Feature Enhancements in Version 24.1 (Banker Edition)

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release.

Updates to Forms and Tools

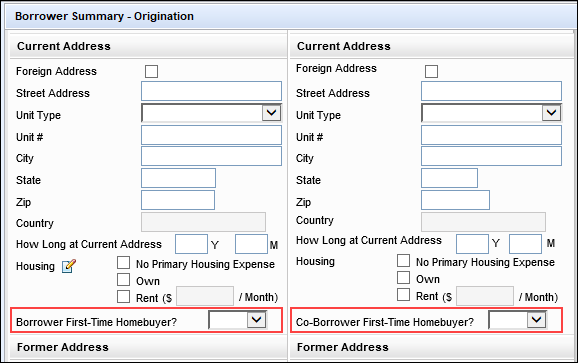

The following fields have been added to the Borrower Summary - Origination input form:

- Borrower First-Time Homebuyer (field ID 4973)

- Co-Borrower First-Time Homebuyer (field ID 4974)

These borrower-level fields were already available on the ULDD/PDD input forms, so they are being added to the Borrower Summary - Origination input form to ensure first-time homebuyer data is displayed consistently within the loan.

These new fields display on the Borrower Summary - Origination input form only when using the Forms > URLA Form Version > URLA 2020 forms in Encompass.

The following new options are now provided in the ARM Index Type dropdown field (field ID 1959) provided on the RegZ - CD and other input forms:

- 2 Year US Treasury CM (daily)

- 2 Year US Treasury CM (weekly)

- 2 Year US Treasury CM (monthly)

These new options are also now provided here:

- ARM Index Type dropdown field on the Lock Request Form (field ID 4512)

- ARM Type pop-up window displayed when the user clicks the Lookup (magnifying glass) icon associated with the Adjustable Rate field (field ID 995)

- Index + Margin dropdown field (field LE2.X96) in the Adjustable Interest Rate (AIR) Table on the Closing Disclosure Page 4.

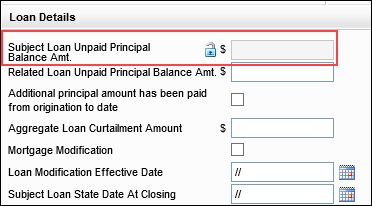

To enable loan team members to override the system-calculated value populated to the Subject Loan Unpaid Principal Balance Amount field (field ID ULDD.X1), a new field Lock is now provided for this field. By default, field ULDD.X1 is populated with the current unpaid principal balance entered in field SERVICE.X57 on the Interim Servicing Worksheet once Interim Servicing is completed. Authorized users can now click the blue Lock icon for field ULDD.X1 to manually enter the value they want reflected on the ULDD export to the GSEs.

The Application Date field (field ID HMDA.X29) has been added to the 2018 HMDA Purchased Loans tab on the HMDA Information input form. (This tab displays in the input form when 6. Purchased loan is selected from the Action Taken drop-down list.) Previously, this field was only available on the 2018 HMDA Originated/Adverse Action Loans tab on this input form.

This field has been added to the Purchased Loans tab because in HMDA, Purchased Loans are expected to report NA for the Application Date since the application dates on purchased loans may happen one or more quarters or even years before the loan is purchased. NA is populated to this field by default. Authorized users may click the Lock icon, and then overwrite the NA value by manually typing or selecting a date from the calendar.

In previous versions of Encompass, when two loans are linked and one or more fees have been added to the 2015 Itemization input form, you cannot update the Paid By dropdown field for the fee directly on the input form. Instead, you must open the Fee Details pop-up window for the fee and then manually update the payment information. Encompass 24.1 has been updated to enable loan team members to update the Paid By dropdown selection for a fee directly on the 2015 Itemization input form in linked loans, just like you can for loans that are not linked.

Changes have been made to the Estimated Construction Interest (field ID 4088) calculation in Encompass. This change only affects Construction Only loans where the Estimated Interest On (field ID SYS.X6) is set to Method B (Full Loan). With this update, the calculation logic for field 4088 is calculating from the estimated closing date (field ID 763), or if that is blank, from the disbursement date (field ID 2553) to the final construction payment date (field ID 1961) for 365/360 (new behavior) and 365/365 (new behavior) loans. This update is being made to ensure that the Estimated Construction Interest calculation includes the final construction pay date (field ID 1961).

