Feature Enhancements in Version 19.1

Support for HELOC Loans

For the new HELOC functionality to be available to your current HELOC programs, you must submit a request through the Encompass Product & Pricing Service (EPPS) Technical Support specifying the programs to be updated. Until the request is submitted and completed, your current workflows and product pricing will remain the same. Once your products are updated, all HELOC program requests will fully utilize the new functionality.

Clients must migrate to Encompass 19.1 to fully integrate the new EPPS HELOC functionality. Loans must be submitted to EPPS through Encompass to be inclusive of all subordinate liens.

Eligibility and pricing changes in support of Community/Affordable Seconds is implemented at the discretion of the Investor. Clients using Custom Investors must implement their own eligibility and pricing changes in support of Community/Affordable Seconds by submitting a request to EPPS Technical Support or making the changes in CPM, depending on the implementation.

Why we made these updates:To integrate the EPPS HELOC functionality to accurately price HELOC loans and to ensure the CLTV and HCLTV qualification calculations are identical between the two products.

Updated on 1/16/2019

When EPPS returns a HELOC program to Encompass, for the purpose of legal documents, the Amortization Type (field ID 2953) selection returned to the Lock Request Form will always be “ARM”.

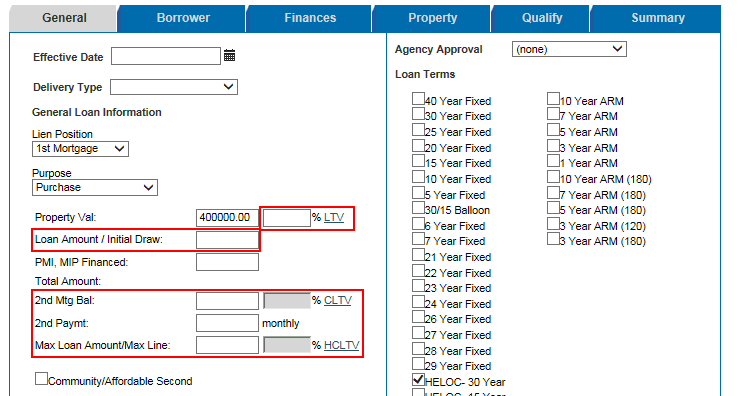

The General tab has been updated to support the pricing of HELOC loans.

- Updated the Cash Out field to be hidden when the Purpose is “C/O Refi” and a HELOC Loan Term is selected for both the “1st Mortgage” and “2nd Mortgage” Lien Position.

- Updated the fields when “1st Mortgage” is selected as the Lien Position to accommodate first lien HELOCs.

Updated on 2/12/2019

- Moved the LTV calculation next to the Property Val field.

- Removed 2nd LTV that was next to 2nd Mtg Bal and the conditional LTV/CLTV that was located next to Total Amount.

- 2nd Mtg Bal - Displays the sum of Subordinate Lien Amounts (field ID 3036) and any open HELOC draw amounts (field ID 3846) minus the subject initial draw (field ID 4510).

- The read-only CLTV calculation is displayed next the 2nd Mtg Bal.

- 2nd Paymt – Displays the value from field ID 1725.

- Modified the following fields when a HELOC loan term is selected:

- Loan Amount is displayed as Loan Amount/Initial Draw.

- The Max Loan Amount/Max Line is displayed.

- The read-only HCLTV calculation is displayed next to Max Loan Amount/Max Line.

-

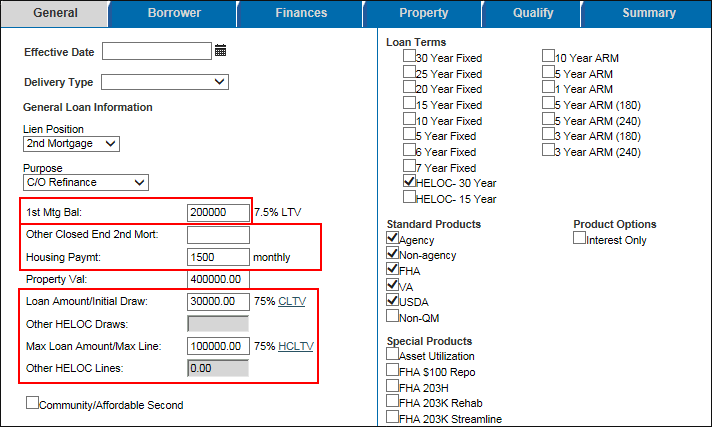

Added new fields when “2nd Mortgage” is selected as the Lien Position to enable HELOCs to be qualified based on the appropriate data.

