Feature Enhancements in Version 21.3 (Broker Edition)

This section discusses the updates and enhancements to existing forms, features, services, or settings that are provided in this release.

Rebranding Updates in Encompass

(Updated on 1/26/2022)

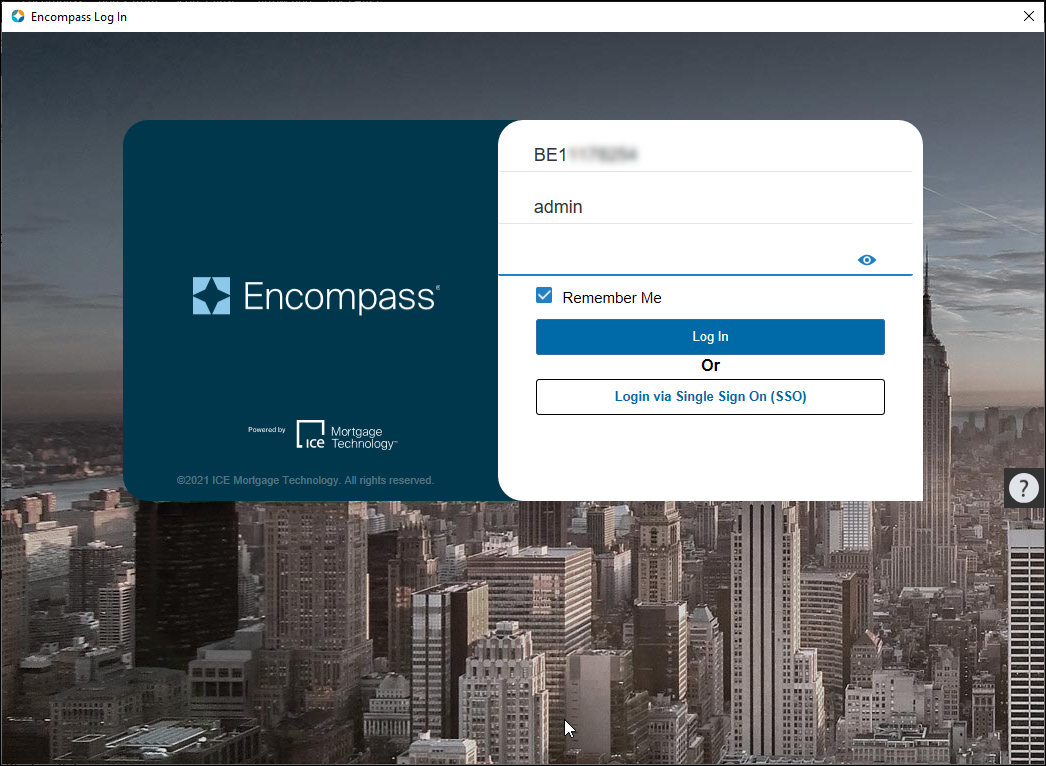

With the acquisition of Ellie Mae, Inc. by Intercontinental Exchange in 2020, Ellie Mae, Inc. officially became ICE Mortgage Technology in May 2021. In support of this company naming update, references to Ellie Mae in the Encompass user experience have now been updated to ICE Mortgage Technology. In addition, a new design for the Encompass logo is being introduced in Encompass 21.3.

For example, the Encompass log in screen now features the new Encompass logo and ICE Mortgage Technology branding.

This newly branded log in screen is also being applied to Encompass 21.2.0.0 - 21.2.0.5 versions. No other changes to these versions of Encompass are being made with the introduction of this log in page.

The “About Encompass” box now features ICE Mortgage Technology branding and naming, along with an updated copyright notice.

References to Ellie Mae on Encompass Settings screens have been replaced with ICE Mortgage Technology.

References to from Ellie Mae - www. elliemae.com have been replaced with from ICE Mortgage Technology - www.icemortgagetechnology.com in the footer of output forms such as the Interim Servicing Tracking Summary.

Support for 0% Interest Loans and Simple Interest Amortization

(Updated on 9/17/2021)

Encompass now supports simple interest amortization for closed end loans (including calculations updates to handle simple interest payment schedules and simple Interest P&I payment) and 0% interest payment loans for lenders originating down payment assistance loans for affordable housing, for example Habitat for Humanity and state and local housing agencies. The supported options include control for how 0% loans are presented from a disclosures standpoint in the projected payments table. These loan options will still require Notes and Mortgages from the State Agencies, which include language around loan payment terms and forgiveness requirements. Concurrent with the release of Encompass 21.3, additional plan codes will be made available to support these documents. Review the Encompass Support for 0% Interest Loans and Simple Interest Amortization Related Forms List for a full list of agency program documents that are supported.

-

0% interest amortizing loans

-

0% interest loan with no payments and the loan amount fully forgiven at term

-

0% interest loan with no payments and a balloon payment due at term

Updates in Encompass include:

-

Support for 0% interest calculations

-

Updates to the RegZ Forms and the Piggyback Loan Tool to support 0% options and simple interest

For detailed information, refer to the Working with 0% Products guide.

