Feature Enhancements in Version 22.3

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release.

Client Flags

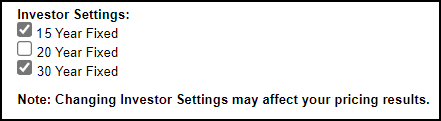

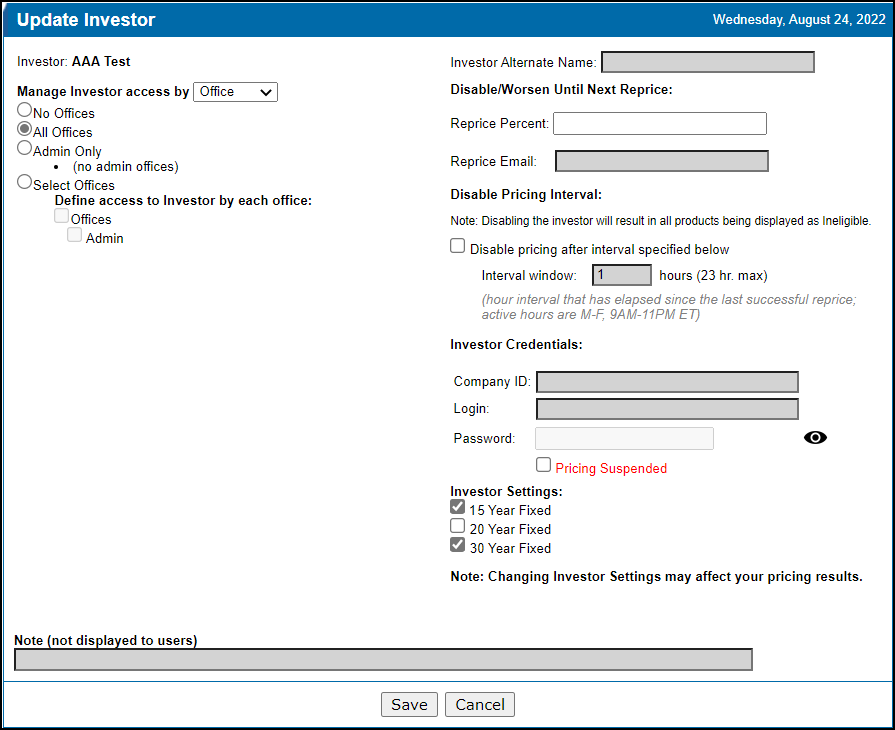

A new Investor Settings section has been added to the Update Investor page. This new section enables/disables client flags for the selected investor. This will enable you to manage these settings without submitting a Technical Support case.

While you can enable/disable the options on the Update Investor page, the options themselves will be maintained by IMT Technical Operations.

To Configure the Investor Settings:

-

Log into EPPS as a Client Admin.

-

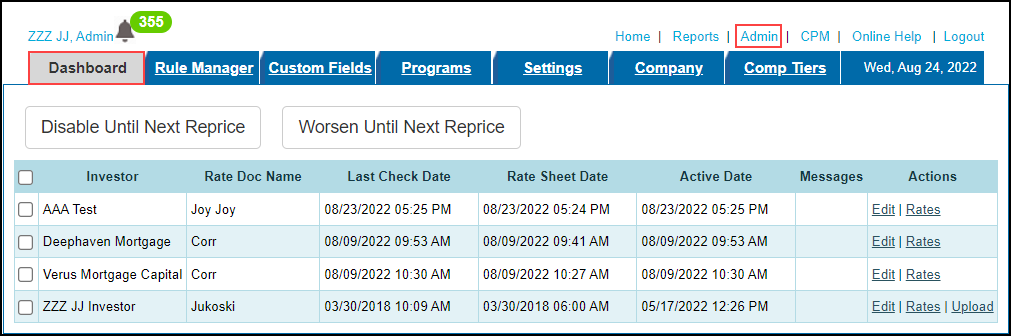

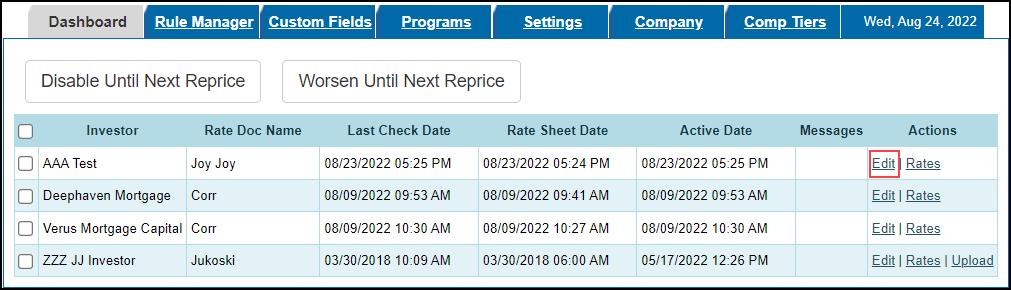

Select the Admin tab, and then select the Dashboard tab.

