Change Log for Version 19.1

This Change Log lists each release notes entry that has been added, deleted, or modified since the initial pre-release version was published.

| Change Type: New entry Change Date: 1/16/2019 Details: The introductory paragraph under the Support for HELOC Loans heading has been updated on the Feature Enhancements page to clarify that the request to update programs should be submitted to EPPS Technical Support, and not Encompass Technical Support. The reference to the "Encompass Technical Support" has been changed to "EPPS Technical Support.". |

|

Change Type: Updated entry Change Date: 10/15/2018 Details: Updated the Updated the EPPS to Encompass Amortization Type Mapping for HELOC Programs entry on the Feature Enhancements page to clarify which documents are affected by the update. Current Entry: Updated the EPPS to Encompass Amortization Type Mapping for HELOC Programs When EPPS returns a HELOC program to Encompass, for the purpose of legal documents, the Amortization Type (field ID 2953) selection returned to the Lock Request Form will always be “ARM”. EPPS-20577

Previous Entry: Updated the EPPS to Encompass Amortization Type Mapping for HELOC Programs When EPPS returns a HELOC program to Encompass, for documentation purposes, the Amortization Type (field ID 2953) selection returned to the Lock Request Form will always be “ARM”. EPPS-20577

|

| Change Type: Updated entry Change Date: 1/16/2019 Details: Updated the Updates to the Qualify and Summary Tabs entry on the Feature Enhancements page to indicate that the addition of the HCLTV value to the Qualify and Summary tabs affects all programs. Current Entry:

Previous Entry:

|

| Change Type: Updated entry Change Date: 1/16/2019 Details: Updated the following entries on the Feature Enhancements page with a note indicating the change impacts CPM users only. |

| Change Type: Updated entry Change Date: 1/17/2019 Details: The introductory paragraph under the Support for HELOC Loans heading has been updated on the Feature Enhancements page to include a note that states clients must migrate to Encompass 19.1 to fully integrate the EPPS HELOC functionality. Clients must migrate to Encompass 19.1 to fully integrate the new EPPS HELOC functionality. |

| Change Type: Updated entry Change Date: 1/18/2019 Details:An introductory paragraph has been added under the Support for Non-Qualified Mortgages (Non-QM) heading on the Feature Enhancements page to to clarify that Non-QM loan pricing is not available in this release, but is scheduled for a future release. In addition, the "Why we made this update" section has been updated to provide similar clarification. Support for Non-Qualified Mortgages (Non-QM) The EPPS 19.1 release does not include pricing for Non-QM loans. The new fields added to the General and Finances tab are part of the effort to provide Non-QM loan pricing, currently scheduled for a future release. Why we made this update: To prepare for the ability to qualify Non-QM loans, new fields have been added to the General and Finances tabs. |

|

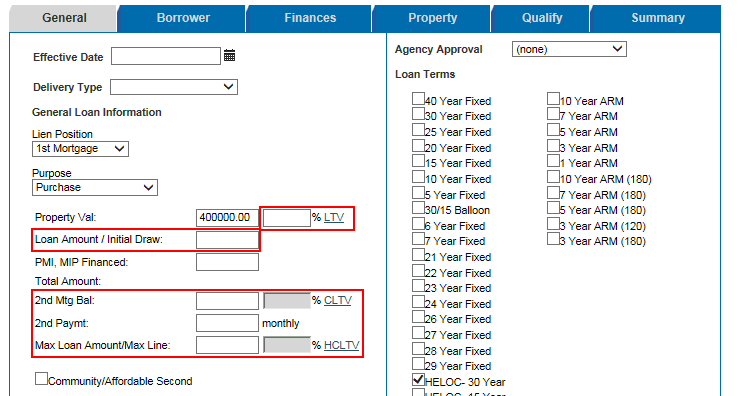

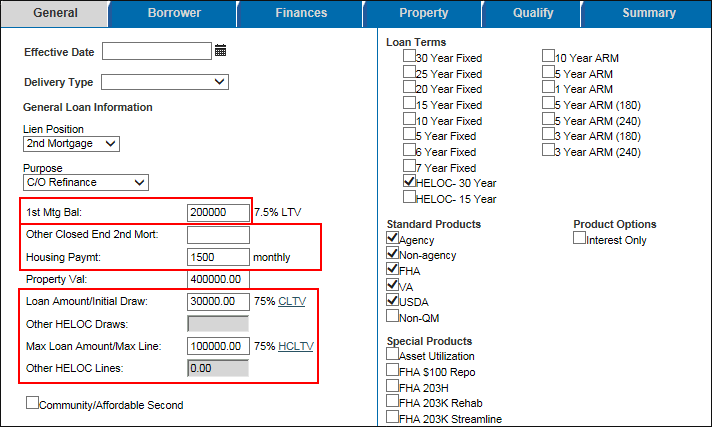

Change Type: Updated entry Change Date: 2/1/2019 Details: Updated the Updates to the General Tab entry on the Feature Enhancements page to correct the calculation for the 2nd Mgt Bal. In addition, the screen shot has been replaced to display the read-only Max Loan Amount/Max Line field. Current Entry:

