Feature Enhancements in Version 25.1

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release.

Attention Client Admins

(Added on 3/19/2025)

Starting with the 25.1 release and going forward, UAT environments are only available in Concept Release (CR) instances. If a CR instance is available to you, the UAT information provided in the ICE PPE 24.2 release notes remains relevant.

If you have any questions related to CR instances, contact your relationship manager.

Updates to the ICE PPE Workflow

ICE PPE Float Option

When enabled, the Float button will be displayed next to the Request Lock button on the Summary page.

For information on the Float admin setting, refer to the entry entitled Support for New ICE PPE Float Option Added to Settings in the Updates to ICE PPE section.

-

When the Float button is selected, program and pricing data will be pushed to the Lock Request Form without locking the loan.

-

The following fields will be pre-populated on the Lock Request Form so the values do not need to be manually entered.

-

Base ARM Margin (field ID 2647)

-

Total ARM Margin Adjustments (field ID 2688)

-

Net ARM Margin Expected (field ID 2689)

-

Base Price (field ID 2101)

-

Total Price Adjustments (field ID 2142)

-

Net Price (field ID 2143)

-

Starting Adjust Price (field ID 3874)

-

Credit to Borrower (field ID NewHud.X1143) - If Commission is positive set

-

Value will be entered as a positive rate in Encompass

-

Fee to Borrower (field ID NewHud.X1150) - If Commission is negative set

-

Value will be entered as a positive rate in Encompass

-

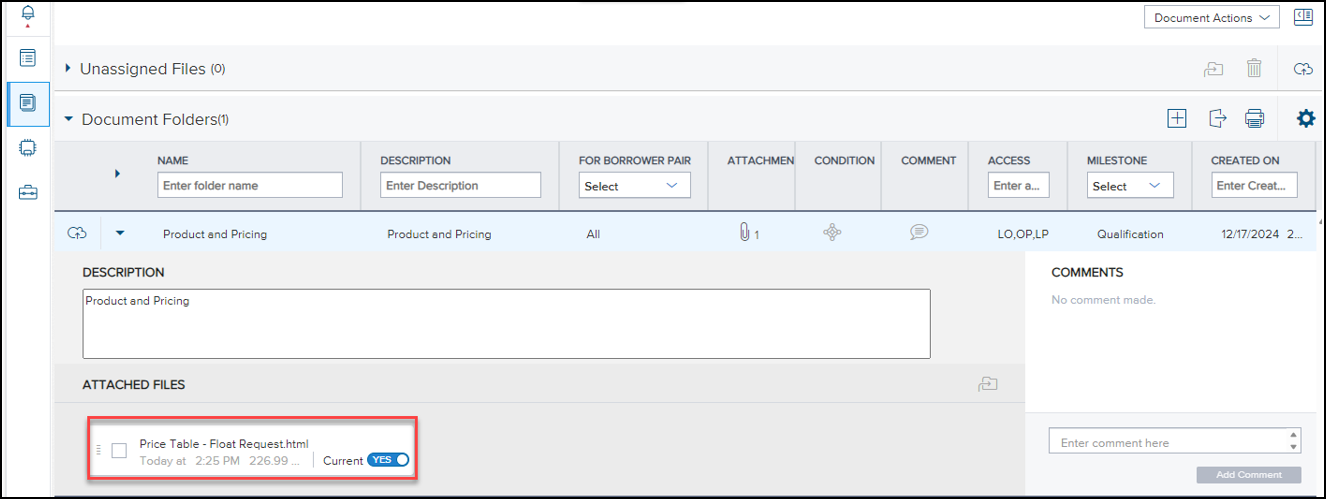

When the Float button is selected, a Price Table - Float Request document link is generated and available under Documents. The link opens a document that captures the rates at the time of the Float.

-

The read-only Float Updated on field (5035) on the Lock Request Form provides users with a way to view the float date and determine if a float rate lock has been requested.

There is a known issue with the Total Loan Amount and Financed Fee when a USDA loan is floated. When a loan is locked, the loan amount and fee are automatically adjusted to reflect the recursive nature of the USDA fee when sent to Encompass. However, when a loan is floated, the adjustment is not applied and the two values sent to Encompass are the same values in ICE PPE.

