Feature Enhancements in June 2019 Service Pack

Support for Non-Qualified Mortgages (Non-QM)

Why we made these updates: Additional functionality and fields have been added to the Maintain Risk Grades, Maintain Conditions, and Maintain Matrices sections of the Custom Program Management (CPM) module, the General tab, and the Finances tab, to ensure Non-QM loans can be accurately qualified,

Encompass TPO Connect and Encompass Consumer Connect

As part of the updated Non-QM functionality within EPPS, the newly added fields must be manually updated after a loan has been submitted through Encompass. Products that apply to these field requirements to price are currently not supported within Encompass TPO Connect or Encompass Consumer Connect.

To access these new programs, your Client Administrator (Client Admin) must enable them under Admin>Programs to receive qualifications. In addition, your Client Admin should disable the old programs because they will no longer supported.

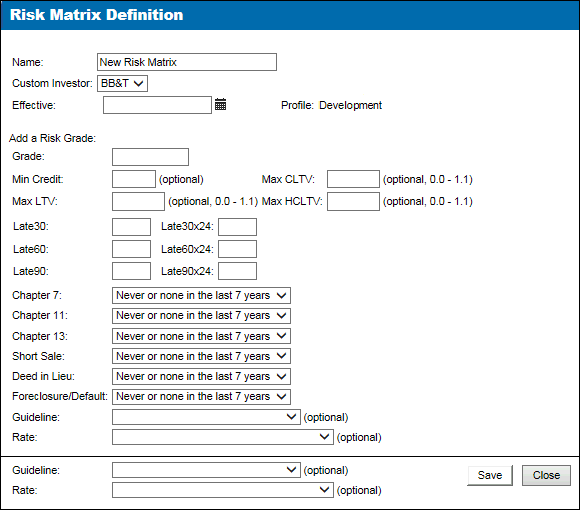

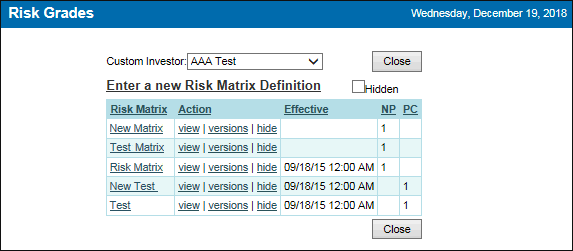

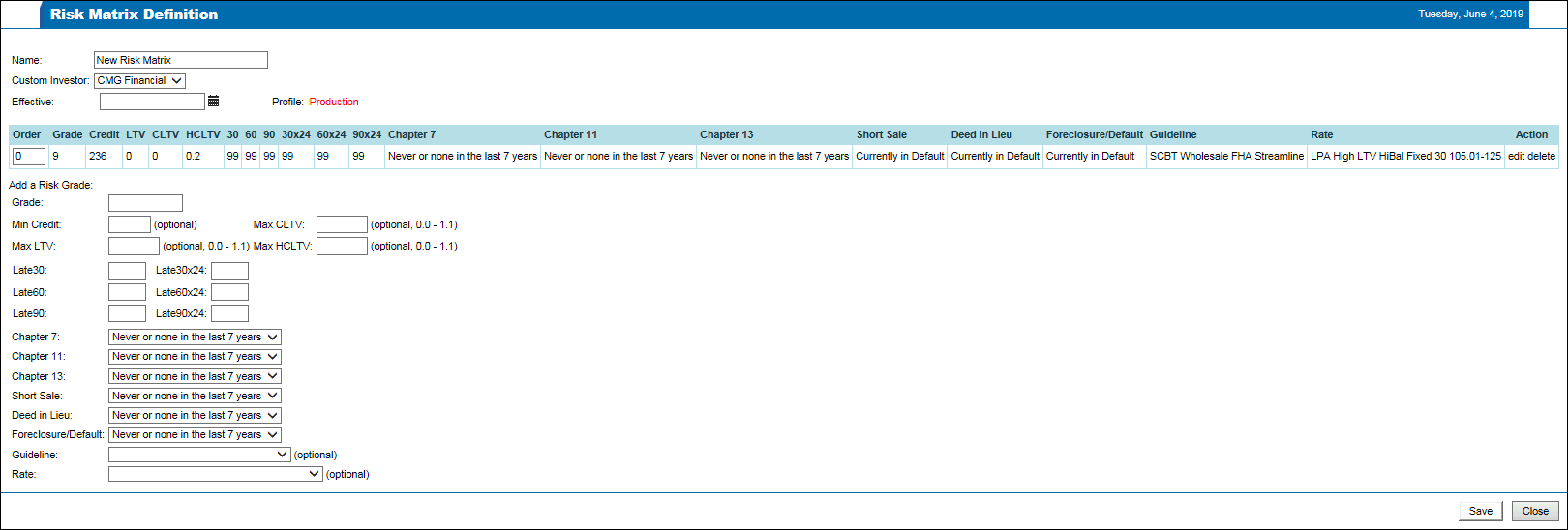

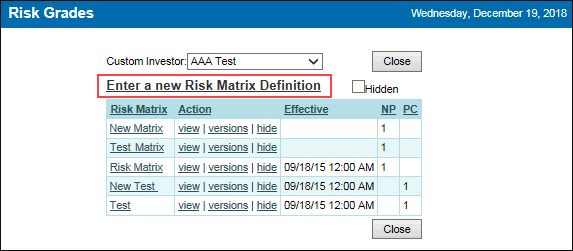

The ability to create Risk Matrix Definitions has been added to the Risk Grades Listing page to ensure Non-QM are qualified properly,

In addition, the following updates have been made to the Risk Grades Listing page:

- Renamed the Investor field to Custom Investor.

- Replaced the existing actions (edit and hide) with the view, versions, and hide actions.

- Added the Effective column to display the Effective date and time of the current or most recent Production version.

- Added the NP and PC columns to display the number of Development and Production versions.

Detailed Procedures

![]() To Create a Risk Matrix Definition

To Create a Risk Matrix Definition

![]() To View a Risk Matrix Definition

To View a Risk Matrix Definition

![]() To View All Versions of a Risk Matrix Definition

