Feature Enhancements in Version 23.3

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release.

Admin

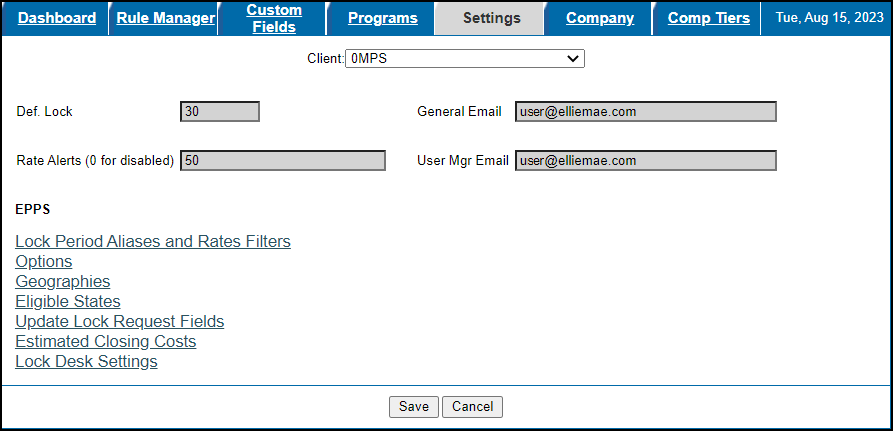

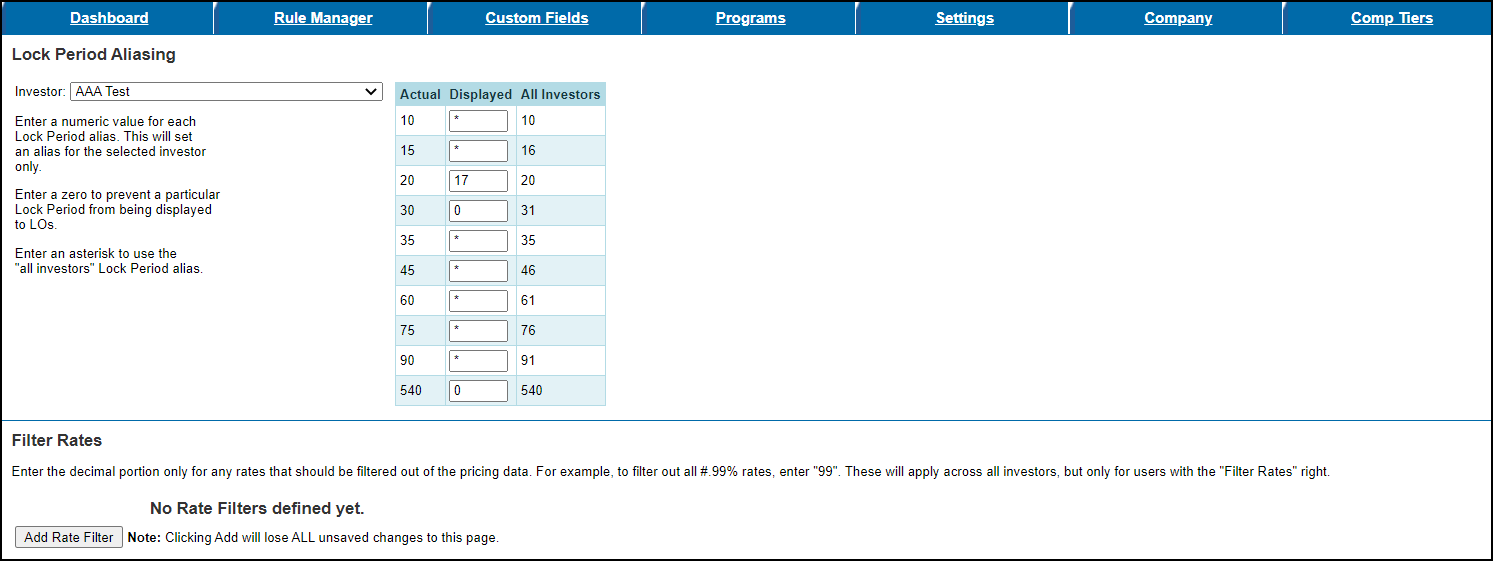

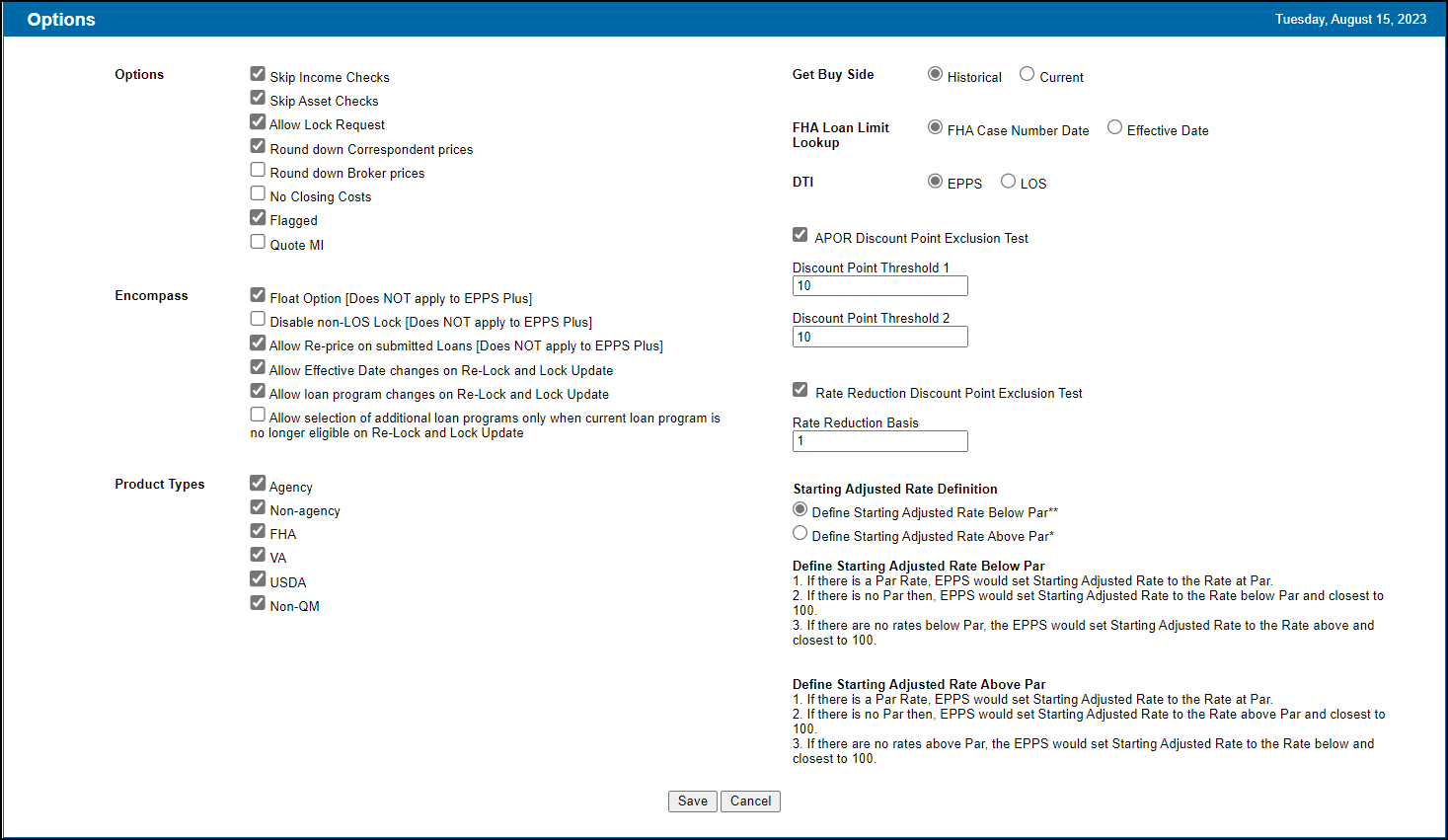

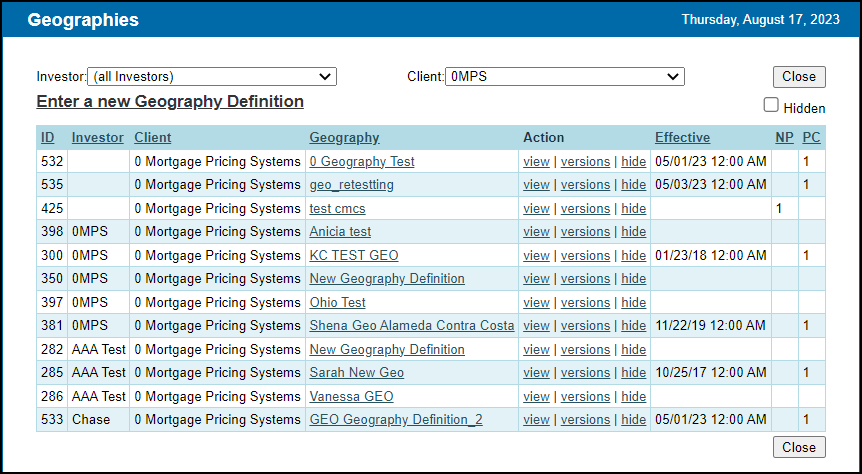

The layout of the Settings tab has been revised to enable a Client Admin to configure their settings easily and efficiently. The original Settings tab has been reorganized and divided across multiple pages - Settings, Lock Period Aliases, Rates Filters, Options, Geographies, Eligible States, and Update Lock Request Fields, Estimated Closing Costs, and Lock Desk Settings - with links to those pages (except Settings) on the main tab. The settings and options remain the same, except for the addition of the new DTI setting on the Options page, and function as before.