CBIZ-24514, CBIZ-34314, CBIZ-35156

Updates have been made to Encompass input forms, payment schedule calculations, and P&I payment calculations to supports simple interest amortization for closed end mortgage loan. Standard interest accrues on a 12-month basis and is calculated using 360 days of interest per year (30 days per month), while simple interest is calculated on a daily basis using 365 days per year (actual days per month), resulting in 5 additional days of interest accruing per calendar year for simple interest.

Encompass now supports the following actuarial accrual methods for simple interest closed end mortgages:

-

Actual 365 (365/365) – Interest calculations are based on a 365-day year regardless of whether the year is a leap year. Interest per day is based on 365 days and interest per month is based on the actual days in each month.

-

Actual 366 (365/366) – Interest calculations are based on a 365-day for standard years and a 366-day year for leap years. Interest per month is based on the actual days in each month.

-

Actual 360 (365/360) – Interest calculations are based on a 360-day year regardless of whether the year is a leap year but is charged based on actual days. This results in the highest total interest charged to the borrower with the highest daily rate and highest number of days collected.

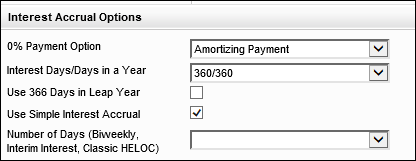

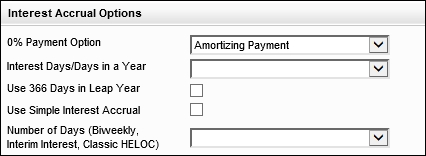

Lenders can configure the interest accrual options for a loan by using a new Interest Accrual Options section that has been added to the RegZ-LE, RegZ-CD, and RegZ-TIL input forms. The selection made in this section affect the calculations for the simple interest payment schedule, which translates into the finance charges and APR, and the calculations for the simple interest P&I payment.

CBIZ-2234

To support simple interest and 0% interest loan options, a new Interest Accrual Options section has been added to the Reg Z-CD, RegZ-LE, and RegZ-TIL input forms. The fields in this section are also available in RegZ popup window accessible from the Piggyback loans tool and in Loan Program templates and on the Select Loan Template pop-up window that opens when you click the Find icon (magnifying glass) next to the Loan Program field (field ID 1401) on forms such as the RegZ-LE.

The Interest Accrual Options section includes a new 0% Payment Option (field ID 4746). This field is applied to loan calculations only when a loan’s note rate (field 3) is set to 0%. The following values can be selected from the dropdown list:

-

Amortizing Payment – This value displays by default.

-

No Payment with Balloon

-

No Payment – Fully Forgiven

All three options can be used with fixed rate 0% loans. The No Payment options require that a loan has a fixed amortization. For ARM loans with an initial 0% interest, Encompass calculations support only the Amortizing Payment option. It is recommended that you do not select a No Payment option when working with 0% ARM loans.

When a user applies a loan program in which the 0% Payment Option is blank, Encompass does not overwrite existing values in the loan.

The following fields have been added to the Interest Accrual Options section to enable lenders originating loans with simple interest to set the parameters used to correctly calculate payment streams, finance charges, and APR.

-

Interest Days/Days in a Year (field ID 1962) – This is an existing field with the following options: 360/360 (standard interest), 365/365, and 365/360. Prior to Encompass 21.3, this field was used to capture the accrual method and days but was not applied to the payment schedule calculations.

-

Use 366 Days in Leap Year (field ID 4748) – This is a new field. When selected, it is applied to calculations only if 365/365 or 365/360 is selected for the Interest Days/Days in a Year (field ID 1962).

-

Use Simple Interest Accrual (field ID 4749) – This field is used in combination with Interest Days /Days in Year (field ID 1962). This field must be selected to apply simple interest calculations to the P&I payment and payment schedule when an option with 365 days (365/365, 365/360) is used.

-

Number of Days (Biweekly, Interim Interest Classic HELOC) (field ID SYS.X2) – This is an existing field. Selections in this field affect interim interest collected at closing, as well as biweekly payment schedules and classic HELOC schedules that are not configured using the HELOC Management input form.

In previous versions of Encompass, simple interest was available only for HELOC and Biweekly loans by using the Number of Days dropdown list (field ID SYS.X2) to select terms to use for the interest calculation (360 or 365) for these types of loans.

Migration

When migrating an existing loan, default values are not populated to the newly added fields. Lenders can set the field value manually or leave it as is if they want to keep the evaluation for their previously closed loans.

CBIZ-34330, CBIZ-40032, CBIZ-24514

Calculation updates have been made to support payment schedules for simple interest loans based on the options selected in the new Interest Accrual Options section on the RegZ-LE, RegZ-CD, and RegZ-TIL.

If the Use Simple Interest Accrual checkbox (field ID 4749) is not selected, a default value of 360/360 (standard accrual method) is used for calculations regardless of the selection made for the Interest Days/Days in a Year (field ID 1962). The 360/360 method uses 30 days of interest for each month regardless of how many days are in the month. The finance charge will include any odd days of interest captured in Fee Line 901 on the 2015 Itemization or 2010 Itemization.

If the Use Simple Interest Accrual checkbox (field ID 4749) is selected, the selections for the Interest Days/Days in a Year dropdown list (field ID 1962) and the Uses 366 Days in a Leap Year checkbox (field ID 4748) are used to determine the simple interest calculations for the payment schedule, according to the logic in the table below.