EPPS-77206

Assumed Income

The Update Lock Request Form and the Request Lock buttons on the Lock Summary page are disabled when the disableLock property in the rateSelector response is "True".

For information on disableLock, refer to the entry entitled "disableLock" Property Added to rateSelector and loanQualifier/loanProgram Responses in the Updates to ICE PPE section.

When a mouse pointer hovers over the disabled button, a tool tip "Locking this Loan Program has been disabled by your Administrator." is displayed.

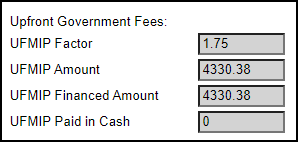

Government Upfront Fees

The selection of Product Types on the Options page under Settings has been modified as follows:

-

Any combination of Agency, Non-Agency, and Non-QM

and

-

FHA, VA, or USDA

-

If more than one product is selected, a validation message "Only one of FHA, VA, or USDA can be selected." is displayed.

If a transaction has a combination of FHA, VA, and USDA selected, your user will be redirected back to the Search page to select only one of the Standard Products.

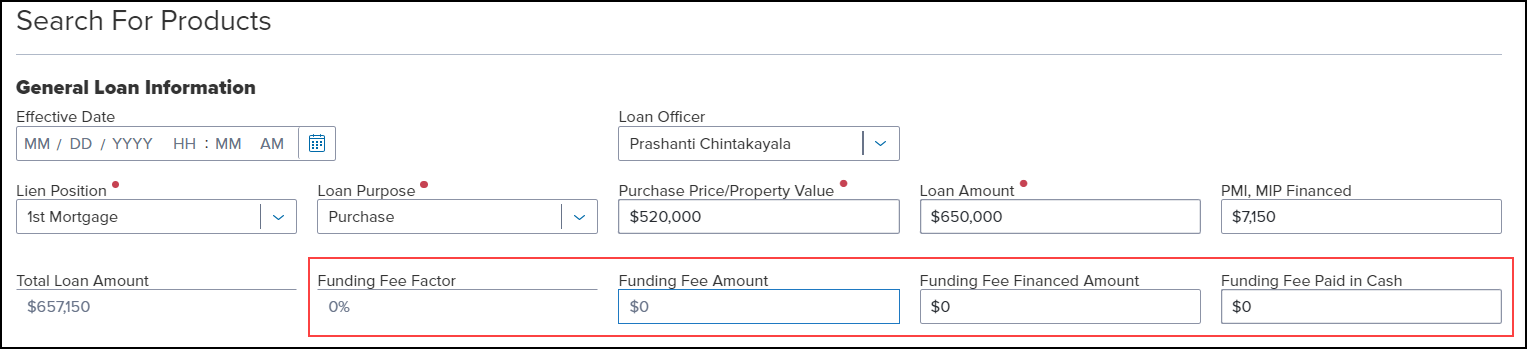

The Search page has been updated to support government upfront fees.

-

The Government Upfront Fee fields are displayed when "FHA", "VA", or "USDA" is selected as the Standard Product.

-

The field labels will be determined by the Standard Product selected.

-

If "FHA" is selected, the fields will be labeled "UFMIP Factor", "UFMIP Amount", "UFMIP Financed Amount", and "UFMIP Paid in Cash".

-

If "VA" is selected, the fields will be labeled "Funding Fee Factor", "Funding Fee Amount", "Funding Fee Financed Amount", and "Funding Fee Paid in Cash".

-

If "USDA" is selected, the fields will be labeled "Guarantee Fee Factor", "Guarantee Fee Amount", "Guarantee Fee Financed Amount", and "Guarantee Fee Paid in Cash".

-

The factor and amount fields are read-only while the financed amount and paid in cash fields can be edited.

-

The factor field displays a percent up to two decimal places.

-

The amount field displays a dollar amount.

-

UFMIP Amount - Defaults to (Base Loan Amount * UFMIP Factor)

-

Funding Fee Amount - Equal to (Base Loan Amount * Funding Fee Factor)

-

Guarantee Fee Amount - Equal to (Base Loan Amount * Guarantee Fee Factor)

-

The financed amount field accepts a dollar amount.