Settings

Lock Period Aliases and Rates Filters

Options

Geographies

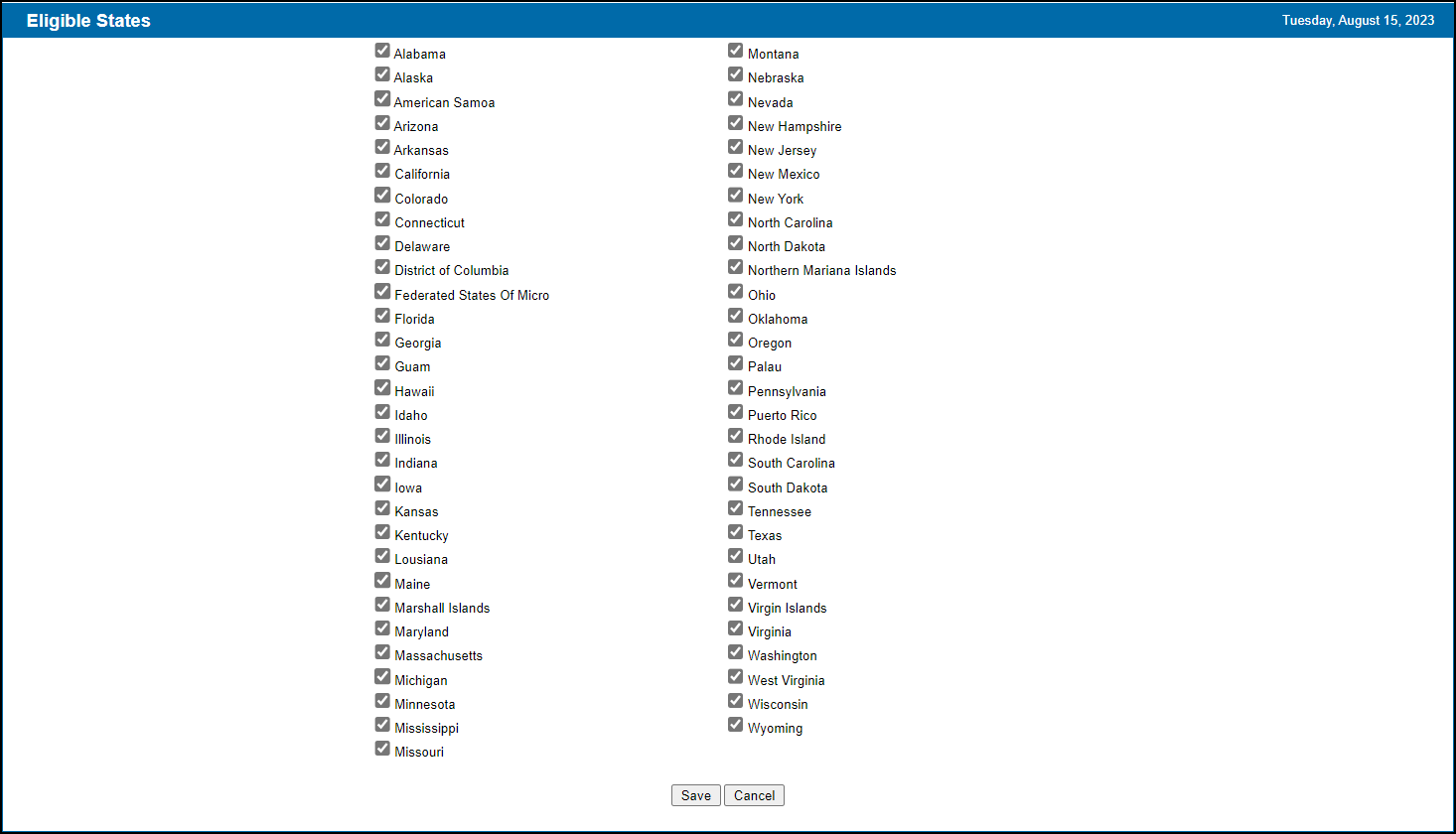

Eligible States

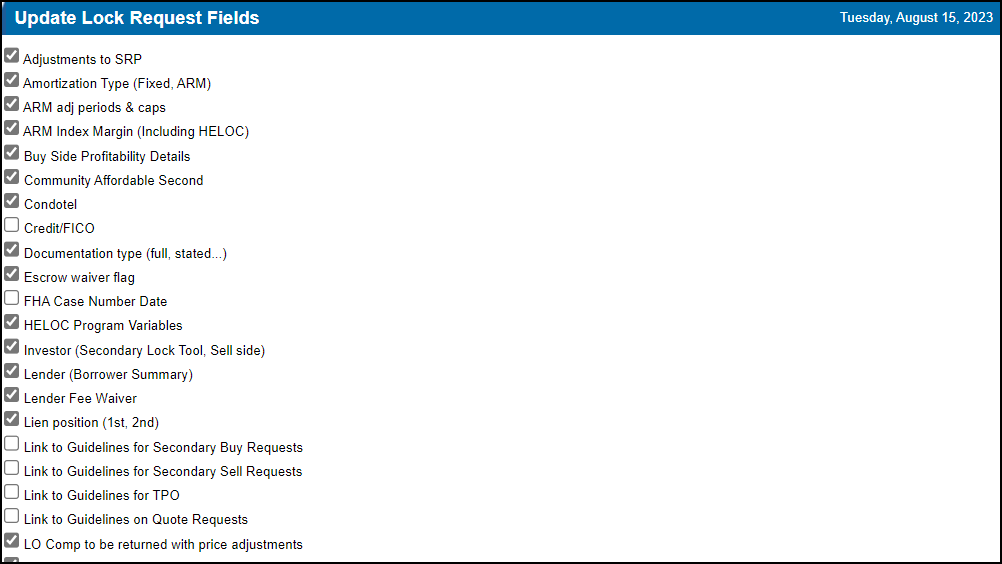

Update Lock Request Fields

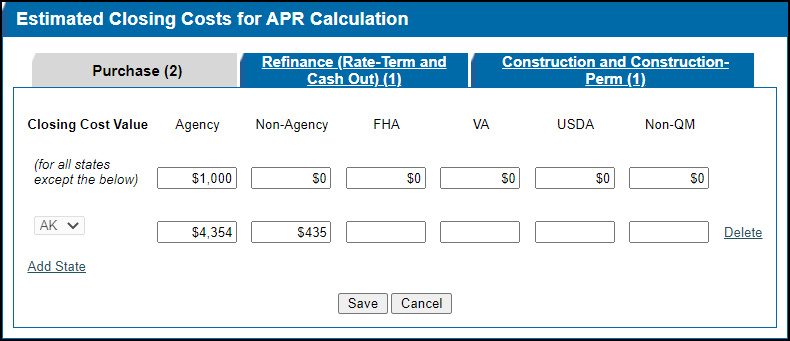

Estimated Closing Costs

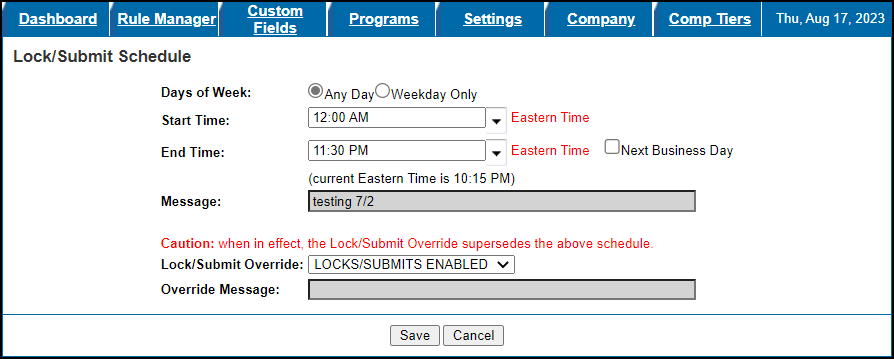

Lock Desk Settings

A new DTI setting has been added to the Settings - Options page. This setting determines whether the DTI uses an EPPS calculated DTI or an Encompass calculated DTI.

For both new and existing clients, this setting will default to “EPPS”.

To Configure the DTI Setting:

-

Log into EPPS as a Client Admin.

-

Select the Admin tab, and then select the Settings tab.

-

Select the Options link.

-

For the DTI setting, select an option.

-

EPPS - The DTI uses an EPPS calculated DTI.

-

LOS - The DTI uses an Encompass calculated DTI.