To View All Versions of a Risk Matrix Definition

![]() To Hide/Unhide a Risk Matrix Definition

To Hide/Unhide a Risk Matrix Definition

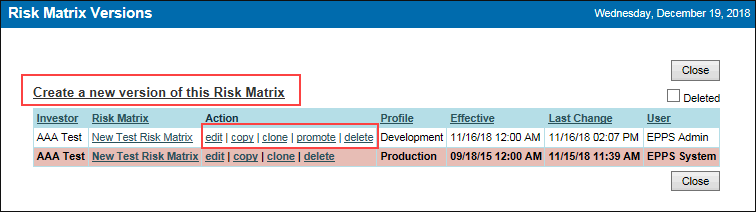

The ability to create and manage Risk Matrix Definitions has been added to the Risk Matrix Versions page to ensure Non-QM loans are qualified properly,

Detailed Procedures

![]() To Edit a Version of a Risk Matrix Definition

To Edit a Version of a Risk Matrix Definition

![]() To Copy a Version of a Risk Matrix Definition

To Copy a Version of a Risk Matrix Definition

![]() To Clone a Version of a Risk Matrix Definition

To Clone a Version of a Risk Matrix Definition

![]() To Promote a Version of a Risk Matrix Definition

To Promote a Version of a Risk Matrix Definition

![]() To Delete a Version of a Risk Matrix Definition

To Delete a Version of a Risk Matrix Definition

New expressions have been added to condition and matrix definitions.

This change does not apply to rate matrix definitions.

- Bankrupt7 – Evaluated in Qualification when Bankruptcy Type is Chapter 7.

- Bankrupt11 – Evaluated in Qualification when Bankruptcy Type is Chapter 11.

- Bankrupt13 – Evaluated in Qualification when Bankruptcy Type is Chapter 13.

- DefaultShortSale – Evaluated in Qualification when the Notice of Default (NOD) Type is Short Sale.

- DefaultDeedinLieu – Evaluated in Qualification when NOD Type is Deed in Lieu.

- DefaultForeclosure – Evaluated in Qualification when NOD Type is Foreclosure/Default.

- DSCR – Debt service coverage ratio (DSCR) for the current loan.

- IsDSCR – This is “True” when the DSCR for the current loan is not null.

- PPPDisp – Sets or resets the prepayment penalty fee in case of disposition of the subject property.

- PPPYears – The loan program’s prepayment penalty terms.

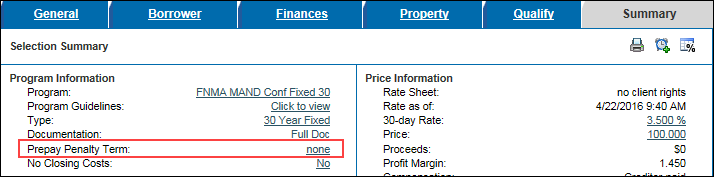

The PPPYears variable has been added to Matrices to enable prepayment penalty terms to be added to loan programs,