-

Select an Investor, and then select Edit in the Actions column.

-

In the Investor Settings section, select the client flags you want to enable.

-

Select Save.

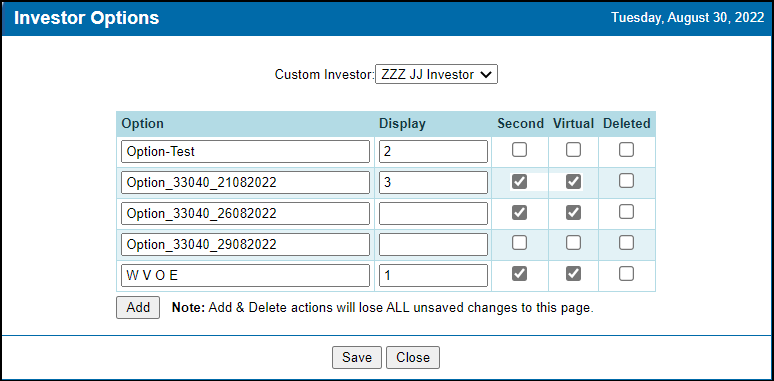

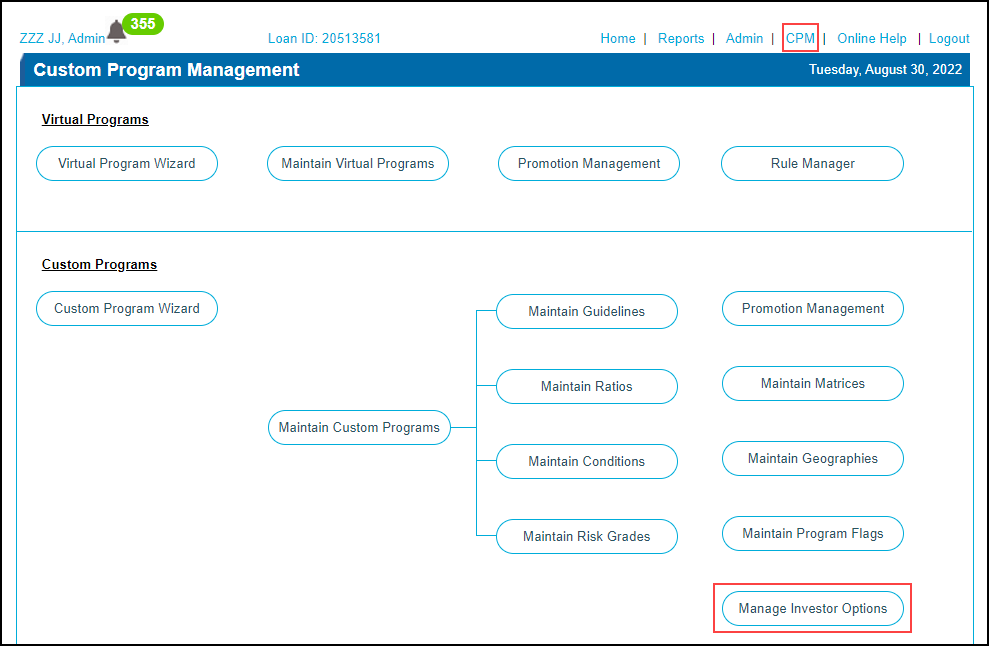

Investor Specific Options

A new Manage Investor Options setting has been added to Custom Program Management (CPM). This new setting enables you to create investor specific options that can be applied on the program level. These investor specific options will be available on the Virtual Program Definition page, as well as Conditions and Matrices.

For example, a variety of loan characteristics (e.g., Low Income, Reduced MI, Section 8, etc.) can be applied to a single 30-year fixed rate program as investor specific options instead of needing several 30-year fixed rate programs with various sets of loan characteristics.

To Add Investor Specific Options:

-

Log into EPPS as a Client Admin.

-

Select the CPM tab, and then select Manage Investor Options.