Please note, this update is strictly a correction to how Encompass calculates the number of days for collecting construction interests for 365/360 and 365/365 loans. The calculation used for 360/360 loans was already correct and has not changed. If you open an existing 365/360 or 365/365 loan file created prior to 24.1, the new interest calculation for field 4088 will be used so that the correct value is provided in the loan.

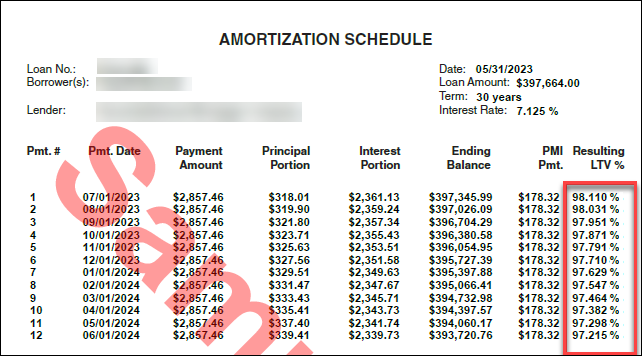

When printing the Amortization Schedule from Encompass, the value provided in the Resulting LTV% column is now rounded to three decimals to match the value provided in the Threshold/LTV% column in the Amortization Schedule viewable in Encompass. Previously, the Resulting LTV% value on the printed output form was rounded to four decimals.

Printed output form in 24.1

A No checkbox for the Borrower LDP/SAM Search field (field ID 3026) and the Co-Borrower LDP/SAM search field (field ID 3027) has been added to the FHA Management input form’s Tracking tab and the HUD-92900LT FHA Loan Transmittal input form to align with HUD’s FHA requirements. Select Yes if the individual is found in the LDP or SAM search or No if they are not found.

Currently in Encompass, when a lock extension is approved, the updated field values for the Lock Request Lock # Days (field ID 2090) and Lock Expiration Date (field ID 2091) fields are not captured to the fields (the values are stored elsewhere within Encompass) but are displayed correctly on the Lock Request Form. This causes inconsistent field values between Encompass and the web version of Encompass because the web version retrieves the field values from the fields themselves. As part of this release, Encompass will be updated to provide the web version of Encompass the most current Lock Request Lock # Days and Lock Expiration Date field values.

In previous versions of Encompass, when a Correspondent loan is priced via the Encompass Product & Pricing Service (EPPS), buy side pricing with an SRP adjustment is requested from EPPS, Encompass is updated with buy side pricing from EPPS, sell side pricing is requested from EPPS, and then the user clicks the Update Encompass button in EPPS, the Secondary Lock Tool is not updated with the sell side pricing data from EPPS. As part of this 24.1 release, Encompass has been updated to ensure the Secondary Lock Tool has the most current sell side pricing data from EPPS.

New GSE Fields and Form Updates

As part of Fannie Mae's ULDD Phase 5(1) specification updates, a new field to capture the Servicing Transfer Effective Date (field ID ULDD.X200) has been added to the ULDD/PDD’s Fannie Mae tab and the Correspondent Loan Status tool. This field has been added to the ULDD/PDD’s Fannie Mae form in the web version of Encompass as well.

Please note, the corresponding field mapping required for the Fannie Mae ULDD export for this field is not available. This functionality will be completed in a future Encompass/GSE Services release.

The following fields have been added to the Fannie Mae tab on the ULDD/PDD input form:

- Other Funds Collected at Closing (field ID ULDD.X110)

- Other Funds Collected at Closing for (field ID ULDD.X111)

Note that these fields already existed on the Freddie Mac tab on the ULDD/PDD input form.

The following fields have been added to the Freddie Mac tab on the ULDD/PDD input form.

- Document Custodian ID (field ID ULDD.X114)

- Servicer ID (field ID ULDD.X116)

These fields were already provided on other input forms in previous versions of Encompass.

