Use the buttons below to view general role definition guidelines for each persona.

Encompass Persona Functional Definition

Closer / Funder

The content contained in the Encompass Persona-Based Release Notes are aligned to the Closer / Funder persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Because closers often act as funders and vice versa, the roles are combined for the purpose of Persona Release Notes. Basic responsibilities of the Closer / Funder include, but are not limited to, the following:

- Manage the closing process

- Completes and audits the closing information

- Orders closing documents

- Reviews, prints, and reorders returned closing documents

- They also manage the funding process

Encompass Persona Functional Definition

Loan Officer

The content contained in the Encompass Persona-Based Release Notes are aligned to the LOan Officer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Loan Officer include, but are not limited to, the following:

- Develops business and initiates loans

- Develops new client relationships and manages relationships over time

- Initiates the loan process

- Gathers basic client info

- Orders services for prequalification and preapproval

- Communicates with processor

- Monitors loans in the Pipeline by tracking milestones and items requiring attention

Encompass Persona Functional Definition

Loan Processor

The content contained in the Encompass Persona-Based Release Notes are aligned to the Loan Processor persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Loan Processor include, but are not limited to, the following:

- Coordinates people and information to construct and finalize loans

- Uses tools such as forms documents, and communication logs

- Monitors own Pipeline by tracking milestones and items requiring action

Encompass Persona Functional Definition

Manager

The content contained in the Encompass Persona-Based Release Notes are aligned to the Manager persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Manager include, but are not limited to, the following:

- Manages the business

- Monitors the Pipelines of loan team members

- Manages the bottom line, such as resource assessment and management, and financial forecasting

Encompass Persona Functional Definition

Post Closer

The content contained in the Encompass Persona-Based Release Notes are aligned to the Post Closer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Post Closer include, but are not limited to, the following:

- Confirms all documents are completed and generated

Encompass Persona Functional Definition

Quality Control

The content contained in the Encompass Persona-Based Release Notes are aligned to the Quality Control persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Quality Control include, but are not limited to, the following:

- Inspects the loan for quality

Encompass Persona Functional Definition

Reporting

The content contained in the Encompass Persona-Based Release Notes are aligned to the Reporting persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Reporting include, but are not limited to, the following:

- Pulls, creates, and manages reports in Encompass

- Manages Encompass Reporting Database

Encompass Persona Functional Definition

Secondary Marketing / Lock Desk

The content contained in the Encompass Persona-Based Release Notes are aligned to the Secondary Marketing / Lock Desk persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Because Secondary Marketing often acts as Lock Desk and vice versa, the roles are combined for the purpose these Persona Release Notes. Basic responsibilities of the Secondary Marketing / Lock Desk include, but are not limited to, the following:

- Determines pricing strategies and develops / implements loan programs

- They also receive and process lock requests

Encompass Persona Functional Definition

Servicer

The content contained in the Encompass Persona-Based Release Notes are aligned to the Servicer persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Servicer include, but are not limited to, the following:

- Services the loan

Encompass Persona Functional Definition

Shipper

The content contained in the Encompass Persona-Based Release Notes are aligned to the Shipper persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Shipper include, but are not limited to, the following:

- Assists with inventory control and provides input to secondary marketing functions

- Ships loans to document custodians and the investor

Encompass Persona Functional Definition

Underwriter

The content contained in the Encompass Persona-Based Release Notes are aligned to the Underwriter persona using very general role definition guidelines. The following description is our interpretation of the standard personas' job roles.

Basic responsibilities of the Underwriter include, but are not limited to, the following:

- Verifies loan accuracy

- Provides conditions to be met

- Verifies that conditions are met

To learn about another persona, select a persona from the options above; otherwise, to view or print the release notes, select Close ("X") at the top of the window and chose one or more options from the Filter by Persona or Print by Persona menu by selecting a button at the top of the page.

Encompass 24.1 Persona-Based Release Notes

The Encompass Persona-Based release notes are broken down by common Encompass personas. We realize every organization may have slightly different functional definitions for these personas. As such, you may want to review each persona's release note segments before forwarding to ensure they match personas / roles within your organization.

How to Navigate Persona-Based Release Notes

To use the Persona-Based Release Notes page, use the navigation buttons described below:

-

Filter by Persona: Create and view a customized on-screen version of the release notes by selecting one or more persona checkboxes. To remove one or more personas, clear the corresponding checkbox for the persona being removed.

-

Persona Definitions: View general role definition guidelines for each persona.

-

Print by Persona: View a dedicated PDF version of the release notes aligned to each of the available Encompass persona by selecting a persona one at a time. A new window will open and display the selected PDF file.

Encompass 24.1 Persona-Based Release Notes

The Encompass 24.1 Persona-Based Release Notes include a high-level overview of new features, feature and form enhancements, and fixed issues applicable to the each Encompass persona, followed by more detailed information and instructions where appropriate.

Refer to the online help and the Guides & Documents page for additional information and related documents.

Your customized on-screen version of the Persona-Based release notes include the following personas:

Closer / Funder

Loan Officer

Loan Processor

Manager

Post Closer

Quality Control

Reporting

Secondary Marketing / Lock Desk

Servicer

Shipper

Underwriter

To create a new customized on-screen version of the Persona-Based release notes, click Filter by Personas, and then select or clear the corresponding checkbox for the persona being added or removed.

New Features & Forms in Version 24.1

This section discusses the new features introduces in the Encompass release.

As part of the new Encompass 24.1 automation enhancements in the web version of Encompass, new disclosure alerts and date fields are being introduced in Encompass. These disclosure compliance alerts can help ensure loans are compliant with all applicable state and federal regulations, including those applicable to timing and content of disclosures to maintain good faith with the consumer. The alerts, which are set up and managed in the Encompass Settings > Alerts tool and triggered in loan files in the desktop and web versions of Encompass, enable lenders to ensure all required data is complete for sending disclosures (both manually and automated).

These new alerts and disclosure date fields are part of a broader initiative to provide automation features in the web version of Encompass. Setting up and enabling these alerts in Encompass Settings ensure that the alerts will be triggered in the desktop version of Encompass when the alert conditions are met, but they will not be triggered in the web version of Encompass without additional configuration of workflow rules and other requirements. For more information about the automation enhancements in the web version of Encompass 24.1, including data perfection tools, schedulers, and configurable rules to trigger loan actions, refer to the Encompass (web version) 24.1 release notes.

As part of the new Encompass 24.1 automation enhancements in the web version of Encompass, new alerts are being introduced in Encompass Settings. These disclosure compliance alerts can help ensure loans are compliant with all applicable state and federal regulations, including those applicable to timing and content of disclosures to maintain good faith with the consumer. These alerts, which are set up and managed in the Encompass Settings > Loan Setup > Alerts tool and triggered in loan files in the desktop and web versions of Encompass, enable lenders to ensure all required data is complete for sending disclosures (both manually and with automated workflows).

These alerts will be triggered for loans using the Forms > URLA Form Version > URLA 2020 input forms only.

The following alerts are being introduced:

- At App Disclosure Requirements

- Three-Day Disclosure Requirements

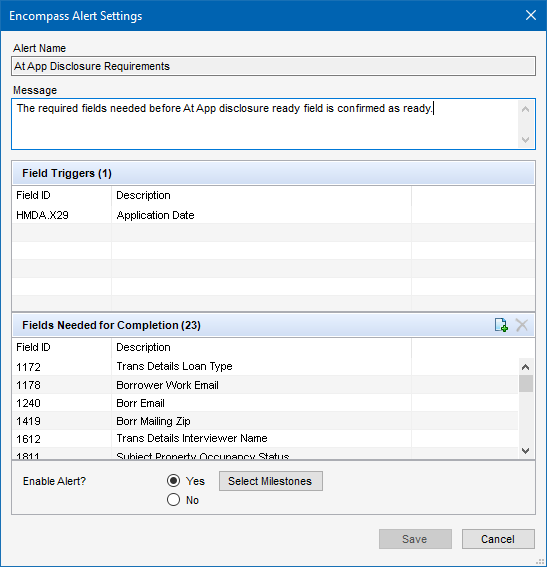

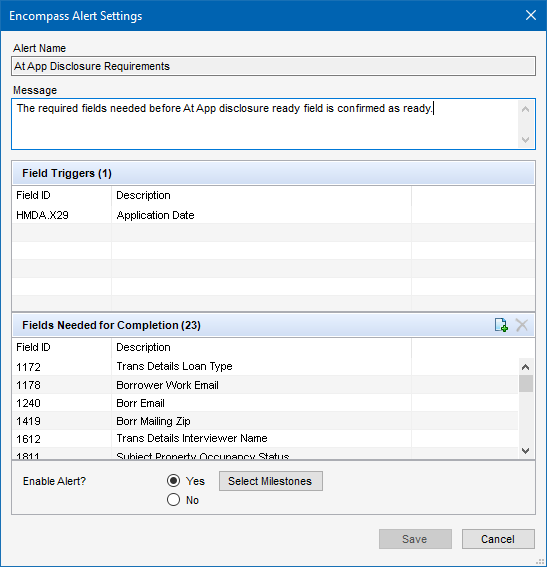

Just like with previous alerts, the Alert Settings screen for each alert provides a default message that displays when the alert is triggered in a loan file (editable) and a Field Triggers section that lists the fields that, once populated in the loan, will trigger the alert.

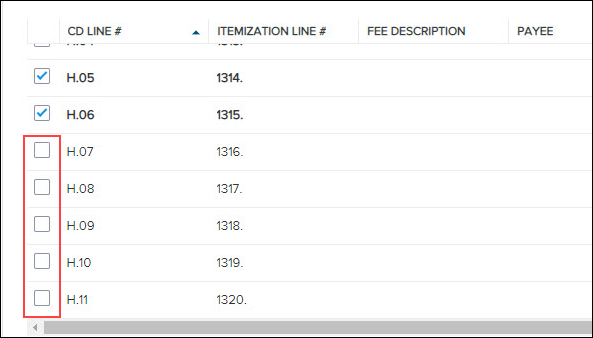

A new section, Fields Needed for Completion, is now provided in the Alert Settings screen for these alerts. The loan level fields listed here are the fields that must be populated in order for the disclosure to be considered completed. Administrators can click the Add icon here to add additional required fields as needed.

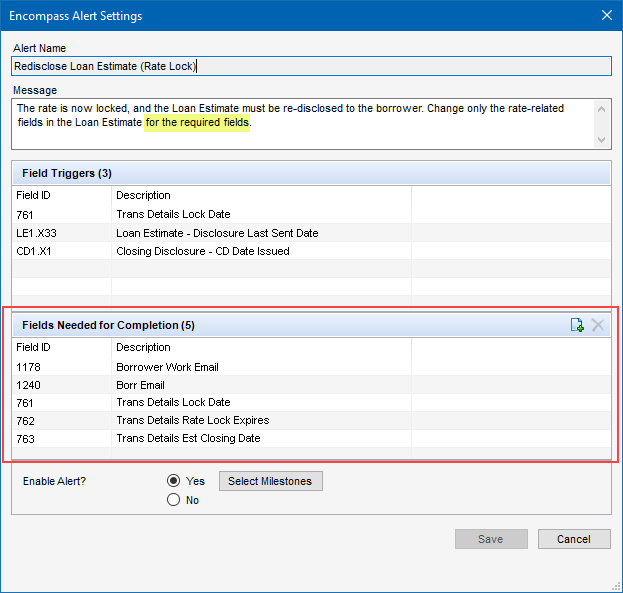

In addition to these new alerts, two existing alerts- Redisclose Loan Estimate (Rate Lock) and Redisclose Loan Estimate (Changed Circumstance)- have been updated with the new Fields Needed for Completion section.

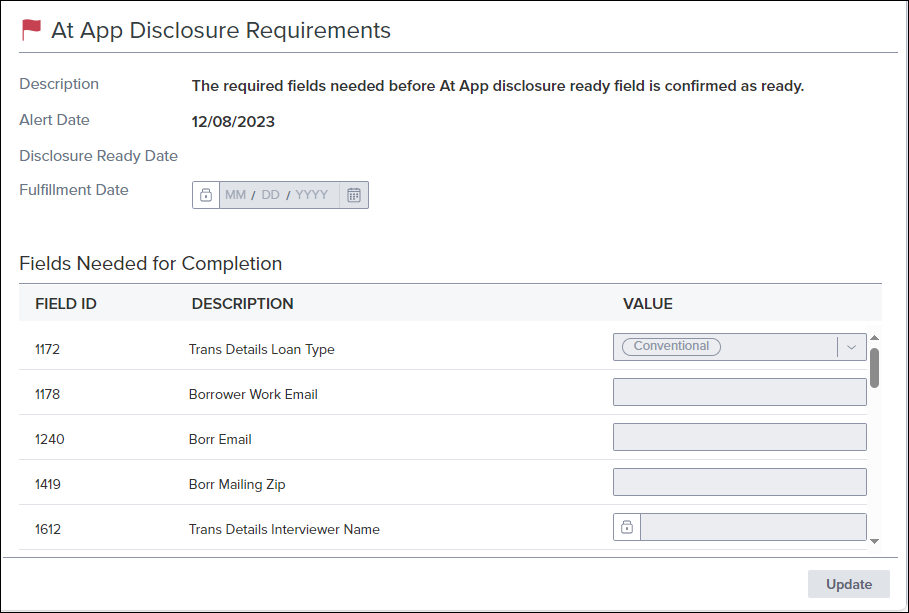

When these alerts are triggered in the loan file, the required completion fields are listed. Once these fields are populated, the Disclosure Ready Date on the alert screen in the loan file will be populated. (Until then, this date field is blank.) When the date is added, a scheduler will then send out the disclosures for the loan. (The disclosures may also be sent manually prior to the scheduler sending them.) Note that the administrator needs to set up a scheduler and a workflow rule for the Disclosure Ready Date field in the web version of Encompass in order for the disclosures to be sent automatically when the date field is populated.)

Alert in Encompass (desktop version)

Alert in Encompass (web version)

Important Notes:

-

As mentioned earlier, these new alerts are part of a broader initiative to provide automation features in the web version of Encompass. Setting up and enabling these alerts in Encompass Settings ensures that the alerts will be triggered in the desktop version of Encompass when the alert conditions are met, but they will not be triggered in the web version of Encompass unless additional configuration of workflow rules and other requirements are met. Refer to the Encompass (web version) 24.1 release notes for more information about these automation enhancements.

-

In addition to the new Fields Needed for Completion section, the default alert message for the Redisclose Loan Estimate (Rate Lock) alert has been updated to indicate that the loan team member should change only the rate-related fields in the Loan Estimate for the required fields. (This potion is highlighted in the Redisclose Loan Estimate (Rate Lock) alert settings screen example provide above.) These required fields are the fields listed in the Fields Needed for Completion section.

-

When a loan is duplicated or borrowers are swapped:

-

The date fields in the Fields Needed for Completion list are cleared out and the system re-checks the loan to determine if it meets the alert requirements.

-

Disclosure Tracking logs are not re-checked prior to the system reviewing the loan again for the alert requirements. Even if initial disclosures have been sent and a Disclosure Tracking record has been created, the date fields are cleared.

-

If borrowers are swapped in the loan after initial disclosures have been sent, a redisclosure is required.