-

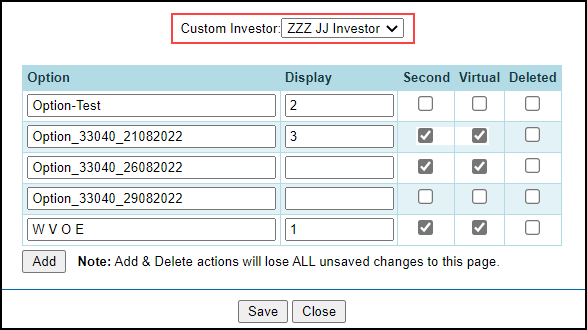

Select an investor from the Custom Investor field.

-

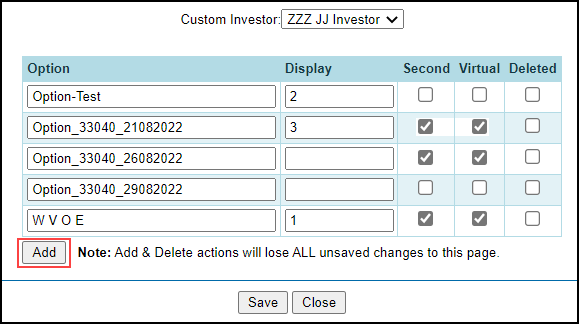

Select Add.

-

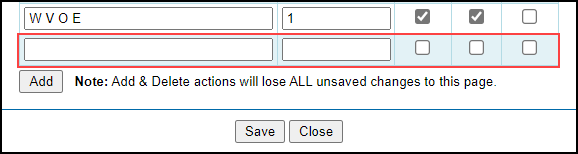

A new row is added to the bottom of the grid.

-

Enter a unique Option name. If the same option name already exists, a message “Option Name must be unique.” is displayed.

-

Enter a Display number if you want the new option to be displayed at a certain position in the list. Based on the screen shot in step 4, entering a “4” would place the new option in 4th place within the list.

-

Select the Second check box to make the option available to second mortgages.

-

Select the Virtual check box to make the option available to virtual programs.

-

Select the Deleted check box to remove the option from the list of investor specific options displayed to users.

-

Select Save.

To Edit Investor Specific Options:

-

Log into EPPS as a Client Admin.

-

Select the CPM tab, and then select Manage Investor Options.

-

Select an investor from the Custom Investor field.

-

In the grid, make your changes.

-

Select Save.

To Delete/Undelete Investor Specific Options:

-

Log into EPPS as a Client Admin.

-

Select the CPM tab, and then select Manage Investor Options.

-

Select an investor from the Custom Investor field.

-

In the grid, select the Deleted check box to remove an option from the list of investor specific options. Clear the Deleted check box to include an option in the list of investor specific options.

-

Select Save.

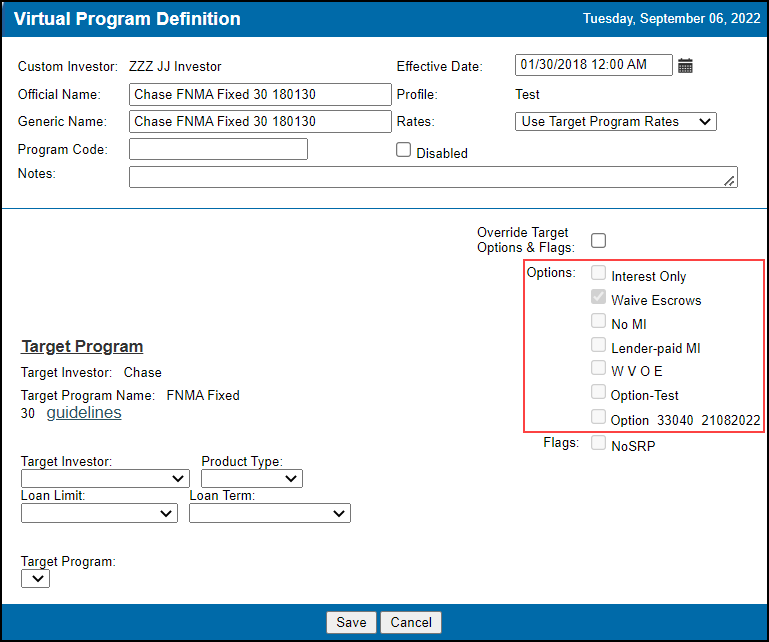

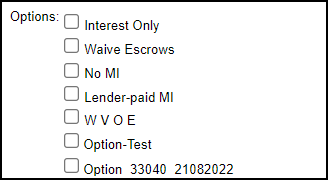

The investor specific options added via the Manage Investor Options setting with the Virtual check box selected will be available on the Virtual Program Definition in the Options section. The investor options will be displayed at the bottom of the list, based on the display order entered in the Investor Options grid.

