Feature Enhancements in Version 19.3

Support for Temporary Buydowns

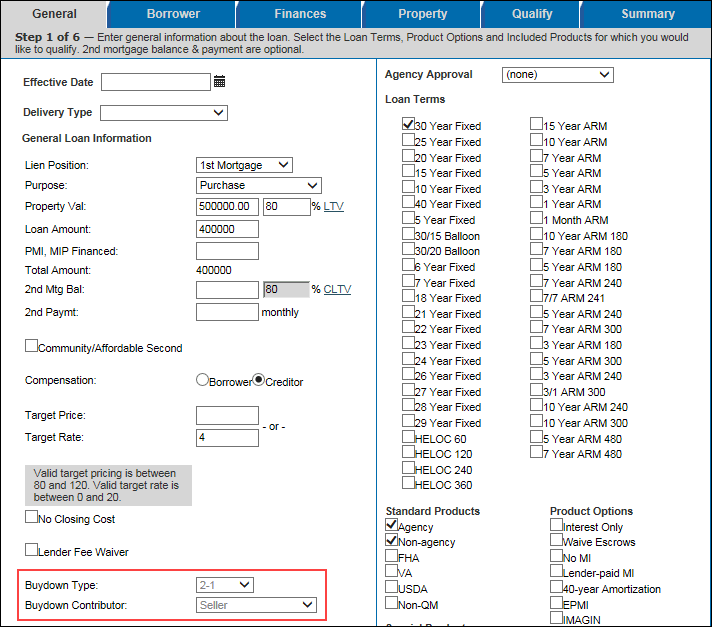

Why we made these updates:To enable the Encompass Product & Pricing Service (EPPS) to accurately price loans with buydown terms submitted from Encompass or Encompass TPO Connect.

Eligibility and pricing changes in support of buydowns are implemented at the discretion of the Investor. Clients using Custom Investors must implement their own eligibility and pricing changes supporting buydowns by submitting a request to EPPS Technical Support or making the changes in Custom Program Management (CPM), depending on the implementation.

Even though both fields are read-only, users will still be able to view all the eligible drop-down options for each field. However, if a user attempts to change either field, a message “Buydown Type/Buydown Contributor must be updated at their point of origination and resubmitted to EPPS.” is displayed.

- If the Buydown Type field value is “None”, the Buydown Contributor field is not displayed.

- If the Buydown Type field value is any value except “None”, the Buydown Contributor field is displayed.

- The Buydown Type selections are populated based on the buydown types selected in the eligible loan programs chosen in Admin>Programs.

- The Buydown Contributor drop-down selections match the buydown contributors available in Encompass and Encompass TPO Connect.:

- Lender

- Seller

- Builder

- Borrower

- Unassigned

- Parent

- Non-Parent Relative

- Unrelated Friend

- Employer

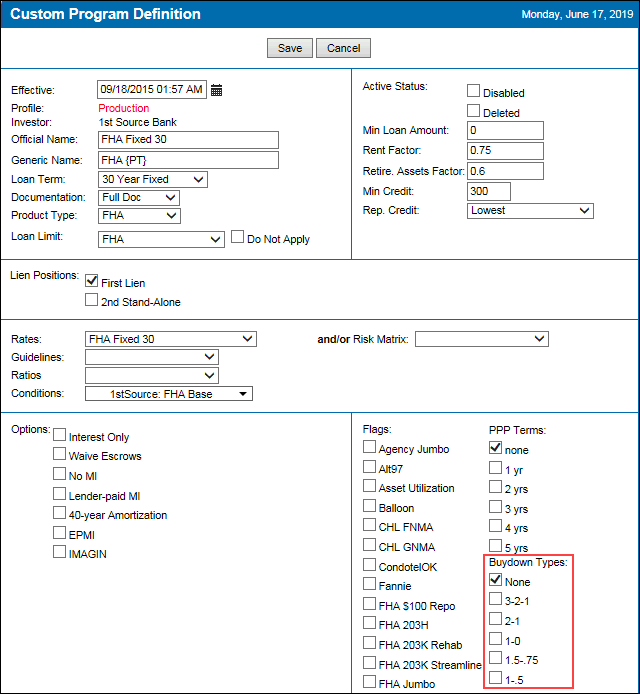

A new Buydown Types section has been added to the Custom Program Definition to assign temporary buydowns to products, which will enable users to select valid buydown terms on the General tab.

-

The selections displayed are the supported buydown types in this release.

- None

- 3-2-1

- 2-1

- 1-0

- 1.5-.75

- 1-.5

- You must select at least one buydown type.

- If no buydown type is selected and a user saves the Program Definition, a message “You must specify at least 1 Buydown type.” is displayed.

- For all programs existing prior to the 19.3 release, the Buydown Type field will default to “None”.

