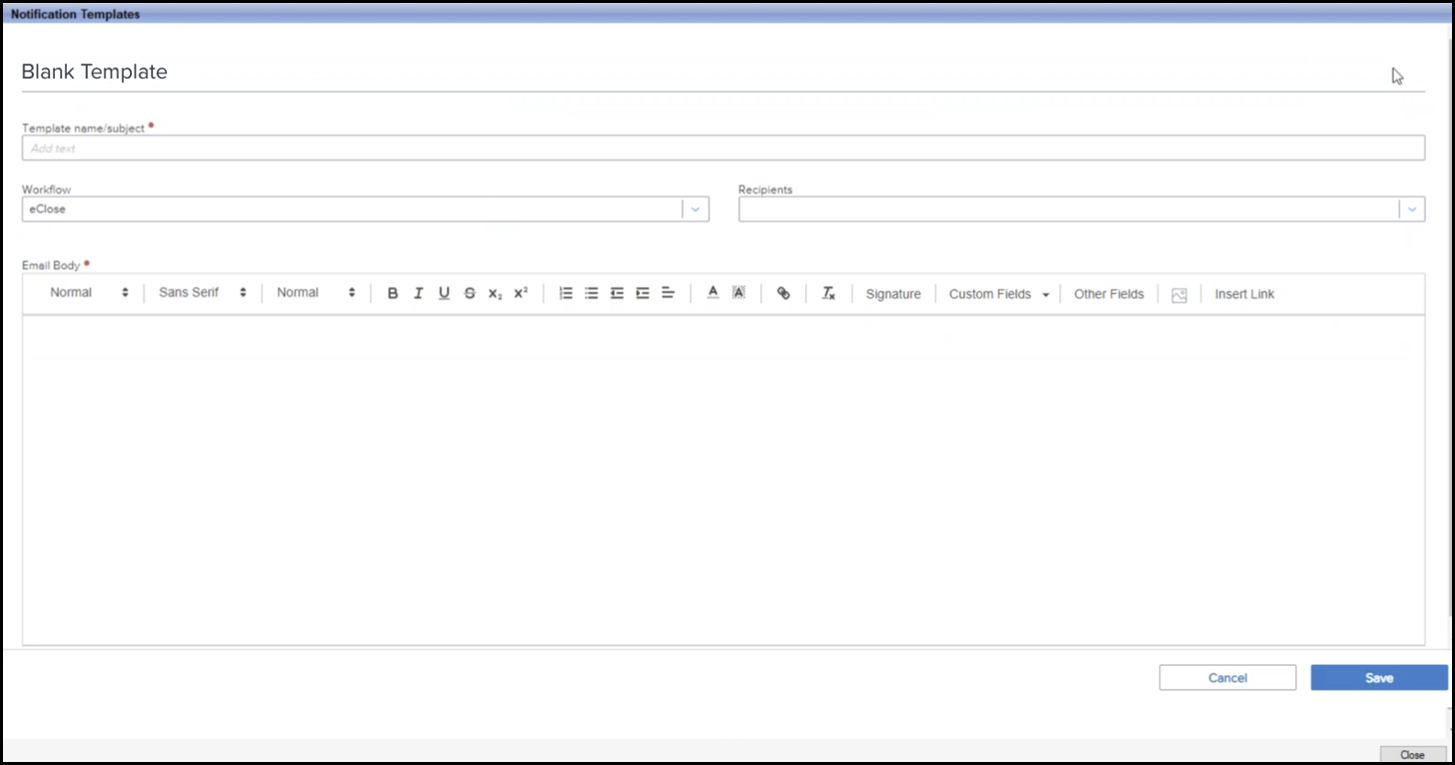

Updates have been made to address an issue that caused most of the style formatting to be removed when some customized HTML coding was pasted into the text entry field for a notification template (Encompass > Settings > eFolder Setup > Notifications Templates). This issued occurred when a user clicked the SHOW HTML button in the Email Body section and then pasted or typed code in the text field. Encompass would perform an HTML validation process on the code and would remove code that did not meet the HTML validations, resulting in formatting errors.