EPPS-6398, EPPS-20677, EPPS-20678

Previous Entry:

EPPS-6398, EPPS-20677, EPPS-20678

|

| Change Type: Updated entry Change Date: 2/5/2019 Details: A second paragraph has been added to the introductory paragraph under the Support for Non-Qualified Mortgages (Non-QM) heading on the Feature Enhancements page to provide information about loans with no credit scores. Support for Non-Qualified Mortgages (Non-QM) The EPPS 19.1 release does not include pricing for Non-QM loans. The new fields added to the General and Finances tab are part of the effort to provide Non-QM loan pricing, currently scheduled for a future release. As part of these efforts loans submitted for pricing that do not have credit scores will now be considered No Credit Score transactions. The credit scores for these transactions will not be editable in EPPS. If the transaction is not a No Credit Score transaction, the credit scores must be updated in Encompass and resubmitted to EPPS. |

| Change Type: Updated entry Change Date: 2/5/2019 Details: Updated the Updates to the General Tab entry on the Feature Enhancements page to emphasize that the LTV/CLTV/HCLTV calculations on the General tab are calculated read-only fields. Current Entry:

For 1st and 2nd lien and a mixed selection of standard products, CLTV is displayed based off the worst case calculation on the General tab only. To update the CLTV calculation, adjust the standard products to reflect either Government (FHA, VA, USDA) or Non-Government (Agency, Non Agency, Non-QM).

For all programs, LTV, CLTV and HCLTV are calculated, read-only fields. EPPS-19530, EPPS-19759, EPPS-20060, EPPS-20689 Previous Entry:

For 1st and 2nd lien and a mixed selection of standard products, CLTV is displayed based off the worst case calculation on the General tab only. To update the CLTV calculation, adjust the standard products to reflect either Government (FHA, VA, USDA) or Non-Government (Agency, Non Agency, Non-QM).

EPPS-19530, EPPS-19759, EPPS-20060, EPPS-20689 |

| Change Type: Updated entry Change Date: 2/12/2019 Details: The introductory paragraph note under the Support for HELOC Loans heading has been updated on the Feature Enhancements page to clarify how to use the new functionality. Clients must migrate to Encompass 19.1 to fully integrate the new EPPS HELOC functionality. Loans must be submitted to EPPS through Encompass to be inclusive of all subordinate liens. |

|

Change Type: Updated entry Change Date: 2/12/2019 Details: Updated the Updates to the General Tab entry on the Feature Enhancements page because the LTV and Max Loan Amount/Initial Draw fields have been updated to be editable. Current Entry:

EPPS-6398, EPPS-20677, EPPS-20678

Previous Entry:

EPPS-6398, EPPS-20677, EPPS-20678

|

| Change Type: Updated entry Change Date: 2/12/2019 Details: Updated the Updates to the General Tab entry on the Feature Enhancements page to clarify the differences between the 1st and 2nd lien position and the LTV/CLTV/HCLTV calculations. Current Entry:

For 1st and 2nd lien and a mixed selection of standard products, CLTV is displayed based off the worst case calculation on the General tab only. To update the CLTV calculation, adjust the standard products to reflect either Government (FHA, VA, USDA) or Non-Government (Agency, Non Agency, Non-QM).

For the 1st mortgage lien position, the CLTV and HCLTV are calculated, read-only fields for all programs. For the 2nd mortgage lien position, the LTV, CLTV and HCLTV are calculated, read-only fields for all programs. EPPS-19530, EPPS-19759, EPPS-20060, EPPS-20689 Previous Entry:

For 1st and 2nd lien and a mixed selection of standard products, CLTV is displayed based off the worst case calculation on the General tab only. To update the CLTV calculation, adjust the standard products to reflect either Government (FHA, VA, USDA) or Non-Government (Agency, Non Agency, Non-QM).

For all programs, LTV, CLTV and HCLTV are calculated, read-only fields. EPPS-19530, EPPS-19759, EPPS-20060, EPPS-20689 |

| Change Type: Updated entry Change Date: 2/21/2019 Details: The introductory paragraph under the Support for HELOC Loans heading has been updated on the Feature Enhancements page to include a tip that states clients must implement their own eligibility and pricing changes in support of Community/Affordable Seconds. Eligibility and pricing changes in support of Community/Affordable Seconds is implemented at the discretion of the Investor. Clients using Custom Investors must implement their own eligibility and pricing changes in support of Community/Affordable Seconds by submitting a request to EPPS Technical Support or making the changes in CPM, depending on the implementation. |