Encompass 24.2 Release Notes

Encompass 24.2 Major Release

These are the release notes for the Encompass 24.2 Major Release. They include a high-level overview of new features and forms, updates and enhancements, and fixed issues, followed by more detailed information and instructions where appropriate. Refer to the online help and the Guides & Documents page for additional information and related documents.

Additional Resources:

What's In This Release

User Interface

-

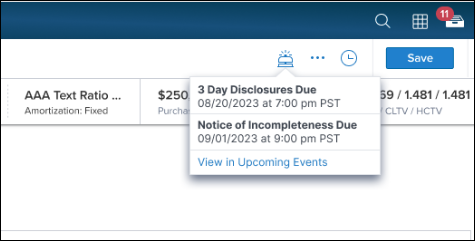

New Scheduler Timeline (ENCW-95770) - A new Scheduler Timeline icon (bell) is now provided in the loan-level top menu bar. Select this icon to view the status of scheduler events that have been configured through the Scheduler Templates administrator settings. You can also select View in Upcoming Events to view a list of active, cancelled, and completed scheduled events for the loan.

-

Paired Devices Moved to Company/User Setup Menu (ENCW-104789) - On the left panel in the Administration screen, the System Administration section title has been removed and the Paired Devices menu item formerly provided in this section has been moved to the Company/User Setup section of the left panel.

-

New Indicator for Fields Required by a Milestone Completion Business Rule (ENCW-108415) - For fields that are required in order to satisfy the requirements for a Milestone Completion business rule, Value is required is now displayed below the field. Once a value is added, the verbiage no longer displays.

Affordable Housing

-

Affordable Housing Enhancements (ENCW-105584, ENCW-104336) - Enhancements have been made in Encompass to facilitate users collecting and applying Median Family Income (MFI) and Area Median Income (AMI) limits and data. Lenders can use these limits to determine income eligibility for affordable housing programs. New fields (MSA Name (5017), Actual MFI Year (5018) , Estimated MFI Year (5019), Actual MFI 100% (5020), Estimated MFI 100% (5021) have been added to the Affordable Loan Eligibility section of the Fannie Mae Additional Data input form to better enable Encompass users to view factors that help determine whether a loan is a good candidate for an affordable loan program such as USDA. These new fields are populated based on the FFIEC MFI database table that is used when the user clicks the Get MFI button (formerly the FFIEC MFI button).

Updates for HELOC Loans

-

New Field for the HELOC Qualifying Payment (ENCW-105957) - A new read-only HELOC Qualifying Payment loan-level field (5025) is now provided on the HELOC Management input form. The value populated to this field is based on the loan amount (1109) and the selections made in the HELOC Qualifying Payment section of the form. As part of this update, fields 1724 (used for the proposed monthly first mortgage payment) and 1725 (used for the proposed monthly second mortgage payment) have been removed from the HELOC Qualifying Payment section. Those fields (which are still provided on the Transmittal Summary and other input forms) are calculated based on the monthly first mortgage payment (120) and other monthly mortgage payments (121) and not the HELOC Qualifying Payment Basis. Therefore, there was no field to reflect the calculate qualifying payment based on the Qualifying Payment Basis data. Fields 1724 and 1725 were also not including investment and second home HELOCs.

-

Calculate HELOC Amount Window Updated (ENCW-84540) - Updates have been made to the Calculate HELOC Amount window to provide more control over when fields are applied to the loan.

Updates to Forms, Tools, Calculations

-

Automated Data Completion for Home Counselor Provider List (ENCW-105630) - New options are now provided to enable Encompass to populate the Home Counseling Provider List on the Home Counseling Providers input form automatically rather than relying on user to select the Get Agency List button. When the required prerequisites are met and the Automated Data Completion option for Home Counselors is enabled in the Encompass Admin Tools > Settings Manager, the Home Counseling Provider List will be automatically populated with 10 or more home counselor names.