The following label changes have been made for three Freddie Mac options in the ARM Index Type dropdown field (field IDs 1959, 4512, LE2.X96) per Freddie Mac’s guidance:

- Freddie Mac PMMS US 15-Year Fixed Rate changed to Freddie Mac PMMS US 15-Year FRM

- Freddie Mac PMMS US 30-Year Fixed Rate changed to Freddie Mac PMMS US 30-Year FRM

- Freddie Mac PMMS US 5-Year Adjustable Rate changed to Freddie Mac PMMS US 5-Year ARM (Retired)

The following fields have been added to the Ginnie Mae tab on the ULDD/PDD input form.

- Settlement Date (field ID ULDD.GNM.SettlementDate)

- Initial Pay Date (field ID ULDD.GNM.InitialPayDate)

- EIN # (field ID ULDD.GNM.EinNumber)

- Subservicer (field ID ULDD.GNM.Subservicer)

The Inspection ID (field ID CASASRN.X220) field is now available on the Freddie Mac Additional Data input form. This field is intended for users to add the inspection identification number provided by Freddie Mac’s bACE API system.

The following new fields have been added to the GSE Additional Provider Data input form:

- Argyle (Bor, CoBor)

- Freddie Mac AIM Check (Bor, CoBor)

- Gateless (Bor,Cobor)

Encompass Document Management (EDM)

(Updated on February 13, 2024)

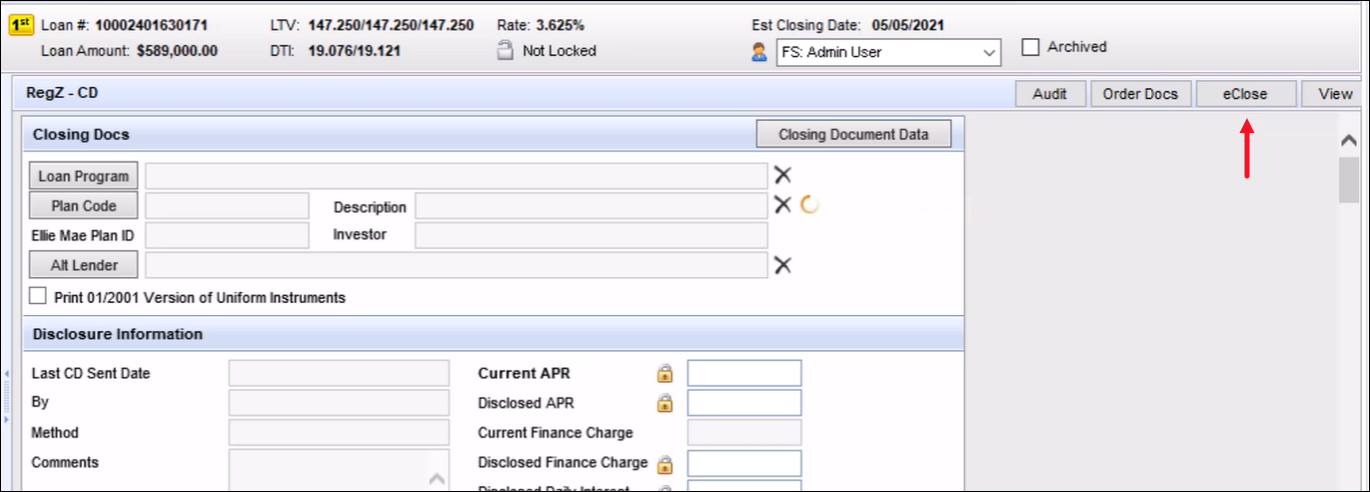

Encompass hybrid eClose is now enabled for all lenders who use the Encompass Docs Solution to generate initial disclosures and closing documents.

Authorized users can click the eClose button on the RegZ-CD input form (or other forms where the traditional Order Docs button is provided) to start ordering closing documents using the eClose workflow.

While a traditional closing involves physical pieces of paper and in-person notary visits, eClosing involves electronic documents that can be signed online and online collaboration rooms for signing with the notary. With eClosing:

- Closing documents that can be electronically signed online

- An online collaboration room for signing.

- Generation of an eNote for electronic signature and delivery of the executed Note to an eVault and registration of the eNote with MERS. (This option is not provided by default. It requires an additional addendum and an ICE Mortgage Technology Professional Services (PSO) engagement. Contact your Encompass relationship manager for more information.)