-

-

When working with the At App Disclosure Requirements, Redisclose Loan Estimate (Rate Lock), and Redisclose Loan Estimate (Changed Circumstance) alert, additional fields are included in the Fields Needed for Completion list if the eDisclosure Fulfillment service is running for the Encompass instance. These fields are:

-

Field ID 5012 - Scheduled Fulfillment Date

-

Shipping To*

- URLA.X197 - Borrower Street Address (Mailing Address)

- 1417 - Borrower City (Mailing Address)

- 1418 - Borrower State (Mailing Address)

- 1419 - Borrower ZIP Code (Mailing Address)

- FR0126 - Borrower Current Street Address

- FR0106 - Borrower Current City

- FR0108 - Borrower Current ZIP Code

*Only one group of these Shipping To fields in the loan must be completed to satisfy the alert requirements. Either all of the FR0xxx fields or all of the other group of Shipping To fields

-

Shipping From

- 3343 - Lender Current Street Address

- 3344 - Lender Current City

- 3345 - Lender Current State

- 3346 - Lender Current ZIP Code

-

If the service is stopped at any time, these fields will no longer be displayed in the list.

-

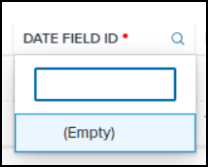

To add additional fields to the Fields Needed for Completion section, click the Add icon, and then type the field ID of the field(s) to add in the Add Fields Needed for Completion pop-up window. When finished, click Add.

-

To delete a field from the list, select the field, and then click the Delete icon. The fields in the default list of Fields Needed for Completion section (shown in the Alert Settings screen example above) cannot be deleted from the alert.

-

If the eDisclosure Fulfillment service is stopped, administrators can use the Add icon to add eDisclosure Fulfillment fields (for example, field 1418) if needed. If the service is then started at a later time, all of the eDisclosure Fulfillment fields will be added to the list and any duplicate eDisclosure Fulfillment fields that were manually added previously will be overwritten. The eDisclosure Fulfillment fields will be considered required and cannot be deleted from the list. If the eDisclosure Fulfillment service is then stopped at a later time, the eDisclosure Fulfillment fields will be removed from the list. Any of these fields that were manually added previously would need to be manually added again to return them to the list.

-

For existing loans and loans opened prior to Encompass 24.1, calculations will not get triggered (i.e., the Disclosure Ready Date field will not be populated even if all required fields are completed). The calculations will only be triggered if a loan team member updates one of the Fields Needed for Completion fields.

For more information about the automation enhancements in the web version of Encompass 24.1, including data perfection tools, schedulers, and configurable rules to trigger loan actions, refer to the Encompass (web version) 24.1 release notes.

New fields have been added to Encompass to enable loan team members to check the progress of disclosures in the web version of Encompass.

Please note, these fields are available in the following Encompass locations only: Encompass Reporting Database, Reports,

- Ready Disclosure 3 Day Package Date (field ID 5001)

- Ready Disclosure at Lock Package Date (field ID 5003)

- Ready Disclosure at Application Package Date (field ID 5005)

- Ready Disclosure Change of Circumstance Package Date (field ID 5007)

- Signing Mode (field ID 5008)

- Notify on Receipt (field ID 5009)

- Notify when not Received Date (field ID 5010)

- Fulfillment Enabled (field ID 5011)

- Scheduled Fulfillment Date (field ID 5012)

(Updated on 3/20/2024)

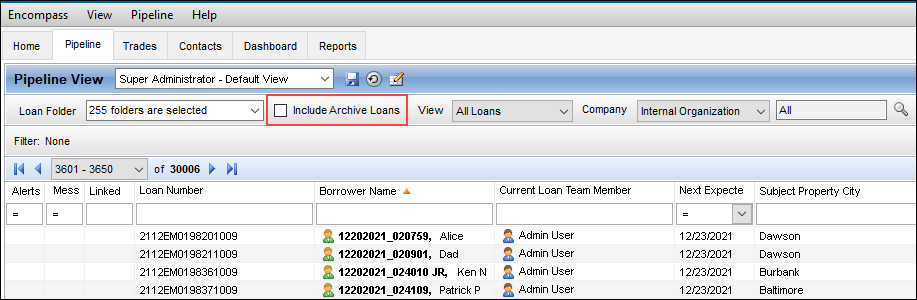

To help optimize Encompass Pipeline loading performance, archived loans will no longer be displayed in the Pipeline by default. For loan team members that want to view archived loans, they can select the new Include Archive Loans checkbox at the top of the screen to include these loans in the Pipeline.

By default, the Include Archive Loans checkbox is not selected and it is disabled (i.e., grayed out) for all non-admin users, which results in archived loans not displaying in the Pipeline.

Loans that are archived are simply excluded from the initial Pipeline load for performance purposes. These loans are not being moved, and they can easily be retrieved by selecting the Include Archived Loans checkbox.

For more details and information about this archive feature, please review the 24.1 - Encompass : New Archive Feature FAQ knowledge article (KA #000115380).

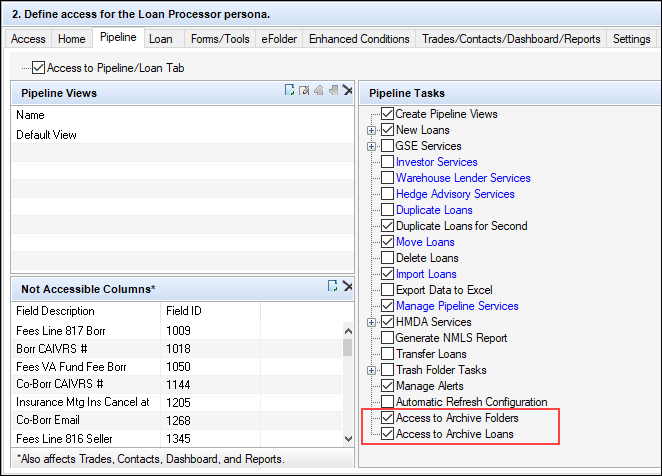

To grant access to this checkbox, go to the Encompass Settings > Company/User Setup > Personas setting, select the Pipeline tab, and then select the new Access to Archive Loans option. Users with this persona access can then select the Include Archive Loans checkbox to include these loans in the Pipeline.

To provide access to archive folders, select the Access to Archive Folders option.

If the administrator grants access to archived loans (Access to Archive Loans) but not to archived folders (Access to Archive Folders), the user will be able to select (or clear) the Include Archive Loans checkbox in a Pipeline view, but archived folders will not be included in the Loan Folders dropdown list and archived loans will be included in the Pipeline only if they are in an active (non-archived) loan folder.

The Access to Archive Folders option was previously called Exclude Archive Folders. When this option was selected in previous versions of Encompass, archived loan folders were not included in the Pipeline’s Loan Folder dropdown list. When it was not selected, the archived folders were included in the list. In instances where the Exclude Archive Folders was selected, the Access to Archive Folders option will not be selected in Encompass 24.1. In instances where the Exclude Archive Folders was not selected, the Access to Archive Folders option will be selected in Encompass 24.1.

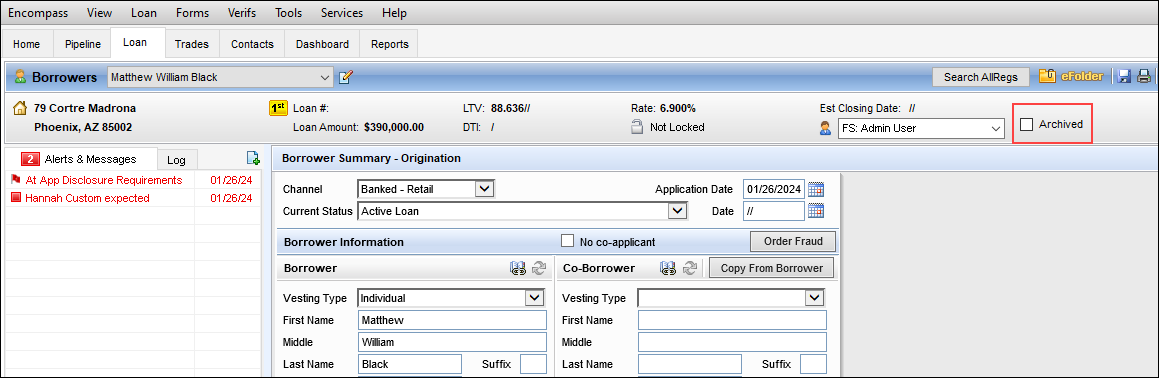

In addition, a new Archived checkbox (field ID 5016) is now provided in the loan view at the top of the screen. Users can select this checkbox to archive the loan.

If you select the Archived checkbox to archive a loan and move it to an archive loan folder, and then you decide later to make the loan active again by clearing the Archived checkbox, it is recommended that you move the loan from the archive loan folder to an active loan folder. If you leave the active loan in the archive loan folder, it will be returned to an archived loan status again when you upgrade to the next Encompass release. Loans in archive loan folders that are not modified for at least three years will also be automatically marked as an archived loan, so best practice is to always move active loans to an active loan folder.

By default, this checkbox is available to all users in the loan file who have edit access. To manage user access to the checkbox, administrators can set up a Persona Access to Field business rule to disable access for anyone who does not specifically need it.

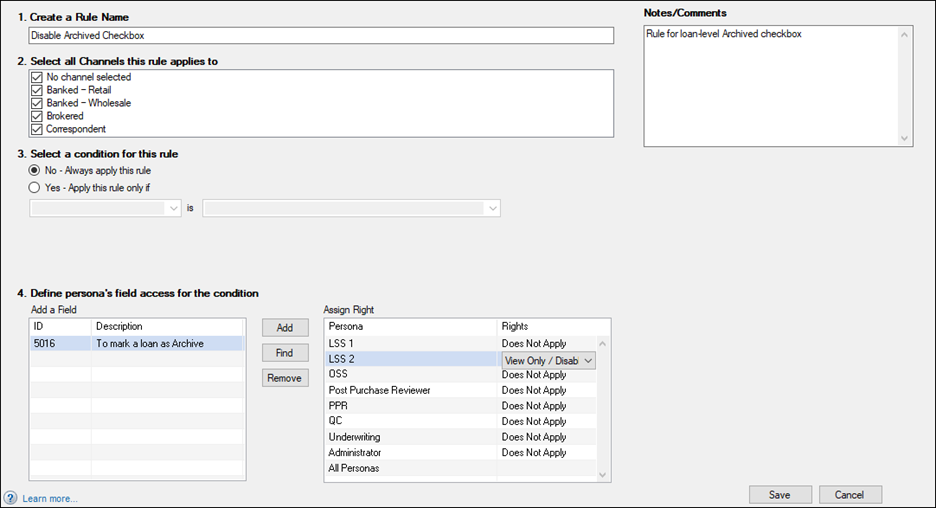

To Set Up a Persona Access to Field Business Rule to Disable the Archived Checkbox:

-

On the menu bar, click Encompass, and then click Settings.

-

On the left panel, click Business Rules, and then click Persona Access to Fields.

-

On the Persona Access to Fields tool, click the New icon.

-

Type a name for the rule.

-

Select the channels where the rule will be applied.

-

Select No to always apply the rule or select Yes to create a condition for when the rule is applied.

-

In section 4, define the persona’s field access.

-

Click the Add button,

-

Type field ID 5016 in the Field ID field, and then click Add.

-

In the Assign Right table, select the applicable persona, and then select the View Only/Disabled option.

-

-

Click Save to save the rule.

-

On the Persona Access to Fields screen, click the Activate button.

Please note if you are using the External Reporting Database (ERDB), changes to the Archived checkbox (field ID 5016) will not be reflected there. When a loan is moved from an active loan folder to an archive loan folder, the value in field 5016 is reflected as N instead of Y. This ERDB issue will be addressed in a future Encompass release.

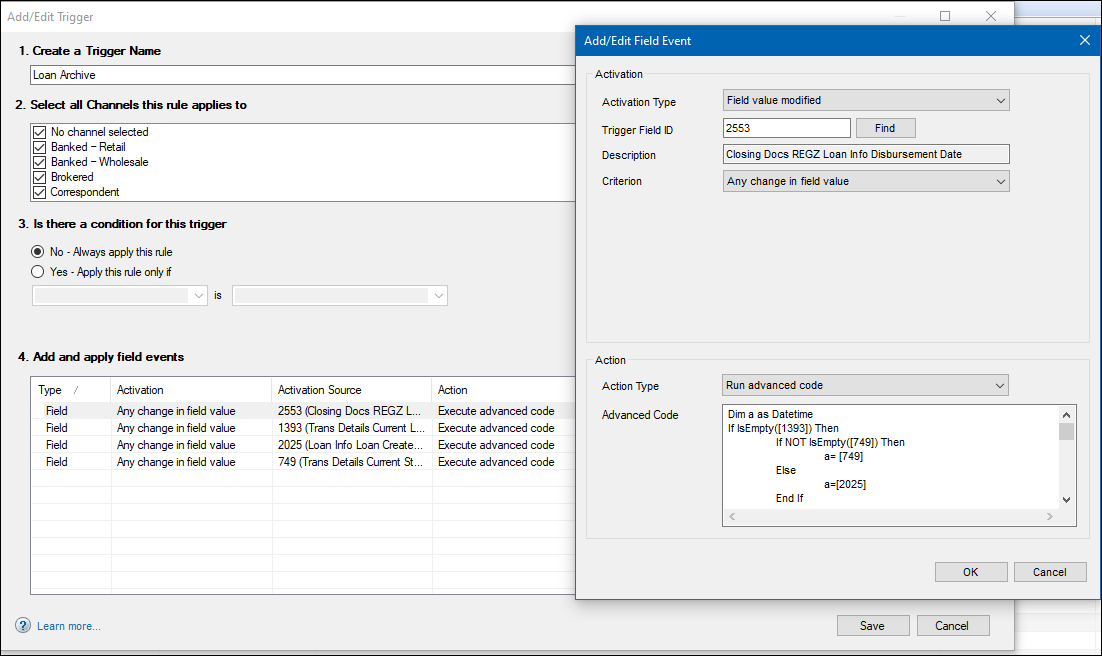

Finally, a new field triggers business rule called Loan Archive is now provided. This sample rule is deactivated by default. It will not run unless the administrator activates it.

When this business rule is activated, the rule's advanced code will run, which results in any time fields 749 (Date the loan status was changed) , 1393 (current loan status), 2025 (Date the loan was started or imported), or 2553 (Date when loans funds are transferred or disbursed) are modified the Archived checkbox (field ID 5016) for the loan will be selected. This results in the loan file being archived and thus it will not be included in the Pipeline (unless the Pipeline's Include Archived Loans checkbox is selected). Again, this business rule is provided as a sample and it can be modified just like any other business rule to fit your business requirements.

For example, the rule's advanced code is written so that when field 1393 is NOT empty (i.e., "null") or active, the rule will use the greater of field 749 or field 2553 to determine if the loan is more than 3 years old. If yes, then the loan's Archived checkbox (field ID 5016) is selected and the loan is archived and no longer displayed in the Pipeline.

Review the advanced code in the Loan Archive field triggers business rule to learn more about how this rule operates when activated.