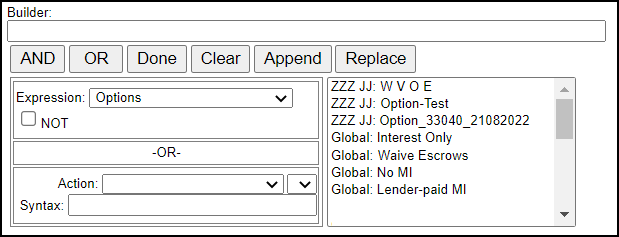

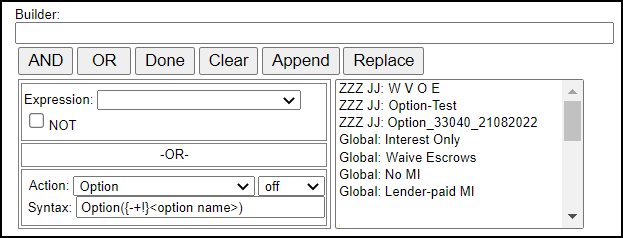

A new “Options” expression and "Option" action have been added to the Builder section of Condition and Matrix definitions. To differentiate between investor specific and global options, the investor options will begin with the investor short name (e.g., ZZZ JJ) while the global options will begin with “Global”.

Options Expression

Option Action

To Use An Option:

-

Once an Option is added, you must enable it, per program, in the Options section of that program’s Custom Program Definition.

-

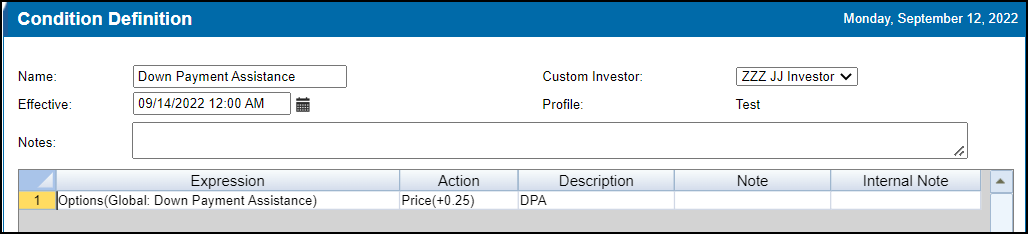

Once an Option is created, you can add it to a condition or matrix. For both a condition and matrix, select an Options expression and then use the action to indicate what should happen. For example, you can create a condition to add 0.25 when the Down Payment Assistance (DPA) option is selected.

This condition will apply a 0.25 price adjustment to any loan that prices with the DPA option selected and displays in the details of the loan as a “DPA LLPA”.

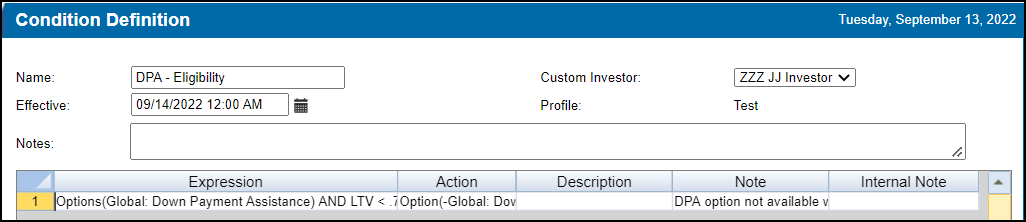

Another example is to create an eligibility condition.

This condition will flag the DPA option as not available and display the note in the Note column to any loan with the DPA option selected and the LTV is less than 70%.