- Options for a hybrid eClose, which is a closing where the borrower eSigns some, but not all, closing documents.

Please note, a PSO implementation is required in order to set up and maximize the benefits of eClosing for users. Visit the Encompass eClose Support page in the Resource Center and contact your ICE Mortgage Technology relationship manager to get started. Refer to the Encompass eClose User Guide as well.

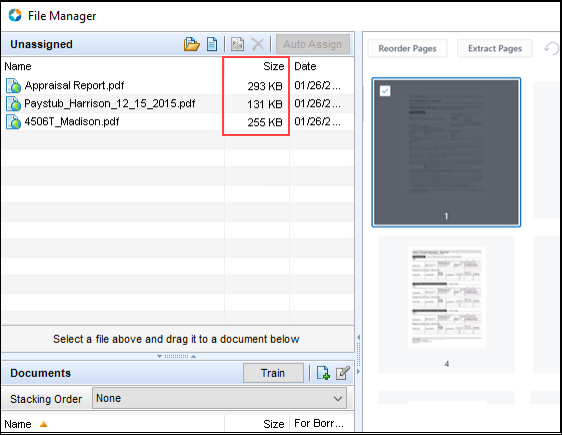

Starting in Encompass 24.1, the file size of attachments and documents in the eFolder is no longer displayed when using the new document viewer. The Size column has been removed from:

- File Manager - Unassigned section (example below)

- File Manager - Documents section

- Document Details window - Files section

This update addresses issues where the correct file size was not displayed after a document or attachment was edited or modified.

This Size column is no longer displayed in the File Manager

The Size and Size Total column may be added to the eFolder’s Documents tab if needed. The applicable file size values will be populated to these columns as in previous versions of Encompass. To add a column to the Documents tab, right-click a column header in the Documents table, and then click Customize Columns. Select the column(s) to add, and then click OK.

(Added on 3/4/2024)

The Audit Rule You have entered an MI premium but did not enter 12 1’s on the Aggregate Setup screen that may be triggered when managing documents using the Encompass Docs Solution (EDS) has been replaced by a more complex calculation to alert Encompass users of incomplete data entry issues in more scenarios. The new audit rule supports Conventional, FHA, and USDA mortgage insurance paid monthly, quarterly, semi-annually, or annually, and alerts the user of potential incorrect data entry in most cases. Please note, mortgage insurance paid bi-weekly will currently not trigger the audit and data entry must be reviewed manually until this feature is added in a future update. The new Audit Rule is now titled You have entered an MI premium but did not fully complete the Aggregate Setup screen.

Any customization that users had made to the previous audit rule requires a new EDS Change Request Form (CRF) to be submitted to apply that customization to the new audit rule.

(Added on 3/14/2024)

In previous versions of Encompass, the loan officer for the loan would receive a separate email notification each time a borrower returned documents to them. Starting in Encompass 24.1, a batch service is run and loan officers will receive one email notification that includes information about all of the recently returned documents from the borrower. The service runs every two minutes and consolidates the received document information (including those returned via fax, scanner, upload, or eSign) into one email notification. This enhancement reduces email clutter and enables the loan officer to have a more complete view of received documents.

The email notifications include different sections that categorize the received documents by eSigned package, uploads, fax, and scanned documents.

The https://archive.elliemae.com web site, known as the EDM Archive, is decommissioned in Encompass 24.1. This is the site where users could retrieve older, archived eFolder documents. This site is no longer available to users and they are not able to access archived documents there. Encompass stores and retains all eFolder documents. The documents can be accessed by opening them in the eFolder itself rather than visiting the EDM Archive web site.

Contacts

When adding borrower information to the Borrower Summary - Origination input form (and others), you can click the Preferred Contact (clock) icon in the Borrower Information section to open the Borrower Contact Preference pop-up window and specify the borrower’s time zone and preferred day and time of day to be contacted. A new Notes field has been added to this pop-up, where you can add additional information about the borrower preferences such as a set time to contact them, whether to use the mobile phone vs. home phone, or any other preference information that cannot otherwise be indicated in the pop-up window. This new field is available in the contact preferences for the borrower (field ID 5013), co-borrower (field ID 5014), and non-borrowing owner (field ID NBOC0141 in the File Contacts tool).

