New Features, Forms & Enhancements

Here is a closer look at the updates introduced in this

Feature Enhancements

Explore improvements and refinements to existing features. These updates, while representative, are aimed at optimizing performance, increasing efficiency, and adding more value to your workflows.

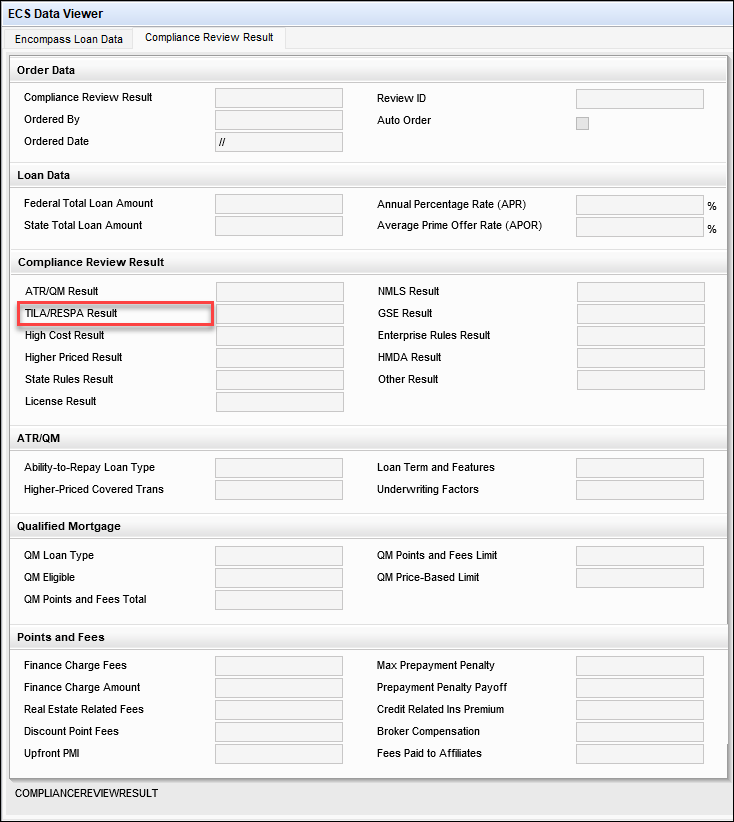

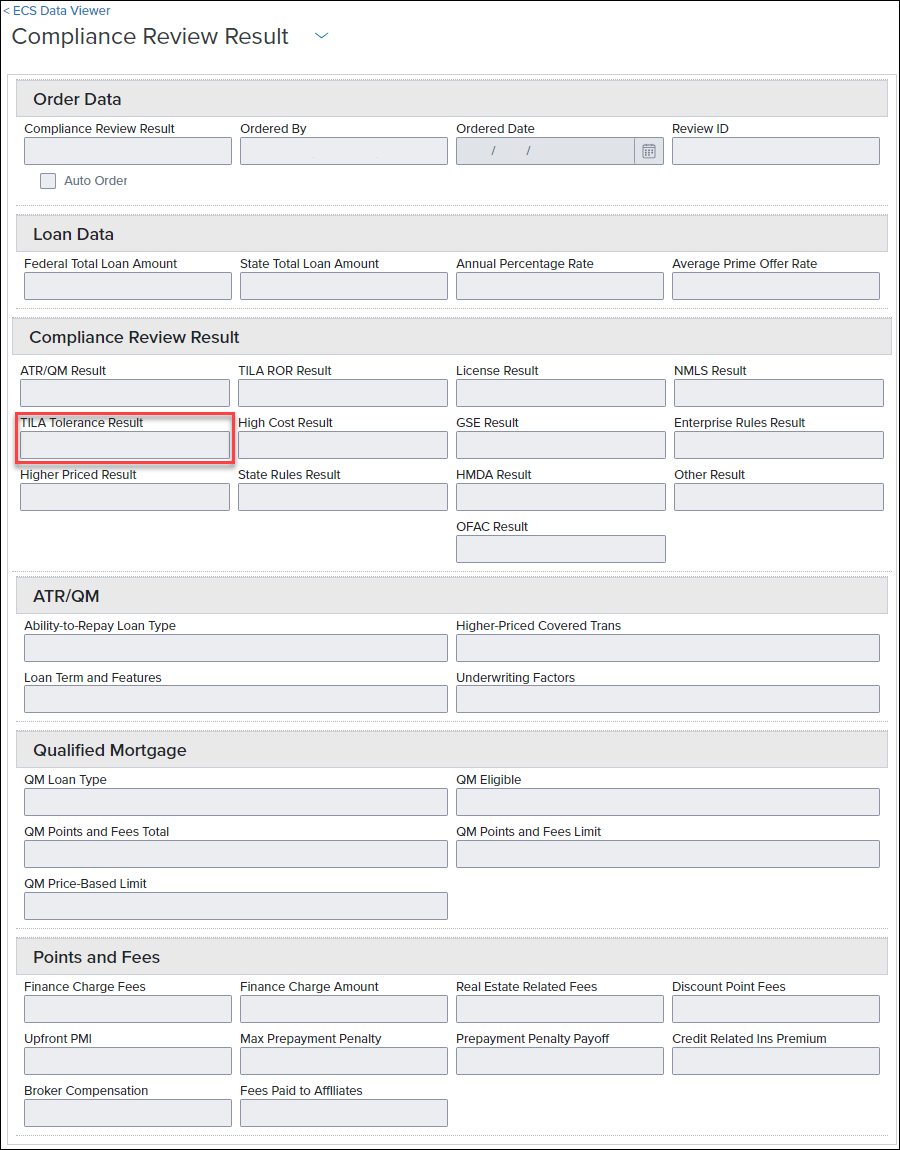

In this release, the Compliance Review Result tab in the Encompass Compliance Service (ECS) Data Viewer has been updated to enhance the clarity and accuracy of compliance result reporting in Encompass (desktop and web versions).

Desktop version

Web version

Key Updates:

-

TILA ROR Result (field ID COMPLIANCEREVIEW.X13) has been removed from the UI, as this review is no longer supported by Mavent.