-

Additional Options Added to Manner in Which Title will be Held Field (ENCW-96164) - A new preconfigured rule added to the Field Data Entry business rule setting for the Manner in Which Title will be Held field is now available for use in the web version of Encompass. This rule can be applied to the Manner in which Title will be held editable drop-down field (field ID 33) on the Borrower Information - Vesting input form. Administrators can use this rule to modify the enumerations that display in this drop-down list and specify specific enumerations they want to display on the input form, including gender neutral options like A Married Person, An Unmarried Person, and A Married Couple.

-

Purchase Support Added to HMDA Information Form (ENCW-100438) - Purchase information has been added to the HMDA Information form. The Purchase fields now display when 6. Purchased Loan is selected in the Action Taken field.

-

Support Added for Request for Transcript of Tax Return Form (ENCW-99181) - The Request for Transcript of Tax Return form has been added. This update includes the 4506-T, 4506-C, and 8821 forms. These forms are used to obtain authorization from borrower, co-borrower, or other individuals or entities to request transcripts of their tax returns (on Form 4506 T or 4506-C) from the Internal Revenue Service, and to verify borrower-provided tax information by ordering electronic copies of 4506-C tax reports from within Encompass. The ability to request the transcripts for 8821 is not available for order through Services at this time.

-

New Secondary Registration Tool (SEC-26062, SEC-26592) - The Secondary Registration tool is now available in the web version of Encompass. This tool is used to receive rate lock requests and rate lock extension requests, enter investor details and pricing information, and lock the loan rate.

-

New Correspondent Loan Status Tool (ENCW-98690) - The Correspondent Loan Status tool is now available in the web version of Encompass. This tool provides a quick summary of a correspondent loan.

-

Down Payment % and Down Payment Dollar Amount Fields Added to 1003 URLA - Loan Information Input Form (ENCW-103280) - The Down Payment % (1771) and down payment dollar amount (1335) fields have been added to the 1003 URLA - Loan Information input form (in the Terms of Loan section). Previously, these fields were only provided on the Borrower Summary - Origination input form in the desktop version of Encompass.

-

New Pre-Approval Credit Report Checkbox Added to Borrower Summary - Origination Input Form (ENCW-104704) - A new Pre-Approval Credit Report checkbox (5006) has been added to the Credit Information section of the Borrower Summary - Origination input form. Only the Prequal Credit Report (4750) or the new Pre-Approval Credit Report checkbox can be selected, not both. If one of these checkboxes is selected and then the other is selected, the original checkbox selection is cleared.

-

Manufactured Home Width Type Field Added to the 1003 URLA - Loan Information Input Form (ENCW-102063) - The Manufactured Home Width Type field (ULDD.ManufacturedHomeWidthType) is now available on the 1003 URLA - Loan Information input form (in the Construction Loan Details section). The field was added to provide easy access to this data when submitting loans to Freddie Mac’s Loan Product Advisor underwriting system. Previously this field was only provided on the ULDD/PDD input form.

-

Fannie Mae 15-Year and 30-Year ARM Index Options Now Retired (ENCW-103834, ENCW-105974) - The following ARM Index options listed for field 1959 have been updated with a (Retired) indicator since Fannie Mae will no longer be supporting them. This update has also been made in the applicable ARM Index dropdown lists (LE2.X96, 4512) where these fields are provided including the RegZ-CD, RegZ-LE, HELOC Management, Closing Disclosure Page 4, and Lock Request Form input forms: Fannie Mae 15Y/60D delivery, Fannie Mae 30Y/30D delivery, Fannie Mae 30Y/60D delivery, and Fannie Mae 30Y/90D delivery. This same update to the indicators has been made to applicable Loan Program Templates as well.

-

Update to the Calculation for Other New Mortgage Loans on the Property the Borrower(s) is Buying or Refinancing (ENCW-107797) - A lock icon has been added to the Total Applied to Down Payment field (URLA.X230) on the Fee Itemization and Application View > Qualifying the Borrower forms. Users can utilize the lock to manually enter a value to override the value calculated by Encompass.

