Rules in July 2024 Release

Enterprise

Discontinued Rule Header Effective 08/10/2024

ER - Federal Real Estate Commission Paid By Borrower Not Allowed (VA)

Real Commission cannot be paid by Borrower (1001190)

This VA loan contains a Real Estate Commission in the amount of ($_) designated as paid by the borrower. Under VA Guidelines, fees or commissions charged by a real estate agent/broker in connection with a VA loan may not be charged to or paid by the borrower. While use of “buyer” brokers is not precluded, a borrower may not be charged a brokerage fee/commission. Since information on property available for purchase and financing options is widely available to the public from a variety of sources, VA does not believe that preventing the veteran from paying buyer-broker fees will harm the veteran. (VA Lender Handbook Chapter 8)

New Rule Headers Effective 08/10/2024

ER - Federal Real Estate Commission Paid By Borrower Not Allowed (VA)

Temporary Local Variance for Buyer-Real Estate Agent/Broker Charges(1001190)

This VA loan contains a Real Estate Commission in the amount of ($_) designated as paid by the borrower. VA authorized a temporary local variance that allows Veterans to pay reasonable and customary amounts for buyer-broker commissions if the home the Veteran is purchasing is an area where: (1) listing brokers are prohibited from setting buyer-broker compensation through multiple listing postings; or (2) buyer-broker compensation cannot be established by or flow through the listing broker. The system does not receive sufficient information to determine whether either of these conditions are met. The lender must confirm with VA or through other methods to determine whether the borrower may pay the real estate commission in this transaction. (VA Circular 26-24-14; VA Lender Handbook Chapter 8)

Real Estate Agent/Broker Commission Cannot be Financed(1001190)

This VA loan contains a Real Estate Commission of ($_) designated as financed by the borrower. Under VA Guidelines, fees or commissions charged by a real estate agent/broker in connection with a VA loan may not be financed by the borrower. (VA Circular 26-24-14; VA Lender Handbook Chapter 8)

CER-23623

Federal

In this release,

Federal - Corrected Closing Disclosure Initial, Six Prior, Last (APR)

Prior CD6 Received at least 3 Days before Closing (Prior CD6 compared to Actual APR)(1001456)

Prior CD6 sent on (_) was received at least 3 business days before closing. The Prior CD6 (_%) APR is inaccurate compared to the (_%) actual APR. The Last CD sent on (_) and Prior CD1 through Prior CD5 were not received at least 3 business days before closing. If the APR is inaccurate, a consumer must receive a corrected CD no later than (_), which is 3 business days before the (_) Consummation Date. If a corrected CD is not provided in person, a consumer is deemed to have received it 3 business days after it is mailed or delivered, unless there is evidence of earlier receipt. The APR on the CD received at closing must be accurate when compared to the APR on the CD received at least 3 business days before closing and the actual APR. (12 CFR 1026.19(f)(2)(ii)(A); OSC 19(f)(2)(ii)-1)

Prior CD6 Received at least 3 Days before Closing (Prior CD6 compared to Last CD APR)(1001456)

Prior CD6 sent on (_) was received at least 3 business days before closing. The Last CD (_%) is inaccurate compared to the Prior CD6 (_%) APR. The Last CD sent on (_) and Prior CD1 through Prior CD5 were not received at least 3 business days before closing. If the APR is inaccurate, a consumer must receive a corrected CD no later than (_), which is 3 business days before the (_) Consummation Date. If a corrected CD is not provided in person, a consumer is deemed to have received it 3 business days after it is mailed or delivered, unless there is evidence of earlier receipt. The APR on the CD received at closing must be accurate when compared to the APR on the CD received at least 3 business days before closing and the actual APR. (12 CFR 1026.19(f)(2)(ii)(A); OSC 19(f)(2)(ii)-1)

Federal - Corrected Closing Disclosure Initial, Seven Prior, Last (APR)

Prior CD7 Received at least 3 Days before Closing (Prior CD7 compared to Actual APR)(1001457)

Prior CD7 sent on (_) was received at least 3 business days before closing. The Prior CD7 (_%) APR is inaccurate compared to the (_%) actual APR. The Last CD sent on (_) and Prior CD1 through Prior CD6 were not received at least 3 business days before closing. If the APR is inaccurate, a consumer must receive a corrected CD no later than (_), which is 3 business days before the (_) Consummation Date. If a corrected CD is not provided in person, a consumer is deemed to have received it 3 business days after it is mailed or delivered, unless there is evidence of earlier receipt. The APR on the CD received at closing must be accurate when compared to the APR on the CD received at least 3 business days before closing and the actual APR. (12 CFR 1026.19(f)(2)(ii)(A); OSC 19(f)(2)(ii)-1)