-

OFAC Result (field ID COMPLIANCEREVIEW.X10) has been removed from the UI, as this review is no longer supported by Mavent.

-

TILA Tolerance Result (field ID COMPLIANCEREVIEW.X14) has been relabeled to TILA/RESPA Result in the ECS Data Viewer to align with updated reporting standards.

These updates are designed to help enhance the clarity and accuracy of compliance review results based on user data input.

ENCW-107930

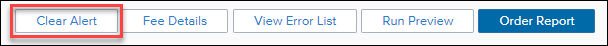

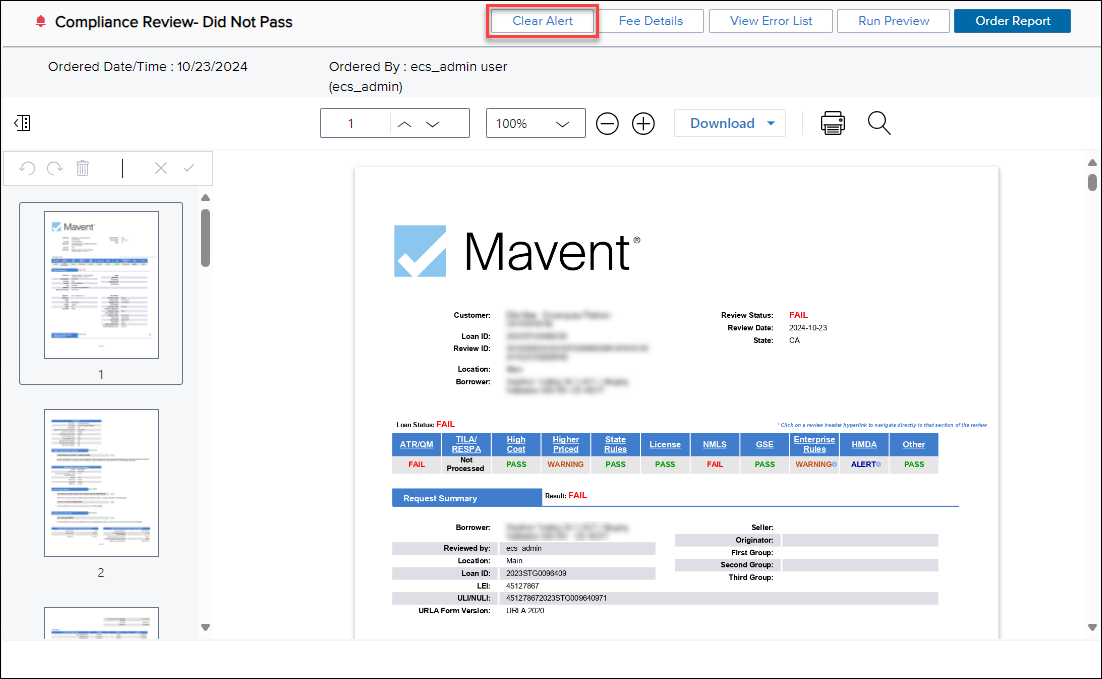

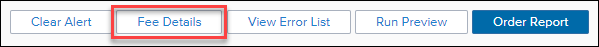

In this release, a new Clear Alert button has been introduced to the Compliance Review Tool within the web version of Encompass. This enhancement is designed to give users the ability to remove specific alerts from the Alerts & Messages section.