The following updates are being introduced to address this issue:

-

The SHOW HTML button has been removed from the notification template style editor in the Email Body section so Encompass users can use the styling options in the editor without having to code the email body and to ensure that the new templates meet security requirements and are compliant with ADA (Americans with Disabilities Act) standards.

-

A default template is being provided, which Encompass users can utilize as-is or modify as needed for each of the workflows in the notification setting (eClose, Disclosures, eConsent, Homeowners Insurance (HOI)).

-

Encompass users can create new templates from scratch or by using the Email Body styling options in the Notification Templates setting to modifying the default template for each of the workflows.

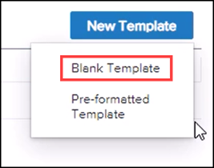

To Create a New Blank Template:

-

Place your mouse pointer over the New Template button and then click Blank Template.

-

Type a template name, select a workflow, and add recipients as needed.

-

Enter content for the email body and use the style menu to adjust the formatting.

-

When finished, click Save.

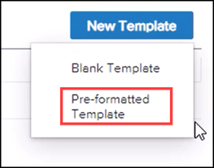

To Create a New Template from the Pre-formatted Template:

-

Place your mouse pointer over the New Template button and then click Pre-formatted Template.

.

-

Type a template name, select a workflow, and add recipients as needed.

-

Adjust the content and formatting for the email template.

-

When finished, click Save.

DOCP-37434, DOCP-46718

The date/time fields in the following eFolder windows now use the local date and time of the computer running Encompass:

-

On Tracking and Files sections in the Document Details window.

-

On the Tracking section on the Condition Details window.

Previously the date/time fields were recorded in Pacific Time regardless of the user’s location.

DOCP-31431

An issue was resolved that caused an “Evaluation Only” text watermark to display across the top of eFolder attachments with a .txt file extension when the file was viewed in the old document viewer.

This issue has been resolved and the watermark no longer displays for TXT files.

This update applies only to .TXT files that are uploaded after the Encompass 23.1 release. Previously uploaded .TXT files need to be uploaded again to ensure the watermark does not display in the viewing panel.