-

Field Lock Added to Line E. Credit Cards and Other Debts Paid Off on 1003 URLA Input Form (ENCW-105013) - A field lock icon has been added to field URLA.X145 on Line E. Credit Cards and Other Debts Paid off on the 1003 input form (Application View > Qualifying the Borrower). Previously, this field on the 2015 Itemization input form had a field lock icon, but the field on the 1003 URLA form did not, which could result in different values in the fields between the two forms. Now that the field has a field lock icon on both forms the values remain consistent.

-

Field Lock Added to Unpaid Principal Balance Field (ENCW-69002) - On the FHA Management input form's Prequalification section, a lock icon has been added to the Unpaid Principal Balance field (26) in the Mortgage Calculation section for consistency with other forms where this field is provided. Users can utilize the lock to manually enter a value to override the value calculated by Encompass. Note that this field only displays on the form for refinance loan types.

-

New FHA Correspondent Fields Added (ENCW-100247) - New FHA fields for FHA Connection data, including upfront MIP dates and principal reduction information, have been added to the FHA Correspondent Information input form. These fields have been also been added to the Encompass Reporting Database available in the desktop version of Encompass' reporting database.

-

Cleanup and Reorganization of the Freddie Mac Additional Data Input Form (ENCW-90959) - The Freddie Mac Additional Data input form has been updated per Freddie Mac guidelines, ensuring that the form contains only the necessary fields. The following fields have been removed from the form: Alt Phone (CASASRN.X80), Secondary Finance (CASASRN.X112), Req'd Doc Type (CASASRN.X144), Affordable Product CASASRN.X114, Allows Negative Amortization (CASASRN.X85), Arms-Length Transaction (CASASRN.X81), Retail Loan (CASASRN.X77), Gift Source (MCAWPUR.X9), Counsel Type (2847), ARM Index (CASASRN.X135), New Construction Type (CASASRN.X197), Condo Develop Name (1298), Condo Class (CASASRN.X84), City (CASASRN.X17), State (CASASRN.X18), 2nd Trust Paid on Closing (CASASRN.X30), Borrower % of Business Owned (CASASRN.X176), Borrower Income From Self Emp (CASASRN.X178), Co-Borrower % of Business Owned (CASASRN.X177), Co-Borrower Income From Self Emp (CASASRN.X179)

-

New Fields Added to New Mexico State Specific Information Input Form (ENCW-105967) - New lock and lock-in fields have been added to the New Mexico State Specific Information input form to enable users to fully populate the New Mexico Rate Lock disclosure included in some disclosure packages.

Updates to ULDD/PDD Input Form

-

New Freddie Mac-specific Versions of Document Custodian ID and Service ID Fields (ENCW-104700) - In previous versions of Encompass, the Document Custodian ID field (ULDD.X114) and the Servicer ID field (ULDD.X116) were provided on both the Fannie Mae and Freddie Mac tabs of the ULDD/PDD form. In Encompass 24.2, new Freddie Mac-specific versions of each of these fields are now used on the Freddie Mac tab instead: the Document Custodian ID field (ULDD.FRE.DocumentCustodianId) and the Servicer ID field (ULDD.FRE.ServicerId). Having GSE-specific versions of these fields benefits users submitting to both Early Check and LQA as now they won’t have to update the field for Document Custodian ID and Servicer ID each time they submit an order.

-

New Modification Loans Section for ULDD/PDD Input Form’s Ginne Mae Tab (ENCW-104698) - A new Modification Loans section has been added to the Ginnie Mae tab on the ULDD/PDD input form. This section provides new pre-modification fields (ULDD.X201 - ULDD.X206).

ICE Mortgage Analyzers

-

Compare and Import New Income Types (ENCW-102994) - The Income Analyzer results have been expanded with Alimony and Child Support income types that can be imported into the Compare and Import tool in the Underwriting Center. The new income types are also reported in the Income Worksheet.

-

Income Import Confirmation - When the income import is complete, Compare and Import tool displays a confirmation message to ensure that user is aware of the process success.