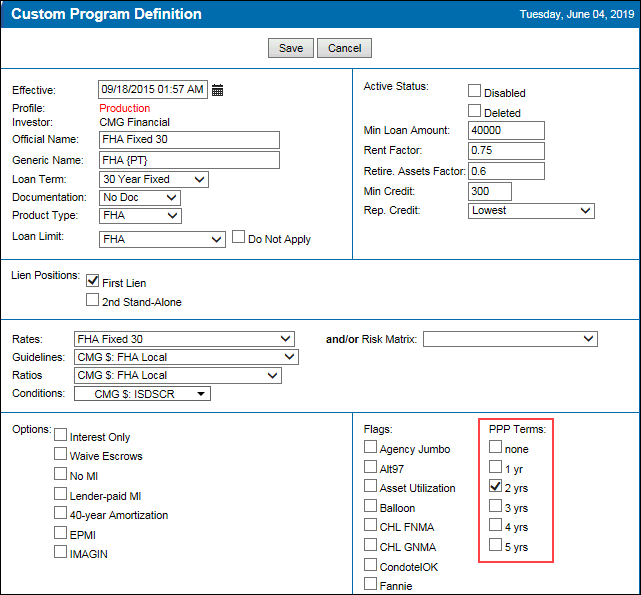

A new required PPP Terms section has been added to the Custom Program Definition to enable loan programs with prepayment penalty options to be available to users,

For a loan program to be included in the Qualification results, the prepay penalty term selected here must be the same as the one selected on the General tab.

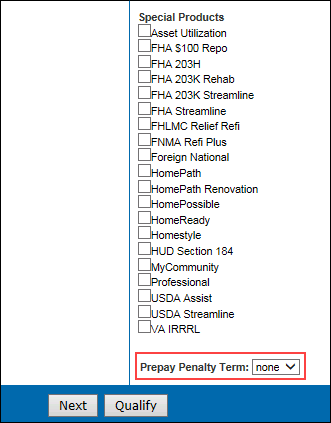

A new Prepay Penalty Term field has been added to enable loan programs with prepayment penalty options to be included in the Qualification results.

The options displayed in the drop-down list are populated based on the prepayment penalty terms selected in the eligible loan programs chosen in Admin>Programs.

For a loan program to be included in the Qualification results, the prepay penalty term selected here must be the same as the one selected on the Custom Program Definition.

When the Penalty Term (field ID 2964) is mapped from Encompass to this new field, the values from Encompass are mapped as follows:

-

Blank is mapped to “none”

-

“1 Year” is mapped to “1 yr”

-

“2 Years” is mapped to “2 yrs”

-

“3 Years” is mapped to “3 yrs”

When the Prepay Penalty Term is mapped from this new field to the Penalty Term in Encompass, the values from EPPS are mapped as follows:

The EPPS values will only update the Penalty Term in Encompass if the Prepayment penalty term option is enabled under Admin>Settings>Encompass Update Elements.

- “none”, “4 yrs”, and “5 yrs” are mapped to Blank

- “1 yr” is mapped to “1 Year”

- “2 yrs” is mapped to “2 Years”

- “3 yrs” is mapped to “3 Years”

Updated on 7/13/2019

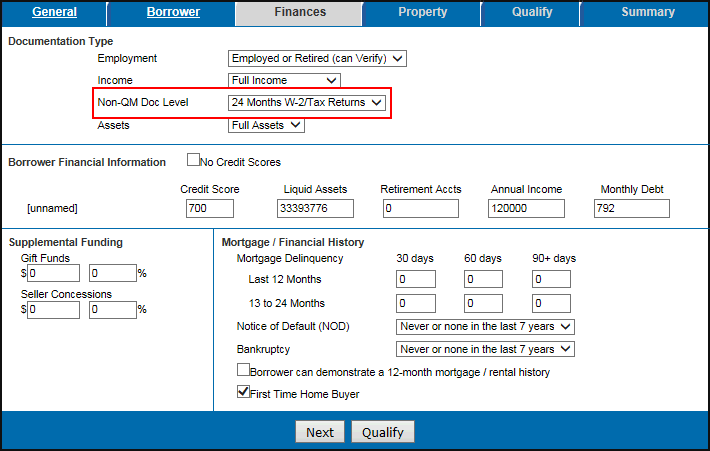

- A new Non-QM Doc Level field in the Documentation Type section has been added to ensure Non-QM loans are qualified based on the Non-QM documentation provided by the borrower.

- This field is only displayed if Non-QM is selected in the Standard Products section on the General tab.

- The available options for the Non-QM Doc Level field will change when “Full Income” or “Alternative Income” (formerly “Limited Income”) is selected for Income.

- When "Full Income" is selected, the following options are available:

- 24 Months W-2/Tax Returns (Default)

- 12 Months W-2/Tax Returns

- When "Alternative Income" is selected, the following options are available:

- 24 Months Personal Bank Statements (Default)

- 12 Months Personal Bank Statements

- 24 Months Business Bank Statements

- 12 Months Business Bank Statements

- The Non-QM Doc Level field is not displayed if “Lite Income”, “Stated Income”, or “No Income” is selected for Income.