Automatic Archiving of Loans Three Years and Older

In addition to the new archived loan features discussed above, when you upgrade to Encompass 24.1 all loans that have not been modified for three years or longer will be marked as archived loans. Loans in archive folders will also get marked as archived automatically.

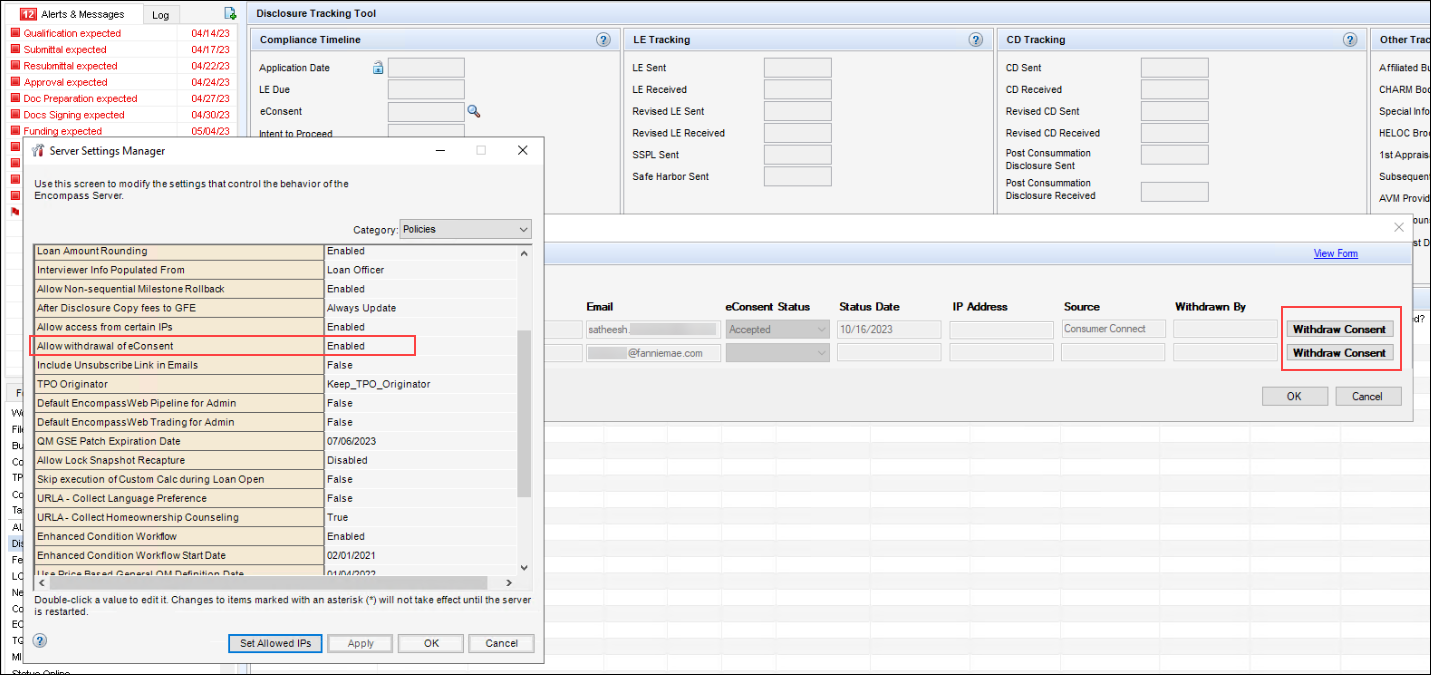

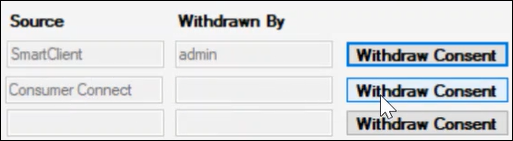

Encompass administrators can now enable loan team members to withdraw eConsent agreements that have been sent to borrowers or other recipients on behalf of the borrower or recipient. This option is useful for situations where a borrower has agreed to accept electronic disclosures (i.e., eConsent), but later decides they prefer printed paper hard copies. Using the Encompass Admin Tools > Settings Manager, administrators can set the new Allow withdrawal of eConsent policy to Enabled. (By default, this policy is disabled and the buttons provided to withdraw eConsent agreements are not available.)

When enabled, a Withdraw Consent button displays next to each eConsent request in the eConsent Status pop-up window for loan team members who are authorized to withdraw eConsent requests. This authorization is based on the loan team member’s persona setting.

In addition, a Withdrawn By column has been added to the eConsent Status pop-up window. This column is populated with the Encompass User ID of the user who has withdrawn the eConsent.

When the Withdraw Consent button is clicked, the eConsent agreement is withdrawn and the eConsent Status is updated to Rejected.

The Withdrawn By and eConsent Status values in this window are also reflected on the Request eConsent screen in the web version of Encompass.

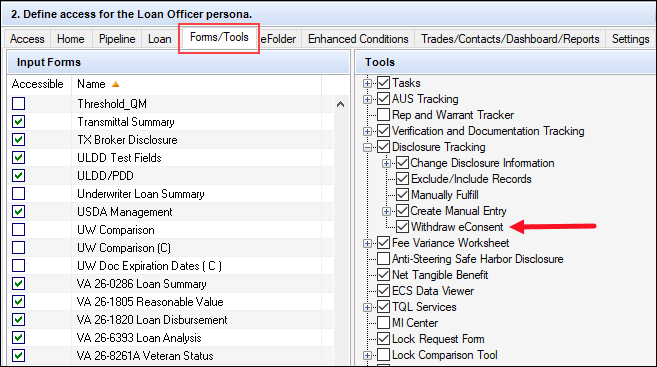

Withdraw eConsent Personas Setting

Using the Encompass Settings > Company/User Setup > Personas settings, administrators select the Forms/Tools tab, and then select the Disclosure Tracking > Withdraw eConsent option to grant the persona authorization to view and click the Withdraw Consent button.

Note that the loan team member must also have edit access to the loan in order to click the Withdraw Consent button. If they have read-only access to the loan, the buttons are displayed but deactivated (i.e., grayed out).

New features are being introduced to help users enter and manage the data on the Request for Transcript of Tax and Request for Transcript of Tax (Classic) input forms: new transcript request templates and a new dropdown field on the input forms that enable users to select the version of the IRS4506 or IRS Form 8821 that is being requested.

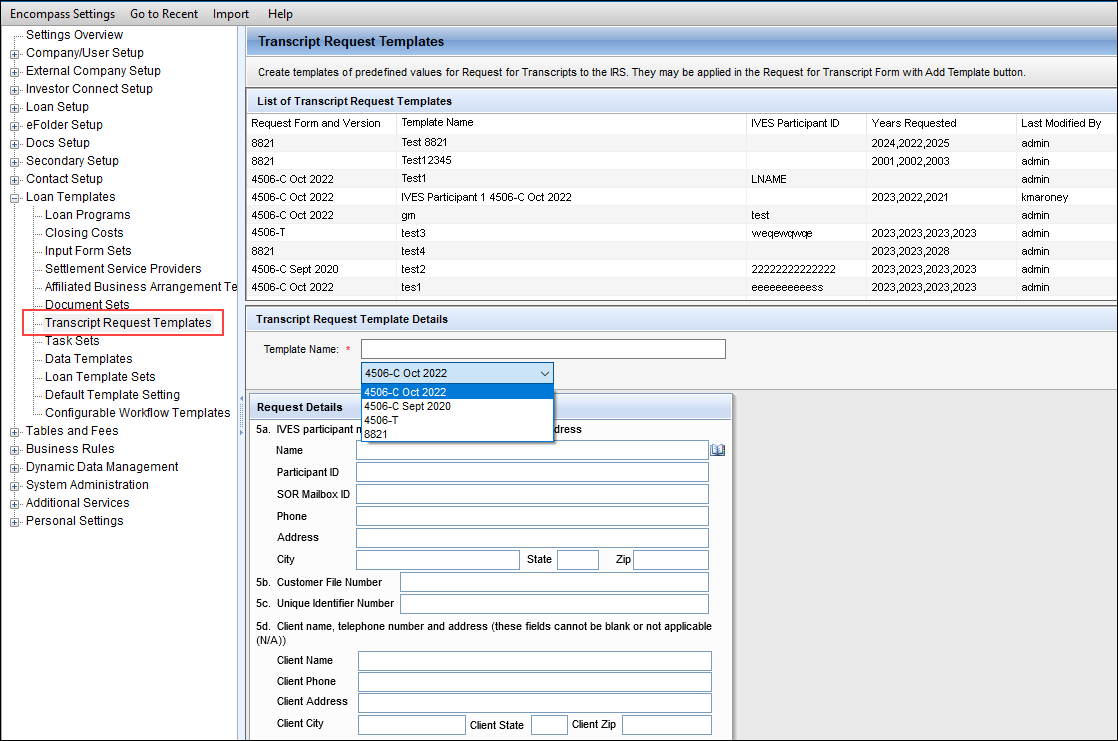

A new Transcript Request Templates setting is now available where administrators can create templates of predefined values for the three versions of IRS 4506 (4506-C Oct 2022, 4506-C Sept 2020, 4506-T) and the new standard IRS Form 8821. This enables transcript request data to be selected as many times as needed at a loan level for IVES Participants, Third Party Designees, tax years, and tax form request information. The structure of the templates is intentionally simple to enable administrators to align tax requests with business rules and their individual workflow processes.

To Create a Transcript Request Template:

-

On the menu bar, click Encompass, and then click Settings.

-

In the left panel, click Loan Templates, and then click Transcript Request Templates.

-

To create a new template, click the New icon.

-

In the Transcript Request Template Details section, type a Template Name.

-

By default, a template for the 4506-C October 2022 form version is selected. If you want to create a template for a different version, select it from the dropdown list.

- Based on the selection, the Request Details section dynamically displays the correct form fields for the template.

- The Request Details displays the form sections below the borrower/co-borrower information and above the signatures section. All other sections are hidden from the template.

- For example, for the default 4506-C Oct 2022 selection, Item 5a, b, c, d, and Item 6, 7, 8 are displayed.

-

Populate the template fields with the applicable data.

-

When finished, click the Save icon.

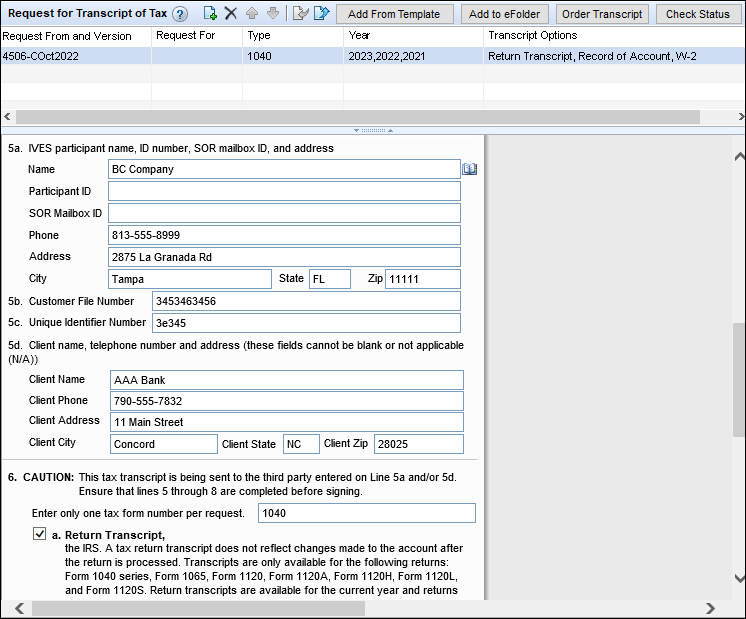

Once one or more templates is created, loan team members can then apply a template to the Request for Transcript of Tax input form using the Add From Template button.

To Apply a Transcript Request Template:

-

Open a loan file, and then click the Forms tab on the lower-left.

-

Click Request for Transcript of Tax.

-

At the top of the screen, click the Add From Template button.

-

In the Select Request for Transcript of Tax Template pop-up window, select the template in the list, and then click Select.

-

The data from the template is populated to the input form. Manually type or select the values for the remaining fields.

-

When finished, click the Save icon.

CBIZ-53687, CBIZ-54107

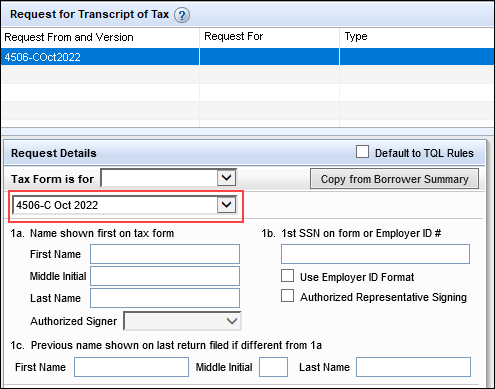

In addition to the new Add From Template button discussed above, a new dropdown field (field ID IR0193) has been added to the Request for Transcript of Tax input form. Use this field to select the version of the transcript of tax form that is being requested:

- 4506-C October 2022

- 4506-C September 2020

- 4506-T

- 8821

By default, the field is populated with the 4506-C October 2022 version.

This new dropdown field effectively replaces the form, version, and checkbox fields that were previously used to indicate the form version on the Request for Transcript of Tax input form.

A different version of this field (field ID IRS4506.X93) is also provided in the same position on the Request for Transcript of Tax (Classic) input form. The dropdown list provides three form options:

- 4506-C October 2022

- 4506-C September 2020

- 4506-T

A Note About Form 8821:

In previous versions of Encompass, Form 8821 Request Tax Information Authorization was included as a custom print form in Encompass. As discussed above, Form 8821 is now provided as an option on the standard Request for Transcript of Tax input form in Encompass 24.1. The custom print form version is no longer included in Encompass. Please note that Form 8821 is now printed in letter size format to ensure it fits both opening and closing document packages. The custom print form version of Form 8821 in previous versions of Encompass was printed in legal size format.

(Updated on March 19, 2024)

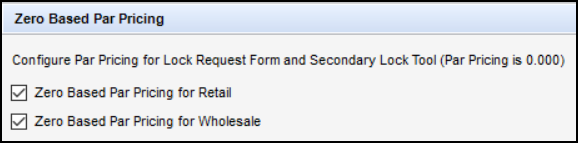

A new Zero Based Par Pricing section has been added to the Product and Pricing setting under Secondary Setup. This section enables locks to be offered in basis points instead of par, by channel, to make them easier for borrowers to understand.

Please ensure your product and pricing provider supports pricing in this format before enabling these settings.

To Configure Zero Based Par Pricing for the Lock Request Form and Secondary Lock Tool:

-

On the menu bar, click Encompass, and then click Settings.

-

On the left panel, click Secondary Setup, and then click Product and Pricing.

-

Navigate down to the Zero Based Par Pricing section.

-

Select the channels (Retail, Wholesale, or both) you want enabled with zero based par pricing. By default, both channels are disabled.

-

Click Save.

The lock extension fee and re-lock fee calculations have been updated on the Secondary Lock Tool based on whether zero based par pricing is enabled or not. If the settings are enabled, each lock extension fee and re-lock fee will be multiplied by -1.