Prior CD7 Received at least 3 Days before Closing (Prior CD7 compared to Last CD APR)(1001457)

Prior CD7 sent on (_) was received at least 3 business days before closing. The Last CD (_%) is inaccurate compared to the Prior CD7 (_%) APR. The Last CD sent on (_) and Prior CD1 through Prior CD6 were not received at least 3 business days before closing. If the APR is inaccurate, a consumer must receive a corrected CD no later than (_), which is 3 business days before the (_) Consummation Date. If a corrected CD is not provided in person, a consumer is deemed to have received it 3 business days after it is mailed or delivered, unless there is evidence of earlier receipt. The APR on the CD received at closing must be accurate when compared to the APR on the CD received at least 3 business days before closing and the actual APR. (12 CFR 1026.19(f)(2)(ii)(A); OSC 19(f)(2)(ii)-1)

Federal - Corrected Closing Disclosure Initial, Eight Prior, Last (APR)

Prior CD8 Received at least 3 Days before Closing (Prior CD8 compared to Actual APR)(1001458)

Prior CD8 sent on (_) was received at least 3 business days before closing. The Prior CD8 (_%) APR is inaccurate compared to the (_%) actual APR. The Last CD sent on (_) and Prior CD1 through Prior CD7 were not received at least 3 business days before closing. If the APR is inaccurate, a consumer must receive a corrected CD no later than (_), which is 3 business days before the (_) Consummation Date. If a corrected CD is not provided in person, a consumer is deemed to have received it 3 business days after it is mailed or delivered, unless there is evidence of earlier receipt. The APR on the CD received at closing must be accurate when compared to the APR on the CD received at least 3 business days before closing and the actual APR. (12 CFR 1026.19(f)(2)(ii)(A); OSC 19(f)(2)(ii)-1)

Prior CD8 Received at least 3 Days before Closing (Prior CD8 compared to Last CD APR)(1001458)

Prior CD8 sent on (_) was received at least 3 business days before closing. The Last CD (_%) is inaccurate compared to the Prior CD8 (_%) APR. The Last CD sent on (_) and Prior CD1 through Prior CD7 were not received at least 3 business days before closing. If the APR is inaccurate, a consumer must receive a corrected CD no later than (_), which is 3 business days before the (_) Consummation Date. If a corrected CD is not provided in person, a consumer is deemed to have received it 3 business days after it is mailed or delivered, unless there is evidence of earlier receipt. The APR on the CD received at closing must be accurate when compared to the APR on the CD received at least 3 business days before closing and the actual APR. (12 CFR 1026.19(f)(2)(ii)(A); OSC 19(f)(2)(ii)-1)

CER-23566

Federal - Loan Estimate/Closing Disclosure Lines Reserved for Lender and Seller Obligated Fees

Line 834 Reserved for Lender and Seller Obligated Fees Only(1001449)

You submitted ($_) paid by Borrower, ($_) paid by Mortgage Broker, and ($_) paid by Other as disclosed on Line 834. Line 834 is reserved for a fee that is either Seller Obligated or Lender Obligated and would appear only on the Closing Disclosure. The system expects a fee submitted on Line 834 to be designated as paid by Seller or paid Lender. Move the fee paid by Borrower, Mortgage Broker, or Other to another Line and resubmit the loan for review.

Line 835 Reserved for Lender or Seller Obligated Fees Only(1001449)

You submitted ($_) paid by Borrower, ($_) paid by Mortgage Broker, and ($_) paid by Other as disclosed on Line 835. Line 835 is reserved for a fee that is either Seller Obligated or Lender Obligated and would appear only on the Closing Disclosure. The system expects a fee submitted on Line 835 to be designated as paid by Seller or paid Lender. Move the fee paid by Borrower, Mortgage Broker, or Other to another Line and resubmit the loan for review.

Line 1115 Reserved for Lender and Seller Obligated Fees Only(1001449)

You submitted ($_) paid by Borrower, ($_) paid by Mortgage Broker, and ($_) paid by Other as disclosed on Line 1115. Line 1115 is reserved for a fee that is either Seller Obligated or Lender Obligated and would appear only on the Closing Disclosure. The system expects a fee submitted on Line 1115 to be designated as paid by Seller or paid Lender. Move the fee paid by Borrower, Mortgage Broker, or Other to another Line and resubmit the loan for review.