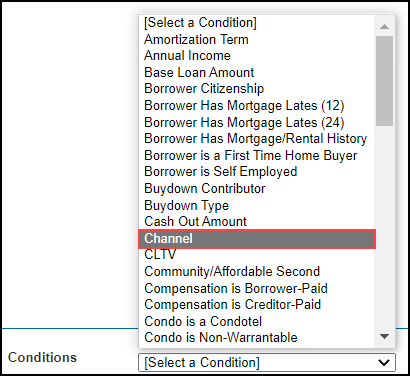

A new Channel condition has been added to the Rule Manager. This new condition enables Encompass TPO Connect users to condition pricing adjustments based on the channel value.

Custom Program Management

An Expression and/or Action in a Condition Definition can now be set to read-only by the Encompass Product & Pricing Service Technical Operations (EPPS Tech Ops). When configured as read-only, a CPM user cannot edit that expression and/or action nor can they delete the row containing the read-only expression and/or action.

If a Condition Definition with read-only expressions and/or actions is copied or cloned, the read-only expressions and/or actions will transfer to the copied or cloned definition.

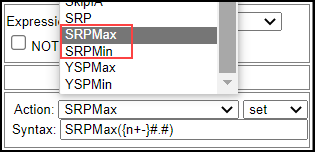

Two new actions, SRPMax and SRPMin, have been added to the Condition Definition.