-

Analyzer Comparison Tool - Worksheet Integration (ENCW-97449, ENCW-106487) - Compare and Import tool now displays the date when the Income Analyzer data was last time imported to the Encompass. This date also indicates when the Income Worksheet was created as it gets generated each time the income data is imported from the Income Analyzer.

-

Document Processing Status in the Analyzers Menu (GSE-30094) - You can view the document processing status in a user-friendly form for each analyzer in the Analyzer's tab in the Underwriting Center.

-

Compare and Import Icon Updated (GSE-32204) - Compare and Import icon in the Analyzers menu has been updated to provide visual distinction from other applications.

Loan Archive Updates

-

Added Archive Loans Option to Pipeline and Loans (ENCW-99127) - Added a separate Archive Loan Option to the Pipeline to enable users to easily filter archived loans in the Pipeline. Additionally, users can now archive individual loan files.

Updates for Correspondent Lending

-

New Remote Online Notary Field and Additional Lending Support ( ENCW-100526) - Updates have been made to enable lenders to document loans that used a remote online notary (RON) and help them identify the loans that have specific requirements to be met before purchasing the loan. A new Remote Online Notary (5004) field is now provided on the ULDD/PDD input form (Fannie Mae and Freddie Mac tabs) and the Correspondent Loan Status tool.

-

New ECS Fields Now Write Back to Newly Added Encompass Fields (CE-51976, CE-50136, CE-51982, CE-50142, ENCW-99123, ENCW-106314) - Several new fields have been added to the ECS Data Viewer to support testing result information from Mavent. This data is imported into a standard set of fields that can be used in business rules or workflow processes. The iLAD/MISMO 3.4 import has also been updated to support these new correspondent fields that were added to ECS Data Viewer.

Updates for Enhanced Conditions

-

Closing Conditions Information Added for Enhanced Conditions (ENCW-97735) - Added an option to view or update the details for closing conditions and/or instructions that have been applied to the loan.

-

Support Added for Longer Enhanced Conditions Names (ENCW-95525) - Added support for enhanced condition names up to 255 characters.

Electronic Document Management (EDM)

-

New eFolder Views - Customizable views are now available for the eFolder. After sorting the column content, applying search filters, and adding, removing or rearranging columns you can save the view for future use. Views are useful if you want to quickly view eFolder content that matches a predefined set of search criteria.

-

New eFolder History (DOCP-49032) - A History screen is now provided for the eFolder, providing a detailed history of all of the changes made to electronic files, documents, and conditions for a loan during the origination process. The screen includes the date and time for the associated change, type (file, document, or condition) of the eFolder item; the name or description of the document or condition, the name of the borrower associated with the file, the event or action taken with the document or condition, and the user ID of the Encompass user responsible for the change.

-

Delivery Recognition with Auto Retrieve (DOCP-60228) - Previously in Encompass, fax and scanned documents retrieved automatically or manually would always be placed in the Unassigned section of the eFolder. In Encompass 24.2 the recognition of these documents has been improved and the rate of assigning these documents to their respective containers will now increase. In addition, the green message notifications that are sent to lenders when fax and scanned items are returned have been updated so that the items that are recognized are separated from the main document upload and are now listed separately with file names that reflect the document folder the file is retrieved to.

-

Update for "Needed" Documents (DOCP-59496) - The Request/Send Documents functionality allows a user to choose multiple Encompass forms, needed docs, and eFolder attachments to include in a single package. Just like with eFolder attachments, users now have the ability to pick a specific person to get a needed document request. This ensures other parties in a package are not getting an unnecessary request for a document. For example, let's say a user is sending a package with two of disclosures to a borrower pair. The loan officer also needs a current paystub from a co-borrower. The request should include the borrower pair and any additional recipients for the Encompass disclosures sent. However, only the co-borrower would receive the request for the "needed" paystub documentation. No other recipient in the package would receive the task.

-

New Loan Audit Feature (DOCP-61843) - A new loan audit button is now provided. Unlike the Audit button provided in the desktop version of Encompass that is specifically for closing audits, the audit button in the web version of Encompass is dynamic and can be used for the disclosure audits and closing audits. Based on the user's permissions (via their assigned persona), users can perform audits based on the audit button provided.