The Gain Loss % (field ID 2296) calculations have been updated in the Sell Side Lock and Pricing column on the Secondary Lock Tool based on whether zero based par pricing is enabled or not. The updated calculations are as follows:

- When zero based par pricing is enabled, the calculation will be Total Sell Price (field ID 2295) + Total Buy Price (field ID 2218) - 100 = Gain Loss %.

- When zero based par pricing is disabled, the calculation will be Total Sell Price (field ID 2295) - Total Buy Price (field ID 2218) = Gain Loss %.

Since Gain Loss $ (field ID 2028) is dependent on the Gain Loss %, the Gain Loss $ value will change based on the Gain Loss %.

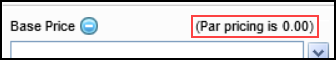

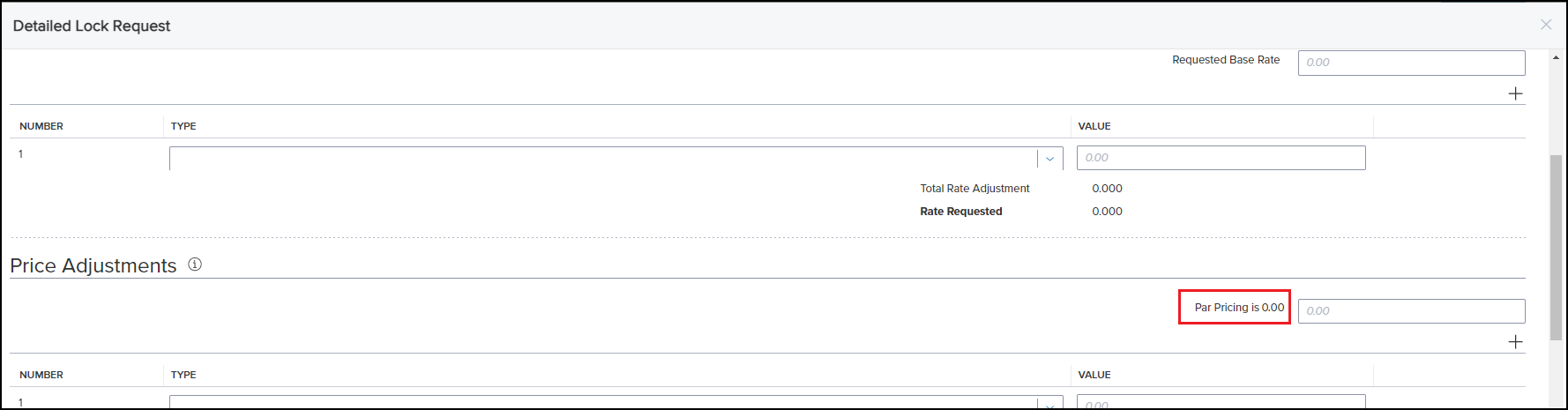

The par pricing text has been updated on the Lock Request Form and the Secondary Lock Tool based on the zero based par pricing setting.

- When zero based par pricing is enabled, the par pricing text in the Request Rate Lock and Pricing column on the Detail Lock Request screen changes from “(Par Pricing is 100.00)” to “(Par Pricing is 0.00”).

- When zero based par pricing is enabled, the par pricing text in the Buy Side Lock Request column and the Buy Side Lock and Pricing column on the Secondary Lock Tool changes from “(Par Pricing is 100.00)” to “(Par Pricing is 0.00)”.

- Regardless of whether zero based par pricing is enabled, the par pricing text in the Sell Side Lock and Pricing column and the Execution Comparison column will display “(Par pricing is 100.00)”.

When zero based par pricing is enabled in Encompass, the par pricing text on the web version of Encompass Detailed Lock Request changes from “Par Pricing is 100” to “Par Pricing is 0.00”.

The following new read-only fields have been added to Encompass to support importing Encompass Compliance Service (Mavent) data into loans. Please note that these fields are available in the Encompass Reporting Database, but they are not currently displayed on any Encompass input forms or tools. These fields will be added to the ECS Data Viewer tool in a future Encompass release.

Please note, Mavent has not yet mapped applicable fields to these fields, so Mavent data is not yet populating in these fields. This mapping will be completed in a future release.

- Annual Percentage Rate (field ID COMPLIANCEREVIEW.X19)

- Finance Charge Amount (COMPLIANCEREVIEW.X20)

- Federal Total Loan Amount (COMPLIANCEREVIEW.X21)

- State Total Loan Amount (COMPLIANCEREVIEW.X22)

- QM Points and Fees Total (COMPLIANCEREVIEW.X23)

- Ability-to-Repay Loan Type (COMPLIANCEREVIEW.X24)

- Qualified Mortgage Loan Type (COMPLIANCEREVIEW.X25)

- Qualified Mortgage Eligible (COMPLIANCEREVIEW.X26)

- Higher-Priced Covered Trans (COMPLIANCEREVIEW.X27)

- Loan Term and Features (COMPLIANCEREVIEW.X28)

- QM Points and Fees Limit (COMPLIANCEREVIEW.X29)

- Underwriting Factors (COMPLIANCEREVIEW.X30)

- QM Price-Based Limit (COMPLIANCEREVIEW.X31)

- Review ID (COMPLIANCEREVIEW.X32)

Feature Enhancements in 24.1

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release.

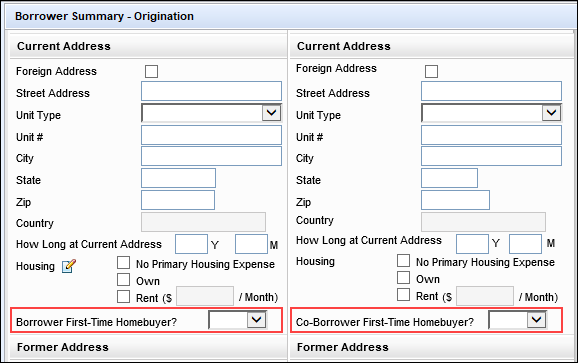

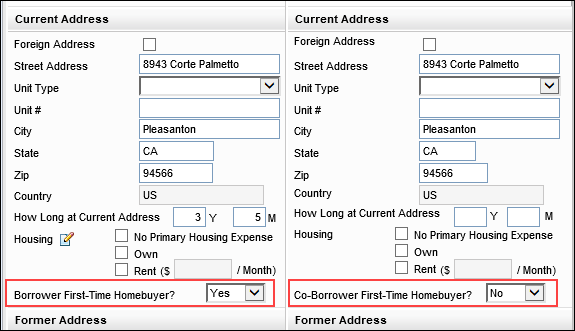

The following fields have been added to the Borrower Summary - Origination input form:

- Borrower First-Time Homebuyer (field ID 4973)

- Co-Borrower First-Time Homebuyer (field ID 4974)

These borrower-level fields were already available on the ULDD/PDD input forms, so they are being added to the Borrower Summary - Origination input form to ensure first-time homebuyer data is displayed consistently within the loan.

These new fields display on the Borrower Summary - Origination input form only when using the Forms > URLA Form Version > URLA 2020 forms in Encompass.

The following new options are now provided in the ARM Index Type dropdown field (field ID 1959) provided on the RegZ - CD and other input forms:

- 2 Year US Treasury CM (daily)

- 2 Year US Treasury CM (weekly)

- 2 Year US Treasury CM (monthly)

These new options are also now provided here:

- ARM Index Type dropdown field on the Lock Request Form (field ID 4512)

- ARM Type pop-up window displayed when the user clicks the Lookup (magnifying glass) icon associated with the Adjustable Rate field (field ID 995)

- Index + Margin dropdown field (field LE2.X96) in the Adjustable Interest Rate (AIR) Table on the Closing Disclosure Page 4.

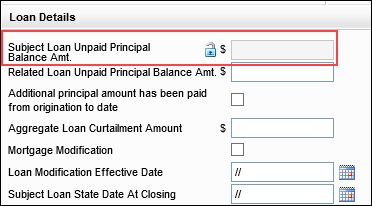

To enable loan team members to override the system-calculated value populated to the Subject Loan Unpaid Principal Balance Amount field (field ID ULDD.X1), a new field Lock is now provided for this field. By default, field ULDD.X1 is populated with the current unpaid principal balance entered in field SERVICE.X57 on the Interim Servicing Worksheet once Interim Servicing is completed. Authorized users can now click the blue Lock icon for field ULDD.X1 to manually enter the value they want reflected on the ULDD export to the GSEs.

The Application Date field (field ID HMDA.X29) has been added to the 2018 HMDA Purchased Loans tab on the HMDA Information input form. (This tab displays in the input form when 6. Purchased loan is selected from the Action Taken drop-down list.) Previously, this field was only available on the 2018 HMDA Originated/Adverse Action Loans tab on this input form.

This field has been added to the Purchased Loans tab because in HMDA, Purchased Loans are expected to report NA for the Application Date since the application dates on purchased loans may happen one or more quarters or even years before the loan is purchased. NA is populated to this field by default. Authorized users may click the Lock icon, and then overwrite the NA value by manually typing or selecting a date from the calendar.

In previous versions of Encompass, when two loans are linked and one or more fees have been added to the 2015 Itemization input form, you cannot update the Paid By dropdown field for the fee directly on the input form. Instead, you must open the Fee Details pop-up window for the fee and then manually update the payment information. Encompass 24.1 has been updated to enable loan team members to update the Paid By dropdown selection for a fee directly on the 2015 Itemization input form in linked loans, just like you can for loans that are not linked.

Changes have been made to the Estimated Construction Interest (field ID 4088) calculation in Encompass. This change only affects Construction Only loans where the Estimated Interest On (field ID SYS.X6) is set to Method B (Full Loan). With this update, the calculation logic for field 4088 is calculating from the estimated closing date (field ID 763), or if that is blank, from the disbursement date (field ID 2553) to the final construction payment date (field ID 1961) for 365/360 (new behavior) and 365/365 (new behavior) loans. This update is being made to ensure that the Estimated Construction Interest calculation includes the final construction pay date (field ID 1961).

Please note, this update is strictly a correction to how Encompass calculates the number of days for collecting construction interests for 365/360 and 365/365 loans. The calculation used for 360/360 loans was already correct and has not changed. If you open an existing 365/360 or 365/365 loan file created prior to 24.1, the new interest calculation for field 4088 will be used so that the correct value is provided in the loan.

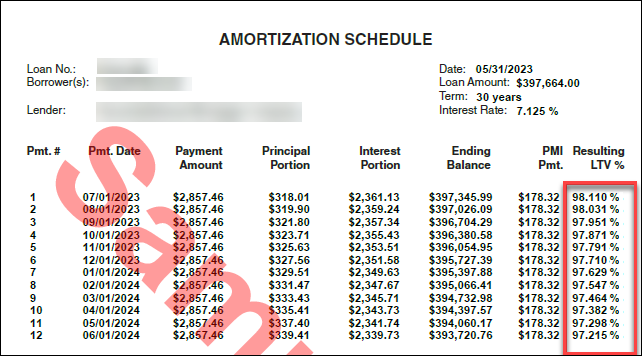

When printing the Amortization Schedule from Encompass, the value provided in the Resulting LTV% column is now rounded to three decimals to match the value provided in the Threshold/LTV% column in the Amortization Schedule viewable in Encompass. Previously, the Resulting LTV% value on the printed output form was rounded to four decimals.

Printed output form in 24.1

A No checkbox for the Borrower LDP/SAM Search field (field ID 3026) and the Co-Borrower LDP/SAM search field (field ID 3027) has been added to the FHA Management input form’s Tracking tab and the HUD-92900LT FHA Loan Transmittal input form to align with HUD’s FHA requirements. Select Yes if the individual is found in the LDP or SAM search or No if they are not found.

Currently in Encompass, when a lock extension is approved, the updated field values for the Lock Request Lock # Days (field ID 2090) and Lock Expiration Date (field ID 2091) fields are not captured to the fields (the values are stored elsewhere within Encompass) but are displayed correctly on the Lock Request Form. This causes inconsistent field values between Encompass and the web version of Encompass because the web version retrieves the field values from the fields themselves. As part of this release, Encompass will be updated to provide the web version of Encompass the most current Lock Request Lock # Days and Lock Expiration Date field values.

In previous versions of Encompass, when a Correspondent loan is priced via the Encompass Product & Pricing Service (EPPS), buy side pricing with an SRP adjustment is requested from EPPS, Encompass is updated with buy side pricing from EPPS, sell side pricing is requested from EPPS, and then the user clicks the Update Encompass button in EPPS, the Secondary Lock Tool is not updated with the sell side pricing data from EPPS. As part of this 24.1 release, Encompass has been updated to ensure the Secondary Lock Tool has the most current sell side pricing data from EPPS.

As part of Fannie Mae's ULDD Phase 5(1) specification updates, a new field to capture the Servicing Transfer Effective Date (field ID ULDD.X200) has been added to the ULDD/PDD’s Fannie Mae tab and the Correspondent Loan Status tool. This field has been added to the ULDD/PDD’s Fannie Mae form in the web version of Encompass as well.

Please note, the corresponding field mapping required for the Fannie Mae ULDD export for this field is not available. This functionality will be completed in a future Encompass/GSE Services release.

The following fields have been added to the Fannie Mae tab on the ULDD/PDD input form:

- Other Funds Collected at Closing (field ID ULDD.X110)

- Other Funds Collected at Closing for (field ID ULDD.X111)

Note that these fields already existed on the Freddie Mac tab on the ULDD/PDD input form.

The following fields have been added to the Freddie Mac tab on the ULDD/PDD input form.

- Document Custodian ID (field ID ULDD.X114)

- Servicer ID (field ID ULDD.X116)

These fields were already provided on other input forms in previous versions of Encompass.

The following label changes have been made for three Freddie Mac options in the ARM Index Type dropdown field (field IDs 1959, 4512, LE2.X96) per Freddie Mac’s guidance:

- Freddie Mac PMMS US 15-Year Fixed Rate changed to Freddie Mac PMMS US 15-Year FRM

- Freddie Mac PMMS US 30-Year Fixed Rate changed to Freddie Mac PMMS US 30-Year FRM

- Freddie Mac PMMS US 5-Year Adjustable Rate changed to Freddie Mac PMMS US 5-Year ARM (Retired)

The following fields have been added to the Ginnie Mae tab on the ULDD/PDD input form.

- Settlement Date (field ID ULDD.GNM.SettlementDate)

- Initial Pay Date (field ID ULDD.GNM.InitialPayDate)

- EIN # (field ID ULDD.GNM.EinNumber)

- Subservicer (field ID ULDD.GNM.Subservicer)

The Inspection ID (field ID CASASRN.X220) field is now available on the Freddie Mac Additional Data input form. This field is intended for users to add the inspection identification number provided by Freddie Mac’s bACE API system.