The Use 366 Days in a Leap Year option is applied to calculations only when the Use Simple Interest Accrual checkbox has also been selected.

| Interest Days/ Days in a Year | Use 366 Days in Leap Year | Description |

|---|---|---|

| 365/365 | Selected | Every year is calculated as 365, except for leap years, which are calculated as 366. Monthly interest is calculated on the actual days in the prior month. |

| 365/365 | Cleared | Every year is calculated as 365, including leap years. Monthly interest for each payment is calculated based on the actual days in the prior month. |

| 365/360 | Selected or cleared | The days per year are always 360 in this method. Monthly interest for each payment is calculated based on the actual days in the prior month. |

For amortizing loans, Encompass will calculate a P&I payment that will bring the loan balance to $0.00 with the last payment. In some cases, the simple interest accrual, even with rounding of the payments within the schedule, can have a higher final payment than the prior payment in the schedule. If this difference in payment exceeds the limit set in certain states, the Encompass Compliance Service will generate an alert notifying the lender. The loan amount may require a slight adjustment in these scenarios to bring the payment schedule into tolerance if it cannot be corrected with rounding.

Because Encompass already supports simple interest for the following types of loans, calculation changes will not affect payment schedules for:

-

Bi-weekly loans

-

Construction-only loans

-

The construction portion of construction-to-perm loan

The permanent portion of construction-to-permanent loans where the Number of Days (field ID 1962) is set to 365/365 will see a difference in the overall finance charge based on updates to the permanent portion of the loan. This affect only the permanent portion of construction-to-permanent loans originated after updating to Encompass 21.3.

CBIZ-34314

Calculations used to determine P&I payments for loans have been updated to correctly determine the payments to populate for simple interest loans. This includes adjustments to ensure that the final P&I payment does not exceed the prior payment by more than the amount set by regulatory requirements. For example, regulatory requirements in West Virginia (HB4411) require that the final payment be no more than $5.00 higher than the prior payment in the schedule. These calculation changes affect P&I payments disclosed on the URLA (2009 and 2020 versions), the Transmittal Summary (1003), and the ATR/QM Management forms.

When the Use Simple Interest Accrual checkbox is selected, the P&I payments are calculated in such a way that the amounts do not change from month to month, with the following exceptions:

-

ARM Loans – When an ARM adjustment occurs, the calculated P&I in the payment schedule is updated using the revised rate.

-

Last Payment – When the initial payment schedule calculation results in a final payment that exceeds the prior payment in the schedule by more than 0.005 multiplied by the number of payments in the loan term, Encompass recalculates the payment schedule until the last payment is within tolerance or until 100 attempts have been made, in which case there is a possibility that the final payment may exceed the allowable limit on the prior payment.

-

Construction to Permanent Loans - Calculated P&I payments in the payment schedule may change at the following points:

-

Construction ARM – P&I adjustments occur when the ARM rate is adjusted.

-

Construction to Permanent – P&I adjustments may occur when the loan moves from the construction portion of the loan to the permanent portion.

-

The calculation updates listed above applies to loans that are not HELOC loans and are not construction-only loans.

These updates do not affect existing construction or construction-to-permanent loans unless you open a construction-to-permanent loan with 365/365 selected for the Interest Days/Days in a Year (field ID 1962) and then select the Use Simple Interest Accrual checkbox.

The recommended best practice is for lenders to review their existing loans to identify any non-construction loans with 365/365 incorrectly selected for Interest Days/Days in a Year. Prior to Encompass 21.3, simple interest accrual was not supported for non-construction loans, so selecting 365/365 would not affect the accrual method used for those loans. With simple interest now supported in Encompass 21.3, any existing non-construction loans with 365/365 selected will throw an error when submitted to the Encompass Compliance Service. Because the Encompass Compliance Service now maps and tests the accrual method against the selection for Interest Days/Days in a Year, the finance charges for existing non-construction loans with 365/365 selected will not match the results expected for simple interest accrual.

CBIZ-35156

Home Equity and HELOC Loans

(Updated on 9/17/2021)

Encompass now supports HELOCs and closed-end home equity loans (HELoans) using the URLA 2020 forms.

-

Actual days and monthly interest options for closed end home equity loans, including the ability to use simple interest for HELOC and HELoans

-

Updates to the 1003 URLA-Lender input form and corresponding updates to Loan Program Templates enable lenders to use either TRID or GFE/TIL disclosures for HELOC loans.

-

Lenders can now use a consistent application format for all their loan and HELOC applications.

For detailed information, refer to the Working with Home Equity Loans and Lines of Credit guide.

CBIZ-38182

To accurately capture the cash to close for a HELOC loan, the HELOC Initial Draw amount (field ID 1888) rather than Total Loan Amount (field ID 2) is now used in the qualifying the borrower calculation for purposes of calculating the cash to or cash from the borrower.