Trade Management

Currently in Encompass, when a loan is assigned to a loan trade and then is assigned to an MBS pool (or vice versa), that loan is updated with a Trade Assignment Status of “Removed-Pending” and is not removed from the Loan Trade (MBS Pool) Loans tab. As part of this release, Encompass will be updated so the loan is removed from the Loan Trade (MBS Pool) Loans tab.

Encompass Settings

(Updated on 3/20/2024)

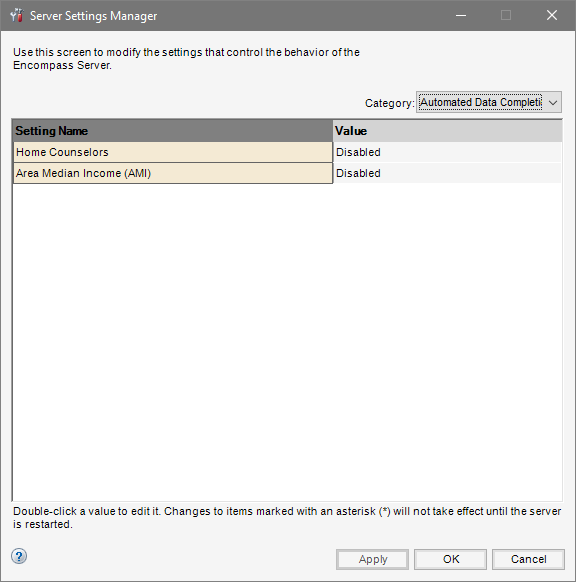

In the Admin Tools > Settings Manager, a new Automated Data Completion category and related settings are now provided. Administrators can use these settings to enable Encompass to retrieve data systematically and automatically populate/complete data within specific forms and settings. This enables the data to be completed without users having to open the form or setting and then manually click a button or similar to populate the data.

Automated data completion may be enabled for the following loan data:

- Home Counseling Provider List on the Home Counseling Providers input form

- Area Median Income (AMI)

Home Counseling Providers

When the Home Counselors option is enabled, Encompass will retrieve Home Counseling data systematically as follows, provided these prerequisites are met:

-

The Home Counseling Services Data Template must be applied to the loan.

-

The following fields must be populated:

- ZIP Code [for Borrower’s Address] (field ID FR0108) (Or, if the borrower’s present address is a Foreign Address (field ID FR0129), then the subject property’s ZIP code (field ID 15) is required.)

- Distance (field ID HCSETTING.DISTANCE)

- At least one checkbox (field ID HCSETTING.SERVICES) in the Multiple Services list must be selected.

- At least one checkbox (field ID HCSETTING.SERVICES) in the Multiple Languages list must be selected. (English is selected by default.)

Based on these prerequisites, Encompass will populate the Home Counseling Providers List automatically rather than relying on a loan team member to manually click the Get Agencies button.

Please refer to knowledge article #000115391 - 24.1 Home Counseling Providers Automation for additional requirements and information about this feature.

Area Median Income (AMI)

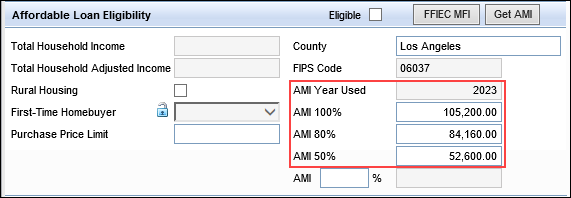

When the Area Median Income (AMI) option is enabled, the AMI data for the loan (as shown below) will be automatically populated when the subject property ZIP code (field ID 15) is entered for the loan. Encompass queries the Area Median Income (AMI) Limits table in Encompass Settings and applies the most current year’s AMI limits.

As part of this update, a new AMI Year Used field (field ID 4970) has been introduced. This field indicates the year of the AMI limits used for the loan.

When the Area Median Income (AMI) option is disabled, loan team members must use the Get AMI button to populate the AMI fields for the loan with the latest AMI limits from the Area Median Income (AMI) Limits table in Encompass Settings.