DOCP-47287

Business Rules

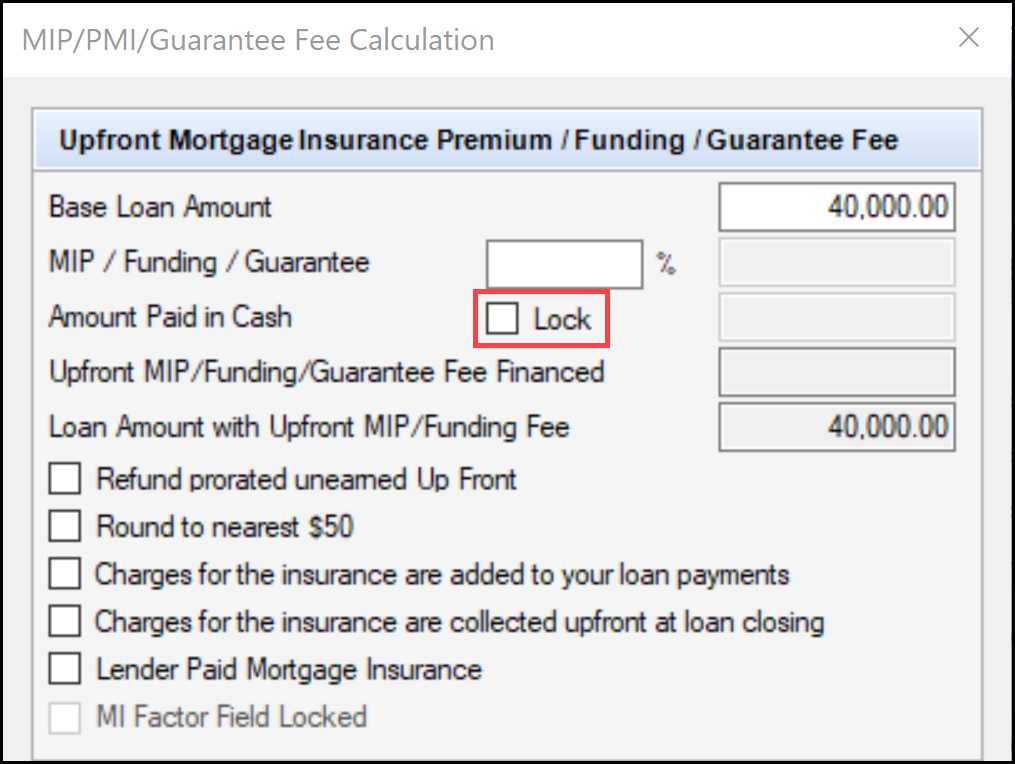

Access to the Lock check Box (field ID 1765) for the Amount Paid in Cash on the MIP/PMI/Guarantee Fee Calculation pop-up window can now be controlled by Persona Access to Fields business rules. Previously, access to the field was not being restricted when a Persona Access to Fields rule was configured to deny access to the field.

