Subordinate Mortgage Loan Amounts

New User Guide: Working with HELOC Loans (for use with Encompass 19.3)

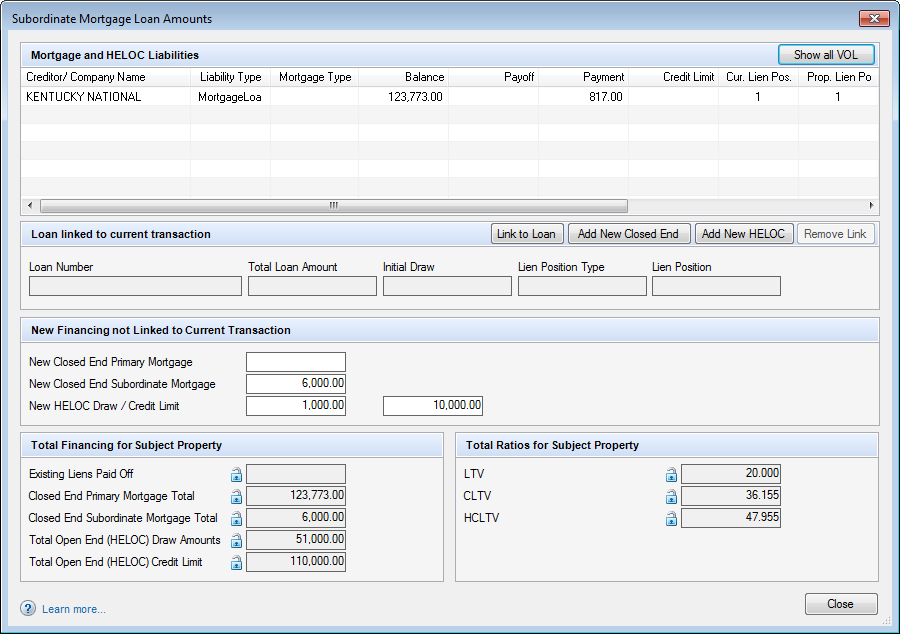

This updated version of the Subordinate Mortgage Loan Amounts pop-up window, accessible by clicking the Sub. Financing button on the Borrower Summary - Origination (and other) input form, was introduced in Encompass 18.4

The Subordinate Mortgage Loan Amounts pop-up window serves as a centralized dashboard that provides a comprehensive view of all financing associated with the subject property and easy access to the component subordinate financing fields. The window is accessed by clicking the Sub. Financing button on forms such as the Borrower Summary - Origination, Borrower Summary - Processing,1003 Page 1, RegZ-LE, and RegZ-CD.

To streamline data entry requirements for loans with new and existing financing, Encompass identifies verification of liability (VOL) records associated with the subject property prior to creating the associated REO Asset record (VOM). Any Mortgage or HELOC liabilities are automatically factored into the related primary and subordinate mortgage totals (field IDs 427, 428, CASASRN.X167, and CASASRN.X168) without requiring additional data entry to synchronize the amounts. Also included in the calculations are any loans linked through the Piggyback Loans tool as well as fields identifying net new financing (primary, subordinate, or HELOC) from another lender.

To originate loans that have subordinate financing (including HELOCs), lenders must consider the entire financing picture of the loan, including liabilities that remain attached to the subject property after the origination of the current loan, as well as any concurrent financing either through another lender or as a linked piggyback loan being closed with the current transaction. The Subordinate Mortgage Loan Amounts window provides a consolidated and functional view for loan officers and underwriters to access and update the related items from a central location.