Updated on 2/12/2019

- 1st Mtg Bal - Displays the value from field ID 3035.

- Other Closed End 2nd Mort – Displays the value from field ID 3036.

- Housing Paymt – Displays the value from the field ID 1724.

- Loan Amount/Initial Draw – This required field displays the value from field ID 4510.

- A warning, “Loan Amount/Initial Draw must be completed.”, is displayed if this field is blank.

- Other HELOC Draws – This read-only field determines the outstanding HELOC Draws apart from the subject draw request. It displays the difference between field ID 3846 and field ID 4510 (3846 – 4510).

- This field will not be updated when fields are changed within EPPS.

- Max Loan Amount/Max Line – This required field displays the value from field ID 3043.

- A warning,“Max Loan Amount/Max Line must be completed.”, is displayed if this field is blank.

- Other HELOC Lines – This read-only field determines the outstanding HELOC Lines of credit apart from the subject credit line request. It displays the difference between field ID 4519 and field ID 3043 (4519 – 3043).

- This field will not be updated when fields are changed within EPPS.

- Added new read-only CLTV and HCLTV calculations next to Loan Amount/Initial Draw and Max Loan Amount/Max Line, respectively.

For 1st and 2nd lien and a mixed selection of standard products, CLTV is displayed based off the worst case calculation on the General tab only. To update the CLTV calculation, adjust the standard products to reflect either Government (FHA, VA, USDA) or Non-Government (Agency, Non Agency, Non-QM).

- For government loans (e.g., FHA, VA, USDA), the CLTV and HCLTV calculations are the same.

- For conventional loans, the two calculations provide a distinction between the credit accessed (CLTV) versus the credit limit (HCLTV).

For the 1st mortgage lien position, the CLTV and HCLTV are calculated, read-only fields for all programs. For the 2nd mortgage lien position, the LTV, CLTV and HCLTV are calculated, read-only fields for all programs.

-

Added validation to the Loan Terms to prevent both HELOC and non-HELOC loan terms to be selected in one scenario.

- If users attempt to select both HELOC and non-HELOC loan terms, a warning, “HELOC can not be selected with any other loan term.”, is displayed.

- Users can select multiple HELOC loan terms together.

- Users can select multiple non-HELOC loan terms together.

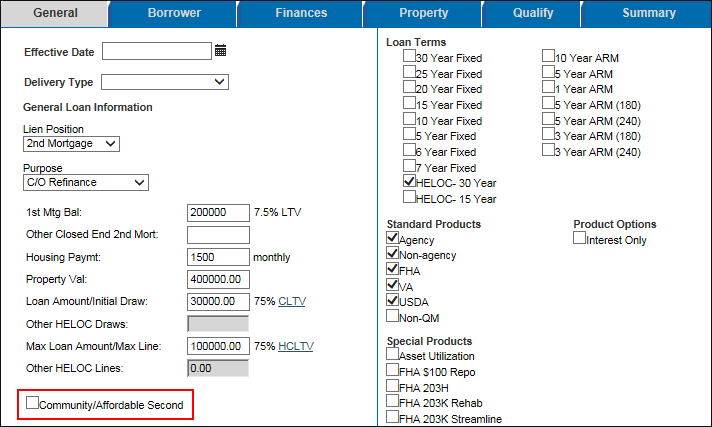

- In addition, added a new Community/Affordable Second check box to designate a second mortgage as a Community or Second.