A user must have either the “View Profit Margin & SRPs” or the “View SRPs” manager right to view the SRP adjustment.

-

SRPMax - Sets or adjusts the maximum total allowable SRP.

-

The drop down field next to SRPMax includes “set”, “plus”, and “minus”.

-

SRPMin - Sets the minimum total allowable SRP.

-

The drop down field next to SRPMin includes “set” only.

A new Special Products drop down field has been added to the Options section of the Custom Program Definition.

This new field lists global flags (flags with no investor). You can only select one Special Product at a time, and a Special Product is optional (Blank is the default selection).

The available options in the Special Products drop down list is maintained by EPPS TechOps.

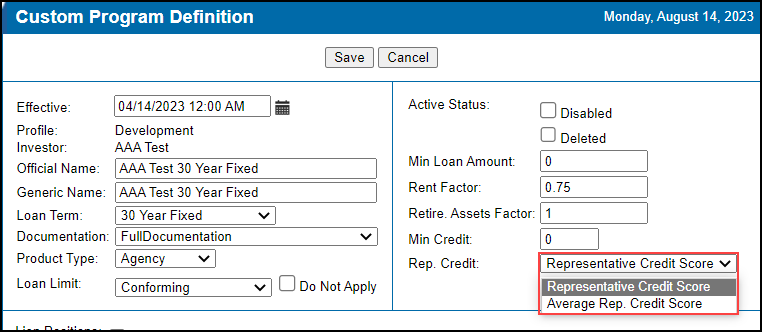

The options available for the Rep. Credit field on the Custom Program Definition have been updated to align with newer credit definitions used in EPPS.

The available options are:

-

Representative Credit Score

-

Average Rep. Credit Score

For existing definitions, the selection will be defaulted to Representative Credit Score.

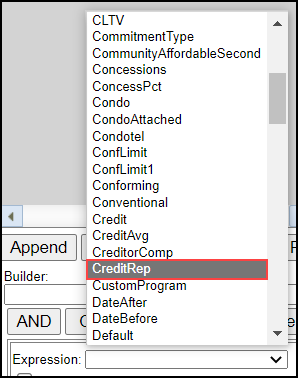

A new CreditRep expression has been added to the Condition Definition. This expression will be set to “Representative Credit Score” for the loan.

In addition, two other changes have been made:

-

If the existing CreditAvg expression is NULL, the expression will be set to “Representative Credit Score”.

-

During qualifications, a program that is assigned “Average Rep. Credit Score” will use the Average Representative Credit Score for the “Credit” variable (and any implied references to credit such as guidelines, ratios, etc.).

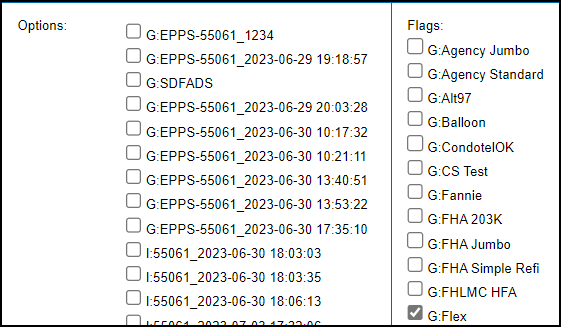

A prefix has been added to the program flags and options on the Custom Program Definition to more easily identify various types of program flags and options.

-

Global program flags and options (Investor is NULL) will begin with “G”.

-

Investor-specific program flags and options for the Investor will begin with “I”.

-

Investor-specific program flags and options for the Alt Investor (Lender) will begin with “AI”.