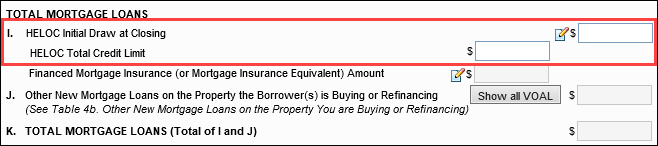

To support this change, when HELOC is selected for the Loan Type (field ID 1172), updates have been made to the Total Mortgage Loans section on the 1003 URLA – Lender input form and a new calculation is used for the Total Mortgage Loans amount (field ID URLA.X148).

For HELOC loans, the Total Mortgage Loans (URLA.X148) is now populated with the combined total of the HELOC Initial Draw at Closing (field ID 1888) and the other new mortgage loans on the property (field ID URLA.X230). The calculation for the Total Mortgage Loans amount will be retriggered when there is a change to the Loan Type (field ID 1172), HELOC Initial Draw at Closing (field ID 1888), or the other mortgage loans on the property (field ID URLA.X230).

The following updates have been made on the 1003 URLA – Lender input form when HELOC is selected for the Loan Type (field ID 1172):

-

In the Total Mortgage Loans section, on line I, the Loan Amount (field ID 2) is replaced with the HELOC Initial Draw at Closing amount (field ID 1888). This field is editable. An Edit icon is available for the field to enable users to open the Calculate HELOC Amount pop-up window.

-

In the second row on line I, the label for the Loan Amount Excluding Financed Mortgage Insurance (field ID 1109) is changed to HELOC Total Credit Limit.

-

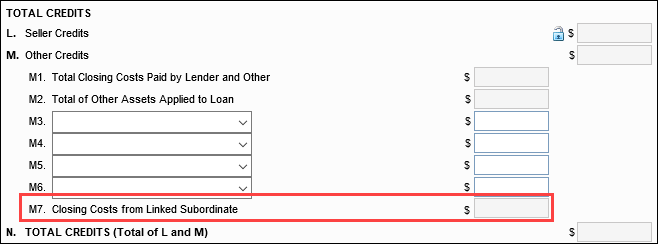

The Total of M1 to M6 line at the bottom of section M has been removed. For loans that are linked via the Piggyback Loan tool, including HELOC loans, the line has been replaced with the following line:

-

If the currently open loan is linked to a first lien loan, the label for M7 reads: Closing Costs from Linked 1st and the amount (field ID 1851) displays in the right column.

-

If the currently open loan is linked to a subordinate lien loan, the label for M7 reads: Closing Costs from Linked Subordinate and the amount (field ID 1851) displays in the right column.

-

Migration

This calculation update is not applied to existing loan files in Encompass when updating to Encompass 21.3, but after the update, the calculation is applied when a loan file is saved or when an update to the loan triggers recalculations in the loan file.

CBIZ-38183

Encompass Forms and Tools

With the introduction of URLA 2020, the USDA no longer requires their own version of the application and the Income Worksheet section has been removed from the RD 3555-21 Rev. 03-21 output form. However, the income worksheet is still required for purposes of originating USDA loans and the Annual Income of Household (field ID USDA.X16) and Adjusted Annual Income of Household (field ID USDA.X17) entered on the worksheet are still populated to the output form using data from the Income Worksheet and Page 6 of the Rural Assistance URLA tab on the USDA Management input form.

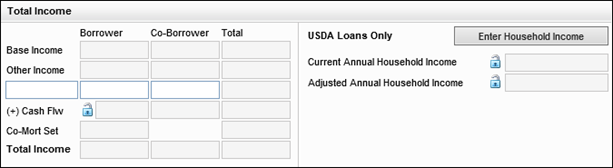

To make this information visible on the URLA 2020 input forms, a new Total Income section has been added to the bottom of the 1003 URLA Part 2 input form.

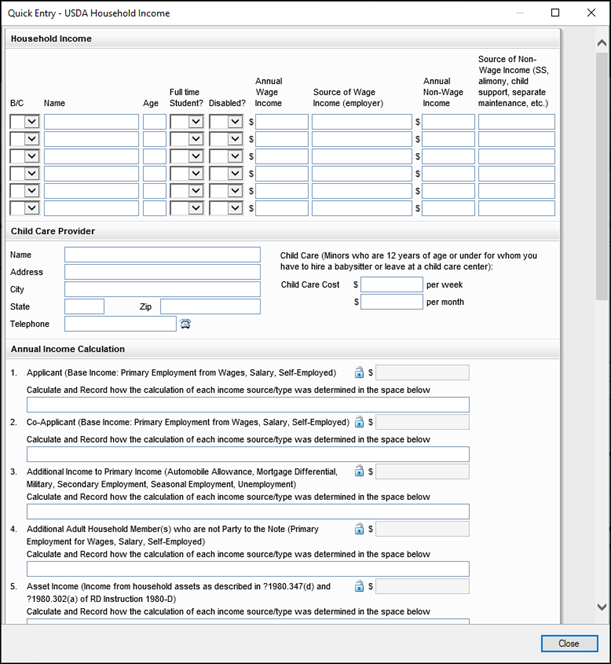

This section displays the Stable Monthly Income block from the Transmittal summary input form and a USDA Loans Only section that includes the Current Annual Household Income (USDA.X16) and Adjusted Annual Household Income (USDA.X17). Both fields have Lock icons that can be clicked to manually adjust the amounts. Click the Enter USDA Household Income button to open a new pop-up window that displays the fields from Income Worksheet and Page 6 of the Rural Assistance URLA tab on the USDA Management input form.