-

Send to Third Party When eClosing(DOCP-56355) - When utilizing Encompass eClose, users with the required permission (via persona) can now send documents to a third party/Loan Connect (for example, a settlement agent) within the eClose workflow.

AllRegs Integration

-

AllRegs Search Integration (ENCW-95099) - A new AllRegs Search option has been added to the Encompass application to enable customers to retrieve loan-specific information from within the web version of Encompass.

Workflow Management

-

Added Ability to Create Notification Templates for External TPO Users (ENCW-97743) - Administrators can now create Notification Templates to send notifications to TPO users in Encompass TPO Connect.

-

New Options Added to Update Service Order Resulting Action (ENCW-97812) - New options have been added to the Update Service Order resulting action for workflow rules. These options enable lenders to control which orders get updates and in what gets updated.

-

Added Ability to Select Multiple Document Folders for File Attached Triggering Event (ENCW-82551) - Administrators can now select multiple document folders that trigger a workflow rule when a document has been attached to any of those document folders.

-

Task Date Calculation Calendar Settings Added to Global Task Settings (ENCW-98102) - Added settings to enable lenders to set a default global calendar that is used to calculate task due dates.

-

Task Date Calculation Calendar Override Setting Added to Task Templates (ENCW-104074) - Added Task Template level override setting to enable lenders to override the global calculation calendar settings on a case by case basis.

-

Type ID No Longer Required on Tasks (ENCW-94158) - The Type ID field for Tasks and Task Groups is now an optional field and lenders no longer have to enter a value in the Type ID field to create a task or task group.

Task Management

-

Workflow Tasks Tool Now Displays Open and Completed Tasks in Separate Tabs (ENCW-101940) - The Workflow Tasks tool has been updated to show open and completed tasks in separate tabs. This update enables users to quickly view the open tasks on a loan without having to search through a combined list of open and completed tasks.

-

Assignment Workflow Enhancements (ENCW-98085) - A new Assign to Me option enables users to quickly assign a task to themselves quickly. Additionally, users can assign to any user group or role in their instance.

-

Disposition Comments Removed from Tasks (ENCW-98097) - Task Disposition Comments have been removed from the task details. Disposition changes are also now tracked in the Task comments history.

Services Updates

-

Service Event Mapping Added for Service Setups (ASO-16432) - Added Service Event Mapping settings to enable administrators to receive events from partners as part of transaction responses to create tasks or send notifications when further action is required for a service order. Partners must add support for this feature before it can be used.

-

Services Landing Page Message Support Added (ASO-16684, ASO-16685) - Added ability for messages to be sent to Partners from a service order on the Services Landing Page. Partners must add support for this feature before it can be used.

-

Drop Down Navigation Added for Service Order Setup Pages For Easier Navigation (ASO-16640) - Added a drop down navigation menu to enable users to easily navigate between service management pages for each partner product.

-

Added Support for Company Wide Partner Configurations (ASO-15875) - Added option to enable administrators to define default settings or other partner specific requirements on a company level. Partners must add support for this feature before it can be used.

-

New Automated Service Ordering Rules Are Now Created Using the Workflow Engine Rule Type (ASO-19979) - Disabled the ability to create automated rules with the older ASO Bot rule type. Existing ASO Bot rules are not affected. Users can also still create automated rules with the newer Workflow Engine rule type.

-

New Outbound Document Mapping Option Added (EPC-35758) Enables administrators to map loan documents folders to automatically send documents from those specific folders to the partner with each order. Partners must add support for this feature before it can be used.

- Outbound Document Mapping Updates (EPC-35615, EPC-35959, EPC-35760):

Document Mapping UI now separates the mapping, for Inbound documents received by Encompass users and Outbound files sent from Encompass users to service providers

Separate buttons for Delete All Inbound Mappings and Delete All Outbound Mappings added to the Document Mapping page footer.

