Fixed Issues for Version 25.3 (Banker Edition)

This section describes the issues that have been fixed in this release.

Why we fixed these issues: These issues were fixed to improve usability and to help ensure Encompass is operating as expected. The issues that are chosen to be fixed are based on the severity of their impact to clients and client feedback.

Encompass Forms and Tools

To help ensure the Adjusted Fully Indexed Rate field (3296) is populated correctly for adjustable rate HELOC transactions, the system calculation for this field has been updated.

The previous calculation used with HELOC loans for 3296 was:

The Margin (689) + the Index (688) - 0.49, rounded to an integer based on the rounding logic indicated in field SYS.X1 (round up or round down) and 1700 (the nearest value to round to).

The new calculation used with HELOC loans for 3296 is:

The Margin (689) + the Index (688), rounded to an integer based on the rounding logic indicated in field SYS.X1 (round up or round down) and 1700 (the nearest value to round to).

The Good Faith Fee Variance Violated alert is generated when there is a variance between the LE and 2015 Itemization in the Total Good Faith Amount section (field ID FV.X345) of the Fee Variance Worksheet or when there is a variance between the CD and 2015 Itemization in the Total Good Faith Amount section (field ID FV.X347) on the worksheet. An issue was introduced in Encompass 23.1 with this alert and closing cost fees entered on lines 1203, 1204, or 1205 of the 2015 Itemization when using fee level disclosures (4461). When a fee entered on one of these lines created an applicable fee variance, and new fees were added to other lines on the 2015 Itemization, the alert was triggered as expected for both fees, but when the user took the needed action to clear the alert for one of the fee lines, the alert was actually cleared for fees on lines 1203, 1204, or 1205 too.

For example, when a fee on Line 1203 of the 2015 Itemization was disclosed as Seller Obligated, and then changed to Borrower Paid, and an additional new fee was then added to the 2015 Fee Itemization input form, the Good Faith Fee Variance Violated alert was triggered as expected showing both fees. However, when a valid Change of Circumstance was added for the newly added fee (not the fee on Line 1203), and then the LE was redisclosed, the Good Faith Fee Variance Violated alert was cleared for the newly added fee and the fee on Line 1203.

This issue has been fixed and now the alert is only cleared for the fee lines that are actually updated to clear the alert.

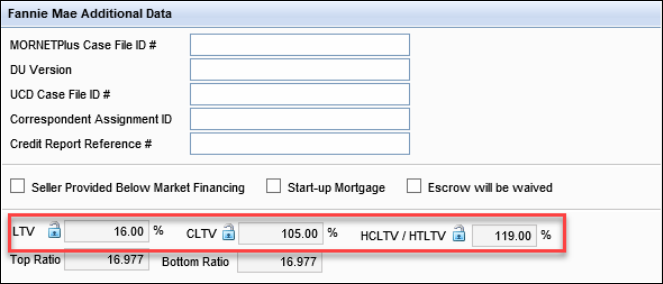

On FHA and VA loans, Fannie Mae's Desktop Underwriter (DU) was indicating different LTV ratios than what was calculated by Encompass. This discrepancy occurred because Encompass was rounding the ratio up, while DU was not (i.e., DU indicated 96.50% while the ratio on the AUS Tracking tool in Encompass indicated 97.00%.) To address this issue in Encompass 25.3, Encompass has been updated to calculate the LTV for FHA and VA loans the same way DU does. Here is how the rounding for LTV (MORNET.X75), CLTV (MORNET.X76), and HCLTV (MORNET.X77) for FHA and VA will be rounded in new loans started in Encompass 25.3:

-

These ratios will display two digits past the decimal, rounding up half on the third decimal.

-

If the third digit past the decimal is 5 or higher, the ratio will be rounded up.

-

If the third digit past the decimal is below 5, the ratio will be rounded down.

Migration Notes:

-

For existing FHA and VA loans created prior to Encompass 25.3 that have LTV, CLTV, or HCLTV/HTLTV values that have been locked, the locked values will be retained.

-

For FHA and VA loans that are in an inactive status (i.e., the Current Status (1393) is not set to Active Loan), they will not be updated. The fields for LTV, CLTV, and HCLTV/HTLTV will be locked to retain their current value.

-

For FHA and VA loans that are in active status (i.e., the Current Status (1393) is set to Active Loan), the new rounding logic will be applied.