The following new fields have been added to the GSE Additional Provider Data input form:

- Argyle (Bor, CoBor)

- Freddie Mac AIM Check (Bor, CoBor)

- Gateless (Bor,Cobor)

(Updated on February 13, 2024)

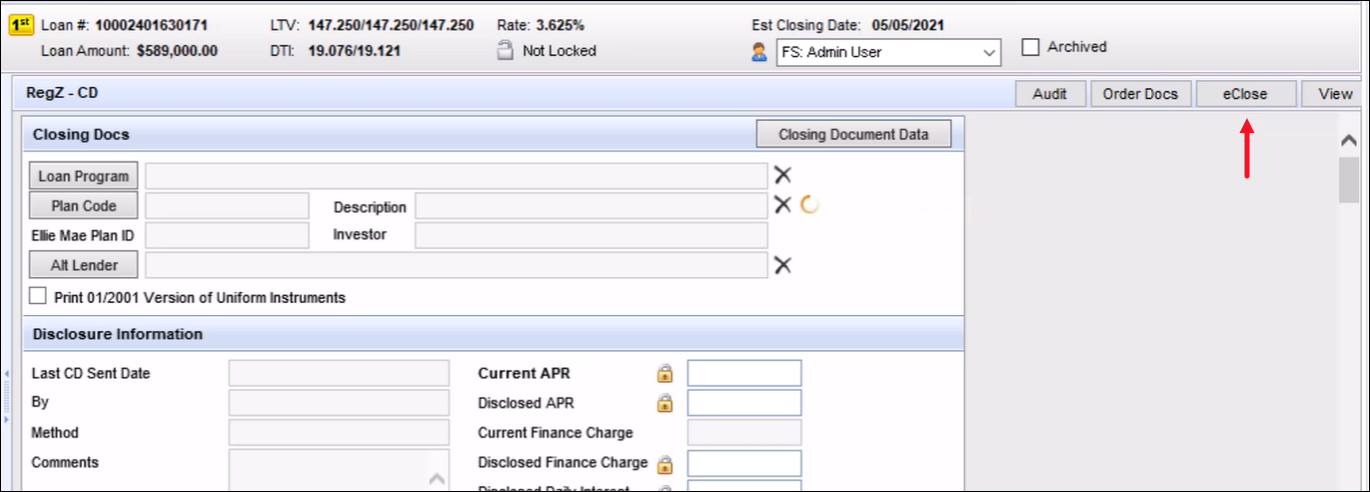

Encompass hybrid eClose is now enabled for all lenders who use the Encompass Docs Solution to generate initial disclosures and closing documents.

Authorized users can click the eClose button on the RegZ-CD input form (or other forms where the traditional Order Docs button is provided) to start ordering closing documents using the eClose workflow.

While a traditional closing involves physical pieces of paper and in-person notary visits, eClosing involves electronic documents that can be signed online and online collaboration rooms for signing with the notary. With eClosing:

- Closing documents that can be electronically signed online

- An online collaboration room for signing.

- Generation of an eNote for electronic signature and delivery of the executed Note to an eVault and registration of the eNote with MERS. (This option is not provided by default. It requires an additional addendum and an ICE Mortgage Technology Professional Services (PSO) engagement. Contact your Encompass relationship manager for more information.)

- Options for a hybrid eClose, which is a closing where the borrower eSigns some, but not all, closing documents.

Please note, a PSO implementation is required in order to set up and maximize the benefits of eClosing for users. Visit the Encompass eClose Support page in the Resource Center and contact your ICE Mortgage Technology relationship manager to get started. Refer to the Encompass eClose User Guide as well.

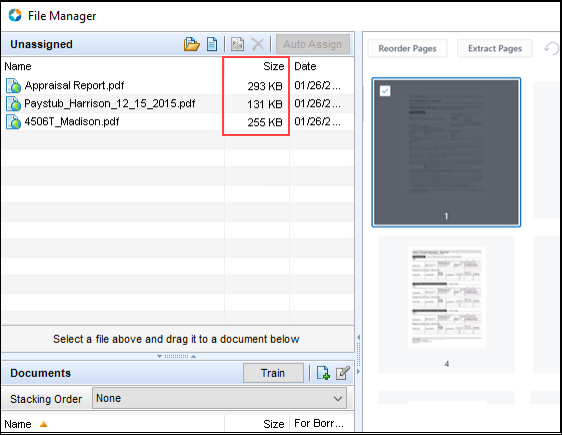

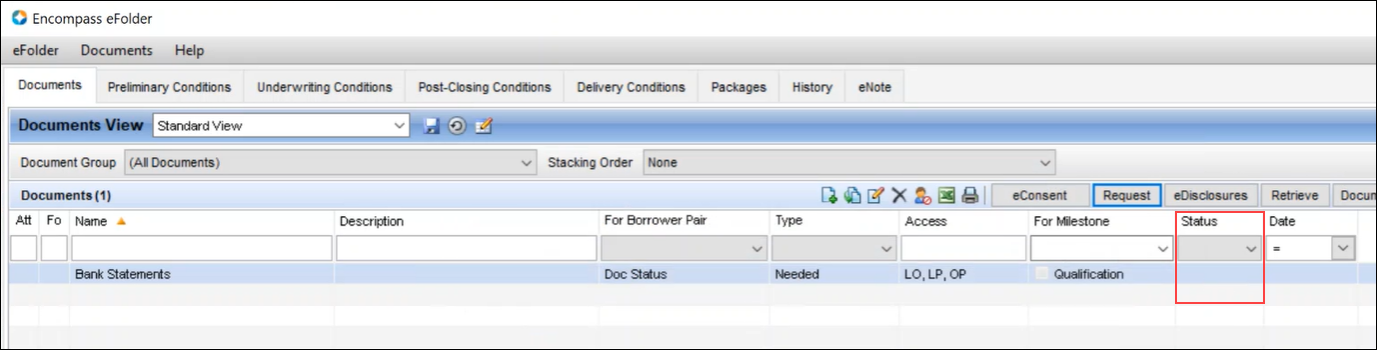

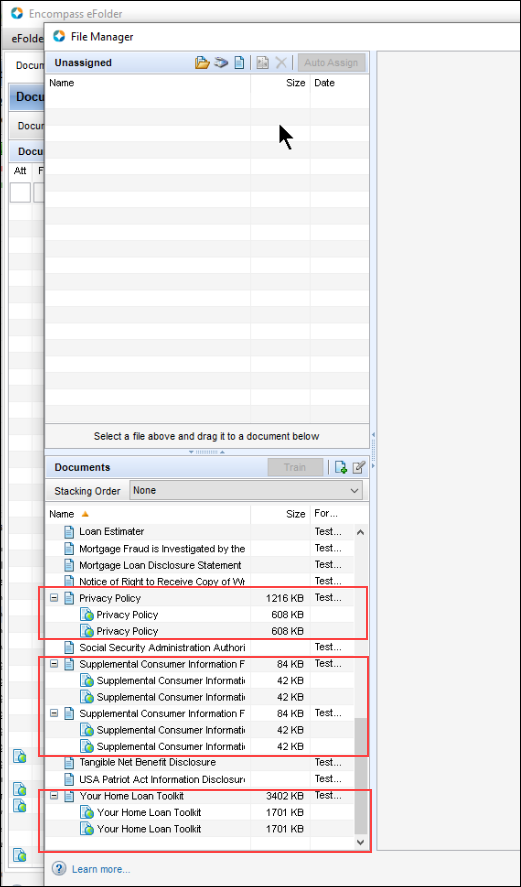

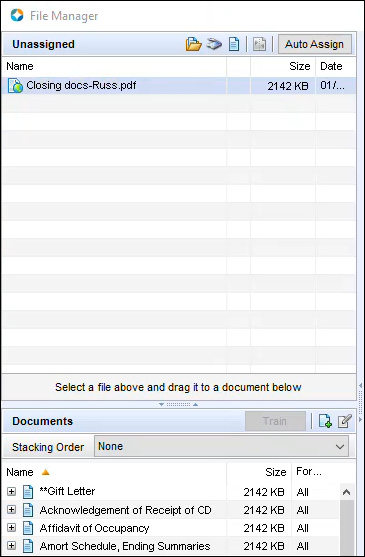

Starting in Encompass 24.1, the file size of attachments and documents in the eFolder is no longer displayed when using the new document viewer. The Size column has been removed from:

- File Manager - Unassigned section (example below)

- File Manager - Documents section

- Document Details window - Files section

This update addresses issues where the correct file size was not displayed after a document or attachment was edited or modified.

This Size column is no longer displayed in the File Manager

The Size and Size Total column may be added to the eFolder’s Documents tab if needed. The applicable file size values will be populated to these columns as in previous versions of Encompass. To add a column to the Documents tab, right-click a column header in the Documents table, and then click Customize Columns. Select the column(s) to add, and then click OK.

The https://archive.elliemae.com web site, known as the EDM Archive, is decommissioned in Encompass 24.1. This is the site where users could retrieve older, archived eFolder documents. This site is no longer available to users and they are not able to access archived documents there. Encompass stores and retains all eFolder documents. The documents can be accessed by opening them in the eFolder itself rather than visiting the EDM Archive web site.

(Added on 3/14/2024)

In previous versions of Encompass, the loan officer for the loan would receive a separate email notification each time a borrower returned documents to them. Starting in Encompass 24.1, a batch service is run and loan officers will receive one email notification that includes information about all of the recently returned documents from the borrower. The service runs every two minutes and consolidates the received document information (including those returned via fax, scanner, upload, or eSign) into one email notification. This enhancement reduces email clutter and enables the loan officer to have a more complete view of received documents.

The email notifications include different sections that categorize the received documents by eSigned package, uploads, fax, and scanned documents.

When adding borrower information to the Borrower Summary - Origination input form (and others), you can click the Preferred Contact (clock) icon in the Borrower Information section to open the Borrower Contact Preference pop-up window and specify the borrower’s time zone and preferred day and time of day to be contacted. A new Notes field has been added to this pop-up, where you can add additional information about the borrower preferences such as a set time to contact them, whether to use the mobile phone vs. home phone, or any other preference information that cannot otherwise be indicated in the pop-up window. This new field is available in the contact preferences for the borrower (field ID 5013), co-borrower (field ID 5014), and non-borrowing owner (field ID NBOC0141 in the File Contacts tool).

Currently in Encompass, when a loan is assigned to a loan trade and then is assigned to an MBS pool (or vice versa), that loan is updated with a Trade Assignment Status of “Removed-Pending” and is not removed from the Loan Trade (MBS Pool) Loans tab. As part of this release, Encompass will be updated so the loan is removed from the Loan Trade (MBS Pool) Loans tab.

(Updated on 3/20/2024)

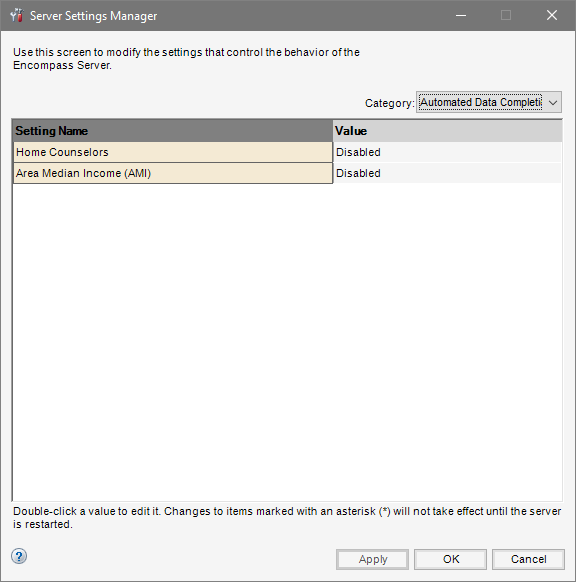

In the Admin Tools > Settings Manager, a new Automated Data Completion category and related settings are now provided. Administrators can use these settings to enable Encompass to retrieve data systematically and automatically populate/complete data within specific forms and settings. This enables the data to be completed without users having to open the form or setting and then manually click a button or similar to populate the data.

Automated data completion may be enabled for the following loan data:

- Home Counseling Provider List on the Home Counseling Providers input form

- Area Median Income (AMI)

Home Counseling Providers

When the Home Counselors option is enabled, Encompass will retrieve Home Counseling data systematically as follows, provided these prerequisites are met:

-

The Home Counseling Services Data Template must be applied to the loan.

-

The following fields must be populated:

- ZIP Code [for Borrower’s Address] (field ID FR0108) (Or, if the borrower’s present address is a Foreign Address (field ID FR0129), then the subject property’s ZIP code (field ID 15) is required.)

- Distance (field ID HCSETTING.DISTANCE)

- At least one checkbox (field ID HCSETTING.SERVICES) in the Multiple Services list must be selected.

- At least one checkbox (field ID HCSETTING.SERVICES) in the Multiple Languages list must be selected. (English is selected by default.)

Based on these prerequisites, Encompass will populate the Home Counseling Providers List automatically rather than relying on a loan team member to manually click the Get Agencies button.

Please refer to knowledge article #000115391 - 24.1 Home Counseling Providers Automation for additional requirements and information about this feature.

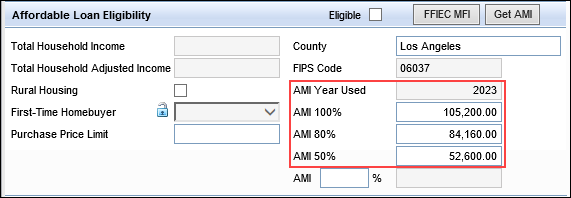

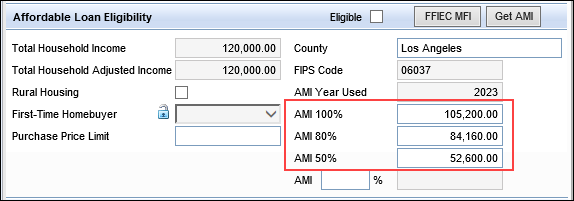

Area Median Income (AMI)

When the Area Median Income (AMI) option is enabled, the AMI data for the loan (as shown below) will be automatically populated when the subject property ZIP code (field ID 15) is entered for the loan. Encompass queries the Area Median Income (AMI) Limits table in Encompass Settings and applies the most current year’s AMI limits.

As part of this update, a new AMI Year Used field (field ID 4970) has been introduced. This field indicates the year of the AMI limits used for the loan.

When the Area Median Income (AMI) option is disabled, loan team members must use the Get AMI button to populate the AMI fields for the loan with the latest AMI limits from the Area Median Income (AMI) Limits table in Encompass Settings.

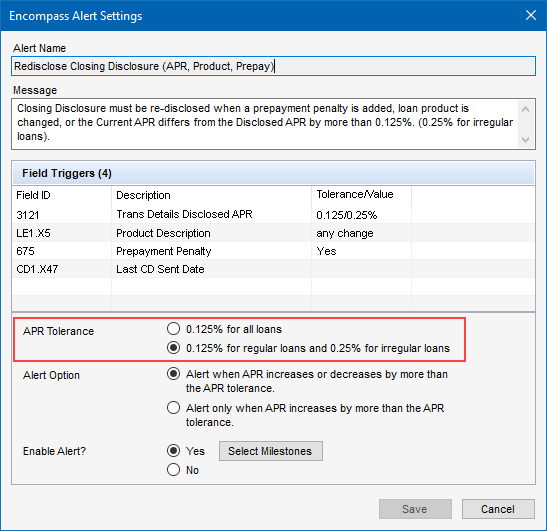

Encompass now treats Construction Only and Construction-Perm loans as irregular for the purposes of APR tolerance, regardless of the amortization type. This update ensures these Construction loans have an APR tolerance of 0.25% instead of the 0.125% tolerance applied to regular loans. Therefore, when the Redisclose Closing Disclosure (APR, Product, Prepay) alert is configured to use the APR Tolerance > 0.125% for regular loans and 0.25% for irregular loans option, the alert will not trigger for Construction Only and Construction-Perm loans when the current APR differs from the Disclosed APR by 0.25% or less.