Updated on 1/16/2019

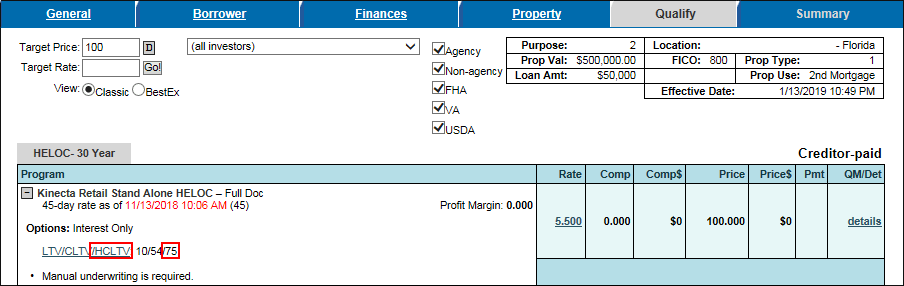

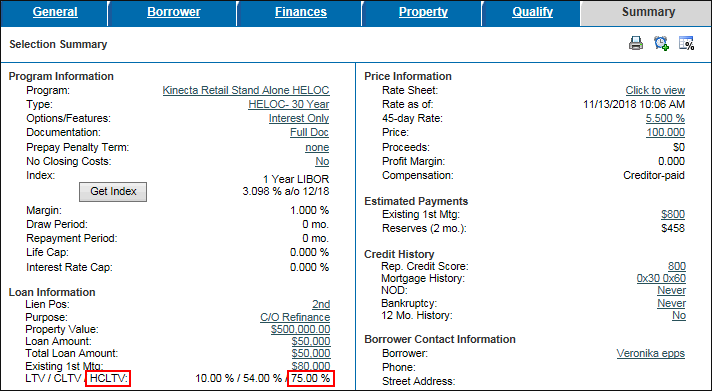

The Qualify and Summary tabs have been updated to support the pricing of HELOC loans.

- For all programs, added the HCLTV value to each program on the Qualify tab to provide the LTV, CLTV, and HCLTV values in one place.

- For all programs, added the HCLTV value on the Summary tab.

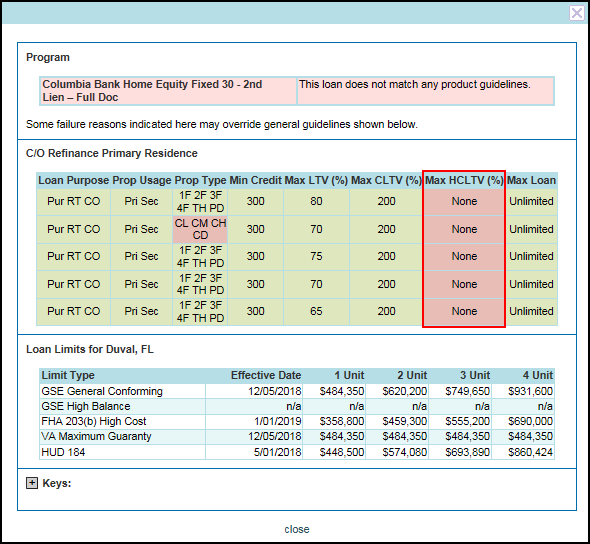

- Added the HCLTV to the Ineligible Product Details window to help users determine whether the product was ineligible due to the HCLTV.

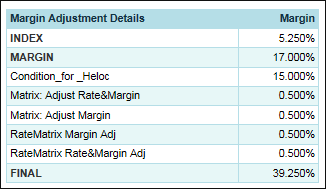

- Added the Margin Adjustment Details to the Summary tab to display the Index, Margin, and margin adjustments as separate line items.

- This grid is displayed under the Adjustment Details.

- This grid is only displayed when “ARM” or “HELOC” is selected as the Program and the user has the View Profit Margin manager right.

-

Renamed the P&I column to Pmt on the Qualify tab and the P&I field to Pmt on the Summary tab for all products.

For the 19.1 release, the Pmt column for HELOC programs will not display any values.

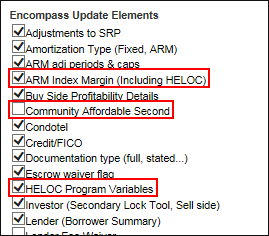

To enable certain HELOC-related data to be returned to Encompass, the following two options have been added to the Encompass Update Elements section on the Settings tab.