Separate Import and Export icons added in each section to import/export files in CSV format, along with an icon to download the mapping template(s)

-

Added Partner Documents Settings for MI and Title Automated or Easy Order Setups (ASO-16686) - Added the ability to define documents to be sent with automated and easy orders for the MI and Title categories.

-

Simplifile Collaboration added for Title and Closing (LS-19695, LS-16393) - Ability to use Simplifile Collaboration service for pre-close and post close workflows natively within the Encompass web browser experience and in conjunction with the Encompass Workflow Engine.

-

New Document Groups Dropdown (EPC-34034): View the list of attachments in the selected document group (for example, documents in an Income document group)

-

Expose Application Object in Service Provider Configuration Page (EPC-36076): Application object actions getPersonas and getRoles, along with other service setup parameters, now available in the service provider configuration page

GSE Integrations and Services

-

ULAD Export API (EVPI-3483): Now includes an optional parameter to include ICE Extension data

-

Freddie Mac Services:

-

Loan Quality Advisor Report EVPI-3989, GSE-31810: LQA reports now display in PDF format

-

Credit Providers API (EVPI-3187): Additional LPA credit provider codes now supported

-

Rep & Warrant Tracker (GSE-32015, GSE-32014): In the Freddie Mac section of the Rep and Warrant Status and the Rep and Warrant Borrower Status sections, UI label updated from Expiration Date to Close By Date

-

-

Fannie Mae UCD Collection Solution (EVPI-896, EVPI-3178): Support for Fannie Mae UCD (Uniform Closing Dataset) Collection Solution available with this release

-

FHA Connection Case View Findings (EVPI-2441): Additional fields automatically populated with FHA findings when results are successfully returned to Encompass, so you no longer need to manually enter data

Underwriting Center

-

Loan Snapshot (GSE-31141): New credit fields added

-

Notification Banner (GSE-30543): Displays status updates for all AUS enabling you to be aware of the latest status of your order, continue working while the loan processes, even if you navigate away from the tool

-

Make Primary Progress Indicator (GSE-31957): Upon clicking the Make Primary option, a progress indicator now displays, replacing the overlay image with an icon.

MI Center

-

Admin Settings (TQL-39978, TQL-40165, TQL-40480):

-

New Products to Display configuration option in Rate Quote Comparison (RQC) setting.

-

Above configuration controls the Products displayed in the following end-user (non-admin) pages:

-

Compare Rate Quotes

-

Order Summary

-

-

-

Order Summary Page Updates (TQL-40297): Documents Received tab now displays all/multiple documents associated with the order

-

Compare Rate Quotes Page Updates (TQL-40384, TQL-39612): Compare Rate Quotes page now includes the following new features:

-

Coverage Percent field

-

Messages from supported MI vendors. Click the links in the top panel added with this release to review the message details. This is particularly useful for unsuccessful orders - providing easy access to information from partners explaining the possible reasons of the failure.

-

-

Order Request Method (TQL-40386): In preparation of automated orders to be introduced with a future release, a new Order Request Method field has been added to the following to display the type of order request - manual vs automated.

-

Order History - new column

-

Order Summary - new field

Currently Order Request Method displays Manual values only, since only manual order types are supported with this release.

-

-

Async (EPCI-27883): Fees, status, and documents automatically sent back to Encompass when the MIS provider has fulfilled the order, eliminating the need to click the Check Status button.

-

Services Landing Page (SLP) (TQL-40810):

-

RQC Orders: To avoid confusion and leverage the MIC as the single source of information for RQCs, Rate Quote Comparison orders are no longer displayed on the SLP and are only available in the MI Center.

-

Re-Order Button: Prior to this release, the Re-Order button on the SLP was generating new orders. With this release, this button has been removed. You can now place subsequent orders from the MI Center only.

-

-

iLAD Mapping Update (TQL-40385): New mapping logic for IntentToOccupyType

Prospect Engagement

-

New Integration: Velocify - Surefire (VEL-66693): For Encompass instances with Velocify integrations that have Surefire enabled, Surefire data is displayed in the Prospects tab.