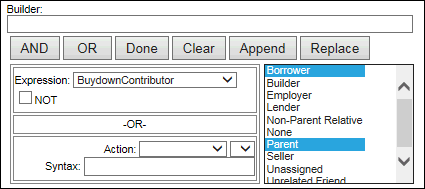

New “BuydownContributor” and “BuydownType” expressions have been added to condition and matrix definitions to enable pricing or eligibility adjustments on loans with a buydown type and buydown contributor.

This change does not apply to rate matrix definitions.

When either expression is selected, all the expression’s values are displayed. You can select one or more of the values.

New “Buydown Contributor” and “Buydown Type” conditions have been added to the Rule Manager to enable Client administrators (Client admins) to condition Client rules on loans with a buydown type and buydown contributor.

The following Encompass fields have been added to the Ellie Mae Network to enable those fields to populate the Buydown Type and Buydown Contributor fields on the EPPS General tab.

- Buydown Type (field ID 4632)

- If the value is “Blank” in Encompass, then EPPS is populated with “None” if no prior value exists.

- If a valid Buydown Type value exists from a prior submission, and then an invalid Buydown Type value is resubmitted, a message “The specified Buydown Type is not supported in EPPS. Please select a valid buydown type in your point of origination and resubmit to EPPS.” is displayed.

- The prior vaild Buydown Type value will be displayed.

- The user will not advance past the General tab.

- If the Buydown Type value does not equal a Buydown Type value enabled in the Program Definition, a message “The specified Buydown Type is not supported in EPPS. Please select a valid buydown type in your point of origination and resubmit to EPPS.” is displayed.

- If a Buydown Type is submitted without a Buydown Contributor, a message “Buydown Contributor cannot be None. Please select a Buydown Contributor in your point of origination and resubmit to EPPS.” is displayed.

- Buydown Contributor (field ID 4631)

- If the value is “Blank” in Encompass, then EPPS is populated with “None” if no prior value exists.

New "BuydownType" and "BuydownContributor" request parameters have been added to the EPPS Web Services and APIs to enable Encompass TPO Connect and API users to include buydown terms when pricing their loans.

-

BuydownType - This is an optional parameter. The value defaults to “None” (zero) if no value is present (blank). The eligible values include the following:

- None

- 3-2-1

- 2-1

- 1-0

- 1.5-.75

- 1-.5

-

BuydownContributor – This parameter is only required if BuydownType is any value except blank. The eligible values include the following:

- Lender

- Seller

- Builder

- Borrower

- Unassigned

- Parent

- Non-Parent Relative

- Unrelated Friend

- Employer

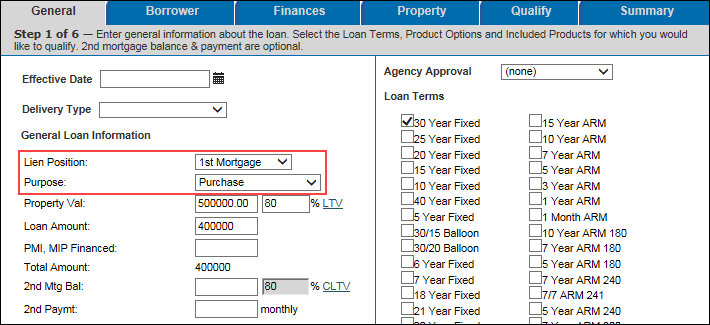

Prior to this release, the drop-down fields for Lien Position and Purpose on the General tab were located below their respective field labels. In this release, the drop-down fields for Lien Position and Purpose have been aligned with their respective field labels to be consistent with the other fields on the General tab.

Custom Program Management (CPM) Enhancements

If the Program Type on the Custom Program Definition is changed from an ARM or HELOC to another program type, a message “Switching Program Types results in loss of Program specific data. To proceed, please select OK. To return to original Program Type, please select Cancel.” is now displayed. This provides users with a warning before losing all program variable data when they switch program types.