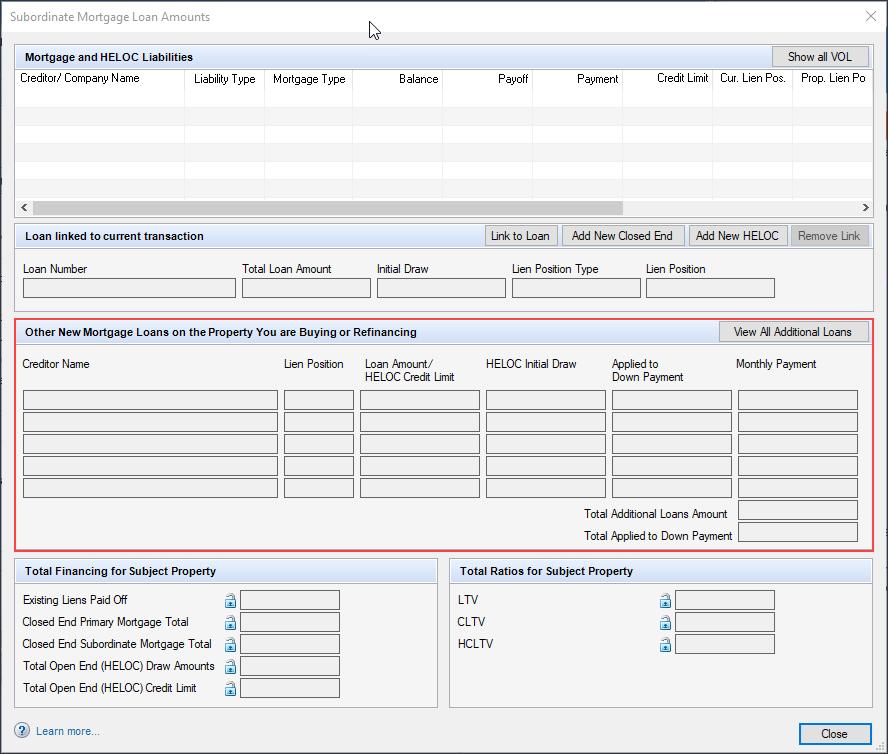

The sections provided in the Subordinate Mortgage Loan Amounts window vary slightly depending on which version of the 1003 URLA forms you are using: URLA 2009 or URLA 2020.

The Subordinate Mortgage Loan Amounts window contains the following sections, which enable loan officers, underwriters and other loan team members to track subordinate financing data related to the current loan:

-

Mortgage and HELOC Liabilities

-

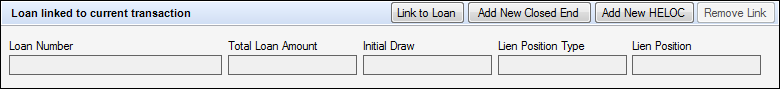

Loan linked to current transaction

-

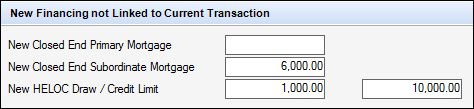

New Financing not Linked to Current Transaction (when using URLA 2009 forms version)

-

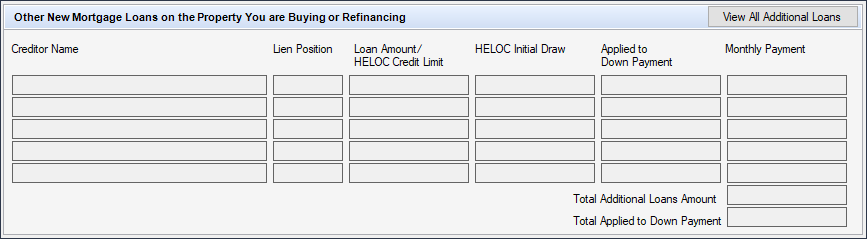

Other New Mortgage Loans on the Property You are Buying or Refinancing (when using URLA 2020 forms version)