The calculation for the USDA Additional Income to Primary Income (field ID USDA.X168) has also been updated:

-

For loans using the 2009 URLA forms, the URLA 2009 monthly income fields (field IDs 146, 149, and 152) are used to calculate the total.

-

For loans using the 2020 URLA forms, the URLA 2020 monthly income fields (field IDs URLAROIS0122, URLAROIS0222, URLAROIS0322, etc.) are used to calculate the total.

CBIZ-38847

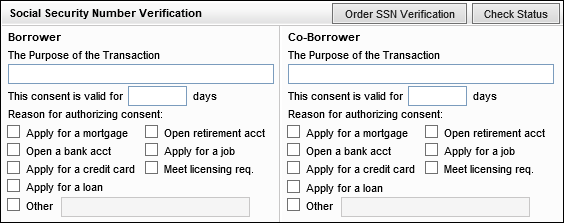

To enable Encompass user to capture an accurate reason for Social Security Number Verification, new fields have been added and updates have been made to the user interface in the Social Security Number Verification section of the Borrower Summary-Origination and Borrower Summary-Processing input forms. The changes shown in the image below have been implemented based on the guidance provided in the Social Security Administration’s revised Form SSA-89 (12-2020) (Authorization for the Social Security Administration (SSA) To Release Social Security Number (SSN) Verification). Use of the revised Form SSA-89 (12-2020) is required beginning on October 1, 2021.

New Fields

The following new fields have been added for the borrower and co-borrower to capture the reason for authorizing consent:

-

Open retirement account (field IDs 4715 and 4716)

-

Apply for a loan (field IDs 4717 and 4718)

-

Other description fields (field IDs 4719 and 4720) – Enter a description in these fields when the Other checkbox is selected.

New Field Labels

The following table lists fields that have been renamed on the Borrower Summary-Origination and Borrower Summary-Processing input forms.

|

Field IDs |

Old Label | New Label |

|---|---|---|

|

3860 & 3866 |

Mortgage Service |

Apply for a mortgage |

|

3862 & 3868 |

Background Check | Apply for a job |

|

3864 & 3870 |

Credit Check | Apply for a credit card |

|

3861 & 3867 |

Banking Service | Open a bank acct |

|

3863 & 3869 |

License Requirement | Meet licensing req. |

The Social Security Administration has not changed the signature policy for users of the Consent Based Social Security Number Verification (CBSV) system. Form SSA-89 (12-2020) still requires a wet signature.

CBIZ-37063

To enable lenders to submit unrounded income or loss amounts to automated underwriting systems (AUS), the Net Rental Income/Loss Amount (field ID FM0032) has been updated to display the amount in two-decimal format (dollars and cents). The calculation for the field has been updated to remove the rounding to the nearest integer and to add rounding to a two-decimal value.

Migration

When upgrading to Encompass 21.3, the new rounding calculation will not be applied to loans created prior to the upgrade. However, values in field FM0032 will be rounded to a two decimal value in these existing loan when a user saves changes to the loan or the Encompass system performs an automatic loan save when the following actions are taken in the loan: a service is ordered, a form is printed, or when certain input forms or tools are opened.

CBIZ-38889

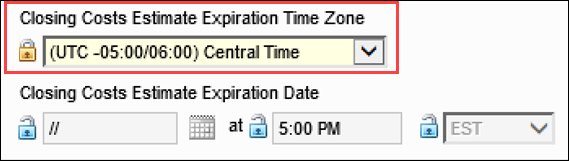

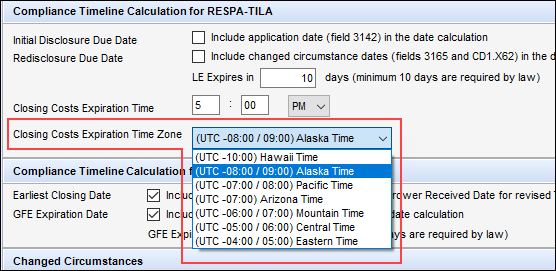

A new Closing Costs Estimate Expiration Time Zone dropdown list (field ID LE1.XG9) has been added to Loan Details section of the Loan Estimate Page 1 input form just below the rate lock information fields.

The Disclosure Tracking Timezone field on the Disclosure Tracking Tool is now populated based on the value in field LE1.XG9. In previous Encompass versions, this field was populated based on the timezone field on the Loan Estimate (LE) Page 1 (field ID LE1.X9).

The new Closing Costs Estimate Expiration Time Zone field (field ID LE1.XG9) is populated by default based on the option configures in the Compliance Timeline Calculation for RESPA-TILA section in the Disclosure Tracking Settings (Encompass > Settings > Loan Setup > Disclosure Tracking Settings).

Users can click the Lock icon next to the field to select one of the following United States time zones. User are not allowed to set the field to a blank value.

