Feature Enhancements in Version 22.1

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release.

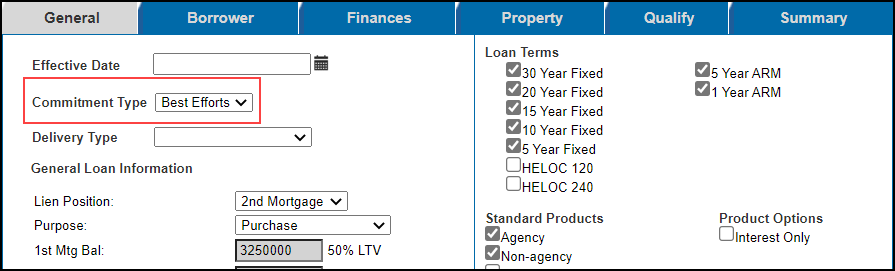

Commitment Type Field

A new Commitment Type field has been added to the General tab to enable the value to be modified before a loan is priced.

A CommitmentType field has been added to the loan record.

A CommitmentType expression has been added to the Condition Definition and Matrix Definition pages. For both the condition and matrix definitions, the available values will be displayed for selection.

The Commitment Type (field ID 4187) field has been added to the ICE Mortgage Technology Partner Network.

-

If a value is added to field ID 4187, that value will be passed from Encompass to EPPS and then stored in the CommitmentType field in the loan record.

-

If a value is present in the CommitmentType field in the loan record, that value will be passed back to field ID 4187 in Encompass.

A CommitmentType element has been added to the GetLoanPrograms and eligibility SOAP services.

2nd Mtg Bal. Field Updates

The 2nd Mtg Bal. field on the General tab will no longer be editable and will be grayed out if a 2nd Mtg Bal. value is passed from Encompass to EPPS to prevent a mismatch of liabilities when the 2nd Mtg Bal. value is passed back to Encompass.

-

If the Lien Position is switched to "2nd Mortgage", the value is altered, and then the Lien Position is switched back to "1st Mortgage", the 2nd Mtg Bal. field will retain the value passed from Encompass.

-

To edit the 2nd Mtg Bal. field, the value must be updated in Encompass and then resubmitted to EPPS.

The warning message displayed when navigating away from the General tab has been updated if the 2nd Mtg Bal. value is different from the value received from Encompass to prevent a mismatch of liabilities when the 2nd Mtg Bal. value is passed back to Encompass.

-

The previous warning message was “2nd Mortgage Balance is used for pricing purposes only. It is not returned to Encompass. Updates to the permanent loan record must be made in Encompass.”.

-

The new warning message is “2nd Mortgage Balance will return to Encompass. Liabilities must be updated on the loan manually in Encompass to match the balance returned.”.

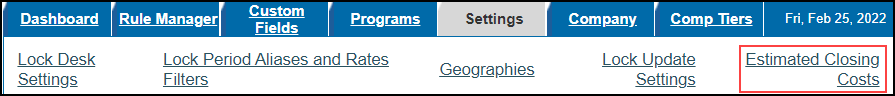

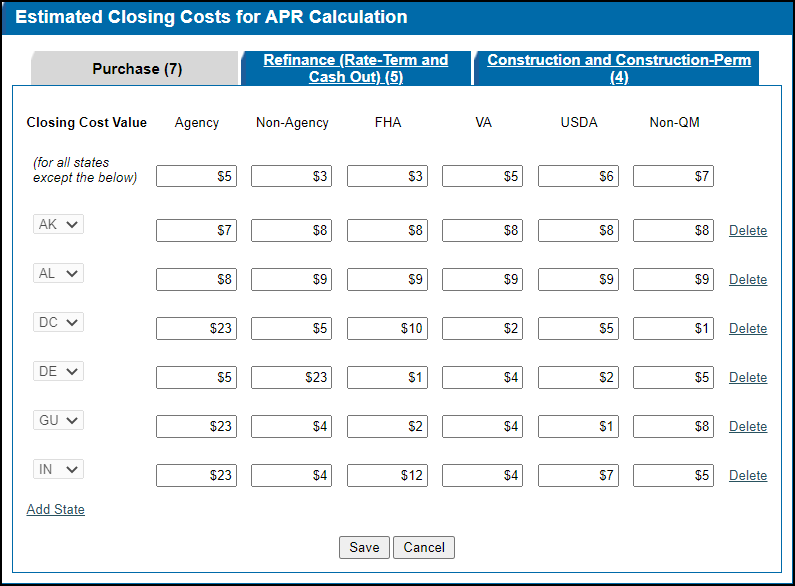

Estimated Closing Costs Setting

A new Estimated Closing Costs link has been added to the Settings page. This new link provides access to the new Estimated Closing Costs for APR Calculation grid.

The new Estimated Closing Costs for APR Calculation grid enables the estimated closing costs to be included in the APR, which will provide an estimated APR while prices are quoted.

The values in the grid will only be applied if no values are passed from Encompass.

To Configure the Estimated Closing Costs for APR Calculation Grid:

-

Log into EPPS as a Client Admin.

-

Select the Admin tab, and then select the Settings tab.

-

Select the Estimated Closing Costs link at the top of the page.

-

Select which loan purpose (Purchase, Refinance (Rate-Term and Cash Out, or Construction and Construction-Perm) you will be adding closing cost values to.

If you enter values on one tab, and then navigate to another tab without selecting Save, the value you entered on the original tab will remain when you navigate back to the original tab.

-

The top row will be the values applied to each loan product unless a specific state’s values are listed.