CBIZ-47418

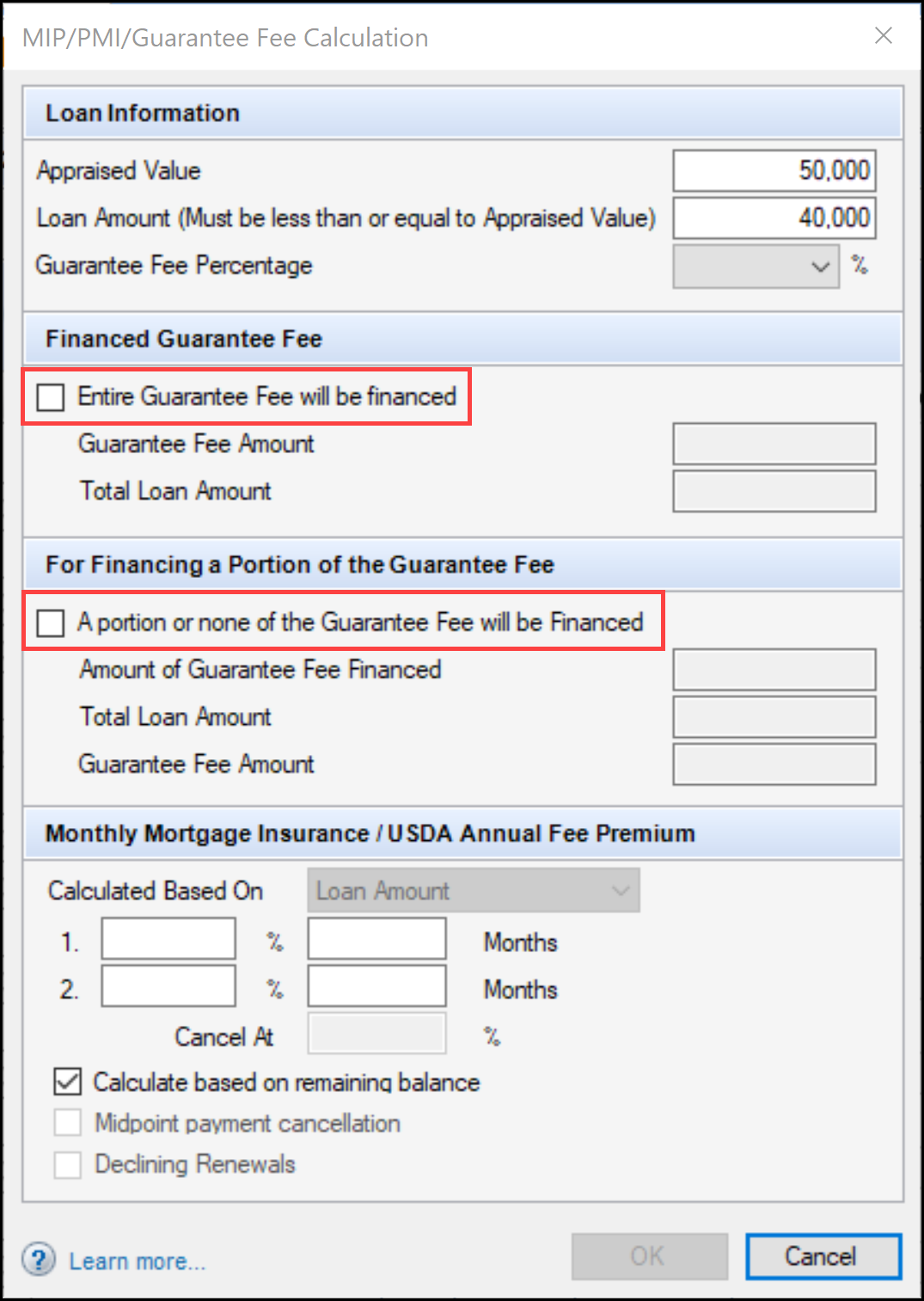

When the USDA-RHS option is selected for the Loan Type (field ID 1172), access to the two guarantee fee financing portion check boxes (field ID 3566) on the MIP/PMI/Guarantee Fee Calculation pop-up window can now be controlled by Persona Access to Fields business rules. Previously, access to the check boxes was not being restricted when a Persona Access to Fields rule was configured to deny access to the check boxes.

CBIZ-47420

When importing a Persona Access to Fields business rule to their Encompass instance, some users received the following error:

'Error During serialization or deserialization using the JSON JavaScriptSerializer. The length of the string exceeds the value set on the maxjsonlength property.'

This issue has been resolved and these users can now import these business rules successfully.

NICE-42141

ATR/QM

An issue was resolved that resulted in the Interest Only drop-down list (field ID 2982) on the Qualification tab on the ATR/QM Management input form being blank when it should have been populated with No. This occurred when the Interest Only Term (field ID 1177) was blank, and it resulted in Blue Flag icons (needs review) displaying for Interest Only on the ATR/QM Eligibility tab on the ATR/QM Management input form. This issue has been resolved and No now displays on the Interest Only drop-down list (field ID 2982) when the Interest Only term is blank.

Workaround Information:

The following workaround was provided for this production issue and is no longer required for new loans created in Encompass 23.1 and later.

-

Enter 0 for the Interest Only Term (field ID 1177) and tab out of the field.

-

Delete the 0 from the Interest Only Term field and tab out of the field.

CBIZ-50122

Alerts

When an Encompass user opens the Fee Details window for line item 1203, 1204, or 1205 on the 2015 Itemization input form and enters a new seller-obligated fee or adjusts an existing seller-obligated fee, Encompass no longer triggers a Good Faith Fee Variance Violated alert. However, the alert will trigger if a seller-obligated fee is changed to a borrower-obligated fee.

CBIZ-50035

Loan File Import and Exports

An issue was resolved that resulted in the Country Code (field ID FR0130) not updating correctly when importing a Blend MISMO 3.4 loan file. This issue has been resolved and the Country Code now updates correctly after importing a Blend MISMO 3.4 loan file.