-

UFMIP Financed Amount - Defaults to UFMIP Amount

-

Funding Fee Financed Amount - Defaults to Funding Fee Amount

-

Guarantee Fee Financed Amount - Defaults to Guarantee Fee Amount

-

The paid in cash field accepts a dollar amount.

-

UFMIP Paid in Cash Amount - Defaults to zero

-

Funding Fee Paid in Cash Amount - Defaults to zero

-

Guarantee Fee Paid in Cash Amount - Defaults to zero

-

The financed amount and paid in cash fields are editable and will display a validation message "The sum of Financed and Paid in Cash must equal the total upfront fee." if the sum does not equal the total upfront fee.

-

The financed amount will be included in the Total Loan Amount calculation.

The following APIs have been modified as follows:

-

The loanQualifier REST API has been modified to save the "Is this the first use of the VA loan program" (field ID VASUMM.X49) field to the loan table.

-

The Rates Partner Service API has been modified to accept VASUMM.X49 (if required).

The Government Upfront Fee fields have been added to the ICE PPE integration transaction response.

For FHA/VA loans, the following fields have been added to the ICE PPE integration transaction response.

-

Field 1826

-

Field 1760

-

Field 1107 (auto calculated field)

-

Field 1045 (auto calculated field)

For USDA loans, the following fields have been added to the ICE PPE integration transaction response.

-

Field 3560

-

Field 3566 (Entire or Portion of the guarantee fee will be financed)

-

If fee financed amount and fee amount are equal, then field 3566's value is "FinancingAll". Otherwise the value is "FinancingPortion".

-

Field 3563

-

Field 1045 (auto calculated field)

In addition, the fee fields have been added to the rateSelector response.

These fields are only returned when the "Government Upfront Fees" option is selected on the ICE PPE Update Lock Request Fields page under Settings.

Rate Alerts

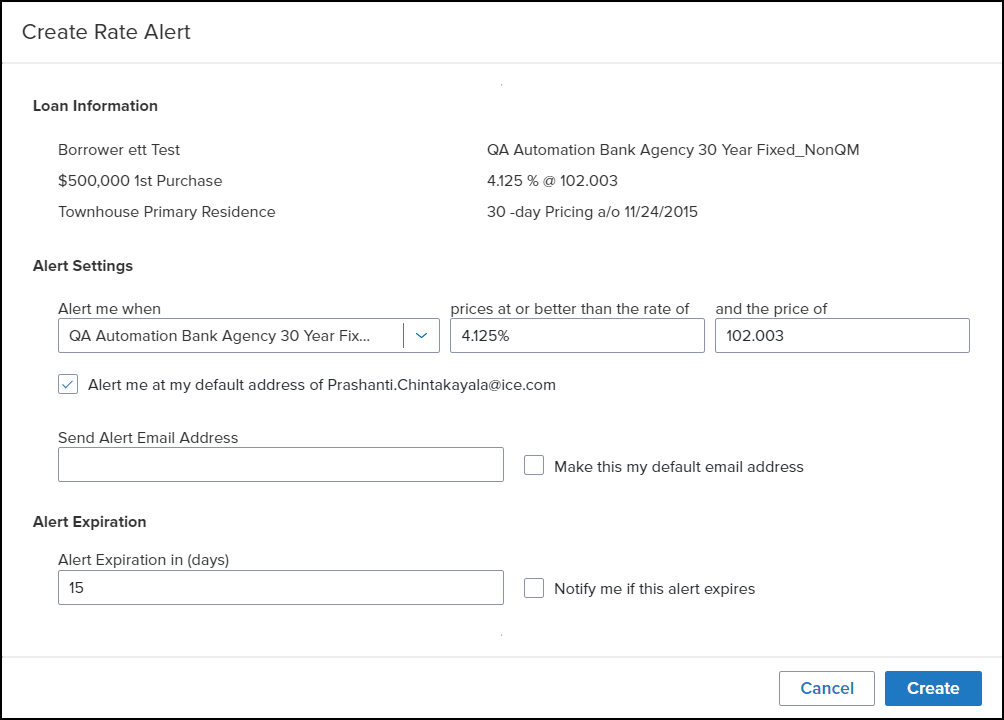

A Rate Alert button has been added to the bottom of the Summary page and a Rate Alert icon has been added to the top right corner of the Summary page.