If working in an existing loan created prior to Encompass 24.1 and the alert is triggered, this new alert logic will be applied.

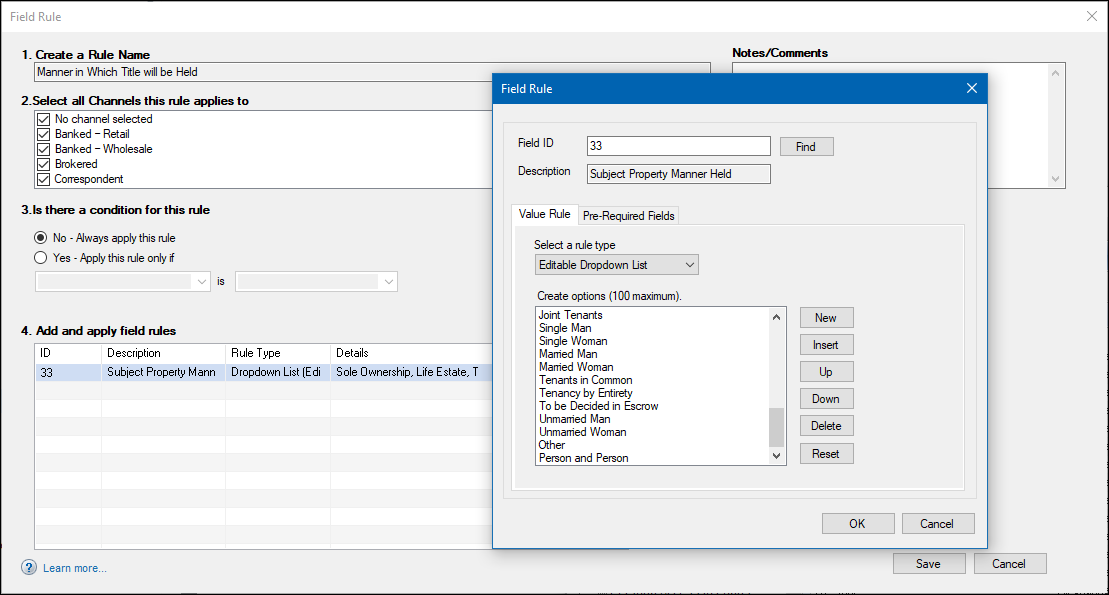

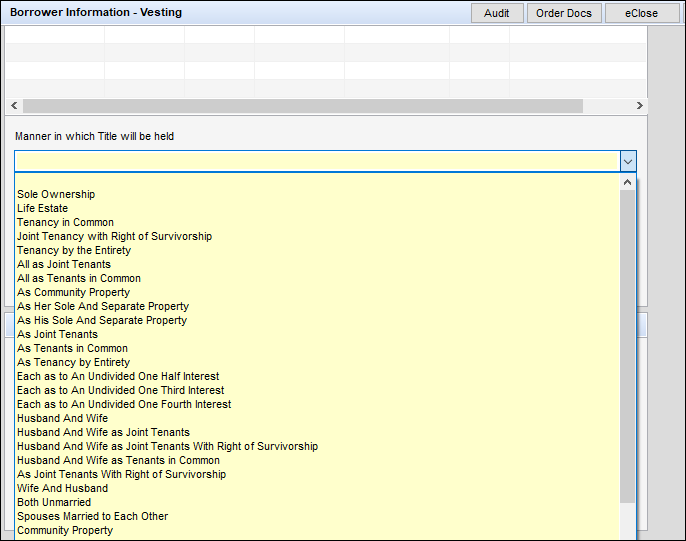

A new preconfigured rule has been added to the Field Data Entry business rule setting for Manner in Which Title will be Held. This rule is intended to be applied to the Manner in which Title will be held editable drop-down field (field ID 33) on the Borrower Information - Vesting input form. Administrators can use this rule to modify the enumerations that display in this drop-down list and specify specific enumerations they want to display on the input form.

This preconfigured rule can only be applied to field 33. When managing the enumerations, click the Reset button to return the list to the default list of enumerations provided by Encompass as needed.

To create custom business rules for Manner in which Title will be held to include additional fields, you can deactivate this preconfigured rule, and then create a new custom rule using field 33.

Since the Trade Update Queue process was moved from the client side to the server side, Field Trigger business rules no longer executed and custom fields were no longer populated based on those rules. As part of this release, the behavior of Field Trigger business rules has been updated to work with the server side Trade Update Queue process.

Encompass has been updated to enable the company’s State License ID # (field 3629) and the interviewer’s State License ID # (field ID 2306) fields to be populated with a ‘create loan’ API call. Previously, when using APIs to populate loan data, these fields could only be populated with a ‘loan update’ or ‘field writer’ API call.

As of July 2023, the AIQ product was rebranded to ICE Data & Document Automation and ICE Mortgage Analyzers. (Learn more about this branding update in the Additional Updates section below.) Due to the branding updates and additional system enhancements that have been performed for related features, the following Encompass fields which maintain the state of Data & Document Automation processing and Mortgage Analyzers eligibility status have been replaced. The NEW Field ID column lists the new field ID's:

| Encompass Custom /Standard Field IDs | Encompass External Field Name | OLD Field ID | NEW Field ID |

|---|---|---|---|

| CX.DV.FOLDERID/AIQ.FOLDERID | DDA Folder ID | EXT.AIQ MirroredFolderId | EXT.DDAFolderId |

| CX.DV.CDU.ELIGIBLE | Income Analyzer Eligible | EXT.AIQ IncomeAnalyzerEligible | EXT.IncomeAnalyzerEligible |

| CX.DV.CDU.INCOME.STATUS | Income Analyzer Status | EXT.AIQ IncomeAnalyzerStatus | EXT.IncomeAnalyzerStatus |

| CX.DV.CDU.FAILURES | Income Analyzer Exceptions | EXT.AIQ IncomeAnalyzerStatus | EXT.IncomeAnalyzerExceptions |

| CX.DV.CDU.ELIGIBLE | Credit Analyzer Eligible | EXT.AIQ CreditAnalyzerEligible | EXT.CreditAnalyzerEligible |

| CX.DV.CDU.INCOME.STATUS | Credit Analyzer Status | EXT.AIQ CreditAnalyzerStatus | EXT.CreditAnalyzerStatus |

| CX.DV.CDU.FAILURES | Credit Analyzer Exceptions | EXT.AIQ CreditAnalyzerExceptions | EXT.CreditAnalyzerExceptions |

| AIQ.LOANWASMIRROREDONPST/ CX.DV.LOAWASMIRROREDONPST |

DDA Loan Mirrored On Date | EXT.AIQ Loan Mirrored on Date | EXT.DDALoanMirroredOn |

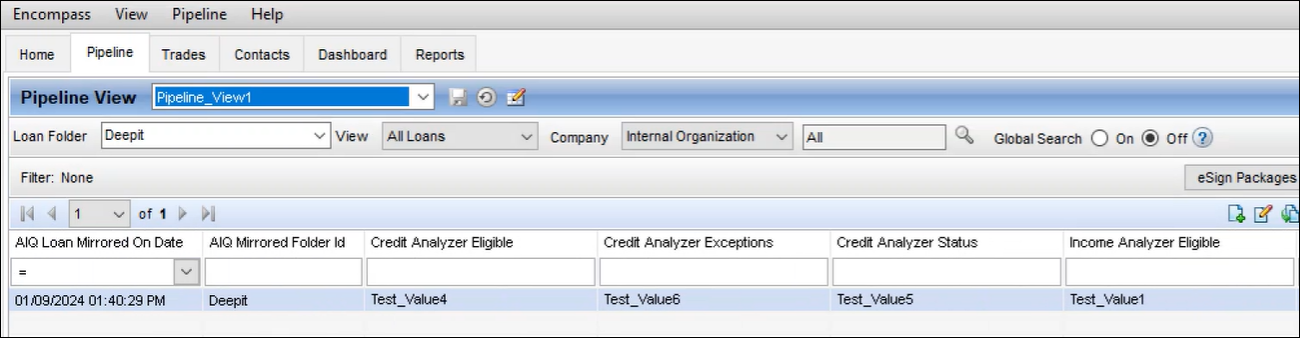

For lenders who have integrated Data & Document Automation or Mortgage Analyzers data into their Encompass instance, review your applicable Pipeline views in Encompass 24.1 to ensure the columns for these fields are still displayed in the Pipeline. Due to the system enhancements mentioned earlier, it is possible you may need to manually re-add these columns back to your Pipeline views. Any field values that were previously provided in these columns will be retained in the newly added columns.

If you do re-add these columns to applicable Pipeline views, please ensure that you also remove the old fields (i.e., the fields listed in the OLD Field ID column above) from the Encompass Reporting Database. Failure to remove these fields will result in an Error loading pipeline: ... message being triggered when you attempt to access a custom Pipeline view that includes the new Data & Document Automation and Mortgage Analyzers fields.

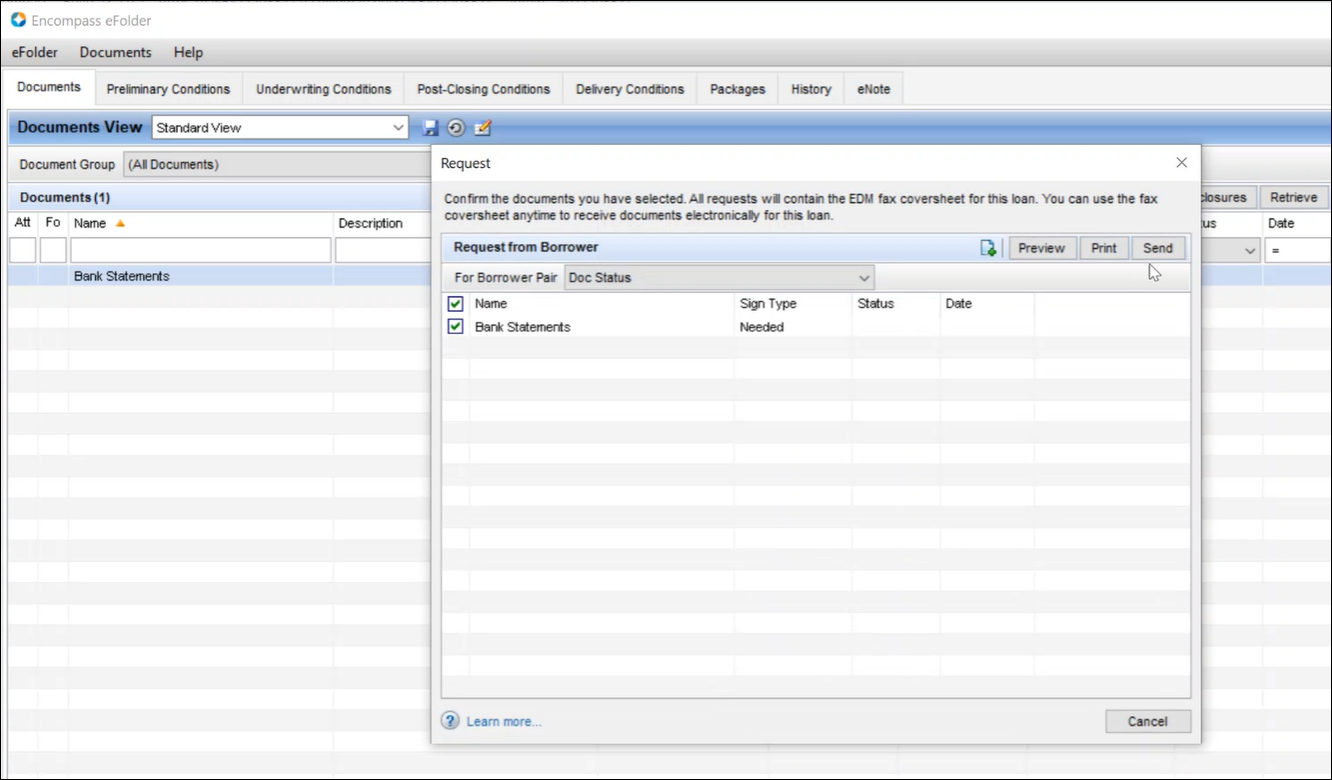

Encompass now performs an auto-save of loan data when the loan team member performs the following actions:

- Clicks the eConsent button in the eFolder.

- Clicks the Request button in the eFolder.

- Clicks the eDisclosures button in the eFolder.

- Clicks Send > Files or Send > Files to Lender button in the eFolder.

- Sends Status Online.

- Sends forms via Secure Form Transfer tool.

With this enhancement, Encompass saves the loan data before triggering external updates to Encompass Consumer Connect loans or other external services. This helps ensure the most current data is reflected in Encompass Consumer Connect loans and elsewhere, preventing errors that may occur if the same loan file has conflicting borrower/co-borrower information in different applications.

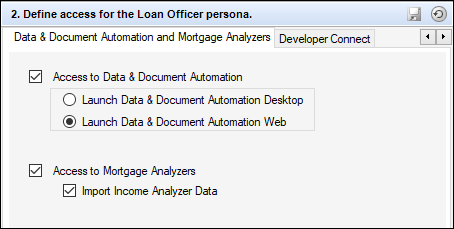

As of July 2023, the AIQ product was rebranded to ICE Data & Document Automation and ICE Mortgage Analyzers. The Encompass user interface and in-product messages have been updated to reflect this new naming where applicable. For example, the AIQ Analyzers button is now the Analyzers button and the ICE Mortgage Technology AIQ tab in the Encompass Settings > Personas setting is now labeled as Data & Document Automation and Mortgage Analyzers as shown below.

When Encompass users click Help > Encompass Help, a Learn More link, or press F1 to view the online help topic for the current screen, the online help system now opens in the user’s default web browser. In addition to the navigation tools provided in the online help user experience, you can use the browser’s Back and Forward arrows and other browser options to navigate the online help system as well. In previous versions of Encompass, the online help opened in anadmin Encompass pop-up window that did not provide access to browser navigation tools.

Fixed Issues in 24.1

This section describes the issues that have been fixed in this release.

Why we fixed these issues: These issues were fixed to improve usability and to help ensure Encompass is operating as expected. The issues that are chosen to be fixed are based on the severity of their impact to clients and client feedback.

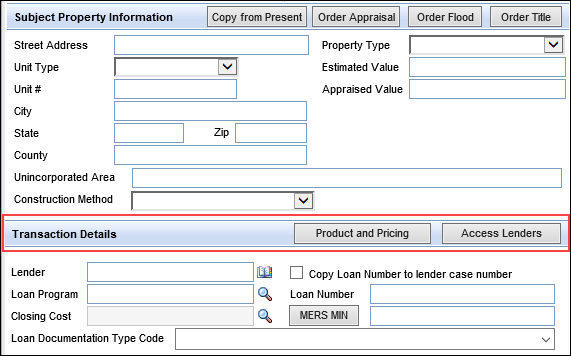

An issue with the Borrower Summary - Origination input form was introduced in Encompass 23.3 where the Subject Property Information section of the form was overlapping/hiding the Transaction Details section heading. This prevented loan team members from accessing the Product and Pricing and Access Lenders buttons provided in the section heading. This issue has been resolved and the Transaction Details and associated buttons now display correctly as shown here.