-

(UTC -10:00) Hawaii Time

-

(UTC -08:00/09:00) Alaska Time

-

(UTC -07:00/08:00) Pacific Time

-

(UTC -07:00) Arizona Time

-

(UTC -06:00/07:00) Mountain Time

-

(UTC -05:00/06:00) Central Time

-

(UTC -04:00/05:00) Eastern Time

Each time zone displays the difference between the selected time zone and the UTC (Universal Time Co-ordinated) time, formerly known as Greenwich Mean Time.

The Lock icon is disabled after the first disclosure record is created for a loan, and the field can no longer be edited.

The Closing Costs Estimate Expiration Time Zone is included in the snapshot for a Disclosure Tracking record.

The Closing Costs Estimate Expiration Time Zone does not change in a loan file if the Disclosure Tracking Settings option for the filed is updated after the loan is created. Loans created after the value is updated in the setting will use the updated value.

For loans that have values entered in the previously existing time zone field (field ID LE1.X9) next to the Loan Estimate Expiration Date (field ID LE1.X28), Encompass will use the values entered in these fields to populate the Closing Costs Estimate Expiration Time Zone. Field LE1.X9 is lockable and editable by users at any time, even after a disclosure tracking log is created.

Migration

Loans created prior to upgrading to Encompass 21.3 will continue to use the time zone field (field ID LE1.X9) next to the Loan Estimate Expiration Date (field ID LE1.X28).

CBIZ-39011, CBIZ-39139, CBIZ-39141, CBIZ-39147, CBIZ-39152, NICE-36069, NICE-36071

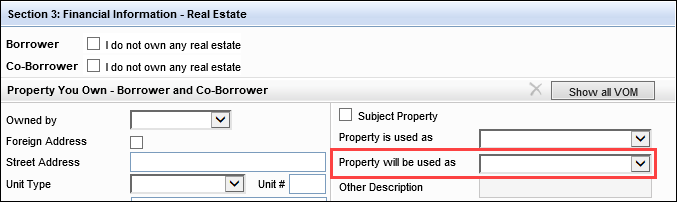

To streamline the entry of property information, the following fields have been added to Section 3: Financial Information – Real Estate on the 1003 URLA Part 3 input form.

-

Subject Property checkbox (field ID FM0028)

-

Property is Used as dropdown list (field ID FM0041)

-

Property will be used as dropdown list (field ID FM0055)

-

Other Description (field ID FM0056)

Previously users would have to open the Verification of Mortgage form to enter or edit information in these fields.

CBIZ-38226

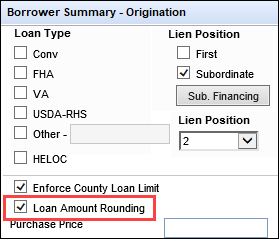

To support the purchase and sale of USDA loans with cents included in the loan amount, Encompass now provides a new Loan Amount Rounding checkbox (field ID 4745) method that enables user to override the company-wide loan amount rounding option set in the Admin Tools. This field is available on the Borrower Summary-Origination input form. The new checkbox is also available in data templates.

By default, the Loan Amount Rounding checkbox matches the selection in the Loan Amount Rounding policy setting in the Admin Tools. Use the checkbox to change the rounding calculation for the loan in which you are working if the loan needs to be processed. For example, if your company default is to Use Loan Amount Rounding, the checkbox will reflect Loan Amount Rounding; if, on the loan level, the loan should be processed with cents in the loan amount, the checkbox can be cleared to turn off the rounding for that loan.

You can also create data templates for loan types that require a rounding policy different from the company-wide policy. When you change the checkbox option, Encompass adjusts the rounding (on or off based on the status of the checkbox) in calculations that use the loan rounding setting and in calculations for the financed amounts for the following fees:

-

Update calculations that use the current loan rounding settings to ignore the loan amount rounding.

-

Update the calculation of the financed amount for the following fees:

-

Line 819 - USDA Guarantee

-

Line 902 - Financed MIP

-

Line 905 - VA Funding Fee

-

The Loan Amount Rounding checkbox does not display on the form when FHA is selected for the loan type (field ID 1172).

CBIZ-35090, CBIZ-38078

(Updated on 10/13/2021)

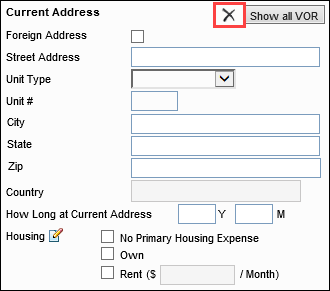

Updates have been made to the new URLA input forms and the Verification input forms to address an issue that resulted in blank verification records being created when a user entered information in some sections of the URLA forms and then cleared the contents from the fields. Encompass assumed that data had been entered in the section and would create a verification record that contained blank fields.

URLA Input Forms

To help users avoid creating blank verification records, Delete icons  have been added to sections of the new URLA input forms that are tied to verification records.

have been added to sections of the new URLA input forms that are tied to verification records.

The icons use the following logic:

-

If you add information to a section, the Delete icon becomes active.

-

The icon stays active even after you clear contents from the section, indicating that a verification form is being created.

-

Click the Delete icon if you do not want to create a verification record.