- HELOC Program Variables – Returns the following HELOC variables from EPPS to Encompass:

- Intro Rate (if defined internally) to Teaser Rate (field ID 4511)

- Intro Period mos (if defined internally) to HELOC Teaser Rate Period Months (field ID 4492)

- CommunityAffordable Second – Returns the Community/Affordable Second value from EPPS to Encompass field ID MORNET.X29.

- Renamed the Arm Index Margin option to Arm Index Margin (Including HELOC) and modified the field mapping from EPPS to Encompass for the following fields:

- Index to Index (field ID 4513) on the Lock Request Form

- ARM Index and HELOC Index to ARM Index Type (field ID 4512) on the Lock Request Form

Updated on 1/16/2019

To enable eligibility to be determined based on the HCLTV value, a new HCLTV expression and HCLTVMax action have been added to condition definitions.

This update impacts Custom Program Management (CPM) users only.

Updated on 1/16/2019

To enable pricing adjustments to be conditioned based on the HCLTV value, a new HCLTV expression and variable have been added to matrix definitions, and a new HCLTV variable has been added to rate matrix definitions.

This update impacts CPM users only.

Updated on 1/16/2019

To enable eligibility to be determined based on the HCLTV value, a new HCLTV column has been added to the guideline definitions.

This update impacts CPM users only.

Updated on 1/16/2019

To enable ratios to be assigned based on the CLTV and HCLTV values, a new CLTV and HCLTV column have been added to the ratio definition grid and a CLTV and HCLTV entry to the legend at the bottom of the page.

The CLTV and HCLTV variables will be applied to qualifications.

This update impacts CPM users only.

Updated on 1/16/2019

To enable risk matrices to be assigned based on the CLTV and HCLTV values, a new Max CLTV and Max HCLTV field have been added to the risk matrix definitions.

The CLTV and HCLTV variables will be applied to qualifications.

This update impacts CPM users only.

Updated on 1/16/2019

To enable pricing adjustments to be conditioned based on the Community/Affordable Second value, a new Community/Affordable Second expression has been added to condition and matrix definitions.

This change does not apply to rate matrix definitions.

This update impacts CPM users only.

To enable Client Admins to condition Client Rules on the HCLTV and the Community/Affordable Second values, new “HCLTV” and “Community/Affordable Second” conditions have been added to the Rule Manager.

To Access the Rule Manager:

- Log into EPPS as a Client Admin.

- Click the Admin menu option, and then click on the Rule Manager tab.

The Ellie Mae Network has been updated to support the pricing of HELOC loans.

- To enable EPPS to receive HELOC variables from Encompass, the following Encompass fields have been added to the Ellie Mae Network.

- Closed End Primary Mortgage Total (field ID 3035)

- 1st Mortgage Payment (field ID 1724)

- Closed End Subordinate Mortgage Total (field ID 3036)

- 2nd Mortgage Payment (field ID 1725)

- Subject (HELOC) Initial Draw (field ID 4510)

- Subject (HELOC) Credit Limit (field ID 3043)

- Total Open End (HELOC) Draw Amounts (field ID 3846)

- Total Open End (HELOC) Credit Limit (field ID 4519)

- To enable the Community/Affordable Second to be used in EPPS to condition price adjustments and qualification rules, the Encompass Community Seconds (field ID MORNET.X29) has been added to the Ellie Mae Network.

-

To enable Encompass to submit HELOC requests and receive the correct HELOC loan type from EPPS, mappings for the HELOC Loan Terms have been added.

- If Encompass passes the loan type of “HELOC” to EPPS, the HELOC programs in the Loan Terms section on the General tab are selected.

- The HELOC programs are selected based on the HELOC program types and term requested in Encompass.

- If no term is requested, EPPS will select all HELOC programs on the General tab and display a message to select amortization.

- If the EPPS program selected to be returned to Encompass is a HELOC program, “HELOC” is sent as the Loan Type (field ID 2952).

-

Margin adjustments are passed from EPPS to the Encompass Secondary Lock Tool.

Encompass accepts up to 20 margin adjustments with margin adjustment descriptions.

EPPS-20373, EPPS-20374, EPPS-20375

-

To ensure the loan fields are populated correctly for HELOC and non-HELOC loans, the Ellie Mae Network has been updated as follows:

- If Encompass passes the loan type of “HELOC”, the Loan Amount/Initial Draw is populated with the HELOC Initial Draw (field ID 4510).