Rate Alert Button

Rate Alert Icon

![]()

Selecting either the Rate Alert button or icon enables you to create an alert.

To Create an Alert:

-

From the Alert me when dropdown list, select either the current program or "any similar program".

-

In the prices at or better than the rate of field, either leave the rate as is or enter a different rate.

-

In the and the price of field, either leave the price as is or enter a different price.

-

If the default email address displayed is where you want the alert sent, leave the checkbox selected.

-

If you want the alert to be sent to a different email address, enter it in the Send Alert Email Address.

-

If you want this email address to be your default, select the Make this my default email address checkbox.

-

In the Alert Expiration in (days) field, enter the number of days you want the alert to be active.

-

If you want to be notified when the alert expires, select the Notify me if this alert expires checkbox.

-

Select Create.

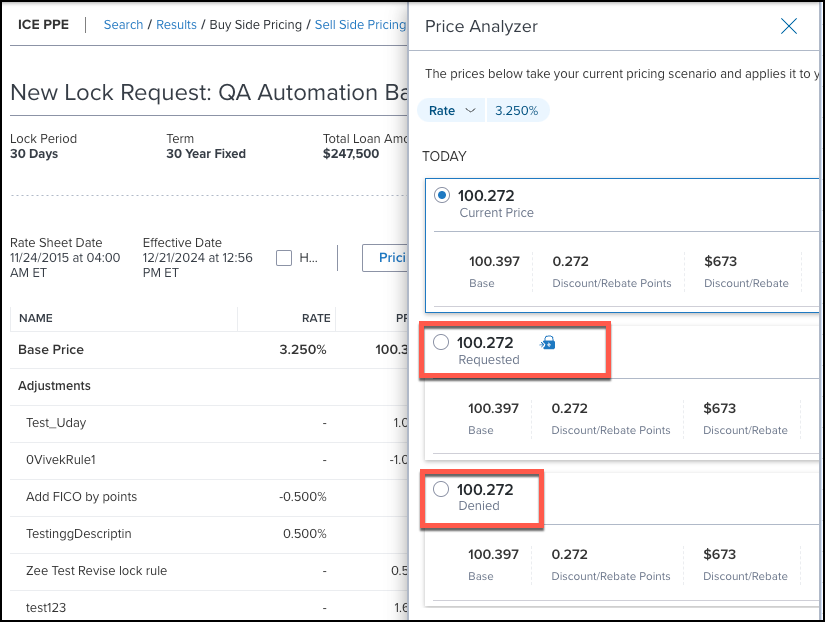

Get Buy Side Price Analyzer Updates

When all the pricing displayed on the Get Buy Side Price Analyzer slide in panel is identical, the Worst Case (![]() ) icon is no longer displayed.

) icon is no longer displayed.

EPPS-74194

The snapshots on the Get Buy Side Price Analyzer slide in panel now display the actual Request Type.

EPPS-74200

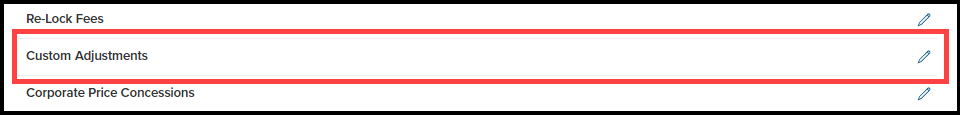

Manual Adjustments

The following updates have been made to the Buy Side Pricing page.

-

The "Custom Price Adjustments" section has been renamed to "Custom Adjustments".

-

The "Custom Price Adjustments" slide in panel has been renamed to "Custom Adjustments" and a new Rate field has been added.

-

Either the Rate or Price field must be entered.

-

The rate adjustments will be displayed on the Summary page.

The new Custom Adjustment Rate field has been added to the ICE PPE API.

Additional Enhancements

The Lock # of Days in the Update Lock Request Fields modal will no longer be displayed for a new lock (New Value is always blank).

When a required field error is generated for a missing field located in a collapsed section, that section will now be forced open to make the missing field easier to find.

A new Online Help link has been added to the following ICE PPE pages.