Line 1116 Reserved for Lender and Seller Obligated Fees Only(1001449)

You submitted ($_) paid by Borrower, ($_) paid by Mortgage Broker, and ($_) paid by Other as disclosed on Line 1116. Line 1116 is reserved for a fee that is either Seller Obligated or Lender Obligated and would appear only on the Closing Disclosure. The system expects a fee submitted on Line 1116 to be designated as paid by Seller or paid Lender. Move the fee paid by Borrower, Mortgage Broker, or Other to another Line and resubmit the loan for review.

Line 1209 Reserved for Lender and Seller Obligated Fees Only(1001449)

You submitted ($_) paid by Borrower, ($_) paid by Mortgage Broker, and ($_) paid by Other as disclosed on Line 1209. Line 1209 is reserved for a fee that is either Seller Obligated or Lender Obligated and would appear only on the Closing Disclosure. The system expects a fee submitted on Line 1209 to be designated as paid by Seller or paid Lender. Move the fee paid by Borrower, Mortgage Broker, or Other to another Line and resubmit the loan for review.

Line 1210 Reserved for Lender and Seller Obligated Fees Only(1001449)

You submitted ($_) paid by Borrower, ($_) paid by Mortgage Broker, and ($_) paid by Other as disclosed on Line 1210. Line 1210 is reserved for a fee that is either Seller Obligated or Lender Obligated and would appear only on the Closing Disclosure. The system expects a fee submitted on Line 1210 to be designated as paid by Seller or paid Lender. Move the fee paid by Borrower, Mortgage Broker, or Other to another Line and resubmit the loan for review.

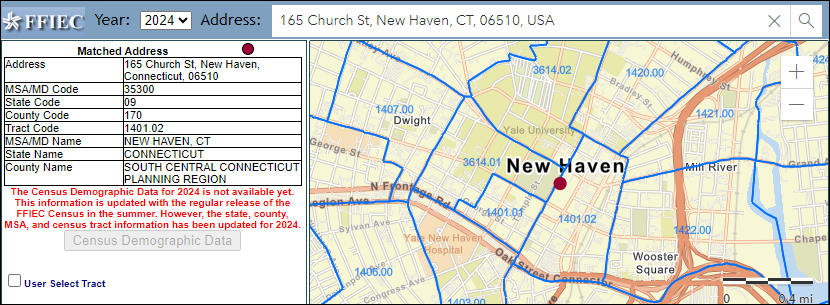

CER-21304

| County FIPS Code | Count Name |

|---|---|

| 110 | capitol planning region |

| 120 | greater bridgeport planning region |

| 130 | lower Connecticut river valley planning regions |

| 140 | naugatuck valley planning region |

| 150 | northeaster Connecticut planning region |

| 160 | northwest hills planning region |

| 170 | south central Connecticut planning region |

| 180 | southeaster Connecticut planning region |

| 190 | western Connecticut planning region |

CER-23675

State Rules

Dollar amounts indexed in the Regulated Loan Act (Minnesota Statutes, Chapter 56.131, subdivision 4) and the Minnesota Consumer Credit Code (Minnesota Statutes, Section 47.59, subdivision 3(i)) mandate periodic updates every July 1 of even-numbered years, including adjustments to specified thresholds.

Effective July 1, 2024, users will see the updated dollar amount values for the following rules when submitting Minnesota loans to

RH 54340 Minnesota - Maximum Late Charge

- Old Amount: $5.20

- New Amount: $9.36

RH 54360 Minnesota - Maximum Late Charge (Regulated Loan)

- Old Amount: $5.20

- New Amount: $9.36

RH 54350 Minnesota - Maximum Late Charge (FCCLP)

- Old Amount: $5.20

- New Amount: $9.36

RH 54280 Minnesota - Minimum Loan Amount (Regulated Loan)

- Old Amount: $4,320

- New Amount: $7,776

RH 28420 Minnesota - Third Party Fees Limitation (Regulated Loan)

- Old Amount: $240

- New Amount: $432

For more information on the updated dollar amounts, please visit the Minnesota Department of Commerce Consumer Credit Code page.