Additional Enhancements

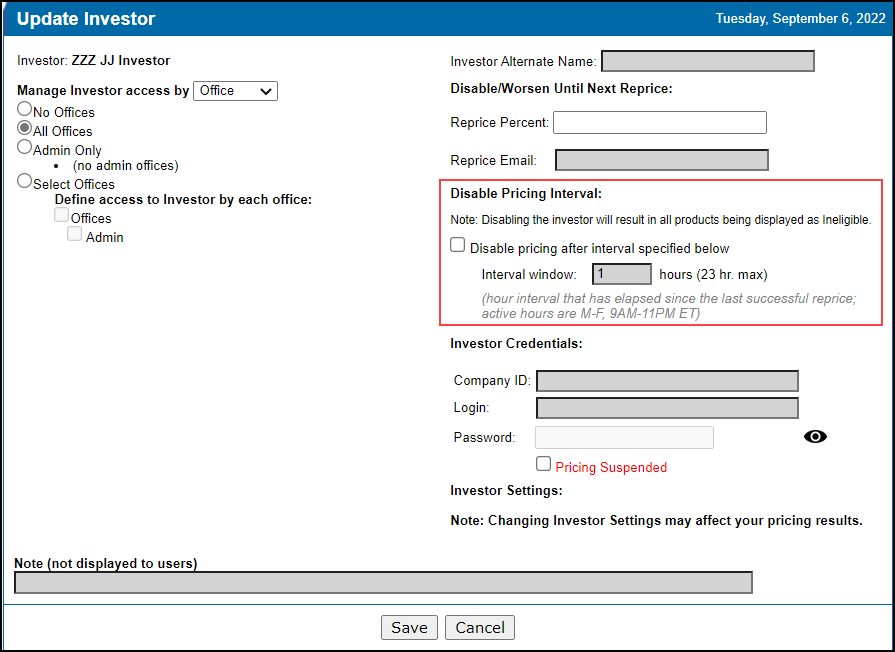

The Stale Pricing options on the Update Investor page have been updated. A new “Disable Pricing Interval” section has been added and the stale pricing options have been renamed and placed in this new section.

-

The Disable Pricing Interval section header has been added.

-

The message “Note: Disabling the investor will result in all products being displayed as ineligible.” has been added.

-

The Disable pricing when stale check box has been renamed to Disable pricing after interval specified below.

-

The Stale Pricing Interval: XXX hours (23 hr. max) field has been renamed Interval window: XXX hours (23 hr. max).

-

The message “(hr interval that has elapsed since the last successful pricing attempt; active hours are M-F, 9AM-11PM ET)” has been updated to “(hour interval that has elapsed since the last successful reprice; active hours are M-F, 9AM to 11PM ET)”.

EPPS has been updated with the 2022 HUD Section 184 loan limits. The new loan limits are available through the Loan Limits table on the CPM tab when the effective date is on or after May 17, 2022 or when the effective date is blank. For loans with an effective date on or after midnight May 17, 2022, EPPS will qualify the loans using the new loan limits for HUD Section 184 products and the loan limits will be displayed in Ineligible Reasons.

Loan with an effective date prior to midnight May 17, 2022 will not be affected.

The Bankruptcy and Notice of Default (NOD) drop down list options have been updated and are displayed on the Finances tab (Bankruptcy and Notice of Default (NOD) fields), the Summary tab, the Summary print preview, and the Summary pdf in the Encompass eFolder.

| Current Text | Updated Text | Bankruptcy/Notice of Default (NOD) API Value (No Change) |

|---|---|---|

| Never or none in the last 7 years | Never or none in the last 7 years | NULL |

| None in last 60 months | Yes within last 60 to 84 months | 60 |

| None in last 48 months | Yes within last 48 to 60 months | 48 |

| None in last 36 months | Yes within last 36 to 48 months | 36 |

| None in last 24 months | Yes within last 24 to 36 months | 24 |

| None in last 18 months | Yes within last 18 to 24 months | 18 |

| None in last 12 months | Yes within last 12 to 18 months | 12 |

| None in last 6 months | Yes within last 6 to 12 months | 6 |

| Within last 6 months | Yes within last 0 to 6 months | 1 |

| Currently in Bankruptcy/Currently in Foreclosure | Currently in Bankruptcy/Currently in Foreclosure | 0 |

As part of the Encompass 22.3 major release, the zip code database and county table will be updated. To maintain consistency between Encompass and EPPS, the same updates that will be made in Encompass will be made in EPPS.

-

For new zip codes, the associated county will be added to the county table.

-

For deleted zip codes, the associated county will be removed from the county table.

-

For county names that do not match between Encompass and EPPS, the Encompass version will be added to the county table.

-

The only zip codes and counties being updated are for the 50 US states plus Guam and Puerto Rico.

As part of the EPPS 22.2 major release, a “View SRPs” user right was added. From this release forward, that user right will be considered when returning SRP adjustments in the following APIs.

-

Eligibility API

-

Adjustments API

-

rateSelector API

Two of the Buydown Type drop down list options have been updated and are displayed on the General tab (Buydown Type field).

| Current Option | Updated Option |

|---|---|

| 1.5-.75 | 1.5-0.75 |

| 1-.5 | 1-0.5 |

A SelfEmployed element has been added to the GetPrograms and eligibility SOAP services.

| Next Section: Fixed Issues |

|

|

|

Previous Section: Introduction |