Key Features:

-

Clear Alerts: Users with the appropriate access rights can now use the Clear Alert button to remove the "Compliance Review – Did Not Pass" and "Compliance Review – Had Warnings/Alerts" messages from the Alerts & Messages section.

-

Button Placement: The new Clear Alert button is located alongside the existing buttons, such as Fee Details, View Error List, Run Preview, and Order Report.

-

Access Control: The Clear Alert button is visible only to users with the necessary permissions. If a user does not have the required access rights, the button will not be displayed.

Adjust permissions for the Clear Alert feature, enabling selected users to clear compliance alerts on loan reports as needed.

This update is aimed at enhancing workflow efficiency and providing users more control over managing alerts related to compliance reviews.

CE-51367, ENCW-104184

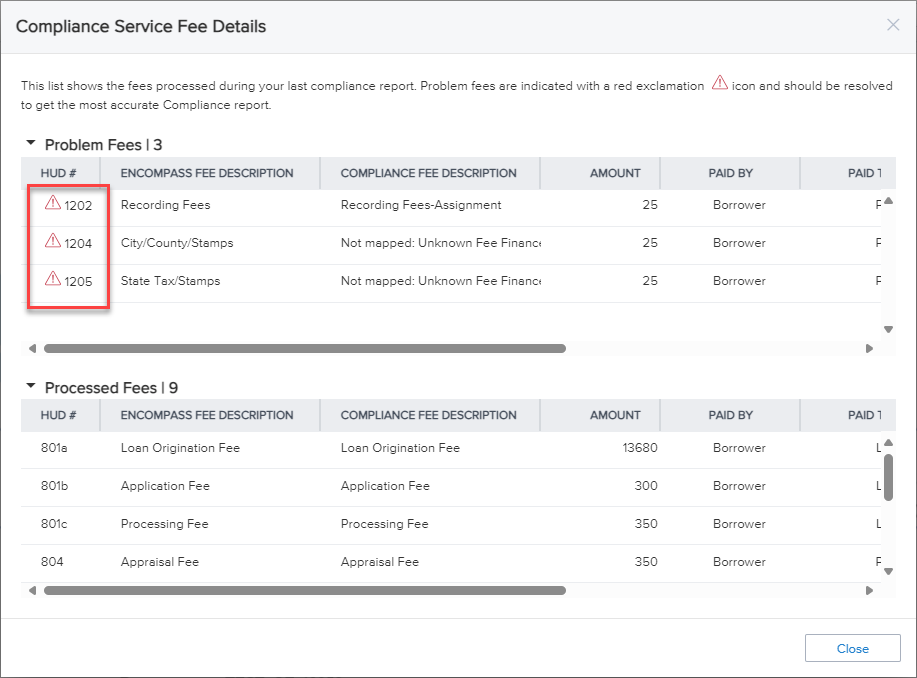

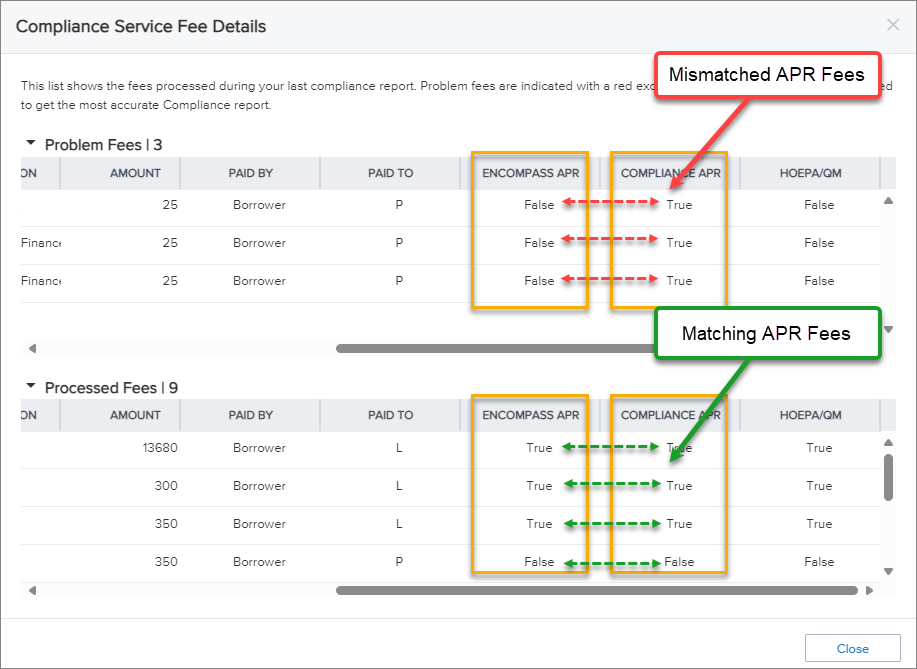

In the web version of Encompass, you can now view a distinct list of “problem fees” at the top of the Compliance Service Fee Details window, positioned above the already available "processed fees" list, whenever discrepancies occur between the Encompass APR and Compliance APR. These problem fees are marked with a red exclamation icon, helping you quickly identify any mismatched APR fees.