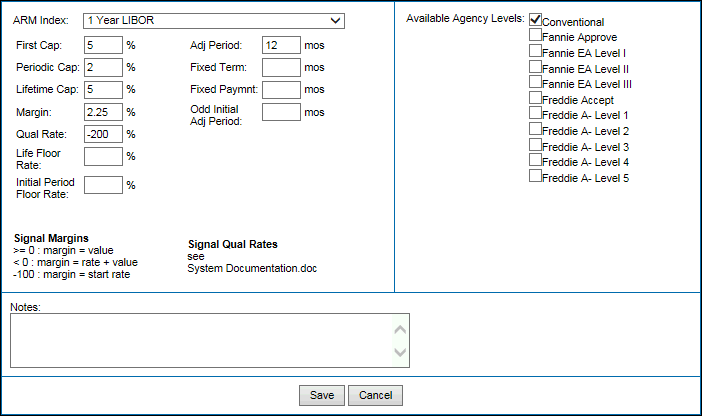

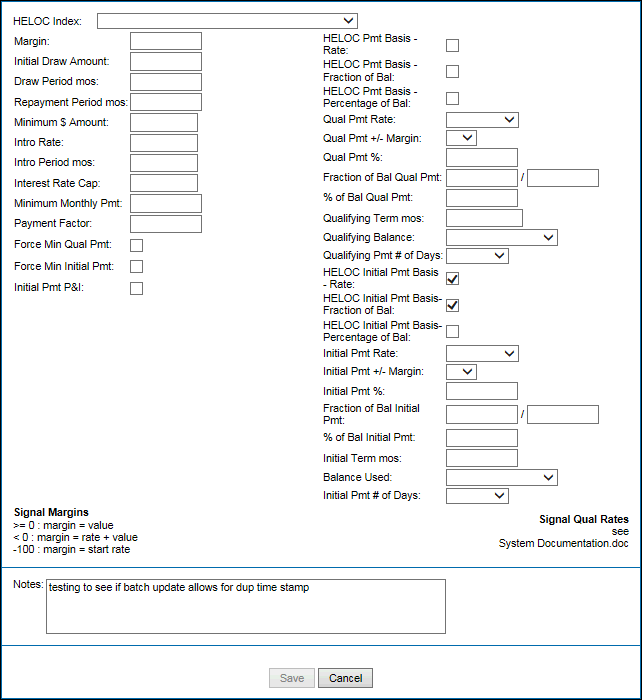

When creating or editing Custom Program Definitions, the Program Variables section (lower portion of the page) now dynamically changes based on the Program Type.

-

Fixed/Blank Program Type

-

ARM Program Type

- HELOC Program Type

When completing the new HELOC program variables on a Custom Program Definition, validations have been added to ensure the HELOC initial and qualifying payments are accurately passed to Encompass.

If HELOC templates set up in Encompass differ from the EPPS HELOC program variables returned to Encompass, EPPS will overwrite the values populated within the Encompass template if the HELOC Program Variables check box is selected on the EPPS Settings tab (Admin>Settings>Update Encompass Elements).

EPPS has a list of HELOC program variables to align with the variables that Encompass uses to calculate initial and Qualifying payments. For details on these fields, refer to the HELOC Program Variables Reference Sheet. Clients admins can pass the HELOC variables back to Encompass by selecting the HELOC Program Variables check box on the EPPS Settings tab.

- Initial Payment Validations

- If the HELOC Initial Pmt Basis – Rate and Initial Pmt P&I check boxes are selected, users cannot select HELOC Initial Pmt Basis – Fraction of Bal or HELOC Initial Pmt Basis – Percentage of Bal.

- If the HELOC Initial Pmt Basis – Rate check box is selected and Initial Pmt P&I is not selected, users can select either the HELOC Initial Pmt Basis - Fraction of Bal check box or the HELOC Initial Pmt Basis - Percentage of Bal check box. You cannot have all three selected at the same time.

- Qualifying Payment Validations

- If the Interest Only check box is not selected, users can only select one of the following options:

- HELOC Pmt Basis - Rate

- HELOC Pmt Basis - Fraction of Bal

- HELOC Pmt Basis - Percentage of Bal

- If the HELOC Pmt Basis – Rate check box is selected and Interest Only product option (General tab) is selected, users can select either the HELOC Pmt Basis - Fraction of Bal check box or the HELOC Pmt Basis - Percentage of Bal check box. You cannot have all three selected at the same time.

EPPS-21737, EPPS-21738

Additional Enhancement

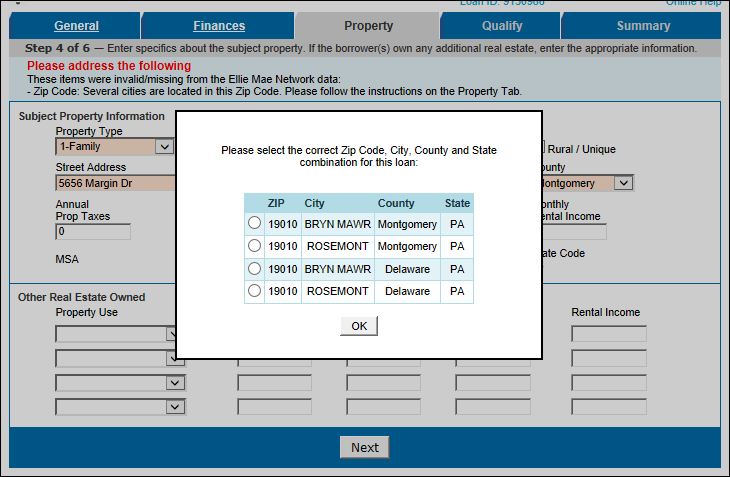

When Encompass passes a zip code to EPPS that is located within more than one county (e.g., 19010 in Delaware and Montgomery counties), EPPS now requires the user to select the correct county from a pop-up window displayed on the Property tab. This ensures that EPPS returns the correct zip code/county data back to Encompass.