- If Encompass passes a non-HELOC loan type, the Loan Amount/Initial Draw is populated with the Loan Amount( field ID 3043).

- If Encompass passes the loan type of “HELOC”, the Max Loan Amount/Max Line is populated with the Loan Amount( field ID 3043).

- If Encompass passes a non-HELOC loan type, the Max Loan Amount/Max Line is not displayed or populated.

- If EPPS passes the loan type of “HELOC”, HELOC Initial Draw (field ID 4510) is populated with the Loan Amount/Initial Draw.

- If EPPS passes a non-HELOC loan type, Loan Amount (field ID 3043) is populated with the Loan Amount/Initial Draw.

- If EPPS passes the loan type of “HELOC”, Loan Amount (field ID 3043) is populated with the Max Loan Amount/Max Line.

- If EPPS passes a non-HELOC loan type, the Max Loan Amount/Max Line is not populated.

Support for Non-Qualified Mortgages (Non-QM)

The EPPS 19.1 release does not include pricing for Non-QM loans. The new fields added to the General and Finances tab are part of the effort to provide Non-QM loan pricing, currently scheduled for a future release.

As part of these efforts loans submitted for pricing that do not have credit scores will now be considered No Credit Score transactions. The credit scores for these transactions will not be editable in EPPS. If the transaction is not a No Credit Score transaction, the credit scores must be updated in Encompass and resubmitted to EPPS.

Why we made this update: To prepare for the ability to qualify Non-QM loans, new fields have been added to the General and Finances tabs.

To identify Non-QM products and access features and pricing unique to those products, a new Non-QM product has been added to the Standard Products section of the General tab.

To Access the General Tab:

- Log into EPPS.

- Click on the Home tab.

-

On the My Loans tab, select a loan, and then click on the Borrower link.

The “Limited Income” option in the Documentation Type section of the Finances tab has been renamed from “Limited Income” to “Alternative Income”.

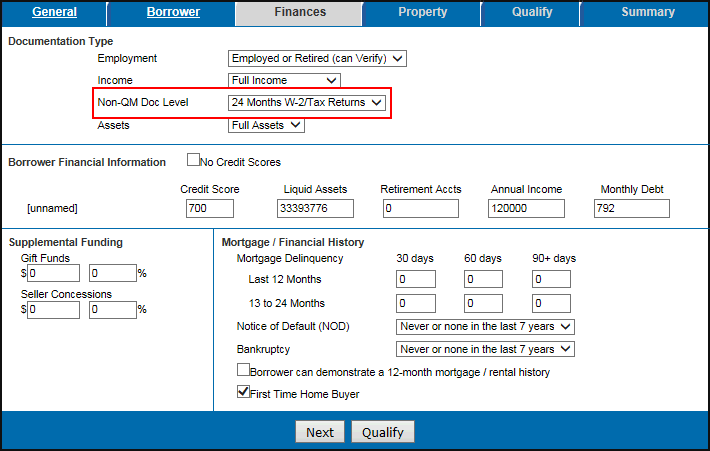

To ensure Non-QM loans are qualified based on the Non-QM documentation provided by the borrower, a new Non-QM Doc Level field in the Documentation Type section has been added to the Finances tab.

- This field is only displayed if Non-QM is selected in the Standard Products section on the General tab.

-

The available options for the Non-QM Doc Level field will change when “Full Income” or “Alternative Income” (formerly “Limited Income”) is selected for Income.

- When "Full Income" is selected, the following options are available:

- 24 Months W-2/Tax Returns (Default)

- 12 Months W-2/Tax Returns

- When "Alternative Income" is selected, the following options are available:

- 24 Months Personal Bank Statements (Default)

- 12 Months Personal Bank Statements

- 24 Months Business Bank Statements

- 12 Months Business Bank Statements

- The Non-QM Doc Level field is not displayed if “Lite Income”, “Stated Income”, or “No Income” is selected for Income.

To Access the Finances Tab:

- Log into EPPS.

- Click on the Home tab.

- On the My Loans tab, select a loan, and then click on the Borrower link.

- Enter the required information on the General tab, and then click Next.

- Enter the required information on the Borrower tab, and then click Next.