-

Search

-

Results

-

Summary

-

Buy Side Pricing

-

Sell Side Pricing

When selected, the ICE PPE help site is opened.

Updates to ICE PPE

ICE PPE Float Option

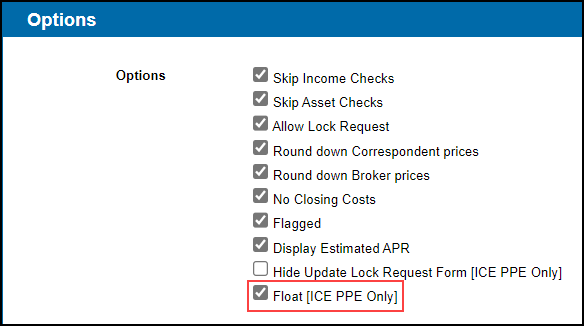

The following additions have been made to Settings to support the new ICE PPE Float option.

-

On The Options page, a new Float (ICE PPE Only) option has been added to the Options page under Settings.

-

When enabled, the Float button will be displayed next to the Request Lock button on the Summary page.

This Float feature does update fees in the 2015 Itemization in Encompass. We encourage you to thoroughly test this feature and adjust, if needed, any of your current Encompass business rules before enabling this feature.

-

The Update Lock Request button is removed.

-

The Float button will only appear when the loan does not have an active lock, expired lock, or canceled lock.

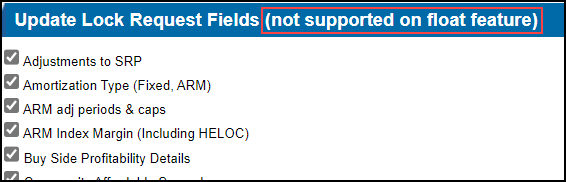

-

On the Update Lock Request Fields page, "not supported on float feature" has been added to the page header.

This addition was made to clearly indicate that the Update Lock Request Fields options are not supported when the Float (ICE PPE Only) option is enabled.

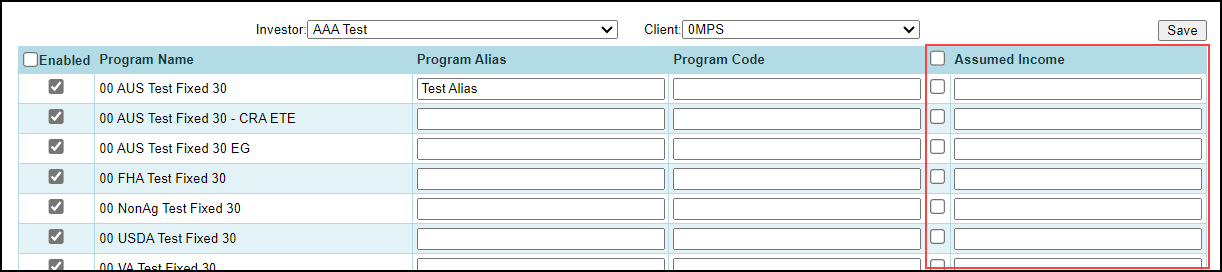

Assumed Income

Two new Assumed Income columns, one for a checkbox and the other for an amount, have been added to the Programs grid.

When enabled (checkbox selected), a Client admin can configure default income, ranging from zero to 10,000,000, for specific products/product categories. This will allow Loan Officers to price before receiving actual income values to return a wider array of products.

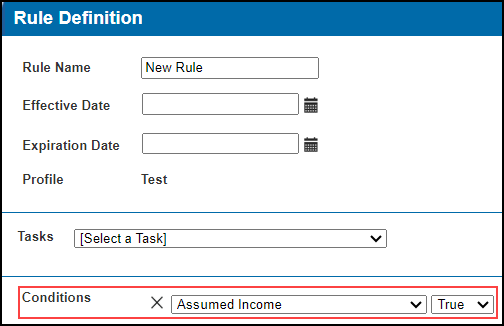

A new Assumed Income condition has been added to the Rule Manager. This new condition identifies when assumed income is used in Qualification so income-sensitive programs can be prevented from being returned to ICE PPE.

A new AssumedIncome expression has been added to the Condition, Rate, and Rate Matrix Definitions. This expression sets AssumedIncome to "True" when Assumed Income is enabled and it is used to calculate the Annual Income for a program.