CBIZ-38884

Encompass Settings

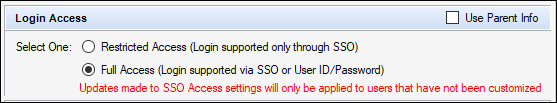

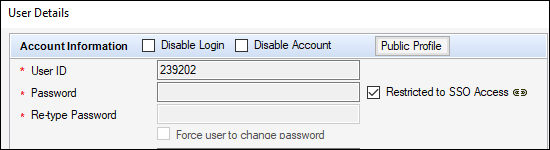

Some users experienced an issue where the Login Access setting for users in sub-organizations were being changed to match the settings of the parent organization erroneously. Any time a change was saved to a parent organization, its Login Access setting was applied to the users in its sub-organizations even though the Use Parent Info option was not selected, and the sub-organizations should not have been updated. As a result, scenarios occurred where users assigned with Restricted Access (login supported only through SSO) were being changed to Full Access (login supported via SSO or user ID/password) any time a change was saved to their parent organization (since the parent organization was set up with Full Access). This issue has been resolved and users in sub-organizations now retain their Login Access settings as expected when the Use Parent Info option is not being used for their organization.

NICE-38883

An issue was resolved that resulted in a persona not being able to access the Investor Connect Settings in (Encompass > Settings > External Company Setup > Investor Connect Settings) if the persona was initially created with the Access to No Features option selected and the persona was later granted access to the Investor Connect Settings. This issue has been resolved and personas can now access the setting under the scenario described above.

Workaround Information

The following workaround was provided for this production issue and is no longer required for the Encompass 23.1 release and later:

-

Create a new persona with the Access to All Features option selected, and then clear the check boxes for any features the persona is not allowed to access.

DND-18945

(Added on 1/31/2023)

An issue occurred where external Encompass users that were logged into Encompass TPO Connect could not access loans if the Organization Name associated with those loans was modified on the Encompass Company Details Basic Info tab. After the Organization Name was modified and a loan associated with that organization was opened, the Site ID (field ID TPO.X1) on the TPO Information screen was cleared. Once that loan was saved, the loan was no longer accessible via Encompass TPO Connect because the Site ID on the TPO information screen was blank. This issue has been resolved because the Site ID on the TPO Information screen is no longer cleared when the Organization Name is modified so loans associated with that Organization Name can be accessed via Encompass TPO Connect.

(Added on 1/31/2023)

An issue occurred on the Normalized Bid Tape Template setting where an error message, “Invalid Target Field, please reenter.”, was generated when a user added a custom field in the Target Field column and then tabbed out to move to the next column. This issue has been resolved and custom fields can now be added to the Normalized Bid Tape Template setting.

There are three types of custom fields that are not eligible for the Normalized Bid Tape Template setting. Custom fields with "Audit" format, custom fields that are calculated, and custom fields with "MONTHDAY' format.

(Added on 2/1/2023)

An issue occurred on the Normalized Bid Tape Template setting where if data entered in a row was incomplete (blank), incorrect, or a duplicate and then Save was selected without tabbing out of the last field completed in the row, the Save trigger was not detected and no required field, error or duplicate field validations were performed. This issue has been resolved and a tab out is no longer required before a Save and field validations are performed.

SEC-24022

(Added on 1/31/2023)

An issue occurred where after a TPO Organization was added (under External Company Setup>Company Details), an Object Reference error was generated if an admin attempted to export the new organization (right-click and then select Export Organizations ). The cause of the issue stemmed from a change made in the 22.3 release (SEC-23156). The system was modified to use "Null" instead of "0" as the net worth if the value was empty. The change to "Null" was the reason for the error. This issue has been resolved and newly added TPO organizations can now be exported.

