Feature Enhancements in 20.1 Release

Admin Enhancement

Prior to this release, users could not automatically hide programs for which any of the following Product Options were “Not Supported”. Users had to manually clear the Flagged check box on the Qualify tab to hide these programs.

- Interest Only

- Waive Escrows

- No MI

- Lender-paid MI

- 40-year Amortization

- EPMI

- IMAGIN

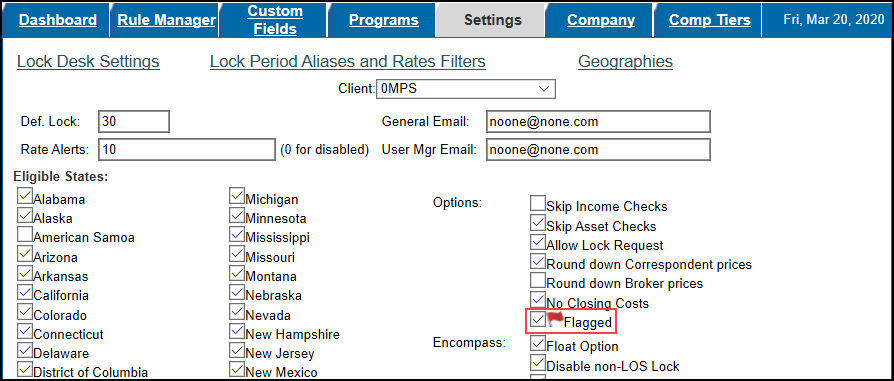

In this release, a new Flagged check box has been added to the Options section of the Settings tab. This new setting enables a Client Admin to determine whether flagged programs are, by default, displayed in Qualification results.

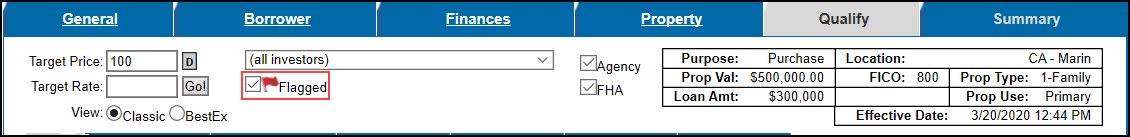

- If the Flagged check box is selected on the Settings tab, the Flagged check box on the Qualify tab is selected, and flagged programs will be included in Qualification results.

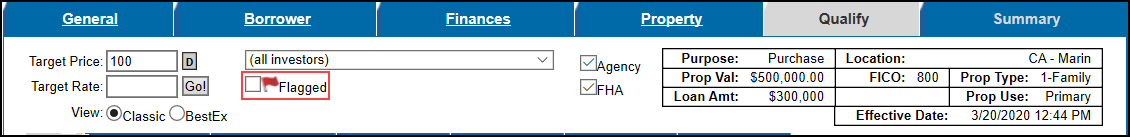

- If the Flagged check box is not selected on the Settings tab, the Flagged check box on the Qualify tab is not selected, and flagged programs will not be included in Qualification results.

General, Qualify, and Summary Tab Enhancements

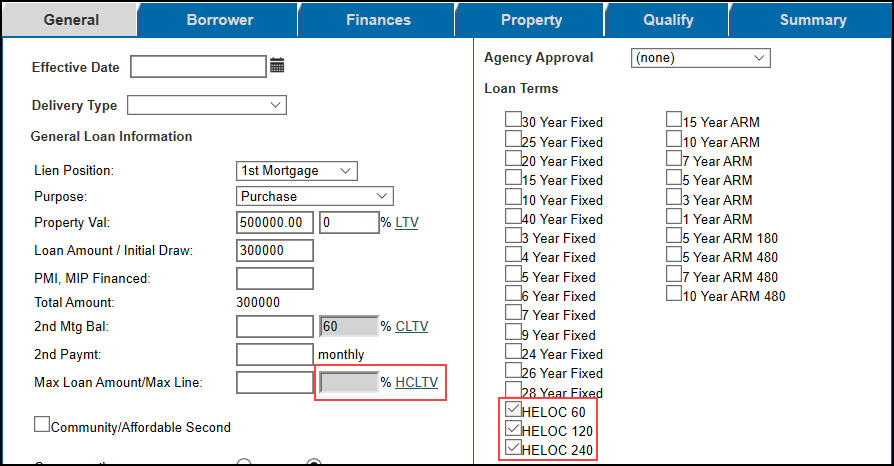

A HCLTV field has been added to the General tab for first lien HELOC loans. This new field enables users who directly access the EPPS web portal to immediately view the HCLTV instead of needing to advance to the Qualify tab for the amount.

For the field to display, a HELOC loan must be selected under Loan Terms.

The LTV calculation has been updated for first and second lien HELOC loans. The updated calculation will use the max loan amount/max line as the numerator.

LTV = Max Loan Amount/Max Line / Prop Val

(Max Loan Amount/Max Line divided by Prop Val)

The modified LTV will be displayed on the General, Qualify, and Summary tabs.

Prior to this release, all Production Versions of enabled loan programs were considered when determining the Loan Terms, Standard Products, Product Options, and Special Products to be displayed on the General tab. From this release forward, only current Production Versions of enabled loan programs and virtual programs will be considered to determine the available Loan Terms, Standard Products, Product Options, and Special Products to display.

In addition, the APIs were updated to reflect the changes made to the Loan Terms, Standard Products, Product Options, and Special Products on the General tab.

API Enhancements

The standardProducts object in the loanQualifier and eligibility endpoint input schemas has been updated to use Standard product IDs instead of a hard-coded list of Standard Products.

A validation has been added to historical pricing qualifications to make sure the loan effective date and time is not more than one year prior to the current date and time. When the validation fails, a message “Effective date must not be prior to MM/DD/YYYY HH:MM AM/PM.” is displayed.

The LenderFeeWaiver object has been added to the loanQualifier and eligibility endpoint input schemas.

The following HELOC fields, from the Program Definition, have been added to the LoanQualifier and rateSelector endpoint output schemas.

- Repayment Period mos

- Intro Rate

- Intro Period mos

- Draw Period mos

Additional Enhancements

The auto update of Rate Matrix Definitions has been modified so the Description, Rate Schema, and Rate columns are no longer cleared. This change ensures pricing is accurately displayed.

The EPPS Zip Code and County tables have been updated to match the zip codes and counties used in Encompass. This change ensures there is consistency between the two products and minimizes any errors.