-

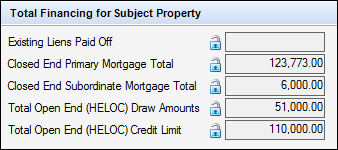

Total Financing for Subject Property

-

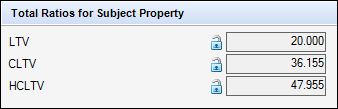

Total Ratios for Subject Property

URLA 2009 Forms Version

URLA 2020 Forms Version

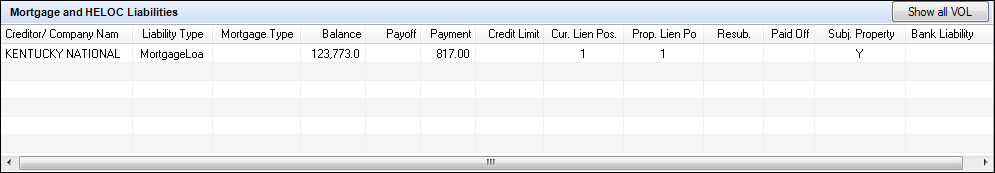

This section displays existing mortgages and liabilities associated with the subject property. The columns in the table provide quick access to detailed information from the VOL records. Click the Show all VOL button on the upper right to open a Quick Entry pop-up window where you can view and edit the VOLs for the loan.

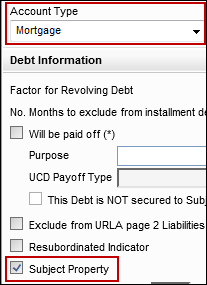

VOLs display in this section when they have an Account Type of Mortgage or HELOC and when the SubjectProperty checkbox is selected in the VOL record.

This section enables Encompass user to click buttons on the upper right to link an existing loan to the current transaction or to create a new closed end or HELOC loan that is linked to the current transaction.

The section lists the loan’s Encompass Loan Number, the Total Loan Amount (field ID 2), the Initial Draw (field ID 1888) if the loan is a HELOC loan, The Lien Position Type (field ID 420) and the Lien Position (field ID 4494). These fields are read-only and are populated from the linked loan file.

To Link to an Existing Loan:

-

Click the Link to Loan button.

-

On the Link to Loan window, select a Loan Folder.

-

Select a loan from the list, and then click the Link button.

-

On the confirmation window, select an option for synchronizing data between the two loans.

-

Data from the linked loan displays in read-only format in the Loan linked to current transaction section.

To Add and Link a New Closed End Loan:

-

Click the Add New Closed End button.

-

On the confirmation window, select an option for synchronizing data between the two loans.

-

The Piggyback Loans tool opens with the new loan information displaying in the 2nd Loan Position column with a blank selection for the Loan Type.

To Add and Link a New HELOC Loan:

-

Click the Add New HELOC button.

-

On the confirmation window, select an option for synchronizing data between the two loans.

-

The Piggyback Loans tool opens with the new loan information displaying in the 2nd Loan Position column with the HELOC option selected by default for the Loan Type.

To Remove a Link:

-

Click the Remove Link button.

-

A confirmation message states that both loans will be saved after the link is removed. Click Yes to continue.

This section, which displays for loans using the URLA 2009 forms, enables manual entry of loans that are in process with another lender during the origination of the current loan, including new closed end primary and subordinate mortgage amounts, and new HELOC draw and limit amounts.

- Record first lien mortgages in the New Closed End Primary Mortgage amount (field ID 4487). These amounts are included in the Closed End Primary Mortgage amount (field ID 427) listed in the Total Financing for Subject Property section. An example of this use case would be a lender who is issuing a simultaneous second to be closed with a first lien from another lender. The other lender’s first lien, which is not yet a liability, is documented in New Closed End Primary Mortgage.

- Record second through fourth lien mortgages in the New Closed End Primary Mortgage. These amounts are included in the Closed End Subordinate Mortgage amount (field ID 428) listed in the Total Financing for Subject Property section. An example of this use case would be a lender who is issuing a first lien with a simultaneous second to be closed from another lender. The other lender’s lien, which is not yet a liability, is documented in New Closed End Subordinate Mortgage.