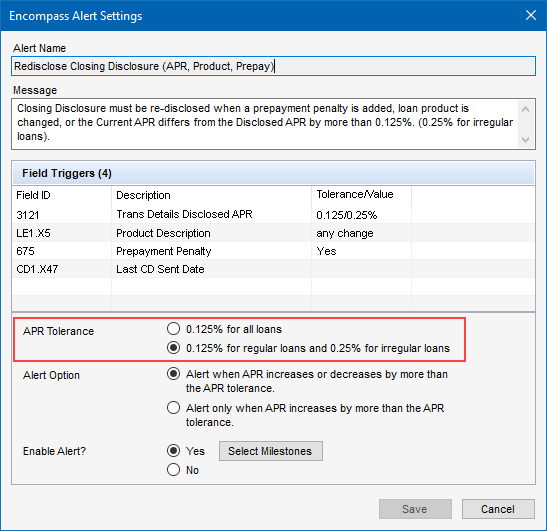

Encompass now treats Construction Only and Construction-Perm loans as irregular for the purposes of APR tolerance, regardless of the amortization type. This update ensures these Construction loans have an APR tolerance of 0.25% instead of the 0.125% tolerance applied to regular loans. Therefore, when the Redisclose Closing Disclosure (APR, Product, Prepay) alert is configured to use the APR Tolerance > 0.125% for regular loans and 0.25% for irregular loans option, the alert will not trigger for Construction Only and Construction-Perm loans when the current APR differs from the Disclosed APR by 0.25% or less.

If working in an existing loan created prior to Encompass 24.1 and the alert is triggered, this new alert logic will be applied.

