Feature Updates and Enhancements

Calculation Updates

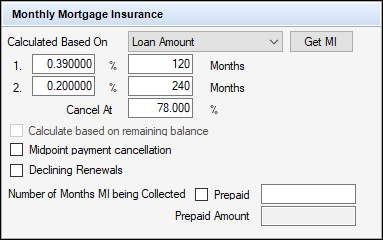

In the Encompass Compliance Service (ECS) 24.2 Major Release, Encompass introduced functionality to correctly calculate Mortgage Insurance (MI) during both the construction and permanent phases, providing comprehensive MI coverage for the entire loan life cycle. However, the initial implementation did not correctly apply the MI premiums during the construction phase into the payment streams.

In the previous setup, when the Purpose of Loan (field ID 19) was set to Construction - Perm, the system was supposed to map enumerations from Escrow 1st Payment Date Basis (field ID HUD69) and apply the MI payment from the construction phase to the beginning of and part of the first MI period. Instead, the MI payments were incorrectly added to the end of the construction phase, extending the MI period beyond its intended duration, resulting in the below FAIL status message.

Federal - Closing Disclosure Total of Payments Disclosure Tolerance

Total of Payments Cannot Be Understated by More Than $100(1001121)

The disclosed Total of Payments ($_) is understated by more than $100 when compared to the actual Total of Payments ($_). The difference is ($_). Regulation Z considers the disclosed Total of Payments inaccurate if it understated by more than $100. (12 CFR 1026.38(o)(1))

Construction Phase: 12 months

- MI Period 1: 120 months

- MI Period 2: 240 months

Incorrect Payment Stream: MI Period 1 would extend to 132 months instead of the intended 120 months.

This issue has been resolved in this release. Now, the system accurately reads MI data from the MI data container in Encompass and applies it starting with the first payment of the construction phase when Escrow 1st Payment Date Basis (field ID HUD69) is set to 1st Payment Date. The corrected calculation aligns the Total Payments values and ensures that loans no longer trigger the Fail status message.

CE-53505

HMDA Edit Updates

In this release, certain validation rules have been updated in alignment with the 2025 Filing Instructions Guide (FIG), a compendium of resources to help you file annual HMDA data collected in 2025 with the Consumer Financial Protection Bureau (CFPB) in 2026.

The revised edit rules will only fire when the relevant Edit Conditions are met and when the HMDA2018 review runs for loans with an Action Taken Date of January 1, 2025, or later. Any previous version(s) of these Edits will continue to run during their appropriate time frame(s).

These updates are designed to support accurate reporting in compliance with HMDA regulations, assisting you in filing annual HMDA data collected in 2025 with the CFPB in 2026.

The updates listed in the table below reflect the most recent version of the 2025 HMDA FIG (published September 2024) aligning

| Type of Data Field | Edit Number | Data Point | Modification |

|---|---|---|---|

| Loan/Application Register | V695 | Mortgage Loan Originator NMLSR Identifier | Updated edit to include NMLSR identifier must be four to twelve digits. |

| Loan/Application Register | Q621 | NMLSR ID | Updated edit to note NMLSR ID must be four to twelve digits. |

| Loan/Application Register | Q651 | Combined Loan to Value Ratio | Updated edit to include the CLTV should be less than 1.5, be reported as a percentage and its general range should be less than 150. |

| Loan/Application Register | Q616 | Discount Points; Total Loan Costs; Total Points and Fees | Updated edit to note discount points should not be higher than 15% of the loan amount and it must be reported in dollars. |

For more detailed information on the edits that financial institutions must run on HMDA data before filing with the Bureau, refer to the respective Filing Instruction Guides (FIG).

CE-53513, CE-53473, CE-53479, CE-53467