- Record HELOC draws and credit limits in the New HELOC Draw / Credit Limit amounts (field IDs 4489 and 4490). The draw amount should be entered in the first box, and the total credit line should be entered in the credit limit box. These amounts are included in the appropriate Total Open End (HELOC) Draw Amount (field ID CASASRN.X167) and Total Open End (HELOC) Credit Limit (field ID CASASRN.X168) fields in the Total Financing for Subject Property section.

This section, which is provided for loans using the URLA 2020 forms, displays additional new mortgage loans on the subject property aside from the existing loan, for example, down payment assistance loans or standalone piggyback loans closed with the current loan by either you or another lender. The total loan amounts and total applied to the down payment for the current loan display at the bottom of the section. The total applied to the down payment is the total of all additional loans applied with the current loan.

The fields in this section are populated with data from Section 4b on the 1003 URLA Part 4 input form, and vice versa.

Click the View All Additional Loans button to open the Verification of Additional Loans (VOAL) input form in a pop-up window to create, edit, or view the entries for Section 4b on the 1003 URLA Part 4 input form.

Existing liens to be retained are captured in the liabilities.

This section includes the following calculated totals for subject property financing:

-

Existing Liens Paid Off (field ID 26) – Refer to Calculating Existing Liens to Be Paid Off for calculation details.

-

First Mortgage Total (field ID 427) – Refer to Calculating the Closed End Primary Mortgage Total for calculation details.

-

Closed End Second Mortgage Total (field ID 428) – Refer to Calculating the Closed End Subordinate Mortgage Total for calculation details.

-

Total Open End (HELOC) Drawn Amounts (field ID CASASRSN.X167) – Refer to Calculating Total Open End (HELOC) Drawn Amounts for calculation details.

-

Total Open End (HELOC) Credit Limit (field ID CASASRSN.X168) – The total of the credit limit from liabilities, the HELOC Credit Limit for loans not linked (field ID 4490), and the loan amount for any Piggyback loans. Refer to Calculating Total Open End (HELOC) Credit Line for calculation details.

This section displays the total LTV, LTV, and HCLTV ratios for the subject property.

-

LTV (field ID 353) –With the exception of USDA or refinance loans, the LTV (Loan-To-Value) ratio is calculated by dividing the total loan amount (field ID 2) by the purchase price (field ID 136) or appraised value (field ID 356), whichever is lower. For USDA or refinance loans, the LTV (Loan-To-Value) ratio is calculated by dividing the loan amount by the appraised value (field ID 356). For 203(K) loans, the LTV (Loan-To-Value) ratio is representative of the Case LTV. See the FHA 203(K) worksheet for details.

-

CLTV (field ID 976) – Refer to Calculating Combined Loan-to-Value Ratios (CLTV, HCLTV) with Subordinate Financing for calculation details.

-

HCLTV (field ID 1540) – Refer to Calculating Combined Loan-to-Value Ratios (CLTV, HCLTV) with Subordinate Financing for calculation details.

To facilitate calculations for loans with subordinate financing, Encompass now calculates the amount of existing liens to be paid off as the total of all payoffs for mortgage and HELOC liabilities associated with the subject property. The following updates have been made to the calculation, triggers, and user interface for the Existing Liens field (field ID 26) to support these changes:

Calculation

The field is populated with the sum of the Payoff Amount (FLxx16) from VOLs that have all of the following criteria:

-

The Will be Paid off checkbox (field ID FLxx18) is selected.

-

The Include checkbox (FLxx63) is selected in the Payoffs and Payments pop-up window.

-

The Subject Property checkbox (FLxx27) is selected.

-

The Account Type (FLxx08) is Mortgage or HELOC.

Calculation Triggers

The calculation for Existing Liens is triggered when the following fields are modified on a VOL:

-

Payoff Amount (field ID FLxx16)

-

Will be Paid off (field ID FLxx18)

-

Subject Property checkbox (field ID FLxx27)

-

Account Type (field ID FLxx08) – Only when the selection changes to Mortgage or HELOC or is changed from Mortgage or HELOC to another account type.

-

Include checkbox (field ID FLxx63) – This field is located on the pop-up window that opens when you click the Payoffs & Payments button on the Loan Estimate Page 2.