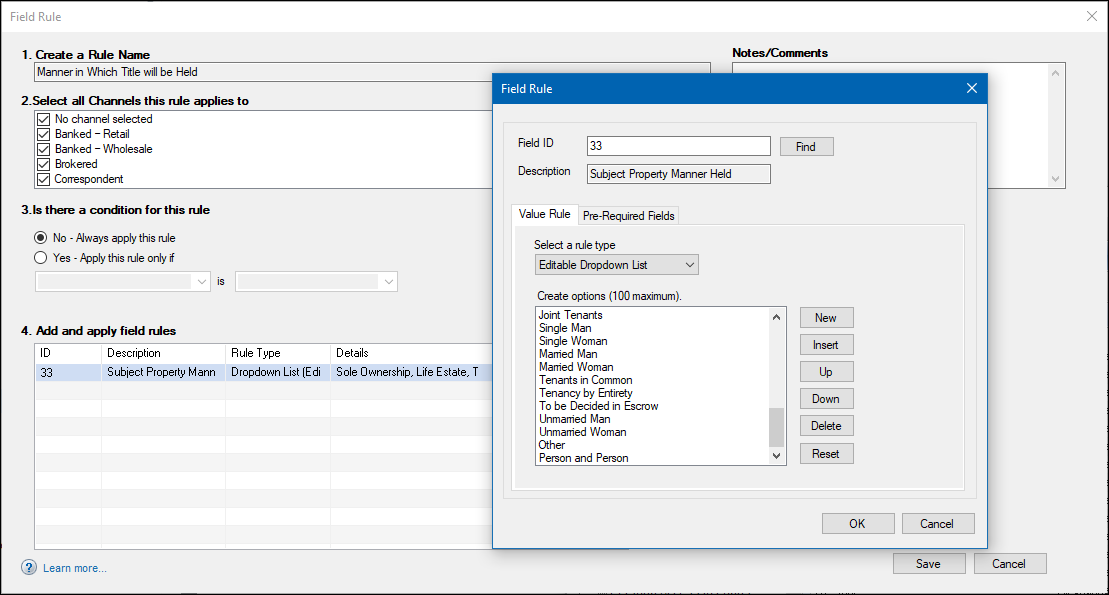

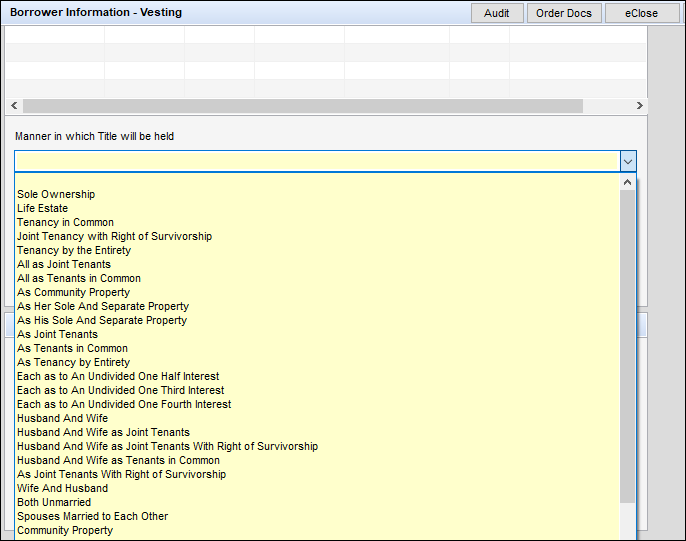

A new preconfigured rule has been added to the Field Data Entry business rule setting for Manner in Which Title will be Held. This rule is intended to be applied to the Manner in which Title will be held editable drop-down field (field ID 33) on the Borrower Information - Vesting input form. Administrators can use this rule to modify the enumerations that display in this drop-down list and specify specific enumerations they want to display on the input form.

This preconfigured rule can only be applied to field 33. When managing the enumerations, click the Reset button to return the list to the default list of enumerations provided by Encompass as needed.

To create custom business rules for Manner in which Title will be held to include additional fields, you can deactivate this preconfigured rule, and then create a new custom rule using field 33.

Since the Trade Update Queue process was moved from the client side to the server side, Field Trigger business rules no longer executed and custom fields were no longer populated based on those rules. As part of this release, the behavior of Field Trigger business rules has been updated to work with the server side Trade Update Queue process.

Encompass APIs

Encompass has been updated to enable the company’s State License ID # (field 3629) and the interviewer’s State License ID # (field ID 2306) fields to be populated with a ‘create loan’ API call. Previously, when using APIs to populate loan data, these fields could only be populated with a ‘loan update’ or ‘field writer’ API call.

Encompass - Data & Document Automation and Mortgage Analyzers Integration

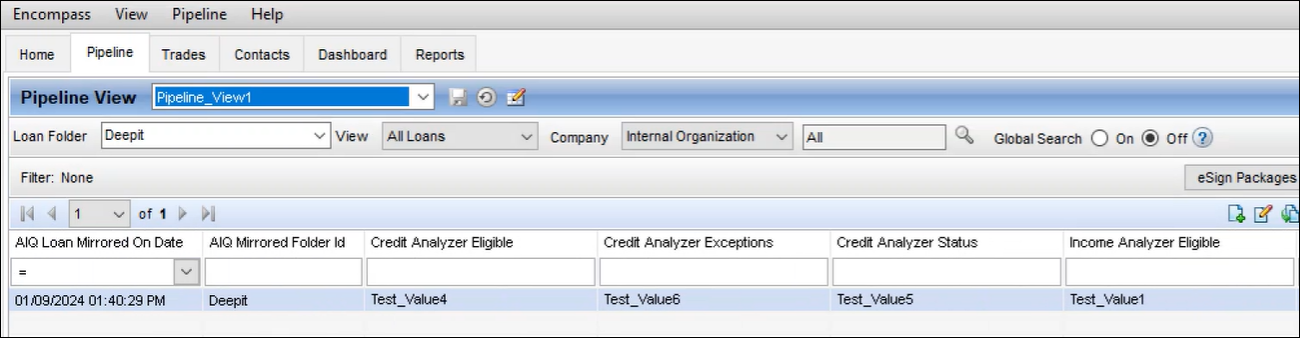

As of July 2023, the AIQ product was rebranded to ICE Data & Document Automation and ICE Mortgage Analyzers. (Learn more about this branding update in the Additional Updates section below.) Due to the branding updates and additional system enhancements that have been performed for related features, the following Encompass fields which maintain the state of Data & Document Automation processing and Mortgage Analyzers eligibility status have been replaced. The NEW Field ID column lists the new field ID's:

| Encompass Custom /Standard Field IDs | Encompass External Field Name | OLD Field ID | NEW Field ID |