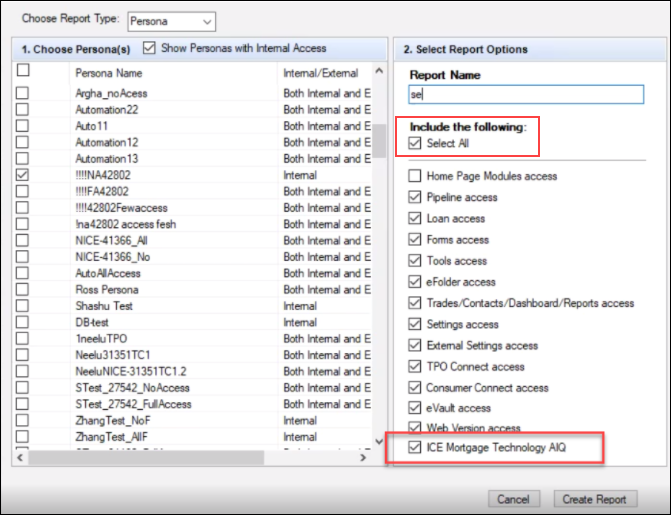

When administrators were configuring Persona Settings Reports, the ICE Mortgage Technology AIQ option was not being selected when the administrator selected the Select All option for the items to include in the report. This issue has been resolved and the AIQ option is now included when Select All is selected.

Trade Management

(Added on 1/31/2023)

An issue occurred where the Pool ID (field ID 4019) and Pool Number (field ID 3890) were not populated on a custom form when loans were assigned to a new MBS pool and then either Update Selected Loans or Update All Loans was selected on the Loans tab. This issue has been resolved and the Pool ID and Pool Number fields are now populated in a custom form when either the Update Selected Loans or Update All Loans button is selected.

(Added on 1/31/2023)

An issue occurred where Encompass froze when loans with extended locks (included a Cumulative Days to Extend (field ID 3431) value) were assigned to an MBS pool and then those loans were updated using the Update All Loans button on the Loans tab. This issue has been resolved and loans that include a Cumulative Days to Extend value are now processed successfully when assigned to and updated in an MBS pool.

Additional Fixed Issues

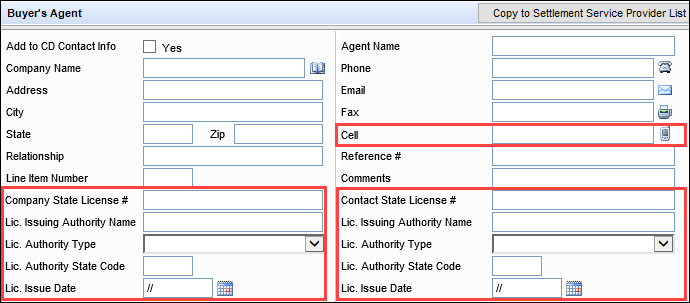

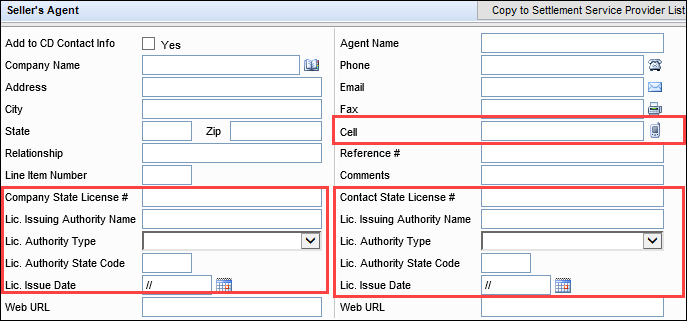

When a Buyer’s Agent or Seller’s Agent has been added to the File Contacts tool, and an Encompass user clicks the Address Book icon in the File Contacts tool to add the agent to the Encompass Business Contacts, the agent’s contact information is now copied correctly when the Business Contacts record is created. Previously, the license information and the cell phone number for the agent was not copied to the Business Contact record. This issue has been resolved and the license and cell phone information shown in the images below are now being copied into the Business Contact record.