-

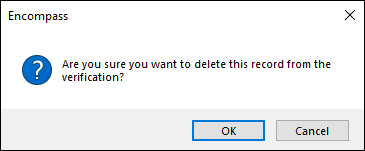

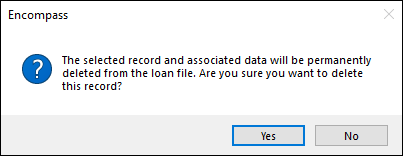

The follow confirmation message displays when you click the Delete icon.

-

After you delete the verification record, the Delete icon becomes inactive.

Delete icons display on the borrower and co-borrower sides of the following sections of the new URLA forms:

-

1003 URLA Part 1

-

Current Address

-

Former Address

-

Mailing Address

-

If you delete the Borrower Current Address and the Same as Current checkbox is selected for the Borrower Mailing Address, both entries clear and both VORs are deleted.

-

If you delete the Co-Borrower Current Address and the Same as Current checkbox is selected for the Co-Borrower Mailing Address, both entries clear and both VORs are deleted.

-

-

-

1003 URLA Part 2

-

1b. Current/Self Employment and Income

-

1c. Additional/Self Employment and Income

-

1d. Previous Employment and Income

-

Delete icons display next to row entries in the following locations:

-

1003 URLA Part 2

-

1e. Income from Other Sources

-

-

1003 URLA Part 3

-

2a. Assets - Bank Accounts, Retirement and Other Accounts

-

2b. Other Assets You Have

-

2c. Liabilities

-

2d. Other Liabilities and Expenses

-

Delete icons display at the top of the following sections on the 1003 URLA Part 3: Section 3:

-

Property You Own

-

Additional Property

-

Additional Property

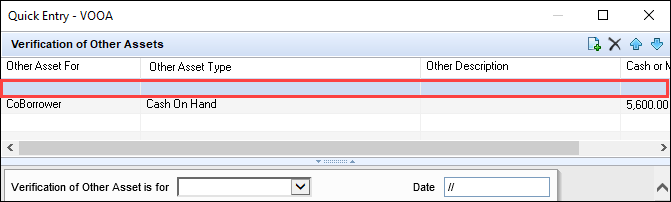

In the verification input forms, the list of records displays blank values for a verification record that has no data entered.

To remove the record, click the Delete icon on the upper-right of the table, and then click OK when the confirmation message displays.

CBIZ-38233

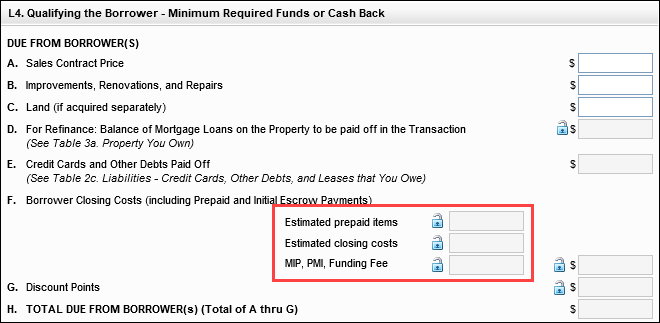

The following three closing costs fields are now available on the 1003 URLA - Lender input form below line F in section L4. Qualifying the Borrower.

-

Estimated prepaid items (field ID 138)

-

Estimated closing costs (field ID 137)

-

MIP, PMI, Funding Fee (field ID 969)

All three fields are populated based on information entered in other fields. Click the Lock icon next to a field to edit the amount.

CBIZ-38604

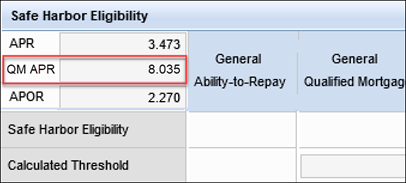

The ATR QM Eligibility tab on the ATR/QM Management input form has been updated to display the QM APR (field ID QM.X381) in the area directly below the header for the Safe Harbor Eligibility section.

CBIZ-39103

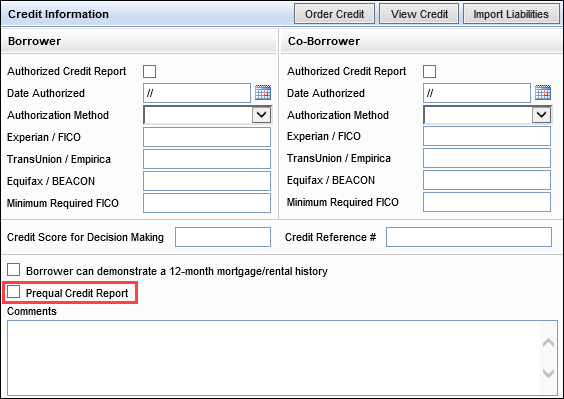

A new Prequal Credit Report checkbox (field ID 4750) has been added to the Credit Information section of the Borrower Summary – Origination and Borrower Summary – Processing input forms to enable lenders to indicate whether the credit report for a loan is a prequal credit report. This credit report type is not a full credit report and is not usable for purposes of fully underwriting a loan. The checkbox applies to the borrower pair currently selected for the loan.

The field is not set by default, and it will not automatically be changed by Encompass if a full credit report is ordered after the prequal credit report. Encompass users can select or clear the checkbox manually, or the field can be managed through automation.

This functionality is currently not supported in Encompass TPO Connect but support will be added in a future release.