Additional Enhancements

-

Milestone Missing Required Data Banner Color Updated (ENCW-102489) - The Missing Required Data banner when completing a milestone has been updated from red error banner to light blue informational banner.

-

Update for Business Contacts (ENCW-96988) - When a user is inside a loan file and selects the Business Contacts icons to view contact details in a pop-up screen, the contact details in the Personal Information, Business Information, and Business Category Additional Fields sections are now read-only and the Create New button (used to create a new contact) is not displayed.

Fixed Issues

-

File Contact Updates for Users Assigned to Roles Now Saved (ENCW-80376) - Fixed an issue where updates made to file contacts assigned to roles on the File Contacts tool were not saved.

-

Pipeline Filters No Longer Change When Saving Views (ENCW-106244) - Fixed and issue where filters associated with a view would change when saving modifications to a view that didn't affect the filter.

-

Negative Values Now Accepted for Dollar Amount Fields (ENCW-93829, ENCW-104866) - Fixed an issue where users were unable to enter a negative number for any fields expecting a dollar value.

-

View Only Access Granted by Persona Access to Loan Business Rule Now Working as Expected (ENCW-103492, ENCW-44607) - Fixed an issue where users who should have been granted view only access to a loan by a persona access to loan business rule were unable to access loan data after the rule was triggered.

-

Fixed Session Not Logging Out After 15 Minutes (ENCW-102838) - Fixed an issue where some sessions would not log out after 15 minutes of inactivity.

-

Persona Enforcement for Cure Variance Option Enforced (ENCW-102573) Fixed an issue where users without persona access to the Cure Variance option for a Good Faith Fee Variance violation were able to select the Cure Variance button.

-

Opening a Loan No Longer Results in a Blank Screen (ENCW-102124) - Fixed an issue where a blank loan screen would display when there was an error loading custom loan data.

-

User List No Longer Blank When at Least One User Available for Role (ENCW-100364) - Fixed an issue where a user list for a specific milestone role (example: closer or loan officer) was blank when only one user was assigned to that role in Encompass.

-

Current Date Now Highlighted When Date Field Calendar is Selected (ENCW-98983) - Fixed an issue where the current date was not always highlighted on the calendar when the calendar icon was selected for a date field.

-

Calculated Custom Fields Now Display on Milestone Required Fields Window (ENCW-98794) - Fixed an issue where custom calculation fields would not display as missing when attempting to complete a milestone.

-

Document Mapping Option Now Only Available for Supported Partners (ASO-17195) - Fixed an issue where the Document Mapping option was enabled for all partners, whether they supported the feature or not.

-

Co-Borrowers Can Now Select Intent to Proceed Checkbox Independently of Primary Borrower (ENCW-96554) - In previous versions of Encompass, the Intent to Proceed checkbox (field ID 3164) could only be selected once the Actual Received Date for the Loan Estimate (LE) for the primary borrower was populated. In loans with borrower and co-borrower, if the co-borrower acknowledged the disclosure package prior to the borrower, the Intent to Proceed checkbox was inactive (grayed-out) and could not be selected by the co-borrower. This prevented them from recording an accurate Intent to Proceed date. This issue has been addressed and the Intent to Proceed checkbox is now accessible for co-borrowers regardless of the primary borrower’s interaction with the disclosure package.

-

Field Data No Longer Autofilled (ENCW-104734) - An issue occurred where some fields like Social Security Number (SSN), address fields , and email address fields were displaying autofill and autocomplete suggestions when Encompass was opened in a Chrome browser and the setting for Autofill in the browser was turned on. Encompass fields are not intended to be autofilled/autocompleted regardless of the browser settings. This issue has been fixed.

-

VA Loan Review Tool (EVP-33073) - When attaching documents to the loan submission to VA, stacking template did not save and documents were not submitted in the sequence recommended by VA

System Requirements for Encompass

Have you reviewed the latest System Requirements?

Before downloading or applying this new Encompass release, it is important to verify the latest system requirements. Review the System Requirements for Encompass to ensure your environment meets the requirements needed to operate Encompass successfully.

| Next Section: Updates & Enhancements |

|