The following calculation is used to populate the Closed End Primary Mortgage Total (field ID 427) with the first lien loan amount. The amount is determined by adding the three sums listed below.

Although the calculation involves adding a series of sums, it is actually used to identify a single first-lien loan and populate the loan amount as the Closed End Primary Mortgage Total.

-

The sum of the Borrower Requested Loan Amount (1109) for all linked loans (including the current loan, but excluding any construction loans linked via the Construction Management Tool) with a Lien Position Type (field ID 420) of First and a Loan Type (1172) that is not HELOC.

-

The sum of the Balance (field ID FL0113) of VOL entries with a Proposed Lien Position (field ID FL0129) of 1, an Account Type of Mortgage, a To Be Paid Off value of N, and the Subject Property checkbox (field ID FL0127) selected.

An alert notifies the Encompass user when multiple loans are assigned to any given lien position.

-

The New Closed End Primary Mortgage (field ID 4487) loan amount.

Example: A first lien can be an existing liability which is being retained (captured in the VOL), the current loan file, a linked loan file (if the loan is part of a piggyback transaction and the current loan file is a subordinate lien) or a piggyback loan file being originated with another lender where the other lender is the first lien holder.

The following calculation is used to populate the Closed End Subordinate Mortgage Total field (field ID 428) with the sum of all lender-originated subordinate liens. This field was formerly named 2nd Mortgage on the pre-18.4 version of the Subordinate Mortgage Loan Amounts pop-up window.

Loans Types of Conventional, FHA, VA or Other are all considered to be closed end transactions in order to correctly calculate CLTV and DTI values associated with the transaction. Additionally, the calculation takes into account any second mortgage amounts against the subject property that are being retained with the transaction.

The amount is determined by adding the sums listed below:

-

The sum of the Borrower Requested Loan Amount (1109) for all linked loans (including the current loan, but excluding any construction loans linked via the Construction Management Tool) with a Lien Position Type (field ID 420) of Subordinate and a Loan Type (1172) that is not HELOC.

-

The sum of the Balance (field ID FLxx13) of VOL entries with a Proposed Lien Position (field ID FLxx29) greater than 1, an Account Type of Mortgage, a To Be Paid Off value of N, and the Subject Property checkbox (field ID FLxx27) selected.

-

The New Closed End Subordinate Mortgage (field ID 4487) loan amount.

Examples: A subordinate closed end lien can be an existing liability against the subject property that is being retained and resubordinated (captured in the VOL), the current loan file where the lien is identified as subordinate and the loan type is not a HELOC, a linked loan file (if the loan is part of a piggyback transaction and the current loan file is a first lien), or a piggyback subordinate loan file being originated with another lender where the other lender is the subordinate lien holder or a provider of a down payment assistance loan. Because a borrower can have multiple subordinate liens against the subject property, this is supported as a sum.

CBIZ-10463

The following calculation is used to determine the Total Open End (HELOC) Drawn Amounts (field ID CASASRN.X167). To facilitate synchronization of piggyback loans, including open end (HELOC) mortgages, Encompass considers the type of loan prior to synchronizing the loan amount or line amount to the second mortgage value on the loan in order to correctly calculate the combined loan to value amounts (CLTV and TLTV). The current balances for HELOC loans that are paid off and resubordinated are not included in the drawn total. Additionally, if there are HELOC lines against the subject property that are being resubordinated with the transaction, this calculation takes those amounts into account.

The amount is determined by adding the sums listed below:

-

The sum of the Initial Advance (field ID 1888) of all linked loans (including the current loan) where the Loan Type (field ID 1172) is HELOC.

-

The sum of the Balance (FL0113) of any VOL where the Resubordinated Indicator checkbox (field ID FL0126) is selected, the Will be paid off checkbox (field ID FL0118) is not selected, the Account Type (field ID FL0108) is HELOC, the Subject Property checkbox (FL0127) is selected, and the loan is not a construction loan linked via the Construction Management input form.