CER-23694

07/11/2024

New Jersey - Appraisal Fee (MLFOP)(First Lien)

Appraisal Fee Cannot be paid to Lender and Broker(63560)

There is not an Appraisal Fee paid to both the Lender and the Mortgage Broker. The New Jersey Mortgage Loans, Fees, Obligations Provisions do not allow an Appraisal Fee to be paid to a lender and a broker in connection with the same mortgage loan application. (NJAC 3:1-16.2(a)3)

Appraisal Fee Cannot be paid to Lender and Broker(63560)

There is a ($_) Appraisal Fee paid to the Lender and a ($_) Appraisal Fee paid to the Broker. The New Jersey Mortgage Loans, Fees, Obligations Provisions do not allow an Appraisal Fee to be paid to a lender and a broker in connection with the same mortgage loan application. (NJAC 3:1-16.2(a)3)

New Jersey - Subordination Fees to Third Party (MLFOP)(First Lien)

New Jersey - Subordination Fees to Third Party (MLFOP)(First Lien)(1000554)

The New Jersey Department of Banking and Insurance (NJDOBI) has provided guidance that a Subordination Fee and Subordination Preparation Fee fall into a class of permitted third party fees only if charged by a third party, benefit the borrower, and represent a cost not associated with the lender's overhead. The system assumes that prior to the lender collecting a Subordination Fee and/or Subordination Preparation Fee of ($_), the lender has confirmed with the NJDOBI that it falls within this permitted category. (N.J.A.C. 3:1-16.2(a)7.xi.)

New Jersey - Escrow Waiver and Buydown Fee Not Allowed (MLFOP)(First Lien)

Escrow Waiver Fee Not Allowed(1001097)

You did not charge a ($_) Escrow Waiver Fee. The New Jersey Residential Mortgage Loans, Fees, Obligations Provisions prohibit an Escrow Waiver Fee (FeeID 103) in a first lien closed-end loan.(N.J.A.C. 3:1-16.2)

Escrow Waiver Fee Not Allowed(1001097)

You charged a ($_) Escrow Waiver Fee. The New Jersey Residential Mortgage Loans, Fees, Obligations Provisions prohibit an Escrow Waiver Fee (FeeID 103) in a first lien closed-end loan.(N.J.A.C. 3:1-16.2)

Temporary Buy Down Fee Not Allowed(1001097)

You did not charge a ($_) Temporary Buy Down Fee. The New Jersey Residential Mortgage Loans, Fees, Obligations Provisions prohibit a Temporary Buy Down Fee (Fee ID158) in a first lien closed-end loan. (N.J.A.C. 3:1-16.2)

Temporary Buy Down Fee Not Allowed(1001097)

You charged a ($_) Temporary Buy Down Fee. The New Jersey Residential Mortgage Loans, Fees, Obligations Provisions prohibit a Temporary Buy Down Fee (FeeID 158) in a first lien closed-end loan. (N.J.A.C. 3:1-16.2)

New Jersey - Office Expenses Not Allowed (MLFOP)(First Lien)

Office Expenses(1001425)

There are ($_) in Office Expenses (general expenses such as fax fees, copy fees, and postage) associated with this New Jersey first lien loan. Under the New Jersey Mortgage Loans, Fees, Obligations Provisions, only the portion of Office Expenses attributable to photocopy fees paid to the title insurer/agent ($_) are permitted. (N.J.A.C. 3:1-16.2; NJ Land Title Insurance Rating Bureau Manual of Rates and Charges Sections 7.2.1 and 7.2.2)

CER-23607

New Mexico - Bona Fide Discount Point Analysis (07/09)

APR > CMR + 1.5 Points (First Lien)(1001245)

You submitted a Loan Discount Amount of ($_). The system calculated ($_) discount points as eligible for exclusion from the New Mexico points and fees calculation because the undiscounted APR of (_%) does not exceed the conventional mortgage rate of (_%) + 1.5 points in a first lien loan. The undiscounted APR is the result of the standard TIL APR calculation using the undiscounted rate instead of the note rate. (N.M. Stat. Ann. 58-21A-5)

APR > CMR + 1.5 Points (First Lien)(1001245)

You submitted a Loan Discount Amount of ($_). The system calculated ($_) discount points as eligible for exclusion from the New Mexico points and fees calculation because the undiscounted APR of (_%) exceeded the conventional mortgage rate of (_%) + 1.5 points in a first lien loan. The undiscounted APR is the result of the standard TIL APR calculation using the undiscounted rate instead of the note rate. (N.M. Stat. Ann. 58-21A-5)