CBIZ-42660

A rounding issue has been corrected that caused a negative number to be populated to the Total points and fees applicable under section 32 (field ID S32DISC.X48) in some scenarios when a user entered a negative value in the field for the additional amount to be applied to the origination credit (field ID NEWHUD.X1227) on the 2015 Itemization input form, and then entered a percentage value for the origination points (field ID NEWHUD.X1150). The resulting number would be round down to 1 cent lower than when a user entered the percentage value first and then entered the amount value. This resulted in a value of -0.01 populating to the Total points and fees applicable under section 32 in some scenarios. The rounding issue has been resolved and logic has been implemented to ensure that the Total points and fees applicable under section 32 is no longer populated with a negative number.

CBIZ-48152

The following locales, which are not recognized by the Unite State Postal Services (USPS) have been removed from the Encompass ZIP code database and no longer display in the Select a City pop-up window.

-

Shepherdsvlle has been removed from the window for the 40165 ZIP code. The entry for Shepherdsville (with an “i”) is still listed in the window.

-

Booneville has been removed from the window for the 27011 ZIP code. The entry for Boonville (with one “e”) is still listed in the window.

CBIZ-48350, CBIZ-48352

When a loan with multiple borrower pairs is saved, the Points paid on purchase or principal residence (field ID 1191) no longer clears when the loan is saved from the second borrower pair. This issue has been resolved and Encompass now always uses data for the first borrower pair to populate the Points paid on purchase or principal residence.

Workaround Information:

The following workaround was provided for this production issue and is no longer required for Encompass 23.1 and later.

-

Select the first borrower pair in the loan file, and then save the loan.

CBIZ-50170

Some users experienced Encompass login and performance issues due to the following errors related to system rules caching.

INFO {001} (ActiveRulesCache): NoActiveRulesCache found

ERROR {001} (ActiveRulesCache): Error while storing to ActiveRules cache: System.ArgumentNullException: Collection cannot be null.

The cause of this issue was identified and the impacted users are no longer experiencing this issues.

NICE-42058

Some users executing batch loan updates experienced an issue where new rows were not inserted into the Reporting Database table when the batch update was initiated when the UpdateXDBBasedOnFieldChanges flag on the database was set to True. This resulted in the Reporting Database, the batch update, and the loan file being out of sync. This issue has been resolved.

NICE-43126

Fixed Issues for Version 23.1.0.1 (Banker Edition)

(Added on 2/23/2023)

This update contains updates to users' Encompass client machines (23.1.0.1). The fixed issue below is included in this update.

The client-side update can be controlled manually via the Encompass Version Manager tool. If the tool has been configured to always apply new releases to users’ computers automatically, users will receive this update upon their initial log in of Encompass following the release.

In Encompass, go to Help > About Encompass in the menu bar to view your Encompass version. Once the upgrade is complete, your new version number will be 23.1.0.1.

SDK Upgrade Requirement for Encompass

The Encompass Software Development Kit (SDK) enables developers to build custom applications that can be added on, or connected to, Encompass and the ICE Mortgage Technology Platform. The Encompass SDK has been repackaged with this 23.1.0.1 update. If you are utilizing the Encompass SDK, upgrading to this new package is needed to ensure that your SDK has the same functionality as this latest version of Encompass.

You may elect to not upgrade your SDK and still be upgraded to Encompass 23.1.0.1. All features and functionality in the 23.1.0.1 release will be provided when you upgrade Encompass.

If your SDK application utilizes the Encompass SmartClient, you can automate this process so the SDK is upgraded automatically every time you apply an Encompass release. If your SDK application is installed on a computer at your location, you must manually upgrade the SDK for every release. For instructions for automating the upgrade process or manually upgrading the SDK, refer to the Upgrading the Encompass SDK page or view the SDK Programmer’s Guide.

Visit the Encompass SDK and Other Install Files page to access the SDK install files for this release.

Update to the Encompass Client Machines

An update to address the issue described below was applied to users' Encompass client machines on February 23, 2023.