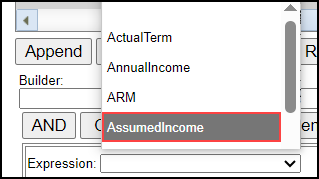

A new Disable Lock rule task has been added to the Rule Manager. This new task disables the Update Lock Request Form button on the Lock Summary page and the Update Encompass button on the Summary tab when the task is "True".

When a mouse pointer hovers over a disabled button, a tool tip "Locking this Loan Program has been disabled by your Administrator." is displayed.

Upon execution, this new method sets the program-level DisableLock property to "True" and the property is returned in the Qualification results.

EPPS-67240, EPPS-67867, EPPS-70973

The AnnualIncome calculation has been updated to use the Assumed Income when the calculated AnnualIncome is zero or null.

disableLock has been added to the rateSelector and loanQualifier/loanPrograms responses. By default, the value will be "False".

The disableLock property is a boolean data type where "True" indicates locking is disabled.

Government Upfront Fees

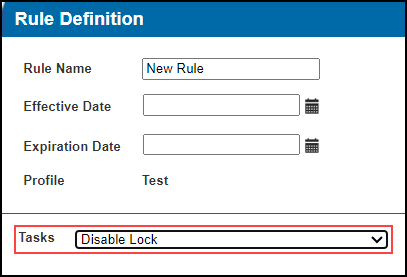

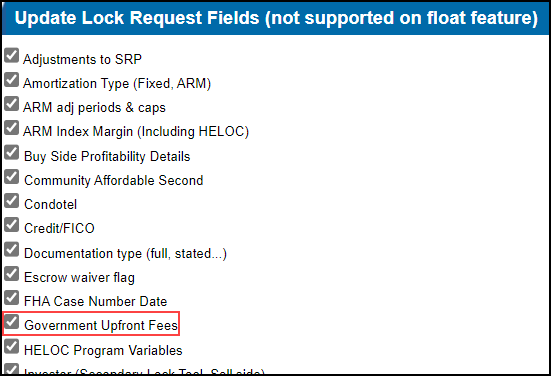

A new Government Upfront Fees option has been added to the Update Lock Request Fields page under Settings. By default, this option will not be selected for new and existing Clients.

The selection of Product Types on the Options page under Settings has been modified as follows:

-

Any combination of Agency, Non-Agency, and Non-QM

and

-

FHA, VA, or USDA

-

If more than one product is selected, a validation message "Only one of FHA, VA, or USDA can be selected." is displayed.

The General tab has been updated to support government upfront fees.

-

A new Upfront Government Fees section is displayed when "FHA", "VA", or "USDA" is selected as the Standard Product.

-

The field labels will be determined by the Standard Product selected.

-

If "FHA" is selected, the fields will be labeled "UFMIP Factor", "UFMIP Amount", "UFMIP Financed Amount", and "UFMIP Paid in Cash".

-

If "VA" is selected, the fields will be labeled "Funding Fee Factor", "Funding Fee Amount", "Funding Fee Financed Amount", and "Funding Fee Paid in Cash".

-

If "USDA" is selected, the fields will be labeled "Guarantee Fee Factor", "Guarantee Fee Amount", "Guarantee Fee Financed Amount", and "Guarantee Fee Paid in Cash".

-

The factor and amount fields are read-only while the financed amount and paid in cash fields can be edited.

-

The factor field displays a percent up to two decimal places.

-

The amount field displays a dollar amount.

-

UFMIP Amount - Equal to (Base Loan Amount * UFMIP Factor)

-

Funding Fee Amount - Equal to (Base Loan Amount * Funding Fee Factor)

-

Guarantee Fee Amount - Equal to (Base Loan Amount * Guarantee Fee Factor)

-

The financed amount field accepts a dollar amount.

-

UFMIP Financed Amount - Defaults l to UFMIP Amount

-

Funding Fee Financed Amount - Defaults to Funding Fee Amount

-

Guarantee Fee Financed Amount - Defaults to Guarantee Fee Amount

-

The paid in cash field accepts a dollar amount.