User Interface

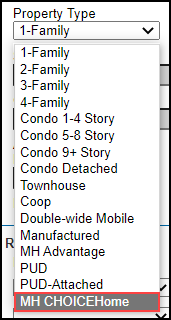

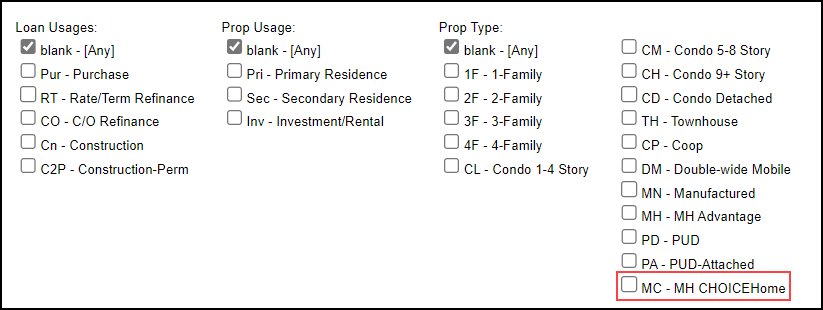

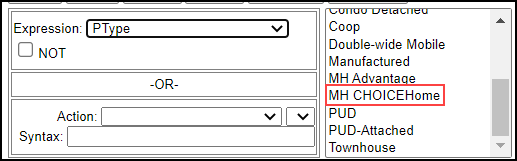

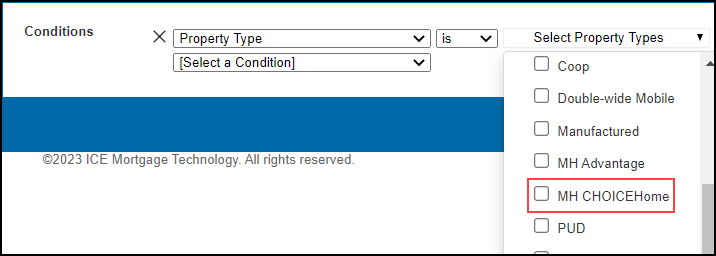

A new MH CHOICEHome option has been added to the Property Type drop down list on the Property tab to enable a property to be identified as MH CHOICEHome and to accurately price loans with that property type.

In addition, the following changes have been made to the Guideline Definition, Ratio Definition, Condition Definition, Matrix Definition, and Rule Definition.

-

MC - MH CHOICEHome check box has been added to the Guideline Definition and Ratio Definition.

-

MH CHOICEHome option has been added to the PType expression on the Condition Definition and Matrix Definition.

-

MH CHOICEHome option has been added to the Property Type condition on the Rule Definition.

