Rules in May 2025 Release

State Rules

(Updated 06/04/2025)

Indiana - Periodic/360 (30/360) Accrual Method Prohibited (UCCC)

30/360 Interest Accrual Method Prohibited(1001289)

This Junior Lien Loan does not use the 30/360 interest accrual method. Effective July 1, 2020, Indiana DFI prohibits the 30/360 interest accrual method for Junior Lien Loans. (Indiana Code 24-4.5-2-201(4)(a)(ii); 24-4.5-3-201(3)(b)(ii); IN DFI Advisory Letter 2020-01)

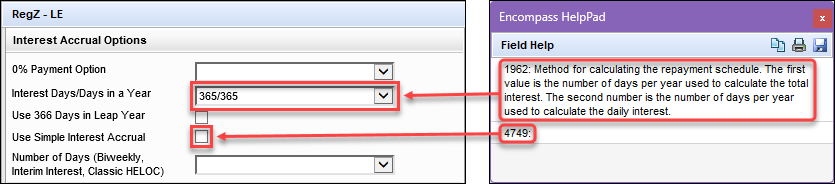

If you select 365/365 in the Interest Days/Days in a Year field (1962) and do not select the Use Simple Interest Accrual checkbox (4749), Encompass ignores your selection in Interest Days/Days in a Year and applies a 360/360 accrual method. This will cause you to receive a FAIL status message under RH 1001289.

Indiana - Periodic/360 (30/360) Accrual Method Prohibited (UCCC)

30/360 Interest Accrual Method Prohibited(1001289)

Please adjust the accrual method. Effective July 1, 2020, Indiana DFI prohibits the 30/360 interest accrual method for Junior Lien Loans. (Indiana Code 24-4.5-2-201(4)(a)(ii); 24-4.5-3-201(3)(b)(ii); IN DFI Advisory Letter 2020-01)

CER-25109

Iowa - Fees Not Allowed (535.8(4)(b))

Iowa - Unallowable Fees (535.8(4)(b))(Less Seller Obligated)(1001480)

There are no Iowa Code 535.8(4)(b)(1) unallowable fees in this loan secured by a 1-2 unit primary or vacation dwelling. (Iowa Code 535.8(4)(b)(1))

Iowa - Unallowable Fees (535.8(4)(b))(Less Seller Obligated)(1001480)

There are ($_) of unallowable fees in this loan. Under the Iowa Money and Interest Provisions, only the following fees specified under Iowa Code 535.8(a) and (b) may be charged in connection with a loan secured by a 1-2 unit primary or vacation dwelling: Loan Discount, Origination Fee, Processing Fee, Broker Fee, Commitment (Rate Lock) Fee, Credit Report Fee, Attorney's Fee Borrower Chosen, Recording Fees-Mortgage/Deed of Trust, Recording Fees-Assignment, Inspection Fee, Mortgage Insurance Premium, Survey Fee, Pest Inspection Fee, Iowa Title Guaranty Fee, property and insurance impounds.(Iowa Code 535.8(4)(b)(1))

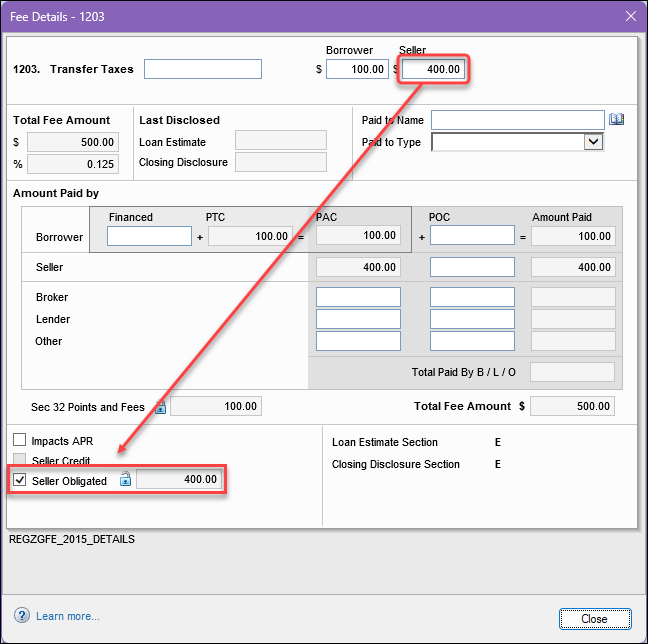

Labeling Seller Obligated Fees

When a fee is entered on the 2015 itemization, you can split the fee between borrower and seller.

To label a portion or all of the seller paid portion as seller obligated:

-

If the entire seller paid portion is seller obligated, select the Seller Obligated checkbox. The system will calculate the value for seller obligated as equal to the amount entered for seller credit (or concession).

