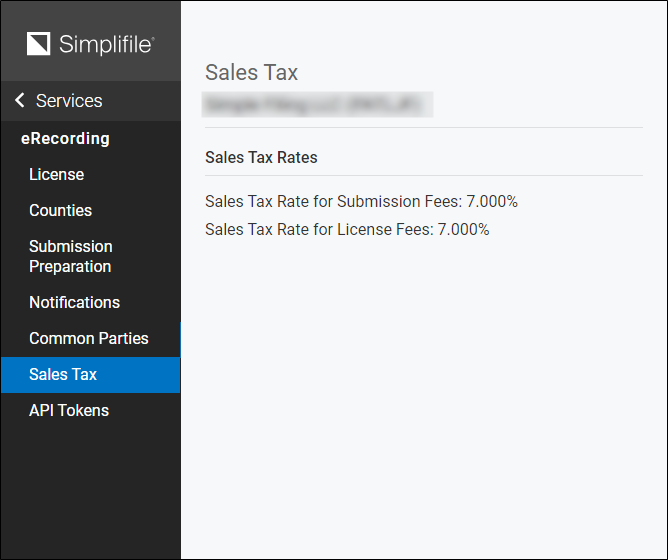

Sales Tax page

Overview

This topic contains information and tasks about your organization's Sales Tax page.

If sales tax is enabled in your state, you can view the sales tax rate set for your location for both submission and license fees. This amount is stored in your Simplifile account and automatically applied to the amount due.

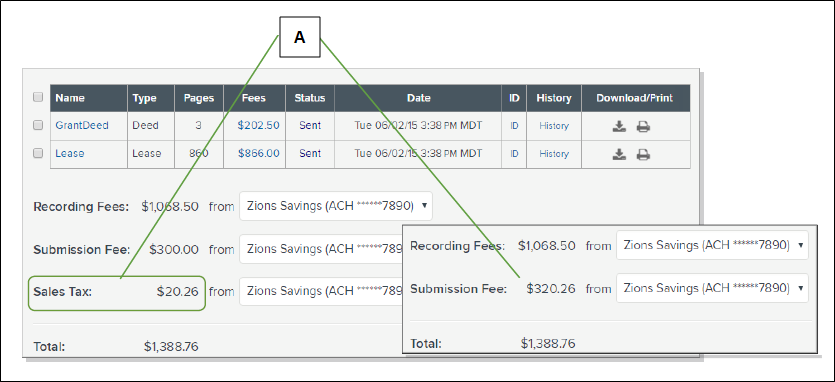

You can choose to combine the amount of sales tax charged with the submission fees instead of displaying tax as a separate fee on the Package Details page and in reports. Below are examples of how each choice affects the display.

| Letter | Description |

|---|---|

| A | The amount of the sales tax charged for fees displays on the Package Details page. If you have set up multiple payment accounts, you can choose the account from which to pay the tax. Alternatively, you can choose to combine the tax with the fees. |

I want to ...

Open the Sales Tax page

- In the navigation menu, select the Organizations item. The Organizations page opens in the left panel.

- If needed, use the Search field filter to display the organization with which you want to work.

- Select the name of the organization of which you want to work. The Organization Contact Information page opens and the navigation menu changes.

- In the navigation menu, select the Services item. The Organization Services page opens and the navigation menu changes.

- In the navigation menu, select the eRecording item. The eRecording License page opens in the right panel and the navigation menu changes with the License selected.

- In the navigation menu, select the Sales Tax item. The Sales Tax page opens.

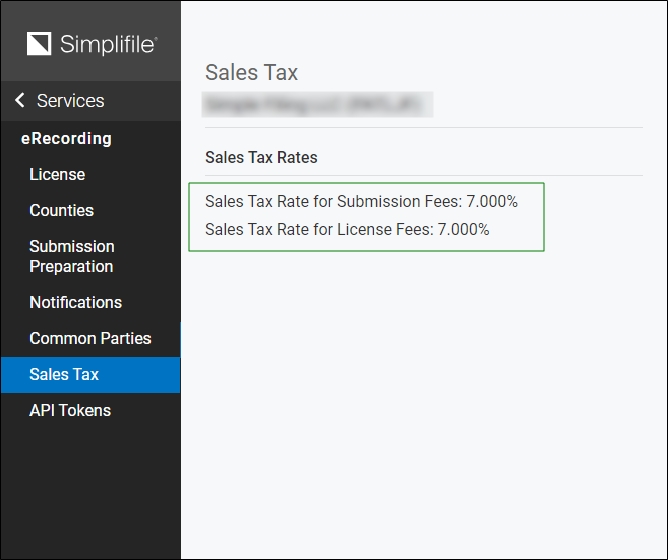

Display and combine sales tax as part of the corresponding fee on reports

- Open the Sales Tax page.

- Mark the Display sales tax as part of the corresponding fee on reports box.

Display and combine sales tax as part of the submission fees on the Package Details page

- Open the Sales Tax page.

- Mark the Display sales tax as part of the submission fees on the package details page box.