CBIZ-40896

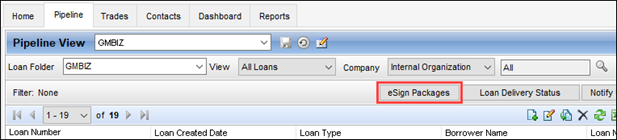

Electronic Document Management (EDM)

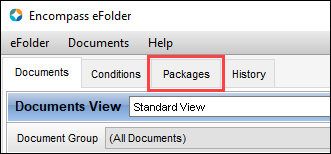

A new Packages tab has been added to the Encompass eFolder. The tab lists all the packages that have been sent for a loan originated on an Encompass Consumer Connect website, regardless of the package status, and provides a history of the packages across the life of the loan. If a loan was not originated on an Encompass Consumer Connect website, the Packages tab does not display.

DOCP-17136, DOCP-27447

(Updated on 10/4/2021)

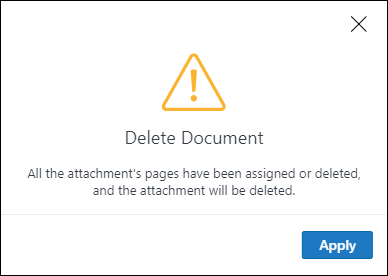

When using the Cloud Viewer (the version of the document viewer designed for viewing files stored on the cloud) a file attachment is now deleted when all the pages within the file attachment are deleted or moved to another file attachment. The following confirmation message displays when all the pages are deleted.

Previously, the delete and move functionality used the following logic:

-

When at least one page remained in the original file attachment, the selected pages would be deleted or moved.

-

When a user attempted to delete all the pages in a file attachment, the pages would not be deleted, and the file attachment would not be deleted.

-

When all the pages in a file attachment were moved to another file, the pages would be moved to the new file, but they would also remain in the original file attachment, and the original file attachment would not be deleted.

DOCP-22446, DOCP-25268

Encompass Settings

The following Windows operating system and productivity suite are now supported for use with Encompass:

-

Windows 10, version 21H1

-

Office 365, version 2106

For more information about Encompass system requirements and compatibility with third-party applications, refer to the System Requirements and Compatibility Matrix.

NICE-36607, NICE-37130

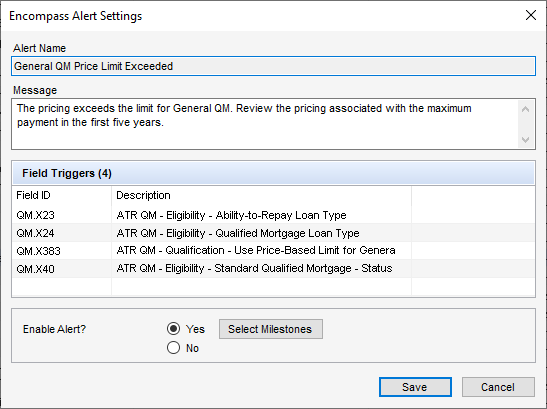

A new General QM Price Limit Exceeded alert is now provided in Encompass Settings. This alert is set up by default to trigger when the loan pricing exceeds the limit for General Qualified Mortgage (QM) and the Use Price-Based General QM option (field ID QM.X383) is used. (Review the screen below for all field triggers for this alert.) The alerts display on the Pipeline and on the Alerts & Messages tab in the Log.

The Use Price-Based General QM option is a loan-level editable checkbox that can be used to override the Use Price Based General QM Definition Date policy setting in the Encompass Admin Tools, which determines when the old DTI-based test is disabled and the new price-based QM APOR test is enabled. The checkbox enables Encompass users to clear the checkbox to use the old DTI-based test during the optional period after the date set in the Admin Tools, but prior to the mandatory date (10/1/2022) for the new price-based rule.

In addition to this new alert, the General QM DTI Limit Exceeded alert setting has been updated so that it will be triggered (when applicable) only for loans in which the Use Price-Based General QM option (field ID QM.X383) is not used. Previously, this alert would be triggered incorrectly when the DTI ratio exceeded the limit for General QM and the Use Price-Based General QM option was used.

With these two alerts now available, the correct General QM alert will now be triggered for loans based on the Use Price-Based General QM option in the ATR/QM Management tool.

NICE-36089, NICE-36100

Miscellaneous Updates

For both purchase and refinance loans, updates have been made to the loan-to-value (LTV), combined-loan-to-value (CLTV), and high-combined-loan-to-value (HCLTV) ratios to use the Estimated Appraisal Value (field ID 1821) if the Appraisal Value (field ID 356) is blank.

This addresses an issue that occurred when the LTV calculations were not using the Estimate Appraised Value when it was lower than the Purchase Price (field ID 136). This was occurring in housing markets experiencing values moving upward or down rapidly.

Calculations for 203K loans have not changed. MI calculations and payment schedules for purchase-only refinances are already working correctly and are using the estimated appraisal value when appropriate. These calculation updates do not apply to construction loans, which use different fields.

CBIZ-38415

The Encompass ZIP Code database has been updated with the latest available ZIP Code data.

CBIZ-38457

| Next Section: Fixed Issues |

|

|

|

Previous Section: Introduction |