APR > CMR + 3 Points (Junior Lien)(1001245)

You submitted a Loan Discount Amount of ($_). The system calculated ($_) discount points as eligible for exclusion from the New Mexico points and fees calculation because the undiscounted APR of (_%) does not exceed the conventional mortgage rate of (_%) + 3 points in a junior lien loan. The undiscounted APR is the result of the standard TIL APR calculation using the undiscounted rate instead of the note rate. (N.M. Stat. Ann. 58-21A-5)

APR > CMR + 3 Points (Junior Lien)(1001245)

You submitted a Loan Discount Amount of ($_). The system calculated ($_) discount points as eligible for exclusion from the New Mexico points and fees calculation because the undiscounted APR of (_%) exceeded the conventional mortgage rate of (_%) + 3 points in a junior lien loan. The undiscounted APR is the result of the standard TIL APR calculation using the undiscounted rate instead of the note rate. (N.M. Stat. Ann. 58-21A-5)

No Discount Points Excluded(1001245)

The system excluded the discount points of (_%) (Loan Discount Amount of ($_) you submitted in this loan from the New Mexico points and fees calculation. Under the New Mexico Home Loan Protection Act, up to 2 points of bona fide discount points plus any conventional prepayment penalty may be excluded from the points and fees. Bona fide discount points mean loan discount points that are knowingly paid by the borrower for the purpose of reducing, and result in, a reduction of the undiscounted APR, provided the APR otherwise applicable does not exceed the conventional mortgage rate by more than 1.5 points in a first lien, or 3 points in a junior lien. The undiscounted APR is the result of the standard TIL APR calculation using the undiscounted rate instead of the note rate. (N.M. Stat. Ann. 58-21A-5)

No Discount Points Excluded(1001245)

The system did not exclude the discount points of (_%) (Loan Discount Amount of ($_) you submitted in this loan from the New Mexico points and fees calculation. Under the New Mexico Home Loan Protection Act, up to 2 points of bona fide discount points plus any conventional prepayment penalty may be excluded from the points and fees. Bona fide discount points mean loan discount points that are knowingly paid by the borrower for the purpose of reducing, and result in, a reduction of the undiscounted APR, provided the APR otherwise applicable does not exceed the conventional mortgage rate by more than 1.5 points in a first lien, or 3 points in a junior lien. The undiscounted APR is the result of the standard TIL APR calculation using the undiscounted rate instead of the note rate. (N.M. Stat. Ann. 58-21A-5)

Undiscounted Rate Exists(1001245)

You submitted an Undiscounted Rate of (_%). The system uses the Undiscounted Rate to calculate the undiscounted APR used in the New Mexico Home Loan Protection Act bona fide discount point analysis. Please submit a value for Undiscounted Rate. The undiscounted APR is the result of the standard TIL APR calculation using the undiscounted rate instead of the note rate.

CER-23548

North Carolina rules affected by this change—

- Rule Header 1000253 North Carolina - High Cost (First Liens 01/14)

- Rule Header 1000254 North Carolina - High Cost (Junior Liens 01/14)

- Rule Header 1000255 North Carolina - High Cost FHA/VA/USDA (First Liens 01/14)

- Rule Header 1000256 North Carolina - High Cost FHA/VA/USDA (Junior Liens 01/14)

CER-23470

North Carolina rules affected by this change—

- Rule Header 25190 North Carolina - Fees Limitation

- Rule Header 25770 North Carolina - Fees Limitation (Banks)

This update aligns with the Interest Provisions Fee Limitations rule test with the North Carolina Interest Provisions statute.

CER-23020

In this release,

Texas - Interest Only (Homestead Rule)

Interest Only Loans Are Not Allowed

This loan does not contain any interest only payments. The Texas Constitution requires some amount of principal be reduced with each installment in loans secured by homestead property. (Tex. Const. Art. XVI Sec. 50(a)(6)(L); 7 TX ADC 153.1; 7 TX ADC 153.11)

Interest Only Loans Are Not Allowed

This loan has (_) month(s) of interest only payments. The Texas Constitution requires some amount of principal be reduced with each installment in loans secured by homestead property. (Tex. Const. Art. XVI Sec. 50(a)(6)(L); 7 TX ADC 153.1; 7 TX ADC 153.11)

CER-23573

In this release,

CER-23562