-

UFMIP Paid in Cash Amount - Defaults to zero

-

Funding Fee Paid in Cash Amount - Defaults to zero

-

Guarantee Fee Paid in Cash Amount - Defaults to zero

-

The financed amount and paid in cash fields are editable and will display a validation message "The sum of Financed and Paid in Cash must equal the total upfront fee." if the sum does not equal the total upfront fee.

-

The financed amount will be included in the Total Loan Amount calculation.

The following fields have been added to the loanQualifier and eligibility responses.

-

FeeAmount

-

FeeAmountFinanced

-

FeeAmountPaidinCash

For FHA/VA loans, the following fields have been added to the ICE Mortgage Technology Partner Network Out.

-

Field 1826

-

Field 1760

-

Field 1107 (auto calculated field)

-

Field 1045 (auto calculated field)

For USDA loans, the following fields have been added to the ICE Mortgage Technology Partner Network Out.

-

Field 3560

-

Field 3566

-

Field 3563

-

Field 1045 (auto calculated field)

These fields are only returned when the "Government Upfront Fees" option is selected on the Update Lock Request Fields page under Settings.

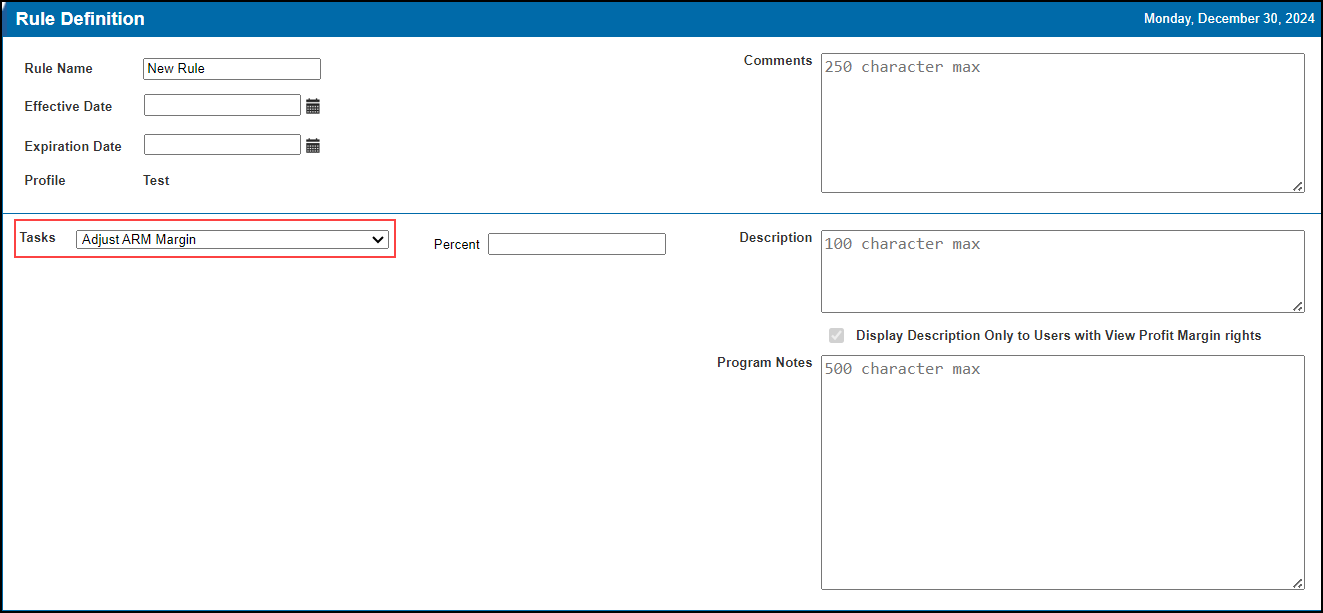

Additional Enhancements

A new Adjust ARM Margin rule task has been added to the Rule Manager. This new task adjusts the ARM Margin by a client-specified amount. The adjustment must be a percent, to three decimal positions, in the range of -25.000% to 25.000%.

To enable users to use a Freddie Mac Mission Score to determine eligibility and pricing adjustments, ICE PPE now supports the Agency Mission Score.

EPPS-73293

| Next Section: Fixed Issues |

|

|

|

Previous Section: Introduction |