|---|---|---|---|

| CX.DV.FOLDERID/AIQ.FOLDERID | DDA Folder ID | EXT.AIQ MirroredFolderId | EXT.DDAFolderId |

| CX.DV.CDU.ELIGIBLE | Income Analyzer Eligible | EXT.AIQ IncomeAnalyzerEligible | EXT.IncomeAnalyzerEligible |

| CX.DV.CDU.INCOME.STATUS | Income Analyzer Status | EXT.AIQ IncomeAnalyzerStatus | EXT.IncomeAnalyzerStatus |

| CX.DV.CDU.FAILURES | Income Analyzer Exceptions | EXT.AIQ IncomeAnalyzerStatus | EXT.IncomeAnalyzerExceptions |

| CX.DV.CDU.ELIGIBLE | Credit Analyzer Eligible | EXT.AIQ CreditAnalyzerEligible | EXT.CreditAnalyzerEligible |

| CX.DV.CDU.INCOME.STATUS | Credit Analyzer Status | EXT.AIQ CreditAnalyzerStatus | EXT.CreditAnalyzerStatus |

| CX.DV.CDU.FAILURES | Credit Analyzer Exceptions | EXT.AIQ CreditAnalyzerExceptions | EXT.CreditAnalyzerExceptions |

| AIQ.LOANWASMIRROREDONPST/ CX.DV.LOAWASMIRROREDONPST |

DDA Loan Mirrored On Date | EXT.AIQ Loan Mirrored on Date | EXT.DDALoanMirroredOn |

For lenders who have integrated Data & Document Automation or Mortgage Analyzers data into their Encompass instance, review your applicable Pipeline views in Encompass 24.1 to ensure the columns for these fields are still displayed in the Pipeline. Due to the system enhancements mentioned earlier, it is possible you may need to manually re-add these columns back to your Pipeline views. Any field values that were previously provided in these columns will be retained in the newly added columns.

If you do re-add these columns to applicable Pipeline views, please ensure that you also remove the old fields (i.e., the fields listed in the OLD Field ID column above) from the Encompass Reporting Database. Failure to remove these fields will result in an Error loading pipeline: ... message being triggered when you attempt to access a custom Pipeline view that includes the new Data & Document Automation and Mortgage Analyzers fields.

Additional Updates

Encompass now performs an auto-save of loan data when the loan team member performs the following actions:

- Clicks the eConsent button in the eFolder.

- Clicks the Request button in the eFolder.

- Clicks the eDisclosures button in the eFolder.

- Clicks Send > Files or Send > Files to Lender button in the eFolder.

- Sends Status Online.

- Sends forms via Secure Form Transfer tool.

With this enhancement, Encompass saves the loan data before triggering external updates to Encompass Consumer Connect loans or other external services. This helps ensure the most current data is reflected in Encompass Consumer Connect loans and elsewhere, preventing errors that may occur if the same loan file has conflicting borrower/co-borrower information in different applications.

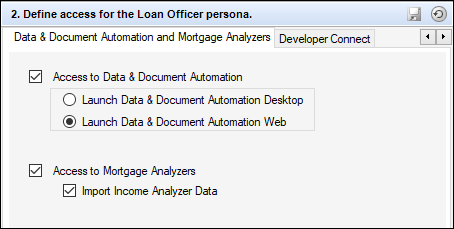

As of July 2023, the AIQ product was rebranded to ICE Data & Document Automation and ICE Mortgage Analyzers. The Encompass user interface and in-product messages have been updated to reflect this new naming where applicable. For example, the AIQ Analyzers button is now the Analyzers button and the ICE Mortgage Technology AIQ tab in the Encompass Settings > Personas setting is now labeled as Data & Document Automation and Mortgage Analyzers as shown below.

When Encompass users click Help > Encompass Help, a Learn More link, or press F1 to view the online help topic for the current screen, the online help system now opens in the user’s default web browser. In addition to the navigation tools provided in the online help user experience, you can use the browser’s Back and Forward arrows and other browser options to navigate the online help system as well. In previous versions of Encompass, the online help opened in anadmin Encompass pop-up window that did not provide access to browser navigation tools.

| Next Section: Fixed Issues |

|

|

|

Previous Section: New Features & Forms |