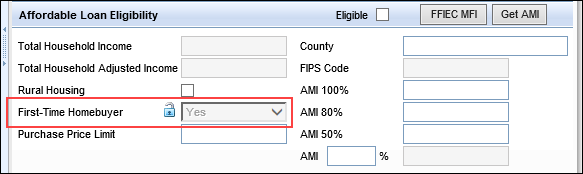

The First-Time Homebuyer field (field ID 934) had an issue where it was not automatically updating to Yes or No like it should have in loans with multiple borrowers or borrower pairs. Specifically, field 934 was not automatically updating when a borrower or borrower pair was removed from the loan. For example, when the Borrower First-Time Homebuyer field (field ID 4973) was set to No and the Co-Borrower First-Time Homebuyer field (field ID 4974) was set to Yes, field ID 934 automatically updated to Yes correctly. However, if the co-borrower was later removed from the loan, field 934 did not automatically update to No. It incorrectly remained as Yes. To address this issue, a recalculation of field 934 is now triggered when a borrower or borrower pair is removed.

By default, the First-Time Homebuyer field (field ID 934) automatically populates based on the values in fields 4973 and 4974. If the field is later locked and a value is manually entered in the First-Time Homebuyer field, it will not automatically update based on fields 4973 and 4974.

In previous versions of Encompass, the Discount Points field (field ID 1093) on the 1003 URLA - Lender input form was not calculating seller obligated discount points correctly. When the discount points entered on line 802e on the 2015 Itemization were seller obligated, these discount points were not applied to the Discount Points calculation for field 1093. As a result, when the seller obligated fees were more than the borrower obligated fees, the Estimated Closing Costs field (field ID 137) was being cleared out and the cash to close amount was then overstated. This issue has been addressed. Seller-obligated fees for line 802e, f, g, and h are now excluded from the Total Seller Amount when Encompass compares borrower obligated closing costs to seller obligated closing costs. In addition, the Discount Points field (field ID 1046) on the FHA Maximum Mortgage and Cash Needed Worksheet has been updated so that when the discount points are seller obligated, field 1046 is cleared out/blank.

For existing, non-active (field ID 1393) loans created prior to Encompass 24.1, fields 137, 1046, and 1093 are locked so they retain their current values. (If you unlock any of those fields on a non-active loan, the new logic will apply on the non-active loan.) For active (field ID 1393) loans created prior to Encompass 24.1, these fields will be locked only if initial disclosures have been sent. If no disclosures have been sent, the fields are recalculated using the new logic described above the next time the loan file is opened.

When co-mortgagors are listed in a loan file, the Monthly Debt Allowed (field ID PREQUAL.X8) field has been updated to be calculated based on the total income documented in the file (field ID 1389). Prior to Encompass 24.1, Encompass was calculating the Monthly Debt Allowed based on the income of the first borrower pair only.

Workaround Description

The following workaround was provided for this production issue and is no longer required for the Encompass 24.1 release and later:

-

Enter co-mortgagors income on other on the first borrower pair and PREQUAL.X8 will calculate from field 1389

(Updated on 3/14/2024)

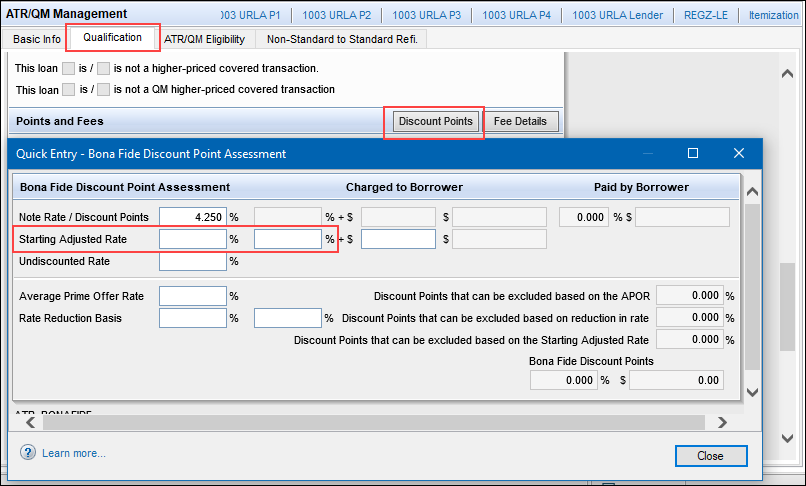

An issue occurred where NEWHUD.X1720 and NEWHUD.X1721 in a loan were cleared when the loan was manually locked and then either the loan was locked and confirmed or the lock was extended. This issue has been resolved and the two fields, which are accessible by clicking the Discount Points button on the ATR/QM Management form's Qualification tab, are no longer cleared when a loan is manually locked and then the loan is locked and confirmed or the lock is extended.

In previous versions of Encompass, the Intent to Proceed checkbox (field ID 3164) could only be selected once the Actual Received Date for the Loan Estimate (LE) for the primary borrower was populated. In loans with borrower and co-borrower, if the co-borrower acknowledged the disclosure package prior to the borrower, the Intent to Proceed checkbox was inactive (grayed-out) and could not be selected by the co-borrower. This prevented them from recording an accurate Intent to Proceed date. This issue has been addressed and the Intent to Proceed checkbox is now accessible for co-borrowers regardless of the primary borrower’s interaction with the disclosure package.

(Updated on 3/14/2024)

To address issues reported with using business rules to populate HMDA data, relevant HMDA data field calculations for Ethnicity, Race, and Gender have been updated to ensure the correct HMDA input fields in Encompass are being used for the relevant field calculations and field triggers relied upon by the business rules. This update helps ensure that business rules intended to capture and populate HMDA data for a loan are using the correct fields and triggering successfully.

Please note, only those customers who utilize APIs with Encompass Data Connect, Encompass Consumer Connect or services to populate HMDA fields would be impacted by the field issues and this fix. In previous versions of Encompass, when the HMDA fields were populated via a business rule or dynamic data management (DDM) rule, the fields would not always be populated correctly, which resulted in blank values being populated to the fields. With this fix in place, the fields are now calculated correctly and the correct value is populated to the fields when they are updated via a business rule, DDM rule or API.

For a list of impacted HMDA fields, please refer to knowledge article #000115397 - Update for Business Rules Used for Populating HMDA Data to Input Forms.

(Updated on 3/20/2024)

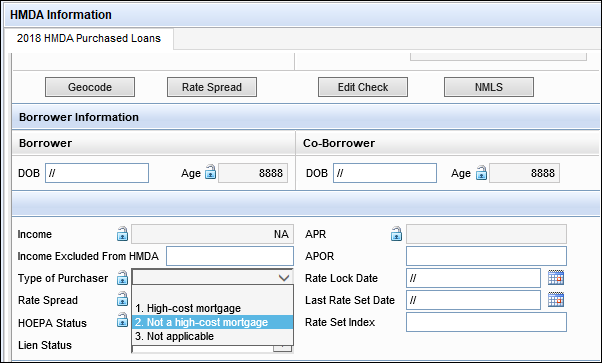

In previous versions of Encompass, the system logic was populating 2. Not a high-cost mortgage to the HOEPA Status field (field ID HMDA.X13) for loans for investment properties and second properties (based on the value in field 1811 (Property will be)). However, based on CFPB high-cost mortgages rules [12 CFR § 1026.32(a)(1)], investment properties and second properties should be indicated as 3. Not applicable in the HOEPA Status field. This new system logic will take effect in Encompass 24.1

For existing loans originated prior to Encompass 24.1, the HOEPA Status field will be recalculated using the new system logic when the loan is opened and saved.

When the Use Actual Down Payment and Closing Costs Financed (field ID LE2.X30) checkbox was selected and the loan amount was changed, the Closing Costs Financed (field ID LE2.X1) value was not updated, though it should have been. This issue has been resolved.

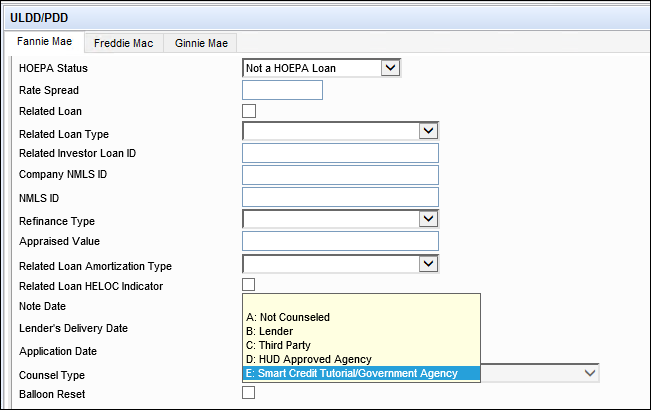

In the Counsel Type dropdown field (field ID 2847) on the Fannie Mae and Freddie Mac ULDD/PDD input forms, the E: Credit Smart Tutorial option has been re-named to E: Smart Credit Tutorial/Government Agency. Since a ‘Government Agency’ option was not available to select from the Counsel Type field previously, this option could not be selected for loans being sold to Fannie Mae or Freddie Mac.

- The E: Smart Credit Tutorial/Government Agency option is now available on the ULDD/PDD and Freddie Mac Additional Data input form, as well as the applicable Data Templates in Encompass Settings.

- There is no change to the field ID or field mapping. This is only a text change in the field 2847 dropdown list on the Fannie and Freddie Mac tabs.

It was discovered that Fannie Mae’s Desktop Underwriter (DU) was calculating the CLTV/HCLTV differently than Encompass in loans where the Verification of Additional Loans (VOAL) form’s HELOC Initial Draw amount was more than the Amount Applied to Down Payment. When DU was ordered for a loan like this (VOAL loan type is HELOC), it was calculating the CLTV and HCLTV based on the Amount Applied to Down Payment (field ID URLARAL0022) and not the HELOC Initial Draw (field ID URLARAL0121). This resulted in DU showing a lower CLTV and HCLTV than what Encompass was showing in the loan file. Encompass has been updated to ensure DU and Encompass reflect the same CLTV and HCLTV amounts in this scenario. The calculation for the total VOAL (URLA.X230) has been adjusted to calculate the full initial draw amount when the additional loan type is a HELOC. Previously, Encompass was using only a portion of the initial draw used toward Closing Costs in its calculation.

The Funding Worksheet has been updated for HELOC loans to ensure that the draw amount (field ID 1888) is included in calculation for the Wire Transfer Amount field (field ID 1990). Previously, the total HELOC loan amount (field ID 2) was used in the calculation for the Wire Transfer Amount. Since HELOC loans only fund using the draw amount, this update helps ensure that lenders do not over fund the transaction by using the total loan amount.

Workaround Description:

The following workaround was provided for this production issue and is no longer required for the Encompass 24.1 release and later:

- Input the remaining principal that is not part of the initial draw as a negative in Overwire Amount (field 2005).

- Create a custom field to calculate Initial Advance (Field 1888) - Loan Amount (Field 1109).

- Create a Field Trigger Business Rule with a Condition to run only on HELOC Loans. The trigger is any change to the custom field created in step 1 copies to field 2005.

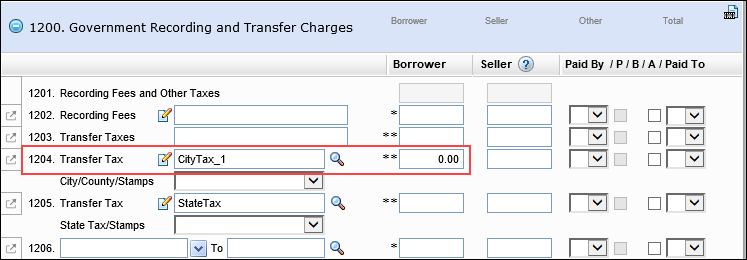

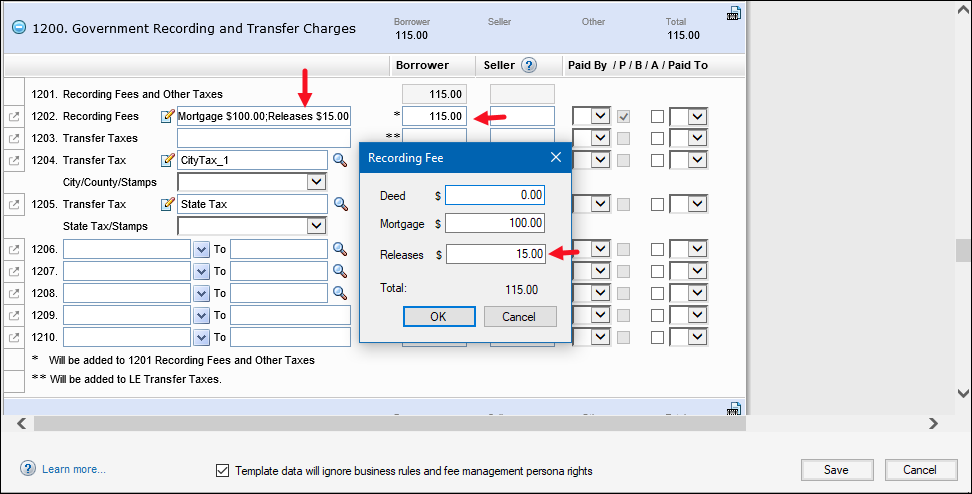

An issue occurred where City Tax tables were not being applied correctly when applied with a Closing Costs template. In Closing Costs templates where line 1204 Transfer Tax was populated with a defined City Tax table that resulted in 0.00 being populated to the borrower-paid fee (field 647) on line 1204, when the Closing Costs template was applied to the loan, the borrower-paid fee (field 647) on line 1204 was populated with 0.00. Field 647 should have been populated with a value based on the City Tax table and relevant loan data calculation.

This issue has been resolved so that the borrower-paid fee (field 647) on line 1204 in the loan is now calculated correctly based on the City Tax table and relevant loan data.

Notes:

- This fix applies only to new Closing Costs templates.

- If a Closing Costs template created prior to Encompass 24.1 has 0.00 populated in field 647 based on the City Tax table calculation and it’s applied to the loan, then 0.00 will be populated to field 647 in the loan. To resolve this issue in existing Closing Costs templates like this, manually delete 0.00 from field 647 in the Closing Costs template, and then reapply the template to the loan.

- Manually entered values in the Closing Costs template will override calculated values when the template is applied. If the administrator has manually entered 0.00 in field 647 in the template, then 0.00 will be populated to field 647 in the loan when the template is applied.

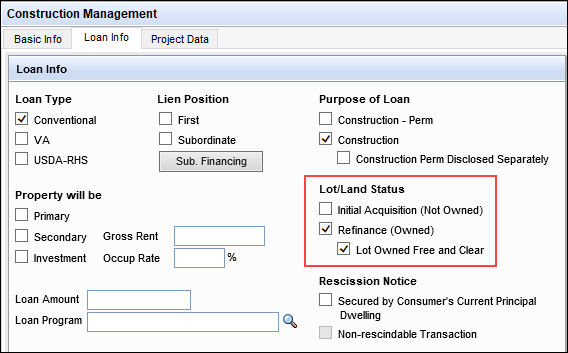

For Construction loans where the lot is owned free and clear, Encompass now calculates the Loan to Value (LTV) ratio as a Limited Refinance transaction in accordance with Fannie Mae and Freddie Mac guidance. Previously, the LTV for these loans was calculated as a Purchase transaction.