(Added on 2/23/2023)

Some users who had set up a custom Pipeline view as their default Pipeline reported receiving an Unhandled Exception... error after logging into Encompass 23.1 and then attempting to view their Pipeline. After clicking the Pipeline tab, the Pipeline did not load and they were forced to close or exit their Encompass application. This issue has been resolved and the custom Pipeline view is now accessible as expected.

NICE-43678

Fixed Issues for Version 23.1.0.2 Server Patch 1 (Banker Edition)

(Added on 3/14/2023)

This update contains updates to users' Encompass client machines (23.1.0.2) and a Server Patch (server patch 1) that is applied to the Encompass server. The fixed issues below are included in this update.

The client-side update can be controlled manually via the Encompass Version Manager tool. If the tool has been configured to always apply new releases to users’ computers automatically, users will receive this update upon their initial log in of Encompass following the release. The Server Patch included with this release will be applied to the Encompass Server automatically and cannot be controlled manually via the Encompass Version Manager tool.

In Encompass, go to Help > About Encompass in the menu bar to view your Encompass version. Once the upgrade is complete, your new version number will be 23.1.0.2 Server Patch 1.

SDK Upgrade Requirement for Encompass

The Encompass Software Development Kit (SDK) enables developers to build custom applications that can be added on, or connected to, Encompass and the ICE Mortgage Technology Platform. The Encompass SDK has been repackaged with this 23.1.0.2 update. If you are utilizing the Encompass SDK, upgrading to this new package is needed to ensure that your SDK has the same functionality as this latest version of Encompass.

Install Files and Downloads

Visit the Encompass SDK and Other Install Files page to access the latest download links to

If your SDK application utilizes the Encompass SmartClient, you can automate this process so the SDK is upgraded automatically every time you apply an Encompass release. If your SDK application is installed on a computer at your location, you must manually upgrade the SDK for every release. For instructions for automating the upgrade process or manually upgrading the SDK, refer to the Upgrading the Encompass SDK page or view the SDK Programmer’s Guide.

Update to the Encompass Server (i.e., Server Patch 1) and Client Machines (23.1.0.2)

In order for this item to be fully integrated into your Encompass system, both the Server Patch and the client-side update provided with this release must be applied. The Server Patch included with this release is applied to the Encompass Server automatically and cannot be controlled manually via the Encompass Version Manager tool. The client-side update in this release can be controlled manually via the Encompass Version Manager tool. If the tool has been configured to always apply client-side updates to users’ computers automatically, users will receive the client-side updates upon their initial log in of Encompass following the release.

Again, the item listed below will not be fully implemented until both the Server Patch and the client-side updates are applied to your Encompass system.

(Added on 3/14/2023)

An issue with custom Pipeline Views was introduced in the Encompass 23.1.0.1 update where custom sorting was not being retained in the view: After sorting their Pipeline based on a loan detail (i.e., sorting the Pipeline based on a column value such as Loan Number or Date File Started) and then saving the view as a custom Pipeline View, when users navigated to a different Pipeline view and then returned to this custom Pipeline View, the sort order was not retained. The Pipeline was sorted by Borrower Name instead of the sort order the user had saved for the view. This issue has been resolved and the saved custom view now retains the correct sort order when users navigate away, and then return to, their custom Pipeline view.

Update to the Encompass Client Machines

This update (23.1.0.2), which is applied to users' Encompass client machines, can be controlled manually via the Encompass Version Manager tool. If the tool has been configured to always apply new releases to users’ computers automatically, users will receive this update upon their initial log in of Encompass following the release.

(Added on 3/14/2023)

An issue was resolved that affected loans that received eConsent through the third-party Blend cloud-based mortgage origination platform and were then imported into Encompass from Blend. When the process development and repository tool used by Equifax was later run on the loan, the eConsent Date (field ID 3983) was cleared for the loan. This issue has been resolved and the eConsent Date is no longer being cleared in the scenario described above.

CBIZ-51845

| Next Section: Change Log |

|

|

|

Previous Section: Feature Enhancements |