-

The New HELOC Draw amount (field ID 4489) from the Subordinate Mortgage Loan Amounts window.

Examples: The amount of HELOC credit line(s) that have been accessed can be found in an existing liability against the subject property that is being retained and resubordinated (captured in the VOL), the current loan file where the loan type is a HELOC (regardless of lien type or position), a linked HELOC loan file, or a piggyback HELOC being originated with another lender. Because a borrower can have multiple HELOC lines against the subject property, this is supported as a sum.

The following calculations are used for CLTV (field IDs 976, MORNET.X76) and HCLTV (field IDs 1540, MORNET.X77) ratios with subordinate financing to enable accurate underwriting for these loan scenarios.

The MORNET fields for CLTV (field ID MORNET.X76) and HCLTV (field ID MORNET.X77) use the same calculation as CLTV (field ID 976) and HCLTV (field ID 1540), but are rounded per Fannie Mae policy, with the ratios first truncated to two decimal points and then rounded up to a whole number.

Conventional Loans

For loans where the Loan Type (field ID 1172) is Conventional, HELOC, or Other:

-

CLTV – The sum of the Closed End Primary Mortgage Total (field ID 427), the Closed End Subordinate Mortgage Total (field ID 428), and the Total Open End (HELOC) Draw Amounts (field ID CASASRN.X167) and the Financed MIP (1045) divided by the valuation used.

-

HCLTV – The sum of the Closed End Primary Mortgage Total (field ID 427), the Closed End Subordinate Mortgage Total (field ID 428), and the Total Open End (HELOC) Credit Limit (field ID CASASRN.X168) and the Financed MIP (1045) divided by the valuation used.

Government (FHA, VA, or USDA)

For loans where the Loan Type (field ID 1172) is FHA, VA, or USDA, the following calculations are being used per the FHA Single Family Housing Policy Handbook and VA guidelines:

-

CLTV – The sum of the Closed End Primary Mortgage Total (field ID 427), the Closed End Subordinate Mortgage Total (field ID 428), and the Total Open End (HELOC) Credit Limit (field ID CASASRN.X168) divided by the valuation used.

-

HCLTV – The sum of the Closed End Primary Mortgage Total (field ID 427), the Closed End Subordinate Mortgage Total (field ID 428), and the Total Open End (HELOC) Draw Amounts (field ID CASASRN.X167) divided by the valuation used.

The CLTV and HCLTV calculations are the same for government loans. This is in contrast to conventional loans, which provide a distinction between the credit accessed vs the credit limit between these two calculations.

The following calculation is used to determine the Total Open End (HELOC ) Credit Limit (field ID CASASRN.X168). To facilitate synchronization of piggyback loans that include HELOC mortgages, Encompass now considers the type of loan prior to synchronizing the loan amount or line amount to the second mortgage value on the loan. This enable the correct calculation of combined loan-to-value ratios. Previously, the synchronization process considered only the total loan amount. Additionally, the calculations also considers any existing HELOC lines against the subject property that are being resubordinated with the transaction.

The amount is determined by adding the sums listed below:

- The sum of the Borrower Requested Loan Amount (1109) of all linked piggyback loans where the Loan Type (field ID 1172) is HELOC.

- The sum of Credit Limit (field ID FLxx31) of VOLs where the Will be paid off checkbox (field ID FLxx18) is not selected and the Account Type is HELOC and the Subject Property checkbox field ID (FLxx27) is selected.

- The New HELOC Credit Limit (field ID 4490) from the Subordinate Mortgage Loan Amounts window.

Examples: The amount of HELOC credit line(s) that have been obtained can be found in an existing liability against the subject property that is being retained and resubordinated (captured in the VOL), the current loan file where the loan type is a HELOC (regardless of lien type or position), a linked HELOC loan file, or a piggyback HELOC being originated with another lender. Because a borrower can have multiple HELOC lines against the subject property, this is supported as a sum.