In this update:

-

Window Access: The Compliance Service Fee Details window can be accessed via the Fee Details button, located between the Clear Alert (if enabled) and the View Error List buttons on the tool panel in the top right of the Compliance Review tool.

-

Details and Messaging: The message at the top of the window reads:

“This list shows the fees processed during your last compliance report. Problem fees are indicated with a red exclamation icon and should be resolved to get the most accurate Compliance report.”

-

Problem Fees Section: Fees that do not match between Encompass APR and Compliance APR now display in a dedicated section at the top of the Fee Details window, positioned above the processed fees list, to facilitate locating and addressing discrepancies.

This enhancement is designed to assist users in efficiently identifying and correcting mismatched APR fees.

CE-52277

In this release, the validation rules for property location reporting have been updated in alignment with the 2024 HMDA Filing Instruction Guide (FIG). This update includes:

-

New Property Location Validation: The validation now prevents filers from inputting invalid street addresses.

The updated validation logic is as follows:

HMDA 2004 Review

Review Error (Q660) - Property Location

1) The Street Address reported is longer than 100 characters, which may indicate that more than one address was reported.

2) The reported Street Address includes the values: “;”, “&”, or the word “and“, which may indicate that more than one address was reported.

3) The reported Street Address includes the values: ?, !, *, %, ^, @, [, ], {, } ,<,>,_, +, = or the word “tbd”, which may indicate that an invalid address was reported.

4) The reported Street Address contains either only numbers or only letters, which may indicate that an invalid Street Address was reported. Street Address should generally be alphanumeric, unless the reported value is "Exempt" or "NA".

These updates are designed to support accurate reporting of property location data in compliance with HMDA regulations, helping you file annual HMDA data collected in 2024 with the Consumer Financial Protection Bureau (Bureau) in 2025.

For more detailed information on the changes to credit score reporting and validation rules, refer to the respective Filing Instruction Guides (FIG).

CE-52271

The validation rules for credit score reporting, specific to Edit ID V660 and V720, have been updated in alignment with the 2024 HMDA Filing Instruction Guide (FIG). This update includes:

-

New Credit Scoring Models: The edit now includes credit scoring models 12, 13, 14, and 15.

The updated validation logic is as follows:

HMDA 2004 Review

Review Error (V660) - Credit Score(50001356)

An invalid Credit Score data field was reported. Please review the information below and update your file accordingly.

1) Credit Score of Applicant or Borrower must be a number, and cannot be left blank.

2) Applicant or Borrower, Name and Version of Credit Scoring Model must equal 1111, 1, 2, 3, 4, 5, 6, 7, 8, 9, 11, 12, 13, 14 or 15.

Review Error (V720) - Credit Score(50001316)

An invalid Credit Score was reported. Please review the information below and update your file accordingly:

1) If Applicant or Borrower, Name and Version of Credit Scoring Model is 1, 2, 3, 4, 5, 6, 11, or 12 Credit Score of Applicant or Borrower should be 280 or above.

2) If Co-Applicant or Co-Borrower, Name and Version of Credit Scoring Model is 1, 2, 3, 4, 5, 6, or 11 or 12, Credit Score of Co-Applicant or Co-Borrower should be 280 or above.

3) If Applicant or Borrower, Name and Version of Credit Scoring Model is 13, 14, or 15, Credit Score of Applicant or Borrower must be 300 or above.

4) If Co-Applicant or Co-Borrower, Name and Version of Credit Scoring Model is 13, 14 or 15 Credit Score of Co-Applicant or Co-Borrower must be 300 or above

-

Clarification on Credit Score Thresholds: The thresholds specific to Edit ID V720 for models 1 through 12 remain at 280 or above, while models 13 through 15 require a minimum credit score of 300.

These updates are designed to support accurate reporting of property location data in compliance with HMDA regulations, helping you file annual HMDA data collected in 2024 with the Consumer Financial Protection Bureau (Bureau) in 2025.

For more detailed information on the changes to credit score reporting and validation rules, refer to the respective Filing Instruction Guides (FIG).

CE-51514