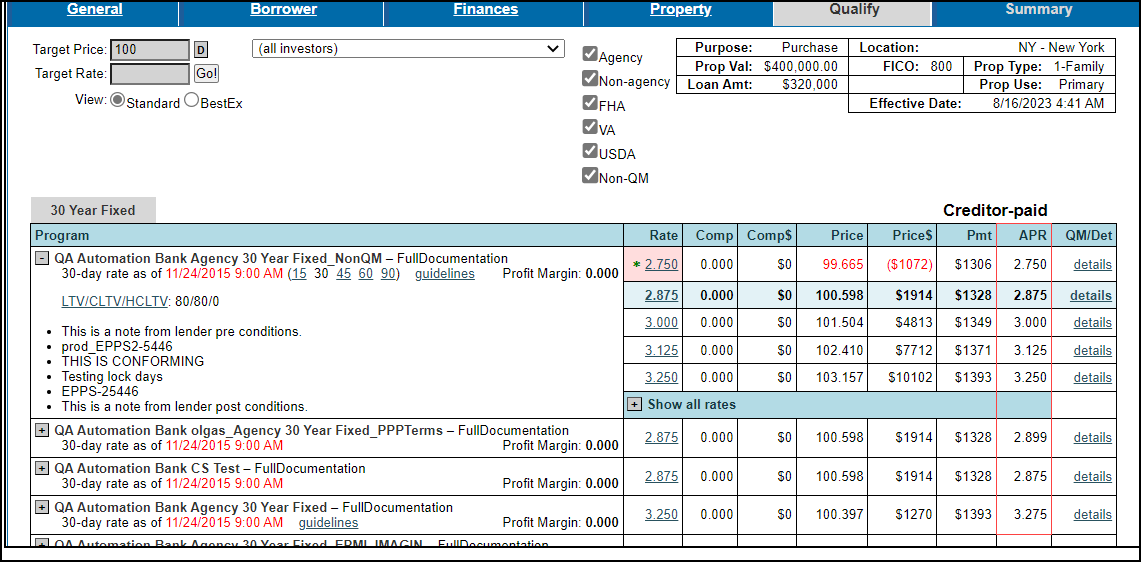

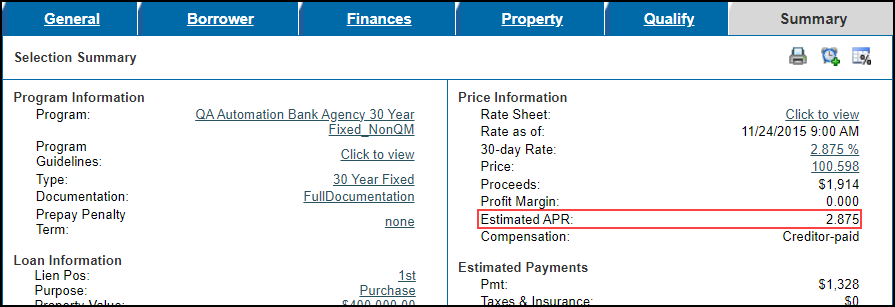

The estimated APR has been added to the Qualify and Summary tabs to enable EPPS users to view that value in EPPS.

The APR provided in EPPS is an estimate for internal comparative purposes only. The APR is calculated using estimated terms, features, and prepaid finance charges, and does not include finance charges such as monthly mortgage insurance premiums or monthly guaranty fees. A more precise APR can be viewed in Encompass.

Please ensure you configure the Estimated Closing Costs setting on the Settings page, which enables estimated closing costs to be included in the APR. The setting will affect the estimated APR displayed on the Qualify and Summary tabs.

Qualify Tab

On the Qualify tab, a new APR column has been added.

Summary Tab

On the Summary tab, a new Estimated APR entry has been added.

APIs

The Encompass Product & Pricing (EPPS) v2 loanQualifier API has been updated to enable a target rate based on the target value to be applied to the corresponding Best Ex rate. In the “rateDetails” and “ratesBestEx” collections of the API, a boolean property “target” has been added. A “true” value indicates the rate/price is the target rate/price, otherwise the value will be “false”.

DTIIncomeOverride and DTIDebtOverride have been added to the loanQualifier and eligibility REST API requests to ensure the calculated DTI is consistent between EPPS and Encompass.

Zero Interest Rates

Investors and clients submitting their own rate sheets can now submit zero interest rates for loan programs (e.g., HELOCS).

EPPS TechOps will be required to perform some set up.

Additional Enhancements

EPPS has been updated with the 2023 HUD Section 184 loan limits. The new loan limits are available via the Loan Limits table on the CPM tab when the effective date is on or after April 24, 2023 or when the effective date is blank. For loans with an effective date on or after midnight April 24, 2023, EPPS will qualify the loans using the new loan limits for HUD Section 184 products and the loan limits will be displayed in Ineligible Reasons.

Loans with an effective date prior to midnight April 24, 2023 will not be affected.

Currently in EPPS, a lock request document displays both a “Raw Price” table and an “Adjusted Price” table while a relock document does not display either table. As part of this release, both tables have been added to the relock document.

To manage which tables are displayed, select or clear the Price Table (adjusted) on Quote Requests and/or the Price Table (raw) on Quote Requests check boxes on the Update Lock Request Fields page under Settings.

As part of the Encompass 23.3 major release, the zip code database and county table will be updated. To maintain consistency between Encompass and EPPS, the same updates that will be made in Encompass will be made in EPPS.

-

For new zip codes, the associated county will be added to the county table.

-

For deleted zip codes, the associated county will be removed from the county table.

-

For county names that do not match between Encompass and EPPS, the Encompass version will be added to the county table.

| Next Section: Fixed Issues |

|

|

|

Previous Section: Introduction |