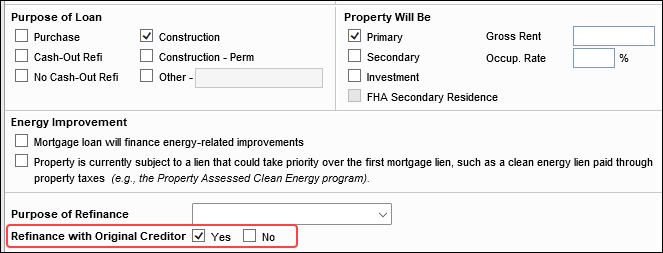

For Construction only or Construction - Perm loans (19) that are refinanced (Constr.Refi), the Refinance with Original Creditor Yes/No checkboxes (QM.X2) are now activated and may be selected on the 1003 URLA - Lender, RegZ - LE, RegZ - CD, and the Rural Assistance URLA tab on the USDA Management input forms. In previous versions of Encompass, the Refinance with Original Creditor Yes/No checkboxes were cleared out and deactivated for these loans, which prevented users from making a selection.

When the loan is a Construction or Construction - Perm loan (19) but it is not being refinanced (i.e., the Refinance Owned (Constr.Refi) checkbox is not selected), then the Refinance with Original Creditor Yes/No checkboxes will continue to be cleared out and deactivated.

In previous versions of Encompass, when the Final Buy Amount (3578) on the Correspondent Purchase Advice loan was locked, the value was not used when calculating the Final Buy Price (3583). Instead, the Final Buy Price was always calculated using the system calculated value for the Final Buy Amount instead of the locked value in the field. This could result in the incorrect buy amount being wired to investors. Starting in Encompass 25.3, the Final Buy Price will be calculated based on the locked value in the Final Buy Amount field when applicable. If the Final Buy Amount value is system calculated (i.e., not locked), then the system calculated value will be used as expected.

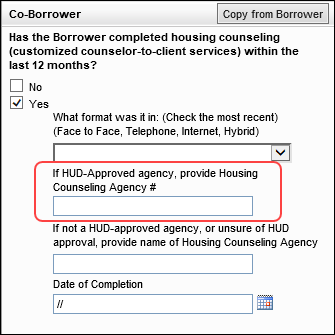

In previous versions of Encompass, on the 1003 URLA - Lender input form, an Edit icon was provided next to the Co-Borrower field where the Housing Counseling Agency number for the co-borrower could be entered (URLA.X161). Clicking this icon resulted in the Quick Entry - Home Counseling Providers pop-up window where the Home Counseling agency contact information could be entered, along with options to add additional agencies to the Home Counseling Provider List. However, the data entered in this quick entry window is only intended for the borrower. The information added here, though intended for the co-borrower, was populating to the borrower specific fields. To address this issue, the Edit icon for co-borrower field URLA.X161 has been removed.

As an alternative to the Edit icon previously provided for URLA.X161, users can click the Copy from Borrower button in the Co-Borrower section to populate the co-borrower information. In addition, the Housing Counseling fields for the borrower and co-borrower do allow manual data entry. If different agency information is needed for the co-borrower or borrower, it can be manually entered.

On the ULDD/PDD input form's Fannie Mae tab, the Transaction Details box, the name of the MERS Registration Status Type field (ULDD.X215) was incorrectly displayed as MERG Registration Status Type. This typo has been fixed.

An issue occurred where the Lock Date (field ID 2149) field on the Secondary Lock Tool was erroneously updated to the current date when an existing lock was revised, Get Buy Side Pricing was clicked, pricing was selected in ICE PPE, and then the pricing data was imported back to Encompass. This issue has been resolved and the original lock date is now imported into the Lock Date field.

This issue only occurred when the Encompass Product & Pricing Service integration was used for the original lock.

An issue occurred when a TPO Organization with an extremely large number of external users was selected on the TPO Information tool. Encompass froze indefinitely because the tool attempted to populate the Loan Officer Name (field ID TPO.X62), Loan Processor Name (field ID TPO.X75), and Correspondent File Contact Name (field ID TPO.X96) dropdown fields from the pool of external users, based on the user’s role.

This issue has been resolved as follows:

-

The Loan Officer Name, Loan Processor Name, and Correspondent File Contact Name dropdown fields have been replaced with read-only fields.

-

An Edit icon has been added to each field. When the Edit icon is selected, a popup of all available external users, based on the user’s role, is displayed.

If no contacts are available, a message “No Contacts found!” is displayed.