-

To add a state’s values:

-

Select the Add State link.

-

A new row will be added to the bottom of the list.

-

Select the state.

-

A state can only be displayed once in the grid.

-

Add a value for each loan product.

-

No decimals are allowed.

-

You can leave fields in the row blank, as needed.

-

To delete a state’s values, select the Delete link at the end of the row, and then select OK when prompted.

-

Select Save to save your changes.

-

The states you enter will be displayed alphabetically.

-

A row will be automatically deleted if no values are added to any of the fields.

-

The count displayed in each tab header will be updated (e.g., Purchase (7)).

-

If an invalid value is entered in any of the rows or if a field is left blank on the top row, a warning message “Enter Estimated Closing Costs value between $0 - $999,999. Decimals are not allowed.” will be displayed.

-

If a duplicate state is entered, a warning message “A State can appear only once in the grid.” will be displayed.

CPM Condition and Matrices Updates for Ginnie Mae Loan Limits

Both the ConfLimit and Conforming expressions on the Conditions Definition and Matrix Definition pages have been updated for Loan Programs with a Product Type of either “FHA” or “VA” that will return the applicable Ginnie Mae limit amount based on the subject property characteristics using the FHA Case Number Date.

-

When the FHA Loan Limit Lookup setting on the Setting page is set to “FHA Case Number Date”, the FHA Case Number Date will be used to look up the Ginnie Mae loan limits from the Loan Limit table.

-

If the FHA Case Number Date is blank, the loan’s Effective Date will be used.

-

When the FHA Loan Limit Lookup setting is set to “Effective Date”, the Effective Date will be used to look up the Ginnie Mae loan limits from the Loan Limit table.

Additional Enhancements

New tool tip messages have been added to various fields when they are editable on the Finances and Property tabs.

-

Finances tab

-

Liquid Assets (All borrowers) – “Entering liquid assets does not save to Encompass. Be sure to update assets in Encompass.”.

-

Retirement Accounts (All borrowers) – “Entering retirement accounts does not save to Encompass. Be sure to update retirement assets in Encompass.”.

-

Annual Income – “Entering annual income does not save in Encompass. Be sure to update borrower’s income in Encompass.”.

-

Monthly Debt – “Entering monthly debt does not save in Encompass. Be sure to itemize liabilities in Encompass.”.

-

Gift Funds $ - “Entering gift funds does not save in Encompass. Be sure to itemize gift funds in Encompass.”.

-

Property tab

-

Market Value (For all other real estate owned) – “Entering market value for other real estate owned does not save in Encompass. Be sure to update other real estate details in Encompass.”.

-

Mortgage Balance (For all other real estate owned) - “Entering mortgage balance for other real estate owned does not save in Encompass. Be sure to update other real estate details in Encompass.”.

-

Monthly Payment (For all other real estate owned) - “Entering monthly payment for other real estate owned does not save in Encompass. Be sure to update other real estate details in Encompass.”.

-

Rental Income (For all other real estate owned) - “Entering rental income for other real estate owned does not save in Encompass. Be sure to update other real estate details in Encompass.”.

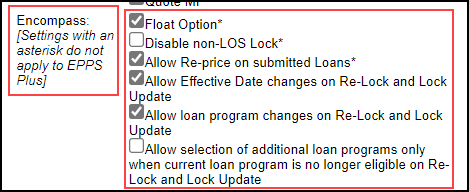

As part of the Encompass 21.3 major release, a new Lock Update lock request type was added to avoid confusion over an active re-lock (Lock Update) and an inactive re-lock (Re-Lock). As part of this Encompass Product & Pricing Service release, various changes have been made to the re-lock options on the Settings page to align with the Encompass changes.

Any changes to existing options are label changes only and do not affect the behavior of the options.

-

A new “(Settings with an asterisk do not apply to EPPS Plus)” note has been added under the “Encompass” label.

-

An asterisk has been added to the Float Option, Disable non-LOS Lock, and Allow Re-price on submitted Loans check boxes.

-

The label of the existing Allow loan program changes on Re-Lock check box has been updated to Allow loan program changes on Re-Lock and Lock Update. In addition, it has been moved below the Allow Effective Date changes on Re-Lock and Lock Update check box.

-

The label of the existing Allow Effective Date changes on Re-Lock check box has been updated to Allow Effective Date changes on Re-Lock and Lock Update. In addition, it has been moved above the Allow loan program changes on Re-Lock and Lock Update check box.

-

A new Allow selection of additional loan programs only when current loan program is no longer eligible on Re-Lock and Lock Update check box has been added.

While this option is accessible in Encompass Product & Pricing Service 22.1, it is not available for use and will not be applied if selected. This option will be available for use in a future EPPS release.

-

This check box and the Allow loan program changes on Re-Lock and Lock Update check box cannot be selected at the same time. If one is selected, the other will automatically be cleared.

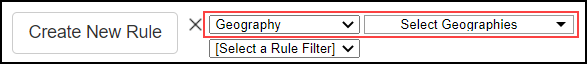

A Geography filter has been added to the Rule Manager listing page to enable rules to be filtered by the available geographies.

As part of the Encompass 22.1 major release, the zip code database and county table will be updated. To maintain consistency between Encompass and EPPS, the same updates that will be made in Encompass will be made in EPPS.

-

For new zip codes, the associated county will be added to the county table.

-

For deleted zip codes, the associated county will be removed from the county table.

-

For county names that do not match between Encompass and EPPS, the Encompass version will be added to the county table.

| Next Section: Fixed Issues |

|

|

|

Previous Section: Introduction |