Process a Piggyback Loan

A piggyback loan is a loan completed at the same time as the primary (or 1st) loan on a property. Piggyback loans are also referred to as concurrent or 80/10/10 loans. Use the Duplicate Loan feature from the Pipeline to save data entry time when starting a piggyback loan. Only the loan forms are duplicated, with changes to loan terms and costs as appropriate.

The following features of piggyback loans are supported:

-

Concurrent loans for a borrower from the same or different lender.

-

Ability to duplicate the information and verifications gathered from the first loan to second loan.

-

Ability to track the progress and milestones of each loan separately.

To Create a Piggyback Loan

![]() Start the 1st mortgage and gather information

Start the 1st mortgage and gather information

Originating a HELOC as a Piggyback for a Down Payment

Use this workflow when originating a HELOC loan as a piggyback loan to cover the down payment for a first lien loan that is being created at the same time. In this example, the borrower is obtaining a piggyback HELOC for the down payment. This HELOC will be fully drawn at closing:

-

Purchase Price: $100,000

-

Loan Amount: $80,000

-

Down Payment Amount: $20,000

To Originate a HELOC as a Piggyback for a Down Payment:

-

Create a loan for the first lien loan with the loan and down payment amounts entered.

-

Click the Sub. Financing button on input forms such as the Borrower Summary –Origination, RegZ-LE, or RegZ-TIL to open the Subordinate Mortgage Loan Amounts pop-up window and then click the Add New HELOC button. This can also be accessed via the Piggyback Loans tool.

-

Select Yes when the pop-up messages asks if you want to synchronize data between two loans.

-

This is required to set up the loan data in the second loan file based on what you have entered in your primary loan file.

-

-

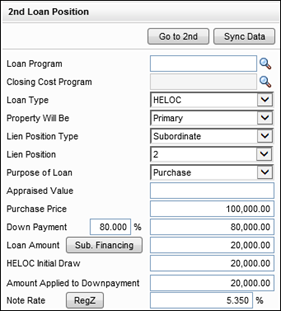

The Piggyback Loans tool opens with the second lien HELOC loan in the 2nd Loan Position column on the right.

-

Close the Subordinate Mortgage Loan Amounts pop-up window.

-

Select a Loan Program to set up the HELOC loan file with your credit policy.

-

The following values are populated by default in the 2nd Loan Position column for the new HELOC loan based on your primary loan scenario. These can be modified as needed per your loan scenario and credit policy:

-

Purchase Price: $100,000 (from the original loan file)

-

Down Payment: $80,000 (the loan amount from original loan file)

-

Loan Amount: $20,000 (the purchase price minus the loan amount)

Adjust the loan amount based on the proposed loan scenario. Example: If the loan is targeted for 95% CLTV, adjust the loan amount to $15,000.

-

-

In the 2nd Loan Position column, enter the amounts for the HELOC Initial Draw (field ID 1888) and Amount Applied to Down Payment (field ID 4493). These amounts are copied to the Subordinate financing (field ID 140) line on the Details of Transaction in the primary loan file and be leveraged in cash to close calculations. In this example, the HELOC will be fully drawn at closing, so enter $20,000.

-

Enter the expected Note Rate (field ID 3).

-

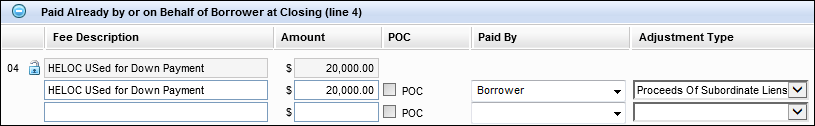

Document the proceeds in the first lien loan file in one of the following locations :

-

For standard disclosures, click the Edit icon for Adjustments and Other Credits in the Calculating Cash to Close section on the Closing Disclosure Page 3, and then enter the down payment amount in Section L, line 04, selecting Borrower from the Paid By list and Proceeds of Subordinate Lien from the Adjustment Type list.

-

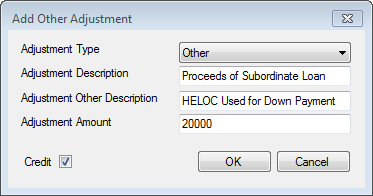

For alternate disclosures, click the Payoffs & Payments button in the Calculating Cash to Close section on the Loan Estimate Page 2. Click the Add icon, select Other as the Adjustment Type and then complete the description and amount fields.

-

For HELOC loans, the Loan Estimate and Closing Disclosure input forms are used for data input only. HELOC loans are not subject to the Consumer Financial Protection Bureau’s (CFPB) Know Before You Owe mortgage initiative. Attempting to generate a Loan Estimate or Closing Disclosure output form for a HELOC loan will result in incorrect forms.

To Synchronize Loans Using the Piggyback Loans Tool:

-

Open the loan containing the data you want to synchronize.

-

Click the Tools tab on the lower-left panel, and then click Piggyback Loans.

-

Click the Sync Data button.

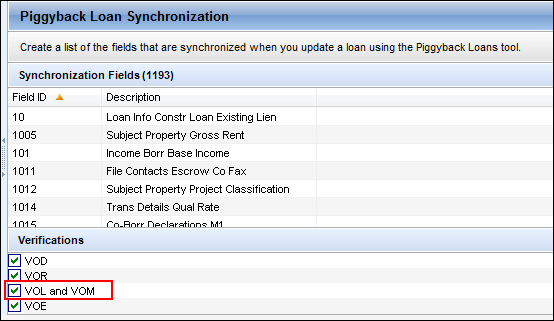

To maintain consistency for piggyback transactions, administrators should review their Piggyback Loan Synchronization configuration in the Encompass Settings (Encompass > Settings > Loan Setup > Piggyback Loan Synchronization) to ensure VOL and VOM are included when piggyback loan data is synchronized.

See Also:

Piggyback Loan Synchronization

Duplicate a Loan for a Piggyback Loan