![]()

-

When the TPO Information tool is subsequently accessed, only the external users selected in the Loan Officer Name, Loan Processor Name, and Correspondent File Contact Name fields are retrieved. If a field is blank, no external user is retrieved until one is selected.

Encompass Settings

The Force user to change password option and the password expiration policy in Encompass were not being honored in certain applications and users were permitted to log in with their expired Encompass password. In the Encompass 25.4 release currently targeted for November 2025, this issue will be addressed. This may result in many users being blocked from logging into their application until they change their password as soon as their company upgrades to Encompass 25.4 in Production environments.

Details and Impacted Users:

When the Encompass administrator selects the Force user to change password option on a user’s profile, or if the password has expired based on the Password Expiration policy (# of Days to Expiration option managed in Admin Tools > Server Settings Manager > Password), the next time the user attempts to log into an application they should be prevented from logging in until the password is changed. However, this setting was not being enforced for Encompass users logging into the following applications with their expired Encompass password:

-

Encompass web interface

-

Encompass Consumer Connect Admin portal

-

Encompass Data Connect

-

Encompass TPO Connect website

-

Encompass TPO Connect Admin Portal

-

Encompass Developer Connect API (OAuth Token response)

-

Encompass Developer Connect Portal (API Keys, SSO Setup, MFA setup)

-

Insights

-

ICE Mortgage Technology Resource Center (Login with Encompass via Access Login)

-

Marketplace (login with Encompass via Access Login)Details and Impacted Users:

In addition, the password expired policy was also not being enforced for external TPO users logging into their assigned TPO Connect websites. If the administrator reset the TPO user password, or if the password had expired based on the Password Expiration policy (# of Days to Expiration managed in Admin Tools > Server Settings Manager > Password), the TPO user was still able to log in with their temporary or expired password.

Starting with the Encompass 25.4 release, if the user’s password has expired or if the Force user to change password option has been selected on their user profile, the user will be prevented from logging into the applications listed above until their password is changed. The users will be required to change their password by logging into the Encompass desktop interface and then following the steps in the resulting change password pop-up notification. They may also contact their Encompass system administrator for assistance.

External TPO users will also receive a change password pop-up notification when they try to log into their TPO Connect website. They must follow the steps in the notification to change their password.

Please note, this change does not impact Encompass desktop interface users, nor users who are signing in with their company SSO.

Recommendations:

To help reduce the number of users who will be required to change their password when Encompass 25.4 is released, administrators can notify intended users now to proactively change their password prior to the Encompass 25.4 release. In addition, it is recommended that Encompass administrators review the user profiles to determine that the Force user to change password option is only selected for the intended users who should be required to change their password.

TPO Connect administrators can also notify external TPO users to change their password prior to the Encompass 25.4 release.

An issue occurred where Persona Access to Fields business rules set up to hide or deactivate the Automate Analyzer Income checkbox (ANALYZER.X18) on the Income Analyzer Message screen based on the user's assigned persona was not operating correctly. The checkbox field was still displayed and active for users with the assigned persona even though the rule was set up to hide it or deactivate it from them. This issue has been resolved and the Persona Access to Fields business rules are now operating correctly and the rule is enforced as expected.

An issue occurred with the Encompass Settings > Tables and Fees > Itemization Fee Management table where the compliance fees selected in the table were not displaying in the correct section of the 2015 Itemization input form. Specifically, if a compliance fee was selected to display in a section of the Itemization input form, the fee was actually displaying in the section below the section selected in the Itemization Fee Management table. For example, if the Title Search fee was indicated in the Itemization Fee Management table to display in Section 1100 of the form, the fee was actually displaying in Section 1200 of the 2015 Itemization input form. The cause of this issue was identified and addressed. The compliance fees are now displaying in the correct section of the Itemization form based on the section indicated in the Itemization Fee Management table.

Encompass Developer Connect APIs

An issue occurred where InternalUser webhook update events were being generated each time an administrator user simply logged into the Encompass desktop interface and then opened the Encompass > Settings screen. These webhook events should have only been generated when a user profile for an internal user was updated in Encompass Settings > Company/User Setup > Organization/Users > User Details. This issue has been resolved and the extraneous webhook events are no longer generated when an administrator opens the Encompass Settings.

ICE will be transitioning from legacy Encompass SDK (Software Development Kit) integrations. This enables our clients, partners and ICE to continue to innovate and automate by eliminating legacy integrations and focusing on modern technology. ICE is transitioning clients and partners off SDK-based applications and plug-ins (lender, partner and ICE created) by December 31, 2026.