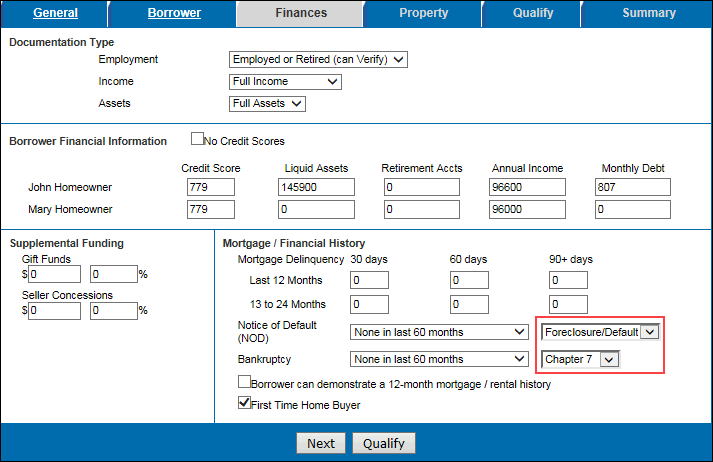

- New NOD Type and Bankruptcy Type fields next to the Notice of Default (NOD) and Bankruptcy fields, respectively, have been added to enable loans to be qualified based on different NOD and bankruptcy types.

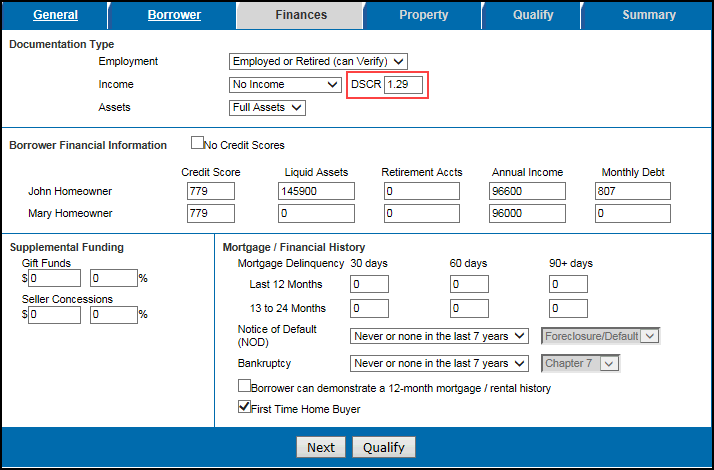

- A new DSCR field has been added to enable loans to be qualified using rent payments.

- For the new field to be displayed, the “Non-QM” Standard Product on the General tab and the “No Income” option in the Income drop-down list on the Finances tab must be selected.

- The field accepts numerals to two decimal places with a maximum value of 9.99.

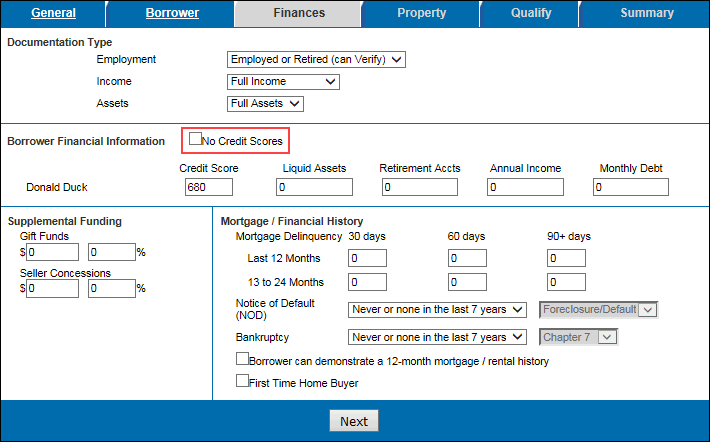

- A new No Credit Scores check box has been added to enable loans to be qualified without credit scores.

- When No Credit Scores is selected:

- The credit score validations will not be performed when the loan is qualified.

- The credit score fields are disabled for all borrowers.

- The credit score values are set to zero.

The Summary tab has been updated to display the Prepay Penalty Term for the selected loan program from the Qualification results.

A new optional PPP request parameter has been added to the EPPS Web Services and APIs. The value defaults to “none” if no value is present.

Additional Enhancements

The EPPS zip code database has been updated to match the Encompass zip code database to ensure consistency between EPPS and Encompass.

- For each new zip code added to EPPS, the appropriate county will be added to the EPPS County table.

- If there are county names in Encompass that do not match county names in EPPS, the EPPS County table will be updated to match Encompass.

- Zip codes and counties will only cover the 50 US States, Guam, and Puerto Rico.