Features

What is Encompass Connector for Salesforce

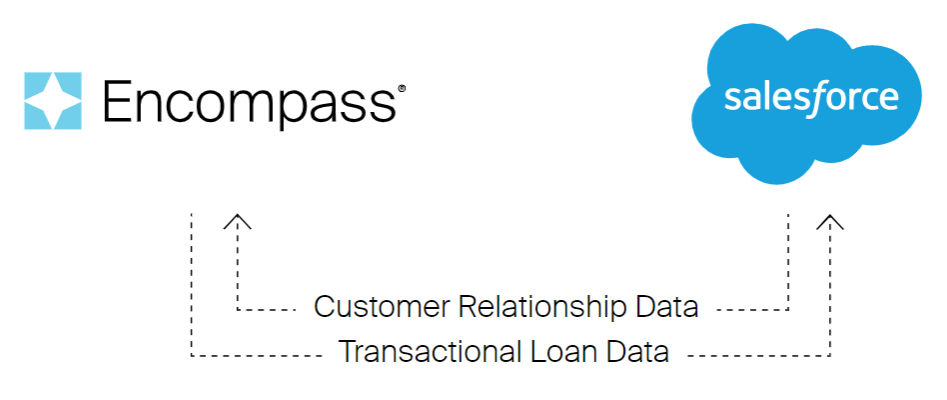

The Encompass Connector to Salesforce (Encompass Connector) brings the borrower and lender experience together with real-time data transfer between Salesforce and Encompass.

Through our strategic partnership with Salesforce, ICE Mortgage Technology® created a secure bi-directional connection between Salesforce and Encompass platforms. The Encompass Connector allows critical loan data to be synchronized in real time, empowering you, the lender, to process loans faster with greater visibility into borrower data and loan statuses.

New in the Encompass Connector App

Starting in 2022, a new standard Encompass object model that provides default data mapping can be used by default with your Salesforce organization. Previously, the FSC (Financial Service Cloud) Mortgage Data Model or creating a data model from scratch, were the only options provided when configuring your Salesforce organization. The new Encompass object model also provides a new Loan Application object that includes employment and residence data objects, along with custom field data mapping.

-

If you are already using a Financial Services Cloud or custom object model, you can switch to the Encompass object model. If considering moving to the new model, it is recommended that you contact your Encompass relationship manager to discuss a Professional Services engagement to assist in assessing migration considerations, tips and tricks, and pre-migration checklists.

-

Existing users utilizing the Financial Services Cloud or custom object model can continue to use those models.

-

New or existing users who are setting up the Encompass object model for the first time should use the steps provided in this guide.

Encompass Connector is available for the Banker Edition only.

Accessing the Latest Encompass Loan Information in Salesforce

The Encompass Connector's secure connection between Encompass and Salesforce helps your team work more efficiently with the capabilities to:

- Access a single loan system of record for complete borrower information

- Check loan statuses and receive updates in Salesforce

- Leverage a 360-degree view to drive insights across all lines of business

Benefiting from the Salesforce and ICE Mortgage Technology Partnership

Beyond the streamlined experience for your users, our strategic relationship with Salesforce eliminates the need to manage or support software updates across both platforms. With critical mortgage data available in Salesforce, the Connector will ultimately enable cross-selling opportunities with other lines of business and help improve your targeted marketing.

Stay tuned for more information about how the Connector could expand beyond the retail lender channel and support the wholesale and correspondent lending channels as well.

Included Features

- Easily create mortgage loans directly from Salesforce

- Create Salesforce records directly from the Encompass Pipeline

- Instantly synchronize data between the two platforms in real time or batches

- Seamlessly map loan fields and data from Encompass to Salesforce

< Go to Previous Section: Introduction Go to Next Section: Product Specifications >