In addition to the new calculation being applied to these loans, the Lot/Land Status section of the Construction Management > Loan Info tab has been updated:

-

The Initial Acquisition checkbox (field ID 1964) has been renamed to Initial Acquisition (Not Owned).

- If selected, the transaction is for the purchase of the real property upon which the dwelling will be constructed and for the construction of the dwelling. For the LE/CD, the Purpose will be a Purchase transaction. The LTV will be based on the lesser of As Completed Purchase Price (CONST.X58) or As Completed Appraised Value (CONST.X59).

-

The Refinance checkbox (field ID Constr.Refi) has been renamed to Refinance (Owned).

- If selected, the transaction is for the construction of a dwelling on real property that is already owned by the borrower(s) and there is existing debt owed on the property. For the LE/CD, the Purpose will be a Refinance. The LTV will be based on the As Completed Appraised Value (CONST.X59).

-

A new checkbox is now provided: Lot Owned Free and Clear (field ID 5015). This field is read-only by default, but is enabled for editing when the Refinance (Owned) checkbox is selected first.

- When both the Refinance (Owned) and the Lot Owned Free and Clear checkboxes are selected, Construction is automatically populated to the loan’s Purpose field (field ID LE1.X4) on the Loan Estimate (LE) Page 1 and Closing Disclosure (CD) Page 1.

- If selected, the transaction is for the construction of a dwelling on real property that is already owned by the borrower(s) and there is no existing debt owed on the property. For the LE/CD, the Purpose will be Construction. The LTV will be based on the As Completed Appraised Value (CONST.X59).

Note that the above changes were also made to the Lot/Land Status section on the 1003 URLA - Lender, 1003 URLA Part 4, RegZ-LE, and RegZ-CD input forms.

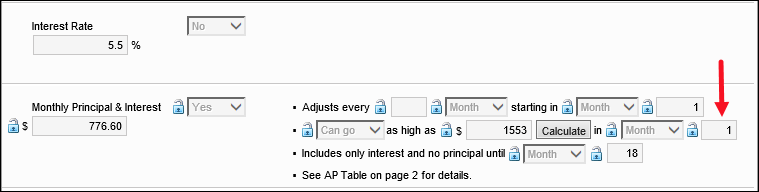

Encompass was calculating the earliest month that the maximum loan payment adjustment could occur (field ID LE1.X25) incorrectly for Fixed Rate, Construction Only loans with terms under 24 months. For these loans, the adjustment could occur in month 1, but field LE1.X25 was reflecting month 2. This occurred because Encompass was counting the balloon payment as the first payment change. This issue has been addressed to ensure field ID LE1.X25 is now calculated correctly. Please note the following:

- This issue has been fixed for Fixed Rate, Construction Only loans with terms less than or equal to 24 months and the construction method (field ID SYS.X6) is A (Half Loan).

- This fix only addresses the issue for field LE1.X25, but not for field LE1.X26 (the maximum month that the payment includes only interest and no principal) for Fixed Rate, Construction Only loans with terms longer than 24 months. Field LE1.X26 was calculated incorrectly in previous versions of Encompass for Fixed Rate, Construction Only loans with terms longer than 24 months and this will not be addressed in Encompass 24.1.

This updated calculation will be applied to existing loans as well as new loans created in Encompass 24.1. This ensures the earliest month for maximum loan payment adjustment calculation is more precise and improves the integrity of the loan data.

Workaround Information

The following workaround was provided for this production issue and is no longer required for the Encompass 24.1 release and later:

-

Create a Trigger Business Rule with an Advanced Condition to Lock field LE1.X25 and change the value to 1.

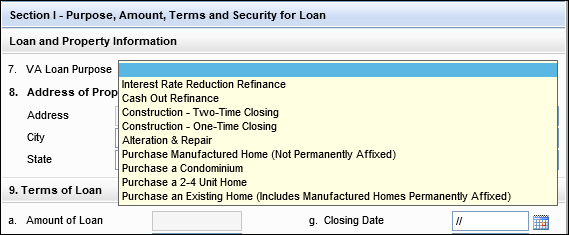

New field enumerations were introduced in the VA Purpose of Loan dropdown field (field ID VASUMM.X155) on the VA 26-1820 Loan Disbursement input form in Encompass 23.1. By design, this drop-down field was displayed on the input form in loans with an Application Date (field ID 745) and GFE Application date (field ID 3142) on or after 4/1/2023. For loans with an Application Date or GFE Application Date prior to 4/1/2023, the Purpose of Loan dropdown field (field ID 28) with different enumerations was used on this form.

Starting in Encompass 24.1, the VA Purpose of Loan field (field ID VASUMM.X155) is used on the VA 26-1820 Loan Disbursement input form in new loans by default (i.e., field 745 and field 3142 are both blank).

- In loans where field 745 and 3142 use dates on or after 4/1/2023, the VA Purpose of Loan field (field ID VASUMM.X155) is used on the form.

- In loans where field 745 or 3142 use dates prior to 4/1/2023, the Purpose of Loan (field ID 28) dropdown field is used on the form.

- In existing loans that are accessed after upgrading to Encompass 24.1, if field 745 is blank and field 3142 uses a date on or after 4/1/2023, field VASUMM.X155 will now be used on the form. (In previous versions of Encompass, field 28 would have been used on the form in this scenario.)

Field ID VASUMM.X155:

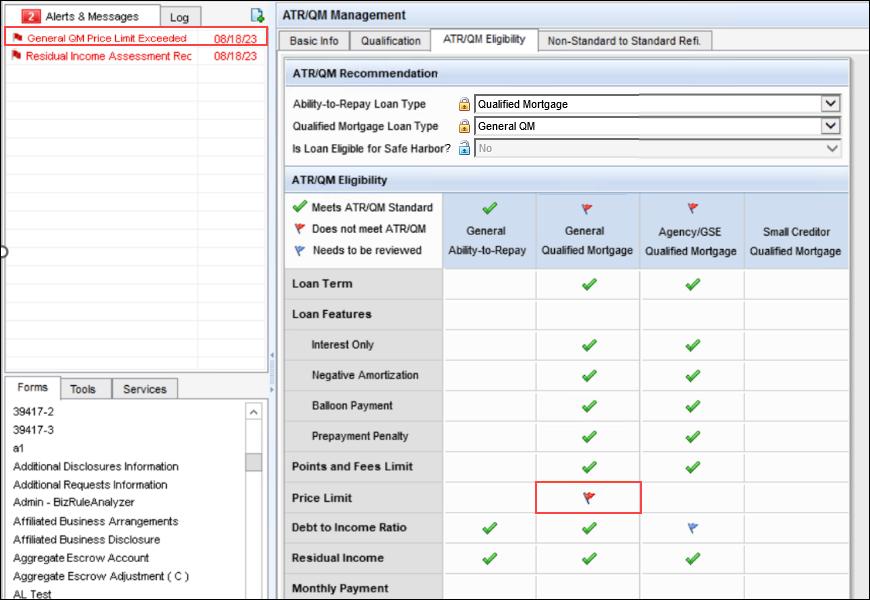

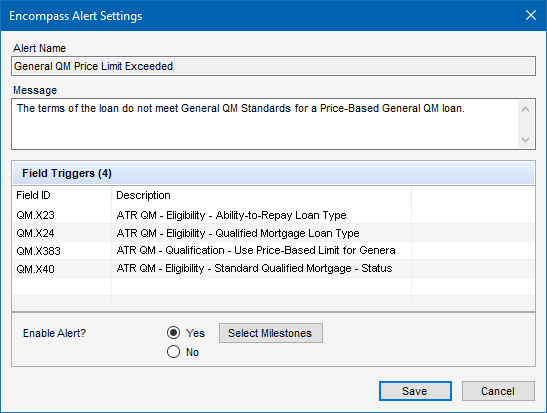

The General QM Price Limit Exceeded alert has been updated to trigger only if the General Qualified Mortgage (field ID QM.X40) does not meet the ATR/QM standard. Prior to Encompass 24.1, this alert was based on the General Qualified Mortgage (field ID QM.X40) and the actual Price Limit indicator (QM.X384), which resulted in the alert being triggered even when the loan met the price limit requirements.

As part of this update, the default message displayed with the alert has been updated to:

The terms of the loan do not meet General QM Standards for a Price-Based General QM loan.

Previously, the message was:

The pricing exceeds the limit for General QM. Review the pricing associated with the maximum payment in the first five years.

Note that the default message may be edited by the administrator.

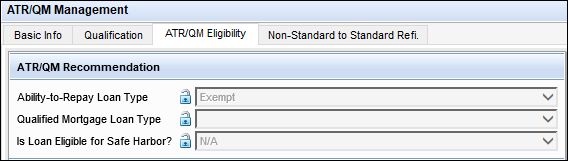

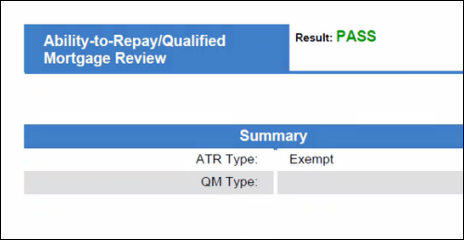

An issue occurred for FHA loans with the Encompass Compliance Service (ECS). FHA loans indicated as exempt from ATR/QM (based on field ID QM.X103), would receive an ERROR result for the Ability-to-Repay/Qualified Mortgage Review performed by ECS along with this message:

Qualified Mortgage Type (FHA Qualified Mortgage) not valid for Ability to Repay Loan Type [Exempt].

ECS was triggering this error based on the Qualified Mortgage Loan Type (field ID QM.X24) field in the ATR/QM Management input form. Encompass was auto-populating FHA QM to this field based on the FHA loan type.

Since the FHA loan was indicated as exempt from ATR/QM, Encompass should not have populated field QM.X24 with FHA QM. This issue has been resolved. In this scenario, field QM.X24 remains blank and the ECS review recognizes the loan as exempt from ATR/QM and provides a PASS result for the ATR/QM Review.

Encompass 24.1

Workaround Description:

The following workaround was provided for this production issue and is no longer required for the Encompass 24.1 release and later:

-

Lock down the QM type and set the value to null.

VOAL (Verification of Additional Loans) records can be created in two ways:

- System generated when a linked loan is created

- Manually created by users

In previous versions of Encompass, the following issues with system-generated VOALs occurred and have now been addressed:

- When a user created a linked loan, Encompass was generating the VOAL record in the current borrower pair rather than only in the primary borrower pair. This has been fixed, so that the VOAL is always created in the primary pair.

- If a loan was previously linked and already had a system-generated VOAL, if it was then linked again, duplicate system-generated VOALs were being created. This has been fixed, so that the system does not generate VOALs in the loan again if there is already a system-generated VOAL. (Note that system-generated VOALs will be created if there is already a manually created VOAL on the loan.)

This update applies to new loans created in Encompass 24.1 and later. For existing loans where the system-generated VOAL has already been duplicated or erroneously added to the non-primary borrower pair(s) record, users will need to manually address the duplicate VOALs in the loans.

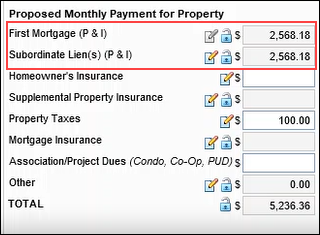

When the first lien of a piggyback loan was updated via a trade, the First Mortgage (P&I) (field ID 1724) value was getting copied into the Subordinate Lien(s) (P&I) field (field ID 1725). This issue has been resolved.

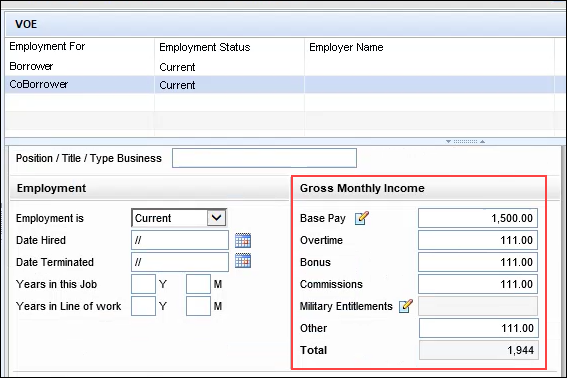

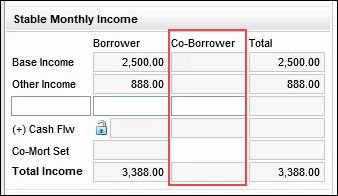

After switching a Verification of Employment (VOE) record from Borrower to CoBorrower, the Gross Monthly Income field values on the VOE were not populated to the corresponding Co-Borrower Stable Monthly Income fields (field IDs 110, 1146, 1759) on the Transmittal Summary as expected. This has been resolved, and when the VOE record is switched, the Co-Borrower income fields on the Transmittal Summary input form are updated with the correct values.

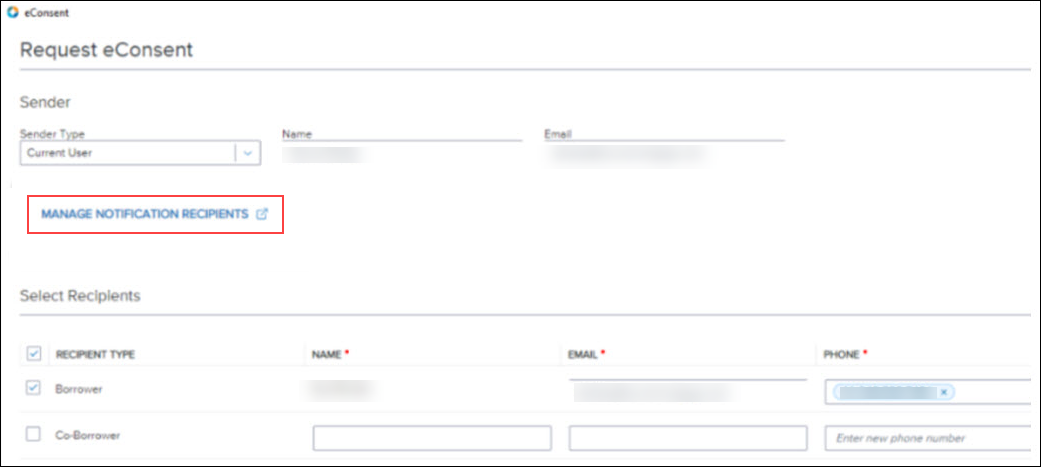

Issue in previous versions of Encompass:

When a loan team member updates the borrower name or email address after the eConsent agreement has been accepted, the eConsent Not Yet Received alert should trigger when they save the loan. However, an issue occurred where this alert did not trigger if they clicked the black X in the top-right corner of the screen to exit the loan, and then saved the loan by clicking Yes when they received the prompt “Do you want to save the changes to the current loan?”. (The alert triggered as expected when the loan team member clicked the Save icon to save the loan prior to exiting the loan file.)