-

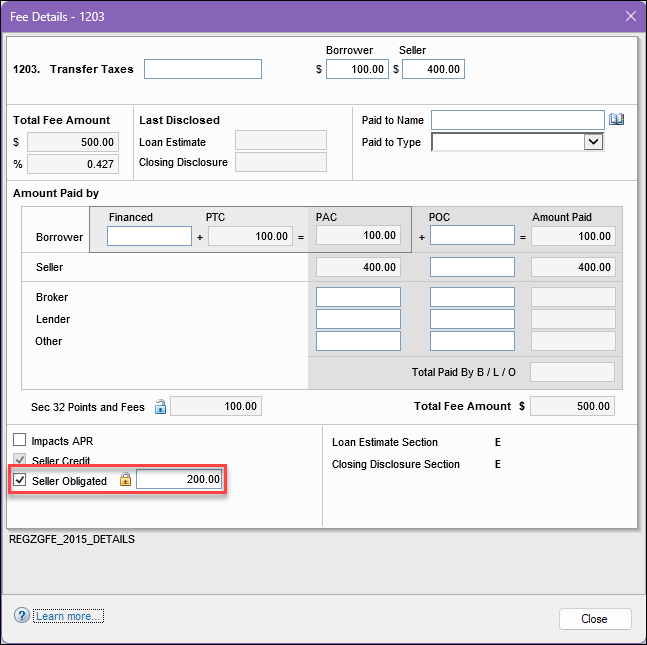

If only a portion of the seller paid portion is seller obligated, select the Seller Obligated checkbox and then use the lock icon to manually enter a value less than the amount entered for seller credit (or concession).

For detailed information on how Seller Obligated fees affect seller-paid fees, including disclosure requirements and tolerance violations, please refer to our knowledge article on Seller Credits and Seller Obligated Fees.

A seller-obligated fee is a type of fee associated with a mortgage loan that is typically customarily paid by the seller, such as transfer taxes and title insurance and escrow fees. These fees are incurred during the home buying process and are often considered the seller's responsibility to pay.

Understanding Seller Obligated Fees

Lenders must accurately identify and disclose seller obligated fees to consumers. To do this, lenders must understand what types of fees are typically considered seller obligated. Seller obligated fees are typically customarily paid by the seller, such as transfer taxes and title insurance and escrow fees.

When a fee is entered on the 2015 itemization, you have the ability to split the fee between borrower and seller. This is known as a "seller credit" or "concession," where the seller pays a portion of the fee on behalf of the borrower. However, according to the CFPB's TRID rule (12 CFR 1026.19), a seller credit is not considered a reduction in the borrower's obligation to pay the fee. This means that even if the seller pays a portion of the fee, the borrower is still ultimately responsible for paying the fee.

-

When the "Seller Obligated" checkbox is selected, the system calculates the value for seller obligated as equal to the amount entered for seller credit (or concession). This means that the entire amount is treated as a seller-obligated fee and is not subject to the same tolerance tests.

-

However, if only a portion of the amount entered for seller credit is seller obligated, you must use the lock icon to manually enter a value less than the amount entered for seller credit. This portion is then treated as seller obligated and is removed from the tolerance tests.

To comply with the TRID rule, lenders must accurately disclose seller obligated fees to consumers, properly categorize fees, and apply the correct tolerance tests.

Why Are Seller-Obligated Fees Important?

Seller-obligated fees are important because they can impact the buyer's closing costs and overall cost of the loan. By understanding what fees are seller-obligated, buyers can better plan their finances and negotiate the terms of the sale.

CER-25103

The following Rule Header is affected by this change:

-

RH 16970 Maryland - No License Required Application Rule

To understand the specific exemptions and licensing provisions added by MD HB 1516, please refer to the Maryland Code, specifically Title 11, Subtitle 3, which outlines the Mortgage Lender license requirements.

CER-25138

Texas Chapter 346 applies to all consumer-purpose HELOCs unless the parties to the contract opt out of Chapter 346.

Tex. Fin. Code § 346.004 states:

(a) Unless the contract for the account provides otherwise, this chapter applies to a revolving credit account described by Section 346.003 if the loan or extension of credit is extended primarily for personal, family, or household use to a person who is located in this state at the time the loan is made or the extension of credit is entered into.

(b) Unless the contract for the account provides that this chapter applies, this chapter does not apply to a revolving credit account described by Section 346.003 if the loan or extension of credit is for business, commercial, investment, or similar purposes.

Opt Out of Texas Chapter 346 Requirements

To exempt your Texas consumer-purpose HELOC loans from Chapter 346 requirements, submit a support ticket requesting that the following parameter be added to your Service Code(s):

name="TX346OptOut" value="true"

If you have any questions or need further assistance, you can:

-

Contact ICE Mortgage Technology's Support Services at 800.777.1718, which is available Monday through Friday from 5:00am to 5:00pm PST, to work with an experienced technical support engineer. Please have your personal User ID ready when you call.

-

Visit the Resource Center to open and track the status of a support case, or search for knowledge base articles for self-service resources and tools.

CER-25059