-

Standalone SDK modules (transition to Developer Connect APIs)

-

SDK loan plugins (migrate to SSF framework and NG plugin framework)

APIs for the most common SDK functions and native Encompass functionality will eliminate the need for many legacy SDK use cases. Encompass APIs are interoperable across web and desktop, as both user interfaces sit on top of the same underlying Encompass loan file. Alternatives to SDK functionality are available with more coming. There may not be 100% parity, but we will provide the most common functions and alternatives. For more information, refer to the Transitioning from SDKs and Legacy Integrations - FAQs.

Here is a list of the known Plugin issues that have been addressed or are targeted for to be fixed in upcoming Encompass releases.

| Known Issue | Encompass Release for Fix |

|---|---|

| Plugins 2.0 premilestoneComplete event not returning Data parameter in Encompass desktop interface (NICE-53462) | 25.3 |

| Plugins 2.0 precommit event not returning Data parameter in Encompass desktop interface (NICE-53422) | 25.3 |

| Plugins 2.0 precommit event not allowing cancel in Encompass desktop interface (NICE-53421) | 25.3 |

| Plugins 2.0 premilestoneComplete event not allowing cancel in Encompass desktop interface (NICE-53463) | 25.3 |

| Plugins 2.0: SSF getField() method must match case of custom field name or error is returned (ENCW-122154) | 25.4 (Targeted) |

| Plugins 2.0: getfield() of custom field of format 'Y/N' returns different values in desktop and web (NICE-53298) | 25.4 (Targeted) |

Fixed Issues for Version 25.3.0.1 Server Patch 1

(Added on 8/4/2025)

This update contains an update to users' Encompass client machines (25.3.0.1) and a Server Patch (server patch 1) that is applied to the Encompass server. The fixed issues below are included in this update.

In Encompass, go to Help > About Encompass in the menu bar to view your Encompass version. Once the upgrade is complete, your new version number will be 25.3.0.1 Server Patch 1.

The Encompass SDK has been repackaged with this 25.3.0.1 Server Patch 1 update. If you are utilizing the Encompass SDK, upgrading to this new package is needed to ensure that your SDK has the same functionality as this latest version of Encompass. Visit the Encompass SDK and Other Install Files page to access the latest download links to

Update to the Encompass Server (server patch 1)

Below is the update in the Server Patch (server patch 1) that is applied to the Encompass Server. The Server Patch contains the relevant Encompass code that applies to the following fixed issue. The Server Patch included with this release will be applied to the Encompass Server automatically and cannot be controlled manually via the Encompass Version Manager tool.

(Added on 8/4/2025)

On the Encompass Home page, an issue occurred in some Encompass instances with the Customization Reporting module where the Advanced Code tab was not displaying any data even though there were business rules or custom fields in the Encompass instance that contained advanced code. This issue has been fixed and the applicable instance ID, number of occurrences of advanced code checked against the Encompass Lending Platform, the number of occurrences that passed the validation process, and the number that failed the validation process now display on the Advanced Code tab as expected.

NICE-55545

Update to the Client Machines (25.3.0.1)

Below are the updates which will be applied to users' Encompass client machines (25.3.0.1). The client-side update can be controlled manually via the Encompass Version Manager tool. If the tool has been configured to always apply new releases to users’ computers automatically, users will receive this update upon their initial log in of Encompass following the release.

(Added on 8/4/2025)

A new analysis tool originally included with Encompass 25.3 in the Encompass Settings > Loan Setup > Loan Custom Fields setting has been rolled back and is no longer included in Encompass the 25.3.0.0 and 25.3.0.1 Server Patch 1 releases. As part of this rollback, the Analyze button previously displayed in the Loan Custom Fields setting is no longer displayed.

CBIZ-67691

(Added on 8/4/2025)

For companies that have purchased the ICE Data & Document Automation and ICE Mortgage Analyzers service, the Income Analyzer scans the data in income-related documents that are imported into a loan attachments and compares it to the data in the Verification of Employment (VOE) income records in the loan. After the analysis, Encompass users can click the green Income Analyzer message icon to open the message and compare and reconcile any incomes data differences between the document attachments and the VOE records. However, some Encompass users had an issue where the Income Analyzer Message window opened as expected, but it displayed an error message instead of displaying the Income Comparison data. The cause of this issue was identified and the issue is now fixed. The Income Comparison data in the message window is now displayed as expected.

CBIZ-67585

| Next Section: Change Log |

|

|

|

Previous Section: Feature Enhancements |